What are the best U.S. blue chip stocks? [2025]

While high-flying stocks tend to grab the headlines, well-established businesses can help your equity portfolio achieve more stable growth. For blue-chip exposure in 2025, consider investing in some of the leading U.S. firms below.

Explore these top U.S. blue chip companies

Company Name | Ticker | Share Price | 1Y Return | Market Capitalisation |

|---|---|---|---|---|

Apple | US$232.62 | +24.30% | US$3.5t | |

Berkshire Hathaway | US$472.61 | +18.83% | US$1.02t | |

JPMorgan Chase | US$274.99 | +56.43% | US$774.19b | |

Mastercard | US$564.70 | +23.11% | US$518.30b | |

Exxon | US$111.67 | +8.24% | US$490.80b | |

Costco | US$1,058.34 | +46.50% | US$469.80b | |

Johnson & Johnson | US$156.13 | -1.09% | US$375.90b | |

Coca-Cola | US$67.60 | +13.23% | US$291.21b | |

McDonald's | US$310.21 | +7.18% | US$222.30b | |

AT&T | US$25.15 | +47.77% | US$180.48b |

Data as of 12 February 2024. Source: Stake, Google.

*The list of blue chip stocks mentioned is ranked by market capitalisation. When deciding what companies to feature, we analyse the company's financials, recent news, advancement in their timeline, and whether or not they are actively traded on Stake.

🎓 Learn more: What are blue chip stocks?→

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

Decide which is the best U.S. blue chip stocks to invest in

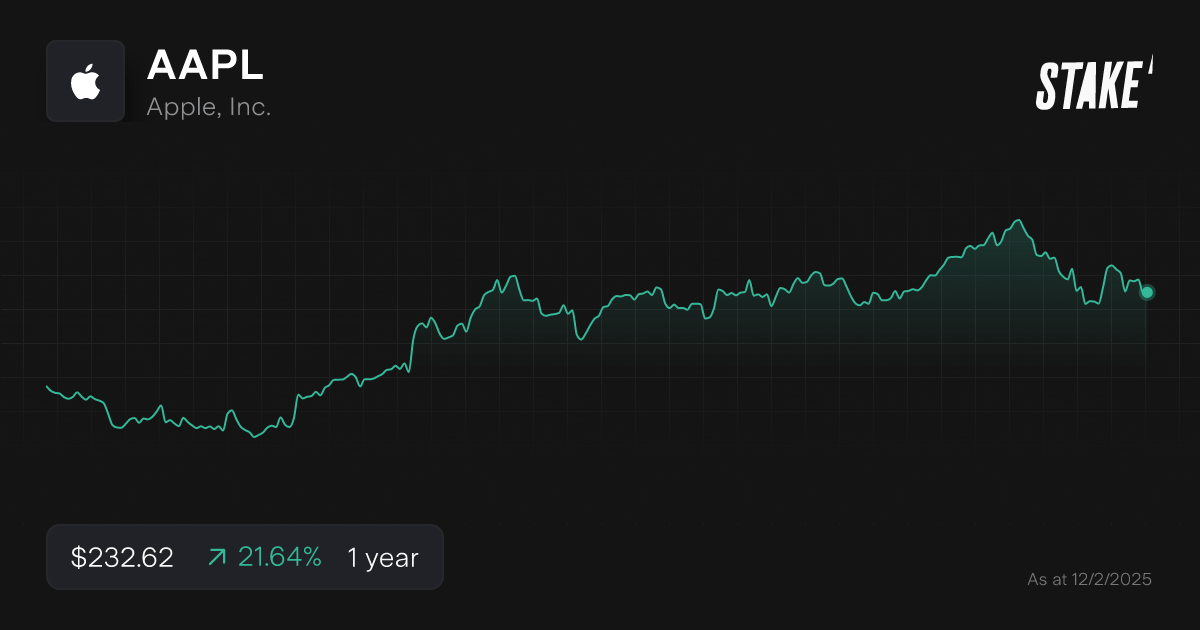

1. Apple ($AAPL)

- 231,334 Stake customers watching

- 354,398 orders executed on Stake

While many tech firms are too volatile to be considered blue chip, Apple is a notable exception. As a company with tremendous brand recognition and proven resiliency across market cycles, Apple is a relatively stable choice in the constantly evolving world of Silicon Valley.

