Is IVV:ASX ETF a good investment right now?

The iShares S&P 500 ETF, more commonly known by its ticker $IVV, has seen greatly increased trading volume over the last 12 months, with the ETF making its way to the top of Stake’s most traded asset list on the ASX for 2024. $IVV holds the top 500 U.S. stocks, and with the S&P 500 soaring, the ETF has seen an explosion of trading volume in 2024, with a 156% increase in buy orders placed compared to 2023.

Is IVV a good investment for the long term?

$IVV has increased 32.00% over the last 12 months and 95.52% over the past five years, as of 15 January 2025. Since its inception, it has had a total return of 7.38% as of 31 December 2024.[1]

It has been one of the best index funds for investors who want broad exposure to U.S. equities for further diversification of their portfolio. The investment is considered to be better for investors with a medium-to-high risk tolerance who seek long-term growth.

The best long-term investment can vary for each investor based on their financial goals and risk tolerance, so it's important to do your research and align if this is the right investment for you.

How to buy IVV shares in Australia?

The main way to invest in the IVV ETF in Australia is by using an online investment platform with access to the Australian Securities Exchange. Follow our step by step guide below:

1. Find a stock investing platform

To buy shares in IVV on the ASX, you'll need to sign up to an investing platform with access to the ASX. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, PayTo, debit card or even Apple/Google Pay.

3. Search for IVV

Find the ETF by name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own the shares, you should monitor their performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

This guide aims to equip you with the necessary steps to begin your investment journey in the $IVV ETF. Remember, investing involves risks, and it's important to do your research or consult with a financial advisor to align your investments with your financial goals and risk tolerance.

IVV share price and performance

At the time of writing this article, the $IVV share price is $62.82 and trading around it's all-time high.

What is the average return on IVV?

The IVV ETF has seen total returns of 37.38% over the past 1 year, 14.62% p.a. over the past 3 years and 17.16% p.a. over the past 5 years, as of 31 December 2024.

What is the IVV management fee?

As of 31 December 2024, the $IVV management fee is 0.04%, as detailed in the current factsheet.[2]

IVV minimum investment

The minimum investment is $500 if you wish to place a buy order on $IVV.

The ASX requires a minimum investment when purchasing shares in any ASX-listed security for the first time. It is known as the Minimum Marketable Parcel rule.

Stake is a CHESS-sponsored platform so to invest in $IVV the minimum amount of your first order must be $500. Once the minimum marketable parcel is met, you can place smaller order sizes to get more shares in $IVV.

IVV holdings

$IVV holds the top 500 U.S. stocks, with the top 10 holdings depicted below.

The fund has strong exposure to tech companies with four out of the top 10 companies held being in the Information Technology sector. The Information Technology sector makes up 31.80% of $IVV, the largest representation of any sector in the ETF.

After Information Technology, the next largest sectors represented in $IVV are the Financials, Consumer Discretionary and Healthcare sectors.

Ticker | Company Name | Sector | Market Value | Weight (%) |

|---|---|---|---|---|

Apple, Inc. | Information Technology | $793,507,479.66 | 7.15% | |

NVIDIA Corporation | Information Technology | $731,916,020.45 | 6.59% | |

Microsoft Corporation | Information Technology | $694,655,729.07 | 6.26% | |

Amazon.com Inc. | Consumer Discretionary | $457,860,773.07 | 4.12% | |

Meta Platforms Inc | Communication | $297,001,389.77 | 2.68% | |

Tesla Inc | Consumer Discretionary | $252,251,085.08 | 2.27% | |

Alphabet Inc. - Class A Shares | Communication | $9,372,406,498.56 | 2.25% | |

Broadcom Inc. | Information Technology | $235,654,085.69 | 2.12% | |

Alphabet Inc. - Class C Shares | Communication | $7,913,323,192.06 | 1.85% | |

Berkshire Hathaway Inc. Hld B | Financials | $7,843,070,510.40 | 1.64% |

Data as of 13 January 2025.

Does IVV pay dividends?

