What are the best Chinese ETFs to invest in? [2025]

China is the world’s second largest equity market after Wall Street. Chinese ETFs offer access to AI, electric vehicles, renewable energy and more.

Check out this list of Chinese ETFs available on Stake

Company Name | Ticker | Share Price | 1Y Return | AUM | Expense Ratio |

|---|---|---|---|---|---|

KraneShares CSI China Internet ETF | US$35.04 | 30.55% | US$8.30b | 0.7% | |

iShares China Large-Cap ETF | US$35.84 | 46.89% | US$7.56b | 0.74% | |

iShares MSCI China ETF | US$54.57 | 35.14% | US$6.33b | 0.59% | |

Xtrackers Harvest CSI 300 China A-Shares ETF | US$26.62 | 8.52% | US$2.65b | 0.65% | |

Invesco China Technology ETF | US$44.50 | 36.21% | US$1.08b | 0.65% | |

SPDR S&P China ETF | US$86.25 | 28.90% | US$474.99m | 0.59% | |

WisdomTree China ex-State Owned Enterprises Fund | US$34.14 | 27.29% | US$432.11m | 0.32% | |

Franklin FTSE China ETF | US$21.42 | 34.13% | US$176.62m | 0.19% | |

KraneShares Hang Seng Tech Index ETF | US$16.18 | 45.16% | US$47.53m | 0.69% | |

Matthews China Active ETF | US$24.48 | 28.09% | US$37.06m | 0.79% |

Data as of 28 March 2025. Source: Stake, Google Finance.

*The list of ETFs mentioned is ranked by assets under management. When deciding what funds to feature, we analyse the financials, recent news, liquidity and volume, and whether or not they are actively traded on Stake.

Decide which China ETFs to add to your watchlist

1. KraneShares CSI China Internet ETF ($KWEB)

The KraneShares CSI China Internet ETF provides access to Chinese internet companies and tracks the CSI Overseas China Internet Index. Its top 5 holdings include Alibaba ($BABA), Tencent ($TCEHY), PDD ($PDD), Meituan and Kanzhun ($BZ). The ETF can buy shares listed on either the Hong Kong Stock Exchange, Nasdaq or NYSE.

$KWEB is up 30.55% over the past year but has delivered an average annual return of -4.69% over the 5 years to 28 February 2025. Its annual operating expense is 0.7%.

The ETF would suit investors with a higher risk tolerance as it tends to have greater volatility than broader categories or developed market investments.

🆚 Compare KWEB vs FXI→

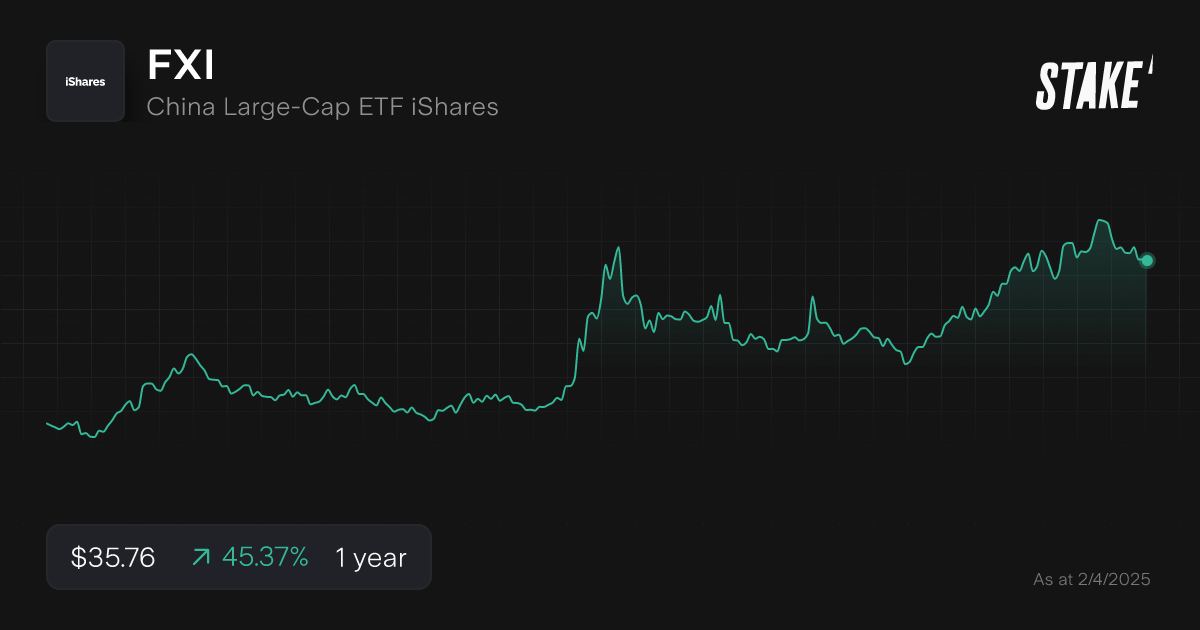

2. iShares China Large-Cap ETF ($FXI)

