Top ASX data centre stocks investors are watching in 2025

Dive into ASX data centre stocks powering AI, cloud and digital infrastructure.As AI and other technologies grow, the need for data centres increases.

Data centre capacity in Australia is forecast to more than double from 1,350 megawatts (MW) in 2024 to 3,100 MW by 2030. Additional investment in Australia’s data centre capacity is forecast to exceed $26b over this period.

Rising demand has lifted shares in global giant Equinix ($EQIX) and attracted a $24b offer for Airtrunk by Blackstone and Canada Pension Plan Investment Board.

Here are seven ASX data centre stocks investing in this crucial infrastructure.

Watch these Australian data centre companies on the ASX

Company Name | Ticker | Share Price | Year to Date | Market Capitalisation | In Watchlists* |

|---|---|---|---|---|---|

Goodman Group | $29.40 | -18.40% | $60.1B | 4,987 | |

Infratil | $10.06 | -11.44% | $10B | 810 | |

NEXTDC Limited | $13.85 | -7.79% | $8.9B | 4,793 | |

Spark NZ | $1.98 | -25.75% | $3.7B | 699 | |

Megaport Limited | $14.24 | +91.91% | $2.5B | 2,874 | |

Macquarie Technology Group Limited | $68.66 | -21.68% | $1.7B | 1,400 | |

DigiCo Infrastructure REIT | $2.47 | -43.99% | $1.4B | 497 |

Past performance is not a reliable indicator of future performance.

Data as of 26 November 2025. Sources: Stake, Google Finance.

The list of shares mentioned is ranked by market capitalisation. When deciding what assets to feature, we analyse the financials, recent news and announcements, the state of the industry and the company's projects, and whether or not they are actively traded on Stake.

*Amount of Stake customers who have added the listed asset into a watchlist.

Explore the top ASX data centre stocks

1. Goodman Group ($GMG)

Goodman Group is evolving from industrial logistics into a digital infrastructure powerhouse. The key driver is their "power bank"—secured electricity capacity vital for hyperscale facilities. By repurposing sites for server hubs, Goodman captures premium margins associated with the AI and cloud computing boom.

Recent updates highlight a global power pipeline exceeding 5GW, driven by demand from major tech firms. This expansion reinforces their position as a leading choice in the data centre industry in Australia.

2. Infratil Limited ($IFT)

Infratil is a heavyweight infrastructure investor, but its significant asset for those watching the digital space is its massive stake in CDC Data Centres. This makes it a compelling proxy for the server farm boom, offering exposure to critical digital infrastructure without the volatility of pure-play tech.

CDC is aggressively expanding capacity to over 700MW to meet the growing surge in artificial intelligence.Valuation uplifts in this portfolio highlight the success of the strategy, as they continue to secure long-term contracts with government and hyperscale partners.

3. NEXTDC Limited ($NXT)

NEXTDC is Australia’s leading independent data centre operator, providing the physical backbone for the digital economy. For investors eyeing the ASX data centre sector, NXT offers pure-play exposure to the structural growth of cloud computing and the rapid rise of artificial intelligence.

The company is capitalising on the AI boom with its new $2 billion M4 Melbourne "AI Factory”, a liquid-cooled campus designed for high-density Nvidia chips. With FY25 contracted utilisation surging over 30% and a record forward order book, NEXTDC is successfully converting hyperscale demand into long-term recurring revenue.

4. Spark NZ Limited ($SPK)

New Zealand’s leading telco is evolving into a digital infrastructure heavyweight. For investors scanning the ASX for data centre exposure, Spark provides a solid alternative to pure-play tech stocks.

The company is supercharging its portfolio, targeting a massive capacity increase to support hyperscale demand. By pivoting capital into these high-tech facilities, Spark is unlocking new growth streams beyond traditional mobile services.

Recently, they accelerated the Takanini campus expansion, bringing substantial new capacity online to capture the rising demand for AI-driven processing power.

5. DigiCo Infrastructure REIT ($DGT)

DigiCo Infrastructure REIT ($DGT) acts as the landlord for the digital age, managing high-security server farms. For investors eyeing local digital infrastructure plays, DGT owns the physical backbone powering the AI and data boom.

