12 Spot Bitcoin ETFs to Watch Right Now [2024]

It's time to deep dive into the 12 spot Bitcoin ETFs available on the U.S. stock market. All these ETFs have a similar goal so what are the differences and what can you look for when deciding which could be the best Bitcoin ETF for your investment portfolio.

Disclaimer: An investment in any crypto ETF can be a volatile investment with a risk of capital loss. Before making any investment decision, consider key risks and all fees and expenses relating to the investment to decide if it’s right for you, and seek advice from a licensed financial adviser where deemed appropriate. This article is for factual purposes only in providing information on the Bitcoin ETF financial instruments. This article does not constitute to any recommendation to invest in these financial products and should not be taken as financial advice.

Bitcoin's new all time highs

Bitcoin touched a new all-time high above $97,400, as crypto market participants reacted positively to Donald Trump’s election victory. Year-to-date, Bitcoin has rallied more than 130%, and many attribute the digital asset’s initial price action this year to one thing: the approval of spot Bitcoin ETFs in January 2024.

These funds made Bitcoin more accessible to retail and institutional investors, leading to increased demand. Recent momentum and the approval of options for spot Bitcoin ETFs have resulted in these funds setting records in daily trading volume.

💡 Discover: Check out the 9 spot Ethereum ETFs on Wall St

Spot Bitcoin ETF list of 12 SEC-approved assets

ETF Name | Ticker | Share Price | Year to Date | AUM* | Expense Ratio |

|---|---|---|---|---|---|

Blackrock’s iShares Bitcoin Trust | US$55.90 | +101.73% | US$45.4b | 0.25%* | |

Grayscale Bitcoin Trust | US$78.05 | +103.50% | US$20.61b | 1.50%* | |

Fidelity Wise Origin Bitcoin Trust | US$85.88 | +101.91% | US$18.44b | 0.25%* | |

ARK 21Shares Bitcoin ETF | US$98.11 | +101.67% | US$4.69b | 0.21%* | |

Bitwise Bitcoin ETF | US$53.51 | +101.37% | US$4.00b | 0.20%* | |

Grayscale Bitcoin Mini Trust | US$43.60 | +41.83% | US$3.3b | 0.15% | |

VanEck Bitcoin Trust | US$111.11 | +101.36% | US$1.26b | 0.20%* | |

Valkyrie Bitcoin Fund | US$27.80 | +100.98% | US$873.8m | 0.25%* | |

Invesco Galaxy Bitcoin ETF | US$98.13 | +102.88% | US$844.24m | 0.25%* | |

Franklin Bitcoin ETF | US$57.00 | +102.26% | US$699.81m | 0.19%* | |

WisdomTree Bitcoin Fund | US$104.29 | +103.13% | US$353.30m | 0.25%* | |

Hashdex Bitcoin ETF | US$111.82 | +98.73% | US$13.98m | 0.90% |

Data as of 21 November 2024. Source: Stake, Google Finance and fund’s website.

*The list of spot Bitcoin ETFs mentioned is ranked by assets under management. We decided to feature these assets since they are the only 12 SEC-approved spot Bitcoin ETFs available to invest in on U.S. markets.

💡Related: Learn how to buy Bitcoin ETFs in Australia→

List of spot Bitcoin ETFs to watch

If you are planning to add cryptocurrency exposure to your portfolio through the new Bitcoin spot ETFs, it’s important to understand they are a relatively new and volatile asset class. Find out more below in our Bitcoin ETF list (in order of assets under management size):

