Are these the best nuclear energy stocks? [2024]

Nuclear energy is becoming more attractive to investors amid support for lower emissions energy to meet net zero targets. The COP28 Agreement saw 22 world leaders support plans to triple nuclear energy by 2050. This will benefit uranium miners, reactor builders and developers of innovative technology like small modular reactors. The International Energy Agency (IEA) forecasts global nuclear generation will reach a new high in 2025. Global nuclear generation is forecast to rise 1.6% in 2024 and 3.5% in 2025. The IEA estimates total investment in nuclear power will reach US$80b in 2024.

Discover our nuclear energy stocks list to add to your watchlist

Company Name | Ticker | Share Price | Year to Date | Market Capitalisation |

|---|---|---|---|---|

NextEra Energy, Inc. | US$82.30 | +33.67% | US$166.8b | |

GE Vernova Inc | US$202.01 | +53.91% | US$55.4b | |

Constellation Energy Corp | US$180.25 | +56.40% | US$54.7b | |

Dominion Energy | US$57.71 | +18.97% | US$48.1b | |

Cameco Corporation | US$37.70 | -10.32% | US$16.1b | |

BWX Technologies Inc | US$95.76 | +25.44% | US$8.8b | |

Brookfield Renewable Partners | US$24.59 | -5.50% | US$7b | |

NuScale Power Corp | US$8.25 | +162.74% | US$1.9b | |

Uranium Energy Corp | US$4.61 | -28.42% | US$1.8b | |

Energy Fuels Inc | US$4.52 | -34.68% | US$690m | |

Centrus Energy Corp | US$36.32 | -31.28% | US$584m | |

Nano Nuclear Energy Inc | US$8.79 | +69.36% | US$223m |

Data as of 10 September 2024. Source: Stake, Google Finance.

*The list of shares mentioned is ranked by market capitalisation. When deciding what assets to feature, we analyse the financials, recent news and announcements, the state of the industry and the company's projects, and whether or not they are actively traded on Stake.

