Are these the best ASX lithium stocks to watch? [2025]

Lithium prices have rallied strongly in recent weeks as China curtails production of a mineral vital to electric vehicles and batteries. Here are 10 of the biggest lithium stocks on the ASX.

Investing in lithium companies on the ASX

Rapid global lithium demand growth is expected over coming years. Strong long-term demand is based on growth in electric vehicle adoption and battery energy storage system deployment. Australia has the second highest lithium reserves in the world and accounts for 36% of lithium extraction.

However, substantial growth in new global lithium supply and advanced recovery techniques in China have created oversupply. This oversupply has placed downward pressure on feedstocks such as spodumene concentrate, Australia’s major lithium export product to China. This has prompted some producers to suspend production.

ASX lithium mining stocks might be worth considering if you’re looking to invest in the rise of electric vehicles using lithium-ion batteries. If you are interested in investing in Australian shares on the ASX, check out the list below of frequently traded lithium shares on the Stake platform.

See out list of the top 10 lithium miners on the ASX

Company Name | Ticker | Stock Price | Year to Date | Market Capitalisation |

|---|---|---|---|---|

$115.20 | -2.55% | $42.76b | ||

$37.56 | +8.12% | $7.38b | ||

$2.28 | +3.39% | $7.35b | ||

$5.45 | +12.14% | $4.13b | ||

$1.00 | +74.04% | $2.40b | ||

$4.04 | -26.01% | $947.09m | ||

$0.028 | -6.67% | $289.12m | ||

$0.19 | -30.74% | $249.94m | ||

$0.11 | +24.44% | $240.02m | ||

$0.11 | +60.00% | $148.25m |

Data as of 11 August 2025. Sources: Stake, Google Finance.

*The list of lithium stocks mentioned is ranked by market cap. When deciding what stocks to feature, we analyse the financials, recent news, the state of the industry, and whether or not they are actively traded on Stake.

Sign up to Stake today and build your watchlist dedicated to the most popular lithium mining companies on the ASX.

Deep dive into Australia's leading lithium companies

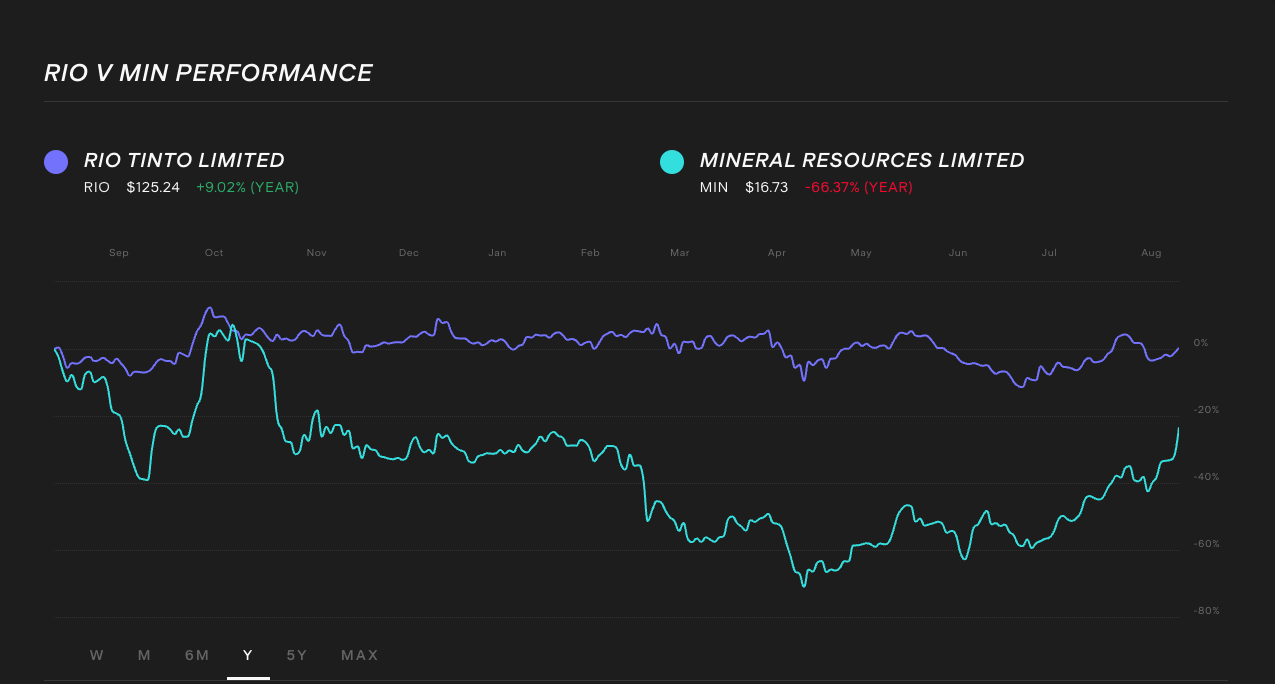

1. Rio Tinto Limited ($RIO)

Rio Tinto is set to become a sizeable lithium producer after it completed the acquisition of Arcadium Lithium for US$6.7b in March 2025. Arcadium has low-cost, long-life assets and provides exposure to lithium through hard rock mining and brine extraction. It also has lithium chemical manufacturing operations. Rio Tinto has also invested US$900m in a joint venture with Codelco to develop lithium projects in Chile. The company also produces iron ore, copper and aluminium.

💡 Related: Discover 10 leading iron ore miners on the ASX

💡 Related: Our list of the 10 ASX copper stocks to watch

2. Mineral Resources Limited ($MIN)

Mineral Resources is one of the world’s largest holders of hard rock lithium reserves. Its Wodgina mining operation, which is a joint venture with Albemarke, has a spodumene concentrate processing plant with an annual processing capacity of 900,000 tonnes. Its Mount Marion operation, which is a joint venture with Jiangxi Ganfeng Lithium, includes a spodumene concentrate processing plant with an annual production capacity of 600,000 tonnes. The company also produces iron ore.

