Are these the best ETFs in Australia? [2024]

Investing in exchange traded funds is a popular way to access various markets and sectors on the Australian Securities Exchange. They range from passive ETFs that track whole stock market indexes, single industry products to actively managed ETFs created by fund managers.

Which ETF in Australia has the highest return?

The BetaShares NASDAQ 100 ETF ($NDQ) had a total five-year annualised return of 22.77% as of the end of February 2024. This ASX ETF tracks the NASDAQ index, which contains the 100 largest non-financial companies listed in the U.S. The top holdings are well-known tech giants like Microsoft ($MSFT), Apple ($AAPL), Nvidia ($NVDA) and Amazon ($AMZN).

Investors gain exposure to the technology sector, which accounts for 50.7% of its holdings. Another 17.2% is in communications firms and 14.5% in consumer discretionary businesses. While the industry saw a significant downturn in 2022, it had a rapid recovery in 2023 and is performing well to start 2024.

Best performing ETFs over the last 5 years

*The list of ETFs mentioned is sorted by best 5-year total return (ann.).

The U.S. tech industry emerges ahead of other asset classes when considering five-year returns.

On average, international shares performed better than Australian stocks over this period and ETFs are a simple way to access various markets through a single trade on the ASX. Some standouts include index funds like $SPY and $IVV, off the back of the S&P 500 hitting all-time highs in March 2024.

Companies that have placed importance on sustainability and those covering specific trends like cybersecurity and tech have also done well.

💡Learn more here: Investing in the S&P 500 from Australia

ETF Name | Ticker | Price | Expense Ratio | 5-Year Return | 3-Year Return | 1-Year Return |

|---|---|---|---|---|---|---|

BetaShares NASDAQ 100 ETF | $41.77 | 0.48% | 22.77% | 16.98% | 52.94% | |

Betashares Global Sustainability Leaders ETF | $14.87 | 0.59% | 19.00% | 14.63% | 32.91% | |

BetaShares Global Cybersecurity ETF | $11.98 | 0.67% | 17.81% | 15.52% | 43.80% | |

VanEck MSCI International Quality ETF | $54.18 | 0.40% | 17.68% | 18.12% | 42.75% | |

iShares Global 100 ETF | $131.90 | 0.40% | 16.92% | 18.12% | 35.19% | |

SPDR S&P 500 ETF Trust | $781.55 | 0.09% | 16.62% | 17.93% | 33.19% | |

Global X Battery Tech & Lithium ETF | $91.10 | 0.69% | 16.55% | 3.80% | -1.65% | |

iShares S&P 500 ETF | $52.20 | 0.04% | 16.37% | 17.74% | 33.08% | |

VanEck Morningstar Wide Moat ETF | $126.80 | 0.49% | 16.32% | 17.01% | 27.40% | |

Global X Morningstar Global Technology ETF | $109.60 | 0.45% | 16.21% | 7.09% | 33.35% |

Price data as of 13 March 2024, rest of data as of 29 February 2024. Source: ASX Monthly Investment Products - February 2024

*Managed funds, hedge funds and geared products have not been included.

Best performing ETFs over the last 3 years

*The list of ETFs mentioned is sorted by best 3-year total return (ann.).

The commodity sector performed particularly well in 2021 and 2022. Prices slowly came back from the 2020s lows of the COVID-19 pandemic and the Russia-Ukraine Conflict added further demand pressures for energy stocks last year.

Global diversification, tech and the S&P 500 also dominate the best ETFs in Australia over the last 3 years.

ETF Name | Ticker | Price | Expense Ratio | 3-Year Return | 5-Year Return | 1-Year Return |

|---|---|---|---|---|---|---|

Betashares Global Energy Companies ETF-Currency Hedged | $6.39 | 0.57% | 18.64% | 4.15% | 1.31% | |

iShares Global 100 ETF | $131.90 | 0.40% | 18.12% | 16.92% | 35.19% | |

VanEck MSCI International Quality ETF | $54.18 | 0.40% | 18.12% | 17.68% | 42.75% | |

SPDR S&P 500 ETF Trust | $781.55 | 0.09% | 17.93% | 16.62% | 33.19% | |

iShares S&P 500 ETF | $52.20 | 0.04% | 17.74% | 16.37% | 33.08% | |

Global X FANG+ ETF | $24.44 | 0.35% | 17.41% | n/a | 83.49% | |

BetaShares Crude Oil Index ETF-Currency Hedged (Synthetic) | $5.71 | 1.29% | 17.21% | -8.52% | 8.70% | |

VanEck Morningstar Wide Moat ETF | $126.80 | 0.49% | 17.01% | 16.32% | 27.40% | |

BetaShares NASDAQ 100 ETF | $41.77 | 0.48% | 16.98% | 22.77% | 52.94% | |

iShares Core MSCI World Ex Australia ESG Leaders ETF | $53.55 | 0.10% | 16.74% | 14.53% | 33.85% |

Price data as of 13 March 2024, rest of data as of 29 February 2024. Source: ASX Monthly Investment Products - February 2024

*Managed funds, hedge funds and geared products have not been included.

