What is the Nasdaq 100? A comprehensive guide

The Nasdaq 100 Index is home to the world’s largest and most innovative tech companies.

Understanding the Nasdaq 100

The Nasdaq 100 is an index of the top 100 non-financial stocks listed on the Nasdaq and is a closely watched performance measure of U.S. tech stocks. The Nasdaq 100 started on 31 January 1985 and is widely regarded as home to some of the world’s largest and leading tech innovators.

Around half the index is invested in information technology stocks such as Nvidia ($NVDA) and Apple ($AAPL), Tesla ($TSLA), Amazon ($AMZN) and Netflix ($NFLX). It also includes industrial, healthcare, utilities and consumer staples stocks.

The companies in the Nasdaq 100 are all U.S.-listed, but they reflect the global economy as almost all the companies in the index have global products and workforces. Around half of the revenues of the Nasdaq 100 are from outside the U.S. The index also includes American Depositary Receipts of large non-U.S. companies like ARM Holdings ($ARM), Linde ($LIN) and AstraZeneca ($AZN).

How the Nasdaq 100 index work

The Nasdaq 100 is a capitalisation-weighted index. This means the bigger a company’s market cap, the higher the weighting in the index. Apple is the largest company with a market cap of over US$3t, so it has the largest weighting in the index. ETF providers will use these weightings to construct a product that tracks the index. Active fund managers, or those who try to outperform an index, will underweight or overweight stocks in the index.

Nasdaq 100 composition

The Nasdaq 100 is composed of 10 sectors (financials are excluded). At 31 March 2025, industry weightings were:

- Technology: 57.23%

- Consumer discretionary: 19.66%

- Health care: 5.80%

- Telecommunications: 5.14%

- Industrials: 4.77%

- Consumer staples: 3.28%

- Basic materials: 1.83%

- Utilities: 1.44%

- Energy: 0.62%

- Real estate: 0.23%

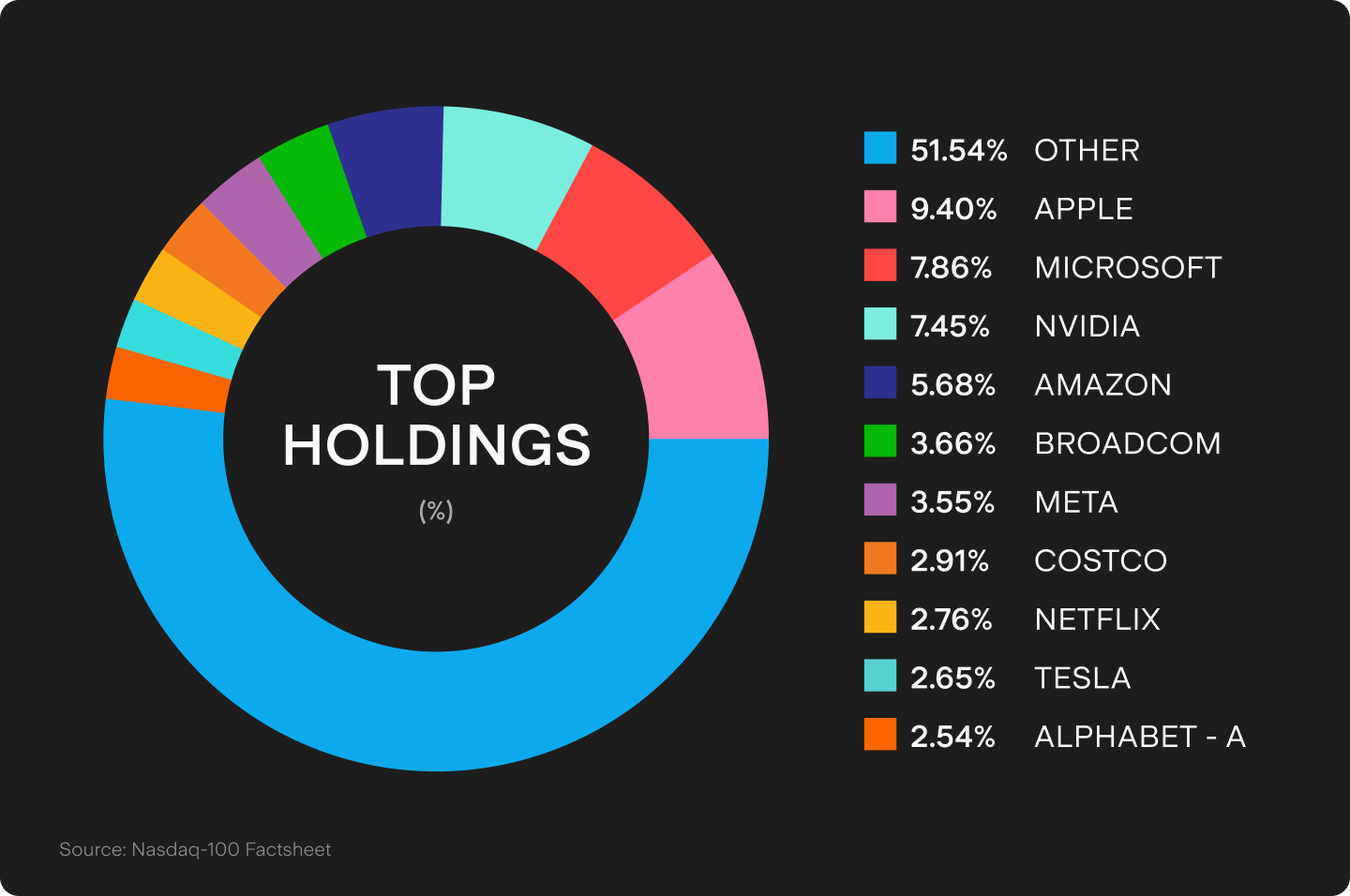

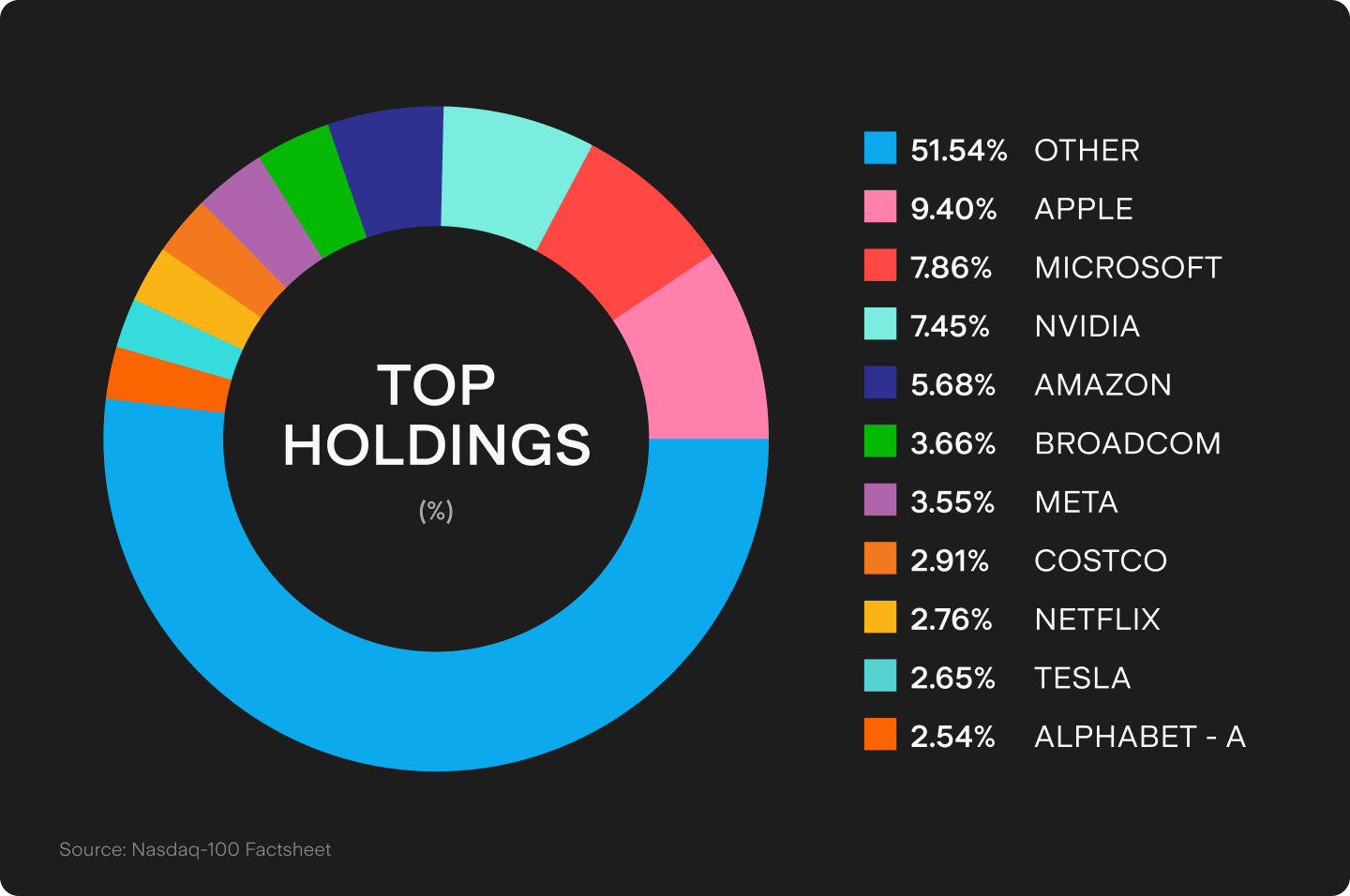

What companies are in the Nasdaq 100?

