What is CAGR? CAGR Formula, Examples and More

The Compound Annual Growth Rate (CAGR) offers a quick and easy way to compare the past returns of different assets. While CAGR struggles to account for dividends and volatility, it is still useful for getting a rough sense of an asset’s historical performance.

Compound Annual Growth Rate (CAGR) definition

When it comes to evaluating investment performance, an asset’s compound annual growth rate (CAGR) is one of the most important metrics to understand.

In technical terms, an asset’s CAGR is the geometric average yearly growth rate of the asset over a certain time period.

While that definition might sound intimidating, the concept is actually quite intuitive. Essentially, CAGR seeks to answer the question:

"Given a certain starting value, how much would an asset have to appreciate on average each year to achieve a certain end value?"

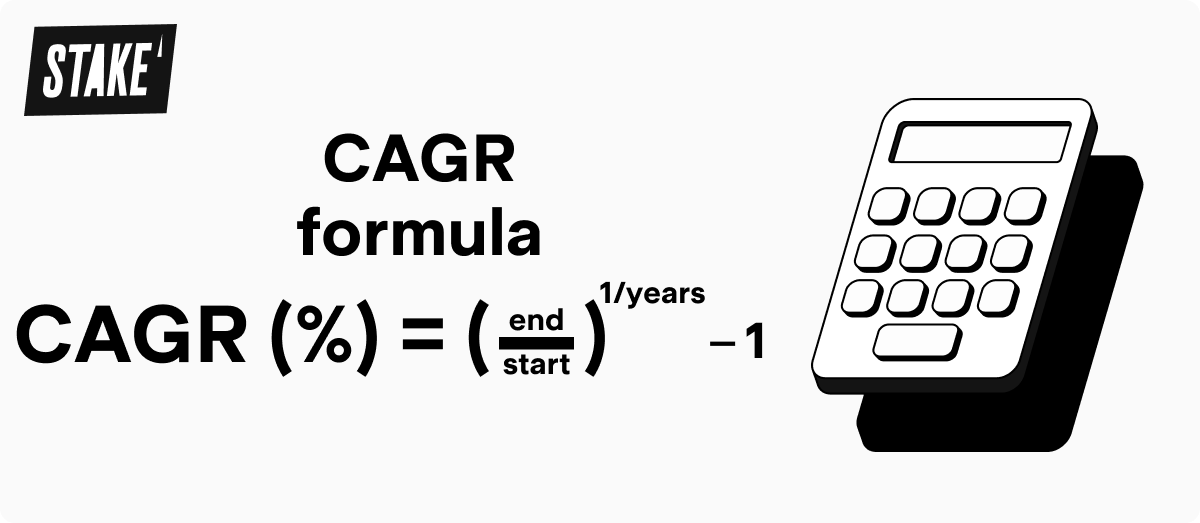

How to calculate CAGR

Unlike many other investment metrics, CAGR is simple to calculate, requiring just three figures: the asset’s starting value, ending value, and the total number of years elapsed.

For instance, suppose you have an asset with a starting value of $100. After three years, the asset’s price has appreciated to $150.

First, we find that $150/$100 = 1.5.

Then, we raise 1.5 to the cubed root, which is approximately 1.1447. Subtract one and we find that the CAGR of the asset is 14.47%.

To double-check our work, we can plug our CAGR into the compound interest formula.

Doing so will indicate that $100 growing at a rate of 14.47% for three years does indeed grow to $150 (with allowance for rounding errors).

It’s also possible to use the CAGR formula to calculate an asset’s losses.

Suppose that we swap our starting and end values, for instance.

Step by step, $100/$150 = 0.6667. The cubed root of this yields 0.8736. Subtract 1 from this figure to find -12.64%, which is indeed the amount an asset would have to depreciate per year to fall from $150 to $100 over three years.

🎓 Learn more: What is a good P/E ratio?→

What is the main way investors use CAGR?

Investors rely on CAGR as a back-of-the-envelope way to compare the long-term investment performance of different assets. If one asset has a five-year CAGR of 10% and another has a five-year CAGR of 5%, the first asset offers more compelling recent price returns.

Think of CAGR as a common language to translate the performance of different assets, allowing for quick comparisons.

Are there any limitations when using CAGR?

While CAGR is helpful, it is not without significant limitations. Generally, while CAGR offers a useful first impression of an asset’s performance, you’ll need to rely on other metrics to gain more detailed insight.

CAGR smooths out investment fluctuations

Consider an asset that grows 50% the first year, falls 20% the second year, and then grows 5% in the third year. Over this three-year period, the asset’s CAGR is a relatively innocuous 8.0%. This figure, however, does not reflect the asset’s tremendous volatility over that timeframe.

CAGR reflects an average, it inherently ‘smooths out’ volatile periods. To better understand the risks and rewards of an asset, consider combining CAGR with metrics like an investment’s annual standard deviation and maximum drawdown.

