How to invest in S&P 500 from Australia [2025 guide]

Investing in the S&P 500 can be a powerful strategy for Australian investors looking to tap into the growth potential of the largest companies in the US. With its long-standing track record of delivering impressive returns, the S&P 500 has become a favoured choice among smart investors seeking to grow their wealth.

This article focuses on how to buy specific securities, however, it is not a recommendation to invest in them and should not be taken as financial advice. Do your own research and make your own decisions, or even consider getting advice from a licensed financial adviser before investing.

The SPY ETF was the first ETF introduced in 1993 that tracked the S&P 500 index and now in 2025 it is averaging US$41b a day in trading volume (more than the combined volume of Amazon, Meta and Microsoft).[1]

Australian investors can invest in the S&P 500 by choosing an Australian-listed ETF that tracks the index on the ASX or by opening an investing account with access to U.S. markets to invest in US-listed S&P 500 ETFs.

If you open an account with Stake you can invest in Australian and U.S. securities, which means you can access the S&P 500 ETFs across both markets. Follow the step-by-step guide below:

- Open an investing account

- Fund your account

- Research the ETFs that track the S&P 500

- Place an order

- Monitor your investment

Steps on how to buy S&P 500 in Australia

1. Open a stock investing account

To invest in the S&P 500 through an ETF, you'll need to sign up to an investing platform with access to the ASX and U.S. markets. Lucky for you Stake has access to both.

Sign up in minutes and join 500k+ investors with access to an industry-leading share trading experience.

2. Fund your account

Complete an application with your personal and financial details. Fund your account with a bank transfer, PayTo, debit card or even Apple/Google Pay.

3. Research the ETFs that track the S&P 500

Find the asset by searching for the name or ticker symbol. Do your own research to ensure it is the right investment product for your own circumstances.

4. Place an order

Buy on any trading day with a market, limit or stop order. Look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Optimise your portfolio by tracking how the security performs with an eye on the long term. You may be eligible for dividends and shareholder voting rights that affect your shares.

S&P 500 index explained

The S&P 500, also known as the Standard & Poor's 500, is a widely followed stock market index in the United States. It comprises 500 of the largest publicly traded companies listed on U.S. stock exchanges.

The index is designed to provide a snapshot of the overall performance of the U.S. equity market and serves as a benchmark for measuring the performance of large-cap stocks.

The S&P 500 is market cap weighted, which means that the companies with the largest market values have a greater influence on the index's movements. It includes the largest U.S. listed companies, ranging through various sectors such as technology, healthcare, finance, consumer goods, and more, offering a broad representation of the U.S. economy.

The index is frequently used by investors and financial professionals as a gauge of the stock market's health and as a basis for constructing investment portfolios. Many mutual funds and exchange-traded funds (ETFs) aim to replicate the performance of the S&P 500, allowing investors to gain exposure to a diversified portfolio of U.S. large-cap companies.

🎓 Check out our article for a deeper dive into the S&P 500 index.

