ASX Copper stocks: Top 12 copper mining companies [2024]

There are several ASX copper stocks that help investors gain exposure to one of the world's most consumed metals. Copper demand is expected to grow 70% by 2050. It’s vital for the energy transition and is used in electric vehicles, wind and solar, and expanding the electricity grid.

The digital revolution relies on copper to power data centres, 5G and AI.

However, copper supply faces headwinds. More than half the world’s operating copper mines are more than 20 years old. Copper grades have halved since the 1990s.

Here are some of the ASX’s top copper plays to gain exposure to industry.

Discover the top Australian copper miners on the ASX

Company Name | Ticker | Share Price | Year to Date | Market Capitalisation |

|---|---|---|---|---|

BHP Group | $40.16 | -20.33% | $203.7b | |

Rio Tinto | $117.18 | -13.62% | $164.5b | |

Sandfire Resources Limited | $10.27 | +39.92% | $4.71b | |

Capstone Copper Corp. | $11.20 | +13.02% | $1.86b | |

Metals Acquisition Limited | $18.97 | -0.16% | $758m | |

Develop Global Limited | $2.01 | -28.98% | $545m | |

29Metals Limited | $0.38 | -41.09% | $266m | |

AIC Mines Limited | $0.33 | -4.35% | $189m | |

Aeris Resources Limited | $0.18 | +27.59 | $174m | |

Hot Chili Limited | $0.78 | -27.78% | $118m | |

Hillgrove Resources Limited | $0.058 | -38.30% | $115m | |

Caravel Minerals Limited | $0.18 | -5.41% | $97m |

Data as at 22 November 2024. Source: Stake, ASX.

*The list of copper stocks mentioned is ranked by market capitalisation. When deciding what stocks to feature, we analyse the company's financials, recent news, advancement in their timeline, and whether or not they are actively traded on Stake.

Add these Australian copper stocks to your watchlist

1. BHP Group ($BHP)

- Market capitalisation: $203.7b

- Share price (as of 22/11/2024): $40.16

- Stake investors watching $BHP: 18,504

BHP is one of the world’s largest copper producers with targeted production of between 1.845m tonnes and 2.045m tonnes in FY25.

A significant share of production comes from its 57.5% stake in Chile’s Escondida, the world’s largest copper mine. BHP increased its exposure to South American copper after joining with Lundin Mining to acquire Filo Mining in July 2024. Filo is developing a project on the border between Chile and Argentina.

BHP plans to grow its South Australian copper business. It acquired OZ Minerals for $9.6b in 2023 and will create a hub that includes its Olympic Dam operations. Copper as a share of BHP’s EBITDA grew from around 20% in FY19 to around 30% in FY24.

2. Rio Tinto ($RIO)

- Market capitalisation: $164.5b

- Share price (as of 22/11/2024): $117.18

- Stake investors watching $RIO: 8,751

Rio Tinto has a sizeable copper business built around its 30% stake in Escondida, the Kennecott mine in Utah and the Oyu Tolgoi mine in Mongolia. Rio Tinto is targeting mined copper production of between 660,000 tonnes and 720,000 tonnes in calendar 2024. Refined copper production is expected to be between 230,000 tonnes and 260,000 tonnes in calendar 2024. Oyu Tolgoi is ramping up to produce 500,000 tonnes a year of copper from 2028 to 2036.

Rio Tinto unveiled plans in 2023 to invest around US$1b in its Kennecott operations, including a rebuild of the smelter. The copper unit delivered EBITDA of US$2.09b in H1 FY24 compared to US$8.85b from its iron ore business.

🆚 Compare RIO vs BHP→

3. Sandfire Resources Limited ($SFR)

Market capitalisation: $4.71b

Share price (as of 22/11/2024): $10.27

Stake investors watching $SFR: 1,096

Sandfire Resources is one of the largest pure-play ASX copper stocks. The company is focused on its MATSA copper operations in Spain and its Motheo asset in Botswana's Kalahari Copper Belt. Sandfire expects the ramp up at Montheo and a record processing rate at MATSA to drive a 13% increase in copper equivalent production to 154,00 tonnes in FY25. Copper accounted for 76% of H1 revenue.

Sandfire also has an interest in the Black Butte copper project in Montana, one of the world’s highest grade undeveloped copper projects.

