S&P 500 Index: Everything investors need to know

Get to know the S&P 500, the world's most important stock market index.

What is the S&P 500 Index?

The S&P 500, or Standard & Poor's 500, is a leading stock market index in the United States, tracking the performance of 500 of the largest publicly traded companies across various sectors.

It is a vital benchmark for assessing the overall health and performance of the U.S. stock market, as it reflects the market capitalisation of these major corporations and their influence on the American economy.

Investors and financial professionals use the S&P 500 as a key reference point for evaluating portfolio performance and making investment decisions in the context of the broader stock market.

What is the S&P 500 calculation?

The S&P 500 Index is calculated using the following formula:

S&P 500 = Σ (Company Market Cap * Weight) / Index Divisor

where:

- Σ represents the sum of those products

- Company Market Cap is the market capitalisation of each company in the S&P 500

- Weight is the weighting of each company in the index, which is determined by its market capitalisation

- Index Divisor is a number that is adjusted daily to maintain the consistency of the index over time

The market capitalisation of a company is calculated by multiplying the company's stock price by the number of shares outstanding. The weighting of a company in the index is calculated by dividing the company's market capitalisation by the total market capitalisation of all 500 companies in the index.

The index divisor is a number that is adjusted daily to maintain the consistency of the index over time. This is necessary because the prices of the companies in the index fluctuate every day, which would cause the index value to change even if any company's market cap did not change. The index divisor is adjusted to offset the effects of these price fluctuations.

How is the S&P 500 constructed?

The S&P 500 is constructed by a committee at S&P Dow Jones Indices, which selects the 500 largest and most liquid publicly traded companies in the United States. These companies are chosen based on various factors, including market capitalisation, liquidity, and industry representation.

The stock index is designed to be a broad representation of the U.S. stock market and includes companies from various sectors. The selected companies are then weighted within the index based on their market capitalisation, with larger companies having a more significant impact on the index's performance.

The committee periodically reviews and updates the list of constituents to ensure the index continues to accurately reflect the market.

How does a company get into the S&P 500?

A company typically gets into the S&P 500 when it meets certain eligibility criteria and is selected by the committee at S&P Dow Jones Indices.

The primary criteria include being a U.S.-based company, having a market capitalisation that ranks among the top 500 in the country, and demonstrating a history of financial viability. Companies usually need to have positive cumulative four-quarter earnings, although exceptions can be made for some real estate investment trusts (REITs).

The committee regularly reviews and updates the index constituents, and when a company meets these criteria and is deemed to be representative of the U.S. stock market, it may be added to the S&P 500. This often occurs when a company grows and becomes one of the largest publicly traded companies in the United States.

What companies are in the S&P 500?

The composition of the S&P 500 can change over time as companies are added or removed based on their market capitalisation, financial health, and other factors. As of the writing of this article, the top 10 companies of the index were:

- Microsoft Corp ($MSFT)

- Apple Inc.($AAPL)

- Amazon.com Inc ($AMZN)

- Nvidia Corp ($NVDA)

- Alphabet Inc A ($GOOGL)

- Meta Platforms, Inc. Class A ($META)

- Alphabet Inc C ($GOOG)

- Berkshire Hathaway B ($BRK.B)

- Tesla, Inc ($TSLA)

- UnitedHealth Group Inc ($UNH)

For the rest of the companies, click here.

How to invest in the S&P 500?

Investing in the S&P 500 can be done through purchasing an S&P 500 index fund or an exchange-traded fund (ETF) that tracks the index.

Index funds allow for automated recurring investments, while ETFs are suitable for manual investments. These funds usually offer low costs and superior diversification for retail investors, as they typically own most or all of the stocks included in the S&P 500, thereby mimicking the performance of the overall index.

💡Related: Learn how you can start investing in S&P 500 in Australia→

💡Related: Is IVV a good investment right now?→

What is the S&P 500 returns for the last 20 years?

Here are the S&P 500 returns for the last 20, 10 and 5 years:

