Are these the best dividend stocks on ASX in April? [2024]

Investors are closely looking at their portfolios as inflation and changing economic conditions have increased risk in FY24. One of the ways to generate returns in Australia is by looking for the best ASX dividend stocks, fortunately, there are plenty of them. Dig in here to discover some of the highest dividend stocks in Australia.

Discover some of the highest dividend yield stocks on the ASX

Company Name | Ticker | Stock Price | Year to Date | Market Cap | Dividend Yield |

|---|---|---|---|---|---|

$5.21 | +0.48% | $6.91b | 13.26% | ||

$4.71 | -11.49% | $3.93b | 10.97% | ||

$25.42 | -13.51% | $79.12b | 8.09% | ||

$3.91 | +7.62% | $1.15b | 7.42% | ||

$30.43 | -3.40% | $57.91b | 7.08% | ||

$9.60 | +2.02% | $1.78b | 7.00% | ||

$7.09 | -8.39% | $5.95b | 6.90% | ||

$122.50 | -10.30% | $45.19b | 5.37% | ||

$45.08 | -10.80% | $224.39b | 5.30% | ||

$120.07 | +5.69% | $201.52b | 3.78% |

Data as of 2 April 2024. Source: Stake, Google Finance.

*The list of shares mentioned is ranked by dividend yield. When deciding what dividend shares to feature, we analyse the dividend yield, consistency of dividend payouts, financials, recent news, the state of the industry, and whether or not they are actively traded on Stake.

Find the best dividend stocks in Australia for you

Discover this short list of 10 of the most popular dividend-paying Australian shares. It's a good place to start if you are interested in income-generating assets on the Australian Securities Exchange.