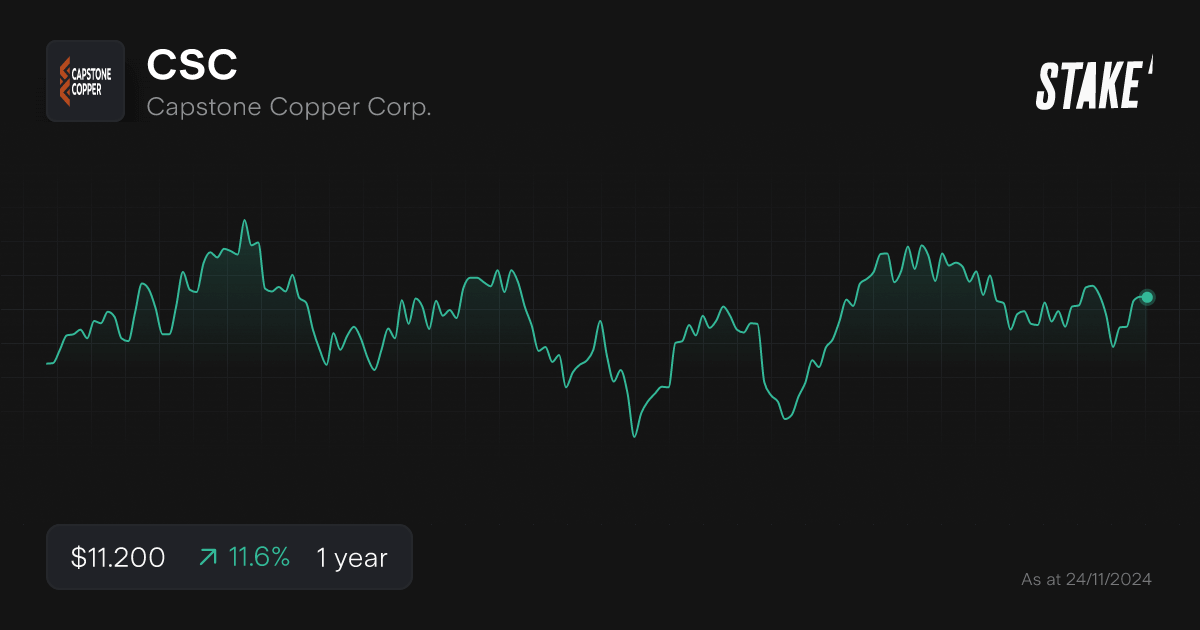

4. Capstone Copper Corp. ($CSC)

Market capitalisation: $1.86b

Share price (as of 22/11/2024): $11.20

Stake investors watching $CSC: 94

Capstone Copper is an Americas-focused copper mining company headquartered in Canada. It owns and operates the Pinto Valley copper mine located in Arizona and the Cozamin copper-silver mine located in Mexico. It also owns the Mantos Blancos copper-silver mine located in Chile and 70% of the Mantoverde copper-gold mine in Chile.

The company recently completed a feasibility study on an expansion of Mantoverde that could deliver an additional 20,000 tonnes a year. Capstone also owns the fully permitted Santo Domingo copper-iron-gold project in Chile. The miner warned in October that 2024 production was expected to be at the low end of its guidance range of between 190,000 tonnes and 220,000 tonnes.

