How to invest $5,000 in Australia today

Whether you are a beginner or seasoned investor, deciding where to invest your cash requires careful thought and decision-making. The first step is understanding your circumstances, followed by familiarity with the different investment vehicles you can park your money in.

Things to consider before you invest $5,000

Making the decision to start investing opens the doors towards having your money work for you. With the average annual historical return of the S&P 500 greatly outperforming that of a standard savings account, taking this first step may be riskier but may be highly rewarding.

But before jumping into investing in the different asset classes, it is essential for you as an investor to know exactly what your goals, risk tolerance, and investment time horizon are in order to build an investing strategy tailored for you.

Start by answering these questions:

What is your investing goal?

Understanding your investment goals plays a crucial role in determining the appropriate investment strategy for you. Goals help investors align their financial objectives with their investment decisions.

When setting investment goals, it's essential to consider factors such as time horizon, risk tolerance, and desired outcomes. Given the robustness of investing, simply saying "I want to make money" may not be enough to create the most optimised investment strategy.

Some common financial aspirations include:

- Saving for retirement

- Purchasing a home

- Funding education

- Achieving long-term wealth growth

Investment strategies would be different for each. For example, a long-term goal like retirement planning may necessitate a more growth-oriented strategy with a higher allocation to equities, while a short-term goal like saving for a down payment on a house may require a more conservative approach with a focus on capital preservation.

How long are you intending to leave the money invested?

Aside from knowing your investing goals, you should also be able to provide a rough estimate of when you might be needing the capital you plan to use for your investments. This time horizon will influence the level of risk you can comfortably take and the potential for investment growth.

The time horizon helps determine the suitable asset allocation. A longer time horizon provides more flexibility and allows for a potentially higher allocation to growth-oriented assets such as stocks or equity funds. This is because, over longer periods, the volatility associated with these assets tends to average out, providing an opportunity for higher returns.

A shorter time horizon necessitates a more conservative approach, with a greater emphasis on capital preservation and income-generating assets such as government bonds or cash equivalents.

Similarly, the time horizon impacts the ability to weather market fluctuations. Riskier investments are subject to short-term volatility, and the longer the time horizon, the better an investor can tolerate these fluctuations.

A longer time horizon allows for potential recovery from market downturns and provides the opportunity to stay invested during periods of temporary market decline. While a shorter time horizon requires a more cautious approach to mitigate the impact of market volatility and ensure that the funds will be available when needed.

Understanding the time horizon is crucial for setting realistic investment goals and managing expectations. It helps you choose investments that align with your specific timeframes, risk tolerance, and financial objectives.

