What are the best Ethereum ETFs to watch? [2025]

Ethereum ETFs dominated 2025, with Q3 marking a historic first: inflows into Ether funds topped US$9B and surpassed Bitcoin’s, signaling a clear shift toward broader institutional crypto exposure. But which fund is right for you? Here is a breakdown of what to look for when deciding on the best Ethereum ETF for your investment portfolio.

Disclaimer: Crypto ETFs can be a volatile investment with the risk of capital loss. Before making any investment decision, consider all risks, fees and expenses relating to the investment to decide if it’s right for you, and seek advice from a licensed financial professional where appropriate. This article is for factual purposes only in providing information on cryptocurrency ETF financial instruments. This article is not a recommendation to invest in these financial products and is not financial advice.

How do spot Ethereum ETFs work?

Spot Ethereum ETFs work by holding actual Ether (ETH) tokens on behalf of investors, allowing them to gain exposure to Ethereum’s price without the need to buy or store the crypto themselves.

These ETFs are designed to closely track the real-time market price of Ethereum by having the fund provider buy and securely store ETH. Here’s a simplified version of how the process works:

- The ETF issuer acquires and manages a pool of actual ETH tokens.

- Shares of the ETF are issued and traded on stock exchanges, where each share’s value reflects the underlying ETH the fund holds.

- The ETF’s price moves in tandem with Ethereum’s spot market price, so as the value of ETH rises or falls, so does the ETF share value.

- If ETF shares become misaligned with the ETH spot price, the provider can create (mint) or redeem (buy back) shares to restore alignment.

List of spot Ethereum ETFs

ETF Name | Ticker | Share Price | Year to Date | Assets Under Management | Expense Ratio |

|---|---|---|---|---|---|

Grayscale Ethereum Trust | US$25.99 | -8.65% | US$3.07B | 2.50% | |

Grayscale Ethereum Mini Trust | US$29.81 | -6.87% | US$2.14B | 0.15% | |

iShares Ethereum Trust ETF | US$23.94 | -7.17% | US$12.3B | 0.25% | |

Fidelity Ethereum Fund | US$31.60 | -6.95% | US$2.25B | 0.25% | |

Bitwise Ethereum ETF | US$22.70 | -6.85% | US$360.7M | 0.20% | |

VanEck Ethereum ETF | US$46.33 | -6.86% | US$197.4M | 0.20% | |

Franklin Ethereum ETF | US$24.04 | -6.93% | US$65.06M | 0.19% | |

Invesco Galaxy Ethereum ETF | US$31.58 | -6.95% | US$24.2M | 0.25% | |

21Shares Ethereum ETF | US$15.81 | -8.45% | US$29.01M | 0.21% |

Data as of 14 November 2025. Sources: Stake, Google Finance, asset manager websites.

*The list of ETFs mentioned is ranked by assets under management (AUM). When deciding what assets to feature, we analyse the financials, recent news and announcements, the state of the industry, fund performance, and whether or not they are actively traded on Stake.

Explore the new crypto ETFs when they launch and become available to trade on Stake.