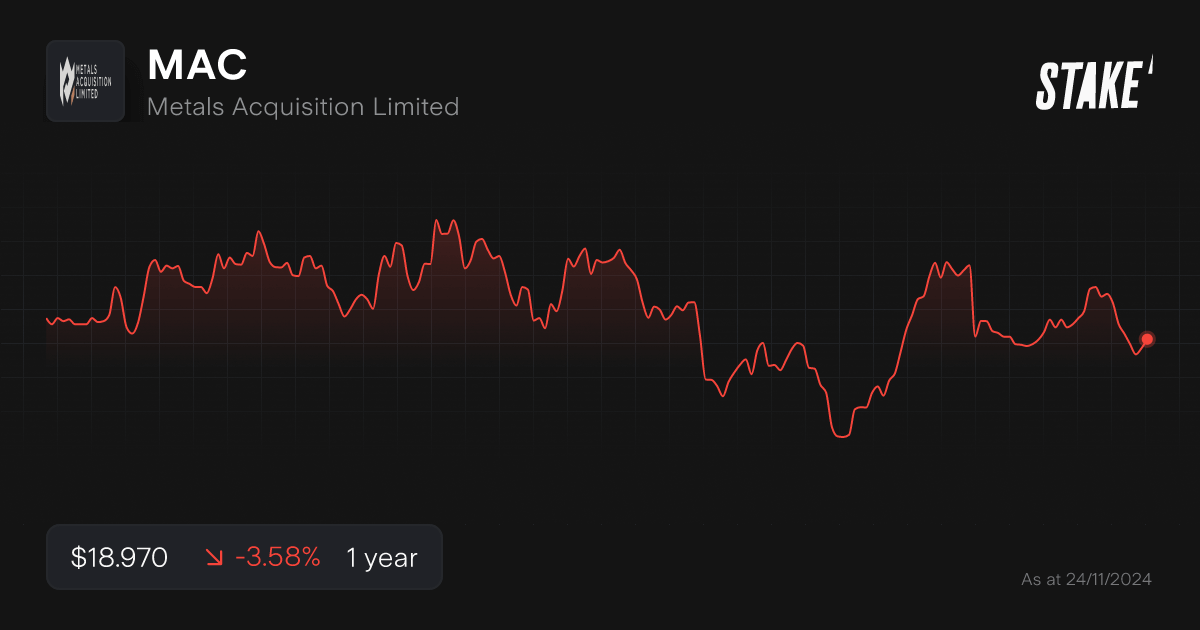

5. Metals Acquisition Limited ($MAC)

Market capitalisation: $758m

Share price (as of 22/11/2024): $18.97

Stake investors watching $MAC: 96

Metals Acquisition owns the CSA Copper Mine in Cobar, New South Wales, which they acquired from Glencore ($GLNCY) in June 2023. Copper production for 2024 is tracking at 40,500 tonnes of copper, the midpoint of guidance of between 38,000 tonnes and 43,000 tonnes. The company is targeting production in excess of 50,000 tonnes a year by 2026. Reserves have increased since the CSA mine was acquired.

MAC raised $150m in October from the sale of new Chess Depositary Receipts at $18 per CDI. The new capital will be used to retire mezzanine debt and provide funding for growth opportunities.

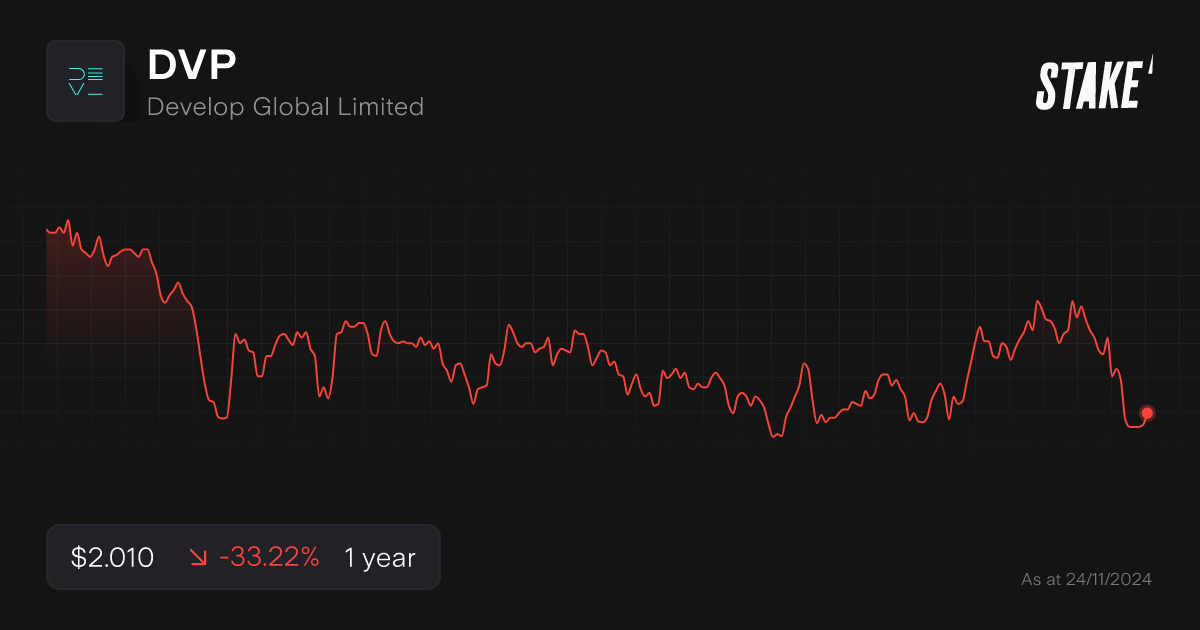

6. Develop Global Limited ($DVP)

Market capitalisation: $545m

Share price (as of 22/11/2024): $2.01

Stake investors watching $DVP: 420

Develop Global generates revenue as a mining contractor but is seeking to develop a number of mining projects. The company earned $52.7m in revenue in the September quarter from mining services. During the quarter it secured a US$65m offtake and funding facility from commodity trader Trafigura for the development of the Woodlawn copper-zinc mine. Production is targeted for mid-2025. Develop Global also is seeking to develop the Sulphur Springs Copper Zinc Project in Western Australia. The company has a joint venture with Anax Metals Limited ($ANX) in the Whim Creek copper-zinc project. It also owns the Pioneer dome lithium project.

