Are these the best ASX Mining Stocks to buy? [2025]

The mining industry plays a huge part in the Australian and global economy. Get to know some of these companies and see what mining companies are popular amongst Stake investors.

Investing in the top mining companies in Australia can offer exposure to a diverse range of commodities, including iron ore, gold, copper, nickel, and mineral sands. This can help diversify an investor's portfolio and reduce risk.

The most traded ASX mining stocks are the large iron ore miners, but also gold and lithium stocks. However, investing in mining shares can be volatile due to factors such as commodity prices, the strength of China’s economy, production levels, and geopolitical risks.

Before investing in these companies, it is important to do your due diligence and carefully consider factors such as the company's financial performance, management team, growth prospects, and sustainability practices. It is also important to have a long-term investment horizon and to be prepared to weather short-term volatility in the market.

What are the most traded ASX mining stocks?

Mining stocks are among the most popular stocks on the ASX due to the importance of the mining and energy sector to the Australian economy. Mining stocks are known for their volatility and high-risk nature, but also have the potential for high returns, particularly in a commodity bull market.

The most traded major ASX mining stocks by volume are:

These companies are all major players in the Australian mining sector, especially iron ore mining, which is a major export commodity for Australia. These companies are also listed as part of the ASX 200 index, which includes the largest and most liquid companies on the ASX.

Watch these ASX-listed mining shares in 2025

Company Name | Ticker | Share Price | YTD | Market Capitalisation |

|---|---|---|---|---|

BHP Group | $39.48 | -0.18% | $200.32b | |

Rio Tinto | $117.18 | -0.24% | $164.92b | |

Fortescue | $16.15 | -11.51% | $49.73b | |

Northern Star Resources | $17.53 | +13.54% | $20.06b | |

South32 | $3.52 | +3.53% | $15.90b | |

Evolution Mining | $6.24 | +29.73% | $12.41b | |

Newmont Mining CDI | $67.84 | +13.94% | $7.96b | |

Lynas Rare Earths | $7.07 | +9.95% | $6.61b | |

Pilbara Minerals | $1.89 | -13.70% | $5.69b | |

Sandfire Resources | $10.65 | +14.76% | $4.89b |

Data as of 4 March 2025. Source: Stake, Google.

*The list of mining stocks mentioned is ranked by market capitalisation. When deciding what stocks to feature, we analyse the company's financials, recent news and earnings, upcoming dividends, and whether or not they are actively traded on Stake.

Discover which mining companies to add to your watchlist

1. BHP Group ($BHP)

- 19,780 Stake customers watching

- 36,556 orders executed on Stake

BHP is the world’s largest mining company with operations spanning iron ore, copper, coal and potash. The miner’s H1 earnings reflected the weakness in Chinese demand for commodities caused by its weak property market. Despite record volumes, H1 revenue fell 8% year-on-year to US$25.2b. Underlying profit fell 23% YoY to US$5.1b. An interim dividend of US$0.50 a share was the lowest in 8 years.

BHP has invested heavily to grow its copper business as China’s demand for iron ore plateaus. The acquisition of OZ Minerals and a stake in Filo will help drive it towards its aspirational goal of over 2 million tonnes a year of attributable copper production. BHP has been the lowest-cost major iron ore producer for 5 years.

🆚 Compare BHP vs RIO stock comparison→

2. Rio Tinto ($RIO)

- 9,252 Stake customers watching

- 11,339 orders executed on Stake

Rio Tinto is the world’s second-largest mining company with exposure to iron ore, aluminium, copper, lithium and minerals including titanium dioxide and borates. FY24 sales volumes rose 3% and underlying earnings fell 8% to US$10.9b. Iron ore accounted for 65% of the net operating cash flow. The average iron fines price was 11% lower in FY24 versus FY23.

There has been a rising contribution from copper and aluminium as iron ore demand has slowed. Its Oyu Tolgoi copper mine in Mongolia is expected to increase production and grades this year and is set to become the world’s fourth-largest copper mine by 2030. Rio Tinto will add lithium to its portfolio following the US$6.7b acquisition of Arcadium Lithium.

