How to invest in index funds in Australia [2025 guide]

Index funds offer a unique opportunity for investors seeking an easy way to diversify their portfolio with varied exposure to different sectors, industries and markets. Read on to discover how you can start investing in index funds in Australia.

This article focuses on buying a specific type of security, however, it is not a recommendation to invest in them and should not be taken as financial advice. Do your own research and make decisions with your financial circumstances in mind, or even consider getting advice from a licensed financial adviser before investing.

Introduction to index funds

In the ever-evolving stock market landscape, different investment vehicles are beginning to gain traction alongside traditional individual equities. Diversification-focused ETFs and index funds have emerged as a beacon of reliability and efficiency for Australian investors.

Our 2025 guide is tailored to break down the process of investing in index funds, offering you a deep dive into the strategies, mechanics, and intricacies of this particular security investment.

Whether you're a seasoned investor expanding your portfolio or a newcomer making your first moves on the stock market, understanding index funds is an indispensable part of your financial journey.

✅ Next step in your journey: Are these the best index funds to invest?

How to invest in index funds in Australia

There are a few ways to access an index fund. One way is to invest in an index fund directly via a provider.

However, if you’re looking to start investing in index funds and want the flexibility to choose from multiple funds and possibly buy Australian shares as well, you’ll need to open a brokerage account with a trustworthy investing platform that has access to the ASX and U.S. markets.

You can easily do this by following these steps:

- Select an investing platform

- Sign up

- Research and choose which index fund is right for you

- Fund your account and place an order

- Track its performance over time

1. Select an investing platform

The gateway to your index fund investment is selecting a platform that resonates with your investment goals.

Australia boasts a plethora of platforms, and the key to choosing the right one will depend on your financial goals. For instance, some platforms focus on passive investing with lower brokerage fees while others may lean towards more advanced trading features and aggressive investing strategies.

As each platform offers something a little bit different, it’s best you conduct your own research before opening an investment account or consult a financial advisor/professional if you require additional guidance.

2. Sign up

Once you've decided on a platform, the next step is signing up. This process typically involves providing personal and financial details and completing a KYC (Know Your Customer) procedure.

More often than not, you’ll need to have easy access to your government-issued ID along with financial information such as your Tax File Number (TFN).

Each platform may have slightly different requirements and processing times so ensure you check for more details with your chosen platform.

Sign up in minutes and join 500k+ investors with access to an industry-leading share trading experience.

3. Research and choose which index fund is right for you

Once you’ve signed up, it’s time to begin your research. It's crucial to have an understanding of financial markets to determine which index funds and securities will align best with your investment strategy.

There are many types of index funds available to invest in. Some track a particular index such as emerging markets or commodities, while others can provide exposure to a broad index like the S&P 500 or ASX 200.

Besides the stock market index being tracked, another consideration many investors have when looking at index funds is administration fees that could factor into the overall return.

Other factors investors tend to consider are whether or not the index fund is actively or passively managed, its current market capitalisation, assets under management and historical performance.

Take time to consider what your financial goals are and be sure to research any potential investment you’re considering ahead of time.

4. Fund your account and place an order

Once you’ve discovered an index fund you’re interested in, it’s time to fund your new investment account and make your move. Most investing platforms will have a range of deposit methods available for funding an account.

For instance, if you open an investing account with Stake, you’d have the option of funding your ASX and/or Wall St account using:

- Direct bank transfer

- Credit/debit card

- Google Pay

- Apple Pay

Once you’ve funded your account, you're ready to buy index fund shares. The minimum investment will depend on the market your index fund resides in, as well as the platform you’re using.

Not unlike individual stocks, placing an order is as simple as selecting your index fund and choosing the order type and amount that suits you.

5. Track its performance over time

The final step is more habitual; keeping a close eye on the performance of your new investment is essential for optimising your strategy.

Similar to regular stocks, index funds may increase and decrease in value over time, depending on the market conditions and investor sentiment.

Index fund investing is typically a long-term strategy, so patience is key.

How do index funds work?

An index fund is a type of mutual fund or exchange-traded fund (ETF) that aims to track the performance of a specific index.

The way an index fund tracks an index is by using invested money to construct a diversified portfolio that replicates the underlying index. Traditional index funds are typically passively managed, which can lead to lower management fees and a well-diversified portfolio while reducing some of the risks associated with individual stock investments.

🎓Learn more: Start your investing journey by learning how to invest in ETFs→

💡Related: Everything investors need to know about the S&P 500 Index →

What is the average return on index funds in Australia?

Index funds, like any other investment, can yield varying returns depending on a number of different circumstances, such as investment timeframe and the underlying index.

For example, the iShares S&P 500 ETF listed on the ASX has a total fund return over the last 10 years (p.a.) of 14.91% (as of 31 July 2025).[1]

A mutual fund or exchange-traded index fund that tracks the index may have a slightly different return over that same period, depending on factors such as the individual fund manager or the product’s expense ratio.

