Are these the best electric vehicle stocks? [December 2024]

As consumer adoption of electric vehicles continues to accelerate, competition is heating up among both legacy auto firms and innovative startups. Consider these 10 electric vehicle stocks for exposure to the EV arms race.

The future of investing in electric vehicle stocks looks promising as the demand for sustainable transportation continues to grow. Popular EV companies such as Tesla, NIO, and Lucid Motors have seen significant growth in recent years, and EV battery companies are also poised for growth as the demand for EVs increases globally. However, as with any investment, there are risks to consider, such as competition and regulatory changes.

Decide which are the best EV companies to watch

Company Name | Ticker | Share Price | Year to Date | Market Capitalisation |

|---|---|---|---|---|

Tesla | US$338.23 | +36.15% | US$1.09t | |

BYD Company ADR | US$65.72 | +22.38% | US$106b | |

General Motors | US$54.79 | +51.98% | US$66.2b | |

Ford Motor Company | US$11.10 | -8.72% | US$45.31b | |

ON Semiconductor Corp. | US$70.82 | -13.05% | US$30.82b | |

Li Auto | US$21.83 | -36.89% | US$23.73b | |

Rivian | US$11.55 | -45.26% | US$11.84b | |

Xpeng | US$11.39 | -18.87% | US$11.03b | |

Nio | US$4.31 | -48.81% | US$9.75b | |

Lucid | US$2.14 | -48.55% | US$6.54b |

Data as of 26 November 2024. Source: Stake, NYSE, Nasdaq, Google.

*The list of electric vehicle stocks mentioned is ranked by market capitalisation. When deciding what EV companies to feature, we analyse the financials, recent news, state of the industry, and whether or not they are actively traded on Stake.

✅ Sign up is fast, paperless and free

✅ Start investing from $3 brokerage across U.S. and CHESS-sponsored ASX trades (for orders up to $30k)

✅ Gain access to pre-market and after hours trading, with a total of 16 hours of market access per trading day

