10 Robotics stocks to watch in 2025

While the rise of AI has made digital automation all the rage, physical automation continues to gather steam, with robotic technology improving year by year. As technology analyst and professor Alec Ross put it, ‘the robots of the cartoons and movies from the 1970s are going to be the reality of the 2020s.’

Read on to discover which companies are leading the automation revolution and which robotics stocks investors should watch in 2025.

Check out this list of the best robotics stocks

Company Name | Ticker | Share Price | Year to Date | Market Capitalisation | In Watchlists* |

|---|---|---|---|---|---|

Tesla, Inc. | US$419.40 | +3.85% | US$1.4T | 355,741 | |

Intuitive Surgical, Inc. | US$578.87 | +10.90% | US$207.5B | 3,500 | |

Boston Scientific Corporation | US$101.36 | +13.48% | US$150.3B | 723 | |

Texas Instruments Incorporated | US$161.77 | +10.93% | US$147.1B | 2,006 | |

Rockwell Automation, Inc. | US$391.30 | +39.16% | US$44.0B | 608 | |

Teradyne, Inc. | US$167.67 | +33.74% | US$26.7B | 1,273 | |

UiPath Inc. | US$13.61 | +7.08% | US$7.3B | 3,536 | |

Serve Robotics Inc. | US$9.71 | +28.07% | US$723.2M | 1,375 | |

iRobot Corporation | US$1.53 | +80.26% | US$49.2M | 1,963 |

Data as of 26 November 2025. Source: Stake, Google Finance.

Past performance is not a reliable indicator of future performance.

The list of stocks mentioned is ranked by market capitalisation. When deciding what companies to feature, we analyse the company's financials, recent news, advancement in their timeline, and whether or not they are actively traded on Stake.

*Amount of Stake customers who have added the listed asset into a watchlist.