$IVV has paid a consistent dividend each quarter since its inception in 2008.

Its most recent dividend was priced at $0.1891 per share and the payment date was 9 January 2025.

The 15:1 stock split in December 2022 saw the average dividend payout drop from between $1-$2 to a dividend between $0.12-$0.19.

What is the dividend yield of iShares S&P 500 ETF ($IVV)?

The dividend yield for the iShares S&P 500 ETF is 0.97% as of January 2024.

Comparing IVV to other S&P 500 ETFs

It’s a smart decision to look at all the options available to you if you are looking to diversify your portfolio by covering the U.S. market. It's crucial to understand that past performance is not indicative of future results and that investing in any asset carries inherent risks.

While $IVV may currently be the most popular U.S. index fund on Stake, there are many ETF options that provide exposure to some of the world’s largest companies listed in America.

✅ Learn how to invest in the S&P 500 from Australia→

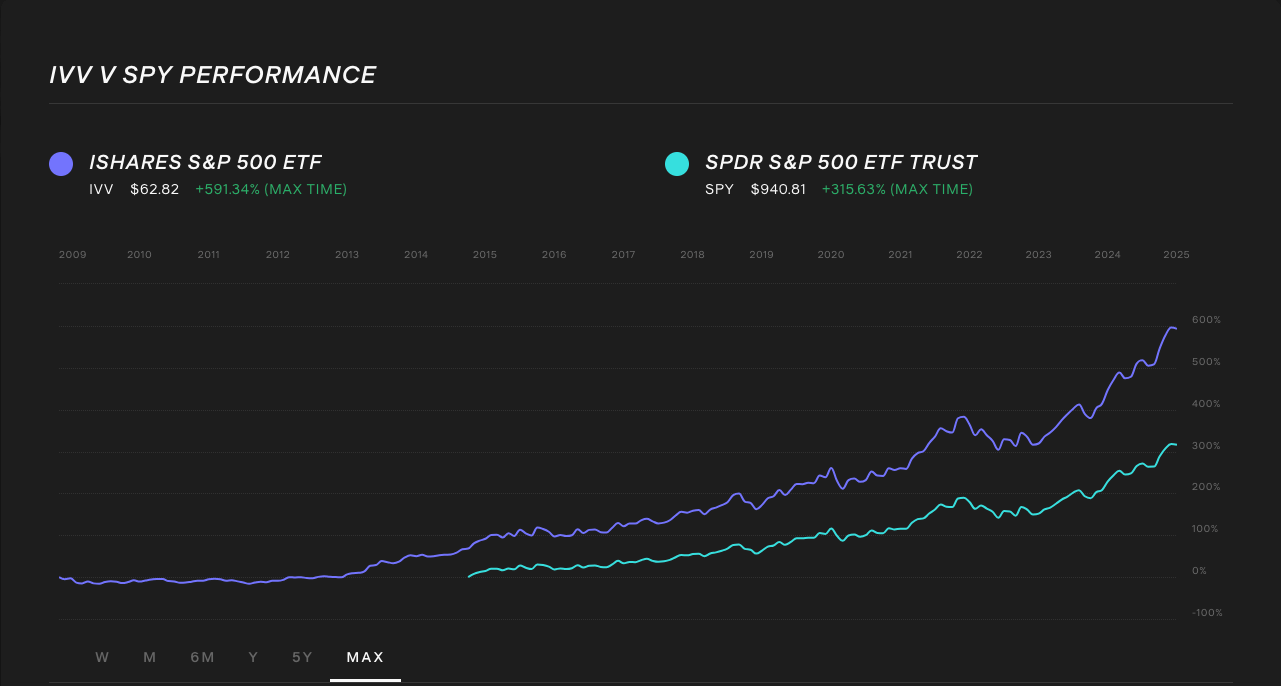

IVV vs SPY

The SPDR® S&P 500® ETF Trust ($SPY) is a very similar ETF to $IVV. Both provide exposure to the 500 largest US-listed companies and are designed to track the performance of the S&P 500 Index.