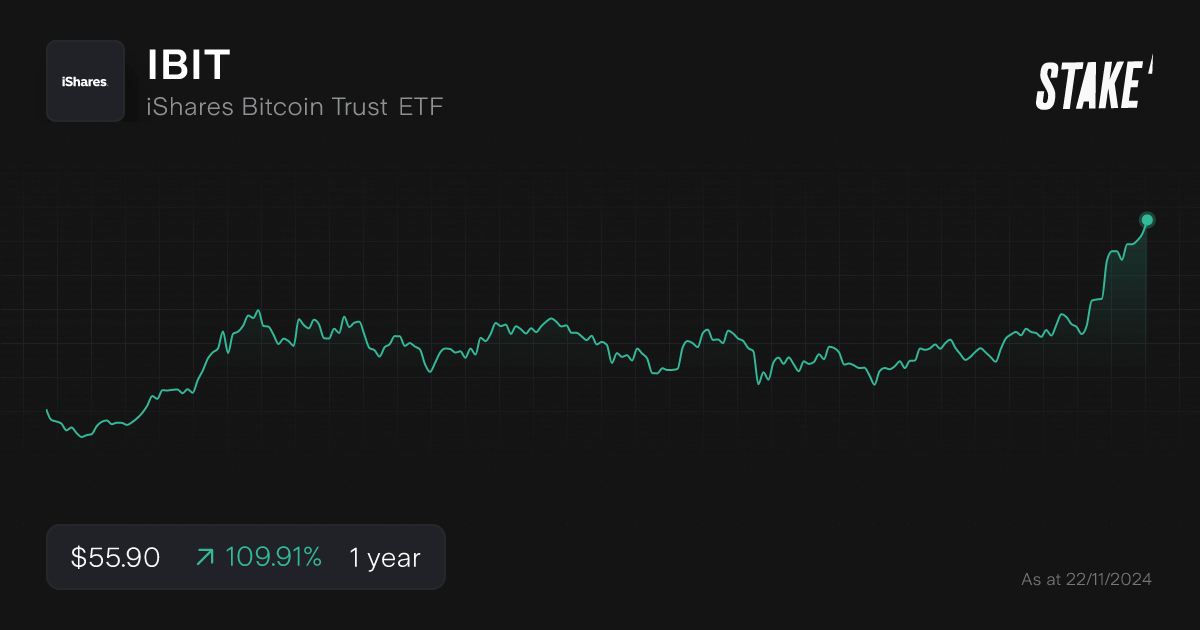

1. BlackRock’s iShares Bitcoin Trust ($IBIT)

- Assets under management (AUM): US$45.4b

- ETF price (as of 21/11/2024): US$55.90

- Stake investors watching $IBIT: 2,596

The iShares Bitcoin Trust ($IBIT), launched by the world’s largest asset manager BlackRock, marks the financial giant's entry into the Bitcoin ETF market. As a leading force in asset management, BlackRock's involvement lends significant credibility to the fund, offering investors a competitively priced option backed by a trusted, well-established institution.

*Fees are initially set at 0.25%, and subsequently reduced to 0.2% for the first $5 billion in assets for a duration of 12 months.

2. Grayscale Bitcoin Trust ($GBTC)

- Assets under management (AUM): US$20.23b

- ETF price (as of 21/11/2024): US$78.05

- Stake investors watching $GBTC: 1,552

The Grayscale Bitcoin Trust ($GBTC) offers investors exposure to Bitcoin through a traditional investment vehicle, issued by Grayscale Investments, one of the first crypto investment managers in the space. Initially launched in 2013 as a private trust, GBTC became publicly traded in 2015, making it the first publicly-traded Bitcoin fund in the U.S.

After years of legal battles with the Securities and Exchange Commission (SEC), Grayscale finally received approval to convert GBTC into a spot Bitcoin ETF in January 2024. The fund’s conversion automatically made it the largest spot Bitcoin ETF by AUM, until it was overtaken by IBIT in May.

*The fund’s fees of 1.5% is the highest among the listed ETFs and has likely played a part in the US$20.5b in outflows it has seen since converting to an ETF.