Discover which electric vehicle stocks are the right investment for you

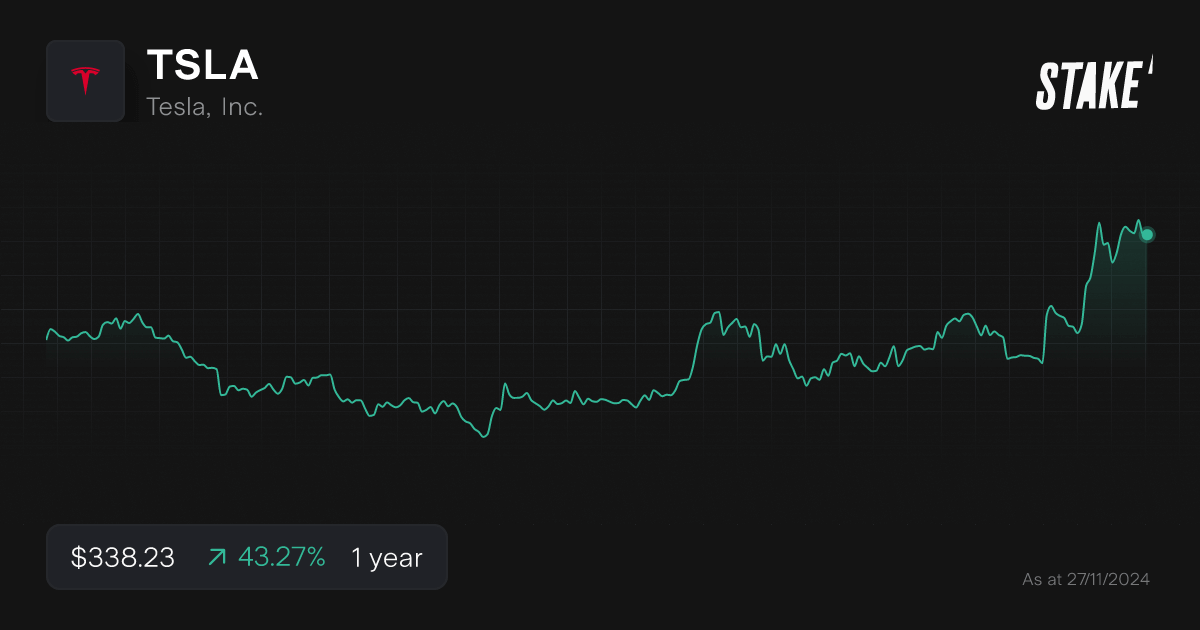

1. Tesla ($TSLA)

- Market capitalisation: $1.09t

- Stock price (as of 26/11/2024): $338.23

- Stake investors watching $TSLA: 232,051

When it comes to electric vehicle stocks, Tesla ($TSLA) needs no introduction. Not only does the company make up nearly half of all EV sales in the US, but its Model Y was the best-selling car in the world last year.

While Tesla shares have posted annualised returns of 68% over the past five years, the stock tends to be more volatile than peers. CEO Elon Musk frequently draws both criticism and acclaim for his ambitious projects and bold vision. Tesla’s latest initiatives, for instance, are focused on autonomous transit systems and humanoid robots.

Recently, Tesla stock has received an extra boost from Donald Trump’s victory in November’s US presidential election. Not only is Elon Musk a notable supporter of the president-elect, but increased tariffs on China could help shield the firm from low-priced competitors. However, investors will need to keep an eye on how Musk’s appointment to the Department of Government Efficiency could impact Tesla.

🆚 Compare TSLA vs BYDDY→

2. BYD Company ADR ($BYDDY)

Market capitalisation: $106b

Stock price (as of 26/11/2024): $65.72

Stake investors watching $BYDDY: 2,589

BYD ($BYDDY) is a Chinese manufacturing conglomerate with a high-performing EV business. Despite an EV slowdown in China, BYD’s total sales outpaced rival Tesla for the first time in Q3 of this year.

While BYD does have consumer electronics and semiconductor divisions, about three-quarters of the company’s total revenue is due to EV sales. Over the past five years, BYD shares have notched annualised gains of 49%.

Thanks to competitively priced vehicles, BYD’s international sales are growing rapidly, with the company doubling overseas volumes in the first nine months of this year. Protectionist policies in the U.S., though, could dampen this trend. Although BYD is only listed on Chinese stock exchanges, international investors can access the company through American Depository Receipts (ADRs) trading over the counter.

