Magnificent 7 stocks: Still worth your investment in 2025?

The Magnificent 7 stocks still offer promising long-term potential, but investors may need patience amid volatile markets.

What are the 'Magnificent 7' stocks?

The ‘Magnificent 7' refers to the dominant U.S. tech companies that are responsible for some of the most innovative products and platforms used around the world today. They are mega-cap stocks that dominate leading indices like the S&P 500 Index and the Nasdaq 100 Index. They are some of the most widely held stocks globally by fund managers and retail investors.

- $AAPL (Apple)

- $MSFT (Microsoft)

- $GOOGL (Alphabet)

- $AMZN (Amazon)

- $NVDA (Nvidia)

- $TSLA (Tesla)

- $META (Meta Platforms)

Alphabet (through Google and YouTube), Meta Platforms (through Instagram and Facebook), and Amazon are the three biggest digital advertising platforms in the world. Amazon, Microsoft and Alphabet are global leaders in hyperscale cloud infrastructure.

All tech companies are investing heavily in AI, with many relying on Nvidia’s world-leading chips to power their AI ambitions. Apple is a leader in smartphones, while Tesla is the leading electric vehicle maker by market capitalisation. But let's dive into each company and what they do a little more.

Closer look at the magnificent 7 companies

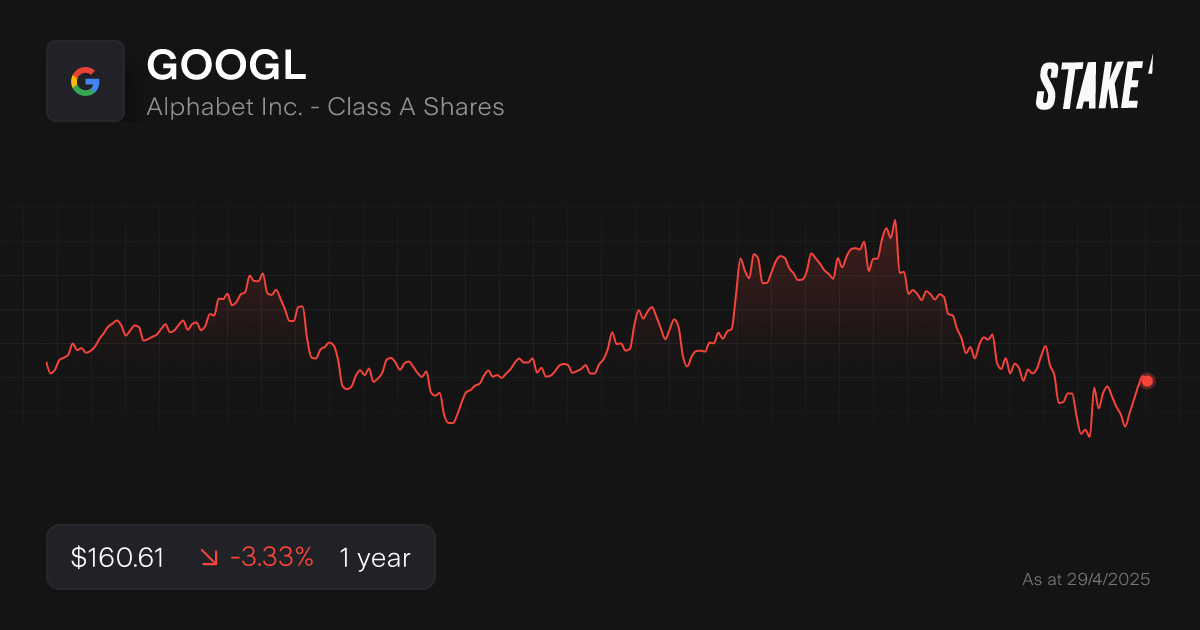

Alphabet ($GOOGL)

- What they do: Search, digital advertising, cloud, AI

- Key products: Google Search, YouTube, Android, Google Cloud

- What sets it apart: Alphabet doesn't just dominate search - it practically owns it. Advertising dollars from platforms like Google and YouTube drive massive profits, while it’s investing heavily in cloud computing and AI.