When searching for your investment opportunity, ensure you read through the Product Disclosure Statement (PDS) to gain a more holistic understanding of the fees and historical rate of return.

List of popular Australian index funds

There are several index funds available for investors in Australia so we've put together a list of some of the most popular among Stake investors below:

- Vanguard Australian Shares Index ETF ($VAS)

- iShares S&P 500 ETF ($IVV)

- Vanguard US Total Market Shares Index ETF ($VTS)

- BetaShares Australia 200 ETF ($A200)

- iShares Core S&P/ASX 200 ETF ($IOZ)

1. Vanguard Australian Shares Index ETF ($VAS)

One of the flagship investments on the ASX, the Vanguard Australian Shares Index ETF tracks the comprehensive S&P/ASX 300 index and provides investors with diverse exposure to local markets.

Its largest holding as of 31 July 2025 was Commonwealth Bank of Australia ($CBA).

2. iShares S&P 500 ETF ($IVV)

The iShares S&P 500 ETF is an ASX security that provides exposure to the largest 500 companies listed on the U.S. market. This includes companies with a large market capitalisation like Tesla ($TSLA), Apple ($AAPL) and Microsoft ($MSFT).

Its largest holding as of 22 August 2025 was Nvidia ($NVDA).

💡Related: Learn how to buy the S&P 500 in Australia →

3. Vanguard US Total Market Shares Index ETF ($VTS)

The Vanguard US Total Market Shares Index ETF casts the net a little wider than the iShares S&P 500 ETF in that it tracks almost 4,000 individual U.S.-listed shares.

Its largest holding as of 31 July 2025 was Nvidia ($NVDA).

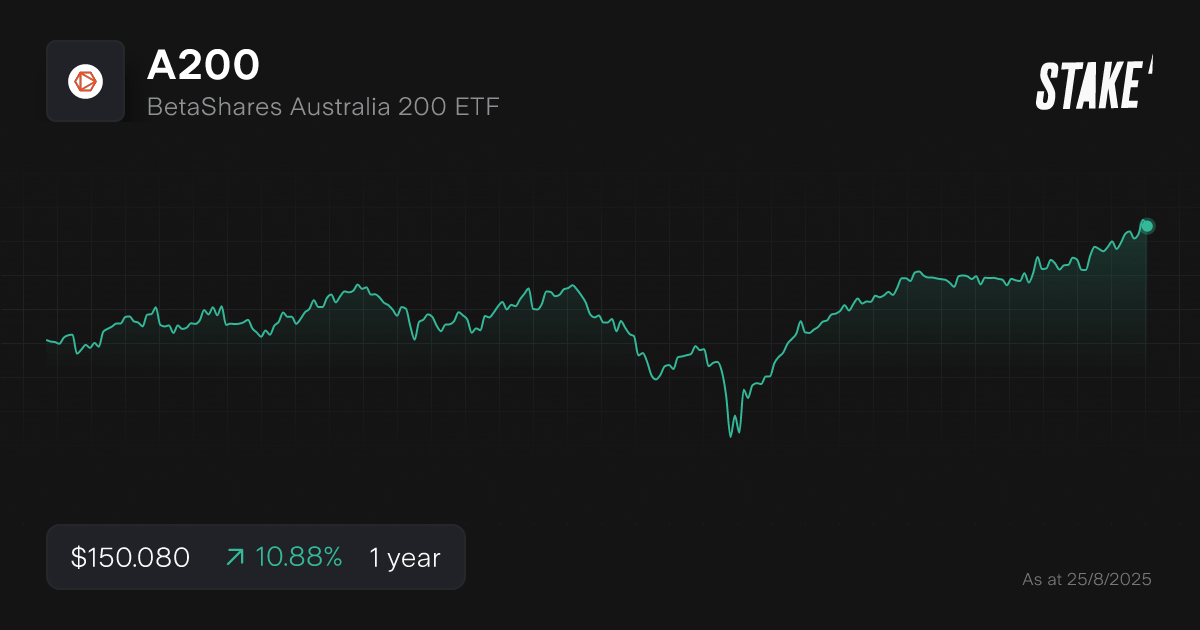

4. BetaShares Australia 200 ETF ($A200)

The BetaShares Australia 200 ETF tracks the ASX 200 index which covers the 200 largest companies listed on the ASX (by market cap).

Its largest holding as of 22 August 2025 was Commonwealth Bank of Australia ($CBA).

💡Related: Learn how to buy the ASX 200 in Australia →

5. iShares Core S&P/ASX 200 ETF ($IOZ)

Similarly, the iShares Core S&P/ASX 200 ETF seeks to provide weighted exposure to the S&P/ASX 200 Accumulation Index.

Its largest holding as of 22 August 2025 was Commonwealth Bank of Australia ($CBA).

What are the benefits of index funds?

Discover some of the benefits of investing in index funds below:

- Diversification: By investing across a broad range of assets in a single trade, index funds provide instant portfolio diversification, which offsets some of the risks associated with single security investing.

