Are these the best index funds to invest in? September [2024]

Index funds offer broad exposure to some of the world’s most popular indexes, such as the S&P 500, Nasdaq or Dow Jones Industrial Average. Many people invest in index funds as a means of low-cost diversification in their portfolio. But what are some of the characteristics of the best index funds? Read on to find out.

Popular index funds to invest in on Stake

Fund Name | Ticker | Share Price | 5-Year Return | AUM | Expense Ratio |

|---|---|---|---|---|---|

SPDR S&P 500 ETF Trust | US$561.46 | 16.09% | $567b | 0.0945% | |

Vanguard S&P 500 ETF | US$516.08 | 15.88% | $506b | 0.03% | |

Vanguard U.S. Total Stock Market Index | US$277.14 | 15.12% | $429b | 0.03% | |

Invesco QQQ Trust ETF | US$476.76 | 21.30% | $291b | 0.20% | |

Vanguard Growth Index Fund | US$376.73 | 18.51% | $137b | 0.04% | |

Vanguard Australian Shares Index ETF | A$100.06 | 8.78% | $16b | 0.07% | |

iShares S&P 500 ETF | A$55.30 | 15.53% | $8b | 0.04% | |

Vanguard MSCI Index International Shares ETF | A$125.60 | 13.17% | $8b | 0.18% | |

Betashares Australia 200 ETF | A$134.96 | 9.09% | $5b | 0.04% | |

Betashares NASDAQ 100 ETF | AU$42.83 | 20.68% | $5b | 0.48% |

Data as of 28 August 2024. 5-year return data as of 31 July 2024. Sources: Stake, ASX.com.au, etfdb.com.

Note: These index funds have been selected based on the following:

- Popularity of the tracked index

- Long-term performance

- Actively traded on the Stake platform

- Expense ratio

- Overall cost

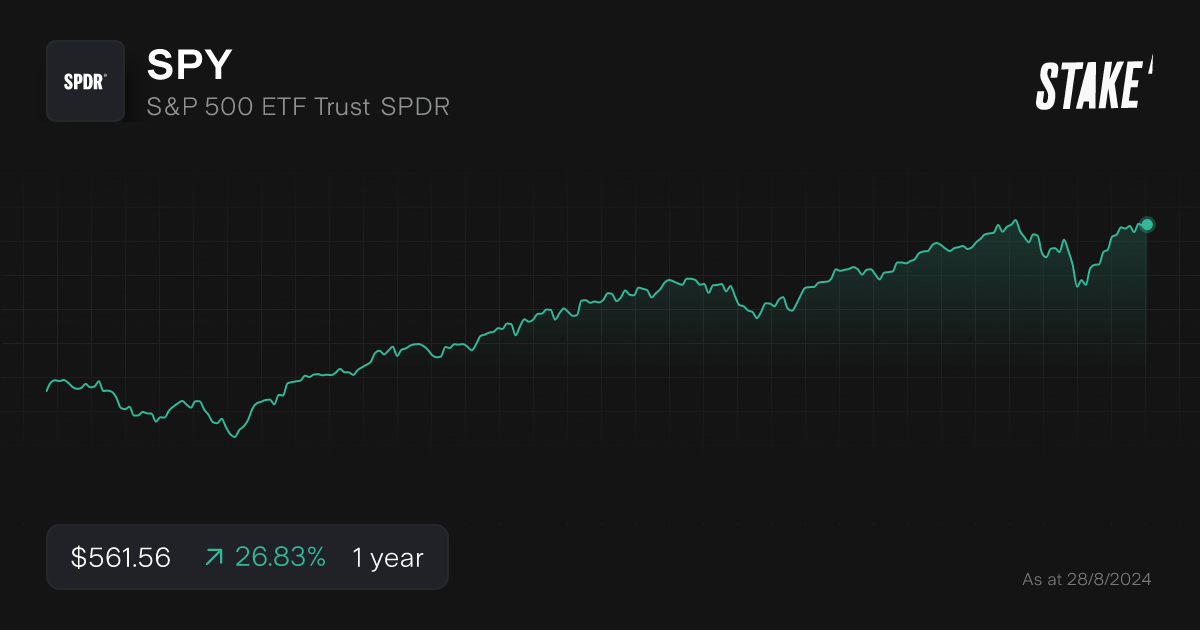

1. SPDR S&P 500 ETF Trust ($SPY)

- Assets under management: US$567b

- Share price (as of 28/08/2024): US$561.46

- Stake investors watching $SPY: 18,637

The SPDR S&P 500 ETF Trust ($SPY) is an exchange-traded fund that aims to track the performance of the S&P 500 index. It is also one of the longest-running ETFs, launched in 1993.

This index is often used to gauge the general health of the U.S. market. The companies in the index represent approximately 80% of the total U.S. market capitalisation. The index fund is available on the ASX and Wall St markets.

Expense ratio: 0.09%

Distribution frequency: Quarterly

Last distribution per share: US$1.59

Available on: Stake AUS and Stake Wall St

2. Vanguard S&P 500 ETF ($VOO)

- Assets under management: US$506b

- Share price (as of 28/08/2024): US$516.08

- Stake investors watching $VOO: 27,491

Like $SPY, the Vanguard S&P 500 ETF ($VOO) is an exchange-traded fund that aims to track the performance of the S&P 500 index. Vanguard launched the ETF in 2010 and remains one of the largest and most popular ETFs tracking the index.

Like the S&P 500, the three largest holdings of $VOO are Apple Inc. ($AAPL), Microsoft Corp, ($MSFT) and Nvidia Corp. ($NVDA).

Expense ratio: 0.03%

Distribution frequency: Quarterly

Last distribution per share: US$1.78

Available on: Stake Wall St

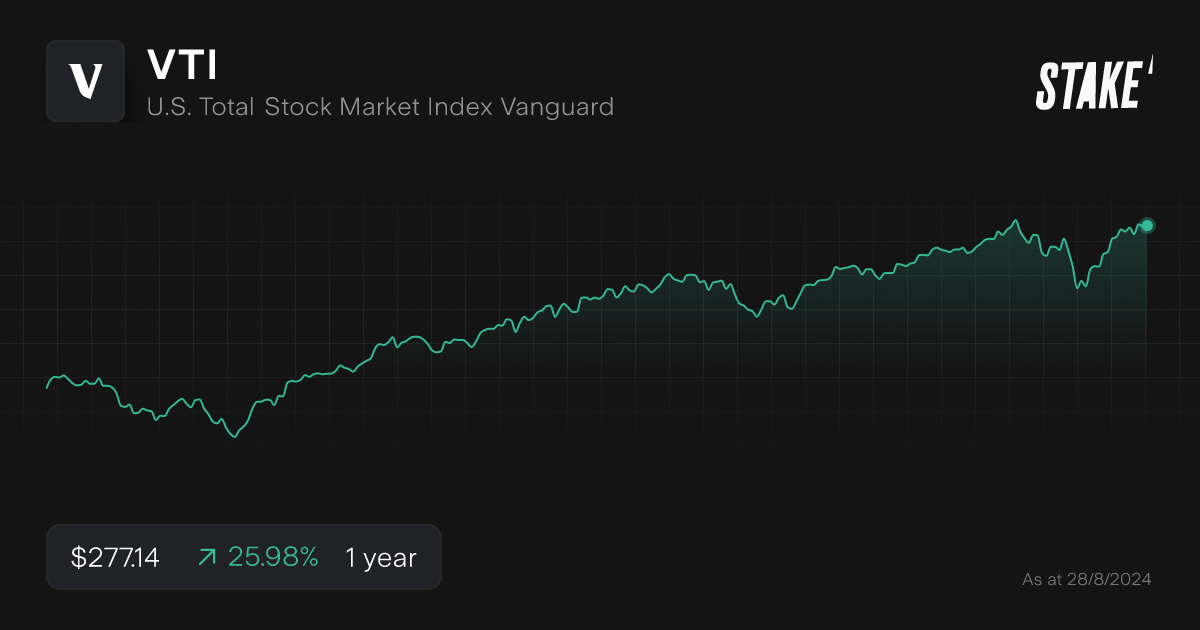

3. Vanguard U.S. Total Stock Market Index ($VTI)

- Assets under management: US$429b

- Share price (as of 28/08/2024): US$2777.14

- Stake investors watching $VTI: 10,095

The Vanguard Total Stock Market ETF ($VTI) is an exchange-traded fund that provides broad exposure to the entire U.S. market.

