Are these the best AI stocks on the ASX? [2024]

Artificial intelligence is changing the way society functions, making productivity skyrocket. Many companies are employing AI to improve their operations, while some are trying to profit by pushing the capability of AI technology forward.

AI shares to watch on the ASX

Company Name | Ticker | Share Price | Year to Date | Market Capitalisation |

|---|---|---|---|---|

Wisetech Global Limited | $96.93 | +26.89% | $32.22b | |

Xero Limited | $128.79 | +13.95% | $19.67b | |

NEXTDC Limited | $17.71 | +30.11% | $10.66b | |

Macquarie Technology Group Limited | $87.77 | +30.25% | $2.27b | |

Megaport Limited | $12.47 | +35.91% | $1.99b | |

Brainchip Holdings Ltd | $0.22 | +22.22% | $399m | |

Appen Limited | $0.495 | -20.16% | $109m | |

Ai-Media Technologies Limited | $0.31 | -6.06% | $65m | |

Bigtincan Holdings Limited | $0.10 | -50.00% | $61m | |

Dubber Corporation Limited | $0.04 | -60.00% | $37m |

Data as of 12 June 2024. Source: Stake, ASX.

*The list of shares mentioned is ranked by market capitalisation. When deciding what assets to feature, we analyse the financials, recent news and announcements, the state of the industry and the company's projects, and whether or not they are actively traded on Stake.

✅ Sign up to Stake to start investing in ASX artificial intelligence stocks from $3 brokerage.

🤖Read more: What are the best AI ETFs to invest in?→

Explore some of the top ASX artificial intelligence stocks

1. Wisetech Global Limited ($WTC)

- Market capitalisation: $32.22b

- Stock price (as of 12/06/2024): $96.93

- Our customers watching and trading $WTC (as of 12 June 2024): 2,291 watching and 3,156 orders executed

WiseTech Global is a leading provider of software solutions to the global logistics industry. Their flagship product, CargoWise One, is a comprehensive platform that enables logistics service providers to manage their operations efficiently, from freight forwarding and customs compliance to warehousing and transportation management.

WiseTech Global has invested heavily in AI and machine learning, integrating these technologies into its platform to enhance its core functionalities and expand into new markets. The company's AI-powered solutions help logistics businesses optimise their operations, improve efficiency, and reduce costs.

WiseTech Global's strong market position, its focus on innovation, and its exposure to the growing AI sector make it an investment opportunity for investors attracted to the tech sector in Australia.

2. Xero Limited ($XRO)

- Market capitalisation: $19.67b

- Stock price (as of 12/06/2024): $128.79

- Our customers watching and trading $XRO (as of 12 June 2024): 4,827 watching and 6,920 orders executed

Xero is a global cloud-based accounting software company, providing small businesses with a comprehensive platform for managing their finances, from invoicing and expenses to payroll and reporting. The company's user-friendly platform and its focus on automation have made it a popular choice for small businesses worldwide.

Xero incorporates elements of automation and machine learning into its platform to enhance its features and improve user experience. The company's AI-powered features help businesses automate tasks, improve accuracy, and gain insights from their financial data.

