CHESS-sponsored brokerage for ASX investing

Invest in the biggest Australian stocks and ETFs with CHESS-sponsored confidence

- Your ASX shares held in your name

- Get your own unique HIN or transfer your existing HIN

- $3 CHESS-sponsored trades for all trades up to A$30,000

Proud to bring you CHESS sponsorship

When you invest on the ASX with Stake, you enjoy:

CHESS-sponsored investing

You’ll get your own HIN (Holder Identification Number) so shares are actually held in your name.

Simple Pricing

$3 brokerage for all trades up to A$30,000, or 0.01% for trades above A$30,000.

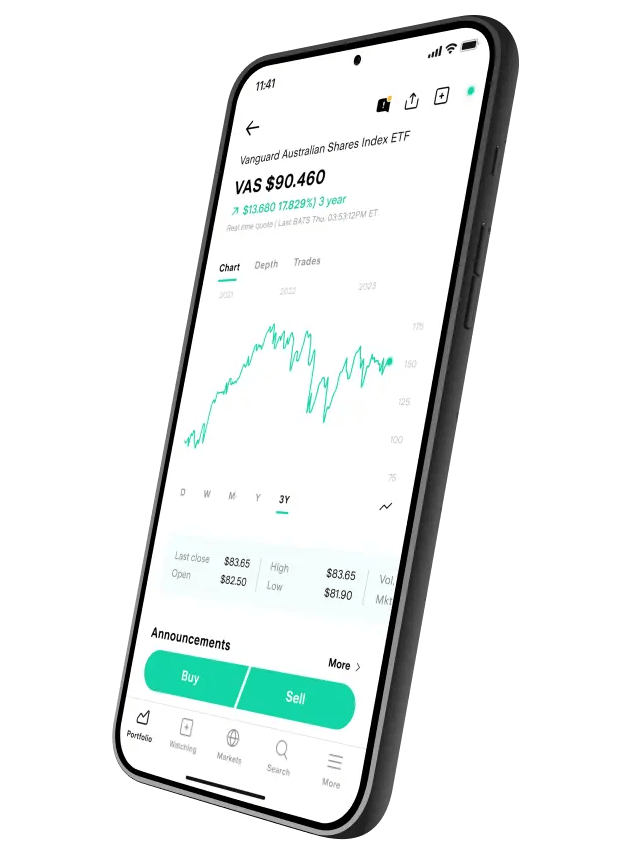

A platform made for this century

A powerful yet easy-to-use experience on mobile and desktop, whether you’re a starter or a pro.

Fast digital transfers

Our patent-pending portfolio transfer process brings your shares to Stake in no time, with no paperwork.

What is CHESS on the ASX?

CHESS stands for Clearing House Electronic Subregister System. It was developed and maintained by the Australian Securities Exchange (ASX).

The CHESS system facilitates trades, settles funds following buys and sells and transfers legal ownership of securities. Most importantly for our investors, CHESS-sponsored platforms like Stake allow positions to be held in an individual’s name.

🎓 Learn more in our guide What is CHESS?

How we compare

Compare Stake’s brokerage fees with other CHESS-sponsored platforms

Trade Amount |  | CommSec | NAB | SelfWealth |

|---|---|---|---|---|

$0 - $1,000 | $3 | $5.00 (with CDIA) | $9.95 | $9.50 |

$1,001 - $5,000 | $3 | $10.00 - $19.95 (with CDIA) | $14.95 | $9.50 |

$5,001 - $10,000 | $3 | $19.95 (with CDIA) | $19.95 | $9.50 |

$10,001 - $20,000 | $3 | $29.95 (with CDIA) | $19.95 | $9.50 |

$20,001 - $25,000 | $3 | $29.95 (with CDIA) | 0.11% | $9.50 |

$25,001 - $30,000 | $3 | 0.12% (with CDIA) | 0.11% | $9.50 |

$30,000+ | 0.01% | 0.12% (with CDIA) | 0.11% | $9.50 |

Last reviewed: 30 May 2025. The information displayed in the pricing comparison table is not exhaustive and is subject to changes. For up-to-date competitor pricing and product offerings, visit their websites. Please check our pricing PDF for details.