The ETF tracks the CRSP US Total Market index which is comprised of over 3,500 U.S.-listed constituents, from micro to mega cap stocks.

Vanguard launched the ETF back in 2001 and continues to be popular with investors looking for diverse exposure to small, medium and large companies across all U.S. sectors.

Expense ratio: 0.03%

Distribution frequency: Quarterly

Last distribution per share: US$0.95

Available on: Stake Wall St

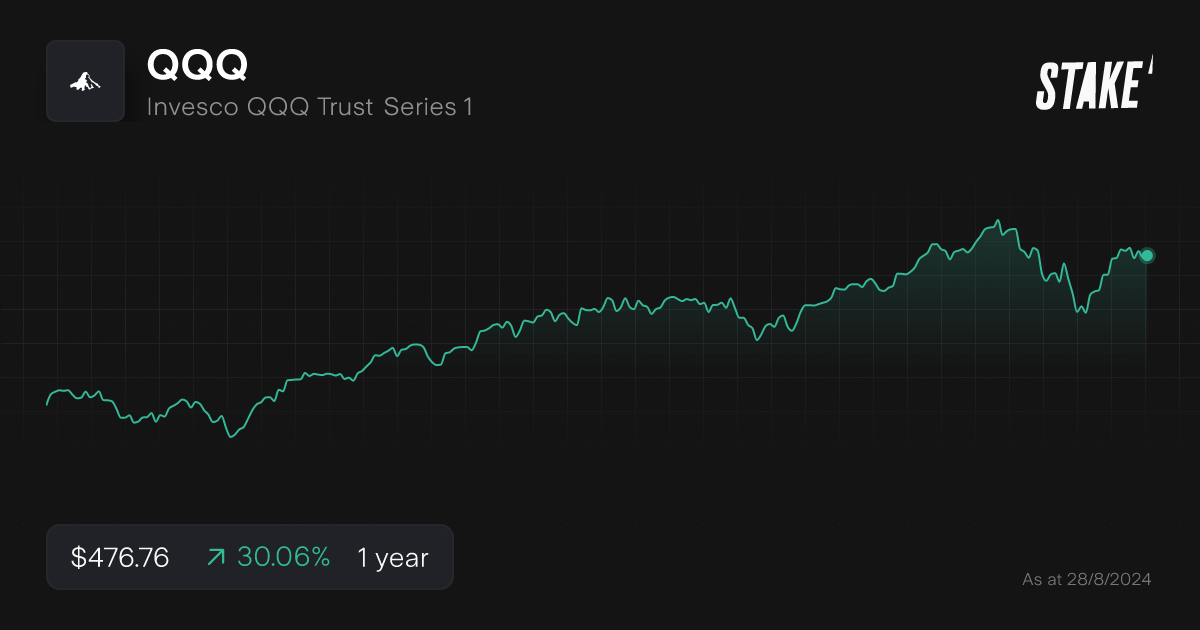

4. Invesco QQQ ETF ($QQQ)

- Assets under management: US$291b

- Share price (as of 28/08/2024): US$476.76

- Stake investors watching $QQQ: 13,947

The Invesco QQQ ETF ($QQQ) is a passively managed exchange-traded fund tracking the Nasdaq-100 index.

This index comprises the 100 largest non-financial companies on the Nasdaq with the top three represented sectors being Information Technology, Communication Services and Consumer Discretionary.

Invesco launched the ETF in 1999 and has gained considerable popularity in the last 10 years thanks to the increased interest in tech and growth industry-leaders like $NVDA and $AAPL.

