How to choose an investment platform in 2024

Investment platforms offer the opportunity to securely buy, sell and hold financial instruments such as shares or exchange-traded funds. However, not all platforms are equal. Dive into our tips on how to choose an investing platform that suits your investing needs.

What is the best investment platform to use?

Choosing an investment platform can be overwhelming, with countless options offering different features, fees, and investment choices. Before you start your search, consider your financial goals and investing experience to determine which features matter most to you.

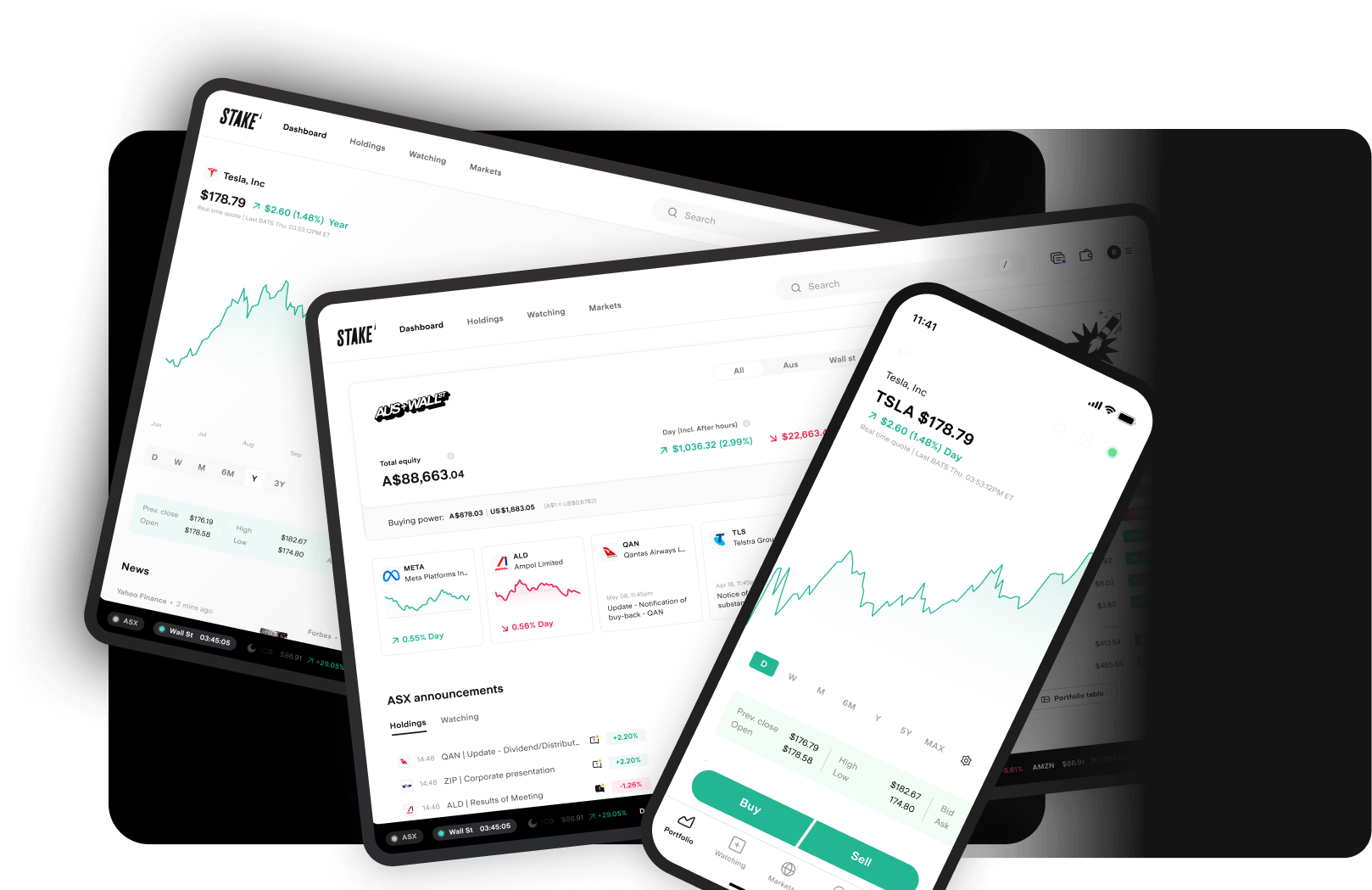

As an example, Stake offers a user-friendly platform, transparent fees, educational resources, and diverse investment opportunities across Australian and U.S. markets, making it suitable for both new and experienced investors. However, as we are an investment platform, we are unable to provide financial advice which some investors may be searching for.

To help you in your search, here are some key areas to consider when choosing an investment platform.

What are the main things to consider when choosing an investment platform?