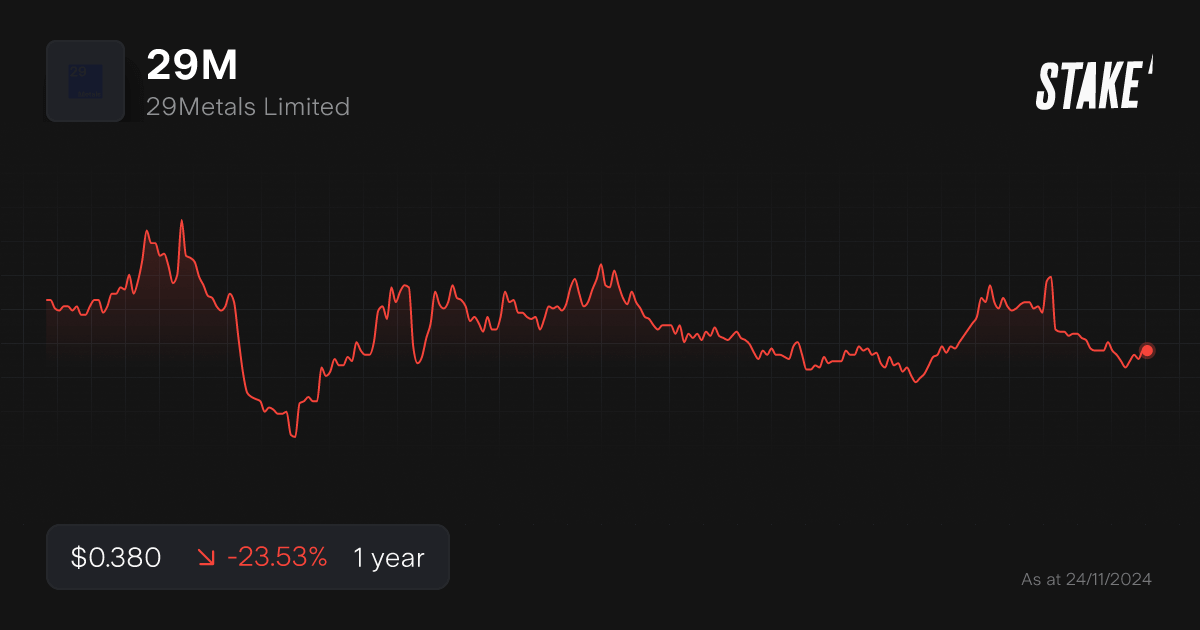

7. 29Metals Limited ($29M)

Market capitalisation: $266m

Share price (as of 22/11/2024): $0.38

Stake investors watching $29M: 506

29Metals operates the multi-commodity Golden Grove Mine in Western Australia. Copper production of between 18,000 tonnes and 22,000 tonnes is targeted in 2024 from Golden Grove. It also produces zinc, silver and gold. The company is progressing towards a final investment decision on its Gossan Valley development, which would provide additional production at Golden Grove.

29Metals is also working towards a restart of its Capricorn mine in Queensland which was flooded in 2023. The company announced in November 2024 it received $21m in insurance payments. It has received $61m of insurance payments so far and continues to negotiate for a final settlement.

💡Related: Discover some of the top gold mining companies in Australia→

8. AIC Mines Limited ($A1M)

Market capitalisation: $189m

Share price (as of 22/11/2024): $0.33

Stake investors watching $A1M: 293

AIC Mines currently operates the underground Eloise Copper Mine near Mount Isa in northern Queensland. The company is targeting FY25 production of 12,500 tonnes of copper and 5,000 ounces of gold. The Eloise mine produced 4,586 tonnes of copper concentrate in the first four months of FY25.

AIC is developing its Jericho copper project, which is located four kilometres south of Eloise. Staged development of the Jericho mine and expansion of the Eloise processing plant capacity to 1.1m tonnes a year could lift annual copper production from Eloise to 20,000 tonnes a year.

