What are the best ASX Gold ETFs to invest in? [2025]

Investors can access physical gold and gain exposure to the gold price through exchange traded funds on the ASX. The stock exchange has both physical gold and gold miner ETFs.

Check out this list of Gold ETFs on the ASX

ETF Name | Ticker | Share Price | 1-Year Return | Assets under Management | Expense Ratio |

|---|---|---|---|---|---|

Global X Physical Gold | $45.50 | +43.87% | $4.48b | 0.40% | |

Perth Mint Gold | $49.25 | +43.67% | $1.35b | 0.15% | |

Betashares Gold Bullion ETF | $25.61 | +35.43% | $944.55m | 0.59% | |

VanEck Gold Miners ETF | $73.40 | +45.92% | $758.17m | 0.53% | |

VanEck Gold Bullion ETF | $49.34 | +43.67% | $126.04m | 0.25% | |

Betashares Global Gold Miners ETF | $8.18 | +46.43% | $97.25m | 0.57% | |

Global X Gold Bullion (Currency Hedged) ETF | $49.70 | NA** | $521,909 | 0.35% |

Figures as at 2 April 2025. Source: ETF product disclosures

*The list of ETFs mentioned is ranked by assets under management. When deciding what funds to feature, we analyse the financials, recent news, liquidity and volume, and whether or not they are actively traded on Stake.

**Listed in late March 2025

Ready to start investing in Gold?

Sign up in minutes and access Gold stocks and ETFs along with 12,000+ other market opportunities across the ASX & Wall St.

Decide which gold ETFs in Australia to add to your watchlist

1. Global X Physical Gold ($GOLD)

- 5,700 Stake customers watching

- 9,710 orders executed on Stake

Global X Physical Gold is backed by physical gold bars held in a vault in London. JP Morgan Chase ($JPM) is responsible for the individually identified and allocated gold bars on behalf of investors. The set up matches the global standards set by the London Bullion Market Association’s (LBMA). Like many commodities, gold is usually priced in U.S. Dollars.

This ETF product tends to reflect the movements of the gold price in Australian Dollars less the annual management fee of 0.40%. This means that shifting exchange rates will affect the returns. Unhedged securities like $GOLD can benefit from a falling Australian Dollar versus the U.S. Dollar, as the currency gains would also be passed onto investors if all other factors are equal.