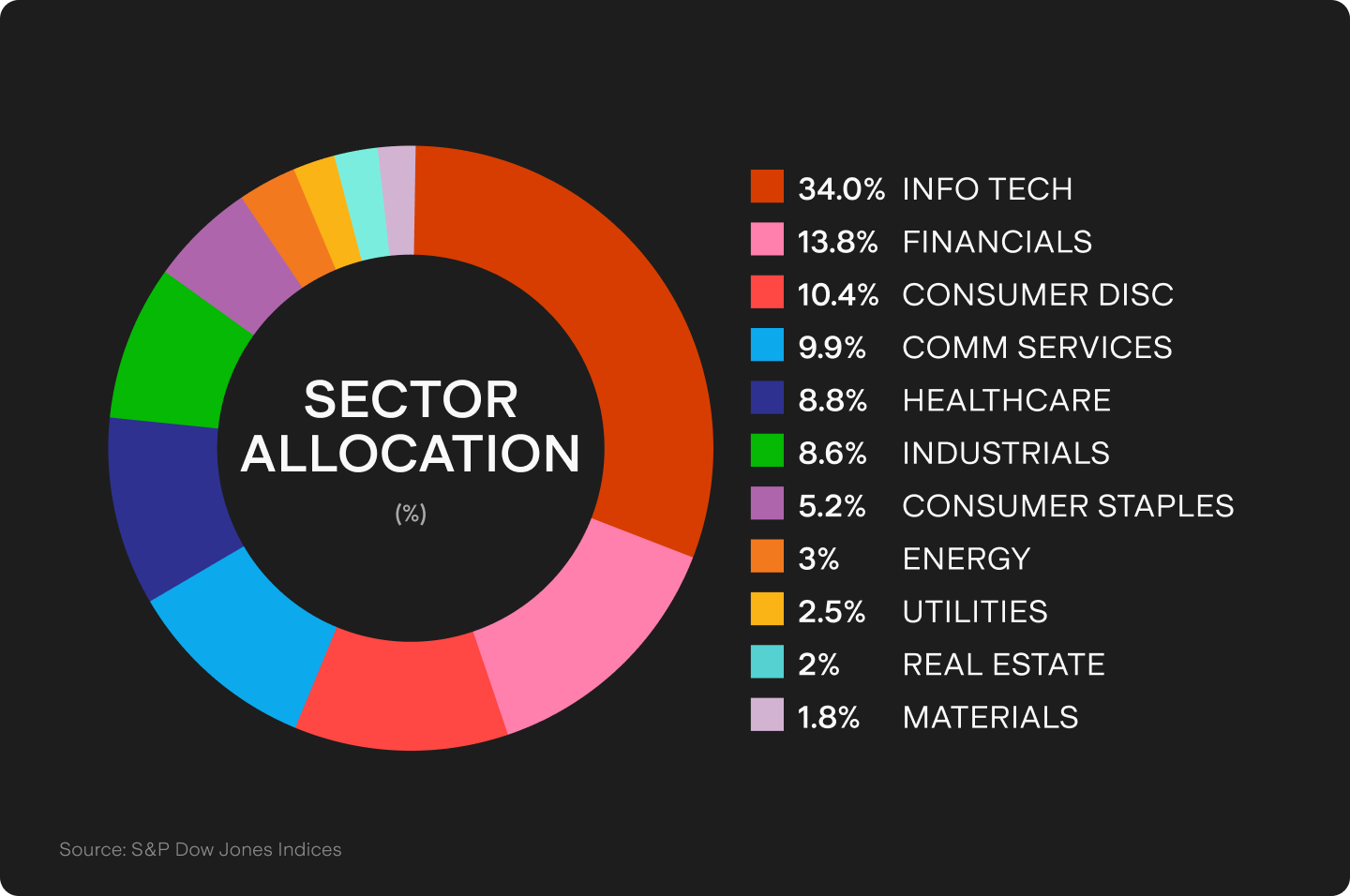

Breakdown of S&P 500 sectors

Understand the weightings for each sector on the index based on GICS system.[2]

Top 10 constituents of S&P 500

As of 31 July 2025 from the S&P 500 factsheet[3], these were the S&P 500 top 10 holdings of the index:

Constituent | Ticker | Sector |

|---|---|---|

Nvidia Corp | Information Technology | |

Microsoft Corp | Information Technology | |

Apple Inc. | Information Technology | |

Amazon.com Inc | Consumer Discretionary | |

Meta Platforms, Inc. Class A | Communication Services | |

Broadcom Inc. | Information Technology | |

Aplabet Inc A | Communication Services | |

Alphabet Inc C | Communication Services | |

Berkshire Hathaway B | Financials | |

Tesla, Inc | Consumer Discretionary |

What Australian ETF tracks the S&P 500 index?

If you are looking to invest in Australian ETFs that track the S&P 500 index, these are the most popular options:

- iShares Core S&P 500 ETF ($IVV): This exchange-traded fund is managed by BlackRock and seeks to provide investment results that correspond to the performance of the S&P 500 Index. It is traded on the Australian Securities Exchange and aims to provide investors with exposure to the top 500 large-cap US companies. The ETF is also one of the most traded Australian shares on the Stake platform, learn more about $IVV ETF and if it's a good investment.

- SPDR S&P 500 ETF Trust ($SPY): This ETF is managed by State Street Global Advisors and is one of the largest and most traded ETFs in the world. While it is primarily listed on U.S. exchanges, it also has a presence on the ASX through Chess Depository Interests (CDIs). SPY aims to track the performance of the S&P 500 Index as well.

- BetaShares S&P 500 Yield Maximiser Fund ($UMAX): The Betashares ETF is designed to provide investors with exposure to the S&P 500 index while offering enhanced income potential. It aims to track the performance of a yield-optimised index based on the S&P 500 and incorporates a covered call strategy to generate additional income.