3. Fortescue ($FMG)

- 15,804 Stake customers watching

- 32,806 orders executed on Stake

Fortescue is the third largest iron ore producer in Western Australia’s Pilbara region. It delivered record H1 iron ore shipments of 97.1m tonnes, which was 3% higher than H1 FY24. However, H1 revenue fell 20% to US$7.63b and attributable net profit after tax fell 53% to US$1.55b.

FY25 guidance is for iron ore shipments of 190m-200m tonnes. Guidance for FY25 capital expenditure in its energy division was cut from US$500m to US$400m reflecting lower spend on green energy projects.

4. Northern Star Resources ($NST)

- 2,505 Stake customers watching

- 5,445 orders executed on Stake

Northern Star Resources is Australia’s largest listed gold mining company with projects across Western Australia, including its Kalgoorlie operations and Jundee. It also operates the Pogo mine in Alaska. The $5b acquisition of De Grey Mining provides an additional growth option in WA. Northern Star’s H1 revenue increased 28% year-on-year to $2.86b due to a higher average gold price. The miner intends to produce 1.65m-1.8m ounces of gold in FY25.

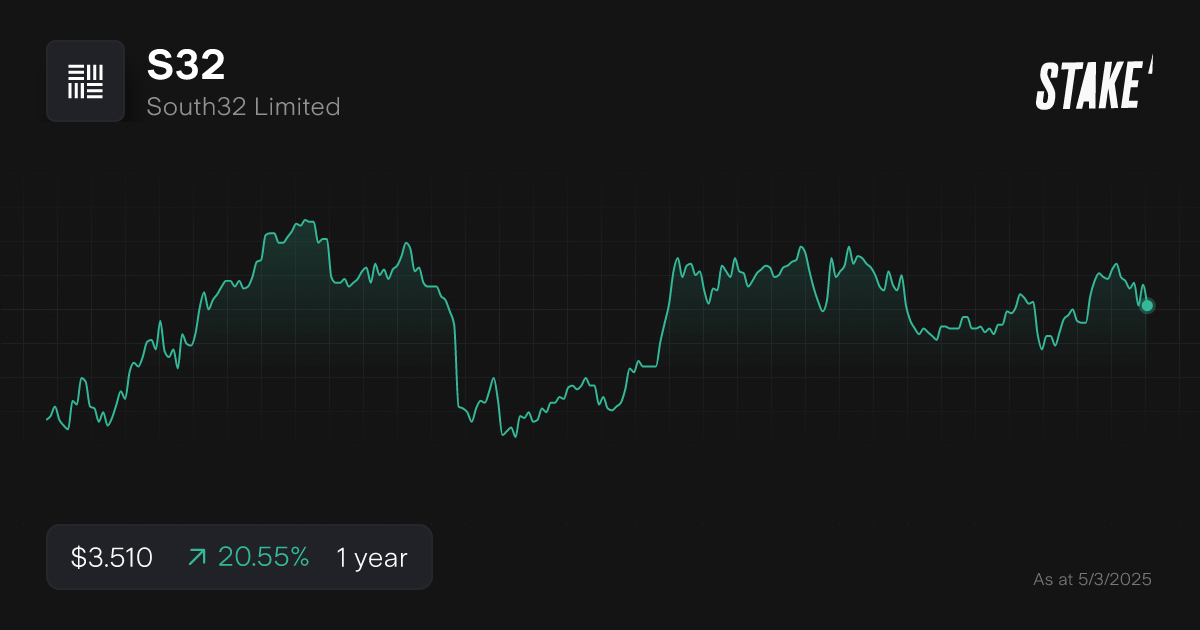

5. South32 ($S32)

- 3,294 Stake customers watching

- 7,499 orders executed on Stake

South32 is a diversified mining company that produces a range of commodities, mostly industrial metals including aluminum, coal, manganese, and silver. The company was spun off from BHP Group in 2015 and has operations in Australia, South Africa, and several other countries. Around 50% of its H1 EBITDA came from alumina, with copper accounting for around 20%. The company is investing in its Taylor zinc-lead-silver mine at Hermosa in Arizona.

