Are these the best ASX blue chip dividend stocks? [2024]

Australia’s most popular blue chip stocks have just unveiled their full year earnings and final dividends that will be paid to millions of shareholders in September and early October. Higher dividends will be coming from Commonwealth Bank, CSL and Woolworths, while miners like BHP will pay out less to conserve cash to fund growth plans.

Explore some of the ASX blue chip dividend stocks

Discover this short list of 10 popular Australian blue chip stocks and how their dividends compare. It's a good place to start if you are interested in income-generating assets on the Australian Securities Exchange.

Company Name | Ticker | Share Price | Year to Date | Market Capitalisation | Dividend Yield |

|---|---|---|---|---|---|

Commonwealth Bank | $143.38 | +26.20% | $240b | 3.33% | |

BHP Group | $39.63 | -21.59% | $201b | 5.76% | |

CSL Limited | $306.03 | +6.15% | $148b | 1.24% | |

Wesfarmers Limited | $71.39 | +24.13% | $81b | 2.67% | |

Goodman Group | $33.07 | +31.70% | $63b | 0.90% | |

Fortescue Ltd | $17.70 | -39.78% | $56b | 11.38% | |

Telstra Group | $3.95 | -0.50% | $46b | 4.58% | |

Woolworths Group | $34.83 | -7.14% | $44b | 2.94% | |

Transurban Group | $13.61 | -1.23% | $42b | 4.58% | |

Coles Group | $18.50 | +14.48% | $25b | 3.51% |

Data as of 3 September 2024. Sources: Stake, Google Finance, ASX.

*The list of stocks mentioned is ranked by market capitalisation. When deciding what assets to feature, we analyse the financials, recent dividend news and company reports and whether or not they are actively traded on Stake.

Find the best blue chip dividend stocks in Australia for you

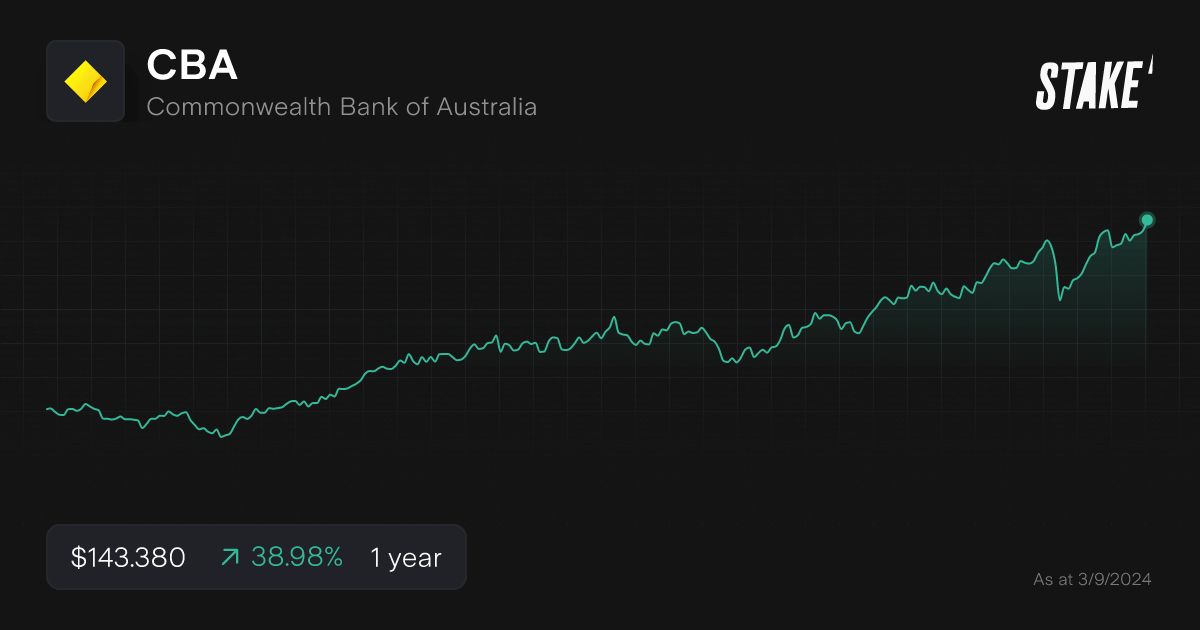

1. Commonwealth Bank of Australia ($CBA)

Dividend yield: 3.33%

Market capitalisation: $240b

Share price (as of 3/09/2024): $143.38

Stake investors watching $CBA: 15,655

Australia’s largest bank rewarded investors with $7.6b of dividends in FY24 despite a slight fall in full-year profits. That’s a handy payout for 13 million shareholders who own Commonwealth Bank shares directly or in their super funds.

The $230b bank paid a final dividend of $2.50 a share, up from $2.40 at the same time last year. The final dividend will be paid on 27 September. Including the interim dividend of $2.15 a share, total dividends were $4.65 a share in FY24.