Expense ratio: 0.20%

Distribution frequency: Quarterly

Last distribution per share: US$0.76

Available on: Stake Wall St

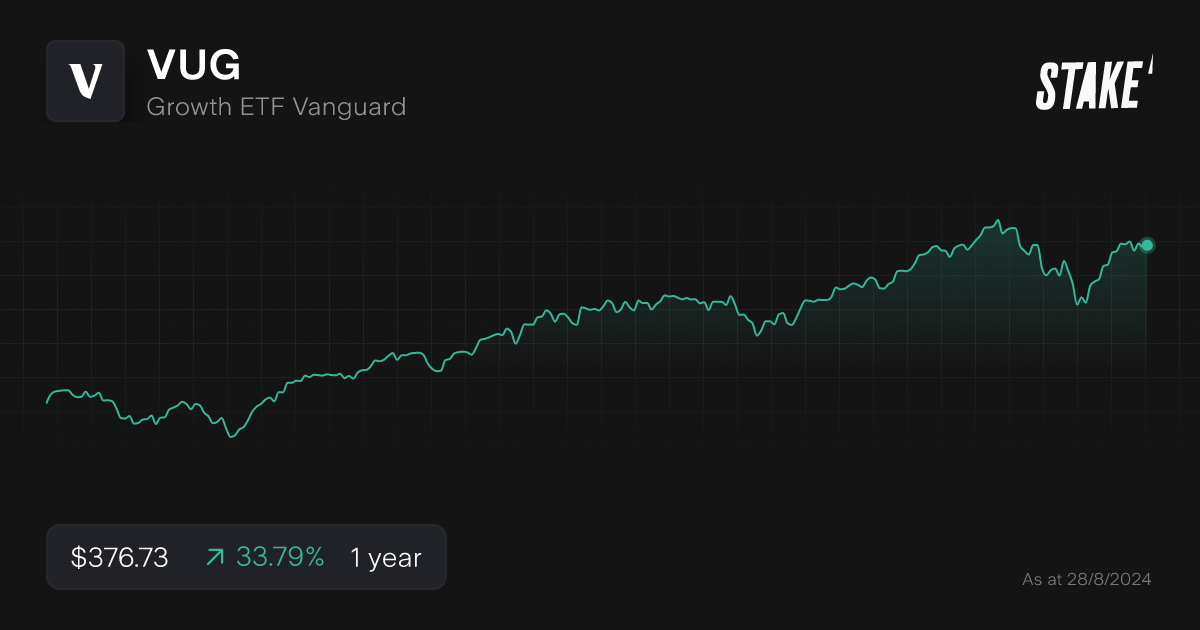

5. Vanguard Growth Index Fund ETF ($VUG)

- Assets under management: US$137b

- Share price (as of 28/08/2024): US$376.73

- Stake investors watching $VUG: 3,877

The Vanguard Growth Index ETF ($VUG) is an exchange-traded fund that aims to track the performance of the CRSP US Large Cap Growth Index, representing 85% of the cumulative capitalisation of the growth-style companies inside the CRSP US Total Market Index (the index $VTI tracks).

First launched in 2004 by Vanguard, the ETF has seen increased interest in recent years given the strong performance from some of its biggest constituents in the Tech, Healthcare and Consumer Discretionary sectors.

Expense ratio: 0.04%

Distribution frequency: Quarterly

Last distribution per share: US$0.46

Available on: Stake Wall St

6. Vanguard Australian Shares Index ETF ($VAS)

- Assets under management: A$16b

- Share price (as of 28/08/2024): A$100.06

- Stake investors watching $VAS: 162,572

The Vanguard Australian Shares Index ETF ($VAS) is an exchange-traded fund offering investors broad exposure to the Australian equities market. The fund seeks to track the performance of the S&P/ASX 300 index, which covers the top 300 ASX-listed companies by market cap.

