Are these the best emerging markets ETFs on the ASX? [2025]

Investing in emerging markets can offer access to dynamic and fast-growing economies in the developing world. While emerging markets aren’t without risk, they can be a valuable source of diversification and offer growth potential.

List of emerging markets exchange-traded funds to watch

ETF Name | Ticker | Share Price | 1YR Return | AUM | Expense Ratio |

|---|---|---|---|---|---|

Vanguard FTSE Emerging Markets Shares ETF | $83.52 | +13.91% | $1.3B | 0.48% | |

iShares MSCI Emerging Markets ETF | $74.15 | +14.38% | $1.1B | 0.69% | |

iShares China Large-Cap ETF | $54.78 | +37.22% | $388.8M | 0.60% | |

VanEck MSCI Multifactor Emerging Markets Equity ETF | $28.46 | +14.30% | $237.0M | 0.69% | |

BetaShares India Quality ETF | $12.08 | +0.58% | $232.6M | 0.80% | |

Fidelity Global Emerging Markets Active ETF | $6.50 | +12.26% | $179.8M | 1.00% | |

VanEck Vectors Emerging Income Opportunities Active ETF | $10.63 | +6.09% | $171.1M | 0.95% | |

iShares MSCI Emerging Markets ex China ETF | $29.16 | +9.74% | $156.2M | 0.25% | |

iShares J.P.Morgan USD Emerging Markets Bond (AUD Hedged) ETF | $75.40 | +2.54% | $53.1M | 0.51% | |

SPDR S&P Emerging Markets Carbon Aware ETF | $27.00 | +17.29% | $25.2M | 0.35% |

Price and return data as of 3 July 2025. Expense and AUM data as of 30 May 2025 Source: Stake, ASX.

*The list of funds mentioned is ranked by assets under management (AUM). When deciding what funds to feature, we analyse the financials, recent news, liquidity and volume, and whether or not they are actively traded on Stake.

Top 10 ASX emerging markets ETFs

1. Vanguard FTSE Emerging Markets Shares ETF ($VGE)

The Vanguard FTSE Emerging Markets Shares ETF is the most popular emerging markets ETF listed on the ASX. Tracking the performance of over 5,000 holdings, VGE offers broad exposure to countries like China, India, and Taiwan. With an expense ratio of just 0.48%, this fund is also one of the lowest-cost options on the list.

VGE’s top holdings include global firms like TSMC ($TSM), Tencent ($TCEHY), and Alibaba ($BABA).

Overall, the fund could be a strong choice for investors seeking efficient and diversified access to emerging markets. VGE is most comparable to IEM, although the two funds have slightly different focuses.