3. Pilbara Minerals Limited ($PLS)

Pilbara Minerals is Australia’s biggest lithium miner, delivering record production of 755,000 tonnes in FY25. It owns the Pilgangoora Project in Western Australia, which is one of the largest hard rock lithium deposits in the world and produces about 8% of global lithium supply. Pilgangoora has a mine life of 32-years. PLS acquired the Colina development project in Brazil following the $560m acquisition of Latin Resources in early 2025.

🆚 Compare PLS vs LTR→

4. IGO Limited ($IGO)

IGO owns a 24.99% stake in the Greenbushes lithium mine, which has the highest grade ore reserve of any hard rock lithium mine in the world. IGO also owns a 49% stake in the Kwinana lithium hydroxide refinery.

However, IGO fully impaired its stake in the refinery in July 2025 after it failed to produce at its nameplate capacity and fell short of FY25 production guidance. IGO is focused on delivering operational improvements at Greenbushes.

5. Liontown Resources Limited ($LTR)

Liontown Resources said in its June quarter production report that it had produced over 300,000 wet metric tonnes of spodumene concentrate in its first 11 months of operation, demonstrating the successful design and ramp up of its Kathleen Valley process plant. The Australian government’s National Reconstruction Fund Corporation invested $50m in Liontown in August.

6. Vulcan Energy ($VUL)

Vulcan’s integrated lithium and renewable energy project adapts existing, commercially proven technology to produce battery-quality lithium from naturally heated subsurface brine in the Upper Rhine Valley in Germany. Vulcan holds 17 granted licences in the Upper Rhine Valley, for a total secured licence area of 2,234km². The Company plans to develop its licensing areas in phases.

7. Sayona Mining Limited ($SYA)

Sayona is set to merge with Piedmont Lithium to create a leading North American hard rock lithium producer. The merged company will be called Elevra Lithium. Sayona’s lithium assets are in Quebec and include a northern lithium hub centred around the Moblan Lithium Project and a southern lithium hub centred on the North American Lithium operation, including the nearby Authier Lithium Project.

🆚 Compare SYA vs PLS→

8. Wildcat Resources Limited ($WC8)

Wildcat Resources projects comprise the Tabba Tabba lithium-tantalum project and Bolt Cutter gold and lithium project in the Pilbara region of Western Australia; and the Mt Adrah gold project in the Lachlan Fold Belt in New South Wales. It also has several early-stage tenements and applications in Western Australia.

9. Core Lithium Ltd ($CXO)

Core Lithium owns the Finniss lithium project in the Northern Territory. A restart study released in May showed the potential for an attractive 20-year mine life. The study provided a high confidence production plan that showed 94% of production over the first ten years would be backed by ore reserves. Pre-production capex was estimated at $175m-$200m.

10. Anson Resources ($ASN)

Anson is focused on developing the Paradox lithium projects in Utah to a significant and environmentally friendly lithium producing operation, to provide high-quality lithium carbonate for the global Li-ion battery market. The Company plans to expedite development at its Green River site to expand its mineral resource base in the Paradox Basin.

How to invest in lithium in Australia?

The main way of investing in lithium is through lithium companies listed in Australia, using an online investment platform.

1. Open a stock investing account

To invest in lithium stocks and ETFs, you'll need to sign up to an investing platform with access to the ASX and Cboe Australia. Lucky for you Stake has access to both stock exchanges.

2. Fund your account

Complete an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for lithium shares or ETFs

Find the asset by searching for the name or ticker symbol. Do your own research to ensure it is the right investment product for your own circumstances.

4. Choose an order type and buy the asset

Buy on any trading day with a market, limit or stop order. Look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Optimise your portfolio by tracking how the security performs with an eye on the long term. You may be eligible for dividends and shareholder voting rights that affect your shares.

Sign up to Stake today and build your watchlist dedicated to the most popular lithium mining companies on the ASX.

What is the lithium forecast for Australia?

The Department of Industry, Science and Resources (DISR) forecasts Australia’s lithium export earnings will increase from $4.6 billion in 2024-25 to $6.6 billion in 2026-27, driven by growth in export volumes. Australian mine output is expected to grow more than 7% a year to 2027.

DISR forecasts global lithium extraction to grow by almost 14% annually to reach over 1.8m tonnes of lithium carbonate equivalent by 2027. Australia is expected to remain the leading lithium supplier to 2027. Its share of global lithium extraction is forecast to fall from 36% in 2024 to 31% by 2027, despite mine output growing 7% annually.

However, DISR expects some near-term production cuts due to weak global lithium prices.

More resources:

✅ Looking for Cobalt mining companies in Australia?→

✅ ASX Uranium Stocks: Top Uranium Shares to Watch→

✅ Are these the best gold ETFs on the ASX?→

Lithium stocks FAQs

Pilbara Minerals ($PLS) is the largest lithium miner in Australia. Pilbara produced 754,000 tonnes in FY25. If you are interested in Pilbara Minerals and the lithium industry, compare the stock against some other players in the sector including PLS vs CXO and PLS vs MIN.

As demand for batteries continues to rise worldwide, lithium prices are to recover. However, the industry faces a period of oversupply. But producers have responded by curtailing production.

The Global X Battery Tech & Lithium ETF ($ACDC) offers exposure to some lithium stocks. Its fourth largest holding is Liontown Resources and its sixth largest holding is Mineral Resources. Find out more about other Australian ETFs and those focused on commodities.

This article was edited by Robert Guy - Senior Markets Writer at Stake.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.