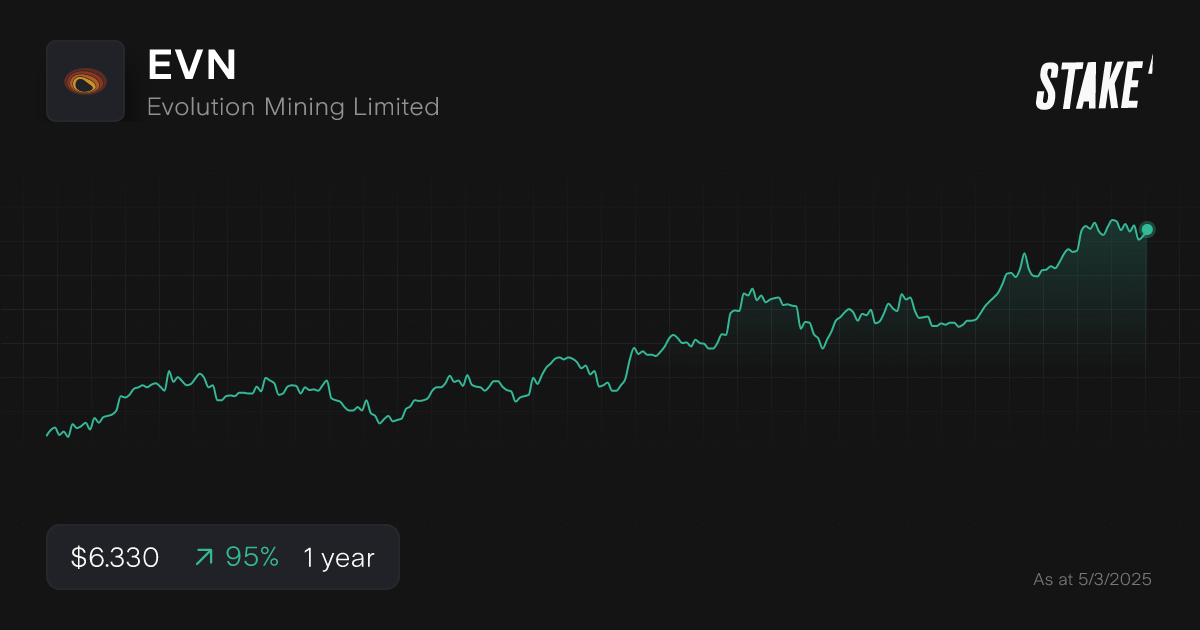

6. Evolution Mining ($EVN)

- 1,685 Stake customers watching

- 3,784 orders executed on Stake

Evolution Mining is a gold producer operating primarily in Australia. The company was founded in 2011 and has since become one of the country's largest gold producers. Evolution Mining's main operations are in Western Australia, New South Wales, Queensland and Canada.

Evolution Mining delivered a record H1 underlying net profit of $385 million, up 144% year-on-year. The company is aiming to produce 710,000-780,000 ounces in FY25.

