How to buy Dividend Stocks? Guide to Dividend Investing

Interested in becoming a dividend investor? In this guide we will explain how to get started investing in dividend stocks and what you should know about this strategy.

What is dividend investing?

Dividend investing is a strategy for generating steady income from the stock market. It involves buying shares in companies that pay dividends - a portion of company profits returned to shareholders. This approach not only provides regular cash flow but also offers potential for capital appreciation, making it a dual-benefit investment tactic.

How to buy dividend stocks

To buy dividend stocks, first, open an account with an investing platform. Next, deposit funds into it. Then, it's research time: identify stocks of companies with a strong dividend track record. Finally, make your move and purchase through the platform. It's not just buying stocks; it's investing in a company's profitability and your future income.

Below is a more detailed step by step guide on how to buy dividend stocks.

Steps to start dividend investing

1. Find an investing platform

Your first step is choosing a reliable investing platform with competitive fees that allows you to invest in dividend stocks that appeal to you. Additionally, a great investment platform should complement your goals and experience levels.

So ensure you check your prospective platform in advance if you’re looking for educational content, research tools to compare assets or even convenient features like instant funding and analyst ratings (available through Stake Black).

If you’re ready to start buying stocks in dividend-paying companies, you can open a Stake investing account in a few minutes and access over 8,000 stocks and ETFs across ASX and Wall St.

2. Research the individual dividend stocks you’re interested in

Once your account is open, you can begin browsing the stock market and analyse the available options. It’s extremely important you conduct your own research before investing.

When researching dividends, it’s usually wise to consider a few key things like dividend growth, dividend yield, competitive advantage and dividend payment dates.

Your investment strategy and risk tolerance should always be front of mind when researching securities. For example, if you’re the kind of investor that is seeking consistent returns from your dividend portfolio you may ask yourself ‘Should I be investing in consistent dividend payouts or seek out assets with higher dividend growth?’.

Always take your own personal finances into consideration when researching and crafting your investment strategy.

👉 Start by checking out these articles: What are the best dividend stocks on ASX? and Are these the best dividend ETFs in Australia?.