Discover the best Ethereum ETFs and add them to your watchlist

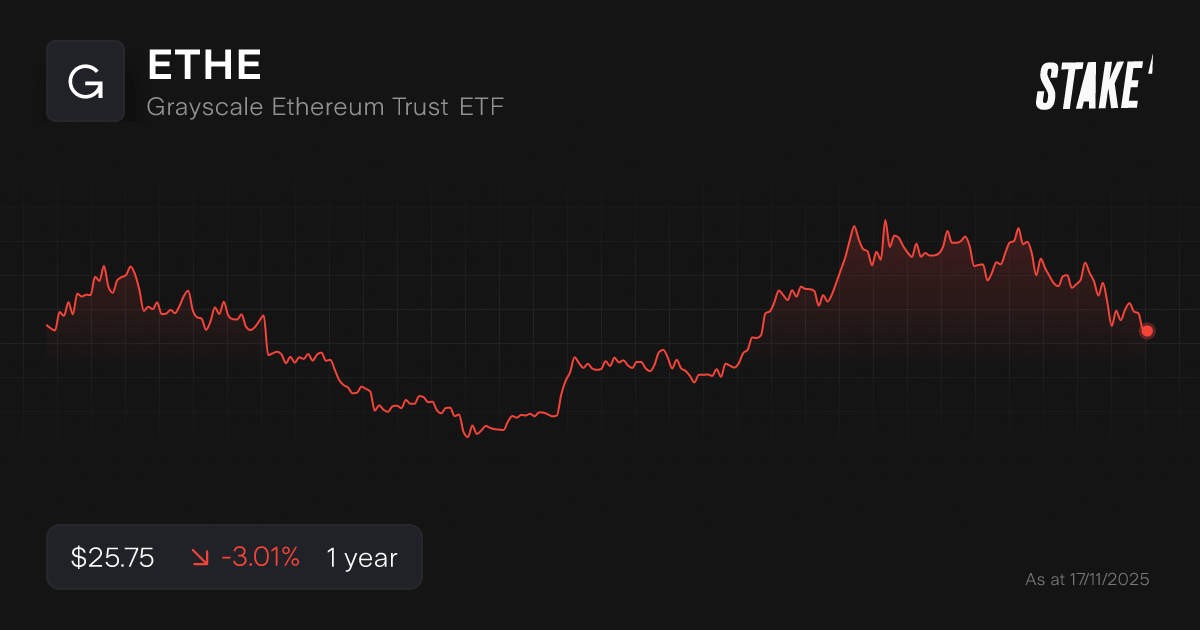

1. Grayscale Ethereum Trust ($ETHE)

The Grayscale Ethereum Trust ($ETHE) is the longest-running and one of the largest spot Ethereum funds in the U.S. We say longest-running because although it began trading as an ETF alongside new entrants from BlackRock and Fidelity, it was the only one to convert from an existing trust structure – a product that had been live since 2017. This gave Grayscale a significant head start in terms of brand recognition, historical performance and assets under management.

The fund tracks the CoinDesk Ether Price Index (ETX), which provides a USD-denominated reference rate for spot Ether prices, and holds actual Ether through Coinbase Custody without engaging in derivatives or leveraged trading.

It has the largest management fee of the nine listed Ethereum ETFs at 2.50%. Grayscale’s reluctance to drop fees lower has hurt its competitiveness, with the firm recording US$4.7B in outflows since converting into an ETF.

Grayscale’s ETHE and its low-cost counterpart the Grayscale Ethereum Mini Trust ($ETH) became the first U.S. ETFs to enable staking. This feature allows investors to earn rewards from staking ETH, which can either be paid out or reinvested to compound over time.

2. Grayscale Ethereum Mini Trust ETF ($ETH)

The Grayscale Ethereum Mini Trust ($ETH) is a low-cost, passively managed fund solely invested in Ether, aiming to reflect Ether's value based on the CoinDesk Ether Price Index (ETX) Price.

ETH was spun off from the larger Grayscale Ethereum Trust ($ETHE) by distributing 10% of ETHE's ether to seed ETH – a mechanism that was designed to be a non-taxable event for existing ETHE shareholders.

At 0.15%, it offers one of the lowest fees and share prices among spot Ethereum funds in the U.S. The fund has attracted US$1.48B worth of inflows since launch, with its total assets now sitting at US$2.83B.