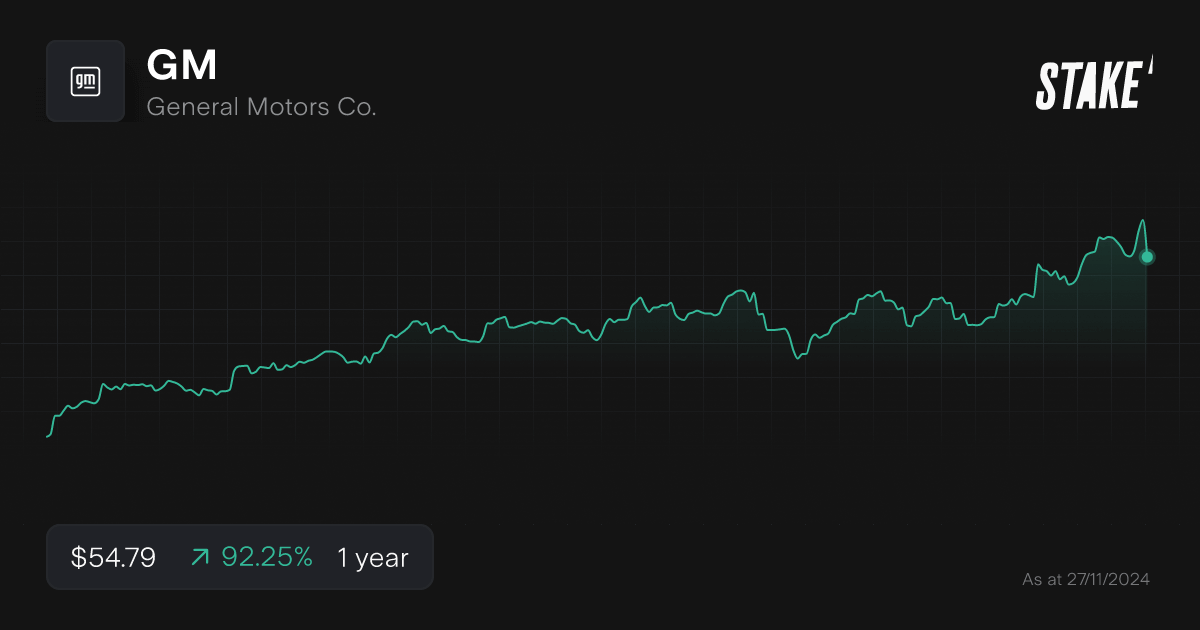

3. General Motors Co. ($GM)

Market capitalisation: $66.2b

Stock price (as of 26/11/2024): $54.79

Stake investors watching $GM: 5,530

General Motors ($GM) is an American automotive manufacturer most well-known for brands like Chevrolet, Buick, and Cadillac. As of 2024, GM had amassed nearly 10% of U.S. EV market share and anticipates generating an operating profit on EVs by the end of the year.

GM stock has gained 10% annualiszed over the past five years, including a 60% gain in this year alone. While the company has cut its quarterly dividends in recent years to preserve liquidity, its yield still sits at 0.8%. Today, GM offers nine electric cars through its various brands, with EVs accounting for just under 5% of all vehicles sold.

Despite these figures, GM’s recent decision to lay off 1,000 workers as part of sweeping cost-cutting measures highlights the challenge of making EVs profitable. Owing to the company’s commitment to sell only non-emissions vehicles by 2035, however, GM stock could be a good fit for investors looking to back a legacy car company navigating the EV transition.

4. Ford Motor Company ($F)

Market capitalisation: $45.31b

Stock price (as of 26/11/2024): $11.10

Stake investors watching $F: 7,199

Ford Motor Company ($F) isn’t traditionally thought of as an electric vehicle company, but the legacy automaker has made significant inroads in the EV market. Ford is runner-up to Tesla in terms of US EV sales, thanks to its best-selling E-Transit van and F-150 Lighting pickup truck.

While Ford stock has notched 9.5% annualised returns over the past five years, that performance has lagged the broader automotive industry. Still, the company’s longevity should attract investors looking for a more stable EV play, especially considering its 5.4% dividend yield.

Due to the company’s sizable legacy operations, EV sales still make up a small portion of Ford’s total revenue. While that may change in the future owing to EV market growth, investors should understand that Ford’s internal combustion engine (ICE) vehicle sales will likely dominate the bottom line for years to come.

5. ON Semiconductor Corp. ($ON)

Market capitalisation: $30.82

Stock price (as of 26/11/2024): $70.82

Stake investors watching $ON: 1,549

Unlike most companies on our list of electric vehicle stocks, ON Semiconductor Corporation ($ON) isn’t an EV manufacturer. The company, commonly known as Onsemi, is a semiconductor supplier based in Arizona. Since the automotive industry is a key end market for Onsemi’s chips, however, the company could be a compelling EV play.

This summer, for instance, Onsemi announced a multi-year deal with Volkswagen to supply power boxes for the company’s next generation of EVs. Onsemi’s products are also notable for helping extend the range of batteries and powering sensor & camera systems. In 2023, Onsemi’s automotive segment accounted for just over half of the firm’s total revenue.

Over the past five years, Onsemi shares have grown by more than 25% annualised, although they’ve had a rough 2024 owing to a meager global EV outlook. That decline could offer a buying opportunity for value investors interested in a company that operates outside the highly competitive EV manufacturing market.

6. Li Auto ($LI)

Market capitalisation: $23.73b

Stock price (as of 26/11/2024): $21.83

Stake investors watching $LI:

Li Auto ($LI) is a Chinese-based EV company primarily focused on SUVs and a flagship seven-seater minivan dubbed MEGA. Notably, Li is just the third company to make an operating profit on EVs, alongside Tesla and BYD.

Despite achieving profitability, short interest in the company has soared in recent weeks owing to a slowdown in new vehicle rollouts. Li, which went public in 2020, has seen shares decline 10% annualiszed over the past three years and nearly 40% in 2024 alone. Still, better-than-expected Q3 results could portend a turnaround for the company.