- What are your investment goals and style?

- What fees are associated with investing?

- What investment products are available?

- Opening an investing account

- Educational resources

- Easy-to-use investment platform

- Minimum investment

- Secure and regulated

- Customer support

What are your investment goals and style?

Your personal finance circumstances, overall investment goals and risk appetite play an important role in discovering the right investment platform that complements your style.

For example, are you a ‘set and forget’ type of investor who is looking for passive/micro investing options for the long term? You’ll probably search for a provider that exemplifies simplicity with platform features like ready-made portfolio options or auto-investing.

If you’re more of an ambitious trader looking to take charge of your investment portfolio, you may search for a trading platform that incorporates comprehensive financial data along with access to alternative investments for lower fees.

Platforms that are considered industry leaders tend to cater to a wide range of experience levels, from new investors to seasoned pros.

What fees are associated with investing?

Another important consideration is how much investment platforms charge for their features and brokerage services. Specialty and alternative investment providers such as mutual funds and financial advisers may charge additional fees for their services.

If you already have your eye on a particular platform, locate its pricing page and have a look at some of the fees they charge and decide if they align with your budget.

As an example, if international markets like the U.S. are part of your investment strategy, then the FX fees (particularly per trade) would likely factor into your considerations. In this case, a brokerage firm that offers a flat fee per trade or a low FX fee may appeal to you. Similarly, if you intend to place large orders it may serve you to ensure there are no hidden fees surrounding lump sum investments. An example of this would be a platform charging $5 for a trade worth up to $1,000 and scaling up to $29.95 for a trade worth $10,000.

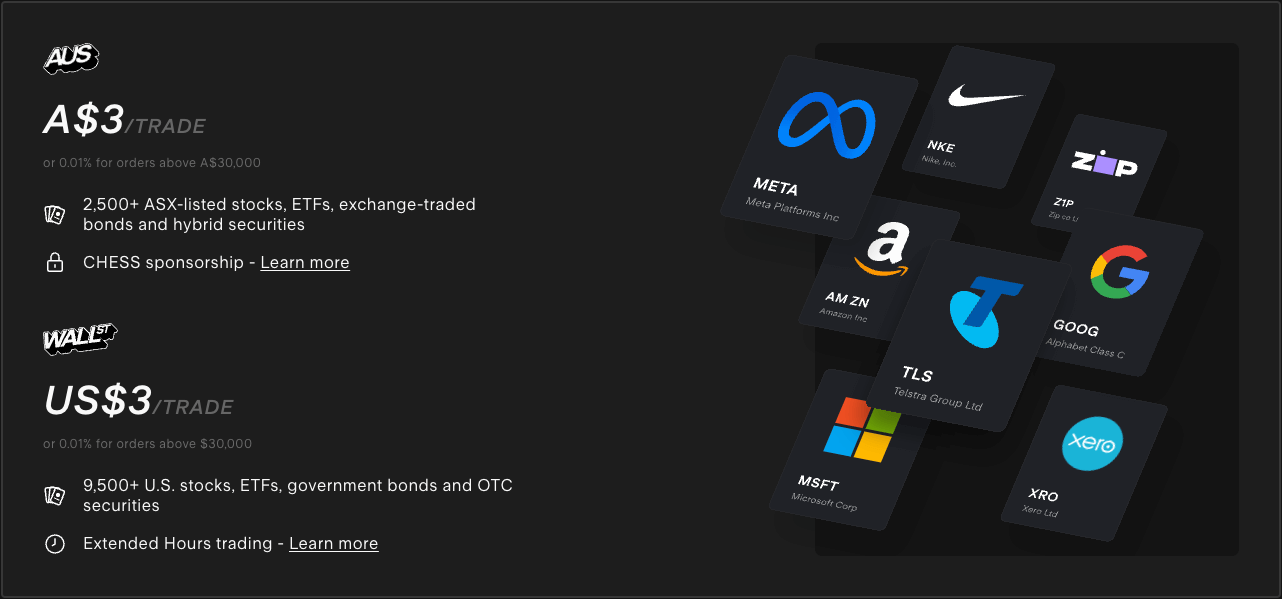

We are transparent about our fees at Stake

At Stake, we’re committed to simple, consistent and transparent brokerage fees. We have a flat fee of $3 on any trade up to $30,000 or 0.01% on trades above $30,000 (AUD for Stake AUS and USD for Stake Wall St) and no inactivity fees. See the Stake fees for more info.

What investment products are available?

It’s advisable to choose an investment platform that offers a diverse range of financial instruments that appeal to you. Ask yourself, are you looking for individual stocks, exchange-traded funds (ETFs) or alternative investments such as government bonds, OTC stocks or REITs?

The types of investment opportunities you’re looking for should guide your decision-making process and help you narrow down your platform options.

