Top 10 high growth ETFs to watch in December [2024]

As growth stocks regain momentum amid easing interest rates, high-growth ETFs are positioned for strong performance. Fuelled by advancements in tech, AI, and solid earnings, these ETFs present attractive opportunities for investors.

Growth ETFs have attracted significant investor interest in 2024, driven by the resurgence of technology stocks and the rise of artificial intelligence. In this article we explore ten popular growth ETFs, analysing their investment strategies, top holdings, and performance to help you determine if they align with your long-term investment goals.

If you like the thought of having exposure to the world's biggest companies like Apple, Nvidia, Microsoft, Tesla and more, these are the exchange-traded funds for you.

Decide which are the best high growth ETFs to watch

Fund Name | Ticker | Share Price | Year to Date | AUM | Expense Ratio |

|---|---|---|---|---|---|

Invesco QQQ Trust | US$516.87 | +28.39% | US$313.8b | 0.20% | |

Vanguard Growth Index Fund ETF | US$414.88 | +35.77% | US$153.1b | 0.04% | |

iShares Russell 1000 Growth ETF | US$404.20 | +35.33% | US$103.1b | 0.19% | |

Vanguard Information Technology Index Fund ETF | US$631.63 | +34.02% | US$83.5b | 0.10% | |

iShares S&P 500 Growth ETF | US$102.14 | +38.23% | US$55.2b | 0.18% | |

Schwab U.S. Large-Cap Growth ETF | US$28.16 | +37.84% | US$36.2b | 0.04% | |

SPDR Portfolio S&P 500 Growth ETF | US$88.46 | +38.18% | US$32.7b | 0.04% | |

Vanguard Russell 1000 Growth Index Fund ETF | US$104.02 | +35.35% | US$24.5b | 0.08% | |

Vanguard Mega Cap Growth Index Fund | US$344.99 | +35.31% | US$24.4b | 0.07% | |

Vanguard Small-Cap Growth Index Fund ETF | US$301.51 | +26.28% | US$20.6b | 0.07% |

Data as of 3 December 2024 Source: Stake, Google, fund’s website.

*The list of growth ETFs mentioned is ranked by assets under management. When deciding what exchange-traded funds to feature, we analyse the financials, recent news, and whether or not they are actively traded on Stake.

Discover if these growth ETFs are the right long-term investment for you

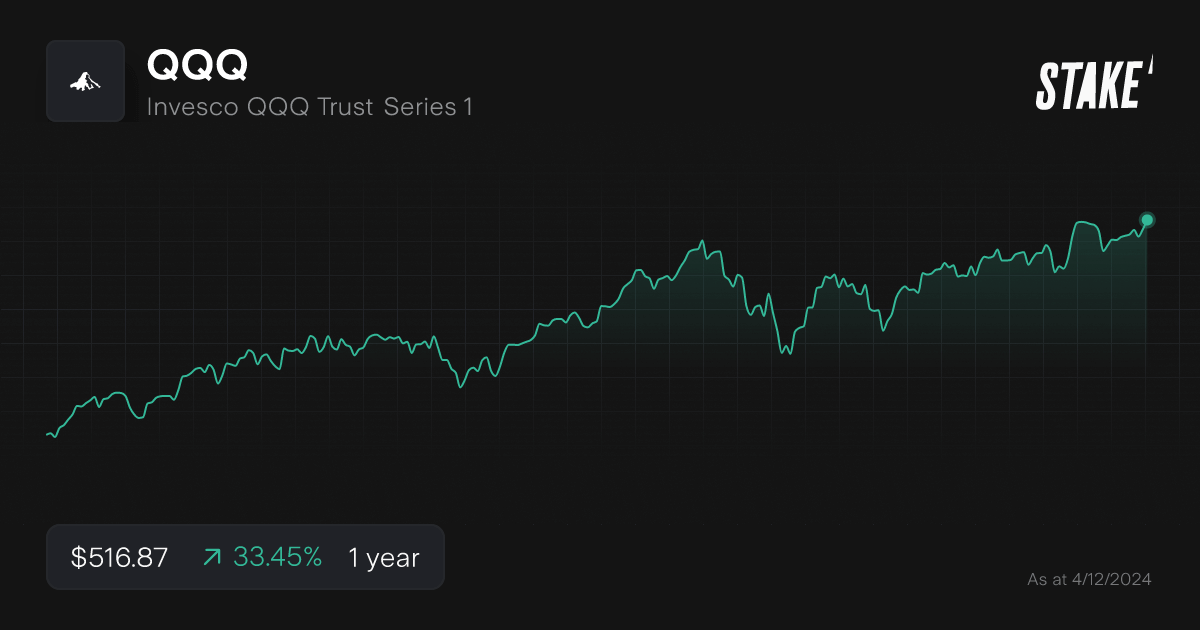

1. Invesco QQQ Trust ($QQQ)

The Invesco QQQ Trust tracks the Nasdaq-100 Index, comprising 100 of the largest non-financial companies listed on the Nasdaq Stock Market. This ETF offers investors exposure to a diverse array of high-growth sectors, with a significant emphasis on technology, consumer discretionary, and communication services.

