What are the best ASX uranium stocks to watch? [November 2024]

As global economies rethink their stances on nuclear energy, these uranium companies have leveraged themselves to the global opportunity. As investors increasingly look for energy diversification, they may provide relative strength.

Nuclear energy has enjoyed renewed interest as countries seek ways to produce low emissions baseload power to provide electricity to households and industries. Uranium is vital to plans to significantly increase nuclear energy use as it provides the fuel used in reactors.

Uranium demand is expected to grow after 22 countries pledged to triple nuclear capacity by 2050 at COP28 in Dubai. Nuclear energy demand will be supported by growth in electric vehicle use and from data centres hosting AI clusters. Microsoft ($MSFT) announced a 20-year deal in September to buy nuclear energy to power data centres.

The expected growth has supported nuclear energy stocks and offers an opportunity for uranium mining stocks. Utilities signed contracts for 160m pounds of uranium in 2023. Uranium demand is expected to increase 30% by 2030 and double by 2040. The nuclear fuel reached above US$100 at the beginning of 2024, the first time since 2007. The spot uranium price was around US$80 a pound in October.

Here are some of the largest uranium stocks listed on the ASX that offer investors ways to gain exposure to the growth in nuclear energy.

Discover some of the top uranium stocks on the ASX

Company Name | Ticker Symbol | Stock Price | Year to Date | Market Capitalisation |

|---|---|---|---|---|

BHP Group Limited | $42.60 | -15.49% | $216.15b | |

Paladin Energy Ltd | $9.83 | -0.20% | $2.94b | |

Boss Energy Ltd | $3.18 | -21.09% | $1.30b | |

Deep Yellow Limited | $1.32 | +21.56% | $1.28b | |

Silex Systems Limited | $5.27 | +21.15% | $1.25b | |

NexGen Energy (Canada) | $11.13 | +10.64% | $1.13b | |

Bannerman Energy Ltd | $2.85 | +5.95% | $509.05m | |

Lotus Resources Limited | $0.245 | -14.03% | $505.14m | |

Peninsula Energy | $0.089 | -12.74% | $289.95m | |

Alligator Energy | $0.044 | -25.42% | $156.80m |

Data as of 4 November 2024. Source: Stake, ASX, Google.

*The list of shares mentioned is ranked by market capitalisation. When deciding what uranium shares to feature, we analyse the dividend yield, consistency of dividend payouts, financials, recent news, the state of the industry, and whether or not they are actively traded on Stake.

Decide which uranium companies in Australia to add to your watchlist

1. BHP Group Limited ($BHP)

- Market capitalisation: $216.15b

- Stock price (as of 04/11/2024): $42.60

- Stake investors watching $BHP: 19,282

The world’s biggest mining company is the biggest uranium producer listed on the Australian Securities Exchange. It produced around 3,500 tons of uranium in the year to September 30 from its Olympic Dam operation in South Australia. Uranium is produced as a by-product of Olympic Dam’s copper production. However, BHP’s share price tends to track the price of iron ore rather than the uranium spot price.

2. Paladin Energy Ltd ($PDN)

- Market capitalisation: $2.94b

- Stock price (as of 04/11/2024): $9.83

- Stake investors watching $PDN: 917

Paladin Energy is the biggest pure-play uranium stock listed on the ASX. Paladin Energy’s flagship asset is a 75% stake in the Langer Heinrich mine in Namibia. Uranium concentrate production and drumming was achieved on 30 March 2024. At full production, the Langer Heinrich Mine’s annual uranium output is enough to supply over ten 1,000 Mw nuclear power plants for a year. Paladin made a C$1.14b bid for Canada’s Fission Energy in June and intends to bring its Patterson Lake South project into production by 2029. Paladin Energy was the fourth most shorted stock on the ASX on 29 October.

Paladin Energy also made our list of the top ASX energy stocks traded by Stake investors.

3. Boss Energy Ltd ($BOE)

- Market capitalisation: $1.30b

- Stock price (as of 04/11/2024): $3.18

- Stake investors watching $BOE: 2,200

Boss Energy’s 100% owned Honeymoon project in South Australia produced its first drum of uranium in April. Management is targeting a ramp up in production to 2.45m pounds a year. The company completed the acquisition of a 30% stake in the Alta Mesa uranium project in Texas in February for US$60m. Production started in June and is expected to ramp up to 1.5m pounds a year. Boss has no debt. The company raised $205m through a placement in December 2023. New shares were sold at $3.95 a share. Boss Energy is the second most shorted stock on the ASX on 29 October.