Explore some of the top nuclear power stocks

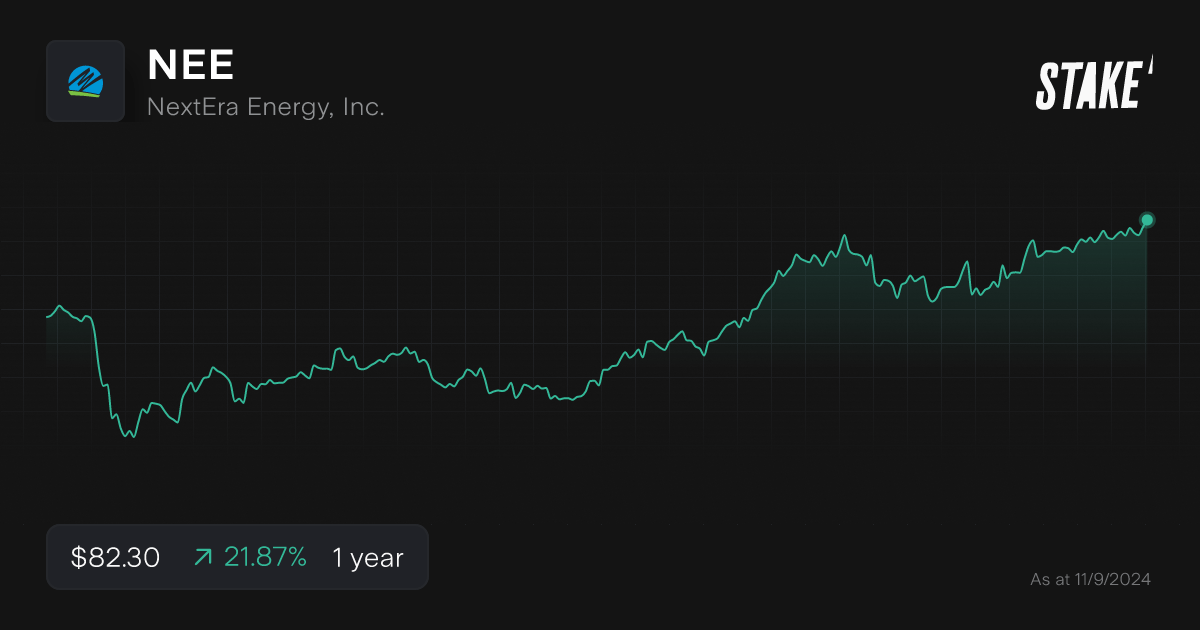

1. NextEra Energy, Inc. ($NEE)

- Market capitalisation: US$166.8b

- Stock price (as of 10/09/2024): US$82.30

- Stake investors watching $NEE: 2,992

NextEra Energy, Inc. is a leading energy company that operates power solutions through its subsidiary, NextEra Energy Resources (NEER). Known for its investment in renewable energy, NEER is the world's largest generator of renewable energy from wind and solar sources.

The company has a diverse energy mix that includes nuclear power, operating three nuclear power plants: the Point Beach Nuclear Plant in Two Rivers, Wisconsin, the Seabrook Station Nuclear Power Plant in Seabrook, New Hampshire, and until recently, the Duane Arnold Energy Center in Palo, Iowa, which ceased operations in 2020. Together, these plants produce a substantial portion of the nation’s nuclear power, combining to deliver over 2,000 megawatts (MW) of net energy output.

The company is targeting annual EPS growth of between 6% and 8% through to 2027. Additionally, annual dividend growth of around 10% is expected through to at least 2026. NextEra Energy, Inc. ($NEE) shares have risen 33.67% YTD.

💡Related: Explore the best renewable energy stocks in Australia→

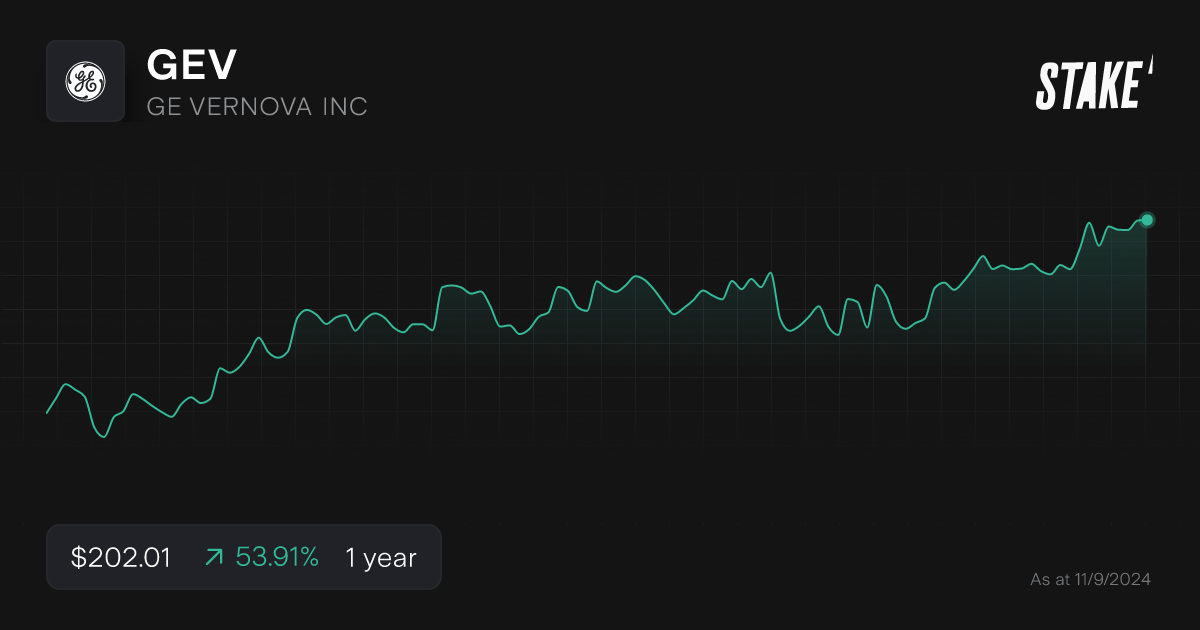

2. GE Vernova Inc ($GEV)

- Market capitalisation: US$55.4b

- Stock price (as of 10/09/2024): US$202.01

- Stake investors watching $GEV: 48

GE Vernova Inc. is a global energy powerhouse with a clear mission: electrifying the world while decarbonising it. Its technology powers approximately 25% of the world’s electricity. In nuclear power, GE Hitachi Nuclear Energy delivers innovative solutions like boiling water reactors and small modular reactors (SMRs).