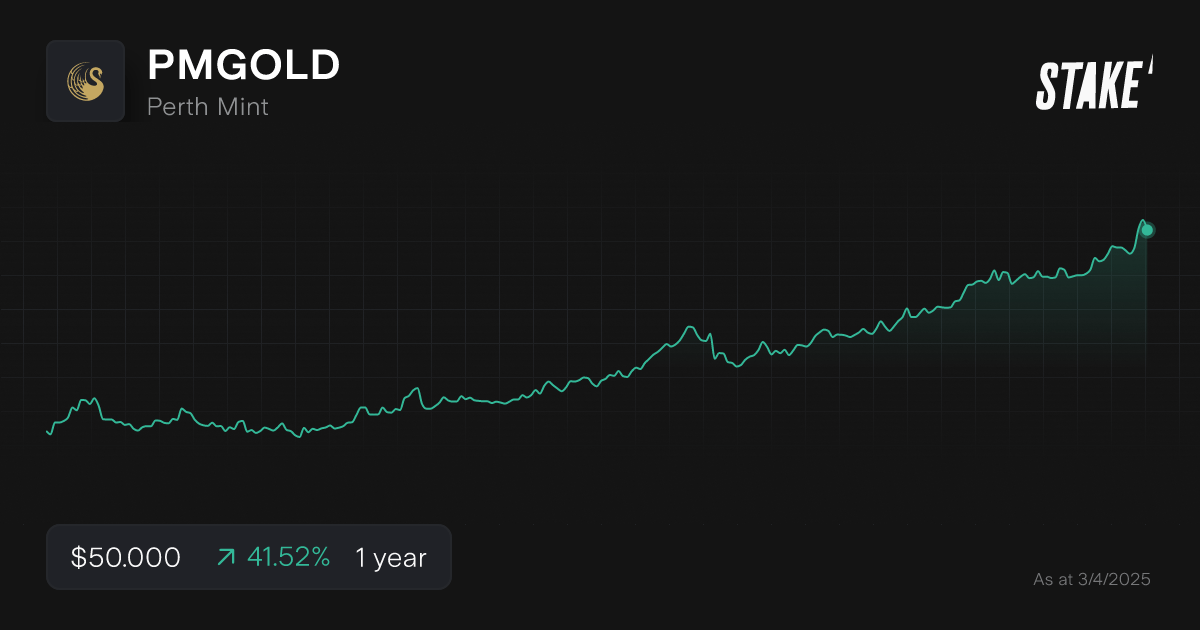

2. Perth Mint Gold Structured Product ($PMGOLD)

- 645 Stake customers watching

- 432 orders executed on Stake

Perth Mint Gold is an exchange traded product that tracks the gold price in Australian Dollars. It is backed by physical gold bullion stored in the Perth Mint, and the Government of Western Australia guarantees the metals on behalf of investors. It has one of the lowest management fees amongst the gold ETF products on the ASX at 0.15%.

PMGOLD can be converted into holdings in a Perth Mint Depository account. As a depository account holder, clients can choose to convert their holdings into any of The Perth Mint’s bullion bars.

🆚 Compare these ETFs: PMGOLD vs GOLD→

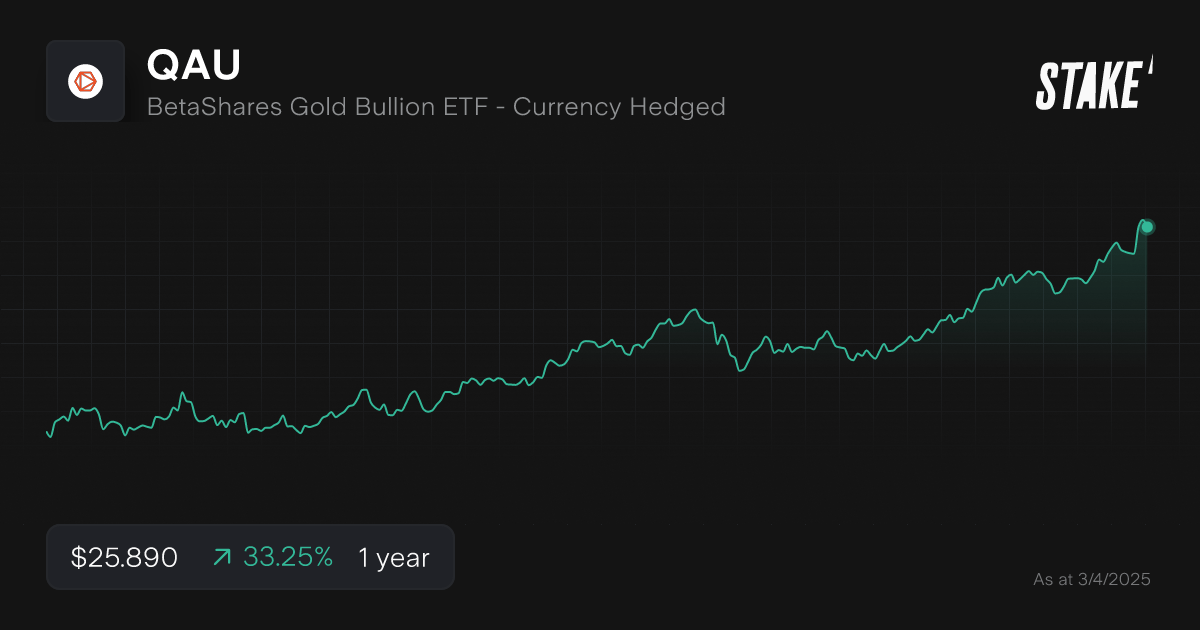

3. Betashares Gold Bullion - Currency Hedged ($QAU)

- 983 Stake customers watching

- 947 orders executed on Stake

The Betashares Gold Bullion is also backed by physical gold bars held in a JPMorgan Chase vault in London, with a similar setup to $GOLD. However, $QAU is a currency hedged ETF. It manages the fluctuations in the Australian and U.S. Dollar exchange rate through financial instruments so that investors have minimal exposure to these changes.

