Dividends on Stake

Receiving a dividend and want to know your options? Check below what is and isn’t possible.

What are my options with dividends?

Decide what best aligns with your investment strategy.

Dividend reinvestment plan (DRIP)

DRIPs automatically use dividends to acquire additional shares. While this isn’t available on Stake Wall St, there are DRIP options for some ASX-listed companies outlined below.

Keep the cash

Dividends not on a DRIP are credited directly to your Stake account. From there you can choose to hold or withdraw these funds.

Manually reinvest dividends

You can also manually reinvest dividends into your current position or a new position. With fractional shares on Stake Wall St, you can buy more stock with as little as US$10.

How to set up a dividend reinvestment plan on Stake?

Stake AUS

DRIPs are set up directly with an ASX stock’s affiliated share registry.

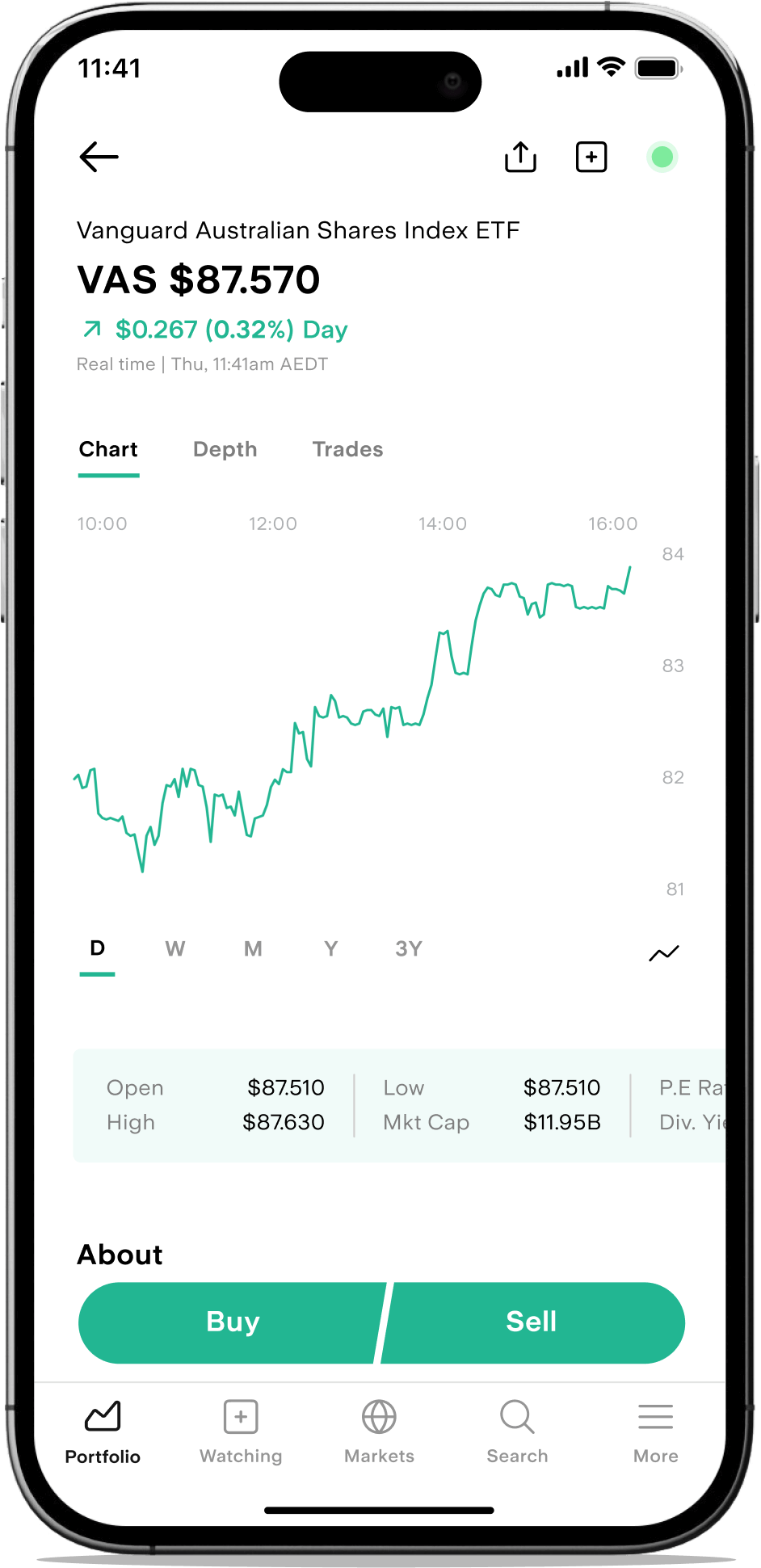

You can find share registry info on the ASX website for your specific asset. For example, this page shows the share registry for $VAS as Computershare.

From their website, simply follow the instructions to set up your DRIP via their online portal.

Please note that not all ASX-listed companies offer a dividend reinvestment plan.

Stake Wall St

DRIPs are currently not available for U.S. dividends. However, with fractional shares you could manually reinvest dividend payments (the minimum trade size is only US$10).

How do I keep track of my dividends?

Head to these areas on the Stake platform to get a report of your dividends.