The REIT secures long-term leases with hyperscale tech giants, targeting steady cash flow driven by exponential data demand. By focusing on sustainable, high-density facilities, DigiCo offers a direct line to cloud computing growth with less volatility then a pure-play tech stock.

DigiCo announced a $200m expansion of its Western Sydney campus to support next-gen AI workloads. This strategic move boosts capacity for top-tier enterprise customers.

6. Macquarie Technology Group Limited ($MAQ)

MAQ is a digital infrastructure heavyweight, blending cloud services with government cybersecurity. For investors tracking the Australian data centre theme, its sovereign assets offer a unique entry point into the AI boom.

The thesis rests on its "Certified Strategic" status and the AI-ready IC3 Super West development. These assets lock in sticky government contracts and high-density hyperscale workloads, aiming to build recurring revenue stability. Momentum accelerated in November 2025, with reports that MAQ is exploring funding for a massive new 150MW campus, signaling aggressive expansion beyond its current pipeline.

7. Megaport Limited ($MP1)

Megaport provides the "pipes" for the digital economy. As a Network-as-a-Service (NaaS) leader, it links enterprises to the clouds across 1,000+ locations. For investors, it offers exposure to digital infrastructure without the heavy capital costs of building physical data centres.

Its platform replaces rigid telco contracts with on-demand scaling, allowing businesses to adjust bandwidth instantlys. This elastic’ connectivity drives recurring revenue by linking customers privately to AWS and Azure, creating a scalable play on surging data traffic.

In November 2025, Megaport agreed to acquire Latitude.sh, integrating high-performance compute with its network. This follows record FY25 recurring revenue and the 1,000-location milestone, reinforcing its momentum in the connectivity sector.

How to invest in data centres through ASX shares

You’ll need to follow these steps if you are wishing to invest in the top data centre companies in Australia:

1. Find a stock investing platform

To buy data centre stocks on the ASX, you'll need to sign up to an investing platform with access to the Aussie stock market. There are several share investing platforms available, of which Stake is one.

2. Fund your account

Open an account by completing an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for the company or ticker symbol

Find the company name or ticker symbol. It is advised to conduct your own research to ensure you are purchasing the right investment product for your individual circumstances.

4. Set a market or limit order and buy the shares

Buy on any trading day using a market order, or a limit order to delay your purchase of the asset until it reaches your desired price. You may wish to look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Once you own the stock, you should monitor its performance. Check your portfolio regularly to ensure your investment is aligning with your financial goals.

How is the AI boom impacting ASX data centre stocks?

The rise of artificial intelligence is significantly increasing demand for data centre capacity, specifically for 'hyperscale' facilities that can handle high-density computing. AI applications require massive amounts of processing power and storage, prompting major tech companies to secure long-term contracts with Australian providers. This trend is driving capital expenditure and expansion plans for operators like NEXTDC and Goodman Group to meet the future needs of the digital economy.

What data centre ETFs can I invest in?

The ASX data centre ETFs available on Stake include:

- Global X Artificial Intelligence Infrastructure ETF ($AINF)

Jumping across to U.S. data centre stocks provides a few more options if you want to gain exposure to this theme and diversify your portfolio.

Check out these other options for data centre ETFs on Wall St:

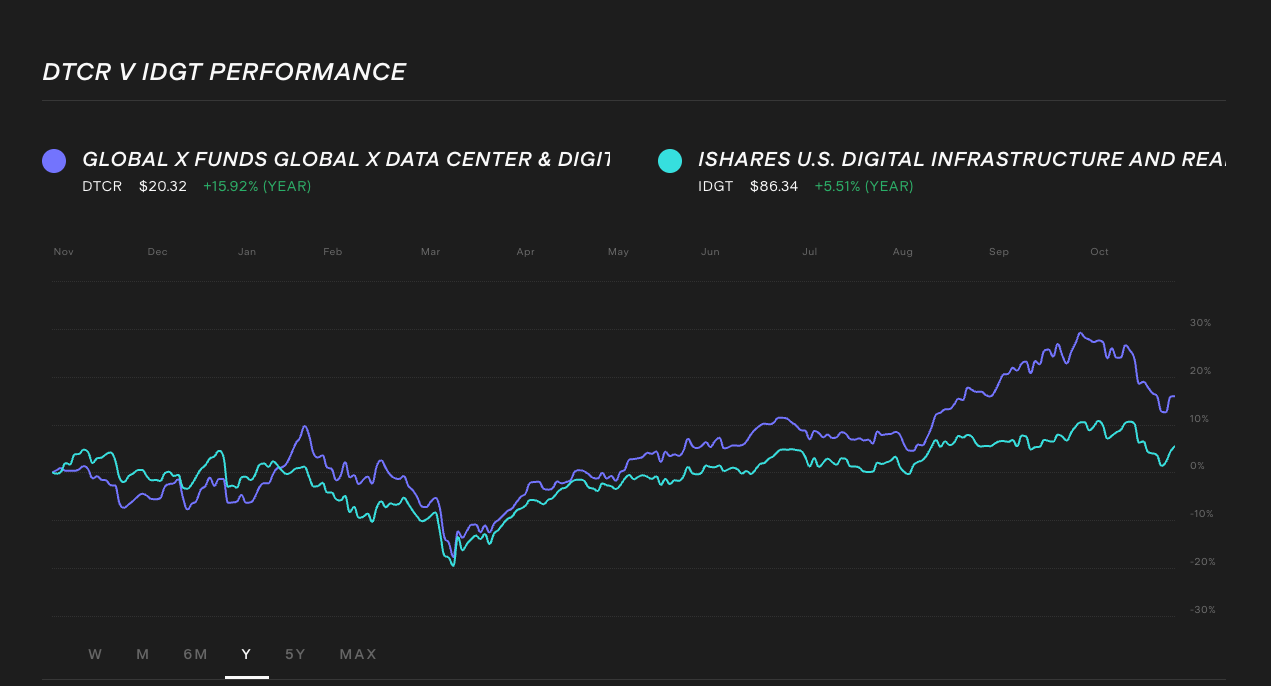

- Global X Data Center and Digital Infrastructure ETF ($DTCR): This ETF seeks to invest in companies operating data centres and other digital infrastructure supporting communication networks, aiming to provide investment results that correspond generally to the price and yield performance of the Solactive Data Center REITs & Digital Infrastructure Index, before fees and expenses.

- iShares U.S. Digital Infrastructure and Real Estate ETF ($IDGT): This ETF targets exposure to U.S.-listed companies involved in infrastructure for the storage, processing, transmission and/or access of digital data and services.

Compare the performance of DTCR vs IDGT using our stock and ETF comparison tool.

What are the risks of investing in data centre companies?

The data centre industry can be an interesting way to diversify for those willing to carefully research and choose companies with solid fundamentals. The choice to invest in data centre shares should align with your individual risk tolerance, investment goals, and time horizon. Consider the potential risks below or consult with a financial advisor before making any investment decisions.

- Capital intensive: Building and operating data centres requires substantial capital investment, which can lead to high debt levels for some companies.

- Competition: The data centre space is already becoming competitive, with both established players and new entrants vying for market share.

- Technological disruption: The rapid pace of technological change can render existing data centre infrastructure obsolete, requiring ongoing investment in upgrades and innovation.

- Regulatory changes: Government regulations related to data privacy, security, and energy consumption can impact the operations and profitability of data centre companies.

Data centre stocks FAQs

The data centre industry is experiencing unprecedented growth, fuelled by the digital transformation of businesses, the rise of cloud computing, and the proliferation of data-intensive technologies like artificial intelligence. This surge in demand for data storage and processing has made data centre companies an attractive prospect for investors seeking exposure to this sector.

Just remember, like any investment, the potential for rewards also carries inherent risks. A thorough understanding of the market and individual companies is crucial for making informed decisions.

Dividend policies vary significantly between growth-focused operators and property-focused trusts. Pure-play operators like NEXTDC often reinvest their cash flow into building new facilities (Capex) to capture growth, resulting in little to no dividend yield.

Conversely, Real Estate Investment Trusts (REITs) like Digico ($DGT) are generally structured to distribute income to investors, making them more likely to pay regular dividends.

A data centre REIT typically owns the physical land and building shell, collecting rent from tenants who manage the servers inside. An operator, like NEXTDC, manages the technical infrastructure, cooling, security, and connectivity services, charging clients for the usage of these critical systems.

Operators generally offer higher growth potential through service expansion, while REITs are often looked to for more stable, property-backed income streams.

Disclaimer

The information contained above is not financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up, and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of a general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and are not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.