GE Hitachi Nuclear Energy (GEH) recently submitted its proposal for the BWRX-300 small modular reactor (SMR) technology to Great British Nuclear’s SMR competition. This 10th-generation SMR, built on decades of operational experience, aims to be a cost-effective and low-risk solution for the UK’s net-zero ambitions.

The first BWRX-300 unit is in development with Ontario Power Generation and is set for operation by 2029. GEH, bolstered by a £33.6 million grant from the UK's Future Nuclear Enabling Fund, is committed to expanding its UK supply chain and collaborating with local partners.

GE Vernova Inc.'s stock price has increased by 53.91% year to date.

🆚 Compare the top 2 nuclear power stocks from this list: NEE vs GEV

3. Constellation Energy Corp ($CEG)

- Market capitalisation: US$54.7b

- Stock price (as of 10/09/2024): US$180.25

- Stake investors watching $CEG: 372

Constellation Energy Corporation is the largest producer of clean, carbon-free energy in the U.S. It has 22.1 gigawatts of nuclear generation capacity and is the largest producer of carbon free generation in the U.S.

Earnings are supported by the Nuclear Production Tax Credit which supports revenue growth. The company raised its full year operations earnings guidance to between US$7.60 a share and US$8.40 a share from prior guidance of between US$7.23 s share and US$8.03 a share. Management says operating EPS will grow at an average annual rate of 10% from 2024 to 2028.

Constellation is also the best operator of nuclear plants given an industry-leading capacity factor of nearly 95%. It averages 21 days of nuclear refuelling, well below the industry average.

The company is further exploring the construction of next-generation nuclear plants, including small modular reactors, at existing sites to meet rising demand from data centres.

Constellation recently repurchased approximately US$500 million of its common stock in the second quarter, totalling US$2b since 2023. Constellation Energy's stock price has risen 56.40% year to date.

4. Dominion Energy ($D)

- Market capitalisation: US$48.1b

- Stock price (as of 10/09/2024): US$57.71

- Stake investors watching $D: 321

Dominion Energy reactors are in prime location to benefit from the boom in data centres. Northern Virginia has connected nine data centres so far this year and expected to connect 15 data centres in total in 2024.

Its Virginia Power business produces 29% of its electricity from its North Anna and Surrey nuclear units. Dominion is considering whether to build a small modular reactor at its North Anna nuclear station. Proposals from SMR vendors were submitted in July. Dominion forecasts peak power demand from data centres could double to 13.4 gigawatts in 2038.

Dominion’s South Carolina business sources around 21% of its electricity from a two-thirds stake in the Summer nuclear reactor. Its Millstone nuclear plant supplies power to Connecticut and New England.

The company recently reaffirmed its FY24 operating EPS guidance of between US$2.62 a share and US$2.87 a share. Dominion Energy shares are up 18.97% YTD.

5. Cameco Corporation ($CCJ)

- Market capitalisation: US$16.1b

- Stock price (as of 10/09/2024): US$37.70

- Stake investors watching $GEV: 1,407

Cameco Corporation is a global leader in uranium fuel production, headquartered in Saskatoon, Saskatchewan, Canada. They control the world's largest high-grade reserves and operate low-cost facilities. With investments in Westinghouse Electric Company and Global Laser Enrichment, Cameco provides comprehensive nuclear fuel solutions to ensure safe, reliable, and carbon-free nuclear power.

Cameco Corporation acquired a significant interest in Westinghouse Electric Company in 2023, aiming to enhance its comprehensive nuclear fuel solutions portfolio. This acquisition strengthens Cameco’s position across the nuclear fuel cycle, incorporating Westinghouse’s expertise in nuclear technology and services. The move aligns with Cameco’s vision of supporting global clean-energy initiatives, ensuring their capacity to meet the growing demands for nuclear fuel globally.

Cameco’s stock price has fallen 10.32% YTD.

