How to buy Bitcoin ETFs in Australia [2024]

Investors can use their existing share trading account to buy Bitcoin ETFs and gain exposure to the world’s largest cryptocurrency by market cap.

Disclaimer: An investment in any crypto ETF can be a volatile investment with a risk of capital loss. Before making any investment decision, consider key risks and all fees and expenses relating to the investment to decide if it’s right for you, and seek advice from a licensed financial adviser where deemed appropriate. This article is for factual purposes only in providing information on how to invest in specific financial instruments. This article does not constitute to any recommendation to invest in these financial products and should not be taken as financial advice.

What are Bitcoin ETFs?

Bitcoin ETFs intend to track the spot price of Bitcoin, aiming to capture the live price of the cryptocurrency in an investment vehicle available on stock markets. They can be bought and sold like any other type of exchange-traded fund on an investing platform.

Before the launch of spot Bitcoin ETFs, retail investors would buy digital coins directly from a crypto exchange or invest in ETFs that traded crypto futures to gain exposure to crypto assets.

These ETFs are held in trading accounts alongside other stocks, while the digital currency can be kept in a Bitcoin wallet.

The U.S. Securities and Exchange Commission approved the 11 available spot Bitcoin ETFs to begin trading on U.S stock exchanges on 11 January 2024. These products look to provide investors with access to the underlying asset - Bitcoin.

Why is Bitcoin hitting new all-time highs?

Bitcoin ETF updates: Bitcoin's recent price surge to all-time highs, above $93,000, can be traced to two major catalysts.

Donald Trump's victory in the U.S. presidential election has injected optimism into the crypto market. Investors anticipate his pro-crypto stance, contrasting with the regulation-heavy approach of a Democratic administration. Trump's plans include easing crypto regulations and potentially establishing a U.S. Bitcoin stockpile, stoking confidence among market participants.

The surge in activity around the spot Bitcoin ETFs, particularly BlackRock's iShares Bitcoin Trust, has fuelled inflows, reaching record levels since the election.

These combined efforts have helped Bitcoin's recent rise to new all-time highs.

How to buy Bitcoin ETFs in Australia

The main way of investing in Bitcoin ETFs is by using an online investment platform. Follow our step by step guide below:

1. Find a stock investing platform

To buy spot Bitcoin ETFs you'll need to sign up to an investing platform with access to the Aussie and U.S. stock market. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, PayTo, debit card or even Apple/Google Pay.

3. Search for the ETF name

Find the ETF by name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

Bitcoin ETFs can be purchased in regular hours, pre-market and after hours. Learn more about extended hours trading.

5. Monitor your investment

Once you own the ETF, you should monitor its performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

🎓Guide: How to invest in Ethereum ETFs in Australia

How do Bitcoin ETFs work?

Buying Bitcoin ETFs works differently to investing directly in the cryptocurrency through a crypto exchange.

Spot Bitcoin ETFs aim to provide investors with exposure to the price of the cryptocurrency. The ETF issuer buys the digital coins from other holders or through a cryptocurrency exchange to be stored in a digital wallet.

The ETF is assigned shares that correspond to the number of Bitcoins it holds. Spot Bitcoin ETFs intend to reflect the current market price of the cryptocurrency as closely as possible. They can occasionally rebalance the ETF by buying or selling the digital coins.

There are also derivative-based Bitcoin ETFs available for trading. These use financial instruments, such as futures contracts, to replicate the price of Bitcoin. These give indirect exposure to the price of Bitcoin and do not need to have custody of Bitcoins.

Futures contracts let investors buy or sell the cryptocurrency for a set price at a date in the future, which can differ from where the price moves in reality. As they have expiration dates, ETF issuers need to continuously reinvest in new contracts, which can result in costs adding up and taking away from the overall returns.

🎓 Learn more: Learn about the latest Bitcoin Halving event→

Where can I buy the new Bitcoin ETFs?

Bitcoin ETFs are available for trading on a number of share trading platforms, one of which is Stake. Check out the different types of Spot Bitcoin ETFs below.

Spot Bitcoin ETFs

There are now 12 spot Bitcoin ETFs available to invest in:

- ARK 21Shares ($ARKB)

- Invesco Galaxy Bitcoin ETF ($BTCO)

- Bitwise ($BITB)

- Valkyrie Bitcoin Fund ($BRRR)

- WisdomTree Bitcoin Trust ($BTCW)

- Tidal Commodities Trust I-Hashdex Bitcoin ($DEFI)

- Franklin Bitcoin ETF ($EZBC)

- Fidelity Wise Origin Bitcoin Trust ($FBTC)

- Grayscale Bitcoin Trust ($GBTC)

- VanEck Bitcoin Trust ($HODL)

- iShares Bitcoin Trust ($IBIT)

- Grayscale Bitcoin Mini Trust ETF ($BTC)

In the case of the Grayscale Bitcoin Trust ($GBTC), it could already be bought and sold on the OTC market by investors, but the new regulations mean it has changed its structure from a trust to an ETF.