💡 Related: 10 Asia ETFs to Watch

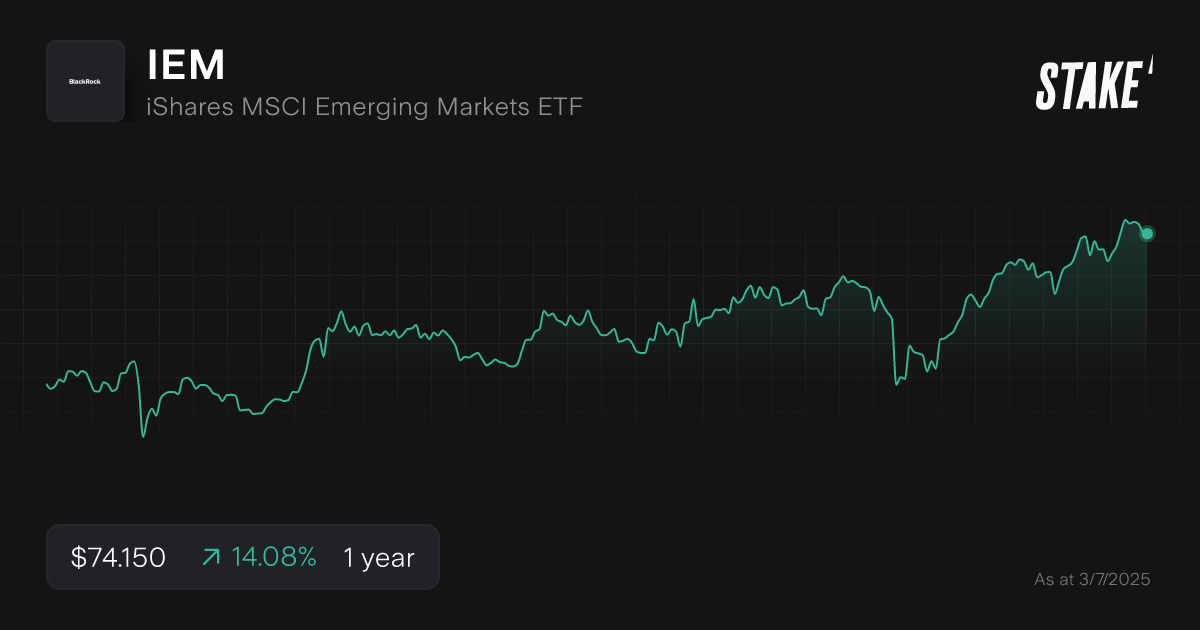

2. iShares MSCI Emerging Markets ETF ($IEM)

The iShares MSCI Emerging Markets Index is the second-largest emerging markets ETF on the ASX.

Like VGE, IEM’s top three countries by equity exposure are China, India, and Taiwan. Notably, IEM also includes roughly 10% exposure to South Korea, which is not considered an emerging market by all index providers.

IEM’s top holdings are TSMC, Tencent, and Alibaba, followed closely by Samsung. The fund has exposure to over 800 underlying emerging market stocks, but features a slightly higher expense ratio than VGE.

🆚 Compare ETFs in our comparison tool: IEM vs VGE→

3. iShares China Large-Cap ETF ($IZZ)

The iShares China Large-Cap ETF’s underlying index consists of the 50 largest Chinese firms by market cap and liquidity trading on the Hong Kong Stock Exchange. Historically, Hong Kong has been a base for international fundraising for growing Chinese firms. While IZZ is more geographically concentrated than most emerging market ETFs, it could be a compelling choice for investors seeking exposure to the world’s second-largest economy.

The fund’s top holdings are Tencent, Alibaba, and Xiaomi Corp. As the Chinese economy has recovered this year, IZZ has soared, notching the highest one-year returns of any ETF on the list. For investors seeking exposure to a broader range of Chinese firms, the VanEck China New Economy ETF ($CNEW) is also worth considering. Investors can explore other Chinese ETFs if they want more narrow exposure to this market.

4. VanEck MSCI Multifactor Emerging Markets Equity ETF ($EMKT)

The Vaneck MSCI Multifactor Emerging Markets Equity ETF holds a portfolio of publicly traded securities from emerging markets. The underlying index is based on a factor investing framework, which selects companies based on traits like value, momentum, quality, and size. While EMKT is not an actively managed fund, this approach may help exclude emerging market firms with undesirable investment criteria.

EMKT’s largest holdings are TSMC, SK Hynix, and Tencent. The fund’s largest geographic exposures are to China, India, and Taiwan. With 228 underlying holdings and a competitive 0.69% expense ratio, EMKT could be a strong choice for investors who prefer a more targeted approach to emerging markets.

5. BetaShares India Quality ETF ($IIND)

Like $IZZ, IIND offers focused exposure to a specific emerging market: India. The BetaShares India Quality ETF provides access to 30 firms selected on the basis of several factors, including profitability, leverage, and earnings. The Indian economy has been one of the world’s fastest-growing in recent years, notching at least 7% growth every year from 2021 to 2024.

IIND’s top holdings are Infosys ($INFY), ICICI Bank ($IBN), and Kotak Mahindra Bank. The ETF could be a good option for investors seeking exposure to India’s growth with a factor investing overlay. Another option to consider is the Global X India Nifty 50 ETF ($NDIA), which gives access to the 50 largest businesses by market cap in India.

6. Fidelity Global Emerging Markets Active ETF ($FEMX)

Unlike other ETFs on the list, FEMX is an actively managed fund, meaning that portfolio managers do not seek to track an index. Instead, managers select firms that they believe have a good track record of corporate governance and are positioned to deliver returns across market cycles. Typically, FEMX holds a portfolio of roughly 30 to 50 emerging market securities.

With an expense ratio of 1.00%, FEMX fees are more expensive than index funds. The fund’s top holdings are currently TSMC, HDFC Bank ($HDB), and Naspers ($NPSNY). Although FEMX underperformed many emerging market index funds over the past year, the ETF is worth considering for investors who believe in the value of active equity research in developing countries.

7. VanEck Vectors Emerging Income Opportunities Active ETF ($EBND)

Like FEMX, EBND is an actively managed fund. However, EBND differs from most emerging market ETFs by investing in bonds, rather than equities. Specifically, this VanEck fund invests largely in government bonds, along with smaller holdings of emerging market corporate bonds.