Two key differences to consider are:

- The management cost of $SPY is 0.0945% vs 0.04% of $IVV.

- The accessibility of $IVV is far better for investors since the share price of the fund is much lower. $IVV is sitting around the $62 mark, while $SPY is currently $940, making it far harder to invest in for investors with less capital.

👉Learn more at IVV vs SPY on our ETF comparison tool.

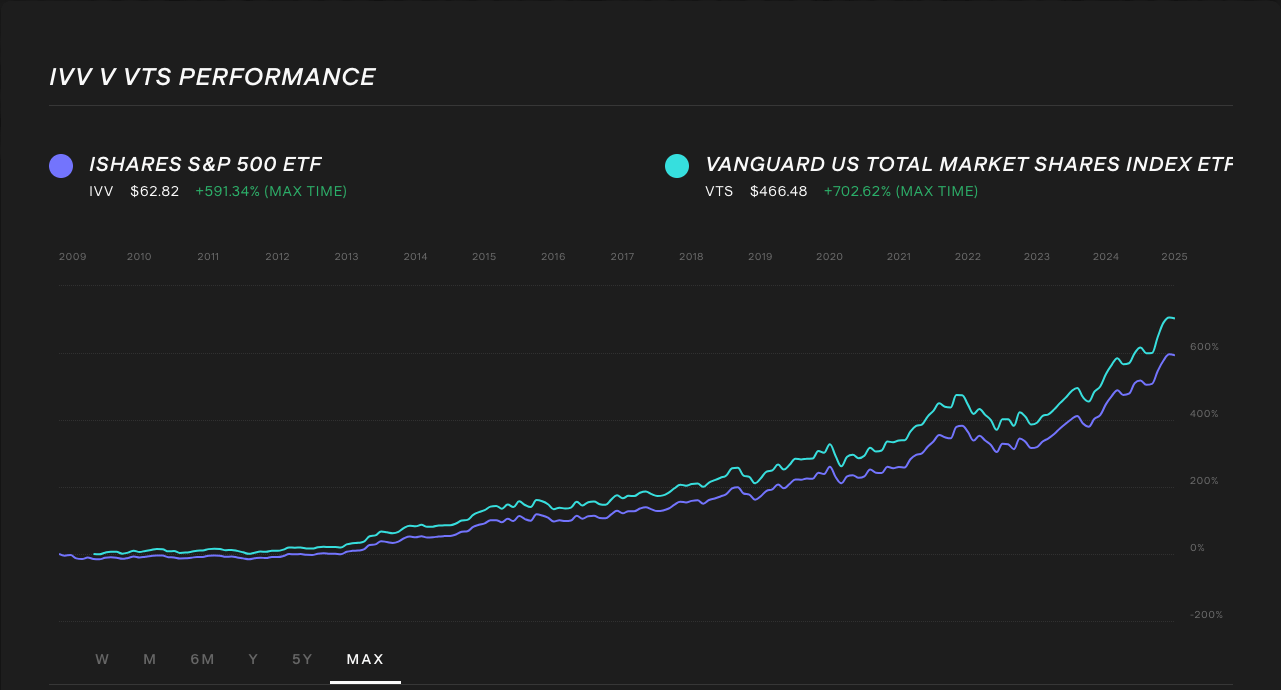

IVV vs VTS

While $IVV covers the performance of the S&P 500 Index, the Vanguard US Total Market Shares Index ETF ($VTS) tracks the performance of the CRSP US Total Market Index. This gives investors exposure to 100% of the investable equity market in the United States (it includes 3,500 constituents across mega, mid, small and micro capitalisations).

👉Learn more at IVV vs VTS on our ETF comparison tool.

