How to Buy BHP Group (BHP) Shares

Learn how to become one of the newest shareholders in the biggest mining company in the world.

This article focuses on how to buy specific securities, however, it is not a recommendation to invest in them and should not be taken as financial advice. Do your own research and make your own decisions, or even consider getting advice from a licensed financial adviser before investing.

BHP Group Limited ($BHP) is by far the biggest mining company in existence. Iron ore, copper, gold, silver, rare earths, you name it: BHP is likely to be a key player in every metals and mining sector.

Stake makes it as simple as possible to buy BHP Group shares and invest in Australian stocks with a digital and sophisticated investing platform.

How to buy BHP Group (BHP) stock

Want to start buying BHP shares but not sure how? Learn how to buy BHP Group Limited stock on the Stake stock trading platform below.

1. Find a stock investing platform

Open an account that offers American and Australian stock exchanges, like Stake, which will probably cover all your needs for a diversified portfolio. Make sure you choose a low-cost CHESS-sponsored platform so that you own the shares under your own HIN. Remember: future returns are uncertain, while costs are fixed. Lowering your costs will always help improve your investment returns.

2. Fund your account

Complete an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for BHP Group Limited or BHP

Enter the stock ticker or company name when searching on the Stake app. Do your own research to ensure it is the right investment product for your own circumstances.

4. Choose an order type and buy BHP stock

Buy on any trading day with a market order or use a limit order to delay your purchase of AMZN shares until it reaches your desired stock price. Look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Optimise your portfolio by tracking how your stock and the business perform with an eye on the long term. You may be eligible for dividends and shareholder voting rights that affect your stock.

✅ Gain access to shares like BHP, Fortescue Metals Group and Rio Tinto and more when you sign up to Stake.

BHP Group Limited (BHP) overview

One of the longest-standing mining companies in the world and one of the most popular Australian mining shares on Stake, BHP was founded in New South Wales in 1885. More than a century later, it has become the world’s biggest mining company, with over 80,000 employees and operations spreading across 10 different countries: Australia, Canada, Colombia, Trinidad and Tobago, Peru, Chile, Brazil, Algeria, Mexico and the United States.

Though most of its revenue comes from iron ore mining, the company also produces a significant amount of copper, coal, nickel and potash, with other commodities playing a smaller role in the company’s focus and revenue. For FY22, BHP’s revenues were over US$65.4b, with gross profits hitting over AUD$54.7b.

Mining is not a sector usually considered to have ESG-friendly stocks, however, BHP is trying to change this. They are focused on reducing carbon emissions, investing in the Great Barrier Reef recovery and working alongside indigenous populations in the countries it operates.