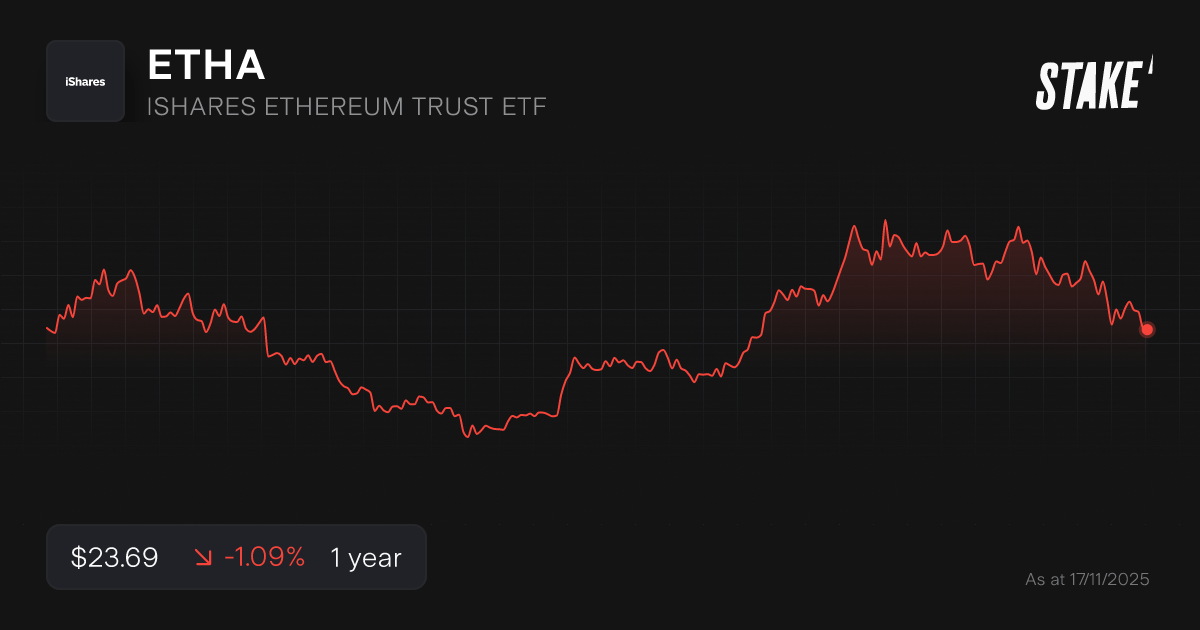

3. iShares Ethereum Trust ETF ($ETHA)

BlackRock’s iShares Ethereum Trust ETF ($ETHA) has quickly become a heavyweight in Ethereum investing. The fund is the largest spot ETH ETF in the U.S. with US$15.68B in assets under management and daily trading volume that’s typically ten times the second-most traded ETH ETF.

The fund has an expense ratio of 0.25% and uses the CME CF Ether-Dollar Reference Rate New York Variant benchmark.

BlackRock and Nasdaq have filed with the U.S. Securities and Exchange Commission (SEC) seeking approval to allow the fund to stake some or all of its Ether holdings. If approved, ETHA holders could benefit from additional yield (of about 3% annually at current network rates) beyond ETH’s price performance.

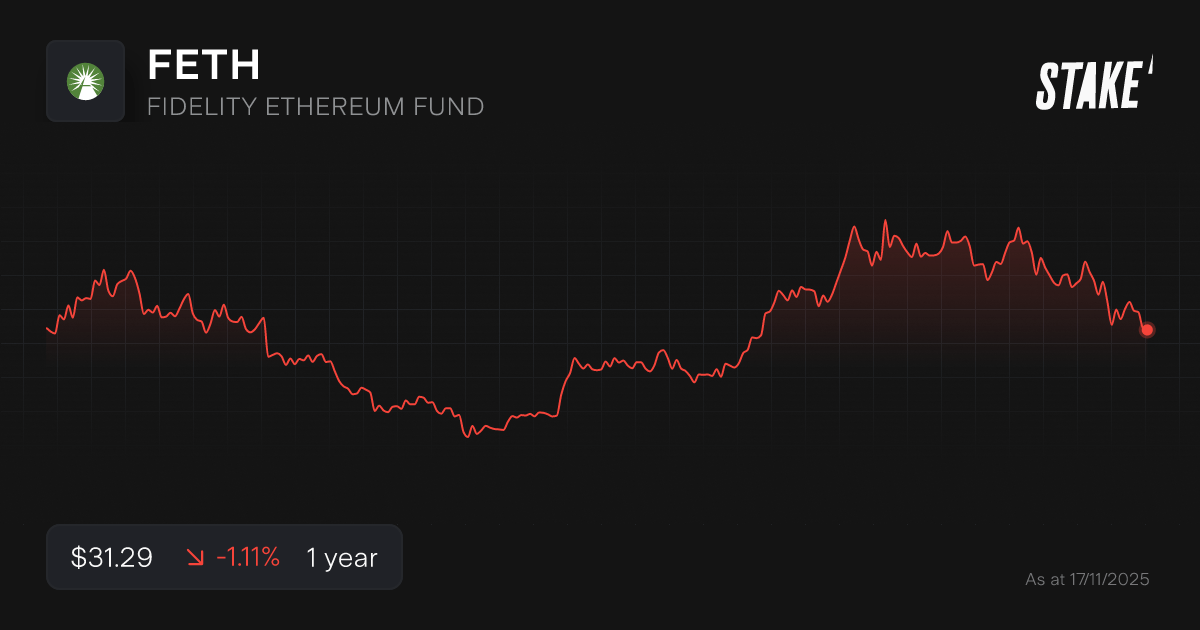

4. Fidelity Ethereum Fund ($FETH)

The Fidelity Ethereum Fund ($FETH) is a spot exchange-traded product measured by the performance of the Fidelity Ethereum Reference Rate. The fund is the third-largest by assets under management which currently sit at US$2.97B.