- iShares S&P 500 AUD Hedged ETF ($IHVV): This ETF provides exposure to the S&P 500 while hedging currency risk for Australian investors, aiming to mitigate the impact of USD/AUD fluctuations on returns.

- BetaShares S&P 500 Equal Weight ETF ($QUS): This fund offers an equal-weighted approach to investing in the S&P 500, ensuring that each constituent contributes equally to the portfolio rather than being dominated by the largest companies.

Each of these ETFs has its own unique characteristics, liquidity and expense ratios.

💡Related: Discover the best-performing ETFs on the ASX→

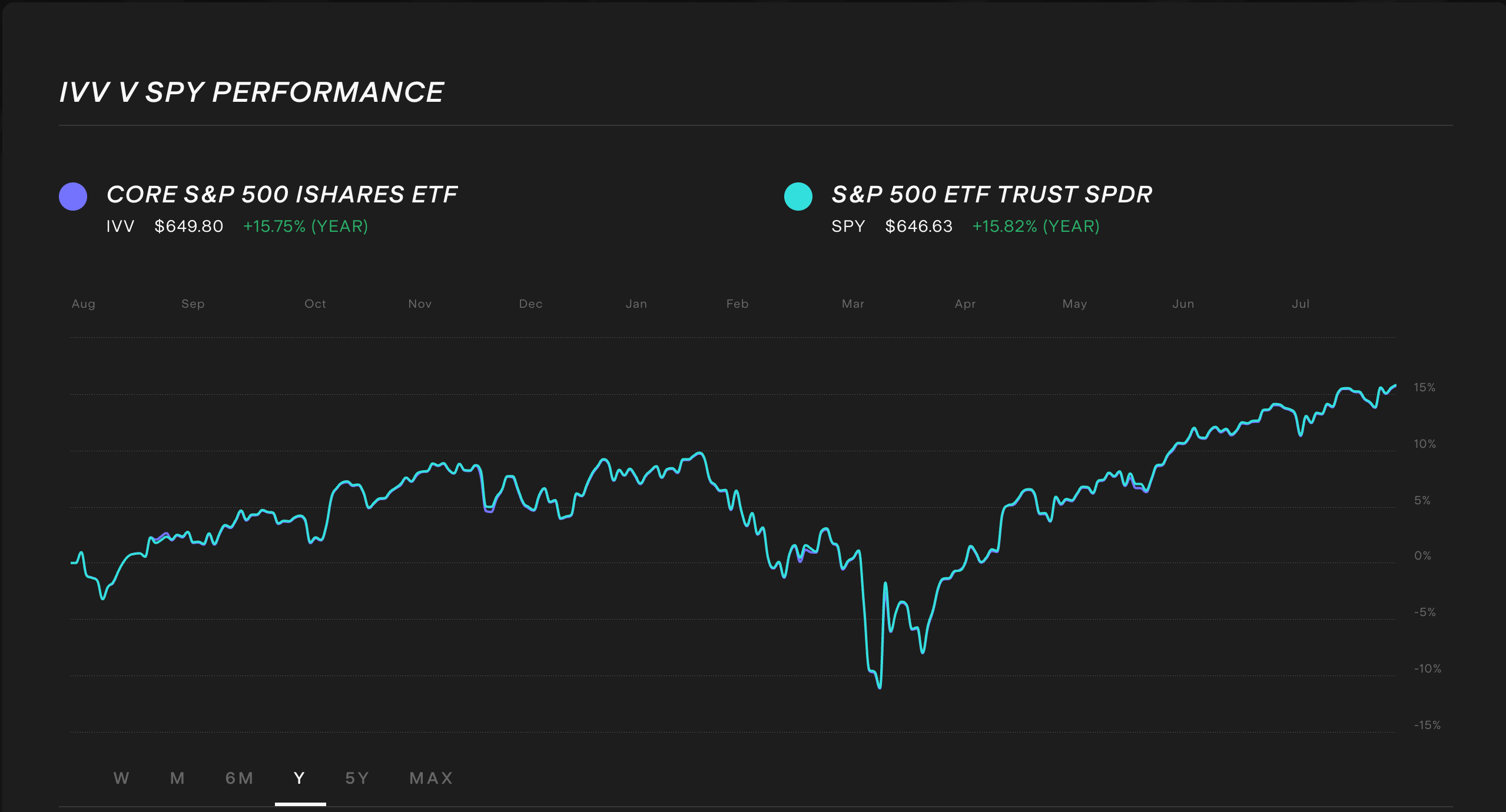

What is the main difference between IVV and SPY?