Commonwealth lifted its payout ratio to 79%, which is at the top end of its target 70%-80% payout target. Consensus forecasts point to total dividends of $4.72 in FY25.

FY24 cash profit fell 2% to $9.83b as operating expenses rose 3%. Net interest margins fell below 2% due to strong competition. The bank increased provisions by $2.2b to insulate itself from the threat of slower growth and higher unemployment.

2. BHP Group Limited ($BHP)

Dividend yield: 5.76%

Market capitalisation: $201b

Share price (as of 3/09/2024): $39.63

Stake investors watching $BHP: 17,436

The world’s largest miner prioritised growth over dividends this reporting season as it preserves cash to fund expanded copper production.

A final dividend of US74¢ a share - or US$3.8b in total - was declared, down from US80c at the same time last year. The final dividend will be paid on 3 October. Total dividends for FY24 were US$1.46 a share, down from US$1.70 a share in FY23. BHP paid total dividends of US$7.4b in FY24. Consensus forecasts estimate FY25 total dividends will be broadly in line with FY24.

BHP’s full year profit fell 39% to US$7.9b after including an impairment of its West Australian nickel operations and a charge related to the Samarco dam failure. Underlying profit rose 2% to US$13.7b in FY24.

The miner warned of commodity market volatility given China’s uneven recovery. Copper production is forecast to grow 4% in FY25 after a 9% increase in FY24 to 1.9m tonnes.

3. CSL Limited ($CSL)

Dividend yield: 1.24%

Market capitalisation: $148b

Share price (as of 3/09/2024): $306.03

Stake investors watching $CSL: 5,712

The global biotech kept investors onside with a forecast increase in net profit after tax and amortisation (NPATA) of 10% to 13% In FY25, offering hope for another solid dividend increase from the vaccine maker.

CSL lifted its FY24 final dividend 12% to US$1.45 a share, bringing the total payout for the year to US$2.64 a share - an 11.8% increase on the total US$2.36 a share paid in FY23. The final dividend will be paid on 2 October.

CSL seeks to grow dividend in line with NPATA growth and targets a payout ratio of between 40% and 45% of net profit. Consensus forecasts point to total dividends of US$2.99 a share in FY25.

Net profit after tax increased 25% on a constant currency basis to US$2.75 billion in FY24. Revenue rose 11% to US$14.8b driven by a 14% increase in revenue to US$10.6b at its CSL Behring division.The strong momentum in CSL Behring was expected to continue in FY25 due to strong patient demand for products from its immunoglobulins business.

4. Wesfarmers Limited ($WES)

Dividend yield: 2.67%

Market capitalisation: $81b

Share price (as of 3/09/2024): $71.39

Stake investors watching $WES: 8,895

The Perth-based conglomerate paid out $2.2b in dividends in FY24 as its iconic retail brands delivered higher revenues and earnings despite pressures on household budgets.

A final dividend of $1.07 a share - up from $1.03 a share in FY23 - a share was declared. This brought the total dividend for FY24 to $1.98 a share, up from $1.91 a share in FY23. The final dividend will be paid on 9 October. Consensus estimates forecast total dividends of $2.15 a share in FY25.

CEO Rob Scott said Wesfarmers had faced challenges from living pressures, rising costs and subdued activity in residential construction. Bunnings revenues grew 2.3% to $18.96b in FY24, while Kmart Group - which includes Kmart and Target - increased sales 4.4% to $11.10b. Officeworks revenue increased 2.3% to $3.43b.

Bunnings continued to see positive sales growth so far in FY25. However, growth had moderated from the second half of FY24 due to a softening in building activity. Officeworks growth was slightly ahead of that in 2H24, while Kmart Group sales growth was broadly in line with 2H24.

5. Goodman Group ($GMG)

Dividend yield: 0.90%

Market capitalisation: $63b

Share price (as of 3/09/2024): $33.07

Stake investors watching $GMG: 2,855

Industrial property giant Goodman Group didn’t didn’t disappoint this reporting season. Operating EPS was up 15% in FY24, exceeding original guidance for growth of 9%.

Despite the strong growth in earnings, the $62b property player’s total distribution of 30¢ per security in FY24 was flat against the total payout in FY23. The payment was equally split at 15¢ per security for the interim and final distributions.

Goodman is preserving its cash to drive its expansion into data centres in FY25. It reported work-in-hand of $13b at the end of FY24, with data centres accounting for 40% of that work.

CEO Greg Goodman forecasts another strong year. Operating EPS is expected to grow 9% to $1.172 per security. And the outlook for full year distributions in FY25? There’s no big surprise: 30¢ per security.

