How to build wealth in Australia: 11 ways to consider

Australians are among the best in the world when it comes to creating long-term wealth.

Australian household wealth grew for a seventh straight quarter to reach $16.5t in the June quarter, according to the Australian Bureau of Statistics. Rising property prices and superannuation gains delivered a 1.5% – or $250b – increase in wealth during the quarter. Over 12 months, Australia’s household wealth increased 9.3%, or an impressive $1.4t.

This makes Australians some of the wealthiest people in the world. Global investment bank UBS ranks Australians fifth on average wealth and second on median wealth.

These numbers highlight the importance of property ownership, superannuation, savings, stocks, ETFs and income funds in driving long-term wealth creation.

Understand wealth building

Wealth building is the process of accumulating assets to secure financial freedom and stability. It involves setting a budget, saving, investing, and managing debt.

Investors need to set realistic financial goals that align with their age, risk tolerance, the need for diversification and whether they are seeking capital growth, income or a combination of both.

Automated savings, conscious spending, and setting investment goals are crucial to get your finances in order.

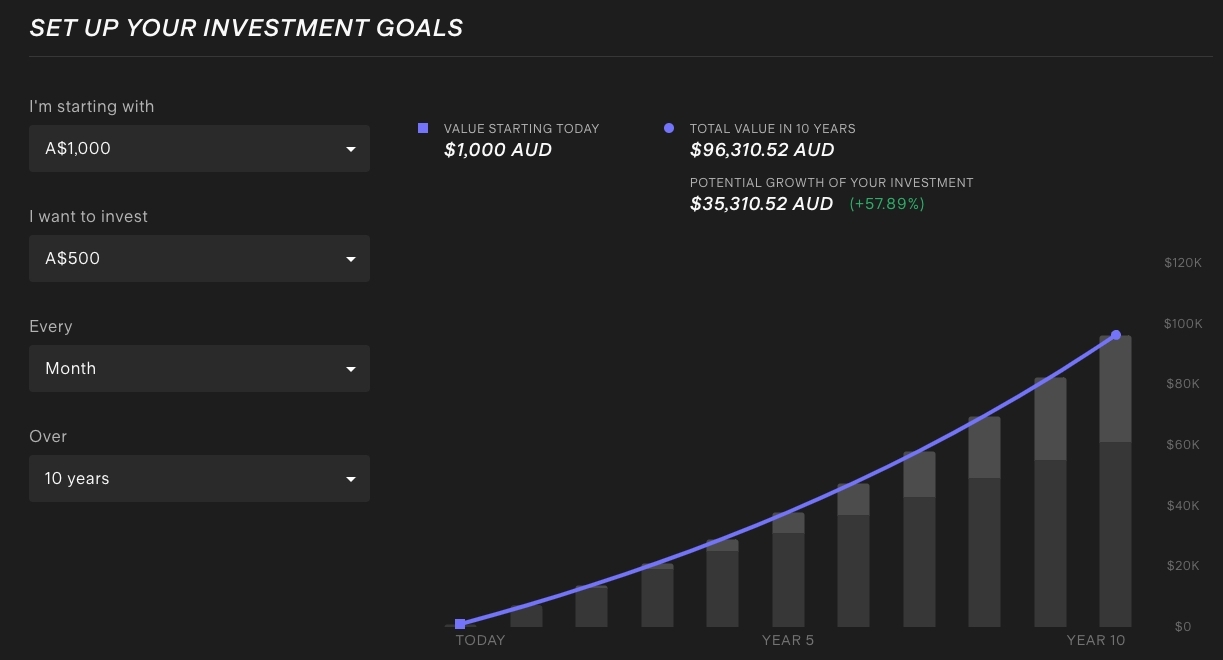

*Figure based on S&P 500 historical annualised return rate of 9.6%. Past performance is not a reliable indicator of future performance. Source: Investment Return Calculator

Discover the best ways to build your wealth below:

1. Make a budget plan and stick to it

Building wealth begins with setting yourself a budget and some financial goals to aim for. A popular saving system is the 50-30-20 rule: 50% for your needs, 30% for your wants, and 20% goes to savings. This rule can be tweaked based on your goals.