There are some core differences between IVV and SPY, the two most popular ETFs that track the S&P 500. See the breakdown below:

IVV | SPY | |

|---|---|---|

Benchmark | S&P 500® Index | S&P 500® Index |

Share price | Lower barrier to entry - $63.90 (as of 3 March 2025) | Higher barrier to entry - $956.88 (as of 3 March 2025) |

Expense ratio | Lower expense ratio - 0.04% | Higher expense ratio - 0.0945% |

Distribution frequency | Quarterly | Quarterly |

Sources: iShares S&P 500 ETF and SPDR® S&P 500® ETF Trust

What U.S. ETFs track the S&P 500?

There are several ETFs in the U.S. that track the S&P 500 index. Here are three popular options:

- SPDR S&P 500 ETF Trust ($SPY): Managed by State Street Global Advisors, SPY is one of the oldest and largest ETFs tracking the S&P 500. It aims to provide investment results that correspond to the performance of the index. SPY is highly liquid and widely traded, making it a popular choice for investors seeking broad exposure to the U.S. equity market.

- Vanguard S&P 500 ETF ($VOO): Offered by Vanguard, VOO aims to track the performance of the S&P 500 index. It is known for its low expense ratio, making it an attractive option for cost-conscious investors. VOO is designed to provide broad exposure to the U.S. equity market and is widely held by both retail and institutional investors.

- iShares Core S&P 500 ETF ($IVV): Managed by BlackRock, IVV seeks to track the investment results of the S&P 500 index. It offers investors a low-cost, tax-efficient way to gain exposure to large-cap U.S. stocks. IVV is known for its tight tracking of the index and is a popular choice among long-term investors.

🆚 Which S&P 500 index fund to choose: SPY vs VOO→

How to choose an S&P 500 index fund?

Choosing an S&P 500 index fund involves considering various factors to align your investment portfolio with your investment goals.

Here's a step-by-step guide to help you select an S&P 500 index fund:

- Understand your investment goals: Determine your investment objectives, such as long-term growth, income generation, or diversification.

- Research different index funds: Conduct thorough research on different S&P 500 index funds available in the market. Consider factors such as expense ratio, fund size, tracking error, and fund provider reputation.

- Review historical performance: Evaluate the historical performance of the index funds. While past performance does not guarantee future results, it can provide insights into the fund's ability to track the index effectively.

- Check fund structure: Determine whether you prefer an ETF or a mutual fund structure. Consider factors such as trading flexibility, minimum investment requirements, and tax efficiency.

- Read the prospectus: Carefully read the prospectus and fund documentation to understand the fund's investment strategy, risk profile, and any additional features or limitations.

Remember that investing involves risk, and it's essential to conduct your due diligence and consider your risk tolerance before making any investment decisions.

✅ Check out this article: Are these the best index funds to invest in?→

Ways to buy S&P 500: ETFs vs mutual funds

When it comes to buying the S&P 500 in Australia, you have the option of investing through ETFs (Exchange-Traded Funds) or mutual funds.

Both options provide exposure to the S&P 500 and both tend to be low-cost index funds, but there are some key differences between them:

Structure

ETFs are traded on stock exchanges like individual stocks, while mutual funds are bought and sold through the fund company at the end-of-day net asset value (NAV).

Flexibility

ETFs can be bought and sold throughout the trading day at market prices, offering more flexibility for investors to enter or exit positions. Mutual funds are typically bought or sold at the end of the trading day based on the NAV.

Cost

ETFs tend to have lower expense ratios compared to mutual funds. ETFs are passively managed and aim to replicate the index performance, whereas mutual funds may have higher management fees due to active management.

Minimum investments

Mutual funds often require a minimum initial investment, which can be a barrier for some investors. ETFs generally don't have such minimum investment requirements which means you can start investing in an S&P 500 ETF from as little as US$10 using fractional shares.

Tax efficiency

ETFs are generally more tax-efficient than mutual funds. ETFs typically have lower capital gains distributions since they are structured to minimise taxable events.

It's important to consider your investment goals, trading preferences, costs, and tax implications when deciding between ETFs and mutual funds to invest in the S&P 500.

The strategies investors are using to invest in the S&P 500

Dollar cost averaging

Dollar cost averaging suits disciplined, risk-averse investors by investing a fixed amount regularly, which averages out the purchase price and mitigates the impact of market volatility. For those less inclined to time the market, it reduces the risk of making a large investment at a market peak.