🆚 Compare the two top-performing ETFs over the last 3 years: FUEL vs IOO stock comparison→

Best performing ETFs over the last year

*The list of ETFs mentioned is sorted by best 1-year total return (ann.).

The tech sector has been a standout performer in 2023 and performing extremely well to start 2024. There has been a notable rise related to companies involved with artificial intelligence and the cryptocurrency space.

Investors quickly identified ways to capture this potential growth in closely related sub-industries like semiconductors and robotics, which helped bolster the share prices of several businesses in these ETFs.

ETF Name | Ticker | Price | Expense Ratio | 1-Year Return | 3-Year Return | 5-Year Return |

|---|---|---|---|---|---|---|

BetaShares Crypto Innovators ETF | $5.00 | 0.67% | 147.03% | n/a | n/a | |

Global X FANG+ ETF | $24.44 | 0.35% | 83.49% | 17.41% | n/a | |

Global X Semiconductor ETF | $16.93 | 0.57% | 74.03% | n/a | n/a | |

BetaShares Global Uranium ETF | $9.07 | 0.69% | 57.30% | n/a | n/a | |

BetaShares NASDAQ 100 ETF | $41.77 | 0.48% | 52.94% | 16.98% | 22.77% | |

BetaShares Metaverse ETF | $14.81 | 0.69% | 52.56% | n/a | n/a | |

Betashares Japan ETF-Currency Hedged | $19.97 | 0.56% | 48.88% | 14.91% | 15.26% | |

BetaShares NASDAQ 100 ETF - Currency Hedged | $37.68 | 0.51% | 45.40% | 7.38% | n/a | |

BetaShares Global Cybersecurity ETF | $11.98 | 0.67% | 43.80% | 15.52% | 17.81% | |

VanEck MSCI International Quality ETF | $54.18 | 0.40% | 42.75% | 18.12% | 17.68% |

Price data as of 13 March 2024, rest of data as of 29 February 2024. Source: ASX Monthly Investment Products - February 2024

*Managed funds, hedge funds and geared products have not been included.

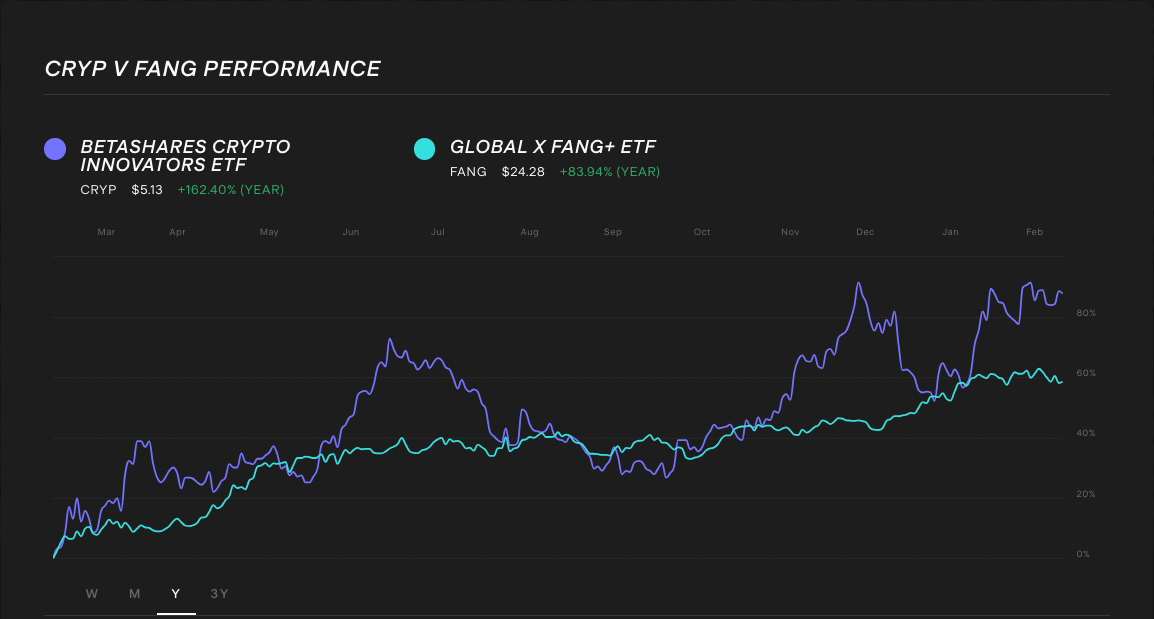

🆚 Compare the two top-performing ETFs over the last 1 years: CRYP vs FANG stock comparison→

What to look for in ASX ETFs?