Launched in 2009 by Vanguard, this ETF is considered one of the best index funds for its diverse range of sector representation ranging from Financials to Materials and Healthcare. Its largest holdings as of July 2024 are Commonwealth Bank of Australia ($CBA), BHP Group Ltd ($BHP) and CSL Limited ($CSL).

Expense ratio: 0.07%

Distribution frequency: Quarterly

Last distribution per share: A$0.67

Available on: Stake AUS

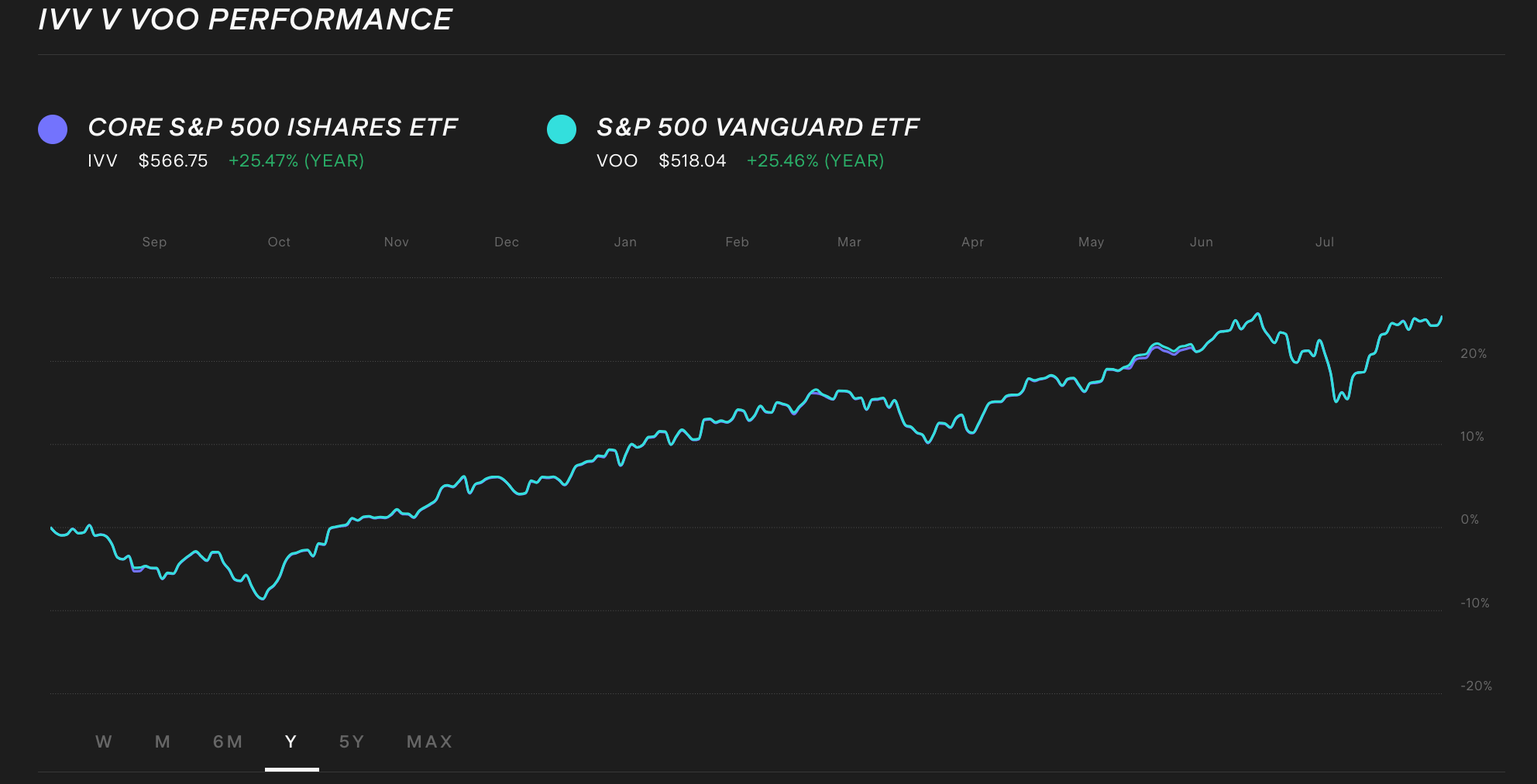

7. iShares S&P 500 ETF ($IVV)

- Assets under management: A$8b

- Share price (as of 28/08/2024): A$55.30

- Stake customers watching $IVV: 17,356

The iShares S&P 500 ETF ($IVV) provides exposure to the 500 leading U.S.-listed companies and aims to replicate the performance of the S&P 500 index.