The iShares China Large-Cap ETF provides access to 50 of the largest and most actively traded Chinese companies on the Hong Kong Stock Exchange. It tracks the FTSE China 50 Index. Its top 5 holdings include Tencent, Alibaba, Xiaomi, Meituan and China Construction Bank ($CICHY).

$FXI is up 46.89% over the past year but delivered an average annual return of -0.62% over the 5 years to 28 February 2025. Its expense ratio is 0.74%.

$FXI is a popular option to gain access to large Chinese equities, though it is heavily weighted to tech and consumer discretionary stocks. Other ETFs on this list provide more diversification.

3. iShares MSCI China ETF ($MCHI)

The iShares MSCI China ETF seeks to track the investment results of the MSCI China Index. The index tracks large and mid-sized Chinese equities across A shares (shares listed in Shanghai and Shenzhen), H shares (stocks of mainland Chinese companies listed in Hong Kong) and ADRs. The ETF’s top 5 holdings include Tencent, Alibaba, Xiaomi, Meituan and PDD.

$MCH is up 35.14% over one year but has delivered an average annual return of -0.95% over the 5 years to 28 February 2025. It has an annual expense ratio of 0.59%.

While the ETF tracks a benchmark commonly followed by fund managers, retail investors need to be aware that its top 2 holdings – Tencent and Alibaba - have a combined 27% weighting.

🆚 Compare MCHI vs CQQQ→

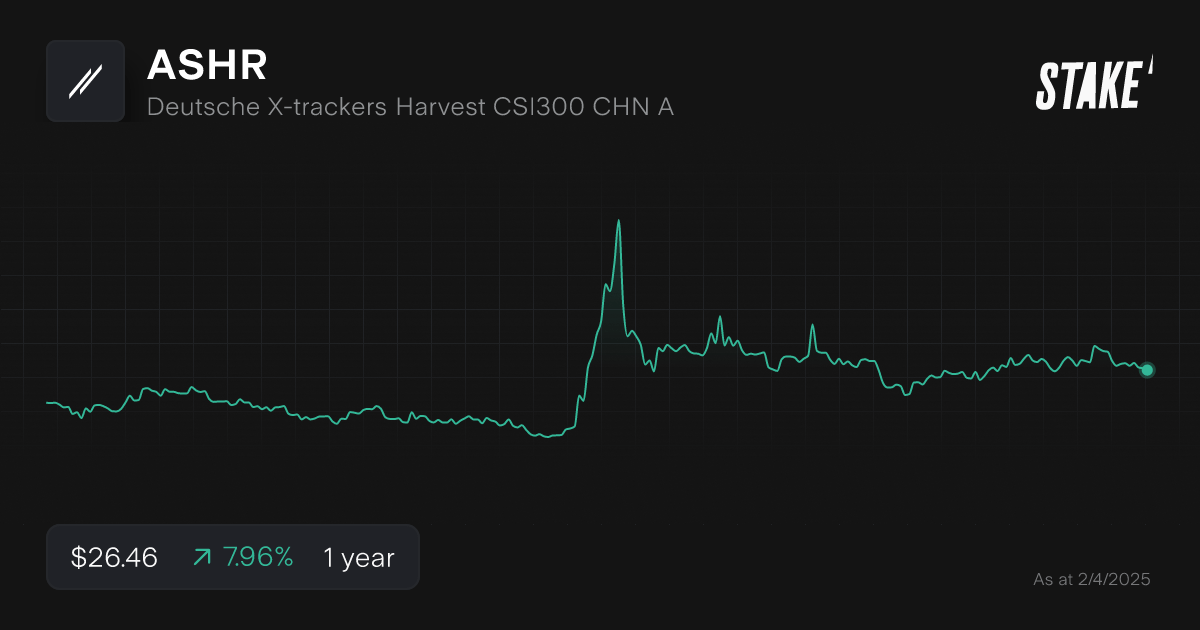

4. Xtrackers Harvest CSI 300 China A-Shares ETF ($ASHR)

The Xtrackers Harvest CSI 300 China A-Shares ETF tracks the CSI 300 Index, which is composed of the 300 large- and mid-cap China A-Share stocks listed on the Shenzhen or Shanghai Stock Exchange. The ETF’s top 5 holdings include Kweichouw Moutai, Contemporary Amperex Technology (CATL), China Merchants Bank, Ping An Insurance ($PNGAY) and Midea.