🆚 Compare PDN vs BOE stock comparison→

4. Deep Yellow Limited ($DYL)

- Market capitalisation: $1.28b

- Stock price (as of 04/11/2024): $1.32

- Stake investors watching $DYL: 1,391

Deep Yellow is focused on the development of its Tumas project in Namibia. Engineering and project financing work on the project continue to progress, and the company is on track to make a final investment decision in Q4. The project’s costs were updated in late 2023. An updated mineral resource for Tumas has enabled the definition of sufficient proven mineral reserves for the first six years of operation and to also support project financing. A definitive feasibility study is underway on its Mulga Rock project in Western Australia. Deep Yellow raised $220m through an institutional placement at $1.22 a share in March. The DYL share price is up 21% this year. Deep Yellow was the ninth most shorted stock on the ASX on 29 October.

5. Silex Systems Limited ($SLX)

- Market capitalisation: $1.25b

- Stock price (as of 04/11/2024): $5.27

- Stake investors watching $SLX: 767

Silex isn’t your average uranium stock. The company doesn’t mine uranium, but quite the opposite: Silex enriches it. They use cutting edge technology to deliver high-quality and low-cost enriched uranium for nuclear reactors worldwide. And uranium isn’t the company’s only business: they also enrich silicon for quantum computers and have their eyes on making components for medical devices. The Company has cash and term deposit holdings of $113.1m and no corporate debt. The SLX share price is up by 51% over the past 12 months.

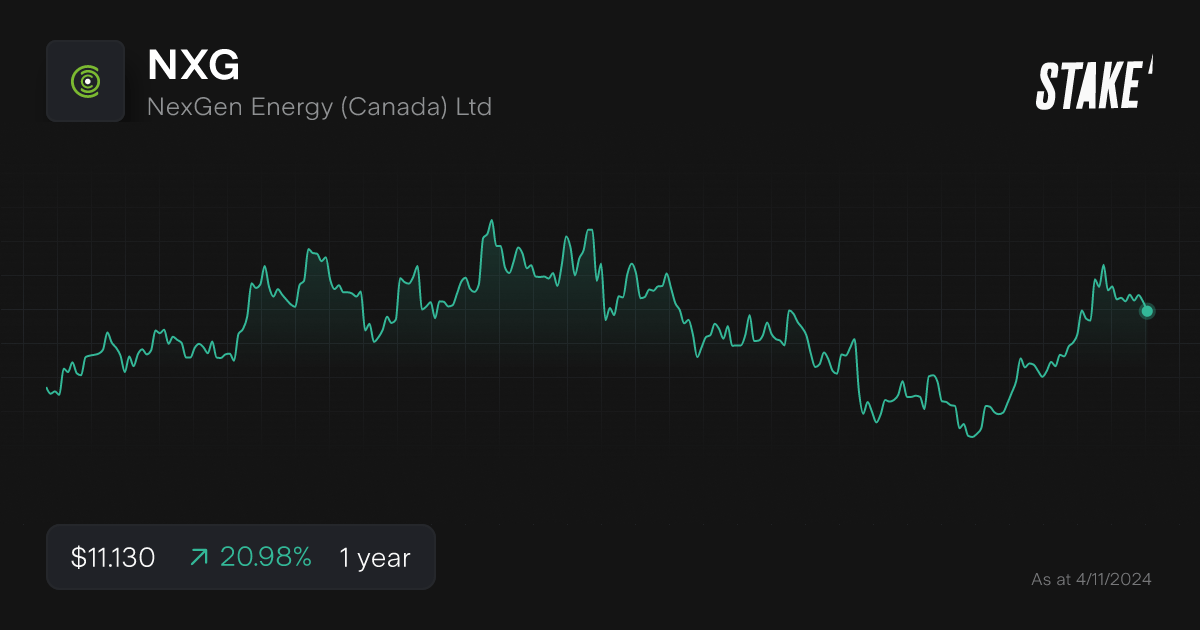

6. NexGen Energy (Canada) ($NXG)

- Market capitalisation: $1.13b

- Stock price (as of 04/11/2024): $11.13

- Stake investors watching $NXG: 425

NexGen Energy is a Canadian company focused on developing the Rook I Project. It is the largest development-stage uranium project in Canada. The proposed new underground mine and mill development is located in the uranium-rich district of the southwestern area of the Athabasca Basin. The company updated the costing of Rook I in August. The estimated pre-production capital cost is C$2.2 billion, with an average cash operating cost over the life of mine estimated at C$13.86 per pound of U3O8. Sustaining capital costs are estimated at C$785m – an average of C$70m per year – inclusive of closure costs of approximately C$70m. NexGen Energy shares trade as CHESS Depositary Interests (CDI) on the ASX.