Over the past five years, QQQ has delivered an annualised return of approximately 20.4%, outperforming many broad-market indices. As of November 2024, QQQ's top holdings include industry giants such as Apple, Nvidia, Microsoft, and Broadcom.

QQQ offers investors a targeted approach to capitalising on the growth potential of the largest and most influential non-financial companies listed on the Nasdaq. However, investors should be mindful of the ETF's concentration in the tech sector, which can lead to increased volatility and sensitivity to sector-specific risks.

2. Vanguard Growth Index Fund ETF ($VUG)

VUG invests in large-cap growth stocks, tracking the CRSP U.S. Large-Cap Growth Index. It provides exposure to sectors like technology, communications, and healthcare, targeting companies with strong earnings and revenue growth potential. The ETF's low expense ratio and strong performance make it a popular choice among growth-focused investors.

The ETF has benefited from the 2024 AI-driven rally, with key holdings like Nvidia (+190% YTD) and Meta Platforms (+60%) delivering significant gains. Over the past five years, VUG has delivered an annualised return of 18.3%, outperforming broader market indices.

Vanguard Growth Index Fund ETF top holdings include Apple, Microsoft, Nvidia, Amazon, and Meta, all of which are leading tech companies with robust growth trajectories. These holdings make VUG a well-rounded option for investors seeking exposure to innovative, high-growth U.S. companies.

3. iShares Russell 1000 Growth ETF ($IWF)

IWF provides exposure to large and mid-cap U.S. growth stocks by tracking the Russell 1000 Growth Index. The ETF covers stocks in sectors like technology, consumer cyclical and communications.

In 2024, IWF benefitted from a resurgence in growth stocks, particularly within the tech sector. The proliferation of artificial intelligence (AI), advancements in cloud computing, and strong consumer demand for innovative products have been major tailwinds. Nvidia, one of IWF's top holdings, saw its stock price soar over 190% year-to-date due to its leadership in AI chips. Meanwhile, Amazon (+35%) delivered solid returns thanks to growth in e-commerce and AWS. Over the past five years, IWF has provided an annualised return of 18.79%.

IWF's portfolio is concentrated in market leaders, with Apple, Microsoft, Nvidia, Amazon, and Tesla among its largest positions. IWF's diversified exposure to high-growth industries makes it a compelling option for investors focused on long-term capital appreciation.