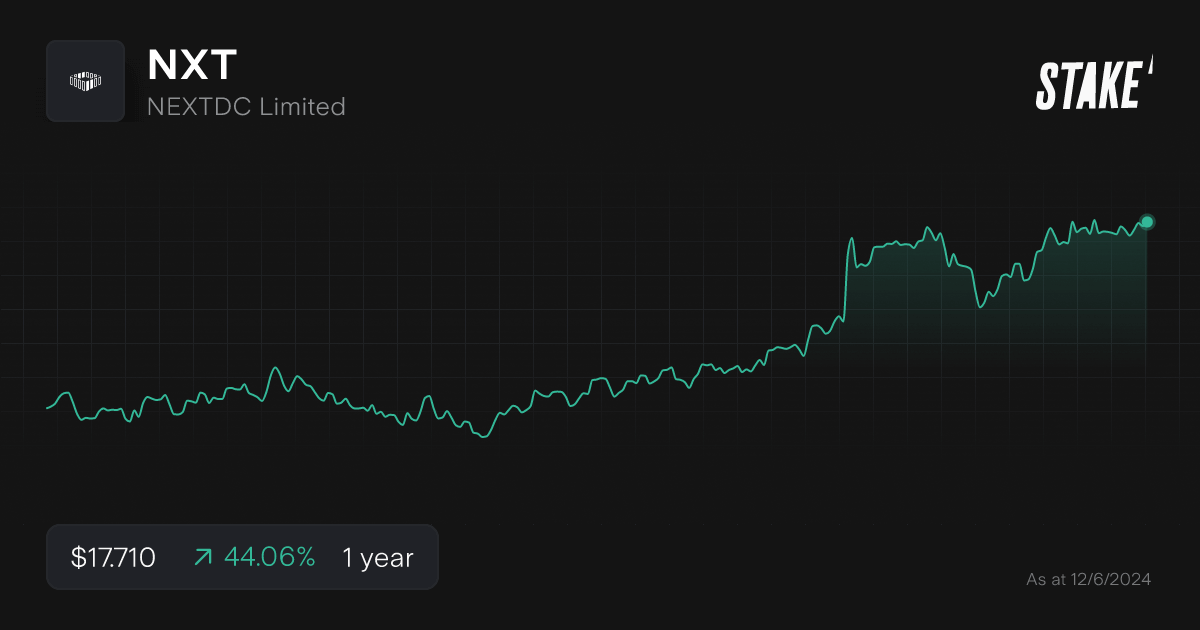

3. NEXTDC Limited ($NXT)

- Market capitalisation: $10.66b

- Stock price (as of 12/06/2024): $17.71

- Our customers watching and trading $NXT (as of 12 June 2024): 1,862 watching and 2,024 orders executed

NEXTDC is a leading Australian data center provider, offering colocation services and cloud connectivity solutions to businesses of all sizes. Their state-of-the-art data centers are strategically located across Australia, providing high levels of security, reliability, and scalability to meet the growing demand for data storage and processing.

While NEXTDC's core business is not directly involved in AI development, the company plays a crucial role in supporting the AI ecosystem by providing the essential infrastructure for AI workloads. Their data centers offer the high-performance computing power, storage capacity, and network connectivity required for training and deploying complex AI models.

NEXTDC's strong financial performance, with significant revenue and EBITDA growth, reflects the company's strategic positioning as a solid ASX data centre stock. The increasing adoption of cloud computing and the rise of AI applications are expected to drive continued growth for NEXTDC, making it an attractive investment opportunity in the ASX technology sector.