Li vehicles are notable for their hybrid range-extender systems, which rely on a small ICE to generate additional battery power when needed. Owing to the success of these systems, competitors like BYD and Xpeng have also begun implementing their own versions. Li shares are listed in China and trade as ADRs on the Nasdaq.

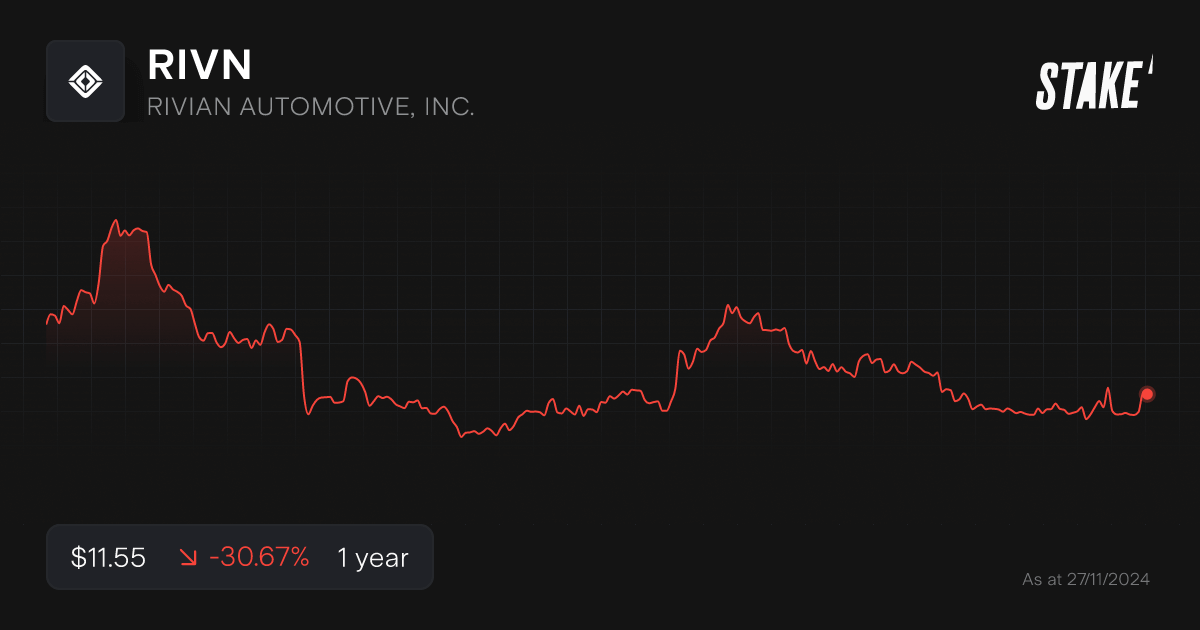

7. Rivian Automobile, Inc. ($RIVN)

Market capitalisation: $11.84b

Stock price (as of 26/11/2024): $11.55

Stake investors watching $RIVN: 9,660

Rivian ($RIVN) is a relative upstart when it comes to the electric vehicle market, but the company now accounts for almost 5% of U.S.US market share. The company’s flagship models include its R1S SUV and R1T pickup truck, with new designs currently in production.

After going public in 2021, Rivian’s stock has had a volatile history. On an annualiszed basis, shares have fallen 57% over the past three years. With the company anticipating that it will earn a gross profit on vehicle sales later this year, however, things might be poised for a turnaround.

Rivian is also notable for its numerous strategic partnerships with established players. Rivian has delivered over 15,000 custom electric vans to Amazon, one of the company’s key investors. A recent $5.8 billion joint venture with Volkswagen, meanwhile, will see the two companies collaborate on software and design.