💡Related: Check out some of the popular ASX uranium stocks→

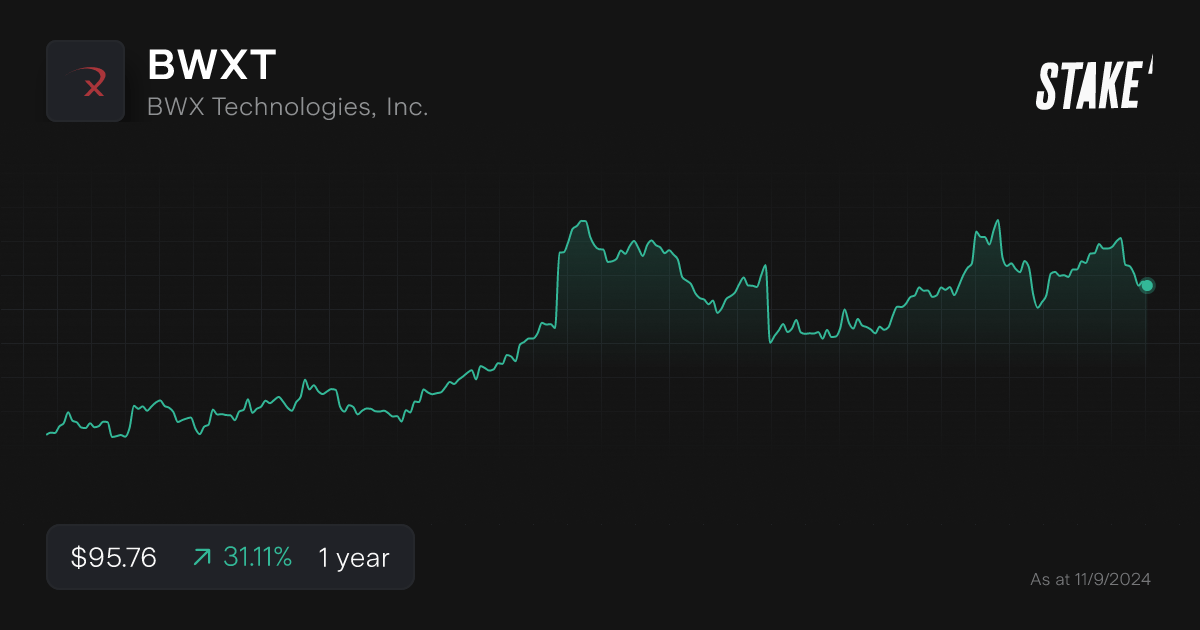

6. BWX Technologies Inc ($BWXT)

- Market capitalisation: US$8.8b

- Stock price (as of 10/09/2024): US$95.76

- Stake investors watching $BWXT: 236

BWX Technologies Inc ($BWXT) powers U.S. Navy submarines and aircraft carriers, supplies clean energy components and fuel, advances nuclear medicine, and innovates reactors and fuels for future capabilities.

The company is well positioned to benefit from government support for reactor development. The recently passed ADVANCE Act directs the U.S. Nuclear Regulatory Commission to reduce licensing application fees and approved additional staff. It continues to work on developing a modular system that can be transported and deliver 50 megawatts of power.

A BWX-led consortium won a contract of up to 20-year and worth potentially US$30b to manage and operate the Department of Energy’s National Nuclear Security Administration’s Pantex plant, which is the primary centre for the assembly and disassembly of nuclear weapons.

Second quarter results were ahead of expectations. The company raised the lower end of its 2024 guidance. EPS is expected to be between US$3.10 a share and US$3.20 a share, up from US$3.05 a share to US$3.20 a share. BWXT's stock price has risen 25.44% YTD.

7. Brookfield Renewable Partners ($BEP)

- Market capitalisation: US$7b

- Stock price (as of 10/09/2024): US$24.59

- Stake investors watching $BEP: 1,869

Brookfield Renewable Partners ($BEP) operates one of the world's largest publicly traded platforms for renewable power and decarbonisation solutions. Their portfolio includes hydroelectric, wind, solar, distributed energy, and sustainable solutions across five continents.