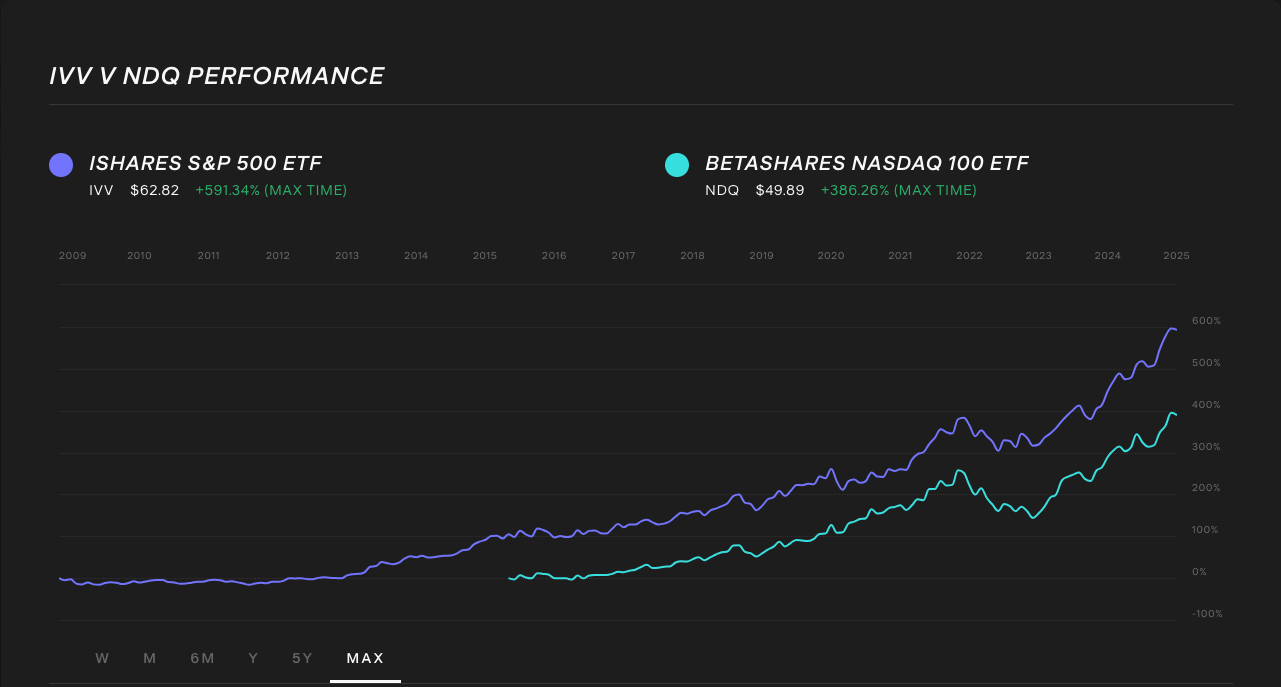

IVV vs NDQ

The Betashares Nasdaq 100 ETF ($NDQ) tracks the performance of the NASDAQ-100 Index, focusing primarily on technology, telecommunications and retail companies. This ETF will not provide as much diversification as $IVV, but is an option for tech enthusiastic investors (follow these steps here to start investing in the Nasdaq from Australia).

👉Learn more at IVV vs NDQ on our ETF comparison tool.

Is IVV the best S&P 500 ETF?

The best S&P 500 ETF will be different for each investor and will be determined by each person’s investment time horizon, strategy, risk tolerance and goals.

$IVV has a low management fee, solid trading volume, significant assets under management and is accessible.

It's essential to conduct thorough research, keep updated on market developments and be aware of the associated risks.

💡Related: Find a U.S. index fund to invest in on Wall St→

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

IVV:ASX ETF FAQs

The iShares S&P 500 ETF ($IVV) is considered a solid option for investors that fit into the following criteria:

- Interested in gaining exposure to established U.S. companies and the overall U.S. market

- Have a long-term time horizon

- Seek growth opportunities

- Have a medium-to-high risk tolerance

Any investment is subject to risk and it depends on your risk tolerance to determine if an asset is a good addition to your portfolio. Blackrock has stated the $IVV ETF is appropriate for investors with a medium-to-high risk/return profile.

Disclaimer

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation, particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

Our $3 applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that apply.

Article sources

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.