One strong reason to consider Apple as part of a blue-chip portfolio is the firm’s investment in innovative trends like artificial intelligence.

In 2025, Apple’s focus is widely expected to be the firm’s proprietary AI technology, dubbed ‘Apple Intelligence.’ While blue-chip investors often need to sacrifice growth for security, that’s not necessarily the case for Apple.

Analysts are forecasting a strong 2025 for Apple, with revenues expected to climb 5.7%. The widely anticipated release of iOS 18.4 should be set to boost iPhone sales thanks to new AI features.

👨💻 Featured: What tech stocks to buy in 2025?→

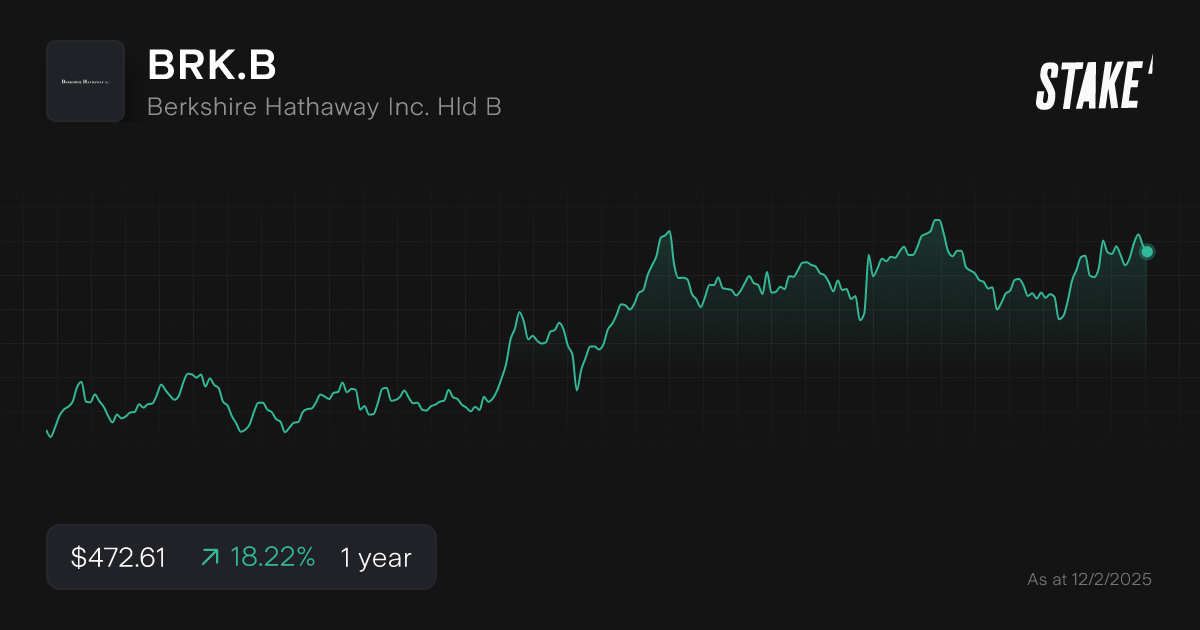

2. Berkshire Hathaway ($BRK.B)

- 14,139 Stake customers watching

- 38,947 orders executed on Stake

Berkshire Hathaway is best known as the holding company of Warren Buffett, widely viewed as one of the most successful investors of all time. Buffett’s track record speaks for itself, with Berkshire shares rising more than 20% annualised since 1965.[1]

Berkshire has two separate share classes, $BRK.A and $BRK.B. Since class A shares have never split, however, their price now eclipses more than $600K, meaning class B shares are more accessible to everyday investors.

At 94, Buffett’s age means the company will likely undergo a leadership transition in the coming years. Nonetheless, Berkshire’s widely diversified holdings in high-quality firms continue to make it a blue-chip stock.