Let’s breakdown the top robotics companies on Wall St

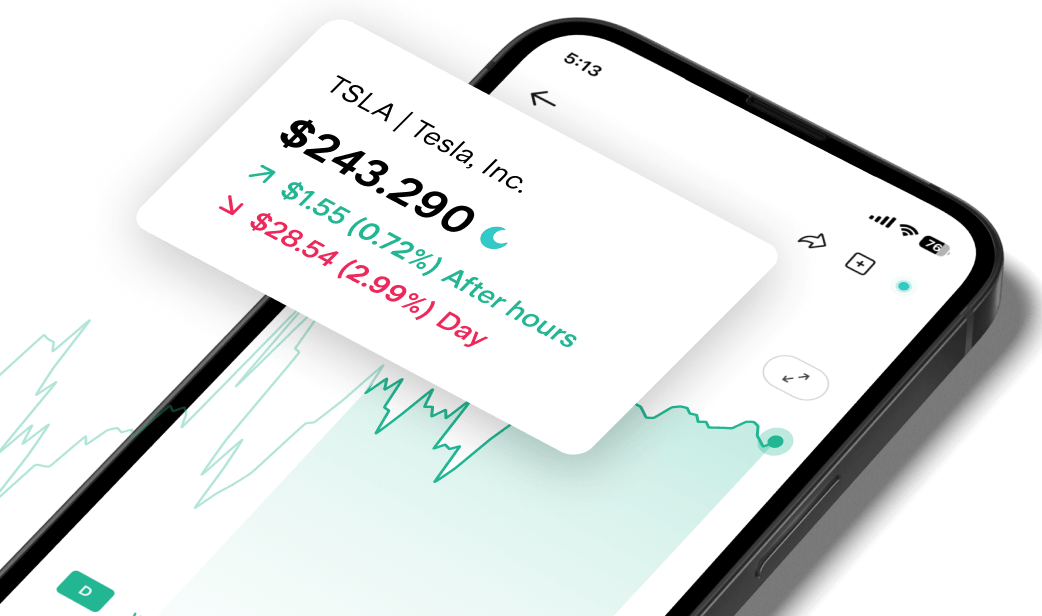

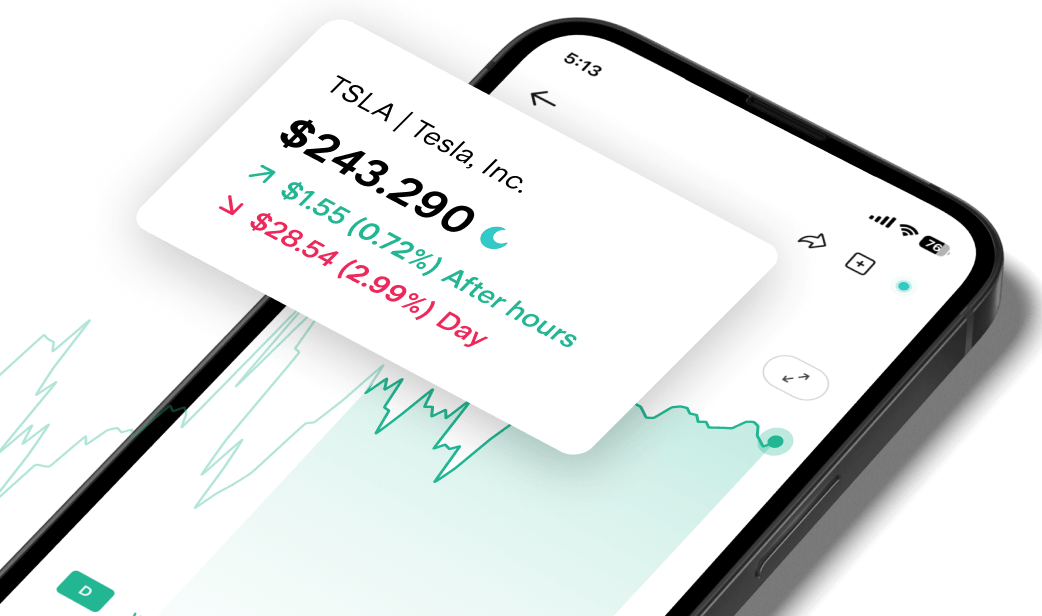

1. Tesla, Inc. ($TSLA)

While best known for their electric vehicles, Tesla is arguably the world’s largest robotics play.

The opportunity hinges on Optimus, a humanoid robot designed to disrupt labour markets, and the AI driving its autonomous fleet. The recent unveiling of the Cybercab and updated Optimus prototypes underscores this pivot, moving the business further away from pure auto manufacturing and towards scalable, automated services.

🚘 Related: Top EV stocks list featuring Tesla→

2. Intuitive Surgical Inc ($ISRG)

Intuitive Surgical dominates the med-tech landscape, having practically invented the category of robotic-assisted surgery. For investors eyeing automation in healthcare, this stock is widely considered a market leader in the sector.

Its flagship ‘da Vinci’ systems enable minimally invasive procedures with unmatched precision. The real value lies in the recurring revenue from instruments and accessories, generating consistent cash flow long after the initial system placement.

Momentum is building around the rollout of the next-generation da Vinci 5 system, which features haptic feedback and significantly improved computing power. This launch could further support a competitive moat as hospitals upgrade to the latest surgical tech.

3. Texas Instruments Corp ($TXN)

Texas Instruments provides the essential nervous system for modern automation, supplying the analog chips and embedded processors that allow machines to sense and move. Rather than building the hardware, this semiconductor giant powers the broader industrial robotics sector. Its technology drives everything from precise motor control to real-time sensing in autonomous mobile units.

The company continues to expand its edge AI capabilities, launching new processors designed to enhance vision in robotic applications. By enabling smarter, local decision-making for warehouse machines, Texas Instruments is becoming a critical supplier for the next generation of smart manufacturing.

4. Boston Scientific Corp ($BSX)

Boston Scientific ($BSX) is a global heavyweight in minimally invasive medical technology. While not a traditional robot manufacturer, the company is a key holding for medical automation strategies, offering precision therapies that often displace or complement robotic surgical systems.

Some of their tech includes the Farapulse ablation system and neuromodulation tools, which utilise intelligent mapping to automate complex procedures. In October 2025, the firm agreed to acquire Nalu Medical to expand its bio-electronic capabilities, a move following Q3 results that delivered impressive double-digit revenue growth.