➡️ Related: How to buy Google shares in Australia

Amazon.com ($AMZN)

- What they do: E-commerce, cloud computing, digital advertising

- Key products: Amazon.com marketplace, Amazon Web Services (AWS), Prime

- Why it stands out: While Amazon is famous for fast deliveries, its AWS cloud business continues to grow strongly as AI drives demand for vital internet infrastructure.

➡️ Related: How to buy Amazon shares in Australia

Apple ($AAPL)

- What they do: Consumer tech, software, services

- Key products: iPhone, Mac, iPad, Apple Watch, App Store, iCloud

- Why it stands out: Apple's brand loyalty is unmatched. Its sleek, must-have devices dominate globally. Its services business provides another revenue engine that's less reliant on selling new gadgets.

➡️ Related: How to buy Apple shares in Australia

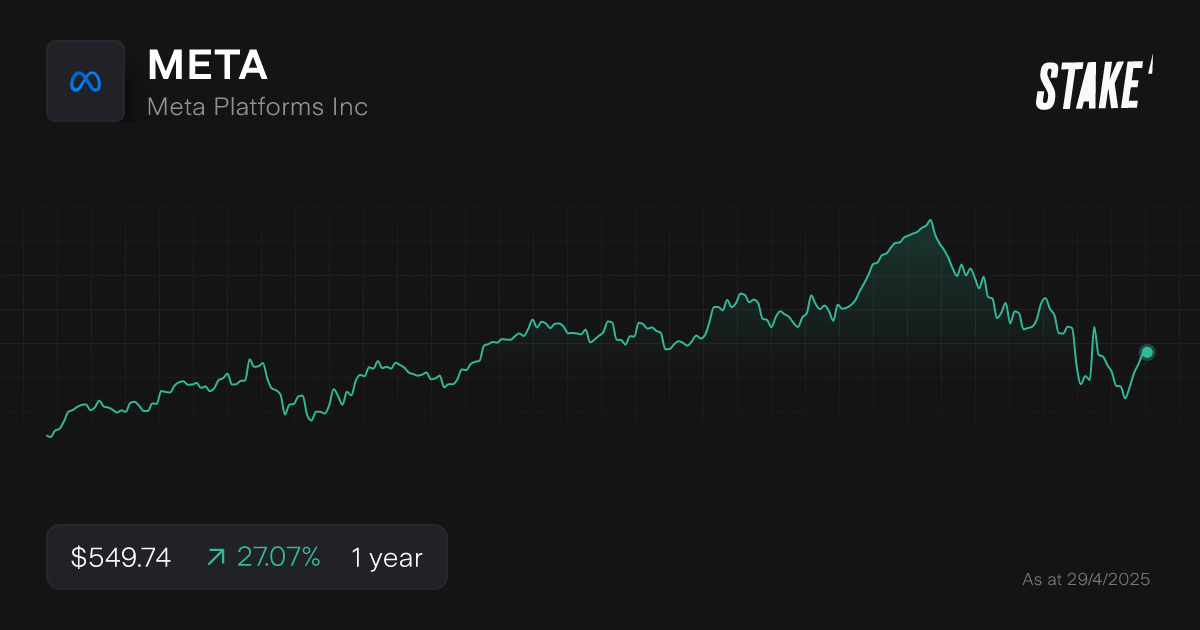

Meta Platforms ($META)

- What they do: Social media, virtual reality, AI

- Key products: Facebook, Instagram, WhatsApp, virtual reality

- Why it stands out: With billions of users checking in daily, Meta remains a giant in social media and digital ads. And while the Metaverse is still a work in progress, Meta is betting big on virtual and augmented reality as the next frontier of tech.

➡️ Related: How to buy Facebook shares in Australia

Microsoft ($MSFT)

- What they do: Software, cloud, artificial intelligence

- Key products: Windows, Azure cloud, LinkedIn, ChatGPT

- Why it stands out: Microsoft has evolved from its Windows roots into a cloud and AI powerhouse. Its pivot to enterprise cloud solutions has paid off and it is investing heavily in AI.