Brookfield Renewable Partners' nuclear business features Westinghouse Electric Company. It acquired a 51% stake in November 2023. Westinghouse services almost half of the global nuclear power generation sector. Westinghouse provides a broad range of nuclear technologies, products, and services through its operating plant services, nuclear fuel manufacturing, energy systems design, and environmental services.

Brookfield Renewable Partners' stock is down 5.50% year to date.

8. NuScale Power Corp ($SMR)

- Market capitalisation: US$1.9b

- Stock price (as of 10/09/2024): US$8.25

- Stake investors watching $SMR: 446

NuScale Power Corp is an energy company focused on innovative advanced small modular reactor nuclear technology. They aim to power the global energy transition by delivering safe, scalable, and reliable carbon-free energy solutions. NuScale's flagship products include the VOYGR SMR Plants and Energy Exploration (E2) Centres.

They've made several critical developments, including securing pivotal partnerships and advancing their groundbreaking SMR technology. NuScale recently achieved significant milestones in regulatory approvals, paving the way for future deployment of their SMR plants. Efforts in expanding their commercial footprint through collaborations and new project agreements show their ongoing commitment to revolutionising the nuclear sector.

NuScale Power Corp's stock price has surged by 162.74% YTD.

9. Uranium Energy Corp. ($UEC)

- Market capitalisation: US$1.8b

- Stock price (as of 10/09/2024): US$4.61

- Stake investors watching $UEC: 2,389

Uranium Energy Corp.owns the most substantial S-K 1300 compliant In-Situ Recovery (ISR) uranium resource base in the U.S. and one of the largest resource holdings in Canada's Athabasca Basin.

The company announced in August that it restarted uranium production at its past-producing Christensen Ranch In-Situ Recovery operations in Wyoming. The first shipment of yellowcake is anticipated to occur in November or December 2024.

The company has 1.16m pounds of uranium on hand, acquired at an average cost of US$59 a pound. The company will buy another 1m pounds via contracted purchases through December 2025 at an average cost of US$39 a pound.

$UEC stock has fallen 28.42% YTD.