🆚 Compare ISRG vs BSX→

5. Rockwell Automation Inc ($ROK)

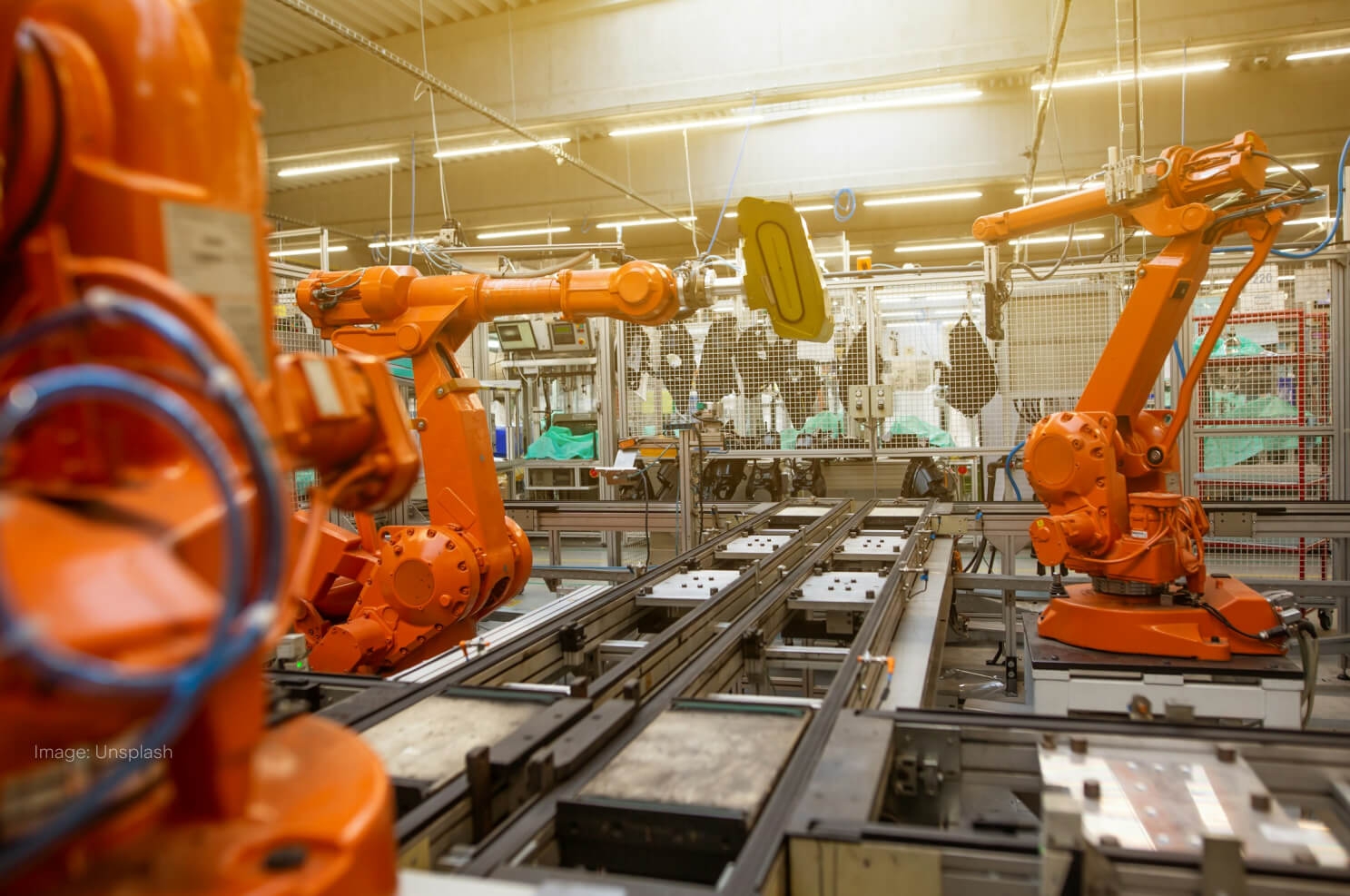

Rockwell Automation acts as the nervous system for modern manufacturing. It provides the essential software and controls powering smart factories, making it a significant component of the industrial robotics sector.

The company’s value stems from its push into autonomous mobile robots (AMRs) via OTTO Motors. By combining these movers with its FactoryTalk software, Rockwell delivers both the brains and brawn for industrial logistics.

Deepened ties with NVIDIA ($NVDA) are now integrating AI into these logistics solutions. This collaboration aims to supercharge their mobile robots' capabilities with digital twins, reinforcing Rockwell's stance in next-gen industrial efficiency.

6. Teradyne ($TER)

While known for semiconductor testing, Teradyne’s industrial automation arm is the real draw. Through Universal Robots, it leads the market for collaborative machines, offering an entry point into the automation sector.

Its strength lies in 'cobots' that work safely alongside humans. With Mobile Industrial Robots (MiR) driving logistics efficiency, Teradyne diversifies revenue beyond cyclical chips, offering exposure to structural growth in manufacturing tech.

Universal Robots recently integrated NVIDIA’s AI tech to supercharge its cobots with faster path planning. This move targets complex tasks in unstructured environments, keeping the firm at the forefront of AI-driven manufacturing.

7. UiPath Inc ($PATH)

UiPath sits in the software side of the automation revolution. While they don't build metal arms, their Robotic Process Automation (RPA) platform is the brain behind enterprise efficiency.

The company empowers businesses to unleash productivity through software robots that handle repetitive tasks. By integrating generative AI, UiPath allows complex workflows to run on autopilot, driving recurring revenue as companies supercharge operations.