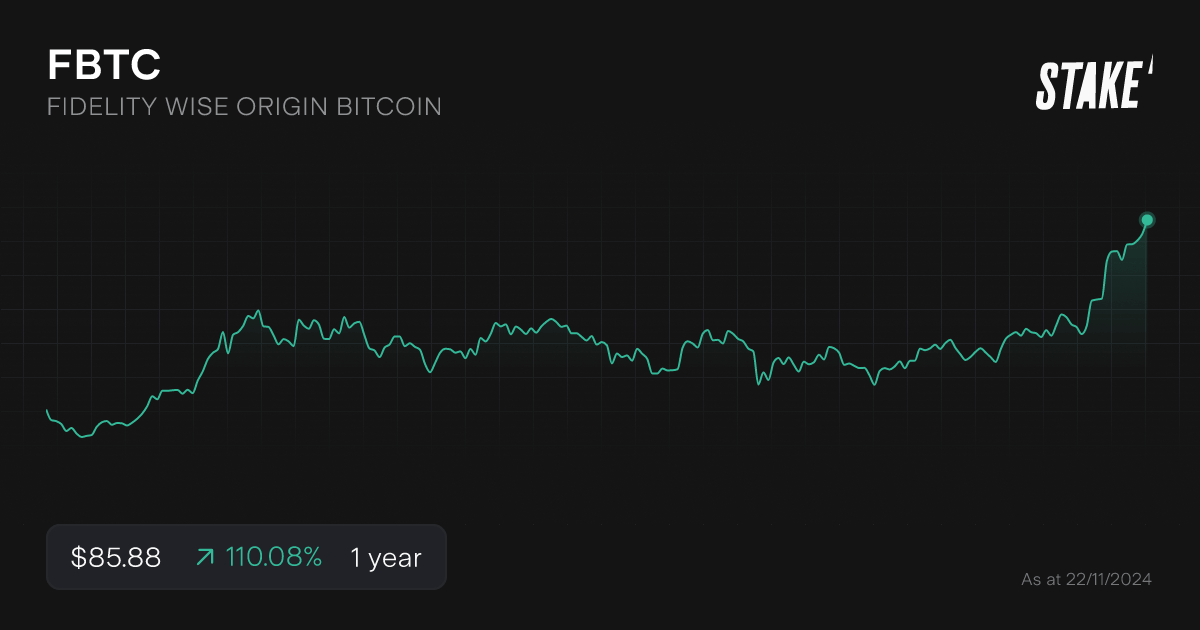

3. Fidelity Wise Origin Bitcoin Trust ($FBTC)

- Assets under management (AUM): US$18.44b

- ETF price (as of 21/11/2024): US$85.88

- Stake investors watching $FBTC: 530

Fidelity's Wise Origin Bitcoin Fund ($FBTC) is issued by Fidelity Investments, another well-established player in the world of asset management. The fund holds actual Bitcoin, which is securely held by the custodian Fidelity Digital Asset Services, setting it apart from many other spot Bitcoin ETFs that outsource custody.

FBTC tracks the Fidelity Bitcoin Reference Rate, a composite index that uses a volume-weighted median price calculation to closely mirror Bitcoin's market value.

The fund’s structure offers investors a regulated and secure way to invest in Bitcoin without the complexities of direct ownership, such as managing private keys or navigating cryptocurrency exchanges

*Fidelity, recognised for its robust investment platform and recent ventures into cryptocurrency, has waived fees until August 1, 2024. Subsequently, its fees are 0.25%.

4. ARK 21Shares Bitcoin ETF ($ARKB)

- Assets under management (AUM): US$4.69b

- ETF price (as of 21/11/2024): US$98.11

- Stake investors watching $ARKB: 632

The ARK 21Shares Bitcoin ETF ($ARKB) is a spot Bitcoin ETF born from a collaboration between ARK Invest, led by renowned investor Cathie Wood, and 21Shares, a leading issuer of cryptocurrency-backed exchange-traded products.

The Bitcoin held by ARKB is custodied by Coinbase Custody Trust Company. 21Shares US acts as the sponsor of ARKB, while Ark Investment Management serves as its sub-advisor. This arrangement leverages the strengths of both companies to manage the fund. Both Ark Invest and 21Shares have extensive experience in the cryptocurrency and investment management spaces, with track records dating back to 2014 and 2018, respectively

*The management fee was exempted until July 10, 2024, or until assets reached $1 billion, whichever came first. The expense ratio is now 0.21%.

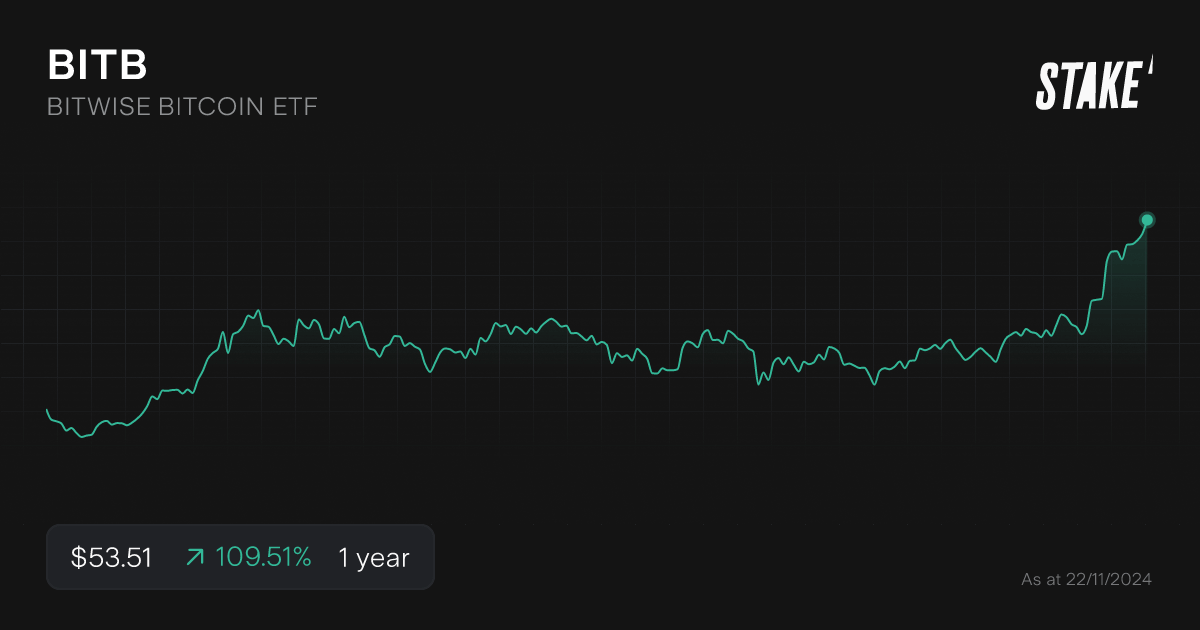

5. Bitwise Bitcoin ETF ($BITB)

- Assets under management (AUM): US$4.00b

- ETF price (as of 21/11/2024): US$53.51

- Stake investors watching $BITB: 592

The Bitwise Bitcoin ETF (BITB) is offered by Bitwise Asset Management, recognised for its specialisation in cryptocurrency index funds. With a total expense ratio of 0.20%, BITB boasts the lowest fee structure among the spot Bitcoin ETFs launched in early 2024.