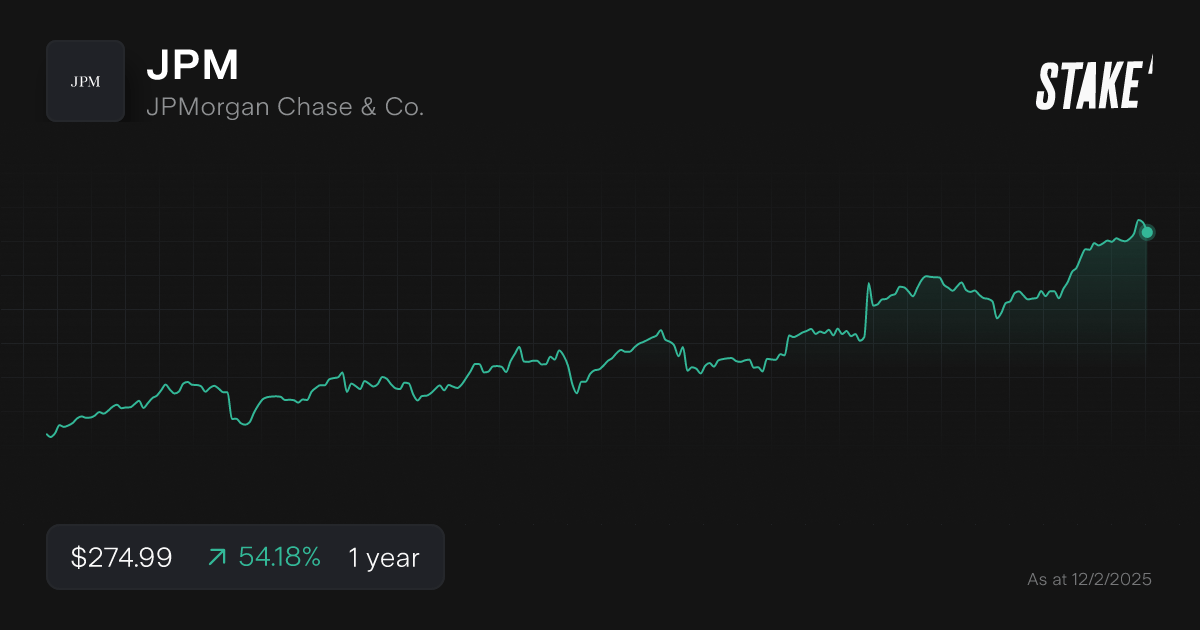

3. JPMorgan Chase ($JPM)

- 6,657 Stake customers watching

- 16,759 orders executed on Stake

JPMorgan Chase is America’s largest bank, with total assets nearly $1 trillion larger than runner-up Bank of America ($BAC).[2]

Notably, JPMorgan is a ‘universal bank,’ meaning its revenue stream is diversified between investment banking activities (e.g., trading & underwriting) and commercial banking (e.g., mortgages & checking accounts).

Today, CEO Jamie Dimon, who has been at the helm for nearly two decades leads JPMorgan. JPMorgan’s blue-chip status is evidenced by the bank’s impressive resiliency during financial shocks, particularly the 2008 crisis.

In 2024, JPMorgan recorded record annual profits of $58.5 billion. Although analysts expect income to fall slightly this year, growth is forecast to pick back up in 2026 and 2027.

🆚 Compare: JPM vs BAC stock comparison→

4. Mastercard ($MA)

- 8,029 Stake customers watching

- 15,537 orders executed on Stake

Mastercard is most well-known for its dominance in credit cards, where its nearly 30% market share is second only to arch-rival Visa ($V).[3]

Compared to Visa, however, Mastercard has a more diversified revenue stream thanks to the firm’s consulting and data analytics divisions.

First established in 1966, Mastercard has long been at the forefront of payment technology and continues to innovate in fields like blockchain and digital assets. Thanks to growing payment volumes, Mastercard is expected to see healthy growth soon, with revenue forecasts rising nearly 12 points annually through 2026.