Developing country government bonds come with unique risks, but they also tend to have a higher yield than advanced economies. With a running yield of 6.42% as of June 2025, EBND could be a compelling choice for investors seeking international income generation. Currently, EBND’s largest holdings are government bonds of Poland, Indonesia, and China.

8. iShares MSCI Emerging Markets ex China ETF ($EMXC)

While funds like IZZ target Chinese stocks exclusively, EMXC takes precisely the opposite approach. This iShares fund invests in emerging market equities outside of China, with top holdings of TSMC, Samsung, and HDFC Bank. EMXC also features the lowest expense ratio on the list at just 0.25%.

There are several reasons that investors may prefer not to invest in China, including a lack of transparent economic information and unique geopolitical risks. Overall, EMXC could be a good choice for these investors, especially considering the fund’s low expense ratio. Notably, the fund excludes small-cap firms, which can be more volatile than mid and large-cap peers.

9. iShares J.P.Morgan USD Emerging Markets Bond (AUD Hedged) ETF ($IHEB)

IHEB is another emerging market bond ETF focused on government bonds. The fund’s strategy provides exposure to U.S. dollar-denominated bonds, although the fund then hedges these positions into Australian dollars. This approach helps minimise foreign exchange risk compared to unhedged competitors like EBND.

The fund’s largest holdings are currently sovereign bonds of Turkey, Saudi Arabia, and Brazil. IHEB is notable for its strong geographic diversification, with no country currently comprising more than 7% of the fund’s capital. IHEB also features holdings with relatively strong credit ratings, with 52% of the fund currently in investment-grade assets.

10. SPDR S&P Emerging Markets Carbon Aware ETF ($WEMG)

Emerging markets are often industrialising nations, companies from these countries can have greater carbon emissions than developing nations. WEMG is designed to navigate that consideration for environmentally focused investors, seeking to minimise the average carbon intensity of the fund’s portfolio. Over the past year, this climate-sensitive approach has paid off for investors, with WEMG posting the second-highest total return on the list.

Currently, WEMG’s top holdings are TSMC, Alibaba, and NetEase ($NTES). Due to the fund’s approach, investors should be aware that WEMG typically features high exposure to the technology and financial sectors. This State Street ETF is worth considering for emerging market investors concerned about the emissions impact of their portfolio.

How to invest in emerging markets ETFs?

The main way of investing in emerging markets funds is using an online investment platform. Follow our step by step guide below:

1. Find a stock investing platform

To buy emerging markets ETFs on the Australian Securities Exchange (ASX), you'll need to sign up to an investing platform with access to the Aussie stock market. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for the ETF name

Find the ETF by name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own the ETF, you should monitor its performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

What is the best-performing emerging markets ETF in Australia?

$IZZ has been the best-performing emerging market ETF on the ASX over the past 12 months. This fund exclusively tracks shares of Chinese companies trading on the Hong Kong Stock Exchange. As fears of an economic slowdown and protracted trade war have faded, Chinese markets have come roaring back, with IZZ shares posting a 37.22% one-year performance.

What are the benefits of investing in emerging markets?

The main benefit of investing in emerging markets is that these countries tend to experience faster growth rates than advanced economies.

In the recent years, the economies of China and India have grown much quicker than regions like the U.S. and Europe. This higher growth is often associated with strong equity performance for emerging market companies.

However, emerging markets are not without risks. These countries can sometimes be more exposed to periods of higher interest rates or currency volatility, not to mention fiscal or government instability. Depending on an investor’s risk tolerance, investing in emerging market ETFs can be a valuable source of diversification and potential appreciation.

More resources:

✅ Are these the best ETFs to invest in?→

✅ List of high dividend ETFs available in Australia→

✅ Which Vanguard ETFs to buy?→

Emerging markets ETFs FAQs

While there is no universal definition of an emerging market, this term generally refers to fast-growing industrialising nations that do not yet meet all the characteristics of a developed nation. Due to the flexibility of that definition, there is often disagreement over whether certain countries should be considered emerging.

For instance, some index providers include nations like South Korea and Poland, while others do not.

Investing in an emerging market ETF can be a valuable source of international diversification. Many global ETFs are focused on developed markets. However, these markets can also be more exposed to instability and geopolitical tensions. Whether emerging market ETFs are a good investment ultimately depends on your financial goals and risk tolerance.

Investing in emerging markets is generally considered riskier than investing in developed markets. These countries often feature less political stability, greater capacity for financial crises, and more exposure to currency trends, interest rate volatility, and geopolitical tension.

At the same time, investing in emerging market funds can offer diversification benefits that cannot be found by focusing solely on developed nations.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.