- In the past 20 years, the S&P 500 has returned +309%

- In the past 10 years, the S&P 500 has returned +135%

- In the past 5 years, the S&P 500 has returned +56%

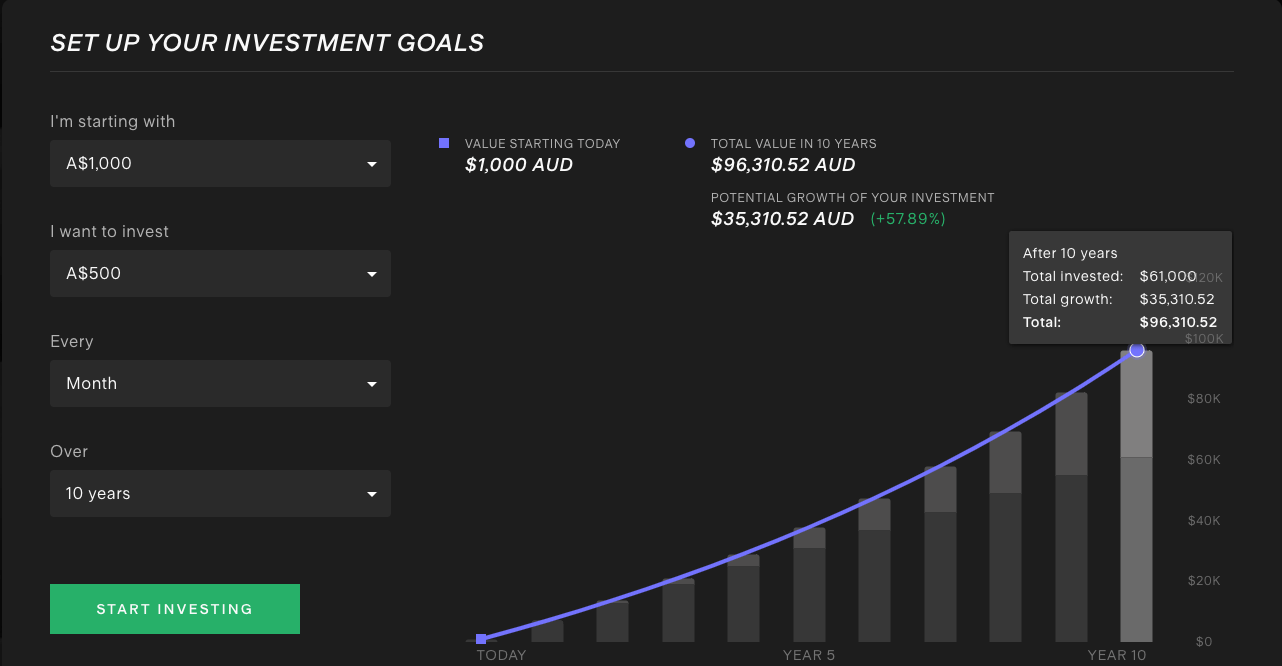

The investment performance calculator uses the nominal annualised S&P 500 return of 9.6% (1982-2022) to show potential growth of your investment over a period of time.

The projected values shown are hypothetical in nature and should not be relied on to inform your investment decisions.

What’s the difference between S&P 500 index and its competitors?

Find out how the S&P 500 index compares to the DJIA, Nasdaq and Russell 1000

S&P 500 vs Dow Jones Industrial Average

The S&P 500 and the Dow Jones Industrial Average (DJIA) are both prominent U.S. stock market indices, but they differ in significant ways. The primary distinction lies in their composition and methodology. The S&P 500 tracks the performance of 500 of the largest publicly traded U.S. companies, covering a broader spectrum of industries and sectors. It is market-capitalisation-weighted, meaning that the largest companies have a more substantial impact on the index.

In contrast, the DJIA index consists of only 30 major industrial companies, making it significantly smaller in scope. The DJIA is price-weighted, where companies with higher stock prices have more influence, irrespective of a company's size or market capitalisation. As a result, the S&P 500 is considered a more comprehensive and diversified representation of the U.S. stock market, while the DJIA provides a narrower view, focusing on a select group of large, well-established companies.

S&P 500 vs Nasdaq

The key difference between the S&P 500 and the Nasdaq Composite Index lies in their composition and focus. The S&P 500 includes 500 of the largest publicly traded companies in the United States, encompassing a wide range of sectors, such as technology, healthcare, finance, and more.

In contrast, the Nasdaq Composite is composed of almost 3,000 companies, and it places a specific emphasis on technology and internet-related businesses. The Nasdaq is known for its tech-heavy nature and is often associated with growth and innovation. It includes many smaller and newer companies, making it more volatile than the S&P 500, which is viewed as a broader representation of the U.S. stock market.

S&P 500 vs Russell 1000

The primary difference between the S&P 500 and the Russell 1000 lies in their respective scope and selection criteria. The S&P 500 tracks the performance of 500 of the largest publicly traded U.S. companies, representing a broad cross-section of industries and sectors.

On the other hand, the Russell 1000 comprises the 1,000 largest U.S. stocks, providing a more extensive coverage of the domestic stock market. The Russell 1000 is not limited to just 500 companies like the S&P 500, and it includes a broader range of companies, both large and mid-sized. As a result, the Russell 1000 encompasses a larger portion of the U.S. equity market, while the S&P 500 offers a narrower focus on the top 500 companies.

✅ Get a breakdown of some of the best index funds to invest in→

Frequently asked questions about S&P 500 Index

Some of the disadvantages of the S&P 500 include its concentration in large-cap stocks, which can lead to the under-representation of smaller and potentially high-growth companies. It may also be impacted by the performance of a few dominant sectors, potentially making it less diversified.

The S&P 500 is market-cap weighted which means that it is influenced more by companies with larger market caps, which can result in a lack of balance in terms of representation.

Lastly, it does not account for market dynamics like sector bubbles or overvaluation, potentially leading to exposure to market downturns or bubbles when share prices of a certain sector could be overvalued.

The S&P 500 is named after its creators and publishers, Standard & Poor's Financial Services LLC. Standard & Poor's is well-known for its financial analysis and providing credit ratings, and it created the S&P 500 as one of its flagship stock market indices. So, the name "Standard & Poor's" is a reflection of the company that developed and maintains the index.

The company responsible for keeping track of the constituents of the S&P 500 is S&P Dow Jones Indices. S&P Dow Jones Indices is a subsidiary of S&P Global and is responsible for maintaining and managing a wide range of stock market indices, including the S&P 500. They regularly review the composition of the index, adding or removing companies as necessary to ensure it accurately reflects the U.S. stock market's performance.

This does not constitute financial product advice nor a recommendation to invest, it is for informational purposes only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking appropriate financial or taxation advice from a licensed adviser before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.