9. Aeris Resources Limited ($AIS)

Market capitalisation: $174m

Share price (as of 22/11/2024): $0.18

Stake investors watching $AIS: 692

Aeris Resources is a mid-tier base and precious metals producer. It is targeting FY25 copper production of between 27,000 tonnes and 32,000 tonnes. Most of this copper will come from its Tritton mine in New South Wales, which is expected to produce between 21,000 tonnes and 25,000 tonnes.

The company produces gold from its Cracow mine in Queensland. Aeris is targeting gold production of between 50,000 ounces and 62,000 ounces in FY25, with Cracow set to deliver between 40,000 ounces and 49,000 ounces. Its Jaguar zinc-copper mine is on care and maintenance, with a preferred restart option to be presented to the board in the December quarter.

10. Hot Chili Limited ($HCH)

Market capitalisation: $118m

Share price (as of 22/11/2024): $0.78

Stake investors watching $HCH: 363

Hot Chili is advancing its Costa Fuego Copper Project towards production. The asset is located at a low elevation near the coast in northern Chile. Costa Fuego is one of the world’s largest undeveloped copper mineral resources. The company will release the Costa Fuego pre-feasibility study in Q1 2025.

Hot Chili announced in November 2024 that it had entered into a three-year option agreement to acquire a 100% interest in the historical La Verde open pit copper mine, approximately 30 km south of Costa Fuego.

11. Hillgrove Resources Limited ($HGO)

Market capitalisation: $115m

Share price (as of 22/11/2024): $0.058

Stake investors watching $HGO: 275

Hillgrove Resources owns the Kanmantoo Copper Gold Mine in South Australia, which lies around 55 km from Adelaide. Production continues to ramp up after commercial production was declared on 1 July 2024. Kanmantoo produced 2,923 tonnes of copper in the September quarter. Management is seeking to improve production rates and reduce costs as the mine moves towards steady state production.

An updated mineral resources estimate was released in October 2024 that delivered a 96% increase in contained copper and a 138% increase in contained gold compared to the 2022 mineral resources estimate.

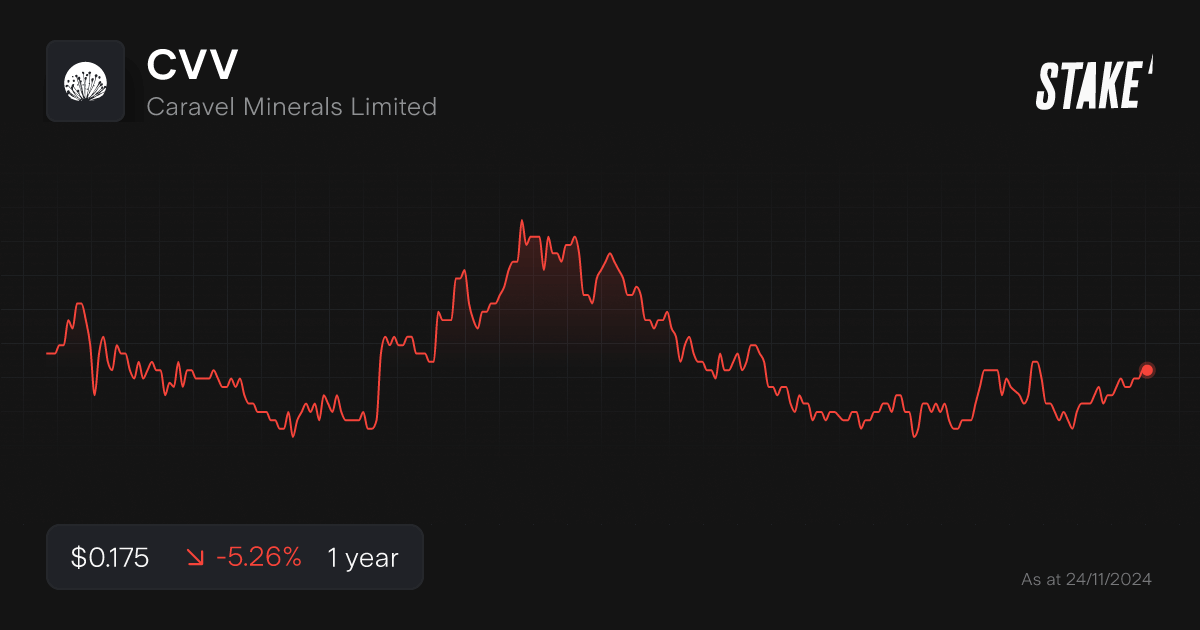

12. Caravel Minerals Limited ($CVV)

Market capitalisation: $97m

Share price (as of 22/11/2024): $0.18

Stake investors watching $CVV: 195

Caravel is developing its flagship copper project of the same name in Western Australia. The Caravel asset lies around 150 km from Perth. The team is currently working on a feasibility study. The project is expected to have a life of more than 25 years and produce 65,000 tonnes a year of copper-in-concentrate and 900 tonnes a year of molybdenum-in-concentrate.