🤖 Related: Discover the top 10 AI stocks on U.S. markets

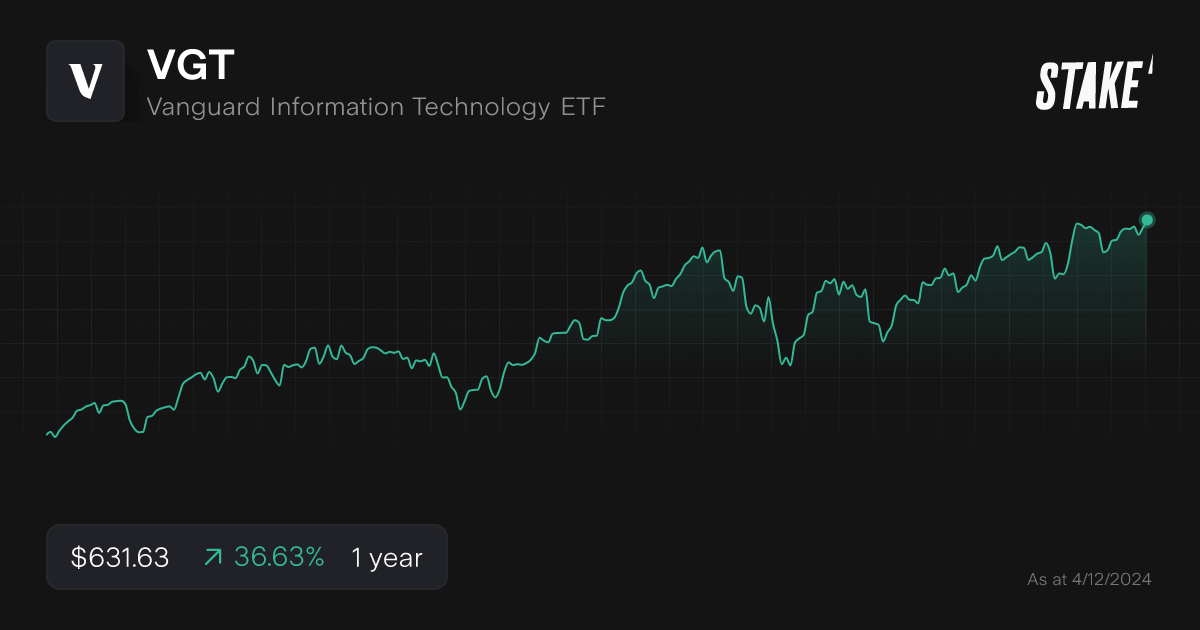

4. Vanguard Information Technology Index Fund ETF ($VGT)

The Vanguard Information Technology ETF ($VGT) offers investors targeted exposure to the U.S. information technology sector by tracking the MSCI US Investable Market Information Technology 25/50 Index. This ETF encompasses a broad spectrum of tech companies, including those in software, hardware, semiconductors, and IT services, providing a comprehensive representation of the industry's landscape.

The technology sector experienced significant growth in 2024, largely driven by advancements in artificial intelligence and increased demand for cloud computing services.

VGT is ideal for investors seeking focused exposure to the U.S. technology sector with diversified sub-sector representation. Its low-cost structure enhances its appeal to long-term investors. While its tech-heavy nature may introduce volatility, its track record of strong returns makes it a compelling choice for those aiming to capture innovation-driven growth.

Over the past five years, VGT has delivered an annualised return of approximately 22.11%.

🆚 Compare VGT vs QQQ→

5. iShares S&P 500 Growth ETF ($IVW)

IVW tracks the S&P 500 Growth Index, focusing on companies with high growth potential in technology, consumer cyclical, and communications sectors. It invests in companies that exhibit higher growth potential based on metrics like earnings and sales growth.

Over the past five years, IVW has delivered an annualised return of around 16.7%, outperforming broader benchmarks. IVW's top holdings include Apple, Nvidia, Microsoft, and Amazon. Together, these companies drive innovation across technology, digital advertising, and cloud computing. This concentrated exposure to growth leaders ensures robust performance during market upturns, though it introduces sector-specific risks.

6. Schwab U.S. Large-Cap Growth ETF ($SCHG)

SCHG focuses on large-cap growth stocks in the U.S., focusing on companies with high earnings and revenue growth potential. The ETF leans heavily toward tech and consumer discretionary sectors.

The ETF has returned 30% YTD, outperforming the S&P 500's return. The ETF holds growth stocks like NVIDIA and Amazon, which has driven its robust return over the past few years.

Recently, growth stocks have seen volatility amid interest rate hikes by the Federal Reserve, impacting valuations. However, the AI boom and strong consumer spending trends have provided resilience to tech-heavy growth ETFs like SCHG.

Its low expense ratio makes it a cost-effective choice for long-term investors aiming to capitalise on U.S. growth trends.

7. SPDR Portfolio S&P 500 Growth ETF ($SPYG)

The SPDR Portfolio S&P 500 Growth ETF offers targeted exposure to growth-oriented companies within the S&P 500. Its relatively low expense ratio makes it an attractive option for cost-conscious investors looking to capture the growth potential of the largest U.S. companies.

SPYG has delivered an annualised return of approximately 17% over the past five years. SPYG's top holdings include Apple, Nvidia, Microsoft, and Amazon.

8. Vanguard Russell 1000 Growth Index Fund ETF ($VONG)

VONG tracks the Russell 1000 Growth Index, comprising large and mid-cap U.S. growth stocks. The ETF holds stocks in technology, healthcare, and consumer discretionary sectors. VONG offers diversified exposure to growth-oriented companies and is designed for long-term capital appreciation.

The technology sector has been a major driver for VONG in 2024, with AI breakthroughs fueling a tech rally. Companies like Nvidia (+190% YTD), Tesla (+29%), and Amazon (+35%) have been standout performers, driven by advancements in AI, electric vehicles, and e-commerce.

VONG has delivered strong returns over the last five years, with about 19% annualised return over the past five years. The ETF experienced a dip during the 2022 market correction but rebounded sharply in 2023 and 2024 as tech stocks regained momentum.

VONG is ideal for investors seeking broad exposure to growth-focused U.S. equities, though its dependence on high-growth sectors may lead to pronounced volatility during economic downturns.

9. Vanguard Mega Cap Growth Index Fund ($MGK)

MGK targets mega-cap U.S. growth stocks, focusing on sectors like technology, consumer cyclical, and communication services. It provides concentrated exposure to some of the largest and most innovative companies in the world.

MGK's portfolio is heavily weighted toward leading companies, with the top holdings including Apple, Microsoft, Nvidia, Amazon, and Tesla. These firms are at the forefront of innovation in their respective industries, contributing significantly to the ETF's overall performance. The concentration in these mega-cap stocks means that MGK's returns are closely tied to the performance of a few key players.