Recent activity: head to More > Funds & balances and select the dividends filter under Transactions

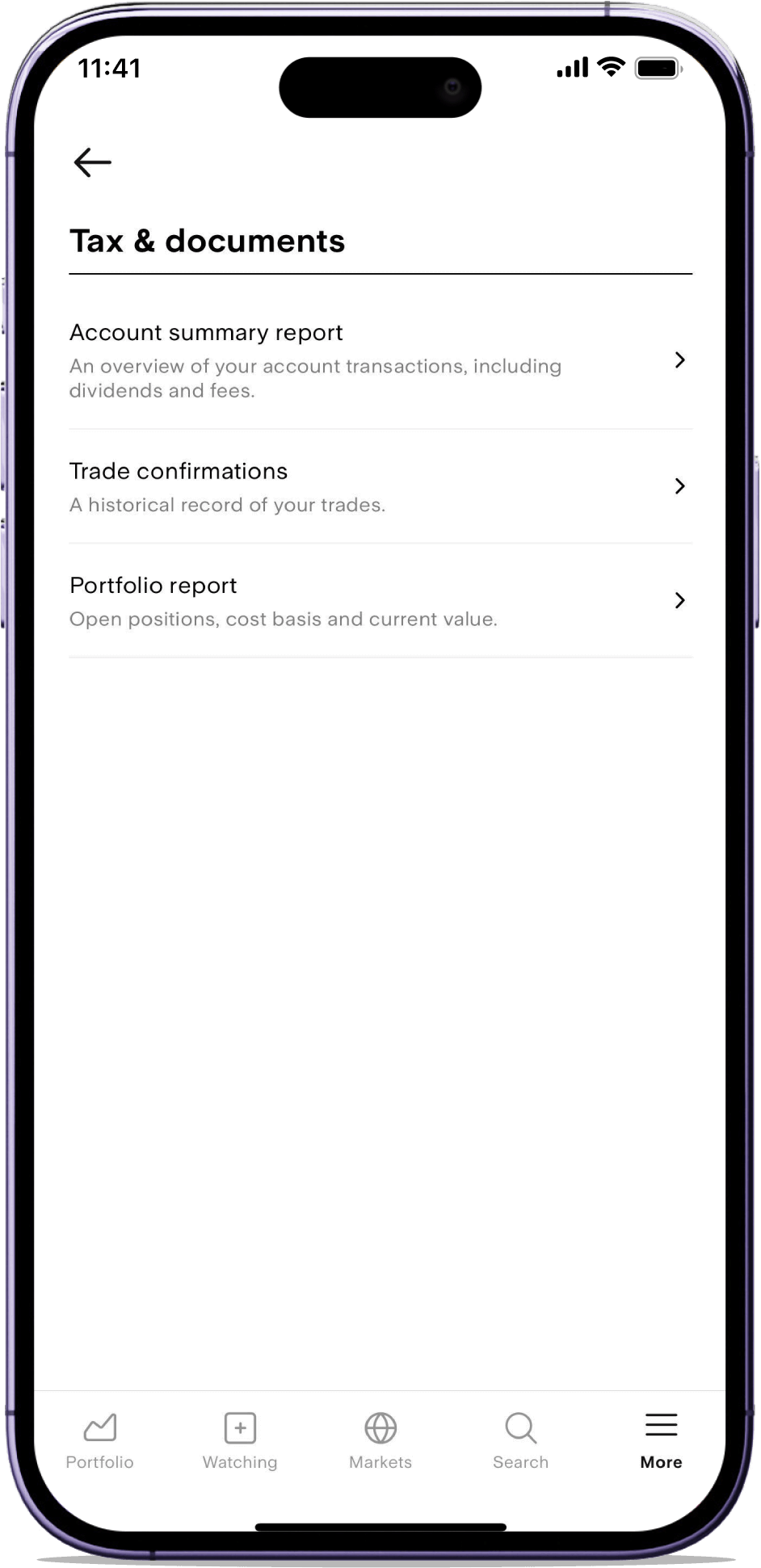

Monthly reports: head to More > Tax & documents > Account statements

Custom date range: head to More > Tax & documents > Account summary report. Select the desired date range, file type and then hit ‘Email report’ to receive a collated summary.

Get 12 months of $0 ASX brokerage

Transfer $1,000+ of Aussie shares to Stake and get a year of $0 brokerage on CHESS-sponsored trades. Portfolio transfers are paperless, fast and only take a few minutes to initiate.

Get startedLearn more about dividends on Stake

Stake dividends FAQs

Yes, Stake facilitates the payment of dividends for eligible shareholders. If you own shares in a company through its ex-dividend date, you should be eligible to receive a dividend.

Unless a DRIP has been set up, dividends are credited directly into your Stake account (in AUD for Stake AUS or USD for Stake Wall St).

In Australia, ASX and U.S. dividends are subject to income tax (see below on further information relating to franking credits). The exact tax treatment of dividends can depend on a range of factors including your residency status and the holding period of the shares.

Seek independent tax advice to fully understand the tax implications on shares and dividends. See the Australian Taxation Office for more info.

Yes, even if you reinvest your dividends through a dividend reinvestment plan (DRIP) or manually, the dividends are still considered income and are therefore taxable. You will need to declare them as income in your tax return for the relevant financial year.

You should report all dividend payments as income on your annual tax return to the Australian Taxation Office (ATO). This includes any amounts reinvested via DRIPs.

The required information can be found in the dividend statements sent by a share registry or via the ‘Transactions’ section of your Stake account.

Ensure that all dividend income, including franked (with franking credits) and unfranked dividends, are reported accurately.

To download a summary of your dividends on Stake go to More > Funds and Balances, and then select Transactions. Use the filter to select Dividends.

Additionally, a comprehensive record of your dividends can be found under More > Tax & documents > Account statements.

The statements will provide a detailed view of all dividend payments received, which you can use for tax reporting and reviewing your investment income.

Franking credits are a type of tax credit for shareholders that prevent the government from taxing the same income twice. In this instance, franking credits would reduce the personal tax liability on the dividend income.

ASX dividends can be classified as fully-franked, partly-franked or unfranked. Due to their offset benefits, franking credits are usually looked at favourably by investors.

Learn more about franking credits.