$ASHR is up 8.52% over the past and has delivered an average annualised return of -0.95% over the 5 years to 28 February 2025. Its expense ratio is 0.65%.

The ETF may appeal to investors looking for a diverse portfolio of Chinese stocks across a range of industries, rather than a heavy weighting towards big internet names like some China ETFs options.

5. Invesco China Technology ETF ($CQQQ)

The Invesco China Technology ETF tracks the FTSE China Incl A 25% Technology Capped Index. This index caps the weights of China’s large tech stocks to limit the overconcentration in some large-cap names seen in other ETFs. The ETFs top holdings include Tencent, Meituan, PDD, Baidu and Kuaishou Technology.

$CQQQ is up 36.21% over the past year, but has returned an average return of -2.95% over the 5 years to 28 February 2025. Its expense ratio is 0.65%.

The ETF may appeal to investors looking for access to China tech stocks without overexposure to one or two particular stocks.

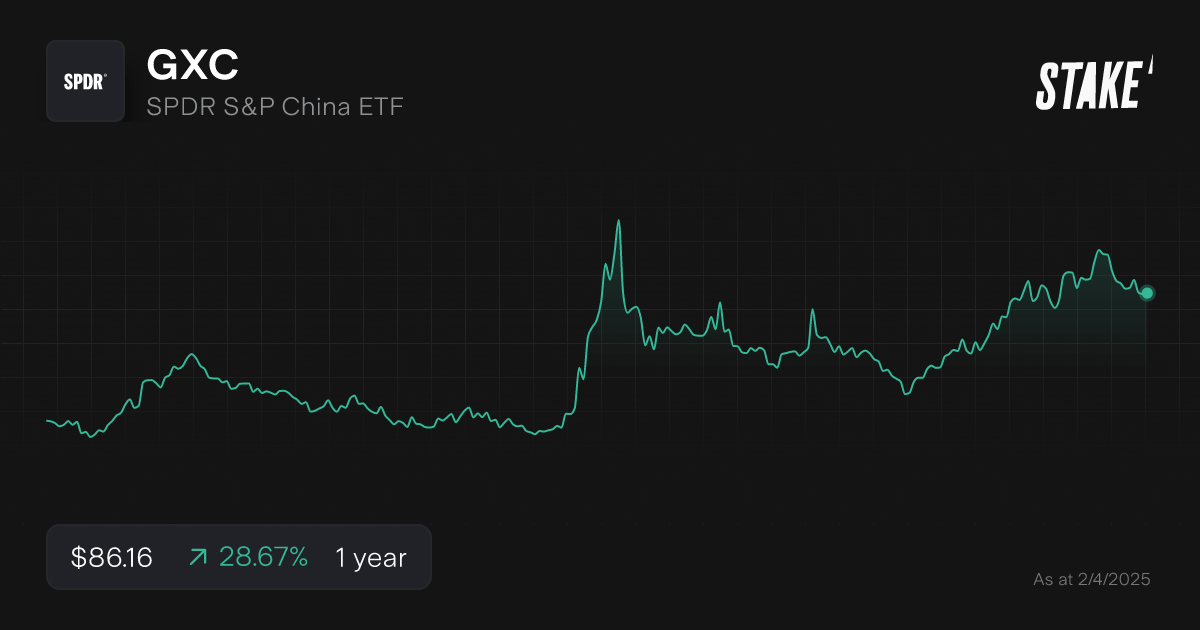

6. SPDR S&P China ETF ($GXC)

State Street’s SPDR S&P China ETF tracks the S&P China Broad Market Index. The BMI is a float-adjusted market capitalisation-weighted index designed to define and measure the investable universe of publicly traded companies domiciled in China available to foreign investors. The ETFs top holdings include Tencent, Alibaba, Meituan, Xiaomi and PDD.