6. Fortescue Ltd ($FMG)

Dividend yield: 11.38%

Market capitalisation: $56b

Share price (as of 3/09/2024): $17.70

Stake investors watching $FMG: 13,805

What to do with $2.2b? That’s the problem confronting rich listers Andrew and Nicola Forrest after the iron ore miner lifted its total dividends in FY24.

Australia’s third largest iron ore producer paid US$4.14b - or $6.1b - in dividends during FY24, delivering a bonanza for the Forrests who own 36.7% of the company’s shares. A final dividend of 89¢ was declared, an 11% drop from the $1 a share paid in FY23. Total FY24 amounted to $1.97, up from $1.75 in FY23. The final dividend will be paid on 27 September.

Underlying net profit rose 3% to US$5.6b in FY24 as iron ore shipments dipped to 191.6m tonnes from 192m tonnes in FY23. Fortescue generated average revenue of $US103 a tonne, up from US$94 a tonne in FY23. C1 costs were US$18.24 a tonne in FY24.

Fortescue is targeting iron ore shipments of between 190m tonnes and 200m tonnes in FY25, with C1 costs of between US$18.50 a tonne and US$19.75 a tonne.

7. Telstra Group Limited ($TLS)

Dividend yield: 4.58%

Market capitalisation: $46b

Share price (as of 3/09/2024): $3.95

Stake investors watching $TLS: 6,226

Australia’s dominant telco delivered its more than one million shareholders just over $2b of dividends in FY24 as its core mobiles business performed strongly.

The $42b company paid a total dividend of 18¢ a share in FY24, equally split between a 9¢ interim dividend and a 9¢ final dividend. The total payout was 5.9% higher than in FY23. The final dividend will be paid on 26 September. Telstra’s policy is to maximise its fully franked dividend and seek to grow it over time. Consensus forecasts estimate total dividends of 19¢ a share in FY25.

Underlying profit grew 7.5% to $2.3b in FY24 as underlying EBITDA increased 3.7% to $8.2 billion. Mobile EBITDA grew over $400 million as the telco added 560,000 new handheld customers. Telstra increased mobile plan prices by between $2 and $4 a month in July.

Telstra CEO Vicki Brady is focused on its T25 strategy that aims to cut costs of $350m in FY25 after reducing expenses $122m over the past two years. The company is targeting EBITDA of between $8.5b and $8.7b in FY25.

8. Woolworths Group Limited ($WOW)

Dividend yield: 2.94%

Market capitalisation: $44b

Share price (as of 3/09/2024): $34.83

Stake investors watching $WOW: 9,561

Outgoing CEO Brad Banducci went out on a high note, rewarding shareholders with a $489m - or 40¢ a share - special dividend as his parting gift from Australia’s largest supermarket chain.

Combined with a final dividend of 57¢ a share and an interim payout of 47¢, Woolworths delivered $1.75b in dividends in FY24. The final dividend, which was lower than last year’s 58¢ a share, and special dividend will be paid on 30 September. The special dividend was funded by the sale of a 5% stake in Endeavour Group ($EDV).

Sales grew 3.7% to $67.9b in FY24, while net profit dipped 3% to $1.7b. While the Australian Food business grew normalised EBIT by 6% in FY24, this was offset by weaker earnings at Big W and in the New Zealand food business.

Incoming CEO Amanda Bardwell will take over as Woolworths’ Australian food business saw sales grow 3% year-on-year in the first eight weeks of FY25. NZ food sales were up 1.5% and Big W sales were flat.

9. Transurban Group ($TCL)

Dividend yield: 4.58%

Market capitalisation: $42b

Share price (as of 3/09/2024): $13.61

Stake investors watching $TCL: 1,779

The toll road giant confirmed its status as a go-to for income investors by highlighting distributions as the first point in its full year profit results.

The operator of toll roads in Sydney, Melbourne, Brisbane and the U.S. declared a final distribution of 32¢. The total distribution in FY24 was 62¢ including an interim payout of 30¢. The $14b company said it will pay total distributions of 65¢ in FY25, an increase of 4.8%.

Transurban’s toll road revenue rose 6.7% in FY24, driving a 7.5% increase in EBITDA to $2.63b. Average daily traffic increased to 2.5m trips a day from 2.4m trips a day in FY23.

CEO Michelle Jablko is focused on delivering the Logan West upgrade in Queensland and the West Gate Tunnel project in Victoria. She is also consulting with the NSW government on proposed toll reforms.