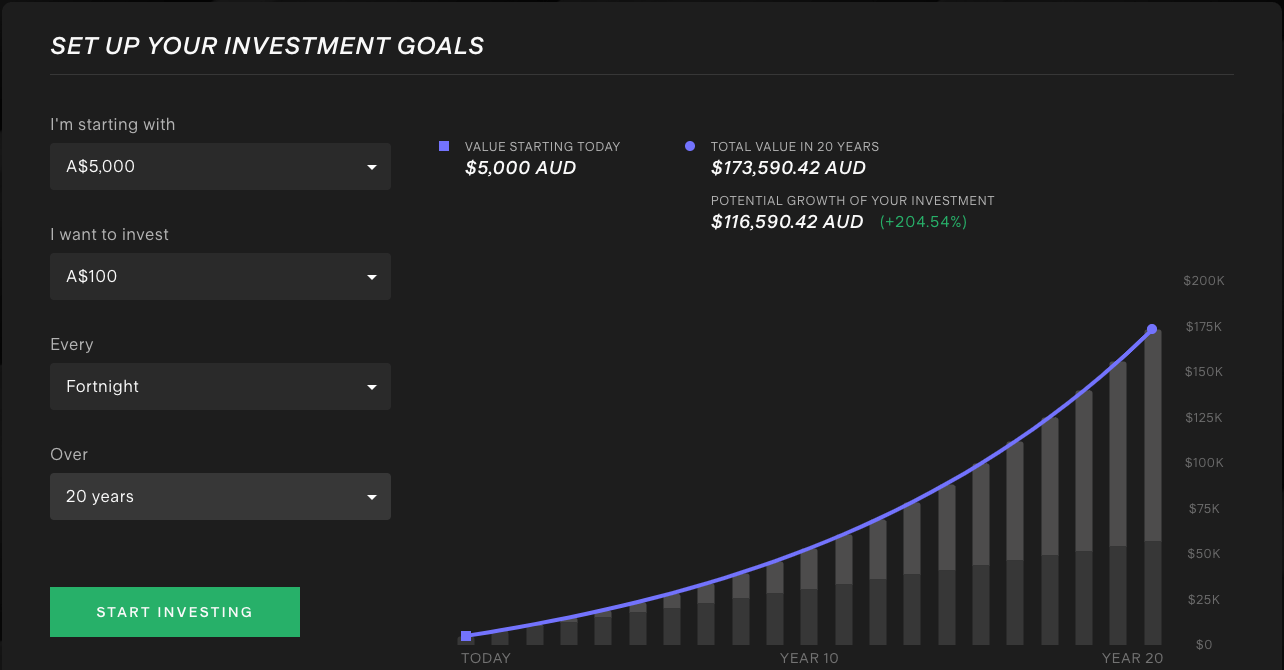

🔢 Check out the investment return calculator to understand your investment time horizon

The projected values shown are hypothetical in nature and should not be relied on to inform your investment decisions.

What is my risk tolerance?

Choosing to invest your cash is naturally riskier than leaving it in savings accounts, given that securities such as shares and ETFs, and even real assets such as investment properties, experience volatility that may lead to your capital losing value.

Understanding how tolerant you are to this risk is essential to creating your strategy. Risk tolerance refers to your ability and willingness to endure the potential losses associated with different investment options.

Choosing riskier investments when your tolerance for risk is low for example, may lead to impulsive and emotional decisions when your investments experience short-term volatility.

A general consensus in investing is that riskier assets also allow for higher potential returns. To illustrate, a savings account offers a fixed interest rate for a time period while shares don't provide any certainty of return, however, shares may also potentially earn more in a single day than savings accounts return in an entire year.

Every type of asset can offer different risk-to-return ratios.

✅ Sign up to Stake and explore the investment opportunities available with $5,000.

👉 Learn more about Stake pricing to discover how seamless investing can be.

Where to invest $5,000 in Australia

Exchange-traded funds

ETFs, or exchange-traded funds, are investment vehicles traded on the stock market that offer investors exposure to a diversified portfolio of assets. They are designed to track the performance of a specific index, sector, commodity, or asset class.

Given the level of diversification within an ETF, they are generally considered to be less risky and volatile than equities. They are commonly marketed as a low-cost way to own a diversified portfolio. There are several types of ETFs, including index funds that track the performance of an index (e.g. S&P 500) and thematic ETFs that track a specific investment theme (e.g. semiconductors).

✅ Are these the best index fund ETFs to invest in?→

✅ Want to start buying ETFs in Australia?→

Pros and cons of ETFs:

Pros | Cons |

|---|---|

Diversification: ETFs offer instant diversification by providing exposure to a basket of securities within a particular index or sector. This diversification helps reduce risk by spreading investments across multiple assets. | Limited control: Investors in ETFs have limited control over the specific securities held within the fund. The portfolio composition is determined by the ETF provider, and investors cannot individually select or exclude specific holdings. |

Liquidity: ETFs trade on stock exchanges like individual stocks, providing high liquidity. Investors can buy and sell ETF shares throughout the trading day at market prices, offering flexibility and ease of access to their investments. | Over-diversification: While diversification is a benefit of ETFs, it can also lead to over-diversification. Holding too many assets can dilute the potential impact of strong performers and make it difficult to outperform the market. |

Low cost: ETFs typically have lower expense ratios compared to mutual funds. Since they aim to replicate the performance of an index rather than actively managed strategies, they incur fewer expenses related to research and management. | Lack of active management: ETFs generally follow passive investment strategies, which means they do not have active managers making specific investment decisions. This may result in missing out on potential market opportunities or adjustments during changing market conditions. |

Shares

Shares, also known as stocks or equities, represent ownership in a company. Shares are often traded publicly on the stock market, allowing for greater liquidity than other investment vehicles. To get access to the stock market, investors are required to register for an investing account either with an online brokerage or an investment platform such as Stake.

