Are these the 10 best U.S. data centre stocks to invest in?

As AI innovation accelerates, the tech industry needs more computing power than ever. This has translated into robust demand for data centres, which house massive arrays of specialised computer chips and digital infrastructure. Read on to learn which companies are leading the data centre industry and how investors can capitalise on the market’s growth.

Decide which U.S. data centre companies to invest in

Company Name | Ticker | Share Price | 1Y Return | Market Capitalisation |

|---|---|---|---|---|

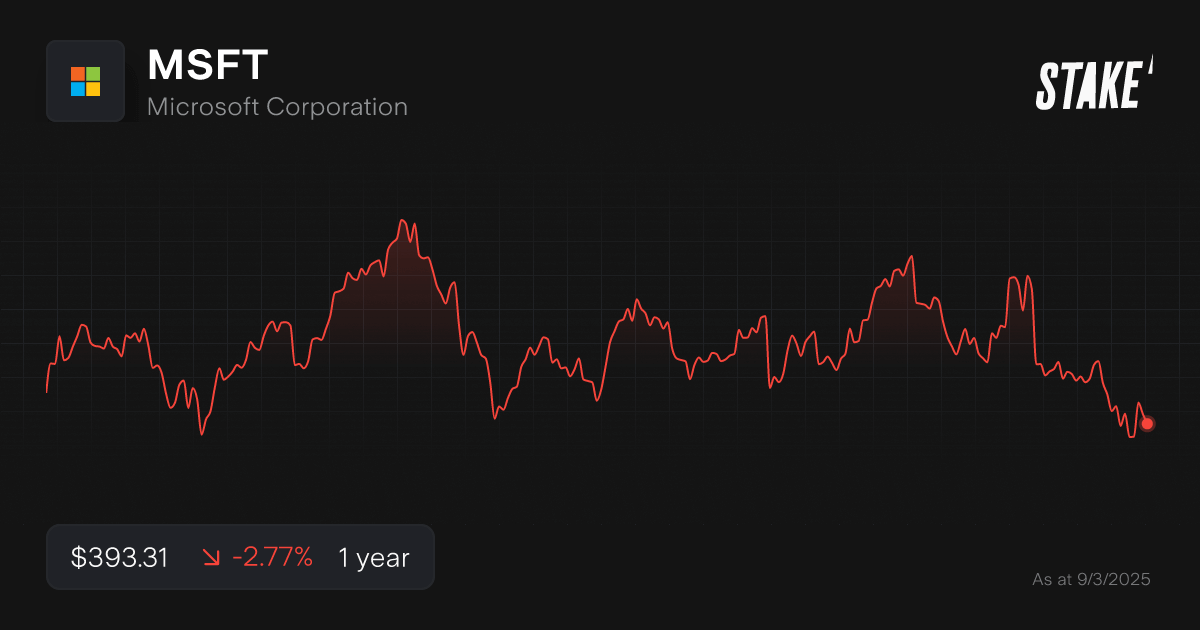

Microsoft | US$393.31 | -3.18% | US$2.9t | |

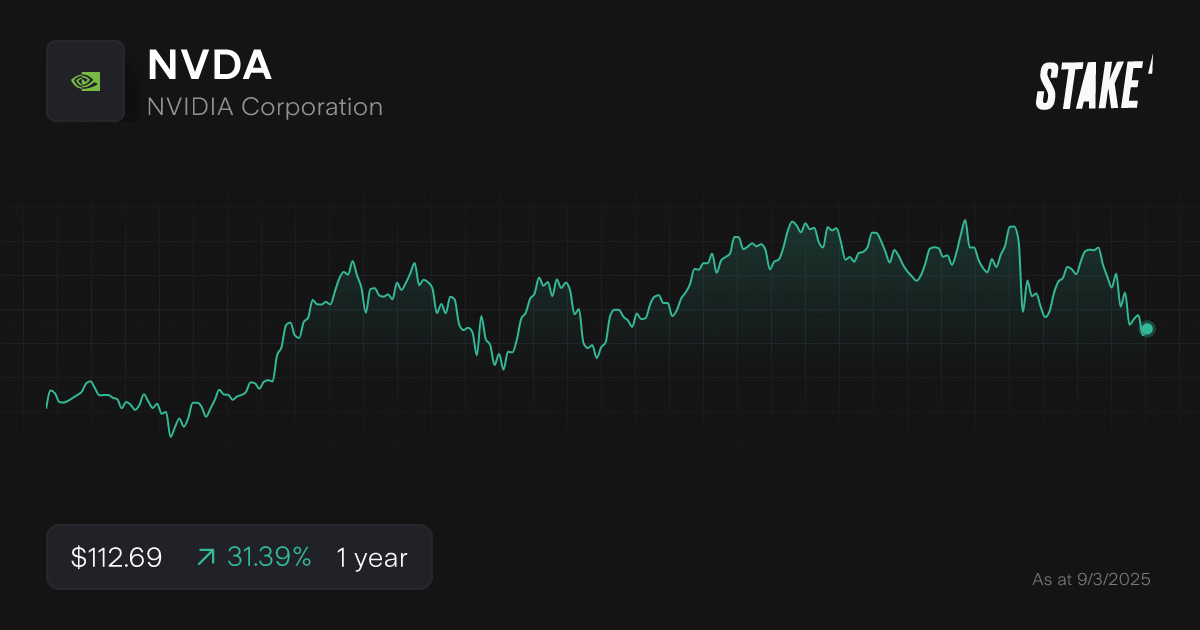

Nvidia | US$112.69 | +28.74% | US$2.6t | |

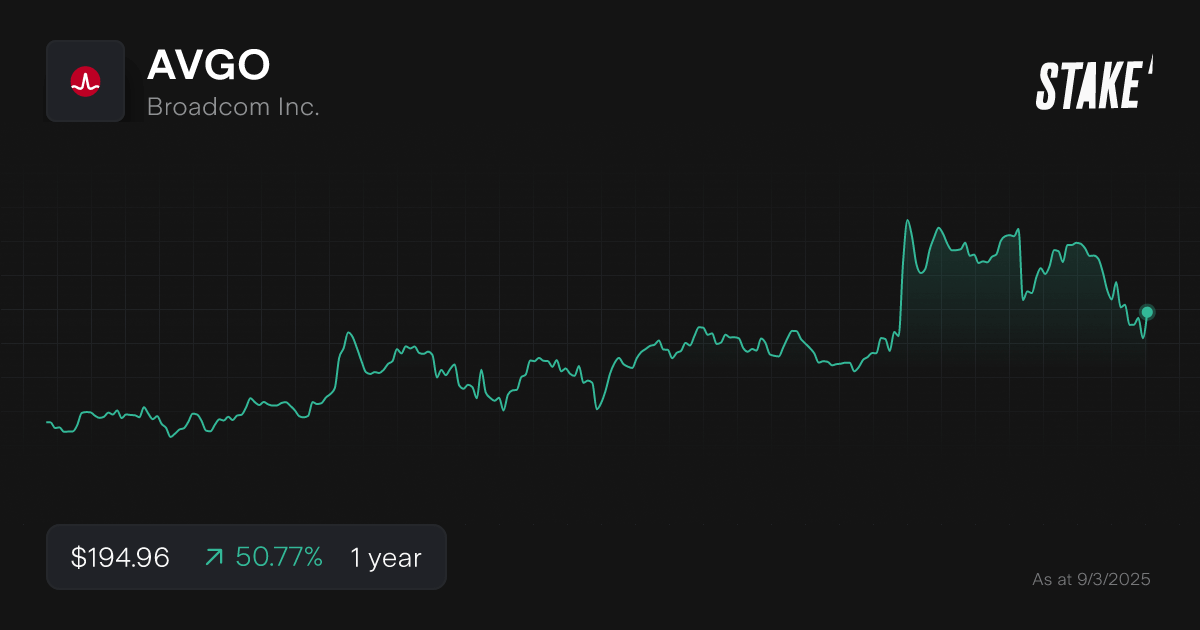

Broadcom | US$194.96 | +48.97% | US$913.8b | |

Oracle | US$155.16 | +38.02% | US$434.0b | |

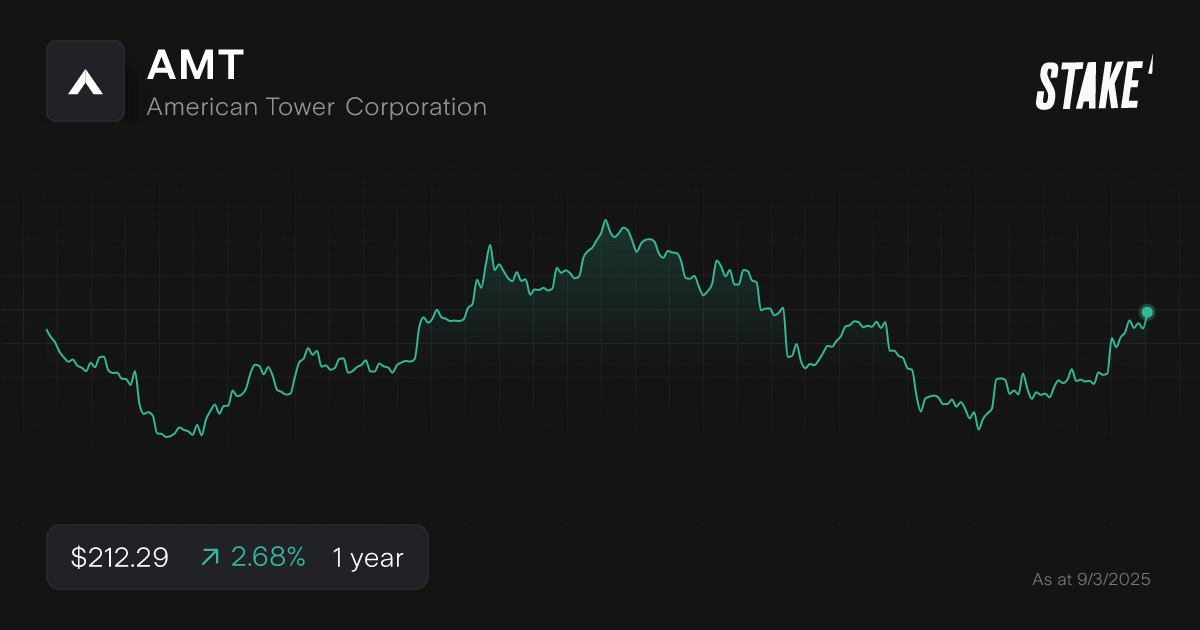