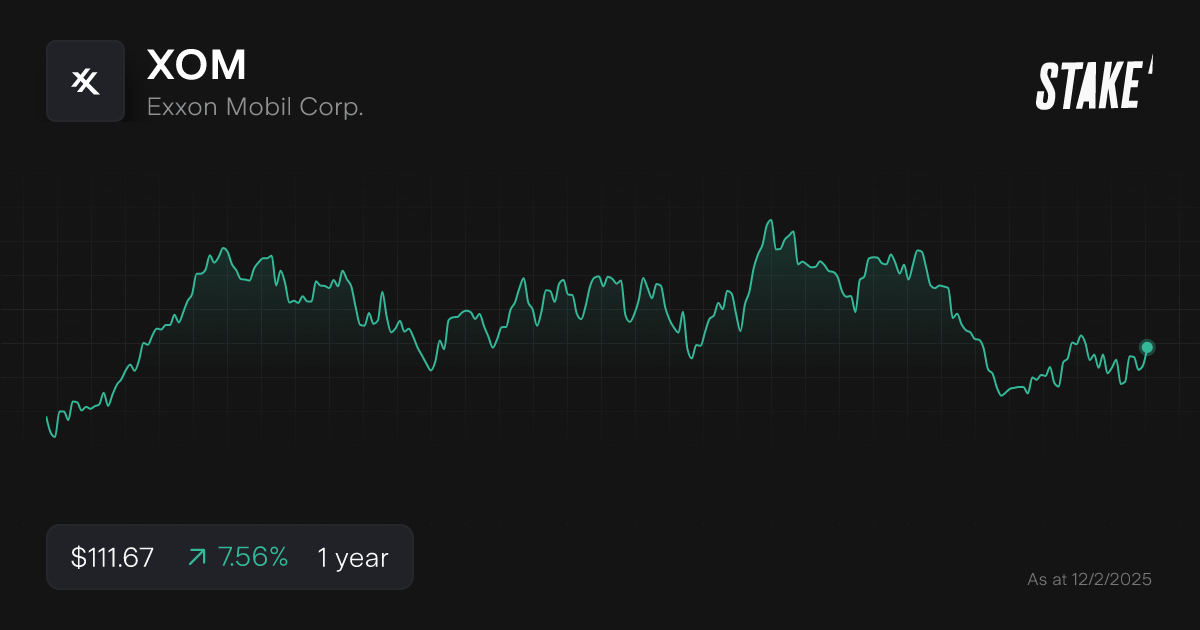

5. Exxon ($XOM)

- 7,861 Stake customers watching

- 21,023 orders executed on Stake

With origins as far back as John D. Rockefeller’s Standard Oil Company, ExxonMobil is the largest oil and gas company in the U.S., with annual revenues of more than $300 billion. Exxon is notable for the firm’s strong dividend yield, which currently sits at 3.6%.

Some analysts have expressed concern about Exxon’s ability to transition to a low-carbon world, with sales expected to fall about 4.5% in 2025. The company's significant investment in fields like carbon capture and green hydrogen should help the firm effectively navigate the energy transition.

6. Costco ($COST)

- 8,759 Stake customers watching

- 15,233 orders executed on Stake

Costco is a wholesale retailer that operates membership-only warehouse stores around the world. The company is nearly half a century old, tracing its roots to an original 1976 location that operated out of an old airplane hangar in California.

Costco has a relatively unique business model in that it makes most of its money through membership fees, offering stability through downturns. Today, Costco is the third-largest retailer in the world, behind only Walmart and Amazon.[4]

Analysts forecast healthy revenue growth, with sales expected to climb 7% annually through 2027.

7. Johnson & Johnson ($JNJ)

- 11,011 Stake customers watching

- 20,713 orders executed on Stake

Originally founded in 1886 by three brothers, Johnson & Johnson has gradually expanded to become one of the world’s leading pharmaceutical and medical technology companies. Some of the company’s most well-known brands include Band-Aids, Tylenol, and Listerine.

Having first IPO’d in 1944, J&J has a long track record on the stock market. Despite some short-term headwinds from increased competition and consumer lawsuits, analysts expect revenue to climb modestly over the next few years.