Returns should largely reflect those of the gold price and exclude currency risk. For example, if the Australian Dollar increases in value compared to the U.S. Dollar, this scenario could negatively impact returns. This ETF product has a slightly higher management fee at 0.59% compared to $GOLD's 0.40%.

🆚 Compare these ETFs: QAU vs GOLD→

4. VanEck Gold Miners ETF ($GDX)

- 837 Stake customers watching

- 1,063 orders executed on Stake

The VanEck Gold Miners ETF provides exposure to a number of gold mining companies listed on an NYSE Arca index. The firms are located across the world, but nearly 44% are listed in Canada, 16% in the U.S. and 11% in Australia. These include some of the world's largest gold miners like Newmont ($NEM), Agnico Eagle ($AEM) and Barrick Gold ($GOLD).

Around 93% of the ETF's holdings are related to gold production. Investors can benefit from a distribution once a year, and the ETF has a management fee of 0.53%. The performance will be affected by the results from the various gold miners, rather than mainly by the shift in gold's price.

💡Related: Watch these stocks for gold mining companies in Australia→

5. VanEck Gold Bullion ETF ($NUGG)

- 364 Stake customers watching

- 384 orders executed on Stake

The VanEck Gold Bullion ETF is another option for investors interested in exposure to the gold price. The product is backed by physical gold bullion, which is only sourced from Australian gold producers. The gold bars are stored in the Perth Mint vault in Western Australia.

The list of registered gold bars held through the ETF is published daily. This ETF is not currency hedged, so its performance could be similar to that of the $GOLD ETF. The returns would be similar to the spot gold price, minus its fee of 0.25%.

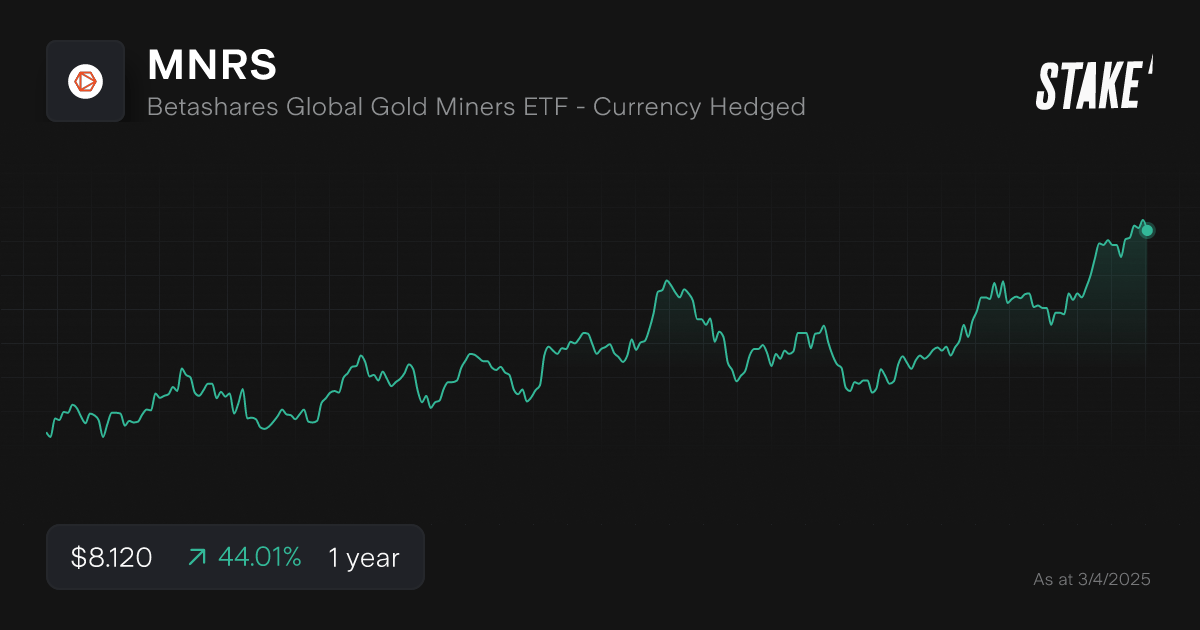

6. Betashares Global Gold Miners ETF ($MNRS)

- 306 Stake customers watching

- 351 orders executed on Stake

The Betashares Global Gold Miners ETF tracks an index of gold mining firms listed outside of Australia. It includes a number of the same companies as $GDX, but it is not exactly the same.