The fund holds actual Bitcoin, allowing investors to gain exposure to the cryptocurrency's price movements without the complexities of direct ownership or management of digital wallets.

Bitwise Asset Management brings years of experience in crypto investment products, having launched the world's first cryptocurrency index fund in 2017.

The combination of low fees, direct Bitcoin exposure, and the backing of an experienced crypto-focused asset manager positions it as an attractive option for investors.

*During the initial six months or until the first $1 billion in assets, fees were waived, followed by a 0.20% fee thereafter.

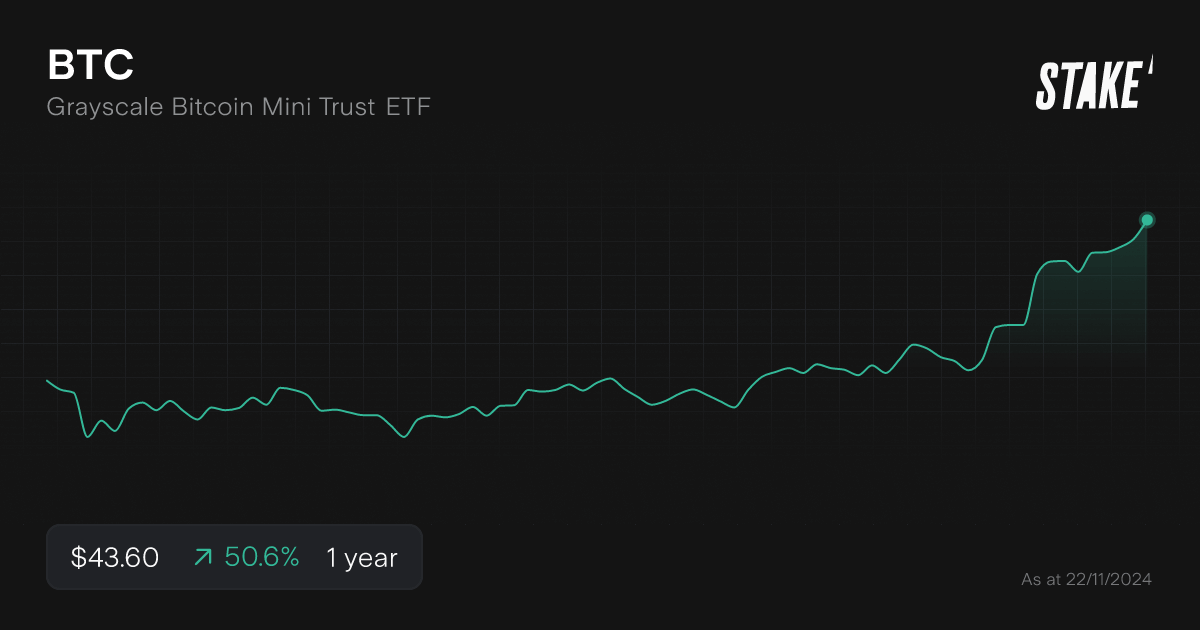

6. Grayscale Bitcoin Mini Trust ETF ($BTC)

- Assets under management (AUM): US$3.3b

- ETF price (as of 21/11/2024): US$43.60

- Stake investors watching $BTC: 31

The Grayscale Bitcoin Mini Trust ETF ($BTC) is issued by Grayscale Investments and is a recently revamped investment product offering exposure to Bitcoin

The fund underwent a 1:5 reverse share split on November 19, 2024, consolidating every five shares into one. Following the split, the share price increased fivefold to reflect the revised net asset value (NAV).

The reverse split allows for fractional share trading via internal company ledgers, though these cannot be traded on the open market.

Overall, the Grayscale Bitcoin Mini Trust ETF performs competitively with other Bitcoin ETFs, offering similar returns with a relatively low expense ratio.