Caravel raised $5m in fresh capital in October, selling new shares at $0.145.

How to invest in copper stocks in Australia?

The main way of investing in copper companies is through copper shares listed on the ASX, using an online investment platform. Follow our step by step guide below:

1. Find a stock investing platform

To buy copper stocks on the Australian Securities Exchange (ASX), you'll need to sign up to an investing platform with access to the Aussie stock market. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, PayTo, debit card or even Apple/Google Pay.

3. Search for the company

Find the company by name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own the shares, you should monitor their performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

Is it smart to invest in copper now?

As seen with the relatively volatile performance of many commodities, the copper price tends to fluctuate over the short term. The movements of 'Dr. Copper' are often said to be related to general levels of economic activity due to its uses across various sectors. This will likely impact the stock market returns for many copper miners, but there are multiple factors that will determine the fate of a specific company.

For example, whether the firm can achieve its goals in the expected timeframe could make it more attractive to investors. The ASX stocks that predominantly produce copper are likely to be more exposed to changes in the red metal’s price compared to more diversified miners. Many see its longer term outlook as very positive, as copper’s characteristics of high conductivity and ductility mean it’s most often used as wiring. As the growth of renewables and EVs will require more electrical components, these trends could drive the demand for copper significantly higher in the future.

What is copper used for?

Copper is mainly used as wiring in electronics and electrical equipment, the building and construction industry, as well as industrial machinery and equipment. The ‘metal of electrification’ is expected to play an important role in the energy transition. Renewable energy systems need over 12 times the amount of copper compared to fossil fuel-based systems, and most EV’s require two to three times more copper than internal combustion engine cars. S&P Global forecasts that copper demand could double by 2035.

There are concerns about the future levels of copper supply because many new projects have been delayed, new deposits are becoming harder to find and more expensive to develop due to lower average grades of copper. Analysis from S&P Global reveals that a market deficit could emerge as early as 2025 and grow to the end of the decade. Recycling amounted to roughly 17% of global refined copper supply in 2022, but is not expected to be enough to cover forecasted demand growth.

Copper stocks FAQs

Australia's largest copper mine is BHP's ($BHP) Olympic Dam operation in South Australia. The project also extracts some gold and uranium. The company is also responsible for other significant producers, including the Carrapateena Mine and Prominent Hill Mine. Rio Tinto ($RIO) has several significant copper assets, but they are located in the U.S. and Mongolia.

There are several ASX-listed copper stocks and ETFs available to Australian investors. These can be bought and sold through an investing platform the same way as any other ASX shares. To start investing in ASX copper shares, follow these steps:

- Download Stake & sign up in minutes

- Deposit funds and they will arrive in minutes

- Find the copper share by name or ticker symbol. Do your own research to ensure it is the right investment product for your own circumstances.

- Place an order and monitor your investment

The Global X Copper Miners ETF ($WIRE) provides exposure to firms across the copper value chain. These are predominantly copper mining companies listed on overseas exchanges such as First Quantum, Southern Copper and Antofagasta.

For those investors interested in all the metals used in clean energy infrastructure and technologies, the Global X Green Metal Miners ETF ($GMTL) covers lithium, nickel and cobalt firms, alongside the copper options. The BetaShares Energy Transition Metals ETF ($XMET) allows a similar kind of exposure to those involved with producing, processing and recycling commodities used in the shift to renewables.

Copper is one of the world's most commonly traded metals, with contracts and futures available on several exchanges. Major markets include the London Metal Exchange (LME), China's COMEX and on the Multi-Commodity Exchange in India.

The copper price was US$4.13 per pound as at 22 November 2024. It's ranged between US$5.11 and US$3.68 per pound over the past year. Considering price data since 1988, the copper price had lows of US$0.62 in April 1999 and reached new highs in 2024 on the back of concerns about supply levels.

This article was edited by Robert Guy - Senior Markets Writer at Stake.

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation, particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

Our $3 applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that apply.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.

.jpg&w=3840&q=100)