🆚 Compare RIVN vs LCID→

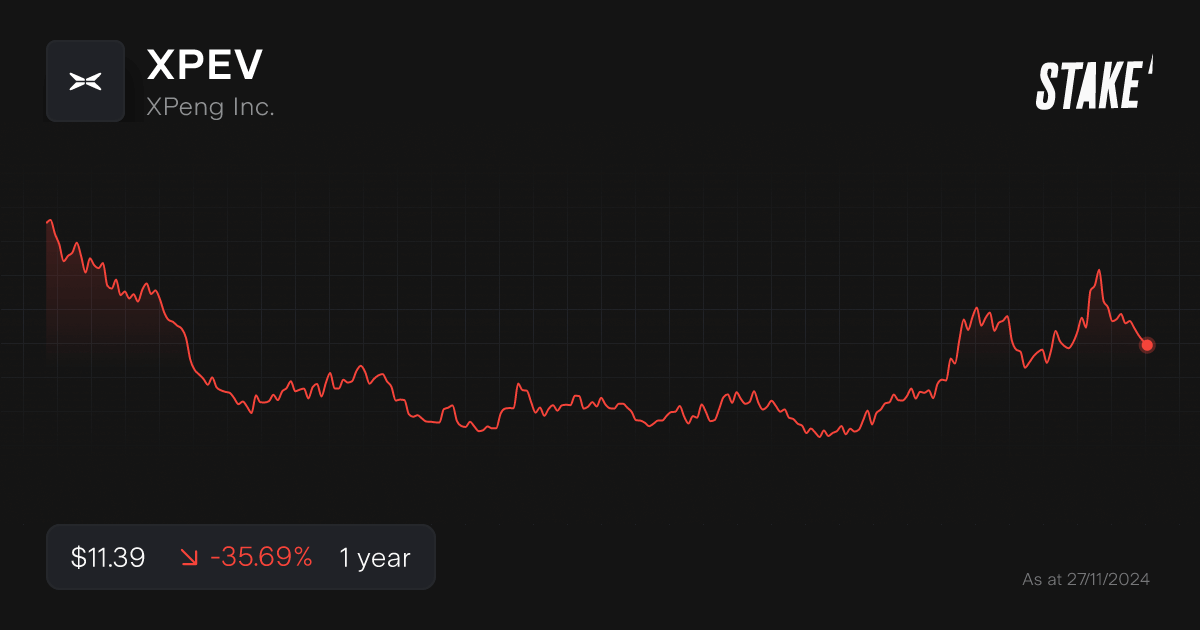

8. XPeng Inc. ($XPEV)

Market capitalisation: $11.03b

Stock price (as of 26/11/2024): $11.39

Stake investors watching $XPEV: 7,458

XPeng ($XPEV) is another of China’s many domestic EV brands, with the company focusing on its roster of mid-market sedans. While Xpeng has a relatively small market share in China, the firm has been making increased efforts to market its vehicles in Europe to expand its reach.

After going public in 2020, Xpeng shares have posted poor returns, with 36% annualiszed losses over the past three years. This summer’s announcement that the company is rolling out a sub-$20K EV with driver assistance features, however, sparked hope of a resurgence.

While Xpeng has faced persistent historical losses, the company recently unveiled a strategic partnership with Volkswagen to develop two new vehicles while cutting costs. Still, investors may need to be patient when it comes to profitability. Xpeng is listed in China and trades as an ADR on the NYSE.

9. Nio Inc. ($NIO)

Market capitalisation: $9.75b

Stock price (as of 26/11/2024): $4.31

Stake investors watching $NIO: 28,911

Nio ($NIO) is a China-based EV manufacturer that focuses on higher-end vehicles than main rival BYD. Nio vehicles are particularly notable for their battery swapping features, which can help minimisze range anxiety. Owing to China’s fiercely competitive EV market, however, Nio holds just a 2.1% market share in the country and has faced persistent quarterly losses.

The company’s stock has had a turbulent history. Over the past five years, shares have notched annualiszed gains of around 20%, trading between lows of less than $2 and highs of more than $60. In 2020, Nio was on the edge of bankruptcy for months but survived thanks to a large government investment.

Today, Nio still faces an uphill battle. Healthy sales growth, however, indicates that the company’s fortunes could be turning. What’s more, the company recently announced a fresh $1.9 capital injection from a group of strategic investors. Nio’s shares are listed in China and trade as ADRs on the NYSE.