Strategic collaborations with Anthropic and Inflection AI have embedded advanced agentic AI capabilities directly into their platform. This move solidifies their lead in the autonomous enterprise space, offering a seamless path to smarter digital operations.

8. Serve Robotics Inc ($SERV)

Serve Robotics automates last-mile delivery with AI-powered sidewalk rovers, positioning itself as an opportunity in the autonomous logistics space. By replacing cars for short trips, the company addresses urban congestion and high labour costs.

The business captures value through delivery fees, fleet advertising, and back-of-house tech. Momentum is building, with Serve recently launching in Atlanta and Chicago, alongside a Middle East pilot. These moves follow its strategic acquisition of Vebu, diversifying revenue beyond sidewalk delivery.

9. iRobot Corp ($IRBT)

As the pioneer behind the Roomba, iRobot remains the household name in consumer automation. The company is executing a critical turnaround to reclaim market share, finally integrating LiDAR navigation and unique "DustCompactor" technology to restore margins and prove its innovation engine still hums.

In March 2025, the firm unveiled its largest product overhaul ever, including the Roomba 205 and 505 Combo series. Concurrently, leadership continues an active strategic review to stabilise liquidity and secure the business's future.

What robotic ETFs are available to invest in?

There are a range of Wall Street-listed ETFs focused on robotics and automation technology, but two stand out:

Global X Robotics and Artificial Intelligence ETF ($BOTZ): This ETF features some overlap with tech indexes due to a complementary AI focus, with top holdings of Nvidia, Intuitive Surgical, and ABB. BOTZ has $2.86B under management and an expense ratio of 0.68%.

ROBO Global Robotics & Automation Index ETF ($ROBO): The ROBO fund tracks an alternate index with a broader scope that invests along the robotics value chain. The ETF’s top holdings include Harmonic Drive, Hiwin Technologies, and Fanuc Corp. ROBO has an AUM of $1.17B and an expense ratio of 0.95%.

For investors interested in ASX-listed ETFs, consider $ROBO from Global X or $RBTZ from Betashares.

Which robotics company is leading the industry?

In robotics, there isn’t a single industry leader to speak of, largely because this market is made up of distinct subsectors.

Intuitive Surgical ($ISRG), for instance, is the market leader in medical robotics, but iRobot ($IRBT) offers superior consumer robotics. Similarly, while ABB has impressive industrial automotive technology, the company would struggle to rival Serve ($SERV) in terms of food delivery robotics.

What are the main risks associated with investing in robotics stocks?

The robotics sector can be volatile due to high research and development costs, and many pure-play robotics companies trade at high valuations based on future growth expectations.

Industrial robotics stocks are often cyclical; when the economy slows, manufacturers may delay capital expenditure on new machinery. Investors should be prepared for price swings and consider a long-term horizon to ride out these economic cycles.

What is the future outlook of the robotics industry?

The outlook for robotics appears quite strong, with forecasts for the industry frequently topping 15% CAGR in the coming years.

For submarkets like collaborative robotics, growth estimates are as high as 35% annualised through 2030.[1]

What’s more, emerging technology like AI could enhance the effectiveness of autonomous machinery, providing a further industry tailwind. Still, this doesn’t mean that every robotics company will be successful – investors need to be mindful of which companies have market-leading technology and compete in high-margin sectors.

Robotics stocks FAQs

While not mentioned in our list of robotics stocks, Nvidia ($NVDA) still fits into this bucket as it provides the essential computing power and AI infrastructure that allows robots to "see," "think," and navigate the real world. While known for graphics chips, their Jetson platform and Isaac robotics software are critical for training autonomous machines.

Industrial automation companies, like Rockwell Automation or ABB, focus on factory efficiency, assembly lines, and logistics, making their performance tied to global manufacturing cycles.

Surgical robotics firms, such as Intuitive Surgical ($ISRG), operate in healthcare, focusing on minimally invasive procedures. The latter often enjoys a "razor-and-blade" business model, generating recurring revenue from disposable instruments used during each surgery, which can offer more stability than cyclical industrial orders.

Absolutely, legacy companies like John Deere ($DE) are rapidly transforming into major robotics players through autonomous tractors and precision agriculture tech. By integrating AI and automation into heavy machinery, they help farmers do more with less labour. These stocks can offer a blend of stability from their core business operations with the potential growth upside of emerging robotics technology.

Collaborative robots, or "cobots," are designed to work safely alongside humans in shared workspaces, rather than being caged off in heavy industrial zones. Teradyne ($TER), through its subsidiary Universal Robots, is a market leader in this segment. This technology opens up automation to small and mid-sized businesses, expanding the total addressable market beyond just massive automotive factories.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.