Buy and hold

For passive investors, this strategy involves buying an S&P 500 index fund and holding it long-term to capture average market returns with minimal management. Active investors might use buy-and-hold as a core, stable component of a broader strategy, accepting short-term volatility for long-term gains. Typically used when an investor is going to make a lump sum investment with a long investment time horizon.

Value averaging

Ideal for investors who want to actively manage their portfolio, value averaging adjusts the investment amount to reach a predetermined target value, buying more when prices dip and less when prices rise. This proactive approach can potentially boost returns, though it demands more frequent portfolio reviews and decision-making.

Rebalancing

Both passive and active investors can use rebalancing to periodically adjust their portfolios and maintain a target asset allocation, ensuring their risk profile remains consistent. This process involves selling assets that have grown disproportionately and buying those that lag, thereby enforcing a disciplined buying low and selling high approach.

Pros and cons of investing in the S&P 500

Pros | Cons |

|---|---|

Broad market exposure: The S&P 500 represents a diverse range of 500 large-cap U.S. companies, providing investors with broad market exposure. | Lack of small-cap exposure: The S&P 500 focuses on large-cap companies, potentially missing out on opportunities presented by smaller or mid-sized companies. |

Historical performance: The S&P 500 has historically delivered strong long-term returns, outperforming many other investment options. | Single-country risk: Investing solely in the U.S. market through the S&P 500 exposes investors to risks associated with the domestic economy and regulatory changes. |

Passive investing: Investing in the S&P 500 allows for a passive investing approach, as it seeks to replicate the index's performance. | Concentration risk: The index is market-cap weighted, meaning larger companies have a greater impact, potentially leading to concentration risk. |

Liquidity: S&P 500 ETFs are usually highly liquid, making it easy to buy or sell shares. | Currency risk (for non-U.S. investors): Non-U.S. investors face currency exchange rate risk when investing in the U.S.-based S&P 500. |

How do beginners start investing in the S&P 500?

The best way for investors to start investing in the S&P 500 is through an ETF. You'll first need to open an account with an investing platform.

This investment option is a low-cost way to gain exposure to the S&P 500 index and instantly adds diversification to your investment strategy.

Utilise our investment return calculator to see the potential growth of your investment over the long term. The projected values shown in the calculator are hypothetical in nature and should not be relied on to inform your investment decisions.

If new investors want to learn more about investing in the market through ETFs, check out this beginner's guide.

What if I invested $1,000 a month in the S&P 500 20 years ago?

An initial investment of $1,000 in the S&P 500 20 years ago would have grown to $5,280 (without dividend reinvestment).

Sign up in minutes and join 500k+ investors with access to an industry-leading share trading experience.

Investing in S&P 500 FAQs

Yes, Australians can invest in the S&P 500.

The most common method is to invest in an ETF that tracks the S&P 500 index. You can set this up in just minutes through the Stake app. Sign up now.

Investing solely in the S&P 500 may provide exposure to a diversified portfolio of large-cap U.S. companies. However, it is important to consider your risk tolerance, investment goals, and overall portfolio diversification. Diversifying across various asset classes and regions can help mitigate risk and optimise long-term returns.

Yes, it is possible to invest AU$100 in the S&P 500. There are fractional shares and low-cost investment options like ETFs that allow investors to buy small amounts of the S&P 500 or its equivalent instruments. If you have more capital to start with, check out our article on how to invest $5,000 in Australia.

You will need a minimum of AU$500 to start investing in an exchange-traded fund that tracks the S&P 500 on the ASX due to the minimum marketable parcel (MMP) rule.

However, when investing in the U.S. stock market, the minimum is US$10 to place your first trade in an S&P 500 ETF using fractional shares.

The S&P/ASX 200 is usually considered the equivalent of the S&P 500 in Australia. The S&P/ASX 200 is a market-capitalisation-weighted index that represents the performance of the top 200 companies listed on the Australian Securities Exchange (ASX). It is designed to measure the performance of the Australian equity market and is widely used as a benchmark for the Australian stock market.

Vanguard Australia does not offer an S&P 500 ETF. The closest alternative is the Vanguard U.S. Total Market Shares Index ETF ($VTS) which tracks the performance of the CRSP US Total Market Index. This index has over 3,500+ constituents and covers 100% of the U.S. investable equity market, making it a much broader exposure asset than one that just follows the top 500 companies.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Articles sources

[1] The ETF Impact Report 2025-2026 from State Street Investment Management