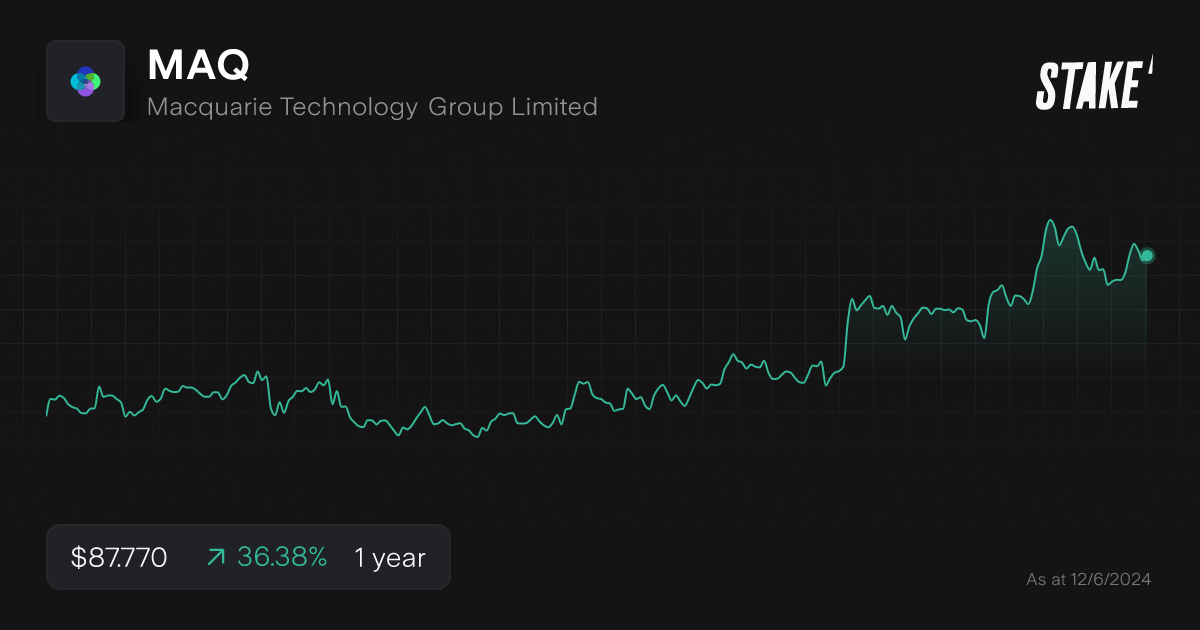

4. Macquarie Technology Group Limited ($MAQ)

- Market capitalisation: $2.27b

- Stock price (as of 12/06/2024): $87.77

- Our customers watching and trading $MAQ (as of 12 June 2024): 730 watching and 421 orders executed

Macquarie Technology Group is a leading provider of telecommunication, cloud computing, cybersecurity, and data center services to corporate and government customers in Australia. The company's comprehensive suite of services caters to the growing demand for digital infrastructure and technology solutions.

Macquarie Technology Group's AI exposure stems from its data center business, which is expected to benefit significantly from the AI boom. With its existing capacity and land positions in place, the company is well-positioned to succeed in the AI-driven data center market.

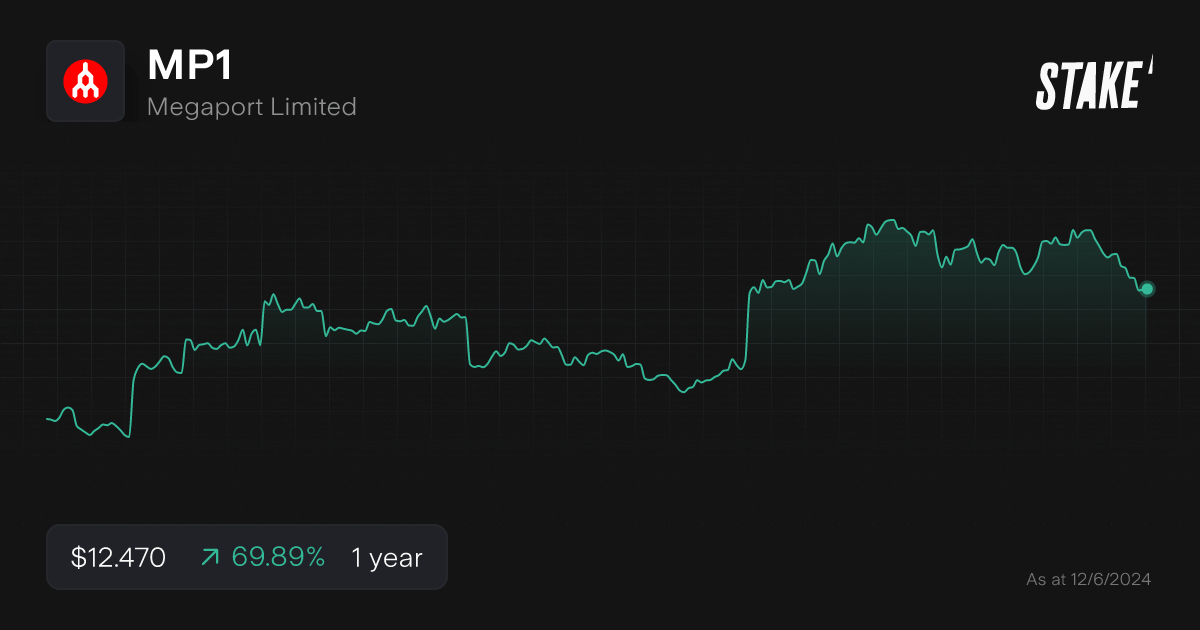

5. Megaport Limited ($MP1)

- Market capitalisation: $1.99b

- Stock price (as of 12/06/2024): $12.47

- Our customers watching and trading $MP1 (as of 12 June 2024): 1,586 watching and 4,819 orders executed