When investors buy shares of a company, they become partial owners and have the potential to benefit from the company's growth and profitability. Additionally, investors may also profit through the movement of stock prices and dividend payments that companies sometimes pay out to shareholders.

✅ Learn more about investing in ASX shares→

✅ Gain unrivalled access to U.S. stocks→

Pros and cons of shares:

Pros | Cons |

|---|---|

Potential for capital growth: Shares offer the potential for significant capital appreciation over time. If the value of the company and its stock increases, investors can benefit from price appreciation and potentially generate substantial investment returns. | Higher risk: Share prices can be subject to significant fluctuations due to market volatility and various factors, including economic conditions, industry trends, and company-specific news. This volatility can lead to short-term price declines and the potential for investors to lose money. Shares are generally more suited for investors with a high-risk tolerance. |

Dividend income: Many companies distribute a portion of their profits allowing shareholders to earn dividends. Investing in dividend-paying stocks can provide a steady income stream, making them attractive for income-oriented investors. | Dividend uncertainty: Not all companies pay dividends, and the decision to pay dividends is at the discretion of the company's management. Dividend payments may fluctuate or be suspended, particularly during economic downturns or when a company faces financial difficulties. |

Liquidity: Shares are generally considered liquid investments since they can be bought and sold on the stock market during trading hours. This liquidity provides investors with the ability to convert their investments into cash relatively quickly. |

Dividend investing

Dividends are payments made by a corporation to its shareholders as a distribution of profits. When a company generates earnings, it can choose to reinvest them back into the business or distribute a portion of those earnings to shareholders in the form of dividends.

Some companies have paid out dividends for decades, many of which even offer shareholders an option to subscribe to a dividend reinvestment plan, where investors are automatically given more shares instead of receiving a cash dividend.

💡Related: Interested in ETFs from the ASX that pay dividends?→

💡Related: Discover monthly dividend stocks for regular income→

Pros and cons of dividend investing:

Pros | Cons |

|---|---|

Regular income: Dividend-paying stocks provide investors with a regular income stream in the form of cash dividends. These dividends can be particularly attractive for income-oriented investors who seek consistent and reliable cash flow. | Dividend reduction or suspension: Companies may reduce or suspend dividend payments during challenging economic conditions or when facing financial difficulties. This can result in a decrease or temporary loss of income for investors. |

Potential for higher returns: Dividend stocks have the potential to generate both income and capital appreciation. By reinvesting dividends or using them to purchase additional shares, investors can benefit from compounding returns and potentially enhance their total return over time. | Limited growth focus: Companies that prioritise paying dividends may allocate a significant portion of their earnings towards dividend payments rather than reinvesting in growth opportunities. This can potentially limit the company's ability to pursue expansion or invest in research and development. |

REITs

Real Estate Investment Trusts (REITs) are a type of asset that owns, operates, or finances income-generating real estate. REITs pool capital from multiple investors and use that capital to invest in a diverse portfolio of properties, such as commercial buildings, apartments, hotels, or industrial facilities. REITs thus offer investors an opportunity to participate in real estate ownership without having to directly buy or manage properties. REITs act like a regular share and are able to be bought and sold on the share market. You can find popular REITs in Australia available on Stake.