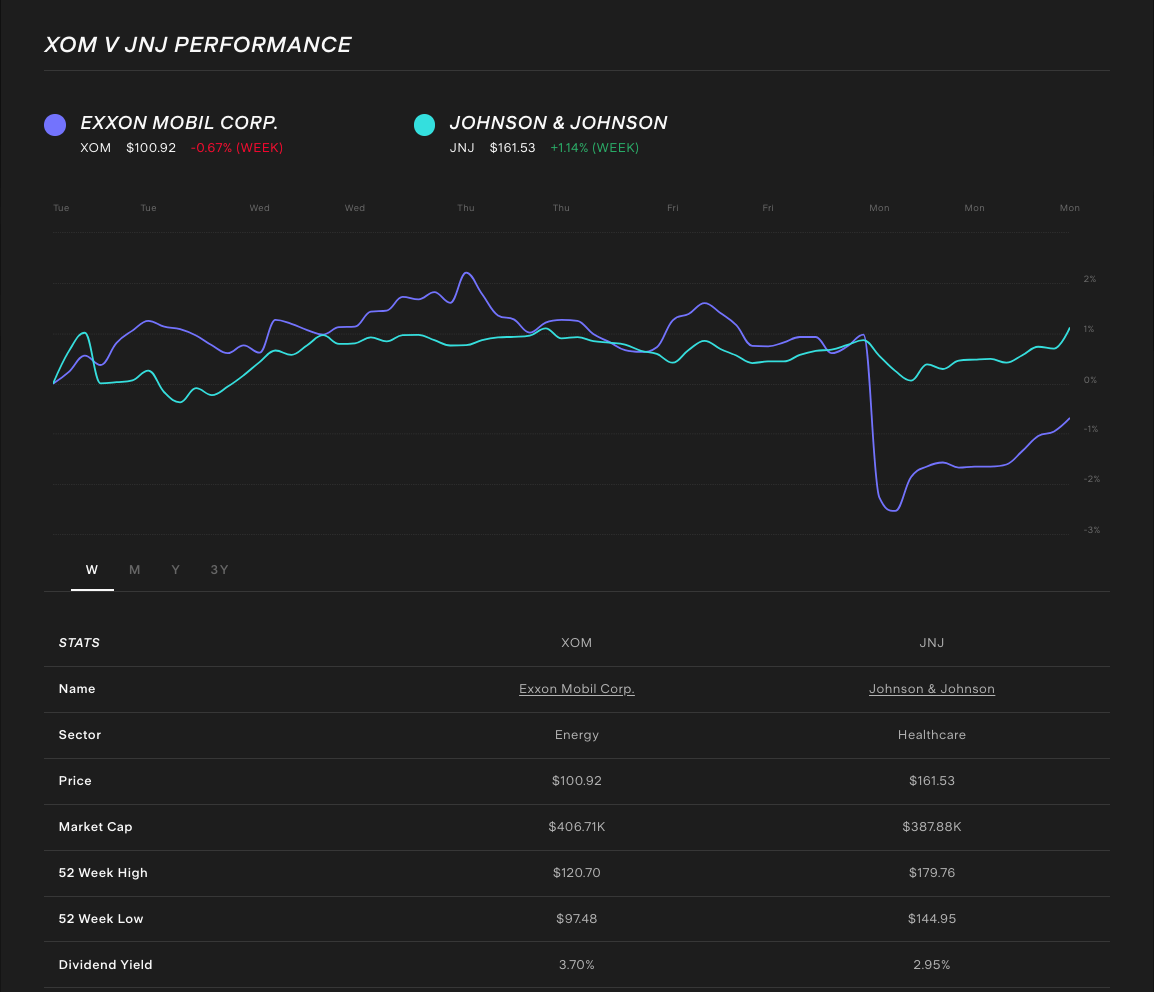

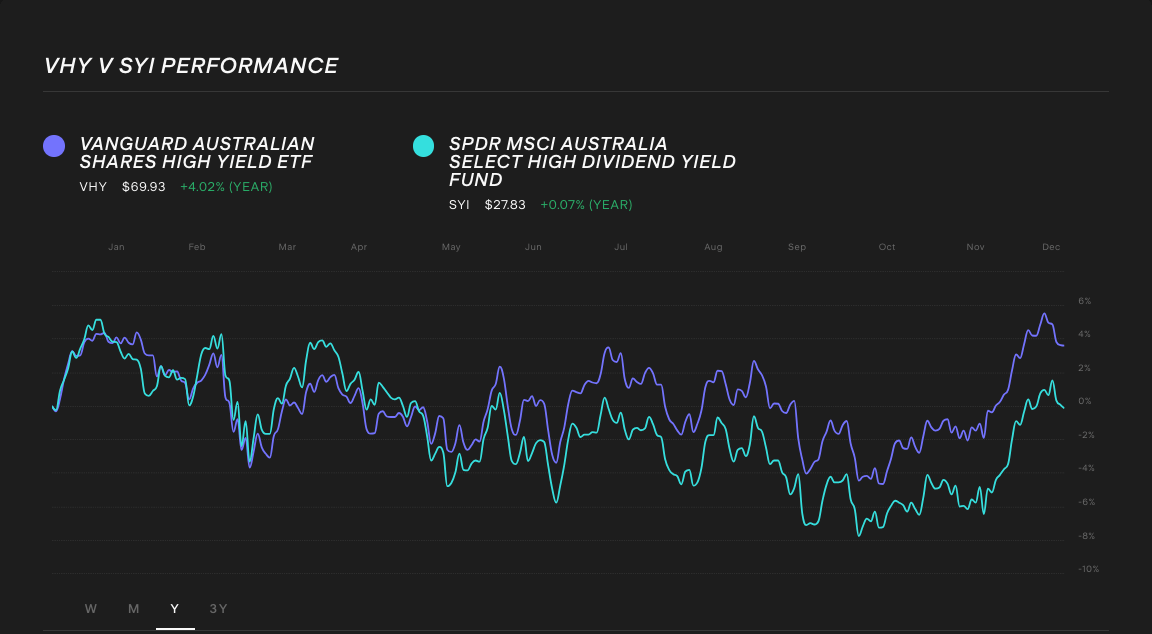

Compare the dividend yield of companies you're interested in using our stock comparison tool.