The top ten Nasdaq 100 companies include the world’s largest tech stocks. At 31 March 2025, the weightings of the top ten stocks were:

- Apple: 9.40%

- Microsoft: 7.86%

- Nvidia: 7.45%

- Amazon: 5.68%

- Broadcom: 3.66%

- Meta Platforms: 3.55%

- Costco: 2.91%

- Netflix: 2.76%

- Tesla: 2.65%

- Alphabet (Class A): 2.54%

The composition of the Nasdaq 100 is reviewed annually, and changes are announced in December. The most recent review saw Palantir Technologies ($PLTR), MicroStrategy ($MSTR) and Axon Enterprise ($AXON) added to the index.

Nasdaq historical performance

The Nasdaq 100 has delivered strong performance since its inception in 1985: it gained approximately 20,000% as of 31 December 2024. That’s an average annual return of 14.25% compared to 11.57% in the S&P 500 over the same time. But remember that past performance is no guarantee of future performance.

The Nasdaq 100 can be volatile and underperform for a long time. Some instances of the Nasdaq seeing major declines include:

- 80% drop in value during the dot-com bust in the early 2000s.

- It fell around 50% during the Global Financial Crisis in 2008.

Butt the index can also deliver big gains in a short period: it rallied 20% in Q1 2023. This shows the Nasdaq 100 Index’s performance can be affected by sentiment towards technology stocks, valuations, the economy and interest rates.

Investing in the Nasdaq 100 from Australia: What are my options?

Investing in the Nasdaq 100 Index is easy if you have opened an account with an investing platform that offers access to U.S. and Australian stocks. Stake offers access to ASX and Wall Street listed Nasdaq 100 Index ETFs. Consider your investment objectives and risk appetite. Investing in tech stocks offers the potential for higher returns but also the risk of higher volatility.

There are a number of ASX listed Nasdaq 100 ETFs available including:

- Betashares Nasdaq 100 ETF ($NDQ) is a very popular pick with Stake investors, usually sitting in the top 10 most traded Australian shares each month. Betashares also offers the Nasdaq 100 Equal Weight ETF ($QNDQ) and the Nasdaq 100 ETF (currency hedged) ($HNDQ).

- Global X Ultra Long Nasdaq 100 ETF ($LNAS), which is a geared fund that invests in Nasdaq futures.

The biggest U.S.-listed Nasdaq 100 ETF options are:

- Invesco’s QQQ ETF ($QQQ), which had assets under management of US$293b at 15 April 2025. $QQQ has a higher fee, but its higher liquidity makes it popular with traders.

- Invesco Nasdaq 100 ETF ($QQQM) has a lower fee and higher yield but sees much lower daily liquidity.

✅ Check out this article if you want to start investing in the Nasdaq from Australia→

➡️ If you want to deep dive more into which is the right asset for you, then read our listicle on the top 10 best Nasdaq ETFs→

Choosing the right ETF to gain exposure

The choice of which Nasdaq 100 ETF to invest in needs to align with your investment objectives and risk tolerance. Fees are an important consideration as they will affect your long-term returns.

Betashares Nasdaq 100 ETF has a management fee of 0.48%, while the Global X Ultra Long Nasdaq ETF charges 1%. Invesco charges 0.20% and 0.15% for $QQQ and $QQQM, respectively. However, investing in U.S.-listed ETFs exposes investors to currency risk.

ASX ETFs (fees)

- Betashares Nasdaq 100 ETF ($NDQ): 0.48%

- Betashares Nasdaq 100 Equal Weight ETF ($QNDQ): 0.48%

- Betashares Nasdaq 100 ETF (currency hedged) ($HNDQ): 0.51%

- Global X Ultra Long Nasdaq ETF ($LNAS): 1.00%

Wall Street ETFs (fees)

Nasdaq 100 vs S&P 500: Which index is right for you?

The Nasdaq 100 will appeal to investors who want to invest in the world’s most innovative companies. While investing in leading tech stocks may deliver higher returns over the long term, it can expose investors to periods of higher volatility and underperformance. The Nasdaq 100 may suit investors with a higher tolerance for risk.

The S&P 500 Index also offers investors access to leading tech companies, but also provides exposure to a wider variety of stocks from different sectors like financials, health care, energy, consumer staples, real estate and utilities. The average returns from the S&P 500 Index have been lower than the Nasdaq 100 over the long term, but with lower volatility. The S&P 500 Index may appeal to investors seeking more diversification.

💡Related: How to invest in the S&P 500 from Australia→

This article was written by Robert Guy - Senior Markets Writer at Stake.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

.png&w=3840&q=100)