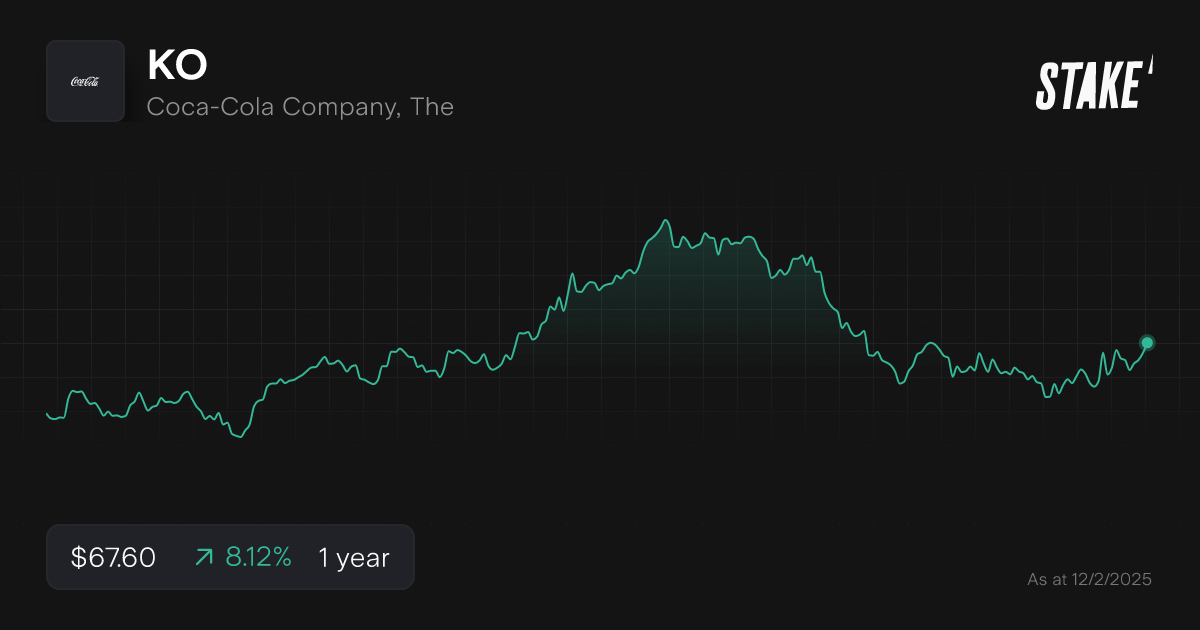

8. Coca-Cola ($KO)

- 12,343 Stake customers watching

- 32,646 orders executed on Stake

With one of the most recognisable consumer brands in the world, Coca-Cola needs no introduction. First launched in 1886, the company has gradually expanded its product line from its eponymous soft drink to include brands like Sprite, Smartwater, and Barq’s.

Demonstrating the firm’s continued resilience, Coca-Cola is widely expected to raise its dividend for the 63rd consecutive year in 2025. Today, Coke’s dividend yield stands at 3.15%. Analysts expect revenue to grow by 3% in 2025 and another 5% in 2026.

9. McDonald's ($MCD)

- 9,322 Stake customers watching

- 14,605 orders executed on Stake

Much like Coca-Cola, McDonald’s has a globally recognisable brand, with nearly 40,000 locations across 118 countries. Less well-known, however, is the firm’s true business model.

At a corporate level, McDonald’s makes the vast majority of its money not from selling burgers, but from leases and rents on franchised restaurants. This model allows for a far more predictable revenue stream across market cycles, earning the company its blue-chip status. In 2025, sales are expected to grow approximately 3%.

10. AT&T ($T)

- 5,743 Stake customers watching

- 26,644 orders executed on Stake

AT&T has its roots in the Bell Telephone Company, originally founded in 1877 by Alexander Graham Bell, inventor of the first practical telephone. After Bell grew to monopolise the U.S. telephone market, regulators forced the company to break up, resulting in the birth of AT&T and the other ‘Baby Bells.’

Today, AT&T is the third-largest network operator in the U.S., behind only Verizon and T-Mobile. The company pays an impressive dividend yield of 4.9%. While AT&T stock is well-known for its stability, investors may see limited upside, with 1% sales growth forecast through 2026.

Characteristics of a blue-chip stock

While there’s no universally agreed upon definition, below are some features common to companies considered ‘blue chip’:

- Financial stability: Blue-chip companies have proven business models with a strong track record of operations. That includes a well-capitalised balance sheet, consistent earnings growth, and revenue streams robust to economic downturns.