Learn more about the benefits of trading with a CHESS-sponsored platform.

The Australian Securities Exchange (ASX) requires a minimum investment of A$500 (excluding brokerage) when purchasing shares in any ASX-listed security for the first time. This is known as the ‘Minimum Marketable Parcel' (MMP) of shares. The MMP applies to all CHESS-sponsored trades.

“STAKE UNDERCUTS STOCKBROKING MARKET BY TWO-THIRDS”

“THE $3 COST FOR ASX BROKERAGE MAKES THE PLATFORM THE LOWEST-COST CHESS-SPONSORED OFFERING”

“A homegrown start-up that has helped “break down barriers” for Australians”

1000's of 5-star reviews

As a former commsec user, I love how easy the app is to navigate and with ASX now available switching between markets is easy.

I've never written an App review before, but Stake really has continued to wow me.

I started using Stake for US trading, and recently (very easily) transferred my ASX portfolio across to utilise the cheap trades.

Switched from nabtrade. Much better experience. Far cheaper.

A well designed and easy to use app to trade on the USA and AUS markets.

Sign up for CHESS-sponsored brokerage

- 1Sign up in minutes, all you need is some I.D.

- 2Click Stake AUS

- 3Deposit in seconds, funds arrive in minutes and you're away

What's on the Stake Desk

FAQs

Yes, Stake is proud to be a CHESS-sponsored broker, allowing users to own shares under their own Holder Identification Number (HIN).

By investing with a CHESS-sponsored broker, you’re given your own Holder Identification Number. Every position in your portfolio is then attributed to this HIN.

When you sign up for a Stake AUS share trading account, ASX CHESS sponsorship automatically applies to your account and you'll have a unique HIN number.

You can find your HIN in the Stake app by going to More > Profile > Account Details > HIN.

The HIN consists of 11 characters beginning with an X.

CHESS-sponsored shares are safe. Here are some reasons why outlined in the ASX CHESS brochure:

CHESS Holding Transactions:

- Transactions on a CHESS holding can only be effected by the CHESS sponsor. By law, the CHESS sponsor needs your specific instructions to access your CHESS holding and must authenticate your identity.

Regulation and Compliance:

- The Corporations Act and ASX Settlement Operating Rules regulate the actions of ASX Settlement participants, including stockbrokers.

- ASX audits these participants to ensure compliance with the rules and legislation.

Notification and Security:

- ASX Settlement notifies you by mail of any changes to your CHESS holdings. To ensure you receive all notices, register your holdings using your direct address, not an intermediary's address. *In the Stake app you can select email communication if you don't want to receive letters.

- Your CHESS Sponsor must maintain an electronic audit trail of all movements in your CHESS holding.

- ASX Settlement employs security measures such as message encryption and secure telecommunications lines to minimise unauthorised access to CHESS.

The main benefit of the CHESS-sponsored system is security, as it gives you direct ownership over your shares. Other brokers may hold shares on their own balance sheet and only attribute to you rights to a position, rather than full ownership.

This is known as a custodian model and it means shares are not immediately attributable to an owner. Should custodian brokers face a shutdown, there may be difficulties in returning the shares to customers.

When you purchase shares through a CHESS-sponsored broker, the HIN is used to identify the relationship between you and the broker. Any shares that you purchase through the broker are linked to you by your HIN number.

When shares are purchased through an issuer-sponsored broker, they're sponsored by the company that first issued them and not the broker. The relationship between you and the shares is managed by a third-party share registry. When you buy issuer-sponsored shares, you receive a Security Reference Number (SRN) for each parcel of shares.

CHESS holding statements provide details on monthly transactions and calculate the holding balance from the beginning to the end of each month.

These statements are only issued if there has been a change in your CHESS holding balance, and you will receive a statement shortly after the end of the month for each security with a balance change.

Get started with $10 on us

Sign up and fund Stake AUS to claim.

Transfer existing ASX stocks and you could also trade for free.