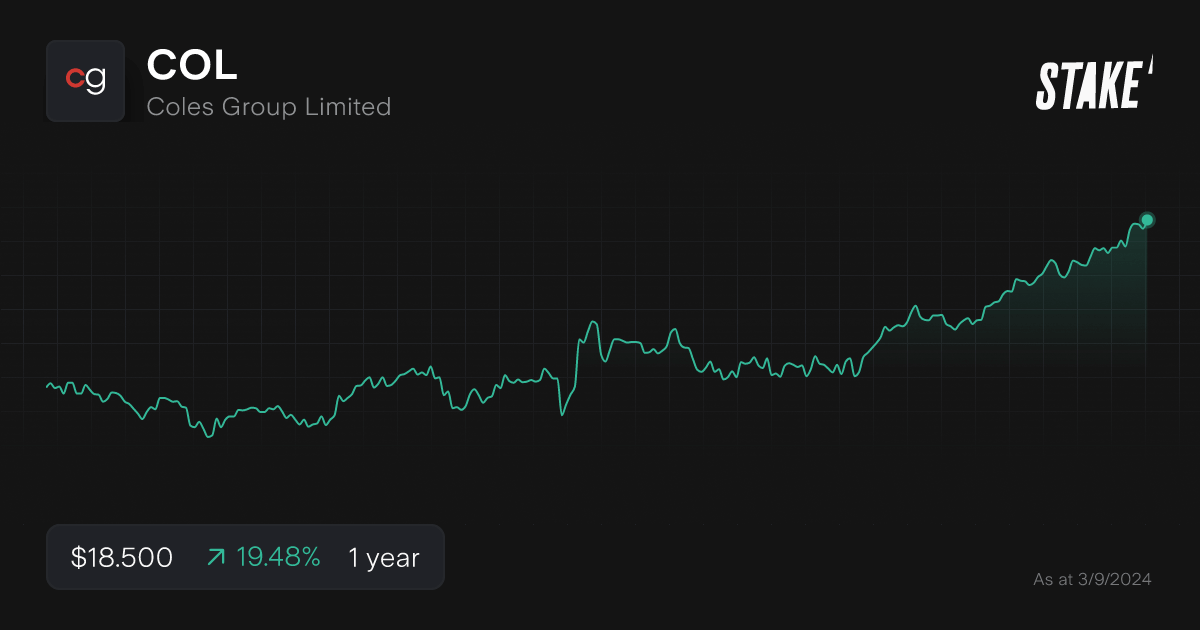

10. Coles Group Limited ($COL)

Dividend yield: 3.51%

Market capitalisation: $25b

Share price (as of 3/09/2024): $18.50

Stake investors watching $COL: 6,663

Australia’s second-largest supermarket chain delivered $884m of dividends into the baskets of shareholders in FY24.

Total dividends were 68¢, composed of a 36¢ interim payout and a 32¢ final dividend. The final dividend was 6.6% higher than FY23 and total dividends increased 3%. The final dividend will be paid on 25 September. Coles is forecast to pay total dividends of 70¢ in FY25 according to consensus estimates.

Underlying net profit rose 4.1% to $1.21b as sales increased 5.7% to $43.5b. Supermarket revenue grew 4.3% to $39b and liquor sales rose 0.5% to $3.7b. Sales per square metre rose to $19,816 from $19,201 in FY23.

CEO Leah Weckert said supermarket sales had increased 3.7% in the first eight weeks of FY25, with strong growth in convenience meals as shoppers looked to save money by eating out less. However, revenue in the liquor division was down 1.4%. Excluding the impact of the CrowdStrike outage in July, liquor sales were down 0.3%.

💡Related: Discover some U.S.-listed blue chip companies→

How to buy blue chip dividend-paying shares in Australia?

There are a few ways to invest in blue chip shares in Australia. The main way is to buy shares in blue chip companies on the ASX that regularly pay dividends through an investing platform. Follow these steps below to learn how to open an investing account and buy blue chip shares.

1. Find a stock investing platform

To buy dividend-paying blue chips stocks on the ASX, you'll need to sign up to an investing platform with access to the Aussie stock market. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for the company or ticker symbol

Find the company name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. A method to mitigate risk is dollar cost averaging but it is recommended for the individual to reach out to a financial advisor to manage risk effectively for individual circumstances.

5. Monitor your investment

Once the stocks have been purchased, you can monitor the performance and dividends. It is recommended to check all portfolios on a regular basis to ensure investments are aligned on an ongoing basis with individual financial goals.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

What blue chip stocks pay the highest dividend in Australia?

There are a lot of companies paying strong dividends in the Australian market. From our list of blue chip companies listed on the ASX, two companies have stood out in FY24.

- Commonwealth Bank of Australia ($CBA) - $4.65 a share

- CSL Limited ($CSL) - $3.89 a share (assume an exchange rate of 1 USD = 1.47 AUD for this conversion)

Compare the performance of CBA vs CSL on our stock comparison tool.

How often are dividends paid out?

In Australia, companies usually pay dividends semi-annually or annually. The frequency can vary by company with some companies paying dividends as often as every month. To get the most accurate information, check the dividend payment schedule of the company you are interested in.

🎓 Learn more: Guide to dividend investing→

This article was edited by Robert Guy.

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.