7. Bannerman Energy Ltd ($BMN)

- Market capitalisation: $509.05m

- Stock price (as of 04/11/2024): $2.85

- Stake investors watching $BMN: 801

Bannerman Energy’s flagship asset is the Etango Project located in Namibia. A definitive feasibility study was completed in 2022 based on conventional open pit mining and heap leach processing of the Etango deposit at 8m a year throughput for average annual output of 3.5m pounds of uranium. A scoping study in February 2024 outlined two future phase development options. A final investment decision on Etango is targeted for 2025. Bannerman raised $85m through an institutional placement in June. New shares were sold at $3.30. The capital was used to pay for earthworks, power contracts and crushing equipment. It has $95m of cash and no debt.

8. Lotus Resources Limited ($LOT)

- Market capitalisation: $505.14m

- Stock price (as of 04/11/2024): $0.24

- Stake investors watching $LOT: 758

Lotus Resources owns an 85% interest in the Kayelekera Uranium Project in Malawi and 100% of the Letlhakane Uranium Project in Botswana. While in production from 2009 to 2014, Kayelekera was Malawi’s largest mine, producing 10.9m of uranium oxide. In October 2024, Lotus released an accelerated restart plan that confirmed Kayelekera ranks as one of the lowest capital cost uranium projects globally, with an 8-10 month timeline to first uranium production and initial restart capital expenditure of US$50m. In October, the company raised $130m through a placement at $0.25 a share.The placement size was raised from $110m due to strong institutional demand. The funds will be used for the Kayelekera restart.

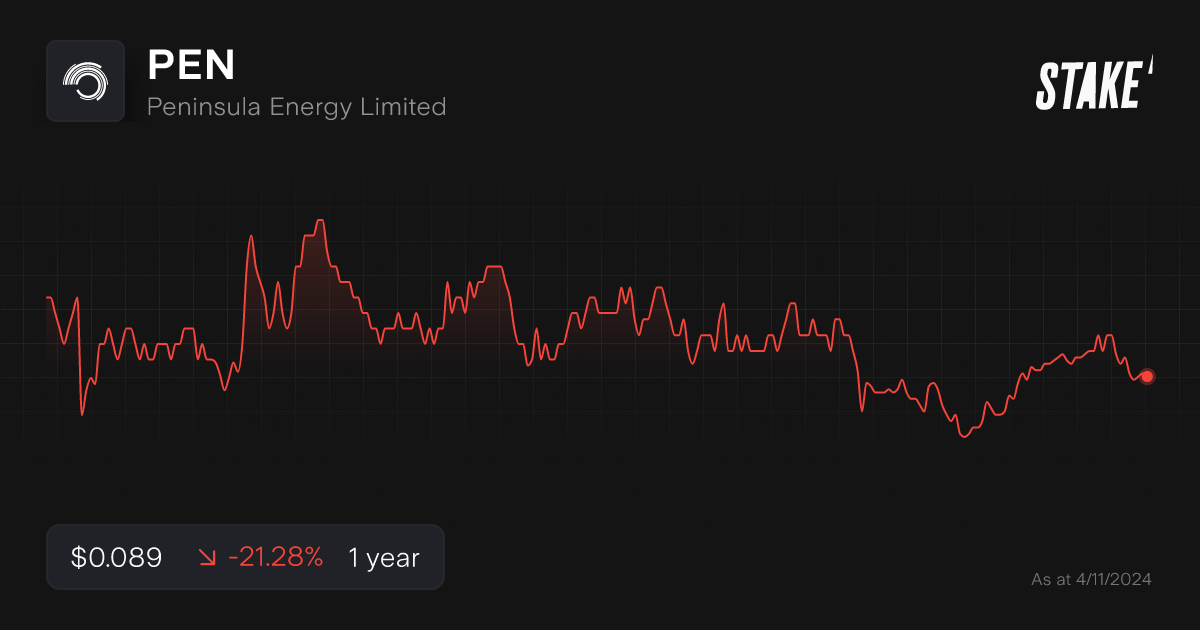

9. Peninsula Energy Limited ($PEN)

- Market capitalisation: $289.95m

- Stock price (as of 04/11/2024): $0.089

- Stake investors watching $PEN: 963

Peninsula Energy is focused on its flagship Lance Project in Wyoming, one of the largest U.S. uranium projects. It has a resource of 58m pounds of uranium oxide. Lance is on track for a production restart in December 2024. Peninsula has 10 years of sales contracts in place with major utilities in both the US and Europe. Peninsula raised $105.9m through a placement and institutional entitlement offer in May. New shares were sold at $0.10 a share. The funds were for the completion of the Lance project. Peninsula is seeking shareholder approval for a 20 for one share consolidation.