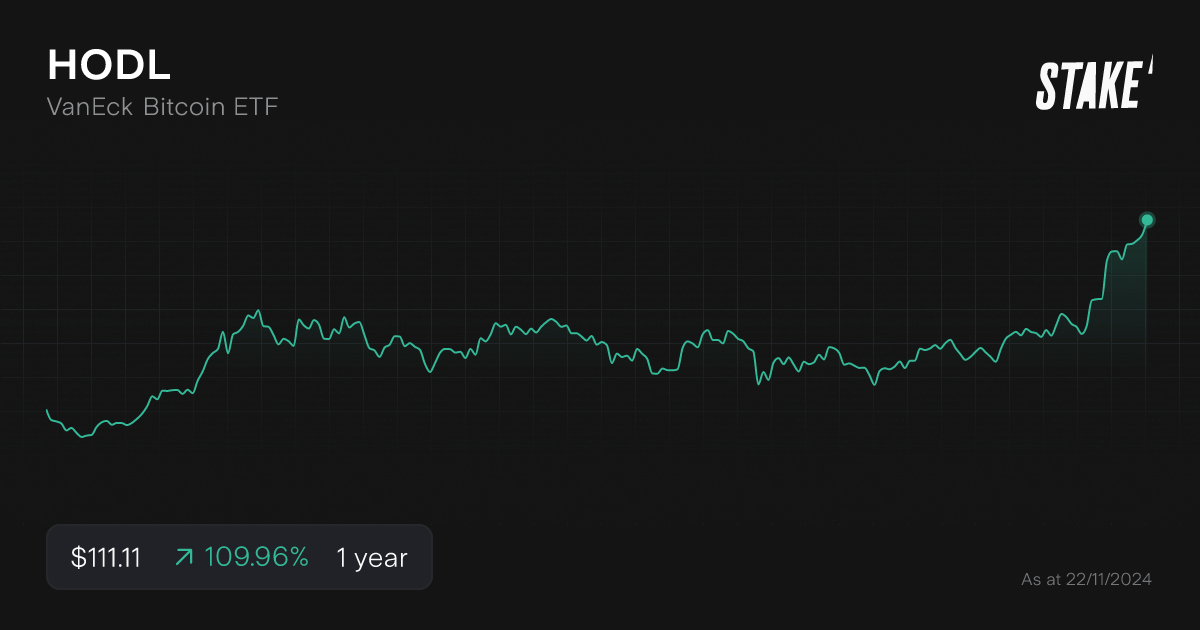

7. VanEck Bitcoin Trust ($HODL)

- Assets under management (AUM): US$1.26b

- ETF price (as of 21/11/2024): US$111.11

- Stake investors watching $HODL: 424

The VanEck Bitcoin Trust ($HODL) was launched by VanEck, a firm with significant experience in both ETFs and digital assets. VanEck seeded HODL with US$72.5m, the largest initial investment among the newly launched spot Bitcoin ETF.

HODL joins VanEck's growing family of digital asset funds, which includes futures-based ETFs for Bitcoin and Ethereum, as well as other crypto-linked investment vehicles. The launch marked a significant milestone in VanEck's long-standing efforts to bring a spot Bitcoin ETF to market, dating back to their first filing in 2017.

*From VanEck’s website: During the period commencing on March 12, 2024 and ending on March 31, 2025, the Sponsor will waive the entire Sponsor Fee for the first $1.5 billion of the Trust’s assets. If the Trust’s assets exceed $1.5 billion prior to March 31, 2025, the Sponsor Fee charged on assets over $1.5 billion will be 0.20%. All investors will incur the same Sponsor Fee which is the weighted average of those fee rates. After March 31, 2025, the Sponsor Fee will be 0.20%.

