Types of orders: Limit, market and stop orders

Entering and exiting positions effectively is key to executing a trading strategy. Stake provides multiple types of orders so investors can place trades with precision. Here’s how to best use the most common order types: market, limit and stop orders.

Key highlights:

- There are multiple trading order types available to investors on both Stake AUS and Stake Wall St.

- Market orders are used when traders want to execute a trade immediately, while price-specific traders like limit or stop orders will only activate when a specific value has been met.

- Price-specific trading orders are helpful as market conditions can be volatile and you're not always able to access your trading platform to react manually.

Any good portfolio needs effective order management. There’s more than one way to place a trade, so let’s look at the trader’s toolkit and discover all the order types available to Stake investors.

What is a trading order?

In the magical world of investing, an order relates to the request you send to the platform when you want to buy or sell a stock.

Sometimes there isn’t a favourable price in the current trading session, so investors use different orders to buy or sell stocks when the price reaches the level they would like.

Types of orders in trading

It’s important for investors to understand the different trading order types available, as they’re all useful tools to use in the stock market.

The types of orders fall into two categories: entry orders and closing orders. Traders will use an entry order to open a trade. Closing orders will close a trade.

What are market orders and how do they work?

When a market order is placed, it executes at that moment, at or around the current market price.

There are a few risks to a market order. While it will try to execute at the market price, if there aren’t enough shares, the order will go to the next highest bid (for a sell order) or next lowest offer (for a buy order). That’s why a market order is expected to be filled instantly. Therefore, placing a market order to buy or sell a stock includes the risk of slippage, which is when the price moves significantly to meet a market order’s immediacy requirement. When initiating market orders, you’re choosing that immediacy over the option to specify a price.

If a market order is placed during the day but there aren’t enough buyers or sellers to meet the order, it will expire at the end of that trading day. If it’s placed after hours, it will become active at the start of the next trading day.

Market order example

You place a market order to buy 1,000 shares in a stock with a bid of $0.99 and an ask of $1.00.

If there are 1,000 shares or more being offered at $1.00 (ask), your order will instantly fill.

- If there are less than 1,000 shares on offer, your order will fill for all available shares at $1.00, then move to the next lowest ask price for the unfilled portion.

What are limit orders and how do they work?

A limit order lets you enter the price you’re willing to buy or sell a stock at, and will only be filled at that specified price or better. They let you wait for the price that’s good enough for you.

For low-volume stocks, a limit order may not fill for some time. So when placing a trade, Stake investors will also have the option to choose whether the order should be cancelled at the end of the day (EoD) or after 30 days, which is also known as a Good ’Til Cancelled order (GTC). This optionality gives traders more control of their investing strategy.

Can you cancel a limit order?

A limit order can be manually cancelled while it is still pending (waiting to be filled). Note that sometimes only a portion of a limit order may be filled if there’s not enough volume to fully complete it. You will only be charged brokerage once, no matter how long a single order takes to fill.

Limit order example

A limit buy at $0.10 will only fill at $0.10 or lower. Your order will only match when the ask falls to $0.10.

For example, a small lithium company could have a bid at $0.10 and an ask at $0.105. A market order would fill at $0.105 but this is 5% off the current bid. A limit buy at $0.10 would only execute at that exact price.

Market orders vs limit orders

The difference between a market order and a limit order is that when opening a market order, the trade is executed at or around the current price, at the time you placed your order.

Limit orders are only executed when the specified price is met, or a lower (for a buy order) or higher (for a sell order) price has been offered. A limit order can be cancelled while it’s still pending (waiting to be filled), but market orders have instant fulfilment during market hours – provided there are enough shares on the bid (for a sell order) or ask (for a buy order) sides of the market.

TIP: The ASX enforces a $500 minimum order (excluding brokerage) on your first purchase of a particular stock. This is known as the minimum marketable parcel. Once you own a share, you can buy or sell any amount.

What are stop orders and how do they work?

Stop orders are orders set to buy or sell a stock when the price of that stock reaches the specified price level. At that point, the order is activated as a market order and is filled at the next available market price. They let you act in case of unexpected price movements.

Stop order example

For example, Maverick ($MVK) is trading at $89.50. You have a stop sell at $85. During the session, the stock slides down past $85 and closes at $80. Once the stock hit $85, a market sell was triggered and your losses were capped.