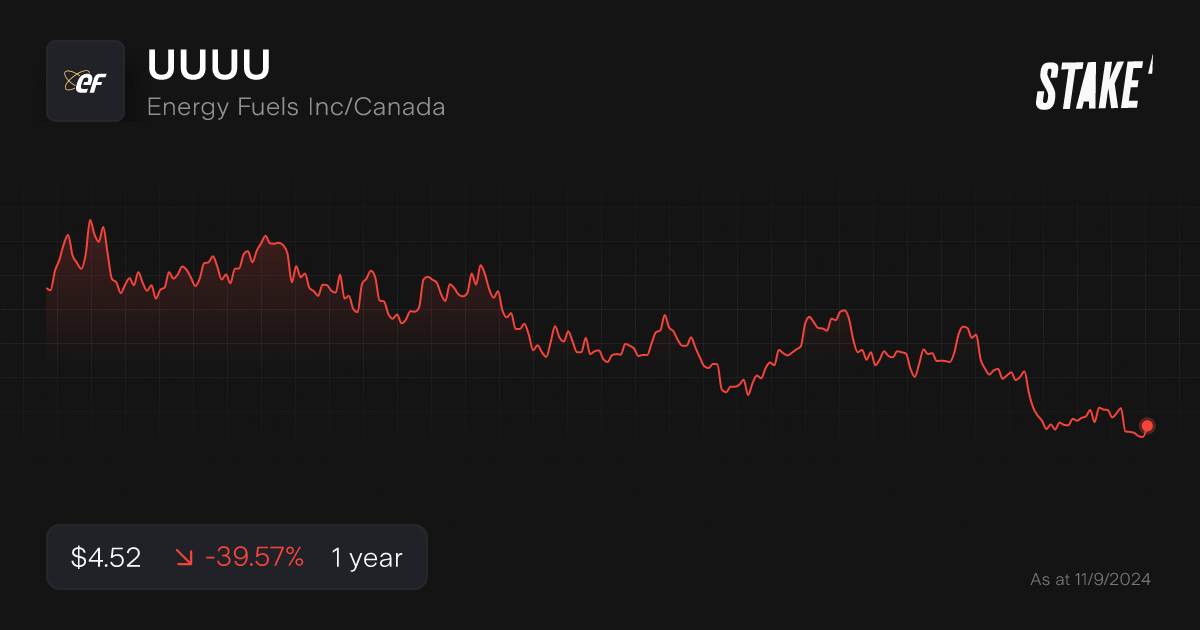

10. Energy Fuels Inc ($UUUU)

- Market capitalisation: US$690m

- Stock price (as of 10/09/2024): US$4.52

- Stake investors watching $UUUU: 704

Energy Fuels Inc. is a leading U.S. producer of uranium, the vital fuel for nuclear power. Their uranium portfolio includes the White Mesa Mill in Utah, Pinyon Plain Mine in Arizona, the La Sal Cplex in Utah and Nichols Ranch in-situ recovery in Wyoming. The company has produced two-thirds of all U.S. uranium since 2017. It is planning to achieve an expected run rate of between 1.1m pounds and 1.4m pounds of U3O8 by the end of 2024. It signed a fourth long-term uranium supply contract with a U.S. utility in Q2.

Beyond uranium, Energy Fuels is the only primary producer of vanadium in the U.S., and an emerging force in the rare earth elements sector. The company is set to acquire ASX-listed mineral sands producer Base Resources.

The share price of $UUUU has fallen by 34.68% year to date.

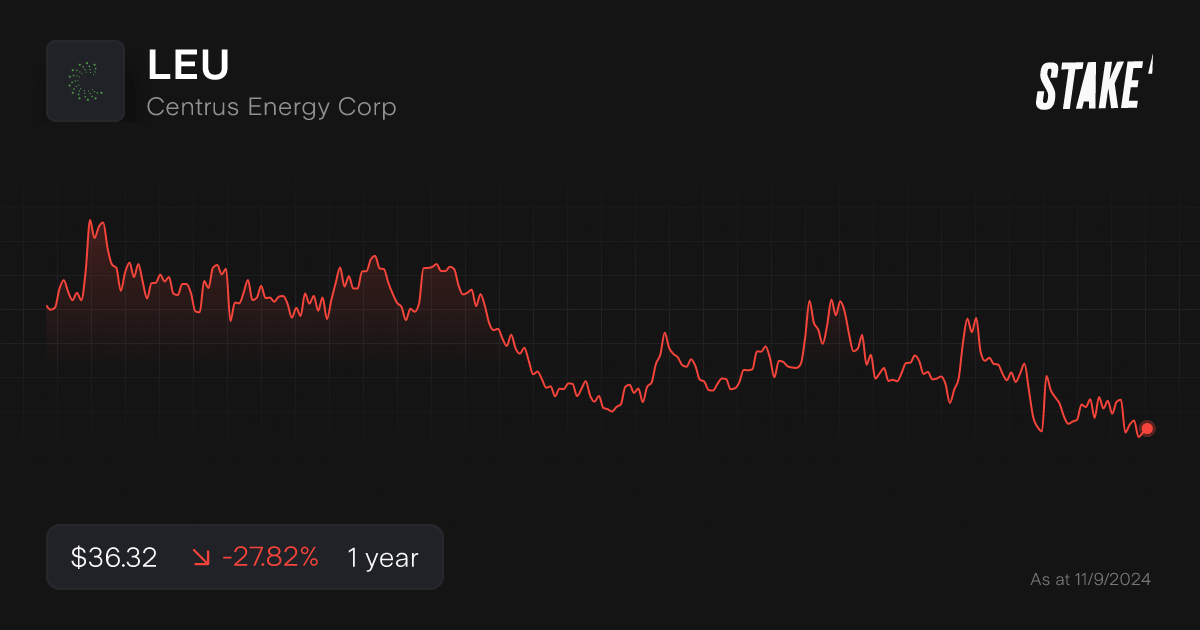

11. Centrus Energy Corp ($LEU)

- Market capitalisation: US$584m

- Stock price (as of 10/09/2024): US$36.32

- Stake investors watching $LEU: 319

Centrus Energy Corp is a leading supplier of nuclear fuel and services to the nuclear power industry. They support commercial reactors, U.S. national security, and advanced reactors by supplying enriched uranium. Their expertise extends to uranium chemistry and nuclear fuel design.