💡Related: Watch these 10 ASX Nickel Stocks→

💡Related: Top Iron Ore Shares on the ASX→

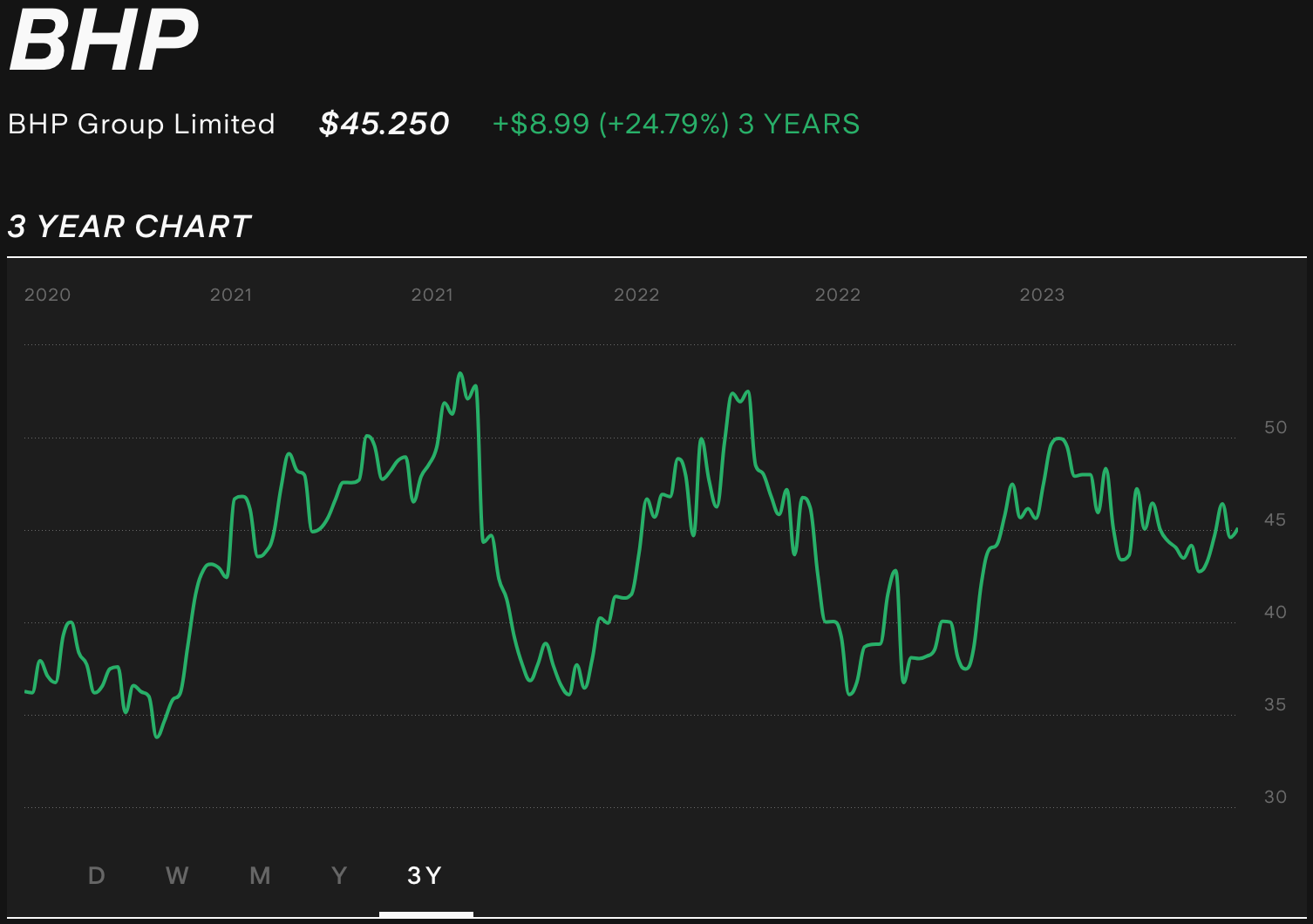

BHP Group Limited share performance

Since it’s IPO on the ASX in 1990, the BHP share price has risen over 5,700%, which means that AUD$100 invested in it would have become over AUD$5,700 by now. It began trading at AUD$0.70 and its all-time-high was hit in July 2021, at AUD$53.49.

Its current market cap sits north of US$230b, and its biggest drawdown lasted over 12 years, from October 2007 to December 2019, when it reached new all-time highs once again.

🆚 Compare BHP vs RIO stock price→

BHP Group stock P/E ratio

BHP Non-GAAP forward P/E ratio is currently 11.97. Its 5-year average is 13.12.

BHP Group stock EBITDA

BHP’s EBITDA in Q2 2022 was US$37.6b.

Does BHP Group Limited shares pay dividends?

Yes. Since 2000 BHP has regularly paid dividends twice every year. In September 2022, BHP paid US$3.50 per share, totalling US$6.50 in the total amount paid over the year.

BHP has been featured on our dividend paying stocks in Australia list.

Has BHP Group Limited (BHP) ever had a stock split?

BHP has gone through three stock splits: one in 1996, another in 2001 and the last one in June 2022.

BHP Group Limited FAQs

Who is the major shareholder of BHP shares?

BHP has no major shareholder, which means that no single person or entity controls over 50% of the company. Only two shareholders have more than 1% of the shares, which are Vanguard and BlackRock, two of the biggest ETF providers in the world.

How many BHP Group Limited shares are there?

There are around 5.06b limited outstanding shares of $BHP.

Stella is a markets analyst and writer with almost a decade of investing experience. With a Masters in Accounting from the University of Sydney, she specialises in financial statement analysis and financial modelling. Previously, she worked as an equity analyst at Australian finance start-up, Simply Wall St, where she took charge of the market insights newsletter sent out to over a million subscribers. At Stake, Stella has been key to producing the weekly Wrap articles and social media content.