What are the best ASX gold stocks? [2025]

The Gold price has seen win after win in 2025, reaching a new all time high in October. With Gold stocks having rallied alongside the precious metals record breaking run.

Explore some of the top Australian gold mining companies

Company Name | Ticker | Share Price | Year to Date | Market Capitalisation | In Watchlists* |

|---|---|---|---|---|---|

Northern Star Resources | $26.76 | +73.20% | $38.3B | 4,157 | |

Evolution Mining | $11.65 | +140.70% | $23.7B | 3,008 | |

Newmont Mining | $134.27 | +122.85% | $12.8B | 1,793 | |

Genesis Minerals | $6.62 | +166.94% | $7.6B | 1,189 | |

Perseus Mining | $5.50 | +110.73% | $7.4B | 1,080 | |

Ramelius Resources | $3.58 | +69.67% | $6.9B | 1,222 | |

Capricorn Metals | $14.26 | +127.07% | $6.2B | 913 | |

Westgold Resources | $6.01 | +107.96% | $5.7B | 1,013 | |

Emerald Resources | $5.24 | +59.76% | $3.5B | 616 |

Past performance is not a reliable indicator of future performance.

Data as of 26 November 2026. Source: Stake, Google Finance.

The list of gold shares mentioned is ranked by market capitalisation. When deciding what assets to feature, we analyse the financials, recent news and announcements, the state of the industry and the company's projects, and whether or not they are actively traded on Stake.

*Amount of Stake customers who have added the listed asset into a watchlist.

Sign up in minutes and get access to a CHESS-sponsored platform, where you can explore Gold stocks and ETF opportunities.

Discover our list of the top ASX-listed gold stocks to watch

1. Northern Star Resources Ltd ($NST)

Northern Star Resources stands as a heavyweight among Australian gold producers, offering exposure to world-class assets in Tier-1 jurisdictions. As a top-10 global player, it provides a reliable entry point for those seeking liquidity and scale in the precious metals sector.

The company’s growth engine is the KCGM ‘Super Pit’ in Kalgoorlie, where the ongoing mill expansion aims to boost annual production toward 900,000 ounces annually by 2028–29. Recent updates confirm the project remains on schedule, positioning the miner to potentially lower all-in sustaining costs and supercharge cash flow for shareholders.

🆚 Compare NST vs NEM→

2. Evolution Mining Limited ($EVN)

Evolution Mining ($EVN) stands as a heavyweight among gold stocks on the ASX, distinguishing itself with tier-one assets like Cowal and strategic copper exposure from Northparkes. This dual-commodity mix lowers All-In Sustaining Costs (AISC) and amplifies margins, offering investors a powerful hedge and a reliable growth platform in the precious metals sector.

The company recently flexed its financial muscle in the September 2025 quarter, delivering record net mine cash flow of $366 million and slashing gearing to 11%. With the Mungari mill expansion reaching commercial production, Evolution is perfectly positioned to convert high bullion prices into sustained shareholder value.

➡️ Check out our list of copper mining stocks on the ASX if you're interested in exploring other metals.

3. Newmont Corporation ($NEM)

As the world’s leading gold producer, Newmont commands attention on the local exchange. Its acquisition of Newcrest solidified a massive footprint in Australia, offering investors exposure to high-quality assets like Cadia and Boddington without the need for international accounts.

The strategy centers on high-margin, long-life operations. By streamlining its portfolio to focus on Tier 1 mines, Newmont aims to supercharge cash flow and sustain reliable dividends. This disciplined approach offers a robust entry point for those seeking exposure to gold.

Management continues to execute its divestment strategy, selling non-core assets like the Telfer operation to optimise the balance sheet. These moves are designed to unlock value, reducing debt while positioning the miner for potential share buybacks and stronger returns.

4. Perseus Mining Limited ($PRU)

Perseus Mining stands out among Australian-listed precious metal miners as a robust African-focused producer. With operations across West Africa, it offers exposure to high-margin ounces outside the domestic market.

The company runs three producing mines: Edikan, Sissingué, and Yaouré, generating consistent cash flow. This multi-asset strategy mitigates single-site risk, allowing $PRU to leverage strong output for expansion and shareholder returns.