If you’re seeking a wide array of investment options in one place, then a platform like Stake would be suitable. Stake provides access to 12,000+ securities to invest in across the ASX and Wall St including shares, ETFs, bonds, OTC stocks, hybrid securities and more.

🎓 Learn more: 10 Reasons why you should invest in U.S. markets→

📈 Learn more: What are over-the-counter stocks?→

🏛️ Learn more: What are government bonds?→

🏢 Learn more: What are REITs?→

Opening an investing account

Now that you’ve thought about your investment goals and are starting to align your strategy, it’s time to open your investing account. You now need to consider the ease of opening an account, which only takes a few minutes when signing up for an account with Stake.

It can be completed entirely via the app or on our website, all you need is your I.D.

Stake AUS investors are automatically designated their own unique Holder Identifier Number (HIN) when signing up for an ASX investment account since we are a CHESS-sponsored investing platform.

When opening a Stake Wall St account to invest in U.S. shares, we complete the W-8BEN form digitally for you.

Educational resources

Remember, the best investment platforms provide more than just a convenient channel to build your wealth. If you’re a new investor and want to learn the fundamentals or you have a passion for the markets as a whole, then your ideal platform should offer access to content that piques your interest.

If you’re currently looking through investment platforms, keep an eye out for the following channels:

Blogs and newsletters

Blog and newsletter content allows investment platforms to engage with audiences on a wider scale by providing timely, relevant and useful content that empowers readers to make more informed decisions. Most will also provide regular newsletter updates to subscribers’ inboxes that allow them to be informed wherever they are.

On Stake, you have a myriad of choices when it comes to informational blog content at The Stake Desk and convenient newsletter deliveries.

The Wrap is Stake’s weekly news update which looks at prevailing market trends and thematic movers and shakers. Under The Spotlight is the weekly deep dive into one of the investment products available on the platform.

Subscribe to our free newsletters

Insights, trends and company deep dives delivered straight to your inbox.

Education

Educational resources are increasingly in demand, particularly as several new investors enter the market.

For retail investors, developing an investing strategy, understanding the importance of due diligence before making a trade or setting a portfolio up for retirement planning can be overwhelming without experience. This is where great investment platforms make their mark. Platforms like Stake provide user-friendly content that introduces investing concepts in a practical and enlightening sense. Stake Academy empowers readers to make informed decisions by delving into relevant investment concepts and lets investors learn the fundamentals on their own terms.

Active social media accounts

A strong social media presence should not be discounted either. Investment platforms that are able to effectively communicate across multiple channels, and do so with a sense of authority and understanding should have some consideration.

Whether it’s a snippet of useful market data or professional analyses of financial markets, an investment platform that is able to capture attention while simultaneously educating is certainly worth consideration.

🎓 Learn more: Use our Stock Comparison Tool to compare stocks→

Easy-to-use investment platforms

Regardless of experience level, investors tend to favour executing trades on intuitive and user-friendly investment platforms.

While broad investment opportunities and low-cost brokerage fees can be important factors, the ease of use and overall fluidity of the platform are equally important. If you have your eye on a particular platform, consider taking it for a test drive by opening an account and exploring some of the unique features available.

If a platform has a mobile/desktop app, it may also help to look through app store reviews and see what existing customers are saying. With over 12,000 5-star ratings across the Apple App Store and Google Play Store, we’d say customers are fond of the Stake platform.

Watch the video below to see how a trade can be placed in less than 30 seconds.

Minimum investment

Investment platforms will typically set a minimum deposit and trading amount. These numbers will typically show up on a platform’s pricing page. Check out Stake pricing for more info.

The ASX

When investing on a CHESS-sponsored platform like Stake, the Australian Securities Exchange (ASX) stipulates a A$500 trade minimum (excluding brokerage) when purchasing shares in any ASX-listed security for the first time. This is known as the ‘Minimum Marketable Parcel’ (MMP) of shares.

Once the minimum marketable parcel is met you can place smaller order sizes to increase your position in that same security. The minimum value of subsequent buy orders is A$20.

The U.S.

If you’re looking to invest lower amounts of money per trade, you might seek out an investment provider that offers fractional U.S. shares, like Stake.

Fractional shares allow investors to buy and sell ‘fractions’ of stocks which makes diversification more affordable. Investors on Stake Wall St have access to fractional shares from as little as US$10.

This means if you wanted to buy Apple shares, you wouldn’t need to pay the full price of the share (US$208.14 as of 24 June 2024) but could buy as little as $10 worth (a 0.03343683 fraction of an Apple share).

Secure and regulated

Data-protection policies and regulation assurances are paramount considerations when choosing an investing platform.

There is always an element of trust when investing your money on a new platform. The platforms that showcase transparency and straightforwardness when it comes to the protection of your personal finances should always be considered.