Centrus successfully completed Phase One of its contract with the U.S. Department of Energy in 2023, delivering High-Assay, Low-Enriched Uranium (HALEU). This initial phase demonstrated Centrus's HALEU production process, setting the stage for Phase Two, which mandates a full year of HALEU production at 900kg per year at their American Centrifuge Plant in Piketon, Ohio. Centrus aims to scale up production, with the potential to expand to a production of 6,000kg of HALEU per year and supporting thousands of jobs nationwide.

Centrus Energy Corp's stock price has decreased by 31.28% YTD.

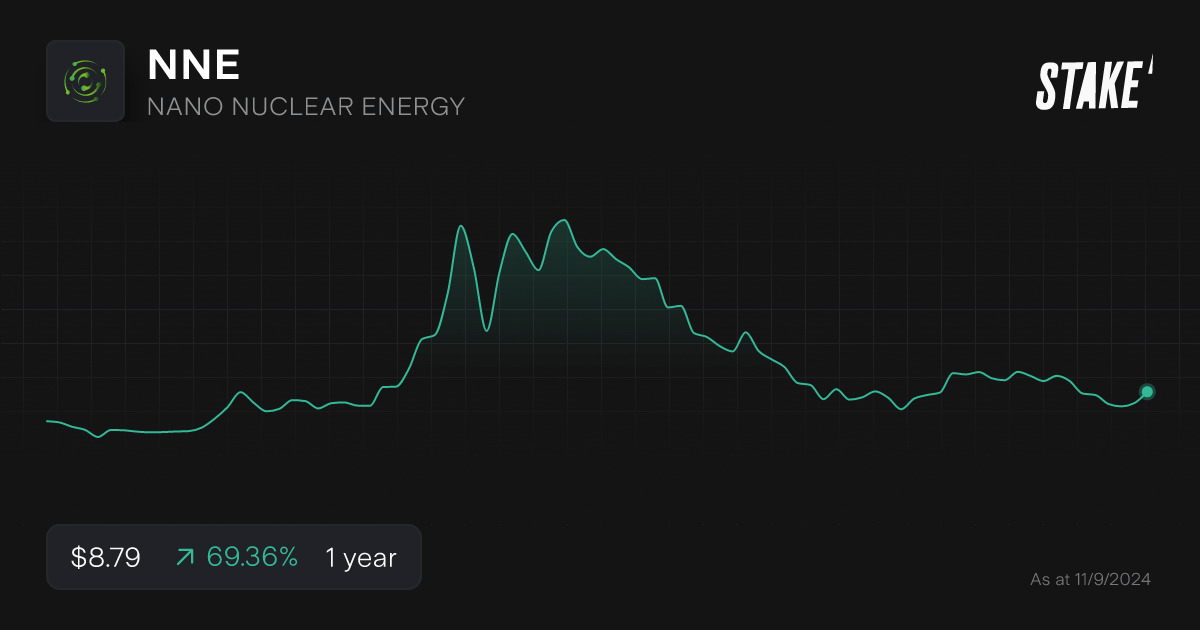

12. Nano Nuclear Energy Inc ($NNE)

- Market capitalisation: US$223m

- Stock price (as of 10/09/2024): US$8.79

- Stake investors watching $NNE: 260

Nano Nuclear Energy is pioneering the development of compact, portable nuclear reactors known as Small Modular Reactors (SMRs). They aim to make nuclear energy more accessible and reliable through innovative technologies. With the acquisition of the annular linear induction pump (ALIP), they’re enhancing reactor efficiency whilst reducing maintenance. Their vision is to address escalating energy demands, particularly in electric vehicle and data centre markets, leading the charge towards a sustainable, nuclear-powered future.

$NNE went public in May 2024, and its shares surged over 462% in July, reflecting significant investor interest despite the company still being unprofitable. The share price has decreased since but still up from their initial IPO.

Analysts are bullish, with experts raising price targets and expressing optimism due to the U.S. Senate's passage of the Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy (ADVANCE) Act, which supports nuclear industry investments. This positions NNE as a high-risk, high-reward opportunity in the emergent nuclear tech sector.

Nano Nuclear Energy’s ($NNE) stock price is up 69.36% YTD.