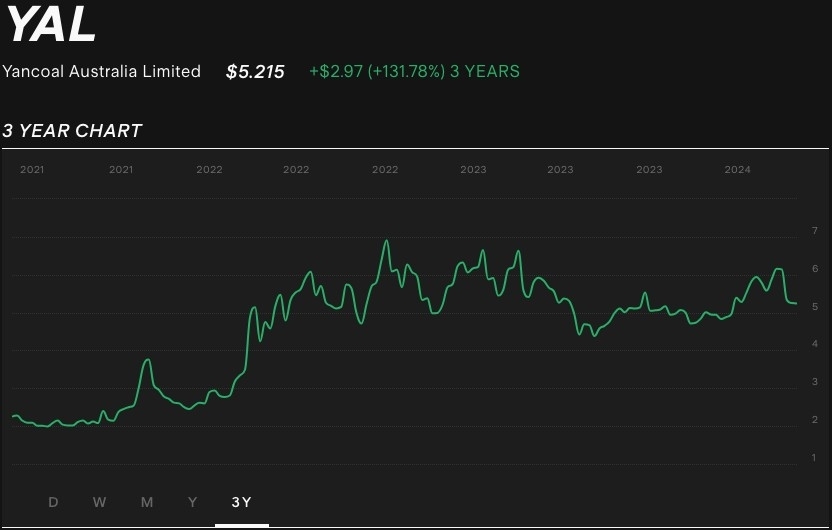

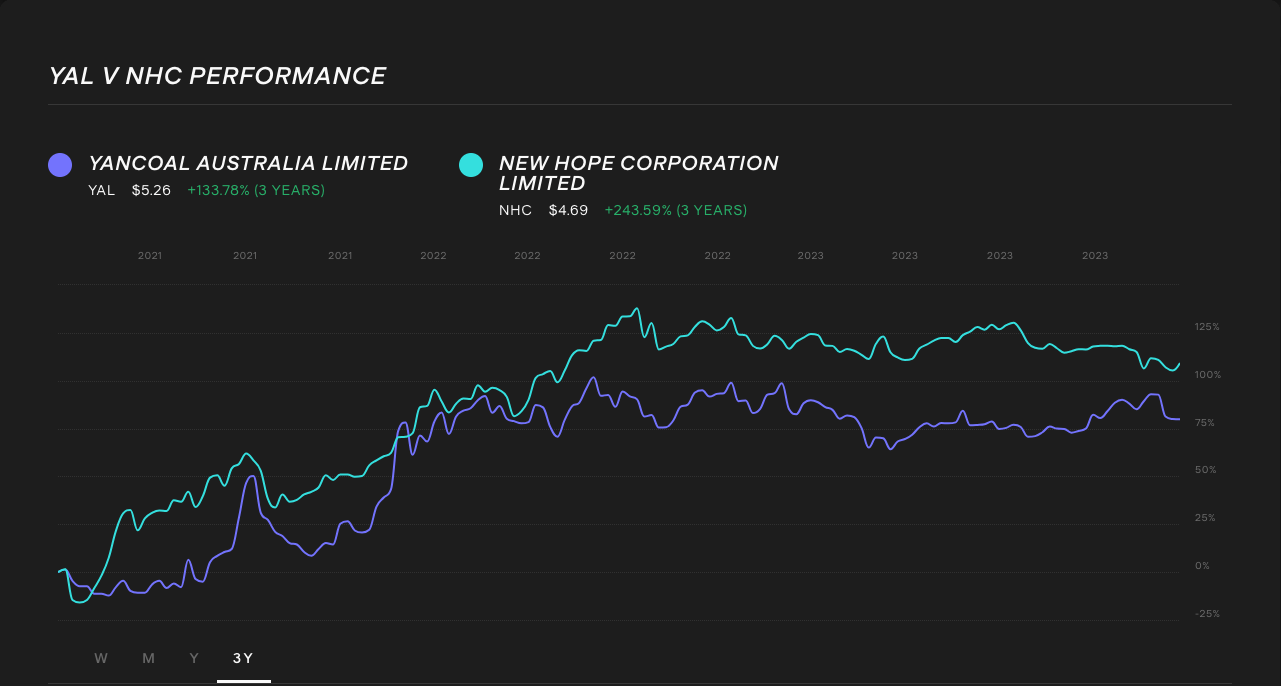

1. Yancoal Australia Limited ($YAL)

Dividend yield: 13.26%

Market Capitalisation: $6.91b

Stock price (as of 2/4/2024): $5.21

Stake Platform Bought / Sold (Jan - Mar 2024): 61% / 39%

Yancoal Australia Limited is a strong player in the mining sector, listed on the Australian Securities Exchange (ASX:YAL) and the Hong Kong Stock Exchange (HKSE: 3668).

The company is predominantly owned by foreign interests, emphasising its international stature within the industry. Yancoal's core business revolves around the mining and production of both thermal and metallurgical coal, catering to a diverse range of markets including Australia, China, and Japan. The company boasts a comprehensive portfolio comprising several large-scale open-cut and underground mining operations, highlighting its extensive asset base across multiple coal mine complexes in the region.

The Yancoal dividend is 100% franked and is paid twice a year in March and September.

2. New Hope Corporation Limited ($NHC)

Dividend yield: 10.97%

Market Capitalisation: $3.93b

Stock price (as of 2/4/2024): $4.71

Stake Platform Bought / Sold (Jan - Mar 2024): 72% / 28%

Another one in the resource sector, New Hope Corporation ($NHC) explores, develops, produces, and processes coal, oil and gas properties. The company owns interests in two open-cut mines in Queensland and New South Wales and has one of the best yields of the last 12 months. Similar to most companies on this list, NHC has distributed dividends for several years. However, there is no visible trend of growth nor decline in its dividends – most likely showing that the company just distributes amounts based on its income for the year.

The coal giant pays out dividends semi-annually in the months of May and November. It has recently announced a dividend of A$0.17 per share. The ex-dividend date of this payment is April 15th, with the payment date to be on the 1st of May. NHC's dividend amounts have grown strongly since 2021, most likely driven by higher coal, gas and oil prices.