To create a budget, you can use tools like a budget planner or a simple spreadsheet. Once you've designed your budget, outline the goals you want to achieve and why:

- Are you saving for a house deposit?

- Do you have a long time horizon and are preparing for retirement?

- Do you need the money in five years time?

Regularly review and adjust your spending habits to align with your financial goals. For major purchases, give yourself time to mull it over. Spending discipline can make a massive difference.

Consistently sticking to your budget will maximise your ability to save and build the capital needed to invest in higher returning assets.

2. Prepare your emergency fund

It’s essential to set up an emergency fund that can cover unexpected expenses or income disruptions. This will allow you to handle emergencies without derailing your long-term goals.

Start by setting a target amount – typically three to six months of living expenses. Break this goal into smaller, manageable milestones.

Prioritise putting aside money from your income before spending on non-essentials. Stay disciplined and avoid dipping into the fund for non-emergencies.

An emergency fund will create financial resilience against life’s uncertainties, paving the way for more stable wealth-building.

3. Set up recurring investments in the stock market

Setting up recurring investments is a powerful strategy to build wealth. By automating your investments, you can take advantage of dollar cost averaging, which helps mitigate market volatility by spreading your investment over time. It involves investing a fixed dollar amount regardless of the share price. It also turns investing into a habit, making it easier to stay committed to your financial goals without the need for large lump-sum contributions.

Recurring investments also make it easier to plan your budget and savings. By treating your investment contributions like any other monthly expense, you consistently dedicate a portion of your income towards growing your portfolio. This approach can accelerate your path toward your financial goals.

Join 750K investors

Get a full U.S. share when you fund Stake Wall St or A$10 trading credit when you fund Stake AUS. Fund both, get both. T&Cs apply.

4. Diversify your investments via exchange-traded funds (ETFs)

Diversifying your investments into exchange-traded funds is a smart strategy for building wealth. ETFs provide easy diversification across a range of stocks and asset classes.

ETFs also offer a blend of both short-term stability and long-term growth potential. The dividends and relatively low fees of ETFs make them accessible and efficient for newer investors to help build compound growth (check out our beginner guide here).

✅ Related: Are these the best ETFs to buy and hold in Australia?

5. Open a high-interest savings account

A high-interest savings account is an important part of managing and building your wealth. The main advantage is that higher interest rates mean your savings grow faster through compound interest.

Ensure your high-interest savings accounts are with Authorised Deposit-taking Institutions (ADIs) overseen by the Australian Prudential Regulation Authority. ADIs include Australia’s big four banks, regional banks, credit unions and branches of some foreign banks.

The Financial Claims Scheme provides protection for deposits of up to $250,000 per ADI.

The key benefit of these accounts is accessibility. These accounts typically allow easy and quick access to your funds, an essential feature for emergency savings and unexpected expenses.

6. Grow your income

When you increase your income, you have more potential capital to invest in your desired stocks and ETFs and to hold in your savings account, enabling your money to grow quicker over time. To do this you will need to find new avenues for income like a side hustle or pay rise.

This access to more funds also allows you to manage and eliminate your debt, which not only reduces financial stress but also frees up more money for long-term investments.

Additionally, an increased income opens up new investment opportunities. With more money at your disposal, you can further diversify your portfolio. Diversification is key to managing risks and ensuring that your wealth can grow under various market conditions.

7. Purchase an investment property

Investing in property can provide long-term rewards for your wealth and future generations. It is also one of the harder investment types to get into due to the sheer size of the capital needed.

Property can provide a steady income stream from rental payments, potentially providing extra cash flow and offsetting mortgage and maintenance costs. Over time, property values tend to appreciate, building equity that can be leveraged for further investments or financial needs.

An investment property can also be an effective hedge against inflation. Rent and property values typically rise with inflation, safeguarding investment value. Whether through rental income, appreciation, tax benefits or inflation protection, property investment offers a pathway to growing wealth steadily and securely.

8. Explore more investment types: bonds, mutual funds

Investing in bonds and managed funds is another powerful way to grow your wealth. Bonds are essentially loans made to corporations or governments – they pay investors back with interest. They’re seen as safer than stocks and provide steady income. While they usually offer lower returns compared to stocks, their stability can help protect your portfolio from market volatility.

Managed funds pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities. This diversification can reduce risk, as losses in one investment might be offset by gains in another.