ETFs usually function like ASX shares and retail investors can find information about each online. ETF providers range from firms like Vanguard and iShares, who generally create products that are traditional index funds. These tend to mirror the companies by the size of their market cap on a stock market index like the S&P/ASX200. They could also just include businesses from a specific sector of the market, like healthcare companies.

There are also active ETF products, which don't strictly follow a major stock market index. Their holdings can be selected based on certain qualities. These can be financial factors such as a high dividend yield or other criteria like ESG standards. Some firms have listed their managed funds as ETFs, which tend to contain a number of specifically chosen businesses based on the team's discretion.

On average passive ETFs tend to have lower fees. There's extra work going into selecting holdings, more rebalancing costs and sometimes even performance fees for actively managed ETFs. Those with greater funds under management (FUM) have higher liquidity. It can be faster to buy or sell out of an ETF at a specific price if there are lots of other investors also interested in the same product. ETFs with very limited FUM can be unprofitable for the providers and investors would need to sell if the product is no longer offered on the ASX.

The major companies held by an ETF should be available on the provider's website. Similarly, investors could check which sectors the product provides exposure to in the same place. Information about past performances is also there. The usual warning about previous returns being no indication of future gains remains, but investors should also check if these results have been generated based only on data rather than supporting a long-standing investment product.

💡Related: Watch these Dividend ETFs in Australia→

What are the risks of investing in ETFs?

Like any investment, ETFs do come with some risks. The ASX offers a significant number of ETF products and there are differences between various types. Index fund instruments do present a level of instant diversification through a single trade that cannot be replicated by a single stock, but the whole stock market does still have periods of going up and down.

Certain sectors might outperform or underperform the index for some time, which means that the returns for single-sector ETFs are usually more volatile than for those covering whole stock markets. Similarly, a good performance from one or a handful of stocks might not translate into the same level of returns for an ETF focused on the sector.

Some stock markets might have relatively high exposures to an industry and these could affect overall returns, such as the ASX having a large number of commodity businesses. Investors also can't invest in a specific firm or type of business if it's part of an ETF, whether in an index fund or as part of a fund manager's decision. Those wanting to strictly avoid some investments, such as fossil fuels, might consider ESG-related ETFs as another option.

ETFs do provide retail investors with a simple and cost effective way of investing in some of the world's largest companies. These are often international shares and do come with currency risk. For example, changes in the Australian Dollar and U.S. Dollar exchange rates could affect the returns of a Nasdaq or S&P 500 ETF. There are currency-hedged ETFs available for those with specific views on this area.

There are a number of geared products, which magnify the returns provided by the stock market. Together with inverse ETF instruments, these are considered higher-risk options as investors' losses can exceed those from general index funds. Those interested in these could be well served with further research before making any investment decisions.

Synthetic ETFs are constructed with various financial instruments and are created when there's no equivalent like a listed company for the specific investment. Their prices and returns may not directly reflect those of the original product. They are often used in the case of single commodity ETF products and for some fixed-income securities, such as bonds ETFs.

More resources:

✅ Looking for high interest cash ETFs in Australia?→

✅ Find the best emerging markets ETFs on the ASX→

Frequently asked questions about ETFs

The expense ratios is the annual fee charged by the ETF issuer to cover the costs of operating the product. These include factors like administration, management, marketing and distribution. It's usually shown as a percentage of the ETF's net average assets. For ETFs on the ASX, it's also often referred to as the managed expense ratio (MER).

The fee is deducted from the ETF's FUM and does affect the overall returns received by investors. This means that investors can benefit from lower expense ratios, when considering similar ETFs. On the ASX, these fees range from 0.03% and 2.27%. More specialised and actively managed ETFs tend to have higher fees as they usually require additional work by the ETF providers.

As ETFs have become very popular amongst retail investors, a number of general index funds have received significant inflows of funds. This has helped these products and their large ETF providers gain economies of scale. Together with increased competition in the industry, these trends have seen fees for popular ETFs tracking the S&P 500 and S&P/ASX200 indexes become among the lowest on offer.

💡Related: How to invest in S&P 500→

ETFs are often characterised as long-term investing products as they provide a relative degree of diversification and come with low costs. As general index funds don't see the same highs and lows as single stocks, investors might not have the same incentive to frequently trade these products.

However, there are now various kinds of ETFs and some have very different characteristics when compared to an ETF tracking the S&P/ASX200. There can be multiple reasons why people invest in one product.

There is no specific period to hold an ETF, rather consider how the product fits into your investment goals. These are shaped by your individual financial situation and risk appetite. Like investing in shares, buying or selling ETFs usually comes with fees, as well as potential capital gains tax implications. Dollar-cost averaging into ETFs remains an attractive investment strategy for many and a simple way to access a diversified portfolio. Looking into the basics of what's in these ETFs and their expense ratios could give an extra degree of comfort ahead of your investment decisions.

Find out which ETFs are the best to buy and hold based on what Stake investors are holding.

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking appropriate financial or taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.