Megaport is a global network as a service (NaaS) provider, offering on-demand data connectivity solutions to businesses worldwide. Their Software Defined Network (SDN) enables businesses to connect their networks to various cloud service providers and data centers quickly and cost-effectively.

Megaport's role in the AI ecosystem lies in its ability to provide the high-speed, low-latency data connectivity required for AI workloads. As AI applications generate and consume vast amounts of data, Megaport's NaaS solutions become increasingly critical for businesses looking to leverage AI effectively.

Despite strong revenue growth and positive earnings guidance, Megaport's share price has experienced fluctuations, potentially due to broader market sentiment and investor concerns about the company's long-term profitability. However, Megaport's strategic positioning in the data connectivity market and its exposure to the growing AI sector suggest potential for future growth.

6. Brainchip Holdings Ltd ($BRN)

- Market capitalisation: $399m

- Stock price (as of 12/06/2024): $0.22

- Our customers watching and trading $BRN (as of 12 June 2024): 5,521 watching and 13,013 orders executed

Brainchip Holdings is at the forefront of neuromorphic computing, developing AI chips and software that mimic the human brain's functionality. Their flagship product, the Akida Neuromorphic Processor, stands out for its ultra-low power consumption and high processing speed, making it ideal for edge computing applications, particularly in areas like vision, audio, and sensor data processing.

Brainchip's Akida processor utilises spiking neural networks (SNNs), a type of artificial neural network that closely resembles the brain's biological processes. This technology allows for real-time learning and adaptation at the edge, reducing reliance on cloud computing and enabling faster decision-making in applications like autonomous vehicles, robotics, and IoT devices.

Despite the promising technology, Brainchip's financial performance has been a cause for concern among investors, contributing to the share price volatility. The company has minimal revenue and increasing losses, raising questions about its ability to compete with established players like Nvidia ($NVDA) in the AI chip market.

7. Appen Limited ($APX)

- Market capitalisation: $109m

- Stock price (as of 12/06/2024): $0.495

- Our customers watching and trading $APX (as of 12 June 2024): 1,777 watching and 6,574 orders executed

Appen Limited is a global leader in providing data for developing artificial intelligence and machine learning systems. The company's unique selling proposition lies in its vast crowd-sourcing platform, which comprises over 1 million skilled contractors speaking over 500 languages across 200 countries. This global reach allows Appen to provide high-quality, human-annotated data for various AI applications, including natural language processing, computer vision, and sentiment analysis.

Appen leverages AI internally to enhance its data annotation processes and improve the efficiency of its platform. The company's expertise in data annotation and its focus on providing high-quality data are crucial for advancing AI development, as accurate and diverse datasets are essential for training robust and reliable AI models.

The recent stabilisation in Appen's revenue, following cost-cutting measures and a focus on new market opportunities, has contributed to the positive share price movement in 2024. However, the company's future performance remains contingent on its ability to secure new contracts and capitalise on the growth of the generative AI market.