$GXC is up 28.90% over the past year and has returned an average of -0.79% over the 5 years to 28 February 2025. Its expense ratio is 0.59%.

While offering exposure to big Chinese companies, its top two holdings account for 20% of the fund. Investors may want to consider whether this offers enough diversification.

7. WisdomTree China ex-State Owned Enterprises Fund ($CXSE)

The WisdomTree China ex-State Owned Enterprises Fund tracks the WisdomTree China ex-State-Owned Enterprises Index, which measures the performance of Chinese stocks that are not state-owned enterprises. State owned enterprises (SOEs) are defined as government ownership of more than 20% of outstanding shares of companies. Top holdings include Tencent, Alibaba, Meituan, Contemporary Amperex Technology and PDD.

The ETF has gained 27.29% over the past year and returned an average of -3.00% a year over the 5 years to 28 February 2025. Its gross expense ratio is 0.32%.

The ETF’s weighting towards Chinese tech stocks will suit growth focused investors.

8. Franklin FTSE China ETF ($FLCH)

The Franklin FTSE China ETF provides targeted exposure to large and mid-sized companies by tracking the China FTSE China Capped Index. The ETF’s biggest holdings include Tencent, Alibaba, Meituan, Xiaomi and PDD. Three of China’s biggest banks are also in the top 10 holdings.

The ETF has risen 27.29% over the past year and returned an average of -0.47% over the 5 years to 28 February 2025. Its expense ratio is 0.19%.

The fund offers investors diverse exposure to Chinese tech companies as well as large government-backed companies like banks.

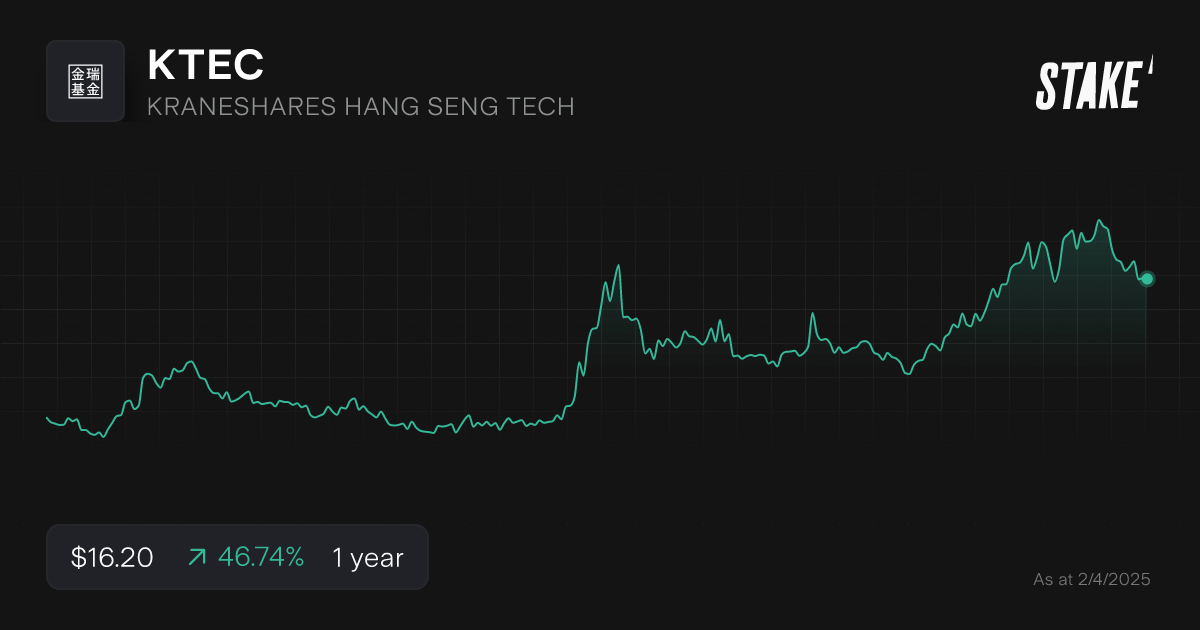

9. KraneShares Hang Seng Tech Index ETF ($KTEC)

The KraneShares Hang Seng Tech Index ETF seeks to track the performance of the Hang Seng TECH Index, which captures the 30 largest companies in Hong Kong's rapidly growing technology sector. The ETF’s top holdings include Tencet, JD.com, Alibaba, Xiaomi and Meituan. Automakers Xpeng ($XPEV) and Li Auto ($LI) are also in the top 10.