➡️ Related: How to buy Microsoft shares in Australia

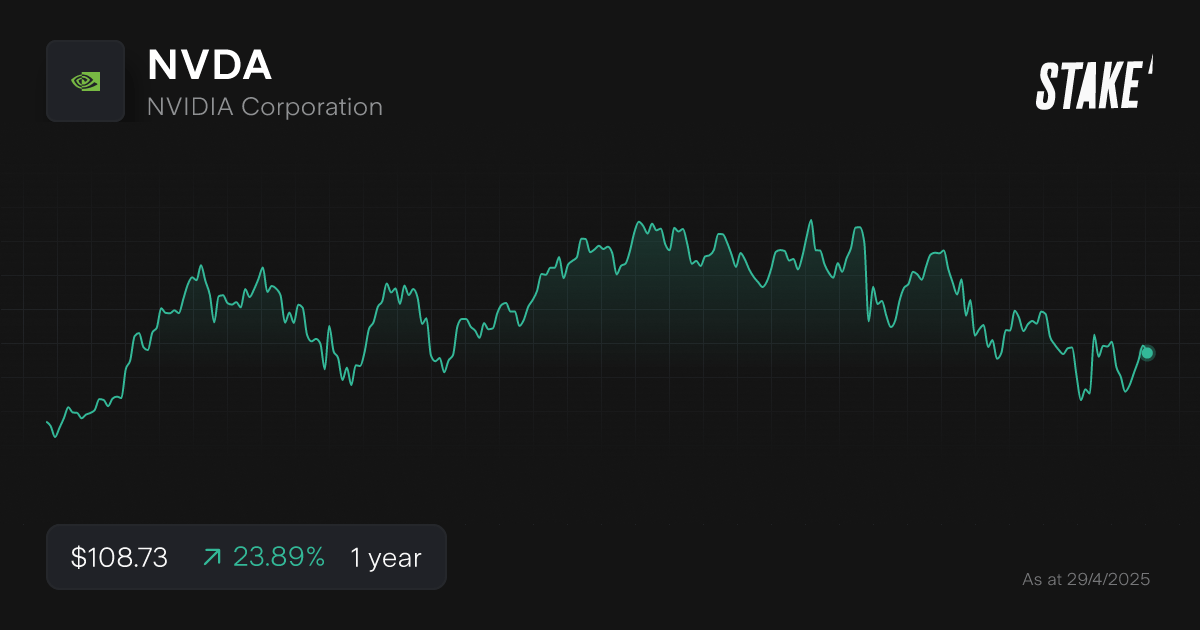

Nvidia ($NVDA)

- What they do: Semiconductors, artificial intelligence

- Key products: AI chips

- Why it stands out: Nvidia’s chips are the brains behind everything from video games to AI models. Nvidia’s graphics processing units (GPUs) are key to driving the AI ambitions of some of tech’s biggest names.

➡️ Related: How to buy Nvidia shares in Australia

Tesla ($TSLA)

- What they do: Electric vehicles, autonomous driving, renewable energy

- Key products: EVs, energy storage solutions, robotaxis

- Why it stands out: Tesla didn’t just make electric cars cool, it redefined what a car company could be. Growth will be driven by innovations in autonomous driving and renewable energy.

➡️ Related: How to buy Tesla shares in Australia

Magnificent 7 stocks performance

Many of the Magnificent 7 stocks have lost ground so far this year amid a selloff in U.S. markets caused by uncertainty over President Donald Trump’s tariffs and trade war. However, nearly all of the stocks have outperformed the S&P 500 Index over the past 5 years. That outperformance has been driven by faster than average earnings growth.

Name | 1 month (%) | 1 year (%) | 5 years (5) |

|---|---|---|---|

Alphabet | -0.14 | -2.41 | +148.14 |

Amazon | -6.14 | +4.44 | +65.35 |

Apple | -6.51 | +20.62 | +189.58 |

Meta Platform | -9.18 | +26.50 | +170.56 |

Microsoft | +0.33 | -2.59 | +124.47 |

Nvidia | -0.38 | +26.49 | +1,470.16 |

Tesla | +4.33 | +46.84 | +509.52 |

Data as at 25 April 2025.

How to buy Magnificent 7 stocks in Australia

Follow our step-by-step guide below to start investing in Magnificent 7 stocks or ETFs from within Australia:

1. Find a stock investing platform

To invest in Magnificent 7 stocks or ETFs, you’ll first need to find an investing platform that offers access to exchanges like the NYSE, Nasdaq and ASX. There are several share investing platforms available, of which Stake is one.