American Tower Corp | US$212.29 | +2.40% | US$99.2b | |

Equinix | US$859.52 | -5.56% | US$82.9b | |

Digital Realty Trust | US$149.17 | -0.21% | US$49.5b | |

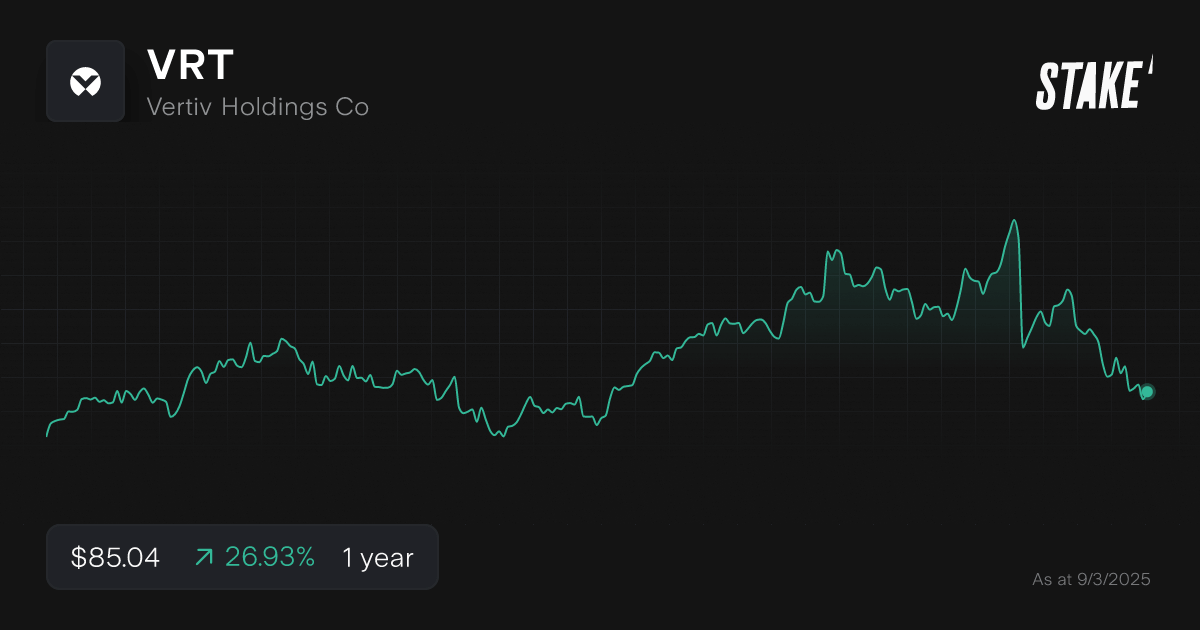

Vertiv Holdings | US$85.04 | +22.59% | US$31.9b | |

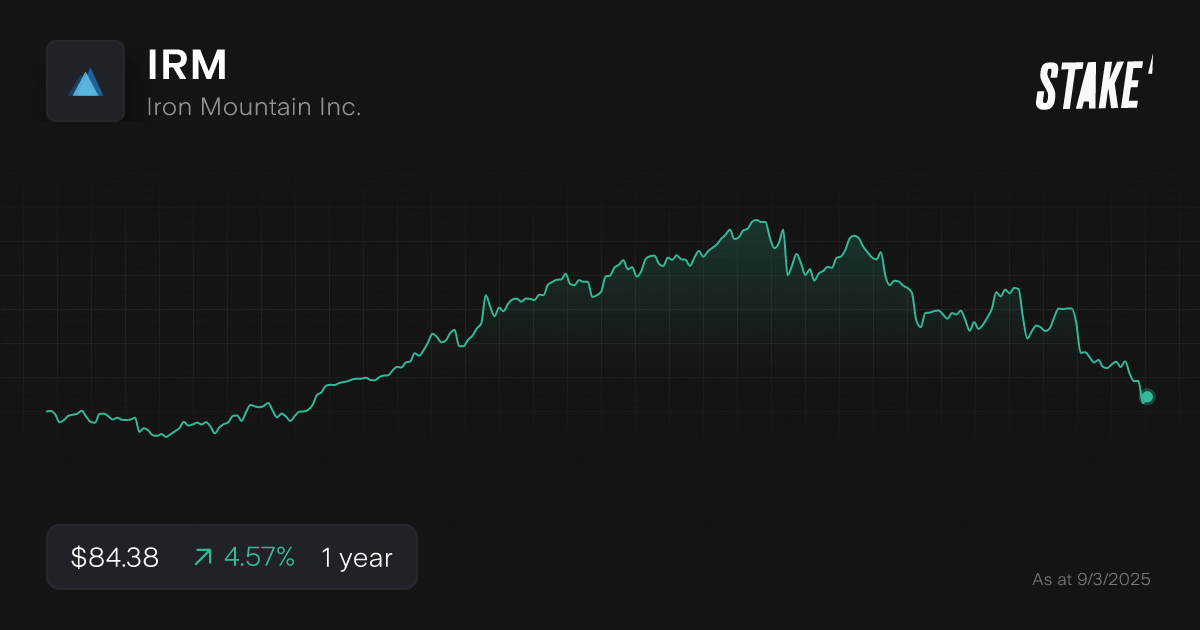

Iron Mountain | US$84.38 | +3.70% | US$24.8b | |

GDS Holdings | US$36.36 | +467.24% | US$6.5b |

Data as of 7 March 2025. Source: Stake, Google.

*The list of data centre shares mentioned is ranked by market capitalisation. When deciding what assets to feature, we analyse the financials, recent news and announcements, the state of the industry and the company's projects, and whether or not they are actively traded on Stake.

Join 750K investors

Get a full U.S. share when you fund Stake Wall St or A$10 trading credit when you fund Stake AUS. Fund both, get both. T&Cs apply.