Managed by financial experts, these funds can offer higher returns compared to individual bonds by tapping into broader investment opportunities. They’re also convenient for hands-off investors, providing professional management and the potential for capital appreciation. However, they do incur a management fee.

✅ Related: What are government bonds?

✅ Related: How to start investing in U.S. treasury bonds in Australia

9. Contribute to your super

Boosting your superannuation through extra contributions is a smart way to ensure comfort in your retirement savings.

Super contributions come in two types: concessional (before-tax) and non-concessional (after-tax).

Concessional contributions include employer superannuation guarantee payments and salary sacrifice contributions, taxed at just 15%. The current concessional cap is set by the Australian Tax Office at $30,000. Non-concessional contributions, like voluntary payments and spouse contributions, utilise post-tax income but face no further tax once added to your fund.

Adding more to your super not only takes advantage of compound growth but also offers potential tax benefits. Special schemes like the First Home Super Saver Scheme (FHSSS) or downsizer contributions provide even more flexibility and advantages.

10. Manage down your debts

All your debts can add up to siphon off a significant portion of your monthly income through interest payments. By eliminating these debts, you save on interest expenses, freeing up cash that can be redirected toward investments or savings.

Paying down on your debts can help improve your financial health but also enhance your ability to grow wealth through compounding returns.

A debt-free profile contributes to increased cash flow, allowing more of your income to be funnelled into high-earning investments rather than servicing liabilities.

11. Work with a financial advisor

Working with a financial advisor can help assist in building a solid foundation by analysing your current financial position in order to develop a clear financial plan and the steps to follow in order to reach your goals.

Advisors advocate for good financial habits, debt reduction, and maintaining a strong credit score. They can also help tailor investment strategies to the goals you have set up.

Financial advisors can also help navigate tax implications and optimise returns. Their goal is to maximise your income, which helps to build your wealth.

What is the fastest way to build wealth?

Building wealth requires a strategic approach and is not something that can be done quickly as it usually takes time to build up significant capital. Here are the steps to follow to ensure you are on the right track to accelerate your financial growth:

- Set clear financial goals

Define what wealth means to you. Whether it’s buying a home, securing retirement, or paying your education fees, clear goals provide direction. - Create a budget and stick to it

Track your income and expenses to identify areas where you can save. Creating discipline in your everyday spending will ensure you allocate funds towards your wealth-building objectives. - Increase your income streams

Explore opportunities to boost your earnings. This could include side hustles, freelancing, or passive income streams like dividends. - Invest wisely

Allocate your savings into diversified investments such as stocks, ETFs, or real estate. Leveraging compound interest can significantly grow your wealth over time. - Minimise high-interest debt

Pay down debts with high interest rates first. Reducing debt frees up more money to invest and save. - Automate your investments

Set up automatic transfers to your investment accounts. Consistent contributions, even small ones, can accumulate substantially.

By following these steps, you can create a robust foundation for wealth accumulation.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

Building wealth FAQs

Building wealth takes time and is influenced by several key factors. Starting early allows you to take advantage of compound interest, letting your money grow exponentially over time.

Consistent contributions are essential; regularly adding to your investments accelerates accumulation and ensures steady progress. Use our investment return calculator to see the impact of regular investments over time.

Your financial goals also impact the timeline, short-term objectives like buying a car require different strategies compared to long-term aims such as retirement planning.

Economic factors like inflation, market volatility, and economic cycles can affect how quickly you achieve your financial milestones, so staying adaptable and informed is crucial.

Generally, with disciplined saving and smart investing, significant wealth can be amassed within 20 to 30 years. This time frame depends on your commitment, the consistency of your contributions, and how well you navigate the various influencing factors.

Deciding whether to invest or pay off debt first hinges on your financial situation. Start by comparing interest rates: if your debt carries a higher rate than potential investment returns, prioritise repayment to save money.

A balanced approach can often serve best by allocating part of your income to debt repayments while simultaneously investing.

Consider your personal comfort level, if debt is causing significant stress, focusing on repayment might enhance your peace of mind. Tailoring your strategy to your specific debt levels, interest rates, and financial goals will help you achieve your goals.

This article was edited by Robert Guy - Senior Markets Writer at Stake.

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.