3. Fund your account and place an order

After choosing dividend stocks to buy it’s time to fund your account and place an order. This step can differ depending on the platform you choose and the payment methods your chosen platform supports.

For example, the Stake payment methods include funding directly into your AUS or Wall St account via bank transfer, credit/debit cards, Google Pay or Apple Pay.

Once you’ve deposited your funds, you’ll be able to search for your chosen security, enter the number of units you wish to buy, and place an order.

The types of orders available will depend on your chosen investment platform. If you were investing on Stake, you have the option to place a market, limit or stop order. You can learn more about different types of orders here.

4. Monitor the performance and receive dividends

Once you own your new assets, you should keep an eye on their performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

Depending on the stock investing app you’re using, you should be able to see the trade price, volume, dividend announcements, related news and other relevant information.

Just remember, markets can be volatile in the short term and impact some of the securities which may in turn impact the share price. It’s important you monitor your portfolio closely and seek out professional financial advice if you’re having issues or worries about your investments.

5. Receive dividends on the payout date

You will receive correspondence about upcoming dividend payments and can stay on top of this by looking at the share detail page of the assets in the Stake app. Depending on how the company or fund has set up dividend payments, there may be a few options for you to choose when handling dividends: dividends paid as cash, dividends paid out as shares, a dividend reinvestment plan and more.

Types of dividend investments

All of these investment options entail purchasing an asset which includes dividend-paying funds or stocks. These are the most common for investors interested in creating an income-generating strategy with dividends.

Individual companies

Buying stocks in individual dividend-paying companies is the most straightforward approach. It requires a lot of research and a keen eye to discover potential, as you're building your own portfolio from the ground up. It will be important to find an investing platform that has low brokerage fees since you will be buying into these companies regularly as part of your strategy.

High-yield mutual funds

If you're looking to simplify yet amplify your dividend investment game, high-yield mutual funds and ETFs are your go-to. They rope in a selection of dividend-rich stocks, curated by fund managers, delivering dividends directly to your pocket – either as cash or reinvested shares. These funds generally operate on a quarterly dividend payout, though some opt for monthly payments. It's vital to weigh the fees against the potential gains – higher fees might nibble at your returns, but the convenience of having experts manage your portfolio can be a compelling trade-off.

Dividend exchange-traded funds

Dividend-appreciation funds and ETFs stand tall. They target stocks that aren't just dividend payers but also consistent dividend growers, often over multiple quarters. These funds echo the high-yield mutual funds and ETFs in structure, with the added allure of focusing on companies with a proven track record of increasing dividends.

Dive into this list of 10 high dividend ETFs in Australia to get the discovery phase started.

What should you look for in a dividend stock?

There are a few metrics and dates to understand when buying dividend-paying stocks. These are not all the metrics but some important ones to pay attention to:

Dividend Yield: An important metric to first look for is the dividend yield. It's the annual dividend payment divided by the stock price, giving a snapshot of what you’ll earn relative to the investment.

But beware, a high yield can be a siren call, luring you towards unstable companies. It's important to dig deeper and ensure the yield is sustainable, not just a temporary spike due to a plummeting stock price.

Yield on Purchase Price: As companies increase their dividends over time, the yield on cost rises, making an initial investment increasingly profitable. This long-term view helps to focus on dividend growth potential, rather than getting swayed by the current yield alone.

Payout Ratio: Payout ratio is the portion of earnings paid out as dividends. A lower ratio suggests a sustainable dividend, hinting that the company has enough room to grow the dividend. But a high ratio? That's a red flag, signalling potential cuts in dividends if earnings drop.