Over the last five years, MGK has delivered an impressive annualised return of 19.4%, outperforming the broader market.

10. Vanguard Small-Cap Growth Index Fund ETF ($VBK)

The Vanguard Small-Cap Growth ETF offers exposure to U.S. small-cap growth stocks, tracking the CRSP US Small Cap Growth Index. VBK zeroes in on companies in their early growth stages, which often means higher risk but also the potential for outsized returns. Its holdings span industries such as technology, healthcare, and industrials, reflecting diverse growth opportunities among emerging businesses.

Small-cap stocks, including VBK, faced challenges in 2024 due to rising interest rates and inflation. However, pockets of strength have emerged, particularly in renewable energy, defence technology, and public safety solutions. Companies like Axon Enterprise, a leader in body cameras and law enforcement technology, have gained over +138% YTD, driven by strong demand for public safety solutions.

VBK has delivered an annualised return of 8.2% over the past five years. The ETF's top holdings include companies like Axon Enterprise, Deckers Outdoor Corporation and PTC Inc.

What are some growth ETFs available on the ASX?

On the ASX, notable growth ETFs include BetaShares NASDAQ 100 ETF ($NDQ) for U.S. tech giants, Vanguard MSCI International Small Companies Index ETF ($VISM) for small-cap global stocks, and iShares S&P 500 Growth ETF ($IVV) for U.S. large-cap growth.

Sector-focused options like BetaShares Global Cybersecurity ETF ($HACK) and BetaShares Global Robotics and AI ETF ($RBTZ) target specific industries with high growth potential.

Always assess your risk profile and investment goals before investing.

💡 Discover: Is IVV the right investment for you?

What should you look for in a growth ETF?

When choosing a high-growth ETF, focus on the underlying index, sector allocation, expense ratio, historical performance, diversification, and liquidity. Growth ETFs often target technology, healthcare, and consumer discretionary sectors, offering potential for significant capital appreciation but higher volatility. They suit investors with a long-term horizon and high-risk tolerance.

Here are some important factors to consider:

- Fund objective: Make sure the fund's investment objective aligns with your investment goals. A growth ETF invests in stocks that are expected to grow at a faster rate than the broader market. So, if your investment goal is to achieve long-term capital appreciation, then a growth ETF could be a suitable choice.

- Investment strategy: Look at the fund's investment strategy to ensure it's consistent with your investment style. Some growth ETFs invest in growth-oriented sectors, such as technology and healthcare, while others may focus on growth stocks with strong earnings growth and revenue growth.

- Portfolio composition: Check the fund's holdings to see what types of stocks it invests in and whether they align with your investment objectives. Make sure the ETF has a diversified portfolio with exposure to multiple sectors, industries, and companies to reduce risk.

- Expense ratio: Look at the ETF's expense ratio, which is the annual fee charged by the fund. Lower expense ratios are generally better, as they reduce the impact of fees on your investment returns.

- Performance history: Evaluate the fund's past performance to see how it has performed over different market conditions. Keep in mind that past performance is not a guarantee of future results, but it can provide insight into how the fund is likely to perform in the future.

- Liquidity: Make sure the ETF has sufficient trading volume and liquidity, so you can easily buy and sell shares without significant price disruptions.

💡Related: Which Thematic ETFs are right for you?→

💡Related: Discover growth stocks on the ASX→

Are growth ETFs a good investment?

Whether growth ETFs are a good investment depends on several factors, including an investor's investment objectives, risk tolerance, and investment horizon. Here are some things to consider when evaluating growth ETFs as an investment:

- Investment objectives: Growth ETFs can be a good fit for investors seeking long-term capital appreciation. These ETFs typically invest in stocks with strong earnings and revenue growth potential. If your investment objective is long-term growth, then a growth ETF may be a good fit for your portfolio.

- Risk tolerance: Growth ETFs are generally considered riskier than value ETFs because they invest in companies with higher valuations and future earnings potential. Therefore, investors with a lower risk tolerance may want to consider a more diversified portfolio, including a mix of growth and value ETFs.

- Investment horizon: Growth ETFs tend to perform well over the long term but can be more volatile in the short term. Investors should have a long-term investment horizon and be willing to ride out short-term market fluctuations.

- Expense ratios: Like all ETFs, growth ETFs charge a management fee or expense ratio. These fees can impact your returns over time, so it's important to evaluate the expense ratio of any ETF you're considering.

- Market conditions: Growth ETFs tend to perform well in a bullish market, while value ETFs tend to perform better in a bearish market. Therefore, it's important to consider the current market conditions and your expectations for future market performance.

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.