Buy U.S. ETFs in Australia

Easily diversify your shareholdings with U.S. exchange-traded funds (ETFs) on Stake.

- US$3 brokerage for ETF trades up to US$30k

- Start investing in any ETF from just US$10

- Over 1,000 ETFs to invest in across Nasdaq and NYSE

Why invest in U.S. ETFs with Stake?

Start small

Invest in the most popular Wall St exchange-traded funds (ETFs) from only US$10 and no FX fees per trade.

Diversification

Access 1,000+ U.S. ETFs available on Stake and diversify your portfolio with more affordability.

Simple brokerage

Start buying U.S. ETFs in Australia with Stake and pay just US$3 brokerage for trades up to US$30,000.

Cost savings

Investing in Wall St ETFs is more cost-efficient than buying the underlying assets individually.

Two huge markets. One powerful platform.

Buy and sell shares, ETFs, bonds, OTC stocks, REITs, hybrid securities and more on Stake

Unrivalled Wall St access

- 6,000+ U.S. stocks, ETFs, OTCs and more

- US$3 brokerage on trades up to US$30k

- Buy fractional shares with as little as US$10

Easy ASX investing

- 2,000+ Aussie stocks, ETFs and more

- A$3 brokerage on trades up to A$30k

- CHESS-sponsored trades

Long-term focus with ASX ETFs

- Access the biggest ASX ETFs such as VAS, NDQ, VGS and more

- $3 brokerage for trades up to $30,000

- CHESS-sponsored, so you own shares under your own HIN

How we compare

Our brokerage stacked up against the rest

| Commsec | CMC | Selfwealth | Superhero | |

|---|---|---|---|---|---|

Brokerage (trades up to US$30,000) | US$3 | US$5.00 | $0 | US$9.50 | US$2 up to US$20k |

Brokerage (trades over US$30,000) | 0.01% | 0.12% | $0 | US$9.50 | 0.01% |

FX Fee | 55bps | 0.55% | 0.60% | 60bps | 65bps |

U.S securities offered | Stocks, ETFs and OTC securities | Stocks, ETFs and OTC securities | Stocks and ETFs only | Stocks and ETFs only | Stocks and ETFs only |

*Last reviewed: 13 February 2025. The information displayed in the pricing comparison table is not exhaustive and is subject to changes. For up-to-date competitor pricing and product offers, visit their websites.

Learn about BPS.

1000's of 5-star reviews

As a former commsec user, I love how easy the app is to navigate and with ASX now available switching between markets is easy.

I've never written an App review before, but Stake really has continued to wow me.

I started using Stake for US trading, and recently (very easily) transferred my ASX portfolio across to utilise the cheap trades.

Switched from nabtrade. Much better experience. Far cheaper.