Recently, Perseus advanced its growth pipeline by developing the Nyanzaga Gold Project in Tanzania. This strategic move diversifies its footprint beyond West Africa, aiming to supercharge long-term production profiles.

5. Capricorn Metals Ltd ($CMM)

Capricorn Metals has cemented its status as a reliable mid-tier producer, anchoring its portfolio with the high-margin Karlawinda Gold Project. For investors eyeing the local gold sector, CMM offers a compelling mix of operational consistency and clear expansion pathways.

The investment case centers on using Karlawinda’s strong cash flows to self-fund the Mt Gibson Gold Project. This second asset is pivotal, aiming to lift total production significantly. Recent progress on permitting and reserve upgrades at Mt Gibson signals the company is on track to become a major dual-asset operator, boosting confidence in its long-term growth trajectory.

6. Genesis Minerals Limited ($GMD)

Genesis Minerals ($GMD) is a standout mid-tier producer in WA’s Leonora district, positioning itself amongst the other top performing ASX gold miners. Led by Raleigh Finlayson, its "ASPIRE 400" strategy aims for 400,000 ounces annually. By consolidating high-grade assets like Gwalia, Genesis delivers a "margin over ounces" model that prioritises profitability over sheer volume.

Momentum is strong, with record production of 72,878 ounces in the September 2025 quarter. The recent $250m acquisition of Laverton assets and new rail agreements for Tower Hill have bolstered resources to over 18 million ounces. With mining resumed at Jupiter, $GMD is on track for FY26 guidance of 260k–290k ounces, reinforcing its appeal in the gold sector.

7. Westgold Resources ($WGX)

Westgold Resources is a significant force in Western Australia mining, offering unhedged exposure to the precious metal. For those scanning the local market for established producers, this owner-operator presents a compelling mix of scale and operational control.

The company focuses on the prolific Murchison and Southern Goldfields, leveraging its internal mining services to manage costs. Recently, Westgold completed the integration of Karora Resources, cementing its position as a top-five domestic producer. This strategic combination targets annual production exceeding 400,000 ounces, aiming to amplify cash flow and deliver robust returns for shareholders.

8. Ramelius Resources Limited ($RMS)

Ramelius Resources ($RMS) has cemented its position as a heavyweight among ASX gold stocks, recently joining the ASX 100 index. Following the transformational acquisition of Spartan Resources, the company offers investors scaled exposure to the sector through high-margin production hubs in Western Australia.

The miner's efficient "hub-and-spoke" strategy which feeds high-grade ore from Penny and Cue to Mt Magnet, delivered a record FY25 net profit of $474.2 million. With the Dalgaranga project now integrated, Ramelius has outlined a clear pathway to 500,000 ounces of annual production by FY30, enhancing its value proposition for those looking to invest in gold companies.

9. Emerald Resources ($EMR)

Emerald Resources stands out among Aussie-listed precious metal producers for its successful operation of the Okvau Gold Mine in Cambodia. This high-margin asset provides a robust foundation for investors seeking exposure to the sector, distinguishing the company from speculative explorers through consistent, low-cost production that underpins its broader growth strategy.

The company leverages strong cash flows from Okvau to fund expansion, most notably the development of the North Laverton Gold Project in Western Australia. Recent updates highlight this dual-growth engine, with Emerald securing a controlling interest in Bullseye Mining to consolidate the Dingo Range assets, while ongoing drilling continues to expand the resource base for a potential second production hub.

Sign up in minutes and get access to a CHESS-sponsored platform, where you can explore Gold stocks and ETF opportunities.

✅ Learn more: How to start investing in Gold in Australia→

Benefits of investing in gold shares

Here are nine benefits that investing in gold shares can have for investors.