With a dividend yield of 10.97%, NHC is one of the highest-paying dividend companies in the ASX. Analysts however do not think that this yield is particularly sustainable – with dividend estimates slowly going down over the next few years.

3. Fortescue Metals Group Ltd ($FMG)

Dividend yield: 8.09%

Market Capitalisation: $79.12b

Stock price (as of 2/4/2024): $25.42

Stake Platform Bought / Sold (Jan - Mar 2024): 68% / 32%

Fortescue Metals Group ($FMG) needs no introduction as one of the biggest commodity companies on the ASX. It deals only with iron ore, leaving it susceptible to changes in the price of the commodity. This is what happened in its last full-year financial results. The company reported record annual shipments of 189m tonnes but revenue fell 22% due to a reduction in the price of iron ore.

Still, the miner has been committed to a higher dividend payout, with investors receiving a total dividend of A$1.75 per share in FY23. It's latest dividend paid out in March was $1.08, up 44% from the $0.75 dividend payment last March.

Unfortunately for investors, there is still concern around the future performance of the miner due to Chairman Andrew Forrests' $9b green plan. The plan has raised concerns about the impact on dividends, with multiple analysts downgrading plans.

✅ Want to invest in FMG? Learn how to buy Fortescue Metals Group shares.

4. Helia Group Limited ($HLI)

Dividend yield: 7.42%

Market Capitalisation: $1.15b

Stock price (as of 2/4/2024): $3.91

Stake Platform Bought / Sold (Jan - Mar 2024): 69% / 31%

Helia Group Limited (HLI), known formerly as Genworth, is a premier entity in the Australian financial sector, primarily recognised for its specialisation in Lenders Mortgage Insurance (LMI). Since its inception in 1965, Helia has been instrumental in the property market, establishing itself as Australia's first LMI provider. The company not only offers lenders mortgage insurance but also crafts customised risk and capital management solutions catering to a broad clientele.

The most recent dividend was paid out in March 2024, at $0.45 per share (up from $0.14 six months prior).

5. Woodside Energy Group Ltd ($WDS)

Dividend yield: 7.08%

Market Capitalisation: $57.91b

Stock price (as of 2/4/2024): $30.43

Stake Platform Bought / Sold (Jan - Mar 2024): 72% / 28%

Woodside Energy Group Ltd (WDS), previously known as Woodside Petroleum Ltd, is a distinguished independent oil and gas entity. With its inception in Australia, the company has grown into a global energy provider, characterized by its operations in exploring, developing, producing, and supplying energy resources.

Woodside emphasises three strategic pillars - oil, gas, and new energy. This diversified approach demonstrates its commitment to adapting and thriving amidst the changing energy landscape.

The company has a robust portfolio of operational assets, including notable oil developments offshore Western Australia like the Ngujima-Yin FPSO, the Pyrenees FPSO, and the Okha FPSO. Their expanded global portfolio has most recently taken their operations to the Gulf of Mexico (US) and Trinidad and Tobago.

Woodside energy offer an 100% franked dividend, paid out twice a year, with the most recent dividend payment date April 4th with a price of $0.9168 per share.

6. Magellan Financial Group Limited ($MFG)

Dividend yield: 7.00%

Market Capitalisation: $1.78b

Stock price (as of 2/4/2024): $9.60

Stake Platform Bought / Sold (Jan - Mar 2024): 53% / 47%

Magellan Financial Group Limited is a distinguished Australian investment management firm, primarily focused on global equities and infrastructure investments. Established to deliver substantial returns for its clients, Magellan is renowned for its comprehensive approach to macroeconomic analysis and risk management.

Magellan are engaged with a diverse client base that includes private customers, institutional investors, and high-net-worth individuals mainly within Australia and New Zealand.

Magellan is committed to constructing portfolios designed for attractive long-term returns, underpinned by rigorous macroeconomic analysis. The firm is also noted for innovations such as the Single Unit Fund Structure, enhancing investor access to open-ended funds.