💡 Related: The best ASX data centre stocks to watch

Discover if these data centre companies are the right investment for you

1. Microsoft ($MSFT)

One of the biggest and best-known tech firms in the world, Microsoft has enormous exposure to the data centre market. The company’s leading Azure cloud computing platform is powered by over 300 data centres globally.

Amid the AI revolution, Microsoft is making significant investments to expand this portfolio, planning to spend US$80 billion developing new data centres in 2025.[1] With that said, Microsoft reportedly cancelled several data centre leases in February, raising questions about the firm’s cloud strategy.

Azure remains Microsoft’s largest revenue segment, accounting for nearly 40% of sales. The stock could be a strong choice for an investor who wants data centre exposure within a blue-chip firm. Microsoft has a five-year annualised sales growth rate of 14.3%, with analyst estimates of 13.1% growth this year.

2. Nvidia ($NVDA)

Nvidia plays a foundational role in the data centre industry. The firm’s advanced GPU chips are currently the industry standard for AI research and development. In fact, Nvidia maintains a remarkable 92% market share in data centre GPUs. [2]

Although Nvidia does not operate data centres itself, the company partners with infrastructure-focused firms to integrate its product suite. These partners include Digital Realty and Equinix, two other companies on our list.

Nvidia’s sales have grown by 64% annualised over the past five years, although analysts expect that to slow slightly to 56% in 2026. Investing in Nvidia stock could make sense for broad exposure across the data centre industry, although performance will depend on the firm’s continued technological leadership.

✅ HOW TO BUY: How to buy Nvidia shares in Australia

3. Broadcom ($AVGO)

Broadcom is best-known for its data centre hardware products, including chips, network switches, and fiber optic equipment. Over the years, however, Broadcom has also become a notable player in the enterprise software industry.

In 2023, Broadcom acquired software firm VMWare in a massive deal worth nearly US$70 billion. Although controversial at the time, the strategy appears to have paid off by allowing Broadcom to sell bundled hardware and software solutions to data centre customers.

Like Nvidia, Broadcom can offer investors supply-side exposure to the data centre industry. The firm’s five-year sales growth rate of 19.2% is expected to accelerate slightly this year to 21.1%.

4. Oracle ($ORCL)

Oracle is one of Silicon Valley’s leading cloud computing providers, with over 160 data centres across all five continents. Like much of the industry, Oracle is investing in data centre expansion. The firm plans to spend US$10 billion in 2025 to build 100 new sites and expand existing capacity.

Although Oracle has several business segments, its cloud division accounts for 75% of the firm’s revenue. Oracle’s sales have grown at 6.8% annualised over the past five years, slightly slower than peers. Still, analysts expect revenue to grow 9% this year and 12.6% in 2026.

5. American Tower Corp ($AMT)

Unlike most companies on our list, American Tower is not a technology firm. Rather, the company is a Real Estate Investment Trust (REIT) whose portfolio focuses on digital infrastructure assets. AMT has a global portfolio of nearly 150,000 sites.

Although AMT’s holdings include assets like cell towers and antenna systems, the firm’s recent focus has been on data centres. In 2021, AMT purchased data centre operator CoreSite for US$10 billion and is actively developing new sites across the United States.

While analysts expect AMT’s sales growth to slow from nearly 6% in recent years to 1% in 2025, the stock is notable for its attractive income generation. With a 3.05% dividend yield, AMT could offer investors slightly more stable returns in a volatile industry.

6. Equinix ($EQIX)

Like AMT, Equinix is a REIT focused on communications infrastructure. The firm has a portfolio of more than 260 data centres worldwide, with additional multi-billion dollar investments announced this year.

Unusually for a REIT, Equinix also offers certain digital services tied to its data centre portfolio. As such, the stock could be a good fit for investors who want the tax efficiency of a REIT without purely being exposed to real estate assets.

Although Equix’s dividend yield of 2.2% is slightly less compelling than peers, the firm has logged an impressive 11.1% annualised sales growth in recent years. In 2025, analysts expect revenue growth to slow to 4.7%.

7. Digital Realty Trust ($DLR)

Another data centre REIT, Digital Realty has a portfolio of over 300 data centres globally. Like Equinix, DLR also offers digital services that make up a small portion of the firm’s revenue.