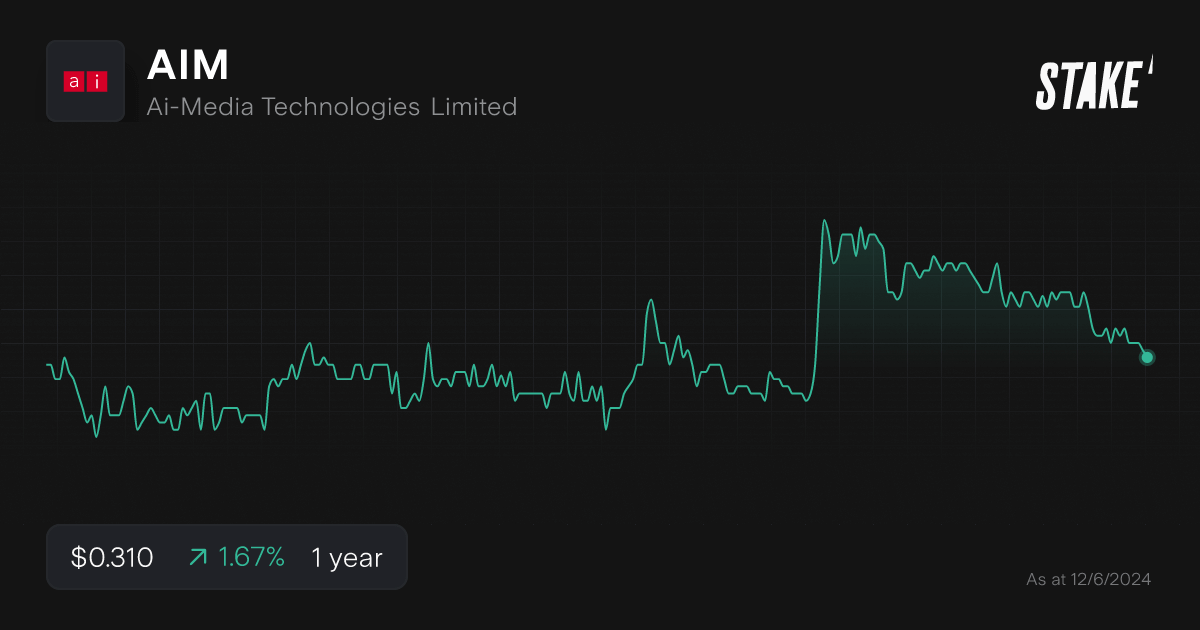

8. Ai-Media Technologies Limited ($AIM)

- Market capitalisation: $65m

- Stock price (as of 12/06/2024): $0.31

- Our customers watching and trading $AIM (as of 12 June 2024): 138 watching and 123 orders executed

Ai-Media Technologies is a global leader in technology-driven captioning, transcription, and translation services. The company leverages AI to deliver high-quality, real-time captioning solutions for various applications, including broadcasting, education, and corporate communications.

Ai-Media's AI-powered platform utilises automatic speech recognition (ASR) and natural language processing (NLP) technologies to provide accurate and efficient captioning solutions. The company's focus on innovation and its commitment to delivering high-quality services have enabled it to secure contracts with major broadcasters and media organisations worldwide.

Ai-Media's profitability remains a concern for investors, contributing to the share price decline. The company's ability to manage costs, improve margins, and achieve profitability will be crucial for restoring investor confidence and driving future growth.

9. Bigtincan Holdings Limited ($BTH)

- Market capitalisation: $61m

- Stock price (as of 12/06/2024): $0.10

- Our customers watching and trading $BTH (as of 12 June 2024): 475 watching and 1,096 orders executed

Bigtincan Holdings is a software company specialising in AI-powered sales enablement automation platforms. Their flagship product, Bigtincan Hub, provides a comprehensive solution for sales content management, sales readiness, and sales engagement. The platform leverages AI to deliver relevant content to users across various devices and networks, enhancing sales productivity and effectiveness.

Bigtincan utilises AI to personalise content recommendations for sales representatives, analyse sales data to identify trends and opportunities, and automate tasks such as content creation and lead scoring. The company's AI-powered platform helps businesses improve sales efficiency, shorten sales cycles, and increase revenue generation.

Despite the potential of its AI-driven platform, Bigtincan's financial performance has been volatile, contributing to the share price fluctuations. The company operates in a competitive market with other established players, and its ability to gain market share and achieve profitability will be crucial for its future success.