Get access to the MAG7 stocks

Sign up today and get a full U.S. share when you fund Stake Wall St or A$10 trading credit when you fund Stake AUS. T&Cs apply.

2. Fund your account

Next, open an account by completing an application with your personal and financial details. You’ll then need to fund your account with a bank transfer, debit card, or Apple/Google Pay.

3. Search for the stock or ETF

Find the stock or ETF name or ticker symbol. Always conduct your own research to ensure that the investment is suited to your risk tolerance and financial goals.

4. Set a market or limit order and buy the shares

You can buy a stock or ETF almost instantly at the current price by using a market order during the trading day. Alternatively, enter a limit order to purchase your stock or ETF when it reaches a specific price. Consider dollar cost averaging to spread out your risk, which involves buying at consistent intervals.

5. Monitor your investment

Once you own the stock or ETF, monitor its performance over time. Check your portfolio regularly to ensure that your investment remains aligned with your financial goals.

The future of the magnificent seven

The Magnificent 7 have been pivotal in driving the U.S. stock market's performance in recent years. However, as of early 2025, these tech giants are navigating a complex landscape marked by geopolitical tensions, economic uncertainties, and evolving regulatory frameworks.

The fast-paced nature of changes in the tech industry means investors need to stay up to date with developments in technologies and policies. Stake provides coverage of the tech sector through The Wrap and Under the Spotlight.

Challenges facing the MAG7

Geopolitical and trade tensions

The Trump administration's implementation of tariffs, including a 145% levy on Chinese goods, has disrupted global supply chains. Companies like Apple and Nvidia, which heavily rely on China, are reassessing their strategies to mitigate these impacts.

Regulatory scrutiny

Antitrust investigations and lawsuits are intensifying. Meta and Amazon are embroiled in legal battles over alleged monopolistic practices, while Alphabet and Apple face ongoing regulatory challenges.

Market volatility and valuation concerns

The combined market value of the Magnificent 7 has seen significant fluctuations, with a notable US$760 billion wiped out in a single day due to tariff announcements. Investors are increasingly cautious about the high valuations of these stocks amid broader market uncertainties.

Opportunities ahead for the world's biggest companies

Artificial intelligence and cloud computing

Despite current headwinds, investments in AI and cloud infrastructure remain robust. Alphabet and Microsoft have reaffirmed capital investment plans totalling $155 billion for 2025, underscoring their commitment to AI.

Supply chain diversification

In response to trade tensions, companies are exploring alternative manufacturing hubs beyond China, such as Vietnam, India, and the U.S., to enhance supply chain resilience.

Global market expansion

Emerging markets present new opportunities for growth. By tailoring products and services to local needs, these tech giants can tap into previously underserved customer bases.

Impact of Trump's tariffs on each company

The tariffs are affecting each of these companies differently. Investors need to be aware of the challenges they are facing and conduct their own due diligence before investing.

- Apple: With devices assembled in China, Apple faces significant challenges. Tariffs have prompted the company to consider shifting production to other countries.

- Microsoft: While less reliant on hardware manufacturing, Microsoft's cloud services could be affected by increased costs of data centre equipment due to tariffs.

- Amazon: Tariffs on imported goods could increase operational costs, impacting Amazon's e-commerce and cloud services.

- Alphabet: Facing antitrust investigations and supply chain disruptions that may affect the economy and advertisers, Alphabet is navigating a complex regulatory and economic environment.

- Meta Platforms: Ongoing legal challenges and potential exposure to weaker advertising revenue streams are key concerns for Meta.

- Nvidia: Export restrictions and tariffs have led to significant financial impacts, including a US$5.5 billion charge after being banned from selling an AI chip to China.

- Tesla: Tesla's valuation has slumped following public backlash to Elon Musk’s involvement in the Trump administration, with Q1 car sales falling 13% year-on-year.