Pros and cons of REITs

Pros | Cons |

|---|---|

Income stream: REITs are required by law to distribute a significant portion of their taxable income to shareholders in the form of dividends. As a result, they often provide a consistent income stream, making them attractive for income-oriented investors. | Interest rate sensitivity: REITs can be sensitive to changes in interest rates. When interest rates rise, the cost of borrowing for REITs may increase, potentially impacting their profitability. Additionally, higher interest rates can make alternative investments, such as bonds, more attractive relative to REITs. As seen in recent developments, REITs have underperformed after consecutive rate rises in several regions. |

Professionally managed: REITs are typically managed by experienced professionals who have expertise in acquiring, managing, and developing real estate properties. Investors can benefit from the expertise and knowledge of these professionals, who are responsible for making strategic decisions regarding property investments. | Lack of control: As a REIT investor, you have limited control over the management decisions of the underlying properties. The performance of the REIT and its properties is primarily dependent on the skills and decisions of the management team. Investors have no direct control over property-level decisions or operational matters. |

Bonds

Bonds are debt instruments issued by governments, municipalities, and corporations to raise capital. When you purchase a bond, you are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity. Bonds are considered fixed-income investments and are generally considered less risky than stocks.

💡Related: See what are popular bonds to invest in Australia→

💡Related: How to buy U.S. bonds on the ASX→

Pros and cons of bonds:

Pros | Cons |

|---|---|

Stability: Bonds provide regular interest payments, known as coupon payments. This predictable fixed rate income stream can be attractive for income-oriented investors seeking stability and consistent cash flow. Bond prices are also considered to be less volatile than those of ETFs' and shares. | Interest rate risk: Bond prices are sensitive to changes in interest rates. When interest rates rise, such as in the existing economic environment, bonds that have already been issued with lower fixed interest rates become less attractive, resulting in a potential decline in their market value. This interest rate risk can affect the value of bonds in the secondary market. |

Less risky: Bonds are generally considered less risky than stocks, making them a potentially more conservative investment option. When investing in highly rated bonds, such as government or investment-grade corporate bonds, there is generally a lower risk of losing the principal investment compared to other investments. | Inflation Risk: In relation to the above, bonds are also susceptible to inflation. If the rate of inflation exceeds the interest rate earned on a bond, the purchasing power of future interest and principal payments may be eroded. This can result in a decrease in the real return on investment. |

Liquidity risk: While some bonds are available to be traded in the share market (known as exchange-traded bonds), they more often have limited liquidity, meaning there may be fewer buyers and sellers in the market. This can potentially make it more challenging to sell a bond at a desired price, particularly for less actively-traded or niche bonds. |

How to invest $5,000 right now

Now that you have considered your investment goals, time horizon and risk tolerance, and now also understand the different types of assets you may invest in, you may finally feel ready to begin your investment journey.

The first step is all about finding the right investment platform for you.

1. Register for an investing account

Opening an account is no longer time-consuming thanks to the establishment of online investing platforms like Stake. There are a few options available in Australia – Stake offers the ability to invest in both Australian and U.S. Markets.

2. Fund your account and purchase the securities

After you decide how much initial investment you're comfortable with, you may fund your account on Stake using either a bank transfer, debit card or Apple/Google Pay.

3. Build out your portfolio

Investing does not have to be black and white – investors have the flexibility to build an investment strategy where they don't have to lump sum invest into one specific asset but can allocate their funds across a diverse set of assets based on predetermined percentages. This approach involves creating a portfolio that consists of different asset classes, each with its own weight or percentage allocation. It's a strategy commonly used by professional fund managers and portfolio analysts.

4. Regularly review your strategy and portfolio

Considering your investment strategy does not end when you start investing. Professionals generally recommend investors regularly review their investing goals, risk tolerance and time horizon in order to decide whether they must rebalance their portfolios in line with any changes. Deciding how often to do so must be a personal decision, with some investors choosing to rebalance every month, quarter or year. Doing this ensures that your portfolio's asset allocation remains relevant to your circumstances.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

This does not constitute financial product advice nor a recommendation to invest, it is for informational purposes only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking appropriate financial or taxation advice from a licensed adviser before investing.

Stella is a markets analyst and writer with almost a decade of investing experience. With a Masters in Accounting from the University of Sydney, she specialises in financial statement analysis and financial modelling. Previously, she worked as an equity analyst at Australian finance start-up, Simply Wall St, where she took charge of the market insights newsletter sent out to over a million subscribers. At Stake, Stella has been key to producing the weekly Wrap articles and social media content.