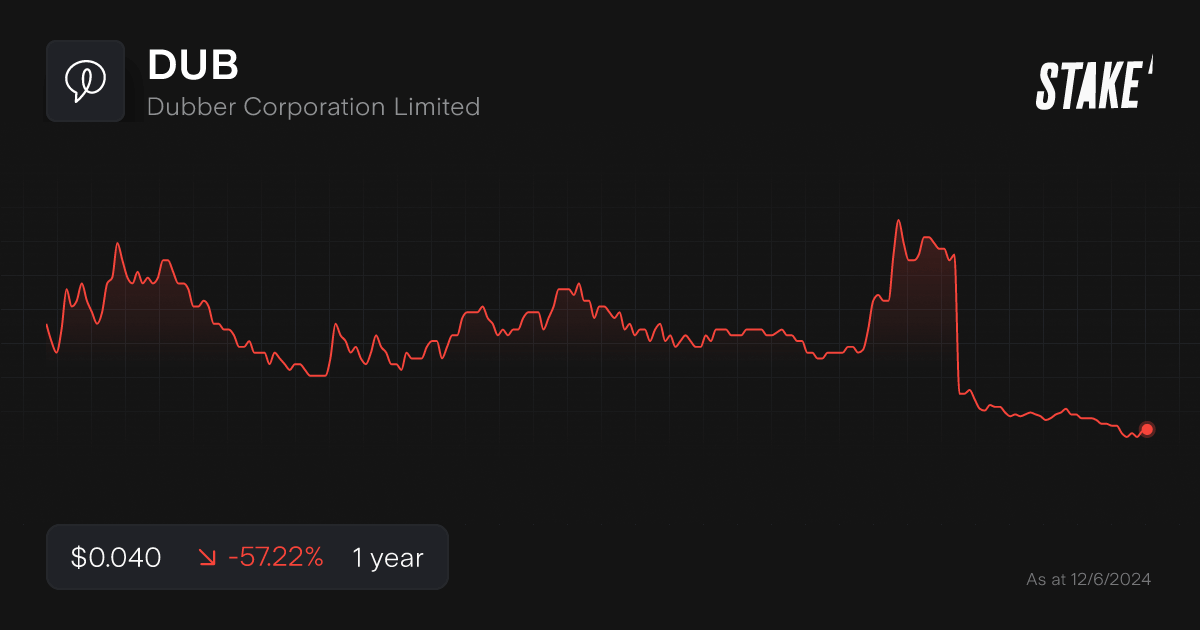

10. Dubber Corporation Limited ($DUB)

- Market capitalisation: $37m

- Stock price (as of 12/06/2024): $0.04

- Our customers watching and trading $DUB (as of 12 June 2024): 293 watching and 1,645 orders executed

Dubber Corporation offers a cloud-based call recording and audio asset management platform. Their platform integrates with various communication services and applications, providing businesses with a centralised solution for recording, storing, and analysing audio data.

Dubber leverages AI to enhance its platform's capabilities, offering features such as real-time search functions, alerts, transcription, and sentiment analysis. These AI-powered features enable businesses to extract valuable insights from audio data, improve compliance, and enhance customer service.

Dubber's financial performance has been mixed, with losses reported in recent years. However, the company's innovative products and its involvement in the growing AI sector could position it for future growth. Monitoring the company's financial performance and industry trends will be essential for investors considering Dubber.

How to invest in AI stocks in Australia?

There are a few ways to invest in artificial intelligence stocks in Australia. One way is to buy shares in ASX-listed companies that are involved in the development and use of AI and other machine learning tools. Another way to invest in AI is through exchange-traded funds (ETFs) that hold shares of companies involved in the artificial intelligence industry.

You’ll need to follow these steps if you are wishing to trade AI stocks:

1. Find a stock investing platform

To buy AI stocks on the ASX, you'll need to sign up to an investing platform with access to the Aussie stock market. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for the company or ticker symbol

Find the company name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. A method to mitigate risk is dollar cost averaging but it is recommended for the individual to reach out to a financial advisor to manage risk effectively for individual circumstances.