Their dividend is paid out bi-annually in March and September, with their most recent paid at $0.294 a share and 50% franked.

7. Whitehaven Coal Limited ($WHC)

Dividend yield: 6.90%

Market Capitalisation: $5.95b

Stock price (as of 2/4/2024): $7.09

Stake Platform Bought / Sold (Jan - Mar 2024): 64% / 36%

Whitehaven Coal is another company in the energy sector.

Whitehaven has been a significant figure in dividends but it's most recent dividend, which was a semi-annual dividend paid in March, was recorded at A$0.07 per share – the lowest interim payout since $0.08 in 2022.

Their last final dividend of 2023 paid out in September was their highest since 2012, with a price of $0.42 per share.

8. Rio Tinto Limited ($RIO)

Dividend yield: 5.37%

Market Capitalisation: $45.19b

Stock price (as of 2/4/2024): $122.50

Stake Platform Bought / Sold (Jan - Mar 2024): 67% / 33%

Rio have an upcoming dividend of $3.9278 payable in April, bringing the full-year dividend to $6.5367, and is 100% franked.

Goldman Sachs was correct in believing that the company would be paying out slightly higher dividends in the next few years, before slowing down in FY2025. The forecasted dividends was $5.98 in FY2024, and $3.40 in FY2025.

9. BHP Group Limited ($BHP)

Dividend yield: 5.30%

Market Capitalisation: $224.39b

Stock price (as of 2/4/2024): $45.08

Stake Platform Bought / Sold (Jan - Mar 2024): 74% / 26%

BHP is one of the best dividend stocks to watch on the ASX. Earlier in March it paid out a dividend of $1.09 per share, consistently paid out at 100% franked.

The dividend amounts have varied significantly over the years for BHP Group. For instance, there was a notable peak in the dividend amount in September 2022 ($2.5518), followed by a decrease in subsequent periods.

There was a gradual increase in both the amount and gross dividends from 2015, peaking in 2022, followed by a notable decrease. The most recent dividends also show a decrease. With BHP having such a strong foothold in the market with their portfolio of diversified resources, the company will remain a solid choice for dividend investors on the ASX.

✅ If you're interested in the mining giant, learn how to buy BHP Group shares.

10. Commonwealth Bank of Australia ($CBA)

Dividend yield: 3.78%

Market Capitalisation: $201.52b

Stock price (as of 2/4/2024): $120.07

Stake Platform Bought / Sold (Jan - Mar 2024): 59% / 41%

Commonwealth Bank is one of the largest stocks to watch by market capitalisation. Why? Well, the nation's largest bank has had an impressive history of share price growth, rising from $5.40 to now sitting at over $120 (at the time of writing).

Investors have not only enjoyed the CBA stock price rise but also the consistent dividend yield. The bank hasn't missed a bi-annual dividend payout in its 31-year history but of course, the payment amounts of these have fluctuated.

Most recently the bank paid an interim dividend of A$2.15 – slightly less then the final dividend in FY2023 at $2.40.

With 100% franked dividends, it's clear that the consistency from CBA make them one of the top dividend stocks to buy with a dividend range from a low of $0.98 in August 2020 to a high of $2.40 in August 2023 over the last 10 years.

💡Related: Wondering which bank shares to buy? Deep dive into the top 10 banks on the ASX→

What are the highest-paying dividend stocks in Australia?

Here are the top three highest-paying dividend stocks in Australia from our list above:

- Yancoal Australia Limited ($YAL) - Dividend yield: 13.26%

- New Hope Corporation Limited ($NHC) - Dividend yield: 10.97%

- Fortescue Ltd ($FMG) - Dividend yield: 8.09%

What are the best dividend stocks for investors?

Well, it's a complicated question, investors first need to understand how dividends work, their benefits and the risks that investing in dividend stocks can have.