Top reasons to invest in MAG7 stocks

Here are some of the main reasons so many investors are invested in these stocks:

Market leadership | These companies dominate their industries – from smartphones and cloud computing to AI, social media, and electric vehicles – giving them massive competitive advantages. |

Strong financials | Most of the Magnificent 7 have healthy balance sheets, steady cash flows, and the ability to invest heavily in future growth, even during tough times. |

Innovation powerhouses | They are at the forefront of major trends like artificial intelligence, cloud computing, clean energy, and autonomous technology – positioning them well for long-term growth. |

Global reach | Their businesses span across the world, tapping into growing markets and diversifying revenue beyond the U.S. |

Profitability and scale | Their size allows them to operate efficiently, negotiate better deals, and reinvest profits into new products, services, and acquisitions. |

Potential for long-term growth | Even after massive runs, many analysts believe these companies still have room to grow because of their exposure to emerging sectors and evolving global markets. |

Attractiveness during tech booms | In times when tech is hot, these stocks often lead the rally - making them popular choices for investors looking to ride the momentum. |

Liquidity and flexibility | These are some of the most traded and widely held stocks, meaning it’s easy to buy or sell them without big price impacts, giving you more control over your investments. Using fractional shares, an investment in these companies can start at just US$10. |

Risks to consider before investing

Investing in the Magnificent Seven can be exciting – and profitable – but it’s important to be aware of the real risks to your money:

Concentration risk | If you put too much of your portfolio into just a few giant tech stocks, your investments could take a big hit if even one company stumbles. |

High valuations | These companies have been priced for perfection. If their earnings slow down or expectations change, their share prices could fall fast. |

Regulatory risks | Governments are cracking down on Big Tech. Lawsuits, fines, or new rules could limit their growth and impact your returns. |

Big price swings | Stocks like these can be extremely volatile. Even strong companies can see large, sudden drops that rattle your portfolio. |

Tech-specific dangers | From cybersecurity breaches to disruptive new technologies, the sector can change overnight. |

Economic sensitivity | When the economy weakens, businesses and consumers spend less, which can hurt revenues at companies you might own. |

Ruthless competition | No matter how dominant they seem today, new rivals and innovation could chip away at their market share over time. |

Geopolitical risks | Trade tensions, tariffs, and political instability, especially with countries like China, could disrupt supply chains or markets these companies rely on. |

Herd behaviour and momentum | When stocks get extremely popular, they can go up fast. But if the mood changes, they can crash just as quickly, leaving latecomers exposed. |

MAG7 FAQs

There are a lot of ETFs that have the magnificent seven as holdings, so we've limited our list of ETFs to these two which have tight exposure to these specfic companies:

Roundhill Magnificent Seven ETF ($MAGS)

- Launched in late 2023.

- A U.S.-listed ETF.

- Directly invests only in the Magnificent 7 companies.

- Offers equal weight exposure to the Magnificent 7 companies.

- Super targeted if you want pure Magnificent Seven exposure without extra stocks.

- Expense ratio is 0.29%

Invesco QQQ Trust ($QQQ)

- Launched in 1999

- Tracks the Nasdaq-100 Index

- About 40% of QQQ is made up of Apple, Microsoft, Amazon, Nvidia, Meta Platforms, Alphabet, and Tesla.

- Very tech-heavy, very Magnificent 7-heavy.

- Expense ratio is 0.20%

💡 Relation: Find more technology ETFs listed on the ASX

FAANG and MAG7 are both acronyms for groups of big tech companies, but they reflect different eras of market leadership.

FAANG stands for Facebook (Meta), Apple, Amazon, Netflix, Google (Alphabet).

- It was popularised around 2013–2015.

- These companies were the face of the digital, cloud, and social media boom of the 2010s.

- Netflix (the ’N’ in FAANG) is a streaming company, which is not in the same league as the others in terms of market cap.

MAG7 stands for Microsoft, Apple, Alphabet, Amazon, Meta, Nvidia, Tesla.

- This term became popular around 2023–2024.

- MAG7 reflects the next generation of dominance, especially with AI (Nvidia, Microsoft), electric vehicles (Tesla), cloud (Amazon, Microsoft), and continued smartphone/social media dominance (Apple, Meta).

- There is a sharper focus on AI, chips, EVs, and cloud/software.

This article was written by Robert Guy - Senior Markets Writer at Stake.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.