Diversification | Gold shares offer an additional layer of diversification to an investment portfolio. Sometimes they move in the opposite direction of traditional assets like stocks and bonds, providing a potential hedge during economic downturns. |

Low volatility | Compared to some other metals, gold shares tend to have lower volatility. This can provide a stabilising effect on a portfolio, reducing the potential risk of significant losses. |

Hedge against inflation | Gold has historically been considered a hedge against inflation. As the value of currency decreases due to inflation, the price of gold tends to rise, preserving purchasing power. |

Liquidity | Investing in gold shares provides a level of liquidity that physical gold does not. Buying and selling shares in gold mining companies can be done quickly and easily through stock investing platforms like Stake. |

Dividends | Some gold mining stocks may offer dividends to their shareholders. This can provide a source of income in addition to potential capital appreciation. |

Global economic stability | Gold's value is not tied to any particular country or currency. This makes it a valuable asset during times of geopolitical instability or when there are concerns about the stability of global financial systems. |

Store of value | Gold has maintained its value over long periods of time, making it a reliable store of wealth. This is a quality that has been recognised for centuries. |

Potential for capital appreciation | If the price of gold rises, the value of gold shares can also increase. This can lead to capital appreciation for investors. |

Accessibility | Investing in gold shares is accessible to a wide range of investors. It can be done through investing platforms, making it more convenient than buying physical gold. |

💡Related: What are the best assets to hedge against inflation?→

Risks of investing in gold stocks

With any financial asset, there are potential benefits and risks. Here are some of those risks to think about if you plan to invest in gold stocks.

- Market sentiment: Investor sentiment towards gold can shift quickly, this can impact demand and therefore the price of gold can be affected.

- Volatility: Gold prices can be quite volatile, leading to fluctuations in the value of gold stocks.

- Exploration and development risks: For gold mining companies that are in the exploration and development phase, there's a risk that their projects may not yield the expected results, impacting their stock price.

- Financial risks: Companies with high debt levels may be more vulnerable to fluctuations in gold prices and interest rates.

- Operational risks: Mining operations face risks like accidents, labour disputes, and regulatory changes, which can affect production and profitability.

It's crucial to research individual companies thoroughly and consider your own risk tolerance before making any investment decisions.

What gold ETFs can I invest in?

Here is a list of gold ETFs that are available on the Australian Securities Exchange (ASX):

- BetaShares Gold Bullion ETF ($QAU)

- iShares Gold Trust ETF ($IAU)

- VanEck Gold Miners ETF ($GDX)

- BetaShares Global Gold Miners ETF ($MNRS)

- Global X Physical Gold ($GOLD)

- iShares Physical Gold ETF ($GLDN)