CAGR does not account for dividends or interest

Suppose that you own a corporate bond with a stable par value of $100 that yields $5 in interest per year. Because the bond’s value stays fixed, its CAGR will always be 0%. Clearly, this investment has a positive yield, earning 5% in interest per year.

Because the CAGR calculation relies only on a starting and end value, it is not built to account for cash flows that occur during an asset’s life. This can make it difficult to accurately evaluate the performance of income-generating investments like bonds or dividend-yielding stocks (learn more about investing in dividend stocks).

To overcome this issue, total return measures work by assuming that all cash outflows are immediately reinvested.

CAGR does not account for irregular cashflows

Because CAGR offers a smoothed average view of investment performance, the calculation assumes that all growth occurs at regular periods and in equal amounts. The time value of money means investors should prefer growth that happens sooner rather than later.

Consider two assets that each start at $100 and grow to $150 five years later. The first asset experiences $10 worth of growth each year while the second experiences $50 growth in the final year. While the CAGR of both of these will be 8.4%, the first asset is more valuable, since we can reinvest the gains earlier.

To compare assets with different cash flows, investors generally use the Internal Rate of Return (IRR). This calculation is more complicated, requiring a spreadsheet, but incorporates both the timing and level of cashflows. Based on Excel’s IRR function, the asset with $10 of annual gains has an IRR of 10%, while the asset with $50 of gains in the last year has an IRR of 8.4%, equivalent to its CAGR.

Example of using CAGR

To understand how to use CAGR in practice, let’s walk through a few examples of using this metric to compare investment performance.

Example #1: Tesla ($TSLA)

To reflect the fact that CAGR does not handle dividends well, we’ll start with a non-dividend-paying stock like Tesla.

On 20 December 2024, Tesla closed at a price of $421.06. Exactly two years previously, on 20/12/2022, Tesla closed at a price of $137.80.

By using our formula, we find that Tesla’s two-year CAGR is 74.8%.

Example #2: Johnson & Johnson ($JNJ)

More ambitiously, we can attempt to calculate the CAGR of a stock with a much longer track record, such as Johnson & Johnson.

Note that since J&J does issue dividends, our CAGR calculation will understate realised historical investment performance. Still, CAGR can serve as a useful first pass at understanding J&J’s historical growth.

On 20 December 2024, J&J closed at $144.47.

40 years earlier, on 20 December 1984, J&J closed at $0.89. Thus, J&J’s CAGR over the past 40 years has been 13.6%.

Example #3: S&P 500 Total Return

Finally, we’ll use an example of how total return indexes can be used to calculate a CAGR that reflects realized investment performance. Total return benchmarks like the S&P 500 Total Return Index assume that all income generated is reinvested.

On 20/12/2024, the S&P 500 Total Return Index was 5,930.85. Five years earlier, on 20/12/2019, it was 3,221.22. This translates into a five-year CAGR of 13.0%, which would reflect realized investment performance if an investor immediately reinvested all dividends.

💡Related: How to invest in S&P 500 in Australia→

What is a good CAGR?

There's no such thing as a ‘good’ CAGR.

Evaluating whether an investment has offered a compelling CAGR depends on factors like the current risk-free rate on U.S. Treasuries and how benchmarks like broad stock indexes have performed.

Higher CAGRs tend to involve higher risk levels. As a backward-looking measure, CAGR is also risky to rely on as a measure of future investment performance.

CAGR FAQs

For investors, understanding a company’s CAGR can offer useful insight into how the company’s shares have performed as an investment.

Generally, a company with a higher CAGR has offered more compelling investment returns. After calculating a company’s CAGR, investors should follow up with deeper research into the stock’s volatility and other risk metrics.

Investors should consider whether the company’s expansion plans will help fuel further growth in the future.

Looking solely at an investment’s growth is an incomplete way to gauge an asset’s historical performance.

An asset that has increased in price from $100 to $150 has notched 50% total growth. Depending on the time it took to achieve that growth, the asset may or may not have been a good investment.

By incorporating time into the performance calculation, CAGR helps compare asset performance on an equivalent basis. In addition, CAGR incorporates the effects of compounding, which other simplified measures of growth often miss.

One of the drawbacks of the CAGR is that it does not account for an asset’s riskiness.

To rectify this, some financial analysts have proposed different methods of calculating a risk-adjusted CAGR to fairly compare different investments.

The most popular way to adjust the CAGR for risk is the Sharpe ratio. The Sharpe ratio works by considering an asset’s CAGR and then subtracting the risk-free rate from it. The resulting amount is divided by the asset’s standard deviation.

Thus, the Sharpe ratio can be thought of as reflecting an asset’s excess return per unit of volatility. While the Sharpe ratio does come with significant drawbacks and is not useful for all assets, it is the most commonly referenced risk-adjusted CAGR measure in the financial industry.

Disclaimer

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation, particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

Our $3 applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that apply.