With the company’s 2004 IPO, Digital Realty became the first listed data centre REIT. Today, the firm partners directly with the industry’s leading software and hardware providers, including Nvidia and Microsoft Azure.

Like many REITs, DLR has an attractive dividend yield, currently 3.3%. Although sales growth is expected to slow to 6.4% this year, that follows 11.1% annualised gains over the past five years.

🆚 Compare DLR vs EQIX stock comparison→

8. Vertiv Holdings ($VRT)

Vertiv is a provider of temperature and power management infrastructure to the data centre industry. Because computer chips generate heat and require significant electricity, effective management of these factors is key to optimal performance.

Vertiv is a truly global company, with regional headquarters in the US, China, India, and the Philippines. While the firm may not be a household name, $VRT could offer investors exposure to a niche supplier within the data centre industry. Vertiv’s sales have grown by 12.5% annualised over the past five years, which analysts expect to increase to 15% in 2025.

9. Iron Mountain ($IRM)

Iron Mountain offers businesses data management services, including backups and shredding. In the data centre context, Iron Mountain focuses on sites that are secure from both natural and man-made disasters. Several of the firm’s data centres are located more than 50 metres underground.

Iron Mountain’s customers tend to be in industries that are highly sensitive to data security, including finance and healthcare. The firm’s sales have seen steady growth of 7.6% annually over the past five years with analysts expecting a 9.3% revenue jump in 2025.

10. GDS Holdings ($GDS)

While most of the firms we discussed today have a global footprint, GDS Holdings is exclusively focused on China. The firm has a portfolio of high-performance data centres in cities like Shanghai, Beijing, and Hong Kong.

$GDS could be a good fit for investors that want exposure to China’s domestic data centre industry, especially following the release of the highly publicised DeepSeek-R1 model. The firm’s sales have grown by 23.8% annualised over the last five years, although that pace is expected to slow to 13.4% in 2025.

List of popular data centre ETFs

For investors that want to back the data centre industry as a whole, several ETFs offer diversified exposure within this sector:

- $DTCR: The Global X Data Centre & Digital Infrastructure ETF features holdings within the data centre and digital infrastructure industries. The fund’s top positions include American Tower, Equinix, and Digital Reality. $DTCR has US$234.5M in assets and an expense ratio of 0.50%.

- $SRVR: The Pacer Data & Infrastructure Real Estate ETF portfolio is similar to $DTCR but offers slightly greater geographic diversification. The fund has US$427.9M in assets and a net expense ratio of 0.55%.

- $IDGT: Although the iShares U.S. Digital Infrastructure and Real Estate ETF has a slightly lower expense ratio at 0.41%, the fund is focused on digital infrastructure more broadly. In fact, one of $IDGT’s top holdings is Crown Castle, which has explicitly ruled out investing in data centres. The fund has assets of US$129.2M.

Where are the largest data centres located in the U.S.?

The U.S. is home to some of the world’s largest data centres, serving the country’s world-leading technology industry. America’s top five largest data centres are listed below[3]:

- The Citadel – Switch. 668,000 square meters in Reno, Nevada.

- Utah Data Centre. 130,000 square meters near Bluffdale, Utah.

- QTS Metro Data Centre. 120,000 square meters in Ashburn, Virginia.

- Apple Mesa Data Centre. 120,000 square meters in Mesa, Arizona.

- Lakeside Technology Centre. 102,000 square meters in Chicago, Illinois.

These sites span a mix of proprietary and shared data centres. Notably, the U.S. government operates the Utah Data Centre, facilitating data storage by agencies like the NSA.

The future of the data centre industry

The data centre industry looks set for an increasingly bright future. AI innovation continues to require massive levels of computing power, translating into robust demand for cloud computing. In fact, Blackstone estimates that over US$1 trillion will be invested in data centres over the next five years in the U.S. alone.[4]

Still, the industry could hit a few speed bumps. Notably, AI models out of China (such as DeepSeek-R1) appear to need far less computing power than those developed by Big Tech. If less-intensive models become the industry norm, the data centre market could face headwinds.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Article sources

[1] Microsoft plans to pour $80B into cloud data centres

[2] The leading generative AI companies