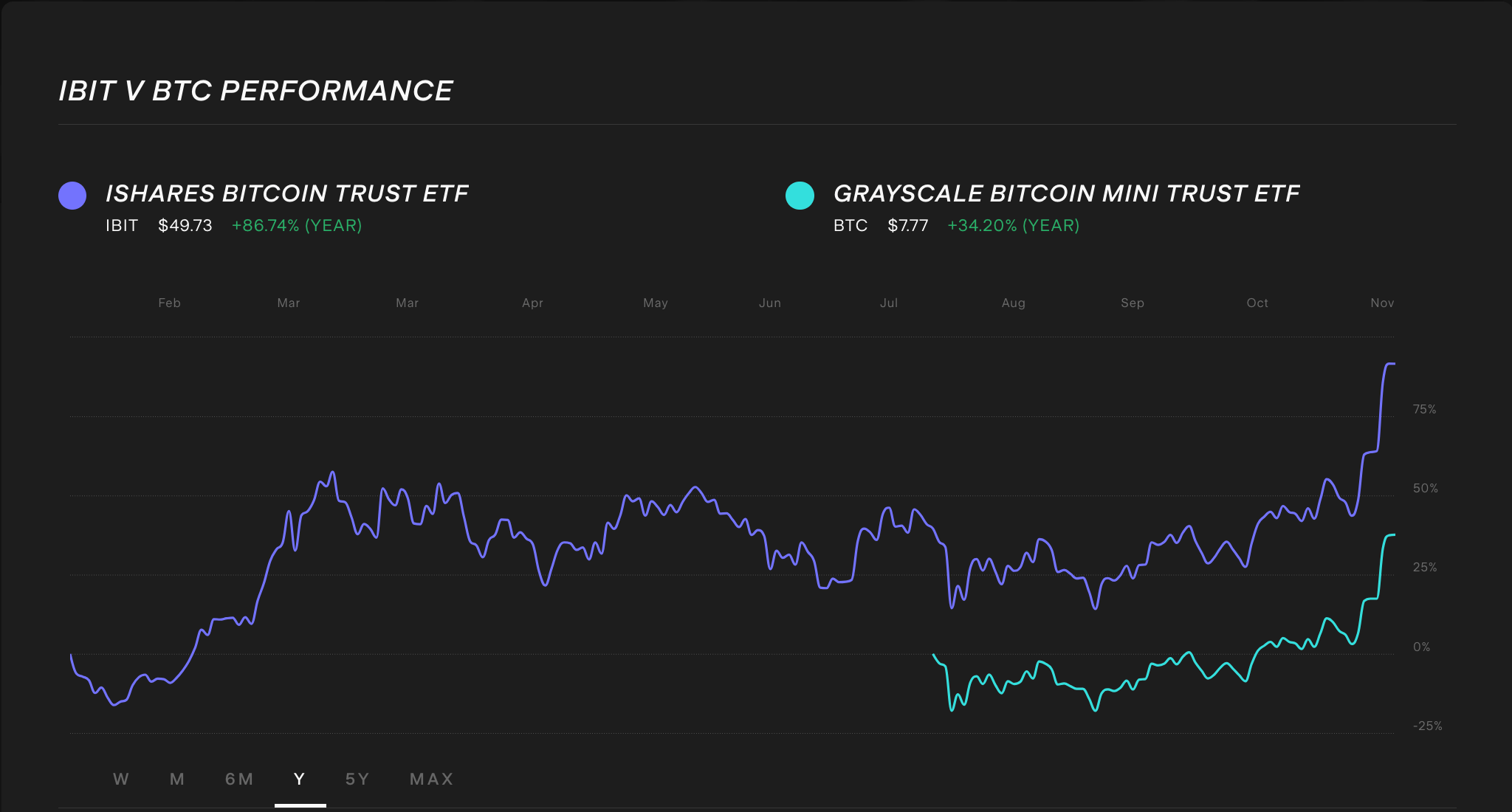

🆚 Compare the performance of IBIT vs BTC ETFs over the last 12 months

Bitcoin Futures ETFs

Other ETFs using futures contracts are also available including:

- VanEck Bitcoin Strategy ($XBTF)

- ProShares Bitcoin Strategy ETF ($BITO)

- 2x Bitcoin Strategy ETF ($BITX)

- ProShares Short Bitcoin Strategy ETF ($BITI)

Some of these products magnify returns of an already volatile asset and should be treated as high risk.

Options that also provide exposure to other kinds of crypto assets include the following:

- Valkyrie Bitcoin and Ether Strategy ETF ($BTF)

- Simplify Bitcoin Strategy Plus Income ETF ($MAXI)

- Bitwise 10 Crypto Index Fund ($BITW)

ASX Bitcoin ETFs

Here are some assets available on the Australian Securities Exchange (ASX) related to Bitcoin and the broader crypto industry:

- Global X 21Shares Bitcoin ETF ($EBTC)

- Global X 21Shares Ethereum ETF ($EETH)

- Betashares Crypto Innovators ETF ($CRYP)

- Monochrome Bitcoin ETF ($IBTC)

- VanEck Bitcoin ETF ($VBTC)

Is Bitcoin ETF worth buying?