Limit orders vs stop orders

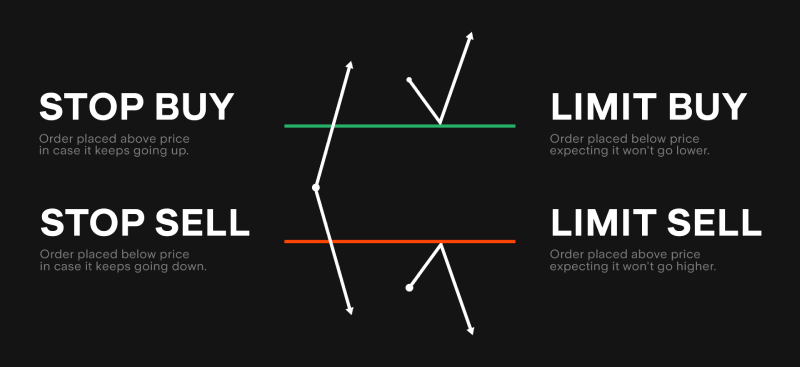

Many traders mistake stop orders for limit orders, as both allow you to specify the prices for future trades. One way to describe the main difference between them is: limit orders are waiting for things to get better (for a price to drop before you buy, or to get high enough that you’re happy to sell), while stop orders are set in case things get worse (buy because the price might keep going up, sell because it might keep going down). This difference should become clearer below.

Different stop and limit orders

Stop sell

A stop sell triggers a market sell when a stock drops below a certain price, like in the Maverick example above.

Stop sell orders (also called stop loss orders) can minimise losses while traders are unable to monitor positions e.g. when sleeping or at work. This gives them peace of mind.

Things to remember:

- On Stake, a stop order will remain pending for 90 days or until cancelled.

- Stop sells must be set at more than $0.05 below the current market price.

- A stop sell and limit sell (see below) cannot be placed concurrently.

Limit sell

On the flip side, a limit sell provides a tool to take profit should the stock rise above a certain price while traders aren’t watching.

For example, $MVK is at $100 a share. You want to take profit if it reaches $150 a share. A limit sell will sell your shares for $150 or better once the price passes $150. This means profits can be locked in at a specified price even if you can’t actively manage your position.

Things to remember:

A limit order can only be placed for a whole number of shares.

Limit orders will automatically cancel at market close.

Our broker-dealer enforces a 200% limit above the market price for a limit sell. However, our broker-dealer may change this limit during periods of market volatility or other times.

A limit sell and stop sell (see above) cannot be placed concurrently.

A limit order will only execute at your specified limit price or better. For larger orders or trades in more illiquid stocks, your order may only partially fill if the price quickly falls below your limit price.

Stop buy

Some traders enter positions based on price action: buy high, sell higher. A stop buy is an effective order type to jump in on a stock as it breaks out. It will place a market buy once a stock passes above a specified price, so you don’t miss out on a possible rally.

Similar to a stop sell order, stop buys must sit $0.05 above the current market price.

Limit buy

Looking to buy the dip without looking? A limit buy is used to purchase shares should the price of a stock fall to a specific level. Such an order type will only fill at your specified price or lower so you can take advantage of price drops.

For example, $MVK is at $90. You only want to buy it if the price falls. You set a limit at $75. A bad earnings report knocks the price down to $75 and your order is automatically filled.

To summarise, take a look at this image where the green line represents the price when you want in, and the red, when you want out. The dots are the price you start from.

Good 'Til Cancelled (GTC)

Good ’til cancelled orders let you specify a target price, either setting a minimum price (for a sell order) or a maximum price (for a buy order) that you’ll accept to fulfil the transaction.

A GTC order stays active until the price requirements are met – or until you cancel it, hence the name. On the Stake platform, if neither of those things happen in 30 days, that is when the order will expire.

ASX order types

When you buy Australian shares on Stake AUS, you’ll have three order types available to use: limit, market and stop orders.

Stella is a markets analyst and writer with almost a decade of investing experience. With a Masters in Accounting from the University of Sydney, she specialises in financial statement analysis and financial modelling. Previously, she worked as an equity analyst at Australian finance start-up, Simply Wall St, where she took charge of the market insights newsletter sent out to over a million subscribers. At Stake, Stella has been key to producing the weekly Wrap articles and social media content.