Similar to $SPY, this ETF is available on the ASX and Wall St, providing more flexibility for those who prefer investing in either market. $IVV has also been available for some time, launching in 2000 and popular among Australian and U.S. investors for its relatively low cost and broad exposure.

Expense ratio: 0.04%

Distribution frequency: Quarterly

Last distribution per share: A$0.14

Available on: Stake AUS and Stake Wall St

✅ Deep dive into IVV and if it's a good investment→

8. Vanguard MSCI Index International Shares ETF ($VGS)

- Assets under management: A$8b

- Share price (as of 28/08/2024): A$125.60

- Stake investors watching $VGS: 155,397

The Vanguard MSCI Index International Shares ETF ($VGS) is an exchange-traded fund that allows investors to diversify their portfolio with a mix of global equities. $VGS tracks the MSCI World ex-Australia Index, which includes large and mid-cap stocks from developed markets outside of Australia.

The fund is heavily weighted towards the United States (73%) with a heavy technology focus. Japan (6%) and the United Kingdom (3.9%) are the next largest market allocations.

Launched in 2014 by Vanguard, it could be one of the best index funds for risk-tolerant ASX investors seeking exposure to medium-large scale international companies.

Expense ratio: 0.18%

Distribution frequency: Quarterly

Last distribution per share: A$2.18

Available on: Stake AUS

9. Betashares Australia 200 ETF ($A200)

- Assets under management: A$5b

- Share price (as of 28/08/2024): A$134.96

- Stakle investors watching $A200: 7,344

The Betashares Australia 200 ETF ($A200) is an exchange-traded fund providing exposure to the Solactive Australia 200 index, which tracks the top 200 ASX-listed companies by market capitalisation (learn more about investing in the ASX 200).

Launched in 2018, this relatively young index ETF is quite popular with those looking to gain tactical exposure to the Australian market over the long-term.

Expense ratio: 0.04%

Distribution frequency: Quarterly

Last distribution per share: A$0.90

Available on: Stake AUS

10. Betashares Nasdaq 100 ETF ($NDQ)

- Assets under management: AU$5b

- Share price (as of 28/08/2024): AU$42.83

- Stake investors watching $NDQ: 155,756

The Betashares Nasdaq 100 ETF ($NDQ) is an exchange-traded fund that aims to track the performance of the popular Nasdaq 100 index, comprised of the 100 largest non-financial Nasdaq-listed companies.

Some investors would argue this is the best index fund to invest in, given the index represents some of the most cutting-edge technology companies and provides diversified exposure to a high-growth sector that is lacking in the Aussie market.

This fund is an ASX-listed equivalent to $QQQ listed on the ASX for Aussie investors who like the comfort of investing in their own backyard without the need to exchange from AUD to USD.

Expense ratio: 0.48%

Distribution frequency: Semi-annually

Last distribution per share: A$0.97

Available on: Stake AUS

Where is the best place to invest in index funds?

One way is directly via the index fund provider such as Vanguard or iShares, though not all the above options will be available. If you want to diversify across multiple fund providers and/or single stocks across the Australian and U.S. markets, your best bet would be choosing an investing platform.

Lucky for you all these index funds mentioned above are available to buy on Stake. To access them, and 12,000+ other stocks and ETFs, follow these steps:

- Sign up to Stake (Hint: you can use the Stake referral code to get rewarded when you fund)

- Explore, research and discover an index fund that aligns with your investment strategy and risk tolerance

- Fund your account and place an order

- Monitor its performance regularly and bear in mind that market fluctuations can happen over time

🎓 Learn more in our guide on how to start buying index funds in Australia.