$KTEC has risen 34.13% over the past year and delivered an average annual return of -9.93% since its inception in 2021. Its operating expense is 0.69%.

The ETF offers growth oriented investors exposure to Chinese internet companies and emerging Chinese EV makers.

10. Matthews China Active ETF ($MCH)

The Matthews China Active ETF offers a high conviction equity portfolio invested in companies benefiting from China’s domestic consumption. It invests in companies of all sizes based on proprietary research. It combines long-term core holdings with more opportunistic ideas to provide consistency through cycles. Its top holdings include Tencent, Alibaba, JD.com, Meituan and PDD. Other top 10 stocks include China Construction Bank and Ping An Insurance.

$MCH is up 28.09% over the past year and has returned an average of -0.15% since inception in 2022. Its expense ratio is 0.79%.

The ETF offers investors an actively managed portfolio of Chinese stocks that includes faster-growing big tech and more stable earnings from large financial stocks.

How to invest in China ETFs in Australia?

Investing in China ETFs is easy if you have a brokerage account that offers access to U.S. and Australian stocks. There are plenty of tools that provide basic information on U.S.-listed China ETFs. Consider your investment objectives and risk appetite. Follow our step-by-step guide below:

1. Find a stock investing platform

To invest in China ETFs, you’ll first need to find an investing platform that offers access to exchanges like the NYSE, Nasdaq and the ASX. There are several share investing platforms available, of which Stake is one.

Join 750K investors

Get a full U.S. share when you fund Stake Wall St or A$10 trading credit when you fund Stake AUS. Fund both, get both. T&Cs apply.

2. Fund your account

Next, open an account by completing an application with your personal and financial details. You’ll then need to fund your account with a bank transfer, debit card, or even Apple/Google Pay.

3. Search for the fund

Find the ETF by name or ticker symbol. Always conduct your own research to ensure that the investment is suited to your risk tolerance and financial goals.

4. Set a market or limit order and buy the shares

You can buy stock almost instantly at the current price by using a market order during the trading day. Alternatively, enter a limit order to purchase your stock when it reaches a specific price. Consider dollar cost averaging to spread out your risk, which involves buying at consistent intervals.

5. Monitor your investment

Once you own the stock, monitor its performance over time. Check your portfolio regularly to ensure that your investment remains aligned with your financial goals.

What ASX Chinese ETFs can I invest in?

There are a handful of choices for investors seeking China exposure via the ASX.

- BlackRock’s iShares China Large-Cap ETF ($IZZ) tracks the FTSE China 50 Index, which measures the performance of 50 of the largest and most liquid Chinese companies that trade on the Hong Kong Stock Exchange. Its management fee is 0.60%.

- VanEck’s China New Economy ETF ($CNEW) offers a portfolio of China A-shares in sectors like technology, health care, consumer staples and consumer discretionary. It has a management fee of 0.95%.

- VanEck’s FTSE China A50 ETF ($CETF) offers dedicated exposure to China A-shares, or those listed in Shenzhen or Shanghai. It is focused on the 50 largest companies in the mainland China markets. Its management fee is 0.60%.

Is it a good time to invest in the Chinese stock market?

Chinese stocks have rebounded from their September lows as the government has unveiled measures to support growth in the world’s second-largest economy.

A property slump has weighed heavily on the economy, especially consumer spending. The government committed to growth of 'around 5%' this year at the National People’s Congress in March. The budget deficit will rise to 4% of GDP this year. An issue for investors will be how U.S. tariffs affect China’s export growth.

China continues to expand its capabilities in advanced manufacturing, namely electric vehicles, batteries, renewable energy and industrial robots. Chinese tech companies have shown they continue to innovate in key areas like AI despite measures to restrict their access to advanced chips. DeepSeek showed Chinese companies can build language models cheaply.

Chinese ETFs FAQs

China has three stock markets based in Shanghai, Shenzhen and Hong Kong. A closely watched benchmark for mainland A-share stocks is the CSI 300 Index, which tracks the top 300 stocks in Shanghai and Shenzhen. The Hang Seng Index tracks the largest and most liquid stocks traded on the Hong Kong Stock Exchange.

The CSI 300 Index and Hang Seng Index are commonly used to track the performance of China’s market. Foreign fund managers closely track indices like the MSCI China Index and the FTSE China A50 Index as they provide a guide to the largest and most liquid stocks for foreign investors.

This article was written by Robert Guy - Senior Markets Writer at Stake.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.