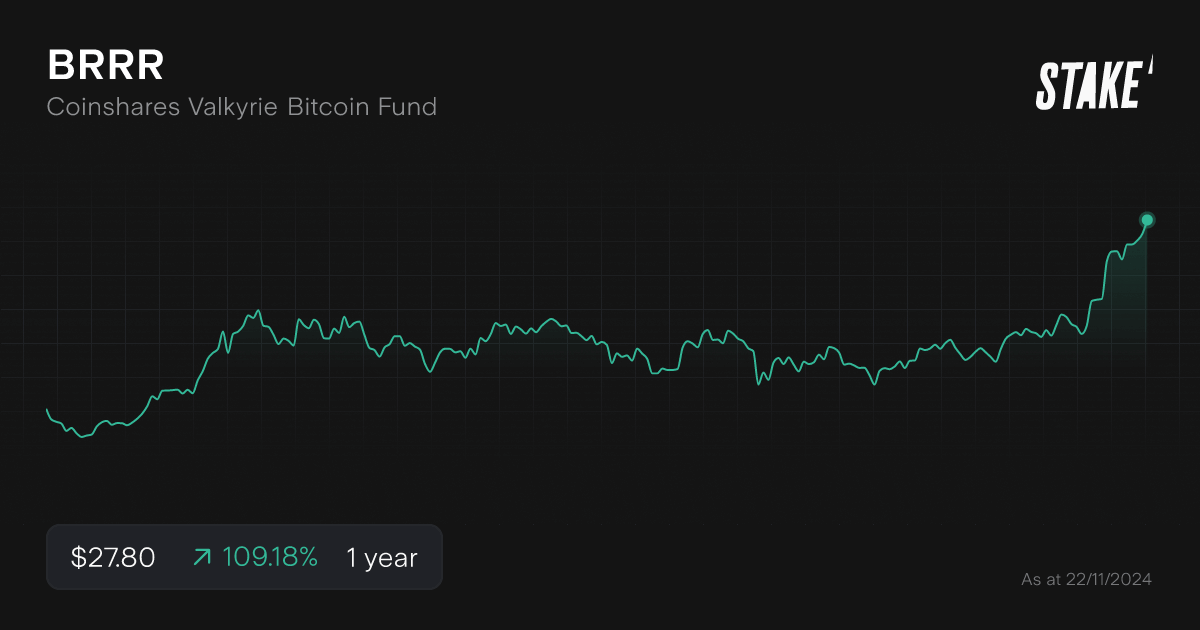

8. Valkyrie Bitcoin Fund ($BRRR)

- Assets under management (AUM): US$873.8m

- ETF price (as of 21/11/2024): US$27.80

- Stake investors watching $BRRR: 190

The Valkyrie Bitcoin Fund ($BRRR) is issued by Valkyrie Investment, which brings specialized digital asset investment management experience to the fund, leveraging its track record in crypto-focused products.

Valkyrie has emphasised its commitment to delivering a high-quality investment product based on expertise rather than marketing gimmicks.

The ticker name for Valkyrie's spot Bitcoin ETF, ‘BRRR,’ is a reference to the ‘money printer go brrr’ meme that gained popularity in 2020.

*Fees are waived for the first 3 months, followed by a 0.25% rate thereafter.

9. Invesco Galaxy Bitcoin ETF ($BTCO)

- Assets under management (AUM): US$844.24m

- ETF price (as of 21/11/2024): US$98.13

- Stake investors watching $BTCO: 264

The Invesco Galaxy Bitcoin ETF ($BTCO) was launched by Invesco and Galaxy Digital and leverages the combined strengths of Invesco's ETF experience and Galaxy Asset Management's deep knowledge of digital assets.

Galaxy acts as the execution agent for buying and selling bitcoin on behalf of BTCO, bringing seasoned expertise and institutional-grade infrastructure to the process.

BTCO's bitcoin holdings are stored in secure facilities through a custody agreement with Coinbase, using tamper-proof hardware modules in secure data centers.

*For the initial six months or until the first $5 billion in assets, fee waiver applies, thereafter a 0.25% expense ratio.

10. Franklin Bitcoin ETF ($EZBC)

- Assets under management (AUM): US$699.81m

- ETF price (as of 21/11/2024): US$57.00

- Stake investors watching $EZBC: 200

The Franklin Bitcoin ETF ($ EZBC) is issued by global investment firm Franklin Templeton. This fund serves as a regulated avenue for investors to access Bitcoin exposure, embodying Franklin Templeton's strategic move into the digital asset space.

The fund leverages Franklin Templeton's 75 plus years of asset management experience and its dedicated Digital Assets team.

The ticker symbol ‘EZBC’ emphasizes the fund's goal to make Bitcoin investment easy and accessible for clients.

*From Franklin Templeton website: The Sponsor's Fee is accrued daily at an annualized rate equal to 0.19% of the net asset value of the Fund. For a period from January 12, 2024 to August 2, 2024, the Sponsor will waive a portion of the Sponsor's Fee so that the Sponsor's Fee after the fee waiver will be equal to 0.00% of the net asset value of the Fund for the first $10.0 billion of the Fund's assets.