How to invest in nuclear energy in Australia?

You’ll need to follow these steps if you wish to invest in nuclear power companies in Australia:

1. Find a stock investing platform

To buy nuclear stocks, you'll need to sign up to an investing platform with access to the Aussie and U.S. stock market. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for the company or ticker symbol

Find the company name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own the stock, you should monitor its performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

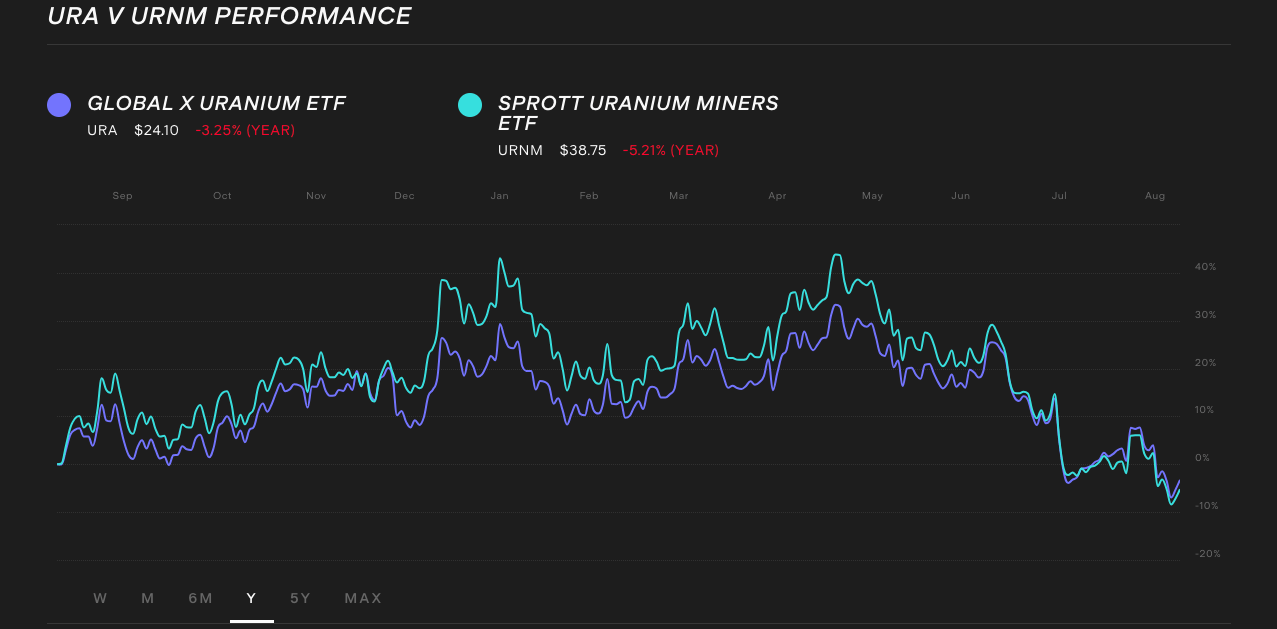

What are some nuclear energy ETFs?

There aren't many pure nuclear energy ETFs available on the market just yet. The focus tends to lean on Uranium ETFs, which are a key component of the nuclear fuel cycle. Here are some options for you to research:

- Global X Uranium ETF ($URA)

- Sprott Uranium Miners ETF ($URNM)

- VanEck Uranium & Nuclear Energy ETF ($NLR)

- BetaShares Global Uranium ETF ($URNM)

Compare the performance of URA vs URNM over the last 12 months.

Is Bill Gates investing in nuclear power?

Bill Gates is diving deep into the nuclear power sector with the goal of finding a solution to rising electricity demands without exacerbating climate change. Gates has committed US$1b to TerraPower’s nuclear power plant in Kemmerer, Wyoming. This plant uses a safer and more efficient sodium-cooling technology instead of traditional water-based cooling. The project aims to offer a more sustainable and secure energy source. TerraPower, a company founded by Gates, is driving this innovation, with Gates as its biggest investor and a strong advocate for the advantages of advanced nuclear technologies.

This article was edited by Robert Guy - Senior Markets Writer at Stake.

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.