If you already have your eye on a platform, take the time to seek out its privacy policy and security measures to ascertain whether you wish to open a brokerage account.

It can help to ask questions like;

- What security measures are in place to protect investment accounts from data breaches?

- Are there procedures to protect investment accounts from fraudulent trading activity?

- Is the platform CHESS-sponsored or protected in the relevant investment market?

CHESS sponsorship

ASX investors should keep an eye out for CHESS-sponsored platforms. CHESS stands for Clearing House Electronic Subregister System and is the system used by the ASX to keep track of trade settlements and share ownership.

Stake is a CHESS-sponsored platform, which means any investments you make on the ASX are registered directly with the exchange under your name and unique HIN. This extra layer of ownership and assurance can make all the difference when it comes to choosing the right investment platform.

Regulators

Whether you’re looking at Wall St, the ASX or other financial markets – your investment platforms should be regulated by the appropriate authorities. The Australian Securities and Investments Commission (ASIC) is the prime regulator for the ASX and ensures proper market conduct.

There are several regulators for U.S. markets. The Securities Investor Protection Corporation (SIPC) serves a similar function as the Federal Deposit Insurance Corporation (FDIC) does in protecting assets and investors.

The Financial Industry Regulatory Authority (FINRA) serves as the ASIC equivalent for Wall St investors.

Stake is licensed and regulated across Australian and U.S. markets. Our U.S. broker-dealer DriveWealth, LLC, is registered with the Financial Industry Regulatory Authority and is a member of the SIPC.

Protecting investment accounts

Another consideration to have is the level of security available on your prospective platform.

Options such as two-factor authentication, biometric authentication and other adjustable security features should be present.

You’ll find the best investment platforms lean heavily into the security of your funds, investments and account, Stake is no exception.

Two-factor authentication methods such as SMS or third-party authenticator applications such as Google Authenticator or Authy are available and used when performing certain actions on the platform.

If you’re on the app, you also have the option of activating additional security measures like biometric scanning or setting a numeric PIN code.

Customer support

Platforms with reliable customer support networks are always preferred, whether you’re a new investor or not. When you’re searching through platforms, discover the ease of finding the answers to frequently asked questions on the site.

If you have a question about account set up or particular trading fees, try reaching out to their support team and make a decision based on the usefulness of the response. Stake is Australian-owned and managed. Our world-class customer support team is always happy to answer any questions you have about the platform, our fees, or features you may want to see implemented in the future. Get in contact with us here.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

Investment platform FAQs

There are some fantastic platforms for new investors and Stake is certainly one of them.

Determining which one is right for you will come down to understanding what trading experience you’re looking for.

Passive investors who seek more hands-on advice may be best suited with a stock trading platform that is able to provide more personalised financial advice based on their financial circumstances.

The ‘set-and-forget’ investor who isn’t looking to actively manage their own portfolio will likely prefer platforms with a seamless interface and ability to make trades in a few taps.

Stake provides powerful tools for experienced investors along with extensive education materials for newcomers. The platform has a slick, user-friendly design that makes it easy to invest, navigate and discover new opportunities.

This will depend on the market you’re looking to invest in and individual factors like your personal finances, risk appetite and your overall investment strategy. In simple terms, to make a trade on the ASX you need a minimum trade size of AU$500, and on the U.S. markets you need a minimum trade size of US$10.

You’ll also need to factor in other fees that may apply. This includes any relevant brokerage or trading fees, FX transfer fees or costs to access premium features.

With Stake, your brokerage fee is just $3 on any trade up to $30,000 (AUD for Stake AUS and USD for Stake Wall St). Please note, as we are CHESS-sponsored, the ASX Minimum Marketable Parcel rule applies to initial investments for any ASX-listed security (as mentioned above).

If you’re looking to invest in Australian companies on the ASX, you may decide that opening a brokerage account with an Aussie-run platform is the best path forward. Stake is proudly 100% Australian-owned and managed with access to over 2,500 Australian stocks and ETFs and seamless Wall St access to 9,500+ stocks and ETFs. Funds are simple to deposit with a range of efficient methods from linking a savings account to Google Pay or Apple Pay.

A growing number of Australians are entering the world of investments and searching for ETFs for simple diversification. Some platforms are catered for customers to invest exclusively in ETFs with the caveat of fewer investment opportunities.

If you’re looking to invest in a variety of ETFs, shares and other securities, then Stake could be the platform for you. There are over 12,000 investable securities on the platform including Australian ETFs and U.S.-listed ETFs that include funds that track artificial intelligence technology to traditional index exchange-traded funds.

Please note that ETF holdings can change over time due to rebalancing and changes in the composition of the underlying index. You should always conduct your own research before you invest in any security for the first time.

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.