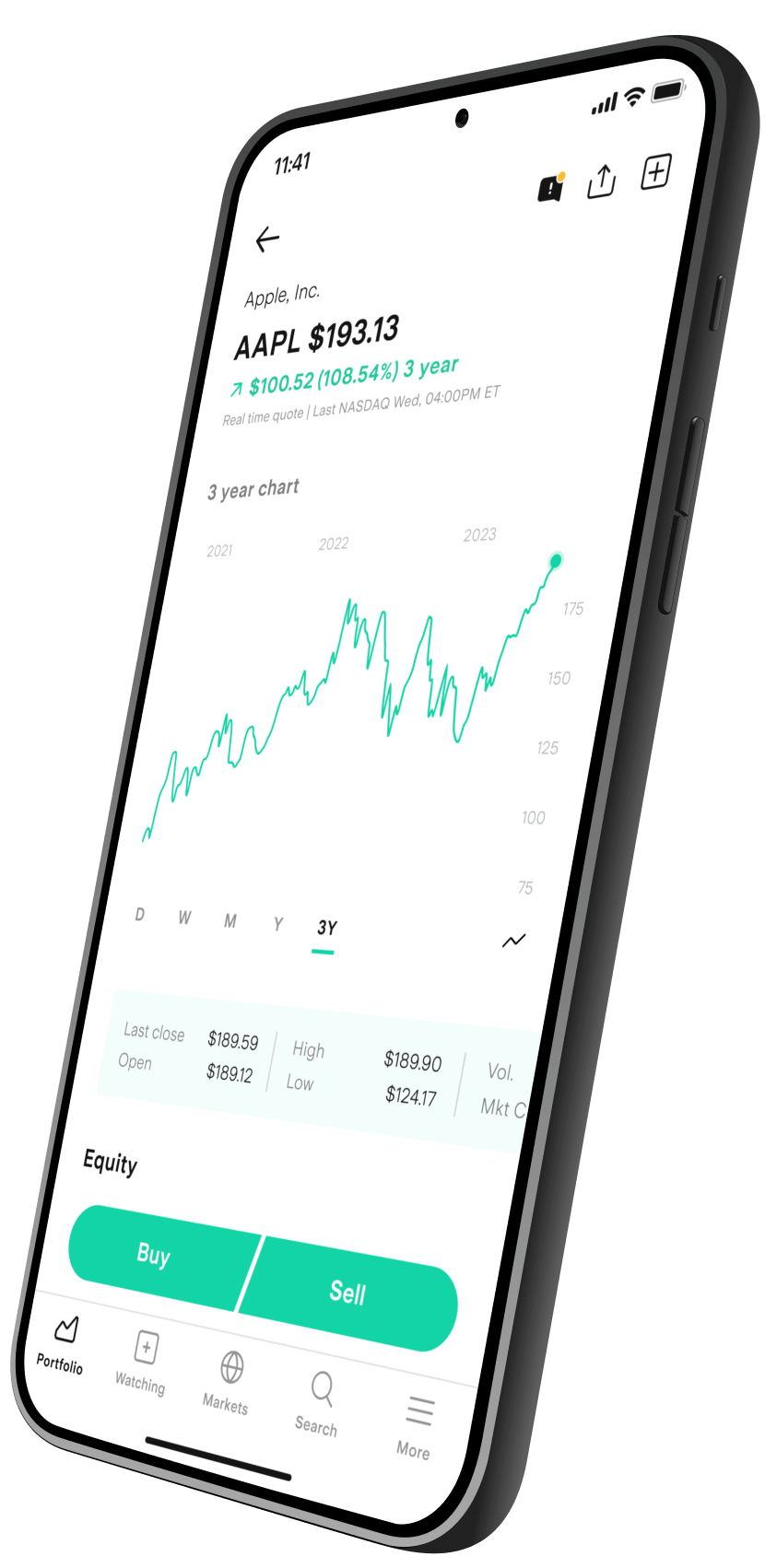

A well designed and easy to use app to trade on the USA and AUS markets.

How to buy U.S. ETFs in Australia

- Download Stake & sign up in minutes

- Activate Stake Wall St

- Deposit funds

- Choose your U.S.-listed ETF

- Place an order

If you want to learn more, check out this in-depth article on how to start investing in ETFs.

Buying U.S. ETFs in Australia has never been easier

Seamless access to the world's biggest market

Stake investors gain unrivalled access to the U.S. stock market, with over 6,000 shares and ETFs available on the platform. There are limitless investment opportunities to explore, from OTC stocks and index funds to government bonds and other thematic ETFs. Check out our stock comparison tool to help you track U.S. ETFs you’re interested in.

Start investing in ETFs on Wall St from just US$10

Buy stocks and ETFs investing as little as US$10 thanks to fractional shares on Stake. You could own a slice of $SPY ETF, for example, without paying for a whole share (valued at over US$400 in September 2023).

Choose simple, transparent brokerage fees

Three is the number. That’s your brokerage fee for all Stake trades up to $30,000 – no matter the investment product, the same brokerage fee applies. Any trade above $30,000 will instead incur a 0.01% brokerage fee.

Keep building your investing experience

Signing up is just the beginning. Check out The Stake Desk and follow us on Instagram to stay up to date with the markets and more. Our Stake Academy articles in particular help you get upskilled. When you’re ready to sharpen your trading even more, Stake Black is our premium membership that unlocks advanced tools and features like Instant Buying Power, Price Targets, Analyst Ratings and Full Financials.

Most actively traded U.S. ETFs on Stake in August

| Ticker | Company Name | Price | Market Cap | |

|---|---|---|---|---|

VOO | S&P 500 Vanguard ETF | $413.80 | - | Trade now |

SQQQ | ProShares UltraPro Short QQQ ETF | $17.72 | - | Trade now |

TQQQ | ProShares UltraPro QQQ ETF | $42.39 | - | Trade now |

SOXL | Direxion Daily Semiconductor Bull 3X ETF | $23.87 | - | Trade now |

SPY | S&P 500 ETF Trust SPDR | $450.32 | - | Trade now |

See the full list of most traded U.S. shares on Stake.

Data as of 31 August 2023 for share price and market cap. The information displayed in the table is based on trade volume on Stake's trading platform for the previous month and should not be relied on to make investment decisions. This is for information purposes only and is not a recommendation to invest in the securities listed. It does not constitute financial product advice. We recommend that you do your own research and consider your own personal financial needs, objectives and circumstances before making any investment decision. Stake does not accept any responsibility for any decisions made based on the data provided.

Transfer your shares and get rewarded

Transfer U.S. shares worth US$500+ to Stake and get a Dropbox stock on us. Better yet, you’ll consolidate your portfolio with the platform that has received Canstar’s 2023 Outstanding Value Award - Trader, Online Share Trading. The transfer process is simple, seamless and only takes a few minutes to initiate.

Find out moreSee what U.S. ETFs investors are buying

Visit the blogUS ETFs FAQs

One of the main differences between an index fund and an exchange-traded fund is that ETFs can be bought and sold throughout the trading day as a security. Index funds are only processed at market close. Both index funds and ETFs remain popular with investors looking at long-term investing strategies, but ETFs typically have a lower minimum investment and can be more tax-efficient.

There are currently 1,000+ U.S. ETFs available on Stake and we’re constantly adding new ones to the platform to give investors even more ways to grow their wealth.

U.S. ETFs can pay dividends if the securities within the fund pay dividends. The ETF issuers are required to pay to shareholders the dividends they’ve collected, but can decide how to distribute the funds: a cash distribution or reinvestment of additional shares in that ETF.

All investments carry risks, so it’s important to do your own research and only invest what you can afford to lose. Having said that, ETFs have been known to carry less risk than other financial assets because they are diversified. Some ETFs are riskier than others, but you may be able to find a fund with stable returns for a long-term hold. If you have a higher risk tolerance, you can buy Australian ETFs or U.S. ETFs with a higher risk/reward ratio.

SPDR S&P 500 ETF Trust ($SPY) is the biggest ETF in the U.S. market, with an AUM of US$414b (as of 19 September 2023).

There are over a dozen U.S. ETFs that follow the S&P 500, with the 3 biggest (by assets under management) being SPDR S&P 500 ETF (SPY), iShares Core S&P 500 ETF (IVV) and Vanguard S&P 500 ETF (VOO). Learn more about how to invest S&P 500 index fund in Australia.

Get started with a free U.S. stock

Sign up and fund Stake Wall St to claim.

Transfer existing U.S. stocks and you could get another free stock.