10. Lucid Group Inc. ($LCID)

Market capitalisation: $6.54b

Stock price (as of 26/11/2024): $2.14

Stake investors watching $LCID: 15,385

Lucid ($LCID), based in California, serves as an upmarket competitor to other domestic EV firms. The firm’s flagship Lucid Air sedan starts at more than $70K, with an upcoming SUV model also set to be priced at the top of the market.

Despite these figures, Lucid has struggled to turn a profit. After going public via SPAC in 2021, shares have fallen to $2 from a peak of more than $50. Since the start of this year, Lucid stock has declined by about 50%, although strong recent revenue figures helped provide a short-term boost to shares.

This summer, Lucid was able to secure a $1.5 billion investment from an affiliate of Saudi Arabia’s public investment fund, which should help the firm meet liquidity demands as it ramps up vehicle production. The company recently reaffirmed their manufacturing goal of 9,000 vehicles this year.

How to invest in EV stocks in Australia?

The main way of investing in electric vehicle companies is through shares listed on the Nasdaq and NYSE stock exchanges, using an online investment platform. Follow our step by step guide below:

1. Find a stock investing platform

To buy EV stocks on the U.S. stock market or over-the-counter stocks, you'll need to sign up to an investing platform with access to Wall St. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, PayTo, debit card or even Apple/Google Pay.

3. Search for the company

Find the company by name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own the shares, you should monitor their performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

What is the best-performing electric vehicle company?

Tesla ($TSLA) has been one of the best-performing electric vehicle stock to date, notching annualised gains of 68% over the past five years and over 25% in this year alone.

Investors have been exposed to significant volatility over that time frame, however. In comparison, legacy companies like Ford ($F) tend to be more stable.

Remember, past performance is no guarantee of future return. As you consider which EV stocks to buy, it’s just as important to consider which companies are best poised for future growth as it is to evaluate their historical returns.

List of electric vehicle ETFs to watch

If you want to gain exposure to electric vehicle shares as a whole instead of one company in particular, ETFs can offer an efficient way to access a diversified basket of EV related stocks. Consider some of the EV ETFs listed below:

Global X Autonomous & Electric Vehicles ETF ($DRIV)

Global X’s DRIV ETF seeks exposure to the EV market as a whole, including both vehicle manufacturers and suppliers of critical EV technologies. As of their most recent reporting, the ETF’s largest holdings included Tesla, Microsoft, Nvidia, Alphabet, and Toyota. The ETF has a 0.68% expense ratio, a 13.47% 5-year annualized return, and net assets of $413MM.

iShares Self-Driving EV and Tech ETF ($IDRV)

iShares’ IDRV ETF offers slightly more focused exposure to manufacturers, although the fund’s mandate does extend to companies along the EV value chain. Current top holdings include Tesla, Xpeng, Arcadium Lithium, BYD, and LG. The ETF has a 0.47% expense ratio, a 7.48% 5-year annualized return, and net assets of $182MM.

SPDR S&P Kensho Smart Mobility ETF ($HAIL)

SPDR’s HAIL ETF focuses on smart transportation and autonomous driving technology, with strong overlap with the electric vehicle sector. Current top holdings include Aurora Innovation, Tesla, Xpeng, Allison Transmission, and Polestar. The ETF has a 0.45%, a 1.28% 5-year annualized return, and net assets of $25.7MM.

Electric vehicle stocks FAQs

When we sort EV manufacturers by market capitalisation, Tesla ($TSLA) has the undisputed number one spot at the moment. Even if we include traditional automakers.

Investor interest in EV stocks remains strong and the market value of the companies often includes a heavy amount of goodwill and long-term assumptions. This leaves the stocks open to high volatility if expectations are missed, or development fails.

The majority of electric car stocks don’t pay dividends, but two of the rare ones are BYD and Ford.

BYD Company ($BYDDY) is one the largest manufacturers of electric vehicles. The company also manufactures lithium-ion batteries and electronics.

While it’s controversial as to whether Ford (F) could be considered an EV stock, the third-largest car manufacturer in the U.S. is focusing increasingly on electric cars and electric trucks.

If we knew the future of the EV market, all employees at Stake would be billionaires.

While it’s clear that electric cars are an important part of a clean energy future, many questions remain. Two key ones are: what will replace lithium-ion batteries, and how will EV charge time be reduced?

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.