Brokerage fees in Australia: What you'll pay to invest in shares

It’s essential for Aussie investors to be aware of brokerage fees when investing in shares and exchange-traded funds. Understanding what they are and how they work can help new investors find an investing platform that’s right for them and be able to invest more with the money they have.

Investors, both new and experienced, may hesitate to invest due to various factors. One of the main reasons is the fees associated with buying or selling shares. In this article, we will paint a clear picture of precisely what a brokerage fee is and how much you can expect to pay when buying ASX stocks or investing in U.S. shares.

What is a brokerage fee?

A brokerage fee is a charge by online investing platforms and full service brokers for executing transactions (buying or selling of an asset). In stock markets, brokerage fees are often expressed as a percentage of the transaction, as a flat fee, or a combination of the two.

Whether you are buying shares using an online investing platform or a professional stock broker, there is an amount of work required to confirm the sale and transfer of securities to the buyer, with the brokerage fee being the associated cost of the transaction.

What will brokerage cost me for Australian shares?

When buying shares in Australia on the Australian Securities Exchange, using an online investing platform is the least expensive option when it comes to the additional brokerage fees. It is important to do your research and see which platform is right for you, and brokerage fees will be one factor to consider but there is a lot more that goes into choosing an investing platform.

Brokerage fee comparison for buying and selling Australian shares

Trade value | Stake | CommSec | Selfwealth | nabtrade | CMC Markets |

|---|---|---|---|---|---|

$0 - $1,000 | $3 | $5 (with CDIA, see CommSec pricing) | $9.50 | $9.95 | $0 (First buy order up to $1,000) |

$1,001 - $5,000 | $3 | $10.00 - $19.95 (with CDIA, see CommSec pricing) | $9.50 | $14.95 | $11 or 0.10% (whichever is greater) |

$5,001 - $10,000 | $3 | $19.95 (with CDIA, see CommSec pricing) | $9.50 | $19.95 | $11 or 0.10% (whichever is greater) |

$10,001 - $20,000 | $3 | $29.95 (with CDIA, see CommSec pricing) | $9.50 | $19.95 | $11 or 0.10% (whichever is greater) |

$20,001 - $25,001 | $3 | $29.95 (with CDIA, see CommSec pricing) | $9.50 | 0.11% | $11 or 0.10% (whichever is greater) |

$25,001 - $30,000 | $3 | 0.12% (with CDIA, see CommSec pricing) | $9.50 | 0.11% | $11 or 0.10% (whichever is greater) |

$30,000+ | 0.01% | 0.12% (with CDIA, see CommSec pricing) | $9.50 | 0.11% | $11 or 0.10% (whichever is greater) |

Last reviewed: 8 May 2024. The information displayed in the brokerage fee comparison table is not exhaustive and is subject to changes. For up-to-date competitor pricing and product offerings, visit their website. See full pricing details for Stake.

Most platforms have a trade value tiered approach to the fees charged. At Stake, our only fee per trade is our brokerage fee of $3 brokerage for trades up to $30,000, or 0.01% on trades above $30,000 when buying or selling Australia shares.

What will brokerage cost me for U.S. shares?

Many investing platforms that are available to Aussie investors have the option to invest in U.S. stocks. The fees involved in trading shares in the U.S. markets can be different to how they work on the ASX.

Brokerage fee comparison for buying and selling U.S. shares

Trade value | Stake | CommSec | Selfwealth | nabtrade | CMC Markets |

|---|---|---|---|---|---|

$0 - $1,000 | US$3 | USD$5.00 or 0.12% (whichever is greater) | USD$9.50 | US$9.95 | $0 (minimum trade value of $1,000) |

$1,001 - $5,000 | US$3 | USD$5.00 or 0.12% (whichever is greater) | USD$9.50 | US$14.95 | $0 (minimum trade value of $1,000) |

$5,001 - $10,000 | US$3 | USD$5.00 or 0.12% (whichever is greater) | USD$9.50 | US$19.95 | $0 (minimum trade value of $1,000) |

$10,001 - $20,000 | US$3 | USD$5.00 or 0.12% (whichever is greater) | USD$9.50 | US$19.95 | $0 (minimum trade value of $1,000) |

$20,001 - $25,001 | US$3 | USD$5.00 or 0.12% (whichever is greater) | USD$9.50 | 0.11% | $0 (minimum trade value of $1,000) |

$25,001 - $30,000 | US$3 | USD$5.00 or 0.12% (whichever is greater) | USD$9.50 | 0.11% | $0 (minimum trade value of $1,000) |

$30,000+ | 0.01% | USD$5.00 or 0.12% (whichever is greater) | USD$9.50 | 0.11% | $0 (minimum trade value of $1,000) |

Last reviewed: 8 May 2024. The information displayed in the brokerage fee comparison table is not exhaustive and is subject to changes. For up-to-date competitor pricing and product offerings, visit their website. See full pricing details for Stake.

Stake pricing is consistent, transparent and simple, and that’s why our brokerage fee from Australian to U.S. markets is the same. The trading fee per trade is US$3 brokerage for trades up to US$30,000, or 0.01% on trades above US$30,000 when buying or selling U.S. shares.