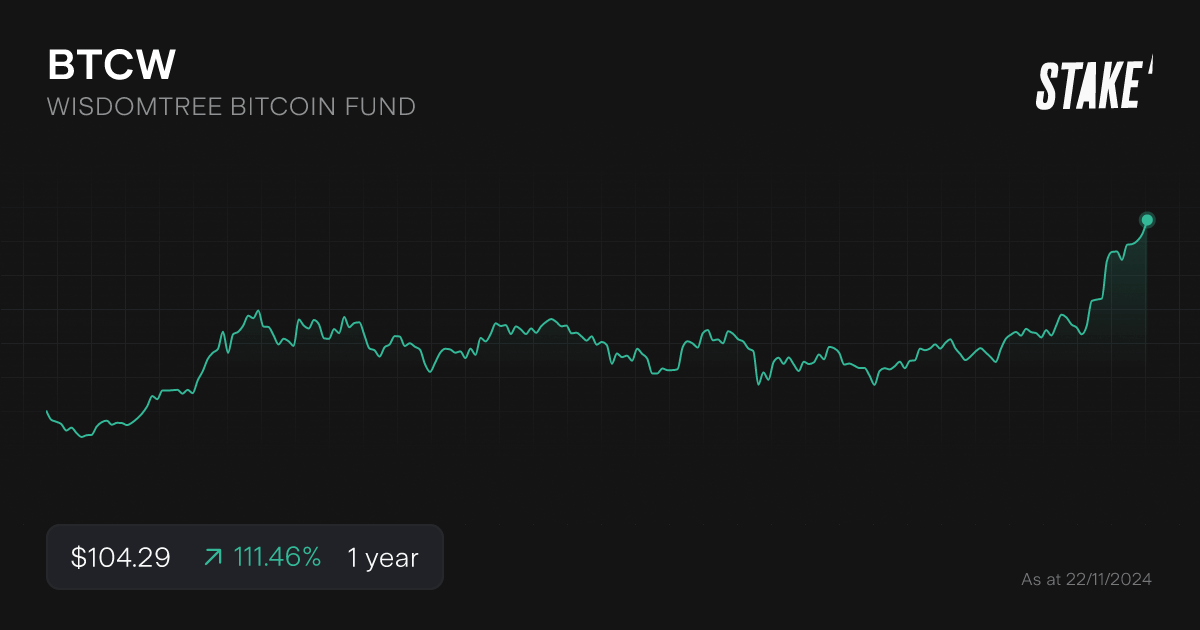

11. WisdomTree Bitcoin Fund ($BTCW)

- Assets under management (AUM): US$353.30m

- ETF price (as of 21/11/2024): US$104.29

- Stake investors watching $BTCW: 138

The WisdomTree Bitcoin Fund ($BTCW) is offered by WisdomTree, offering investors regulated exposure to Bitcoin. Widely recognised for its diverse ETF offerings, WisdomTree extends its expertise into the digital asset domain with this fund.

The fund employs a physical replication strategy to track the price of Bitcoin and generally values its shares daily using an independently calculated value based on an aggregation of executed trade flow of major bitcoin spot exchanges.

Each share of the fund has a corresponding Bitcoin entitlement that is professionally secured in ‘cold storage.’

*The fee structure includes a waiver for the initial 6 months or until the first $1 billion in assets, followed by a 0.25% fee.

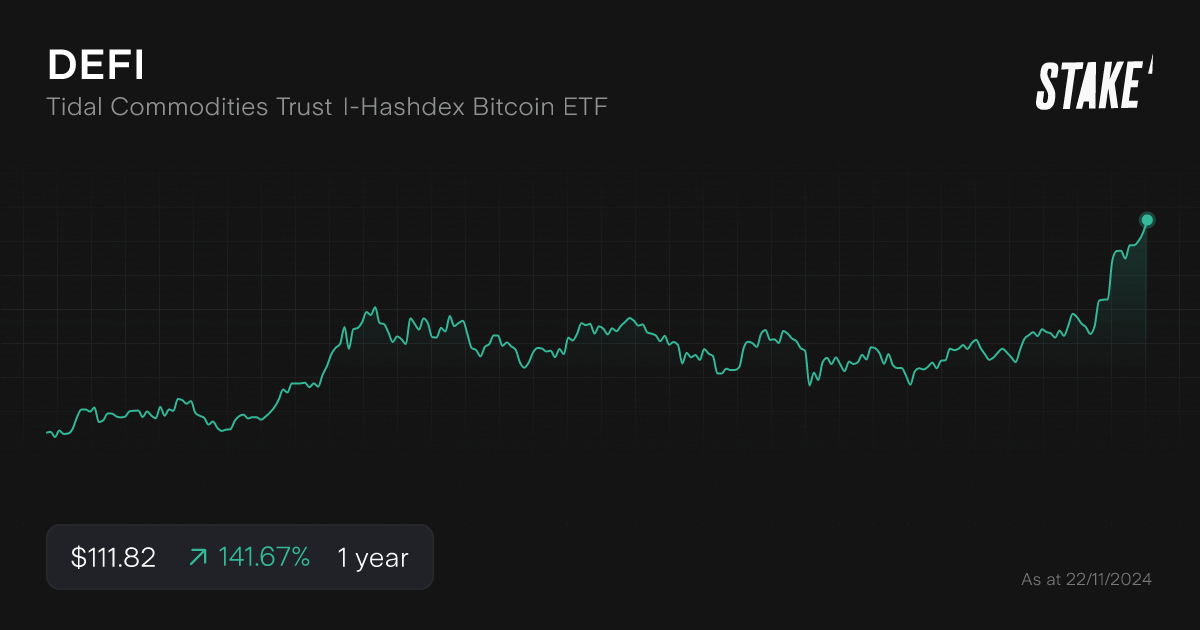

12. Hashdex Bitcoin ETF ($DEFI)

- Assets under management (AUM): US$13.98m

- ETF price (as of 21/11/2024): US$111.82

- Stake investors watching $DEFI: 107

The Hashdex Nasdaq Bitcoin ETF ($DEFI), issued by Hashdex, is a fully physically backed ETF designed to provide investors with a straightforward, secure, and cost-effective method of gaining exposure to the Nasdaq Bitcoin Reference Price.