Bitcoin ETFs are higher risk than traditional investments due to their increased volatility but can be an option for some investors with a high risk profile.

The appetite for the spot Bitcoin ETFs since their launch has shown they’ve been a great success, recording $107.91 million in inflows across a 9 day streak in May 2024.

Investing in Bitcoin or cryptocurrency assets should be considered high risk and is not suitable for all investors. Investors should do their due diligence and understand the risks and features of these assets before investing.

💡 Related: How to indirectly buy crypto without an exchange

The daily flows (in USD) for spot bitcoin ETFs, namely BlackRock (IBIT), the Grayscale Bitcoin Trust (GBTC), Fidelity (FBTC), Ark Invest/21Shares (ARKB), Bitwise (BITB), Franklin (EZBC), Invesco/Galaxy (BTCO), VanEck (HODL), Valkyrie (BRRR) and WisdomTree (BTCW).

What are the advantages and disadvantages of Bitcoin ETFs?

It’s important to recognise that Bitcoin, the underlying asset to Bitcoin ETFs itself, is volatile and may not be suitable for each individual’s risk appetite. Investors should be aware that Bitcoin ETFs also come with a number of risks and don’t fit within everyone’s investment strategy.

Advantages | Disadvantages |

|---|---|

Retail investors can gain exposure to the Bitcoin price on platforms that don’t specifically offer cryptocurrencies. | Like any ETF, they come with management fees. Some issuers are discounting fees for a temporary period, but this is not in their long-term plans. |

There is no need to make additional trading accounts on cryptocurrency exchanges or set up a crypto wallet. Rather, Bitcoin ETFs can sit alongside other shares in an existing account. | These ETFs provide exposure to an underlying Bitcoin asset price, which means there is a tracking risk and the ETF might not always reflect the exact price of Bitcoin. |

Allocating some funds to crypto ETFs could provide diversification from other asset classes. | Most Bitcoin ETFs only contain one asset, whereas ETFs are often associated with diversification due to giving exposure to multiple areas. |

Investors will have the ability to trade these ETFs through the same processes as others on investing platforms. Exchange-listed ETFs are required to uphold regulations set by exchanges. They may also face disciplinary actions such as being penalised. | Bitcoin and cryptocurrencies are generally considered to be volatile assets and investors might need to have a high risk tolerance to large and rapid price changes. |

Bitcoin ETF FAQs

The share price for the Bitcoin ETFs ranges between US$7 - US$100 as of 15 November 2024. The lowest share price for these assets is the Grayscale Bitcoin Mini Trust ETF ($BTC) at $7.76. While the highest share price sits at $100.71 for Tidal Commodities Trust I-Hashdex Bitcoin ETF ($DEFI).

Management fees for the 12 spot ETFs range from 0.15% for Grayscale Bitcoin Mini Trust ETF ($BTC)to 1.50% for the Grayscale Bitcoin Trust ($GBTC).

The transaction cost of buying or selling the ETF should also be considered, as well as any FX fees. Learn more here about the cost of trading these assets on Stake.

Investing in a Bitcoin ETF is not the same as owning Bitcoin. Spot Bitcoin ETFs intend to track the spot price of the underlying asset, Bitcoin, and aim to capture the current price of the cryptocurrency. However, the ETFs might still trade at a premium or discount to the actual Bitcoin price.

Buying Bitcoin directly usually occurs through a crypto exchange and the assets are then stored in a digital wallet in an individual’s name. For ETFs, the issuer will buy the digital coins and make an arrangement with a custodian to hold the assets, with the individual investor seeing the ETF alongside other holdings in their account on an investment platform.

The risks and benefits of investing in a Bitcoin ETF vs buying the actual asset are quite different. It’s important to understand how both products operate and line up with your own risk appetite and investing goals. Higher potential rewards tend to come with higher risk levels when investing. This means that certain products can present more downsides than benefits for the average investor.

Whilst the Bitcoin spot ETFs will attempt to track the spot price of Bitcoin, it may be harder to predict how they will influence the price of Bitcoin.

The new ETFs create additional opportunities for frequent traders, a trend that could lead to higher levels of speculation and volatility. Institutional investors no longer need to purchase large volumes of Bitcoin through private funds and trusts. As these investments often required paying a premium, some say the greater levels of access could play a part in pushing down prices of the cryptocurrency.

If the ETFs experience significant inflows of investment, this demand could in turn boost the price of the underlying asset, Bitcoin. The market could also interpret regulatory approval of these products as a sign of validation, which could improve the reputation of Bitcoin among investors.

It’s important to note though that there are many factors that have and will continue to affect the price of Bitcoin beyond these Bitcoin spot ETFs.

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation, particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

Our $3 applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that apply.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.