- Cost-effectiveness: Index funds are more cost-effective than purchasing the underlying assets individually (particularly in cases where a large number of securities are represented). When it comes to management fees, passive index funds will usually charge lower annual fees compared to actively managed funds.

- Simplicity: Index funds offer an easy way to invest in a variety of sectors or the entire market without having to invest in individual securities, making diversification much simpler.

- Accessibility: Many index funds and mutual funds allow investors to start with small amounts, making the markets accessible for a range of different investor types, from starters to pros.

- Transparency: One of the advantages of index funds is their asset allocation typically reflects well-known indices. This means that investors have clear visibility of where their money is invested, plus providers and fund managers will often have up-to-date information on holdings readily available for investors and researchers.

Some risks associated with an index fund investment

With any investment product there are always risks to consider before adding it to your portfolio.

- Market risk: As index funds track market indices, they are subject to fluctuations that may occur in the financial market. There are always risks associated with share investing, so ensure you make decisions with your risk tolerance in mind.

- Limited upside: Since index funds aim to match market performance, they don't offer the potential for above-market returns. Some investment funds have a stronger focus on growth and exceeding a stock market return, but they typically come with higher risk.

- Lack of flexibility: Passively managed index funds don’t adapt to market changes quickly, which can be a disadvantage during market downturns.

- Tracking error: This happens when there’s a discrepancy between the performance of the fund and its underlying index and can occur for any number of reasons. This is also why it’s important to keep a close eye on your investments over time and monitor them periodically.

- Inflation risk: Over time, inflation can erode the purchasing power of index fund returns.

Are index funds good for beginners?

Index funds are a great entry point for anyone new to investing. They’re low cost, easy to understand and give you instant diversification by tracking a benchmark index. That means you’re investing across a broad mix of stocks or bonds—no need to pick individual winners.

If you’re in it for the long term, market highs and lows along the way tend to matter less. It’s natural to worry about buying at the top, but over time, those peaks often fade into perspective. That’s the strength of a consistent, long-term investing approach.

🔥 Use our investment return calculator to see how your money could hypothetically grow in an index fund—or anything else you’re backing.

How to choose the right index fund

Selecting the right index fund for you will depend on a wide range of factors, including your investment goals, risk tolerance and investment horizon.

As you begin your investing journey, it’s a great idea to sit with a financial expert and assess different indices and the sectors they cover. There are an array of indexes that cover different market opportunities, sectors and sizes.

For instance, you may opt for commodity index funds which provide exposure to a particular commodity (such as gold or oil) without the impracticality of physically holding/storing the underlying commodity.

More risk-averse investors may instead look at bond index funds, which experience lower levels of volatility, but at the cost of higher returns.

Head to the stock comparison tool to analyse index funds and see which one is right for you. Check out a performance comparison of the index funds IVV and VAS over the last 5 years below.

How much money do you need to start investing in index funds?

Once you’ve opened a brokerage account and found an index fund you want to invest in, you’ll have to consider the minimum initial investment. This amount can vary between markets, platforms and regions.

For an index fund listed on the ASX

The Australian Securities Exchange (ASX) requires a minimum investment of A$500 (excluding brokerage) when purchasing shares in any Australian-listed security (including an index fund) for the first time. This is known as the ‘Minimum Marketable Parcel’ (MMP) of shares.

After owning A$500 of shares in an index fund, you’ll be able to invest smaller amounts thereafter.

For an index fund listed in the U.S.

The U.S. operates a little differently when it comes to the subject of minimum investment. On Stake Wall St, you can potentially begin investing in an index fund with as little as US$10 (excluding brokerage) with fractional shares.

Fractional shares allow investors to own a slice of a stock, without having to pay for a full share.

Sign up in minutes and join 500k+ investors with access to an industry-leading share trading experience.

Index fund FAQs

As with stocks, mutual funds and other investments, index funds can pay dividends (also known as distributions) to investors. Dividends paid are still subject to capital gains tax and can be impacted by expense ratios among other fees and factors.

Investors have the option to receive a cash dividend or some index ETFs let you set up a dividend reinvestment plan.

To get a better understanding of how distributions work for a particular index fund, it’s best to seek out further information from the provider of your chosen index fund.

The iShares Global 100 ETF ($IOO) generated the highest five-year annualised rate of return for investors. The index fund generated a 19.67% total annualised return over five years (date ending 31 July 2025).[2]

Index funds are becoming more popular with investors for a variety of reasons. In a single trade, investors can gain access to diversified investment portfolios in a particular market sector or across an entire stock market exchange.

The low cost of entry is another possible reason for the surge of investors seeking to invest regularly in index funds, especially when compared to buying the underlying stocks the ETFs hold individually.

Index funds have been popular so far in 2025 for Stake investors. In fact, the most purchased security on Stake AUS has been the iShares S&P 500 ETF ($IVV). The most popular index fund purchase on Stake Wall St was the S&P 500 Vanguard ETF ($VOO).

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.