Debt to Equity Ratio: The debt-to-equity ratio is a key marker of financial health. High debt can hamstring a company's ability to maintain or raise dividends. You could lean towards companies with lower debt-to-equity ratios, as they're generally in a better position to weather economic downturns and keep those dividends flowing.

Free Cash Flow to Equity: Free cash flow to equity (FCFE) is the cash available to equity shareholders after all expenses, reinvestment, and debt repayments. A strong FCFE is a green light, indicating a company can support its dividend payouts without straining its finances.

💡Related: Discover some popular ASX blue chip dividend stocks→

What is the best thing to do with dividends?

Deciding on what to do with your dividends is up to each individual investor.

If you choose to reinvest dividends through a dividend reinvestment plan, your choosing to empower your long term returns thanks to compounding interest.

Other investors might choose to receive their dividends in cash since they want the income now and this can also be a good option that can allow them to diversify into other assets or just have more available cash.

✅ Find out how dividends work on Stake

What are the pros and cons of dividend investing?

There are advantages and disadvantages of dividend investing but this may differ for every investor and the investment strategy they are following.

Pros

Reliable income stream: Dividend investing is like a steady paycheck for your portfolio, offering a steady income stream that can weather market storms.

Very little fluctuations: Dividend-paying companies are the calm in the storm, often showing less price volatility and more stability.

Use dividends how you want: The beauty of dividends lies in their versatility; reinvest them for compound growth or use them as a stable cash flow for your financial needs.

Cons

Company changes dividend distributions: Companies unpredictably adjust their dividend distributions, potentially changing the steady amount of income you’ve been receiving.

Share prices fluctuate: While dividends offer stability, share prices can still shift with the market's unpredictability, affecting the overall value of your investment.

Dividends can change every year: Dividend payouts aren't set in stone and can vary each year, adding a layer of uncertainty to the expected income stream.

The ceiling for bigger gains is lower: When searching for higher returns, dividend stocks often don't soar as high as their growth seeking counterparts, potentially capping growth prospects.

High-yield dividend traps: High dividend yields can sometimes be a trap, luring investors into unsustainable payouts and shaky financial foundations.

Our tips to consider before you start dividend investing

Remember to do your reserch and decide if this new venture into dividends is the right direction to achieve your investing goals.

Fees: When diving into dividend investing, you need to understand the fees on your platform of choice, as these could eat into your potential profits. Brokerage fees, transaction costs, and any hidden charges. Why pay $10 or more in fees per trade when using Stake you will only pay a $3 brokerage fee on all trades up to $30k.

Customer service: Exceptional customer service is crucial when investing your hard-earned capital. Find a platform with knowledgeable and accessible support. If you need to get in touch with someone at Stake, contact us here.

Security: In the digital age, financial data is as precious as your investments. Robust encryption, two-factor authentication, and a solid track record of protecting client assets are non-negotiable when selecting a platform to start dividend investing.

Research: Make sure you delve deep into company financials, dividend histories, and market trends before starting your journey into dividends. Staying informed with up to date research and analysing potential investments thoroughly helps to find stronger opportunities.

Looking to invest in dividend stocks?

Join Stake and access dividend securities along with 8,000+ other market opportunities across the ASX & Wall St.

FAQs

Dividend stocks are taxed under a system called 'imputation' in Australia. This system is designed to prevent double taxation on dividends. When Australian companies pay dividends, they often come with franking credits, which represent the tax the company has already paid. These credits can be used by shareholders to offset their own tax liabilities. The dividends can be either franked (tax already paid by the company at the corporate tax rate) or unfranked (no tax paid).

For shareholders, franked dividends provide a tax credit, which can reduce the tax they owe on their dividend income. The system ensures that the income from dividends is taxed at the shareholder's tax rate, rather than being taxed twice – first at the corporate level and then at the individual level.

Yes, dividend stocks usually have less volatility in the markets than stocks that don’t payout dividends.

Dividends do not necessarily go down when the stock price goes down. Dividend payments are typically decided by the company's board of directors and are based on the company's profitability and dividend policy, not directly on the stock's current market price.

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking appropriate financial or taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.