The fund is known for its comparatively higher fee structure among approved ETFs. Hashdex, a trailblazer in cryptocurrency investment products, seeks to harness its proficiency in digital assets to provide a regulated Bitcoin investment option.

Before SEC approval of spot Bitcoin ETFs, the fund was a Bitcoin futures ETF that invested in bitcoin futures contracts.

*The fund will charge annual fees of 0.9%.

💡 Check out: Crypto ETFs list for new altcoin ETFs launching in 2025

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

What’s the difference between buying Bitcoin ETFs vs Bitcoin?

Investing in a Bitcoin ETF is not the same as owning Bitcoin directly. Bitcoin ETFs offer simplified exposure to Bitcoin's price movements without requiring investors to manage private keys or secure storage. However, ETF shares may trade at a premium or discount to the actual Bitcoin price, unlike direct ownership where investors have full control and exposure to the underlying asset.

The choice between the two depends on individual preferences and risk tolerance.

It’s important to understand how both products operate and line up with your own risk appetite and investing goals. Higher potential rewards tend to come with higher risk levels when investing. This means that certain products can present more disadvantages than benefits for the average investor.

🎓 Learn more: How to invest in crypto without buying crypto→

🎓 Learn more: Learn about the recent Bitcoin Halving event→

Are Bitcoin ETFs regulated?

Yes, the new Bitcoin ETFs are regulated. They are, like all exchange-listed ETFs, subject to oversight by regulatory bodies like the U.S. Securities and Exchange Commission (SEC).

SEC regulations are intended to protect investors, maintain fair markets, and facilitate capital formation. Importantly, this does not mean the underlying assets of these ETFs, Bitcoins, are being regulated. The risks and benefits of investing in a Bitcoin ETF vs buying the actual asset are quite different.

It’s important to note that while regulation provides some level of protection, it does not eliminate all risk associated with investing in spot Bitcoin ETFs. Investors should understand how both Bitcoin and Bitcoin ETFs operate and whether they line up with your own risk appetite and investing goals. Higher potential rewards tend to come with higher risk levels when investing.

Frequently asked questions about the Spot Bitcoin ETFs

When choosing a spot Bitcoin ETF, some relevant factors to consider include the expense ratio, the size of the fund (AUM), the reputation of the fund sponsor, the underlying index that the ETF tracks, and the past performance of the ETF.

Remember, past performance is not indicative of future results, and it’s crucial to do your own research and consider your individual investment goals and risk tolerance before investing.

As of 21 November 2024, BlackRock’s iShares Bitcoin Trust ($IBIT) is the biggest Bitcoin ETF, with over US$45b AUM.

The 11 spot Bitcoin ETFs approved by the SEC are:

- ARK 21Shares Bitcoin ETF ($ARKB)

- Bitwise Bitcoin ETF ($BITB)

- Blackrock’s iShares Bitcoin Trust ($IBIT)

- Franklin Bitcoin ETF ($EZBC)

- Fidelity Wise Origin Bitcoin Trust ($FBTC)

- Grayscale Bitcoin Trust ($GBTC)

- Hashdex Bitcoin ETF ($DEFI)

- Invesco Galaxy Bitcoin ETF ($BTCO)

- VanEck Bitcoin Trust ($HODL)

- Valkyrie Bitcoin Fund ($BRRR)

- WisdomTree Bitcoin Fund ($BTCW)

- Grayscale Mini Trust ETF ($BTC)

Bitcoin ETFs can be a good investment for some, but not for everyone. For those who are interested in the growth and risk exposure of the underlying asset, Bitcoin, Bitcoin ETFs offer a simpler alternative to direct ownership of Bitcoin.

Comparative to direct Bitcoin ownership, they offer ease of access, some form of regulatory oversight, some level of diversification, liquidity and tax efficiency through the scale of the ETF and its demand on the listed market.

However, they also come with notable downsides and are primarily suited for risk-tolerant investors. Bitcoin ETFs can provide potential gains, but they also present investors with a wide range of outcomes that will test their tolerance for risk. As with all investing, when you invest your capital is at risk, It’s generally recommended to maintain a balanced portfolio with a diversified list of assets that cater to your risk tolerance.

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation, particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

Our $3 applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that apply.

Rodrigo is a seasoned finance professional with a Finance MBA from Fundação Getúlio Vargas, one of Brazil's premier business schools. With seven years of experience in equities and derivatives, Rodrigo has a profound understanding of market dynamics and microstructure. Having worked for Brazil’s biggest retail algorithmic trading platform SmarttBot, his expertise focuses on risk management and the analysis, development and evaluation of trading systems for both U.S. and Brazilian stock exchanges.