5. Monitor your investment

Once the stocks have been purchased, you can monitor the performance. It is recommended to check all portfolios on a regular basis to ensure investments are aligned on an ongoing basis with individual financial goals.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

What artificial intelligence ETFs can I invest in?

There are no ETFs listed on the Australian Securities Exchange (ASX) that specifically track artificial intelligence companies.

However, there are a number of ETFs that invest in tech companies, which may include companies that have a significant focus on artificial intelligence and machine learning.

Some examples include:

If you expand your universe of artificial intelligence stocks to the NYSE and NASDAQ, there are a few AI ETF options:

- Global X Robotics & Artificial Intelligence ETF ($BOTZ) - This ETF tracks the performance of companies that are involved in the development, production, or use of robotics and artificial intelligence.

- First Trust NASDAQ Artificial Intelligence and Robotics ETF ($ROBT) - This ETF tracks the performance of artificial intelligence and robotics stocks.

- Global X Internet of Things ETF ($SNSR) - This ETF tracks the performance of companies that are involved in the Internet of Things (IoT) technology, which is closely related to AI.

- ARK Innovation ETF ($ARKK) - This ETF tracks companies that are working on disruptive innovation, which include companies working on AI, automation, and other cutting-edge technologies.

💡Related: Top Metaverse ETFs to watch→

💡Related: Are these the best tech stocks to watch?→

Artificial Intelligence stocks FAQs

Investing in artificial intelligence can be a compelling opportunity for all investors considering the rapid growth and adoption of AI across various industries. However, it’s essential to realise that investing in AI like any investment can come with risks. Investors should be aware that these new advancements in technology can come with several risks and may not fit within everyone’s investment strategy.

Artificial Intelligence (AI) is a broad field that can be applied to a wide range of industries. Here are some examples of industries that use AI:

- Healthcare: AI is used in healthcare to improve patient care, such as through the development of diagnostic tools and personalised treatment plans.

- Finance: AI is used in finance to detect fraud, make investment decisions, and analyse financial data.

- Retail: AI is used in retail to personalise customer experiences and optimise supply chain management.

- Automotive: AI is used in the automotive industry for the development of autonomous vehicles and for the optimisation of manufacturing processes.

- Agriculture: AI is used in agriculture to optimise crop yields, predict crop failures and improve animal breeding.

- Energy: AI is used in energy to optimise the efficiency of power plants and predict maintenance needs.

- Manufacturing: AI is used in manufacturing to optimise production processes, predict equipment failure and improve quality control.

- Transportation: AI is used in transportation to optimise logistics and improve the efficiency of supply chain management.

- Marketing: AI is used in marketing to personalise advertising, predict customer behaviour, and optimise marketing strategies.

- Cybersecurity: AI is used in cybersecurity to detect and prevent cyberattacks and analyse network data.

This is not an exhaustive list since AI is being used in various other industries as well. The artificial intelligence space is rapidly evolving, and new applications are being developed constantly.

Any smart investor will consider the benefits and also the risks associated with a sector they are researching. See what possible risks investing in AI could pose:

- Market volatility: AI stocks can experience significant price fluctuations due to the rapid pace of technological advancements and changes in market sentiment.

- High competition: The industry right now is incredibly competitive, with numerous companies vying for market share. This competition can impact profitability and market positioning.

- Technology becomes outdated: The AI space is evolving very quickly, and companies must continually innovate to avoid becoming obsolete. Investing in companies that fail to keep up with technological advancements can lead to losses.

- Regulatory uncertainty: There are a lot of regulations and ethical considerations the AI industry is currently facing. This will impact the operations and profitability of many companies focusing heavily in artificial intelligence.

- High valuations: Many AI stocks are priced at high valuations based on future growth expectations, making them susceptible to sharp declines if these expectations are not met.

- Dependency on data: AI technologies rely heavily on vast amounts of data. Issues related to data privacy, security, and availability can pose significant risks to companies in the space.

- Market hype: AI is right now subject to excessive hype, leading to inflated stock prices that do not reflect the underlying business fundamentals. This can result in significant corrections in the future.

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.