More S&P 500 index funds on Stake

As the S&P 500 is the most traded and watched index in the world, there are many options available to investors. There are smaller index funds that track small-cap U.S. companies only, such as the Vanguard Russell 2000 ETF ($VTWO).

Discover some other popular S&P 500 choices here:

S&P 500 Index Fund Name | Ticker |

iShares Core S&P 500 ETF Stake Wall St) | |

Vanguard S&P 500 ETF (Stake Wall St) | |

SPDR S&P 500 ETF Trust (Stake Wall St) | |

BetaShares S&P 500 Equal Weight ETF (Stake AUS) |

Top Nasdaq index funds on Stake

For investors who align their strategy more closely to growth and technology, the Nasdaq 100 Index is a great way to diversify across that sector. Find a few other Nasdaq funds below:

Nasdaq 100 Index Fund Name | Ticker |

Invesco QQQ ETF (Stake Wall St) | |

Invesco NASDAQ 100 ETF (Stake Wall St) | |

Fidelity NASDAQ Composite Index ETF (Stake Wall St) | |

Betashares Nasdaq 100 ETF (Stake AUS) |

Which index fund has the strongest return over the last 10 years?

From the above list, the Invesco QQQ Trust ETF ($QQQ) has the highest annualised return over the last 10 years with +17.89% as of 26 August 2024.

What are the considerations when investing in index funds?

As you search for the best index fund to invest in, it’s important to take certain considerations into account.

- Sector concentration: Some indexes can be heavily weighted toward certain sectors or industries (e.g., tech in the Nasdaq and S&P 500). Sector concentration can be beneficial if the concentration is on an upward trajectory, however, this can inversely increase risk if those sectors perform poorly.

- Expense ratios: Expense ratios are effectively annual management fees. You’ll notice passively managed index funds typically have lower expense ratios over actively managed funds. If you’re looking to buy and hold, pay close attention to the ratio of your chosen provider. Bear in mind, some index funds replicate indexes with strong long-term performance, which may incur a higher expense ratio.

- Long-term strategy: Index funds are best suited for long-term investors who are willing to hold through market fluctuations. Taking the time to look at the performance of a given index fund over 5-10 year periods will give you a possible idea of what your investment could look like. Please note, past performance is not indicative of future performance.

- Volatility: Like any financial instrument, index funds are still subject to market volatility. You should always assess your risk tolerance before investing and determine what level of potential short-term loss and fluctuation you’re comfortable with.

Remember, all investing comes with inherent risk, so precautions and research should always be front-of-mind in your search.

Frequently asked questions about index funds

Index funds are considered strong investments by some investors due to their relative low-cost, broad diversification and consistent long-term resilience to market fluctuations.

They tend to follow a passively managed and fully replicated approach to their index tracking, reducing the potential risks associated with active management (particularly with human error), with lower expense ratios and some tax benefits for certain investors.

Investors also tend to favour index funds due to their compound-friendly nature, making them ideal for long-term investors.

As with any investment product, there are always risks to consider before adding them to your portfolio, so make sure to do your research before investing.

Investing in index funds on Stake will cost $3 brokerage for each trade (in AUD for Aus or USD for Wall St). For U.S. markets, you can start investing in index funds with as little as US$10 thanks to fractional shares.

Investing in any security on Stake (including index funds) will incur a brokerage fee of $3 per trade on any trade up to $30k in value (AUD for Stake AUS and USD for Stake Wall St).

If you’re making an investment in an ASX-listed index fund for the first time, there is a A$500 minimum value for the first trade, this is an ASX rule known as the Minimum Marketable Parcel of shares.

There are a few indexes globally that are seen as the most popular with high amounts of trade volume. They are:

- Standard and Poor’s 500 (S&P 500)

- S&P/ASX 200

- Dow Jones Industrial Average

- Nasdaq Composite

- Nasdaq 100

- Russell 2000

- Hang Seng Index

- FTSE 100

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.