Last year in FY22, ASX 200 shares announced dividends totalling $42.3 billion, down 1.7% year over year. The most common form of a dividend is a cash payment, but there are other ways a company can return profits to shareholders.

Dividend stock investors view a stock’s yield as the key measure of a stock’s value. It offers an insight into how great the return on an investment will be. Remember that past performance is no guarantee of future performance and you should consider your personal circumstances before investing.

To find the right dividend stocks to add to your portfolio, conduct thorough research and examine the long-term income potential of the ASX dividend-paying stocks available.

💡Related: Looking for high dividend ETFs in Australia?→

💡Related: Looking for U.S. stocks that pay monthly dividends?→

What long-term dividend ETFs on the ASX are there?

There are ways for investors to access dividend stocks without putting all their eggs in one basket. This includes a number of ASX ETFs in the market that offer regular dividend payments. Look at three popular options below or for a larger list, check out the top dividend ETFs in Australia.

BetaShares has two products, the Australian Financials Sector ETF ($QFN), Australian Top 20 Equity Yield Maximiser Fund (managed fund) ($YMAX). QFN comprises the largest ASX-listed companies in the financial sector while YMAX tracks 20 of the largest blue-chip stocks on the ASX.

There are a number of Vanguard ETFs available for investors looking to buy and sell ASX stocks. The Australian Shares High Yield ETF ($VHY) seeks to track the return of the FTSE Australia High Dividend Yield Index. This ETF provides exposure to companies listed on the ASX that have higher forecast dividends relative to other ASX-listed companies.

The companies these ETFs invest in can be found in their product disclosure statements.

What are the 3 important dividend dates?

For most investors, the key dates to watch are the declaration date, ex-dividend date and record date. Find out more about these dividend terms below:

Declaration date: This is the day you find out how much the company is set to pay out. This date usually coincides with the release of a company's financials, so with its half-yearly or annual results. The ASX release will contain the amount to be paid per share and the level of franking. It will also state the ex-dividend date, record date and payment date.

Ex-dividend date: The ex-dividend date is the first trading day upon which an upcoming dividend is not included in a share's price. If you buy before this date, you get the payout. If you buy after, you won't.

Record date: The record date is the day the company makes a list of all its shareholders to allocate dividend payments.

More resources:

✅ Looking for high dividend U.S. stocks?→

✅ REITs that pay dividends from Wall St→

✅ What is a Dividend Reinvestment Plan (DRP)?→

Dividend stocks FAQs

The key to finding strong ASX stocks lies in the evaluation of the company, however, many investors have their own way of researching a stock. But for dividend investors, three important metrics can help decide which dividend stock to add to a portfolio: dividend yield, dividend payout growth rate, and dividend payout ratio.

The dividend yield is a ratio expressed as a percentage that shows how much a company pays in dividends relative to its share price.

The payout growth rate is the average percentage rate of growth a stock's dividend has experienced over a specific period.

The dividend payout ratio, or the percentage of a company's earnings or free cash flow used to cover dividend payments.

Check out our article 'Are these the best Australian shares to buy for long-term?' if you aren't focused on pure dividend stocks.

In simple terms, the dividend yield is calculated by adding up all payouts in the last 12 months (including special dividends) and then dividing the value by the current share price.

Yields for a current year can be estimated using the previous year's dividend or by multiplying the latest quarterly dividend by 4, then dividing by the current share price.

The yield is used to measure the amount of cash flow you're getting back for each dollar you invest in an equity position. So essentially it's the return on investment for a stock without any capital gains.

A company only has a finite amount of money. So if they are paying out investors, that gives them less money to invest in themselves to make capital gains. So yes, a company with a high dividend could be costing a company its growth potential.

It pays to do some research, sometimes a high yield could be a result of a stock price tanking, which would make the yield mathematically rise. Like any investment, you should consider your personal circumstances and if in doubt, seek advice from a licensed financial adviser.

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation, particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.