$FETH has an expense ratio of 0.25% and does not intend to include staking as part of its offering.

Investors that choose FETH typically do so for the straightforward exposure to ETH with operational security and convenience provided by Fidelity's institutional-grade custody. Unlike other funds that use third-party custody services, Fidelity Digital Asset Services hold FETH's ether.

5. Bitwise Ethereum ETF ($ETHW)

The Bitwise Ethereum ETF ($ETHW) is the fifth-largest U.S. spot ETH ETF with US$360M in assets under management. Bitwise is a leading crypto asset manager known for scale and specialist expertise, catering to institutional, wealth management, and individual investors.

ETHW has a management fee of 0.20% but is best known for donating a portion of its profits from the Ethereum blockchain’s core development, supporting network security and innovation. Investors in the fund tend to consider their investments a contribution to Ethereum’s future.

The fund uses the CME CF Ether-Dollar Reference Rate - New York Variant index returns. ETHW’s ether tokens are held in custody by Coinbase, while the Bank of New York Mellon acts as the fund's administrator and KPMG functions as the auditor.

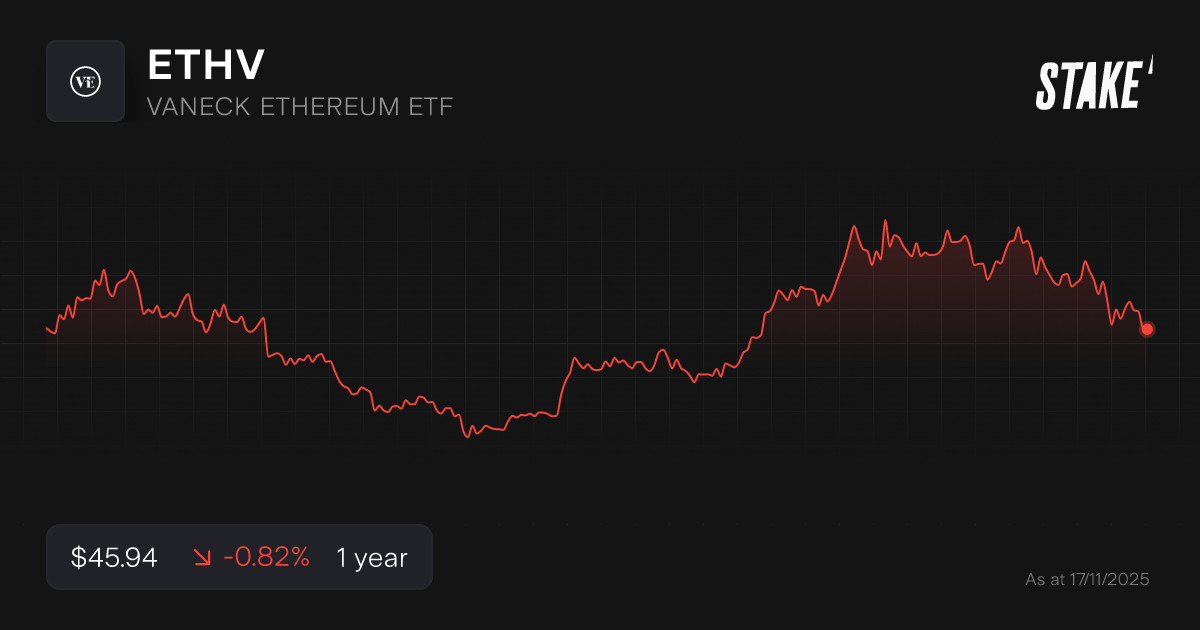

6. VanEck Ethereum ETF ($ETHV)

The VanEck Ethereum ETF ($ETHV) offers convenient exposure to Ethereum. The fund has around US$197M in assets under management with an expense ratio of 0.20%.

It mirrors the price performance of ether (ETH) and tracks the MVIS CryptoCompare Ethereum Benchmark Rate Index.

While shares are physically backed by ETH, VanEck emphasises on security. All ETH holdings are kept in cold storage at a qualified custodian. Cold storage means ether is kept offline, substantially lowering risk from hacking and digital theft.