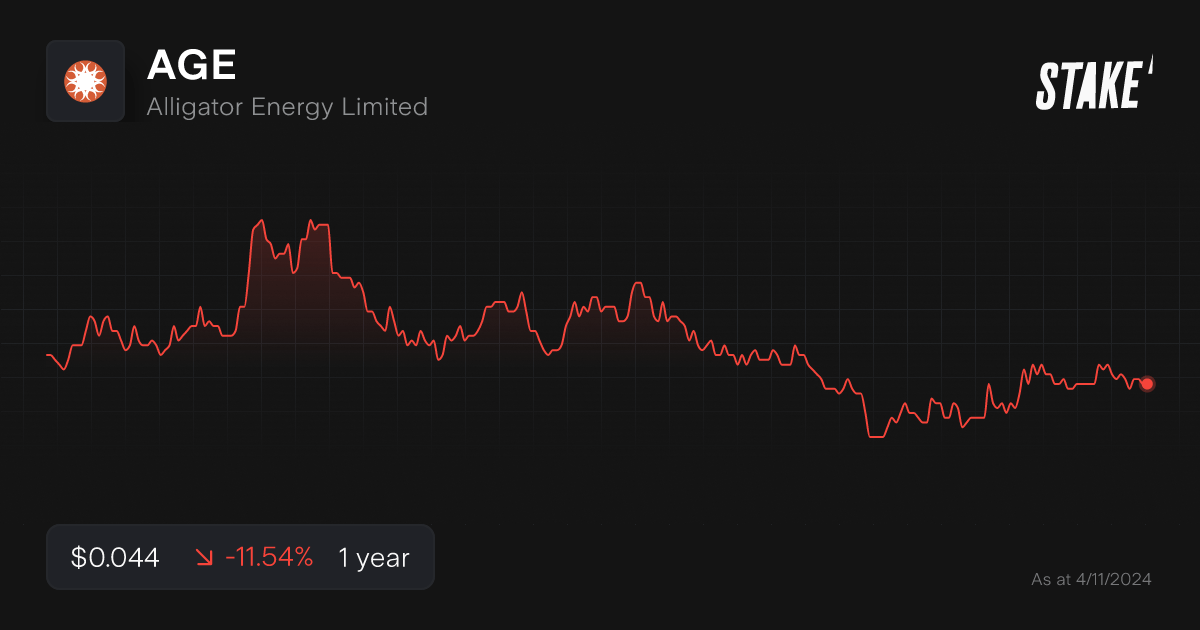

10. Alligator Energy ($AGE)

- Market capitalisation: $156.80m

- Stock price (as of 04/11/2024): $0.044

- Stake investors watching $AGE: 756

Alligator Energy owns the Samphire uranium project, 20 kilometres south of Whyalla in South Australia. It has a 17.5m pound uranium resource, a scoping study for production of 1.2 million pounds a year, and a pilot plant planned, subject to approvals. Alligator continues to drill around the Samphire resource. It also owns the Big Lake uranium project in South Australia. Its inaugural drilling program was completed in August.

How to invest in uranium stocks in Australia?

The main way of investing in uranium is through uranium mining companies listed in Australia, using an online investment platform.

1. Find a stock investing platform

To buy uranium stocks on the Australian Securities Exchange (ASX), you'll need to sign up to an investing platform with access to the Aussie stock market. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, PayTo, debit card or even Apple/Google Pay.

3. Search for the company or ticker symbol

Find the company name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own the stock, you should monitor its performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

Are uranium stocks under or overpriced?

Figuring out whether a stock is under or overpriced is extremely hard. Financial analysts look through a lot of data to decide whether to buy, sell, or just stay away from an asset. One of the easiest ways to find out if a certain stock is cheap or overvalued is with the help of Stake Black. With a Stake Black membership, not only can you get access to every company’s financial data, but you’ll also be able to check analysts’ recommendations and price targets, enabling you to invest better and make informed decisions.

💡Related: Deep dive into the best nuclear energy ETFs on Wall St

More resources:

✅ Looking for lithium mining companies in Australia?→

✅ What are the best rare earth stocks on the ASX?→

✅ Are these the best gold ETFs on the ASX?→

Uranium stocks FAQs

Uranium is mostly used as a fuel for nuclear energy generation. However, it is also used in weaponry (not only in nuclear weapons) as it enables weapons to penetrate high-density armour. There is also some residual use in photographic chemicals and as a tiles and glass stainer.

The biggest uranium company in Australia is currently BHP, with its Olympic Dam in South Australia producing over 3,500 tons of uranium ore per year.

According to the World Nuclear Association, the world’s biggest uranium producers are Kazakhstan, Namibia, Canada, Australia, and Uzbekistan. They are responsible for the production of 45.1%, 11.9%, 9.1%, 8.7% and 7.2% of the world's annual production respectively. On the other hand, Australia has the highest amount of uranium resources in the world.

This article was edited by Robert Guy - Senior Markets Writer at Stake.

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.