Deposits and withdrawals

How to move money in and out of Stake:

- Discover how to deposit via bank transfer, Apple Pay, Google Pay and debit/credit card

- An outline of funding fees and charges

Deposit methods

Stake currently supports three secure funding methods: bank transfer, Apple Pay/Google Pay and Credit/Debit card. Here’s how they work:

Bank transfer

You can deposit funds directly from your bank account using your unique Stake BSB and account number.

- Head to your dashboard (AUS or Wall St) and hit the ‘Add’ button next to your buying power

- Enter the desired deposit amount and Next

- Select Bank transfer as the method and Next

- Use the details to send a direct deposit from your online bank

- Once submitted, simply hit I’ve made a transfer to confirm

When funding your account via bank transfer, ‘Airwallex Pty Ltd’ may be flagged as an account name mismatch due to Confirmation of Payee (CoP) requirements.

Airwallex is our trusted payments provider, so you can be sure that your funds will arrive safely and securely.

You can learn more about Airwallex and our other partners here.

Apple Pay/Google Pay

Using a Google Pay or Apple Pay compatible device?

- Head to your dashboard (AUS or Wall St) and hit the ‘Add’ button next to your buying power

- Enter the desired deposit amount and Next

- Select Apple Pay or Google Pay as the method and confirm

- Depending on your device, there may be an additional prompt from Google or Apple

Debit/Credit card

Use a credit or debit card and save it to your Stake account for future deposits.

- Head to your dashboard (AUS or Wall St) and hit the ‘Add’ button next to your buying power

- Enter the desired deposit amount and Next

- Select Debit/Credit card as the method and confirm

- Add your card details and tap Save card

- Now click Submit

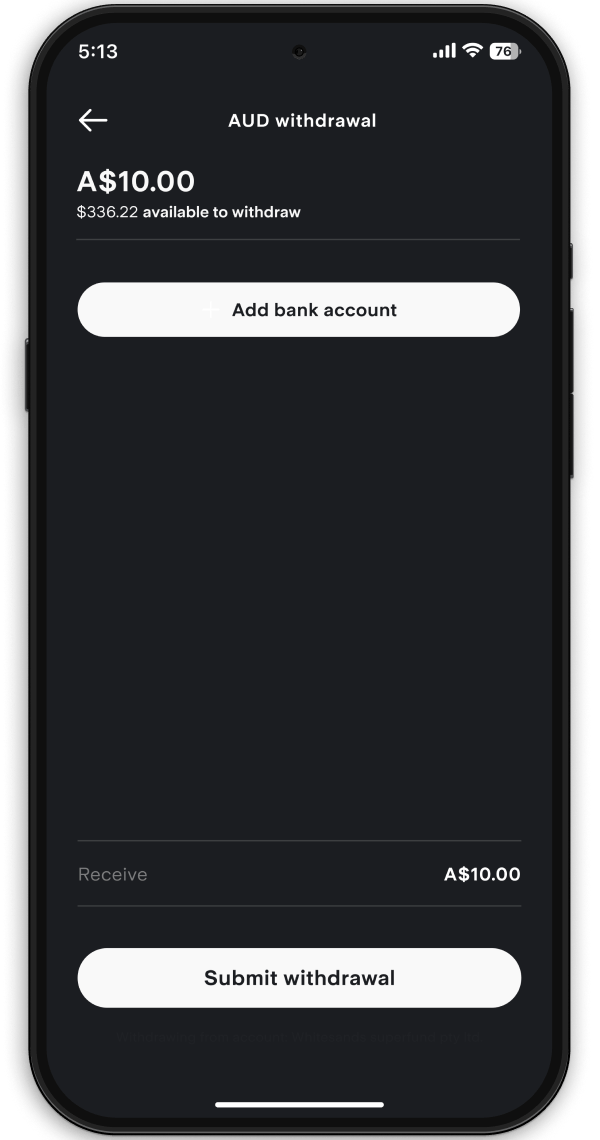

How to withdraw

Follow these steps below to withdraw from your Stake balance:

- On the Stake app, head to Manage > Balances > Withdraw – or if you’re on the web, select the Wallet icon > Withdraw > Choose either USD or AUD

- Enter the withdrawal amount and select the receiving bank account

- To add a new or different receiving account, select ‘Edit account’ and follow the prompts (please note, the name on the receiving account must match the name of the Stake account owner)

- You’ll receive an estimated summary of your withdrawal request

- Verify the withdrawal with a PIN sent to your mobile number or authenticator app

- Confirm your withdrawal request

Only settled cash can be withdrawn. Please note, withdrawal settlement times depend on the market you’re withdrawing from, your bank institution and the complexity of the withdrawal request.

Stake deposit and transfer fees

Both markets

Fee | Amount | Description |

|---|---|---|

Card funding | Debit 0.5% | Fee applicable for card funding and Apple Pay/Google Pay. |

Stake Wall St only

Fee | Amount | Description |

FX transfer fee | 55bps | This is the fee charged on all fund transfers in and out of your Stake account between AUD and USD. There is no FX fee charged per trade. |

Settlement timeframes vary depending on the deposit method and the market being funded.

Get 12 months of $0 CHESS-sponsored trades

Transfer an ASX portfolio worth A$1,000+ to Stake and get a year of $0 brokerage for Stake AUS trades up to A$30k. Transferring is simple, seamless and 100% digital.

Brokerage discount applies on up to 10 Stake AUS trades per month up to A$30k per trade. This does not constitute financial advice. Stake AUS Rewards T&Cs apply.

Claim nowWorld-leading partners

Payment Methods FAQs

For most banks, funds are credited to your Buying Power within 5–15 minutes.

If it’s been more than an hour, here’s what to check:

- BSB and account number

- Bank holds

- Non-NPP banks

If it’s been more than 2 business days (note that public holidays add an extra day or two) and your bank has confirmed the funds have been sent successfully, please send our team a proof of payment by going to our contact us page. You can include a screenshot of the transaction receipt or a bank statement, as long as it shows:

- Bank logo

- Bank account name

- Account number

- Bank details the funds were transferred to

- Date the transfer was made

- Amount

- Description/reference

The minimum deposit amount is A$50.

There is a A$1 minimum withdrawal amount from your Stake AUS account. On Stake Wall St, there's a minimum withdrawal of US$10.

Stake AUS

Successful withdrawals from your Stake AUS account to your external Australian bank account will typically settle within 1-2 business days.

Stake Wall St

Successful withdrawals from your Stake Wall St account to an Australian bank account will typically settle within 2-3 U.S. business days. Please note, we don’t currently support direct USD withdrawals.

Stake does not charge fees to withdraw funds to your local bank account.

FX and speed fees can apply when withdrawing from your Stake Wall St account or transferring funds between accounts. Please check out our pricing PDF for a detailed breakdown of our fees.

When funding your account via bank transfer, ‘Airwallex Pty Ltd’ may be flagged as an account name mismatch. This is due to the rollout of Confirmation of Payee (CoP) requirements by Australian banks to combat the rising tide of online scams.

Airwallex is our trusted payments provider, facilitating secure deposits, withdrawals and wallet functionality on Stake, so you can be sure that your funds will arrive safely.

Ready to discover the next big thing?

Join 500k+ ambitious people building wealth on Stake