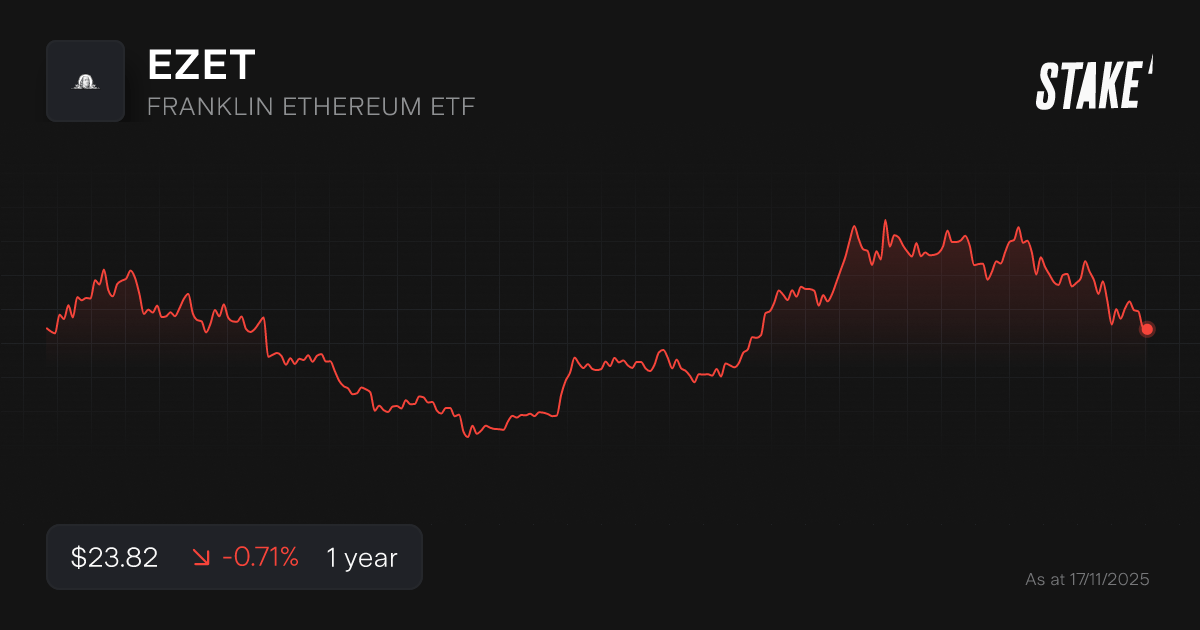

7. Franklin Ethereum ETF ($EZET)

The Franklin Ethereum ETF ($EZET) is Franklin Templeton's Ethereum-focused ETF. The fund has an expense ratio of 0.19% with US$65M in assets under management.

$EZET uses the same benchmark as ETHA, CETH and ETHW – the CME CF Ether-Dollar Reference Rate NY Variant. The fund uses Coinbase as its ether custodian and is backed by Franklin Templeton’s long-standing investment expertise spanning over 75 years.