➡️ Discover: Find out what ASX silver ETFs are available

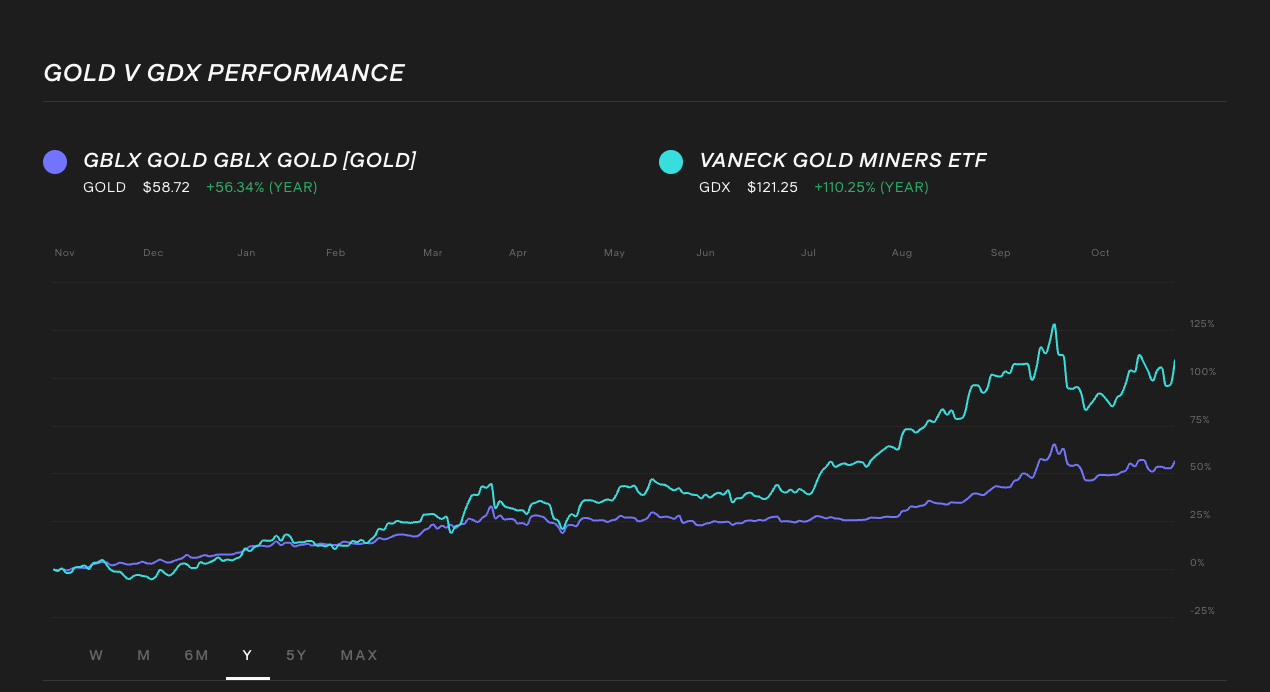

Find out which are the best gold ETFs to monitor and add to your watchlist, and compare them against each other like the GOLD vs GDX 1 year price comparison.

Do ASX gold miners pay dividends?

Many established producers pay dividends, although yields can fluctuate based on the commodity price and capital expenditure needs. Companies like Northern Star and Evolution Mining have a history of returning cash to shareholders, but it is important to check their recent earnings reports as payouts are never guaranteed.

What is the difference between holding physical gold and gold stocks?

Physical gold is a defensive asset that tracks the metal's spot price, whereas gold stocks offer operating leverage. This means miners can potentially outperform the metal itself during bull markets as they expand production, but they also carry company-specific risks like operational delays or rising costs.

Are gold stocks considered a safe haven investment?

While the metal itself is often viewed as a store of value during economic uncertainty, gold mining stocks are equities and can still be volatile. They tend to attract attention when inflation is high or markets are fearful, but they are not immune to broader market sell-offs and operational challenges.

More resources:

✅ Looking for Cobalt mining companies in Australia?→

✅ Silver stocks on ASX: Top 5 silver shares to watch→

✅ Are these the best ASX mining stocks to watch?→

Gold stocks FAQs

There is no simple answer to this question, as the timing for investing in gold and gold mining companies depends on a variety of factors, including market conditions, investor risk tolerance, and individual investment goals.

Some people believe that gold can be a good investment in times of economic uncertainty, as the metal is considered a safe haven asset that can potentially hold its value during market downturns.

Others invest in gold as a way to diversify their portfolio, as the gold price can often move independently of other asset classes.

Gold shares, on the other hand, can be more volatile than the metal itself, as their performance is influenced by a number of factors, including the price of gold, production costs, and the economic and political conditions in the countries where they operate. As with any investment, it is essential to carefully consider the risks and potential rewards before making a decision.

Yes, ETFs are a hassle-free way to gain exposure without the company-specific risks of individual miners. You can choose funds that track the physical price of bullion, such as Global X Physical Gold ($GOLD), or opt for ETFs that hold a basket of global gold mining companies, like the Betashares Global Gold Miners ETF ($MNRS).

The exchange rate is a crucial factor because gold is priced in U.S. dollars, while Aussie miners typically pay their operational costs in Australian dollars. A weaker AUD against the USD acts as a natural hedge, effectively boosting the profit margins for local producers even if the global gold price remains flat.

AISC stands for All-In Sustaining Costs, which is the industry standard for measuring the full cost to keep a mine operational and producing an ounce of gold. Investors look for a low AISC relative to the gold price, as this indicates the company is efficient and can remain profitable even if market prices dip.

Newmont is a U.S.-based company and the world's largest gold miner, but it has a secondary listing on the ASX via CHESS Depositary Interests (CDIs). This allows local investors to trade Newmont shares directly on the Australian market with the security of CHESS sponsorship, just like any other local stock.

Disclaimer

The information contained above is not financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up, and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of a general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and are not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.