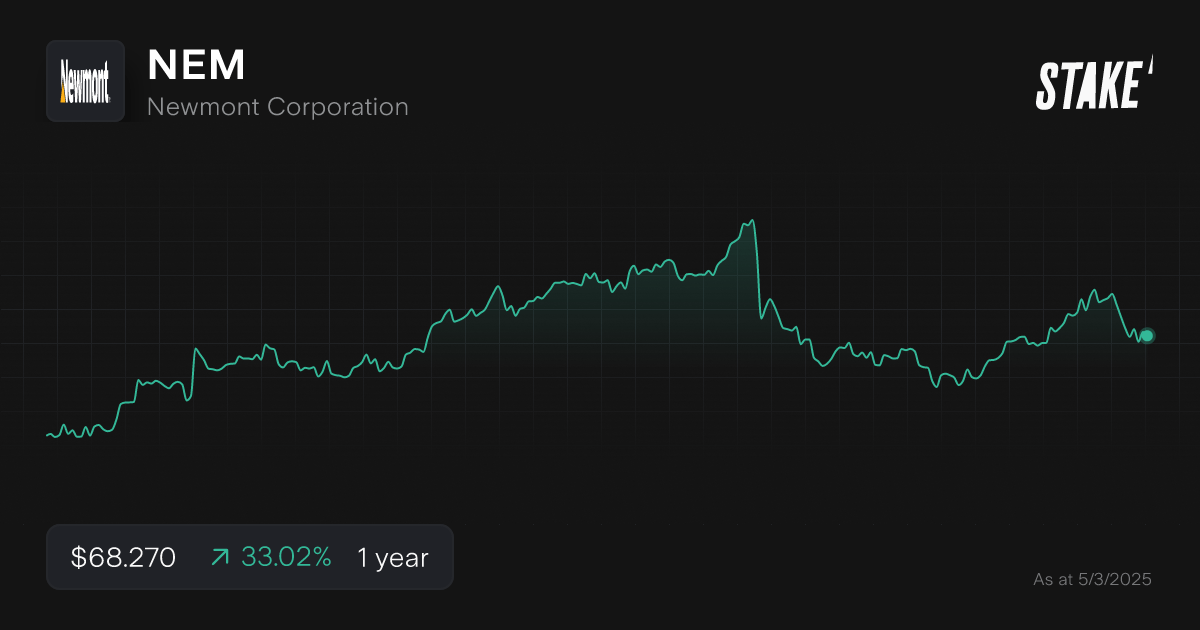

7. Newmont Corporation ($NEM)

- 885 Stake customers watching

- 1,337 orders executed on Stake

Newmont Mining is the world’s largest gold producer, targeting production of 5.6m ounces in FY25. The company grew its production and reserves with the $26b acquisition of Australia’s Newcrest Mining in late 2023. It has operations across Australia, the U.S., Canada and Papua New Guinea. It owns and operates some of the gold industry’s top mines and is divesting non-core assets.

As of 5 February, Newmont had 116,193,650 Chess Depositary Instruments listed on the ASX, giving it a market cap of $7.96b.

🆚 Compare: Which is the best gold share: NEM or NST→

8. Lynas Rare Earths ($LYC)

- 3,078 Stake customers watching

- 6,549 orders executed on Stake

Lynas Rare Earths is the world’s only significant producer of separated rare earth materials outside of China. The Lynas Mt Weld mine in Western Australia is one of the world’s premier rare earth deposits. Lynas also operates the world’s largest single rare earths processing plant in Malaysia where it produces high-quality separated rare earth materials for export to Asia, Europe and the United States.

H1 sales revenue increased 8% to $254.3m due to the increased neodymium and praseodymium (NdPr) sales volume. The average China domestic price of NdPr fell from US$56/kg in December 2023 to US$49/kg in December 2024.

9. Pilbara Minerals ($PLS)

- 14,767 Stake customers watching

- 44,878 orders executed on Stake

Pilbara Minerals is a leading global producer of lithium materials, with a diversified portfolio of assets and strategic partnerships in the rapidly growing battery materials sector. It owns 100% of the world’s largest, independent hard-rock lithium operation, the Pilgangoora operation in Australia, and the Colina lithium project in Brazil. Pilbara has a joint venture with POSCO in South Korea, which manufactures battery-grade lithium hydroxide.

H1 revenue fell 44% to $426m driven by the 58% decrease in the average realised price spodumene concentrate, partly offset by a 37% increase in sales volumes.