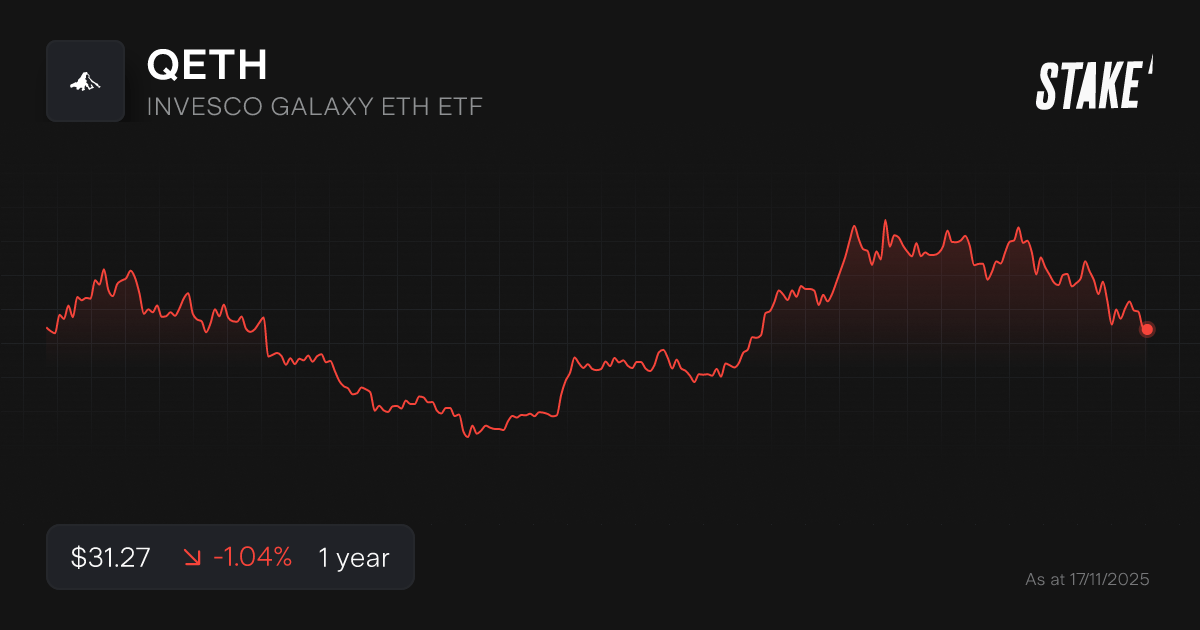

8. Invesco Galaxy Ethereum ETF ($QETH)

The Invesco Galaxy Ethereum ETF ($QETH) is an Ethereum-based ETF born through a partnership between Invesco and Galaxy Asset Management. The fund has a 0.25% expense ratio with US24.42M in assets under management.

The fund tracks the spot price of Ether using Lukka Prime Ethereum Reference Rate. Traded on the Cboe BZX exchange, it offers investors a streamlined way to gain exposure to Ethereum’s price movements, less fees and liabilities.

9. 21Shares Ethereum ETF ($TETH)

The 21Shares Ethereum ETF ($TETH) is an Ethereum-focused exchange-traded fund issued by 21Shares, which manages over US$11B in assets across around 55 listed crypto products globally.The fund has an expense ratio of 0.21% with US29M in assets under management.

The ETF tracks the CME CF Ether-Dollar Reference Rate, reflecting ether's price performance adjusted for the fund’s expenses and liabilities while also including staking rewards.

The fund’s assets are held in cold storage by a leading crypto custodian, providing enhanced security compared to typical digital asset holdings.

Ethereum ETFs listed on the ASX

For ASX investors, there are now ways to gain exposure to Ethereum via exchange-traded funds listed on Aussie markets.

ETF Name | Ticker | Share Price | Expense Ratio |

Global X 21Shares Ethereum ETF | A$5.09 | 0.59% | |

Betashares Ethereum ETF | A$34.40 | 0.99% | |

Monochrome Ethereum ETF | A$37.24 | 0.25% |

Data as of 14 November 2025.

Ethereum strategy ETFs

ETF Name | Ticker | Share Price | Expense Ratio |

ProShares Bitcoin & Ether Equal Weight ETF | US$58.51 | 0.95% | |

CoinShares Bitcoin and Ether ETF | US$13.92 | 1.25% |

Should I invest in Ethereum or Ethereum ETFs?

Before diving in, make sure you understand both Ethereum as an asset and how ETFs that track it actually work – and how they align with your risk tolerance, preferences and long-term goals.

Ethereum is a high-volatility asset, capable of sharp swings in either direction. Add in shifting regulations, and it’s clear this isn’t a set-and-forget investment.

If you want direct exposure, full control, and don’t mind volatility or managing wallets, investing in Ethereum itself might fit your style. If you prefer simplicity, regulation, and the convenience of a traditional brokerage account, Ethereum ETFs give you crypto exposure without the technical headaches.

See below for the pros and cons of each investment product.

Investing in Ethereum

Pros | Cons |

|

|

|

|

|

|

|

|

Investing in Ethereum ETFs

Pros | Cons |

|

|

|

|

|

|

|

|

Ethereum ETF FAQs

Ethereum ETFs provide a simple, accessible gateway into the crypto market, without the chaos of managing wallets or navigating extreme volatility.

Spot ETFs let investors tap into Ethereum’s growth using the same familiar tools they use for stocks and bonds. They’re ideal for investors who want crypto’s upside but prefer the structure and safety of traditional investment platforms.

But ETFs aren’t without drawbacks. Management fees can chip away at returns and structural limitations may lead to tracking errors that prevent the fund from perfectly mirroring Ethereum’s price.

And while ETFs soften some of crypto’s rough edges, Ethereum’s inherent volatility still flows through – just one step removed.

The largest Ethereum ETF by assets under management is the iShares Ethereum Trust ETF ($ETHA) with approximately US$15.68B in assets as of November 2025.

Disclaimer

The information contained above is not financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up, and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of a general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and are not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Samy is a markets analyst at Stake, with seven years of experience in the world of investing, working across roles in private banking, venture capital and financial media. She has a Master’s degree in Finance and Data Analytics from The University of Sydney Business School.