- Brand recognition: Blue-chip companies tend to have well-known consumer-facing brands. This brand recognition offers a moat that cannot be easily replicated by newer competitors.

- Strong leadership: Although blue-chip firms have often outlived their original founders, these companies tend to have strong internal cultures that cause capable executive leadership. This contrasts with newer companies which can often have untested and unproven CEOs.

- High liquidity: Because blue-chip stocks are so well-known, investors will rarely face problems buying or selling their shares thanks to ample liquidity.

- Solid dividend history: Although there are some notable exceptions, many blue-chip firms have a track record of strong and increasing dividend payouts.

It’s worth noting that blue-chip companies don’t always have the best-performing stocks. Their track record and stability, however, tend to make them less volatile than peers, which can make them an attractive addition to a diversified portfolio.

What U.S. blue-chip stocks pay high dividends?

Blue-chip stocks tend to have higher dividend yields than other firms. Here are a few examples:

- Exxon ($XOM): Unlike some oil peers, ExxonMobil maintained the company’s steady dividend payouts even during the Covid pandemic. Dividend Yield: 3.6%.

- Johnson & Johnson ($JNJ): This healthcare company boasts an impressive 10-year dividend growth rate of 5.9% annualised. Dividend Yield: 3.4%.

- AT&T ($T): Although AT&T’s dividend growth has slowed, the company continues to pay out a large portion of its earnings to shareholders. Dividend Yield: 4.9%.

It’s worth noting that dividend yields aren’t the only way that companies return cash to shareholders, especially as stock buybacks have increased in popularity in recent years. For dividend-payers in Australia, explore popular ASX blue-chip companies paying dividends.

U.S. blue chip companies FAQs

America isn’t the only country to boast blue-chip companies. Discover a few examples of blue-chip Australian stocks below:

- Commonwealth Bank of Australia ($CBA): CBA is one of the ‘big four’ Australian banks, with the largest network of branches in the country. The company is known for its strong balance sheet and CBA stock has gained over 40% in the past year.

- BHP Group Limited ($BHP): BHP is a diversified global resources company, with operations including mining, oil & gas, and more. Founded in 1885, BHP is the world’s third-largest mining company by revenue, although sales have slowed in recent years.

- Rio Tinto Limited ($RIO): The world’s second-largest mining company and a fierce competitor with BHP, Rio Tinto traces its roots back to a Spanish government concession in 1873. Rio is notable for its 5.5% dividend yield.

- CSL Limited ($CSL): CSL is a global biotechnology company and one of the largest ASX companies. Although shares have struggled recently, sales are expected to climb more than 12 points in 2025.

Curious for more high-quality companies in Australia? Review our full list of top blue-chip shares on the ASX.

There are several U.S. ETFs with sizeable exposure to blue-chip stocks, including:

- SPDR Dow Jones Industrial Average ETF Trust ($DIA). This ETF tracks the performance of the Dow Jones Industrial Average, an index that includes 30 of the largest and most well-known blue-chip stocks in the U.S. The fund’s largest holdings include Goldman Sachs, UnitedHealth, and Microsoft.

- iShares MSCI USA Quality Factor ETF ($QUAL). This fund seeks exposure to firms with high-quality fundamentals, such as low leverage and consistent earnings growth, traits commonly associated with blue-chip companies. QUAL’s largest holdings are Microsoft, Nvidia, and Apple.

- Vanguard S&P 500 ETF ($VOO). While not the most creative selection, a standard large-cap ETF like VOO has significant exposure to leading blue-chip firms in the U.S. and boasts rock-bottom fees. For more on the S&P 500, explore our article on the famous index.

When investing in ETFs, be sure to consider factors like the fund’s expense ratio and management team in addition to the underlying holdings.

The term 'blue chip' is thought to have originated from the game of poker, where blue chips typically have the highest value. According to Wall Street folklore, Oliver Gingold, an employee of Dow Jones & Company applied the phrase first to stocks in 1923. While Gingold used the term to refer to stocks with high share prices, the phrase is now more commonly used to describe high-quality companies in general.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Article sources

[1] One Amazing Stat That Captures Warren Buffett’s Investing Career

[2] Large Commercial Banks - September 30, 2024 - Federal Reserve Board