In contrast, it is a currency hedged product and provides distributions twice a year. This ETF's fee is also slightly higher at 0.57%.

Around 85% of the holdings are dedicated to gold mining, while the remaining 15% is in the production of other precious metals like silver. In terms of the country exposure, around 50% of miners are in Canada, 13% in the U.S. and 10% in South Africa. This ETF has holdings in 47 miners as at April 2025, while $GDX has 57.

7. Global X Gold Bullion (Currency Hedged) ETF ($GHLD)

- 9 Stake customers watching

- 3 orders executed on Stake

The Global X Gold Bullion (Currency Hedged) ETF offers a simple and cost-effective way to invest in physical gold while being hedged against the risk of a rising Australian Dollar. JPMorgan Chase in London vaults the gold bullion.

The ETF seeks to provide investment results which correspond generally to the spot price of gold bullion, hedged with the aim of eliminating the impact of currency movements between the US dollar and Australian dollar, before fees and expenses. The ETF has a management cost of 0.35%. $GHLD was listed on the ASX in late March 2025.

What is the largest gold ETF in the U.S.?

SPDR Gold Shares ($GLD) is the largest gold ETF by funds under management (FUM) in the U.S. market. It's designed to track the price of gold bullion in the over-the-counter (OTC) market. As at April 2025, it had over US$93.25b of FUM and its gold bullion is held in a vault in London.

Other popular gold ETF options on Wall Street include:

Why invest in Gold ETFs?

Gold ETFs provide a cost effective and simple way to invest in the precious metal.

Buying, storing and insuring physical gold requires organisation and comes with considerable expenses, while the management fees for ETFs usually account for these costs. ETFs also generally give much greater diversification than one or two gold mining companies, whose performance is more likely to be affected by their production and strategies rather than the gold price.

Many consider gold to have safe haven status, meaning they expect the price to go up or at least be stable during periods of economic downturns or instability. The gold metal itself is still seen as a physical store of value, unlike most financial securities and paper money. It's often characterised as a hedge against inflation and other negative macroeconomic trends, so it can be viewed as a way to diversify your investment portfolio beyond traditional equities.

💡Related: Explore the steps on how to invest in Gold in Australia

Gold ETFs in Australia FAQs

The performance of gold ETFs is often influenced by the precious metal's price. They're usually a cheaper option than investing in physical gold itself and are less volatile than shares of a single gold firm. The specific kind of gold ETF can be affected by currency movements.

The gold price has historically been known for its stability and occasional outperformance during periods of high inflation. However, its safe haven asset status is no guarantee in the future.

In terms of mining companies, gold is the most commonly searched for metal. The ASX has multiple firms across various stages of development. Some of the major producers include firms like Northern Star Resources ($NST), Evolution Mining ($EVN) and Perseus Mining ($PRU).

Investing in gold bullion involves buying, insuring and storing physical gold, while Gold ETFs purchase the gold bars and are then responsible for managing them and organising deals to store them in secure vaults on behalf of their investors.

The costs are usually less on a larger scale and should be covered by the management fees. Investors might not always be able to access fractions of the gold bars and need enough cash to purchase the entire bullion at the start. Gold ETFs can provide a lower entry point in this respect. ETFs can be traded in a similar manner to shares, so investors can realise their potential gains quickly instead of coordinating a deal to safely sell a gold bar themselves.

The value of gold ETFs is also indicated in real time by stock exchanges and investment platforms. The value of the transaction of a physical gold bar might be affected by its circumstances and could result in a greater difference to the gold price compared to ETF returns after subtracting management fees.

This article was written by Robert Guy - Senior Markets Writer at Stake.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

.jpg&w=3840&q=100)