✅ Learn more about Stake pricing

🎓 Related: Discover the 10 reasons why you should also invest in U.S. stocks

What is an FX fee?

When investing in the U.S. markets you need U.S. dollars and this requires your AUD funds to be converted into USD. This conversion of currency has an FX fee (or foreign exchange fee) attached to it.

Say you deposit A$1,000 at the exchange rate of US$0.65 per Australian dollar. Our FX fee of 70 bps (minimum of $2) would cost US$7.00 and you’d get US$643.00. Use the FX fee calculator to see the available amount of USD funds from your Australian dollars.

Just to be clear we don’t charge an FX fee on the individual trades just on the initial deposit into your Stake Wall St account. The FX fee will also apply to the conversion of USD to AUD when you withdraw funds.

🎓 Learn more: Basis points (bps) explained→

How to save money on brokerage fees?

It is important to do your research and find the right investing platform with fees that you are happy to pay. It can also come down to the type of investor you are, casual investors that are infrequently purchasing stocks will not pay a lot of brokerage fees.

But the types of investors that are trading every day will see the cost of brokerage fees creeping up, so it’s crucial that you're not paying over $10 for each trade you place.

For example, let’s say you have $10,000 you would like to invest.

Investing $10,000 through Stake in one lump sum would cost you just $3 brokerage. If however, you intended to dollar cost average it out over 10 trades of $1,000 each, this would add up to $30 in brokerage.

To use this same example at another platform with higher brokerage costs, it could amount to $19.95 for a single lump sum trade or $50 brokerage over 10 individual trades.

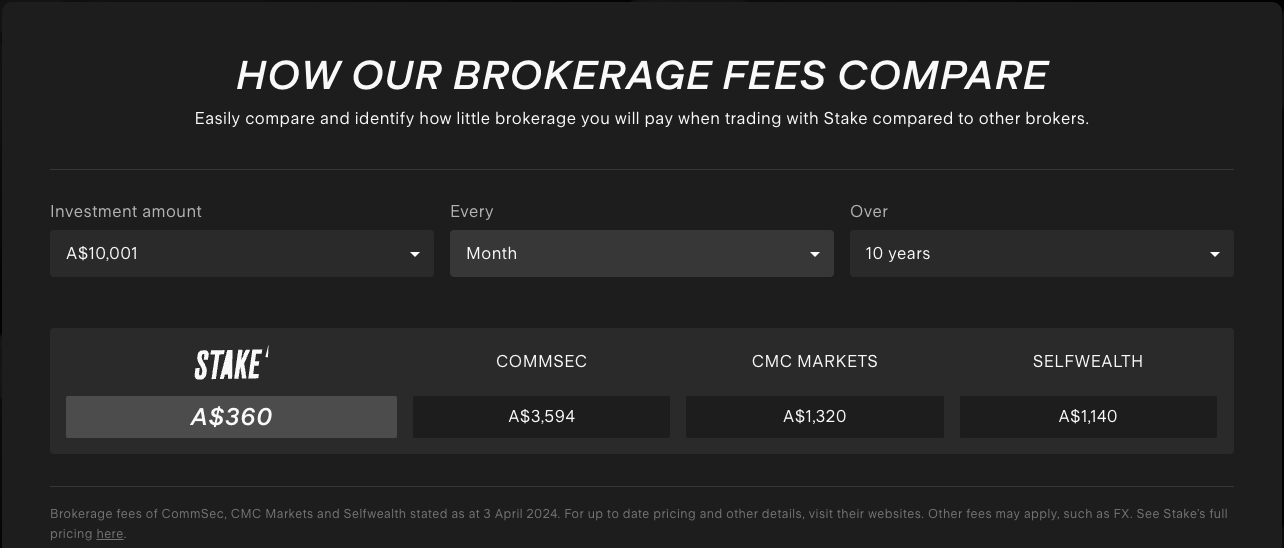

Your personal financial circumstances, investment goals and risk appetite will be factors when discovering the right investment platform for your needs. Check out the investment return calculator and use the brokerage fee tool to see how much you could save on fees with Stake.

How much should I pay in brokerage fees?

It’s up to you to decide which amount of fees you are willing to pay to place a trade. Some investing platforms offer free brokerage which includes requirements, like a minimum trade size amount. Other platforms can charge up to $29.95 which can drastically add up if you are making many trades.

When share trading with Stake, you will find consistent, transparent and simple fees of $3 brokerage for trades up to $30,000, or 0.01% on trades above $30,000 (in AUD for Stake AUS and USD for Stake Wall St).

Frequently asked questions about brokerage fees

What other fees are included when investing in stocks?

Some online share trading platforms may include brokerage charges like inactivity fees, FX fees etc. Make sure to check all the information about investing on the platform's website.

Find all the Stake fees here.

Who has the cheapest brokerage fees in Australia?

At Stake, we offer outstanding value with our simple brokerage fees (we even won an award for it, Canstar’s 2023 Online Share Trading Awards: Outstanding Value - Trader).

There are some cheaper investing platforms that offer zero commission fees on certain markets, however, they may have some requirements you need to meet e.g. minimum transaction value.

More resources:

✅ How to buy shares in Australia→

✅ Which investment is right for you: ETFs or stocks?→

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation, particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.