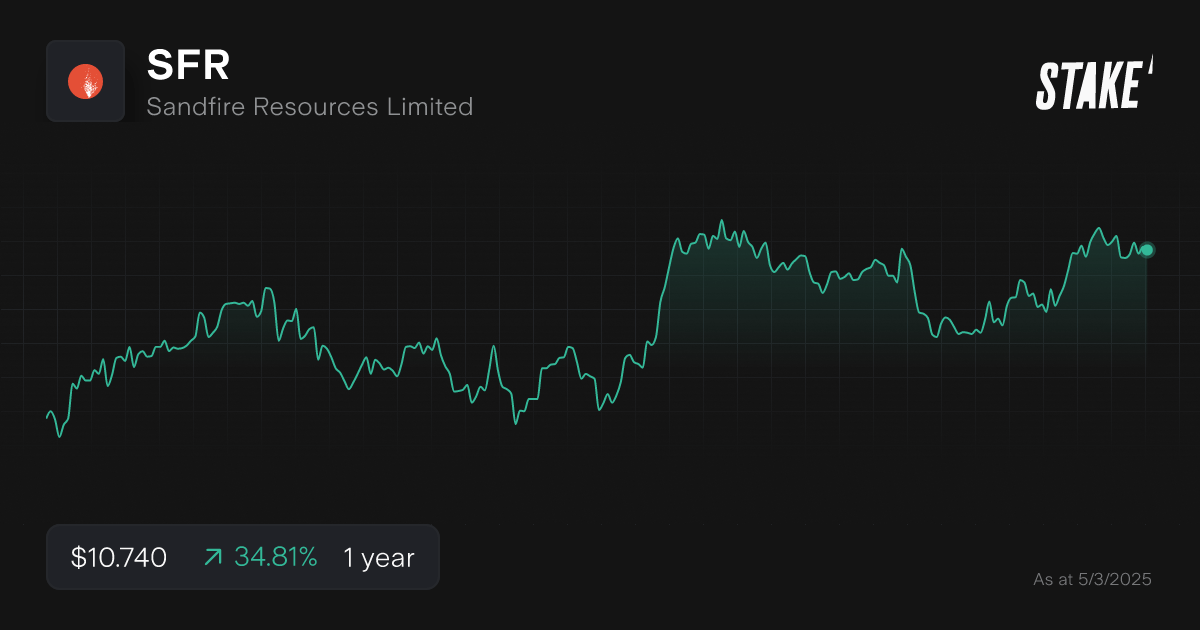

10. Sandfire Resources ($SFR)

- 1,150 Stake customers watching

- 1,992 orders executed on Stake

Sandfire Resources is a copper miner that owns the MATSA mine in Spain and the Montheo mine in Botswana. Copper represented 73% of H1 revenue, followed by zinc at 16%. H1 revenue rose 37% year-on-year to $572m as copper equivalent production increased 16%. The copper mining company is targeting a minimum reserve life of 15 years at MATSA within 5 years. Motheo’s throughput rate of 5.6m tonnes a year will enable the miner to bring forward metal production.

How to invest in mining companies in Australia

The main way to invest in mining companies is through shares listed on the ASX, using an online investment platform. Follow our step by step guide below:

1. Find a stock investing platform

To buy mining shares on the ASX, you'll need to sign up to an investing platform with access to the Aussie stock market. There are several share investing platforms available, of which Stake is one.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for the company or ticker symbol

Find the company name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own the stock, you should monitor its performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

What materials are Australian investors interested in?

Australian investors have historically shown interest in a range of minerals and raw materials, but some of the most popular minerals that Australian investors are interested in include gold, iron ore, copper, and lithium.

💡Related: Gold Stocks ASX: Top Gold Mining Companies→

💡Related: ASX Iron Ore Stocks to Watch→

💡Related: Top Lithium Stocks to Watch on the ASX→

Mining stocks FAQs

Investing in mining stocks can be a good option for investors who are willing to take on higher risk for potentially higher returns. Mining stocks are often tied to the prices of commodities, or precious metals such as gold, silver, copper, or iron ore, and can be influenced by a range of factors including geopolitical events, supply and demand, and global economic trends.

Ultimately, the decision to invest in mining stocks should be based on an individual's investment goals, risk tolerance, and overall portfolio strategy.

This article was edited by Robert Guy - Senior Markets Writer at Stake.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

.jpg&w=3840&q=100)