10 Best stocks you need to watch in 2025

U.S. stocks are well positioned to deliver another year of gains in 2025 on President Trump’s plans to support economic growth, lower interest rates and the ongoing AI boom. Tech giants are in the spotlight after lifting the S&P 500 Index 23% higher in 2024 and driving a 28% gain in the Nasdaq. Valuations are high, leaving little room for earnings to disappoint.

Watch these stocks closely in 2025

Company Name | Ticker | Share Price | 1Y Return | Market Capitalisation |

|---|---|---|---|---|

Apple | US$229.98 | +18.61% | $3.46t | |

Nvidia | US$137.71 | +130.86% | $3.37t | |

Microsoft | US$429.03 | +8.20% | $3.19t | |

Alphabet | US$197.55 | +33.74% | $2.41t | |

Amazon | US$225.94 | +45.97% | $2.38t | |

Meta Platforms | US$612.77 | +60.50% | $1.55t | |

Tesla | US$426.50 | +104.26% | $1.34t | |

The Boeing Company | US$171.09 | -20.40% | $128.01b | |

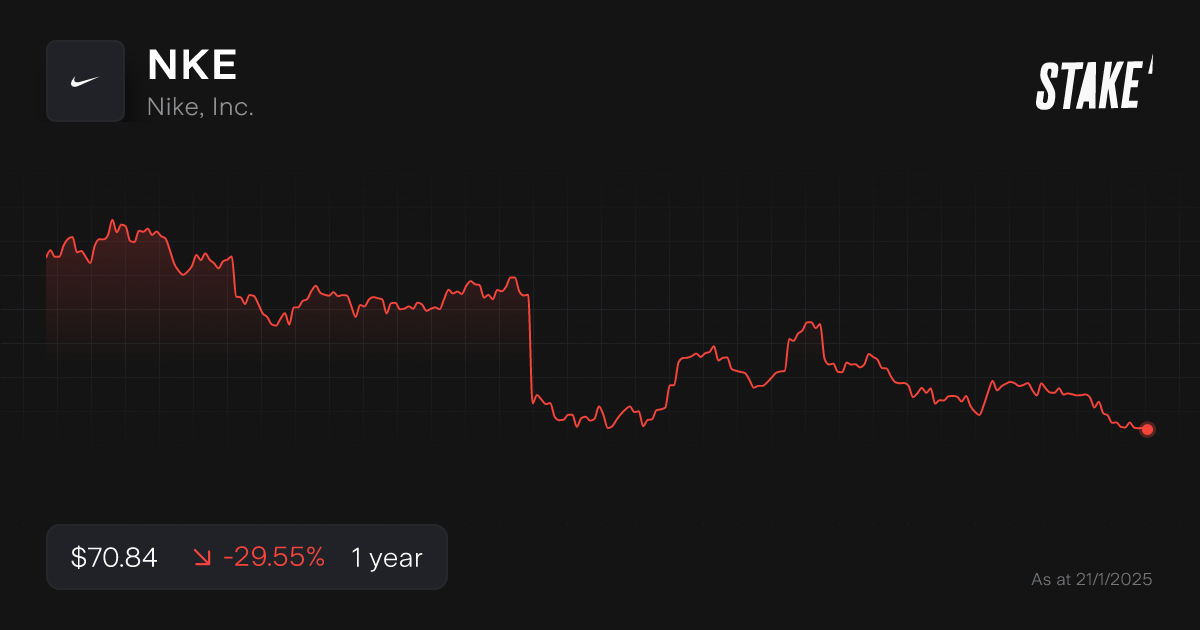

Nike | US$70.84 | -29.55% | $106.12b | |

Constellation Energy | US$316.36 | +169.91% | $98.95b |

Data as of 17 January 2025. Source: Stake, Google.

*The list of stocks mentioned is ranked by market capitalisation. When deciding what stocks to feature, we analyse the company's financials, recent news, advancement in their timeline, and whether or not they are actively traded on Stake.

Let's breakdown these U.S. companies

1. Apple ($AAPL)

- 224,613 Stake customers watching

- 352,521 orders executed on Stake

The broader availability of Apple Intelligence is expected to drive an iPhone upgrade cycle in 2025. The importance of Apple Intelligence was underscored by a report that Apple had lost its crown as the top selling smartphone in China to local rivals Vivo and Huawei due to the absence of Apple AI on its smartphones. Four iPhone 17 models are expected later this year and more AI investment and development. Upgrades to Siri, ChatGPT integration and AI image tools may lift sales. The inclusion of more AI tools is expected to drive more revenue in Apple’s services segment.

Less than 50% of Apple’s users pay for services. Analysts estimate growing user numbers and pricing power can sustain double digit services revenue growth. Strong cash flows should support more buybacks and dividends.

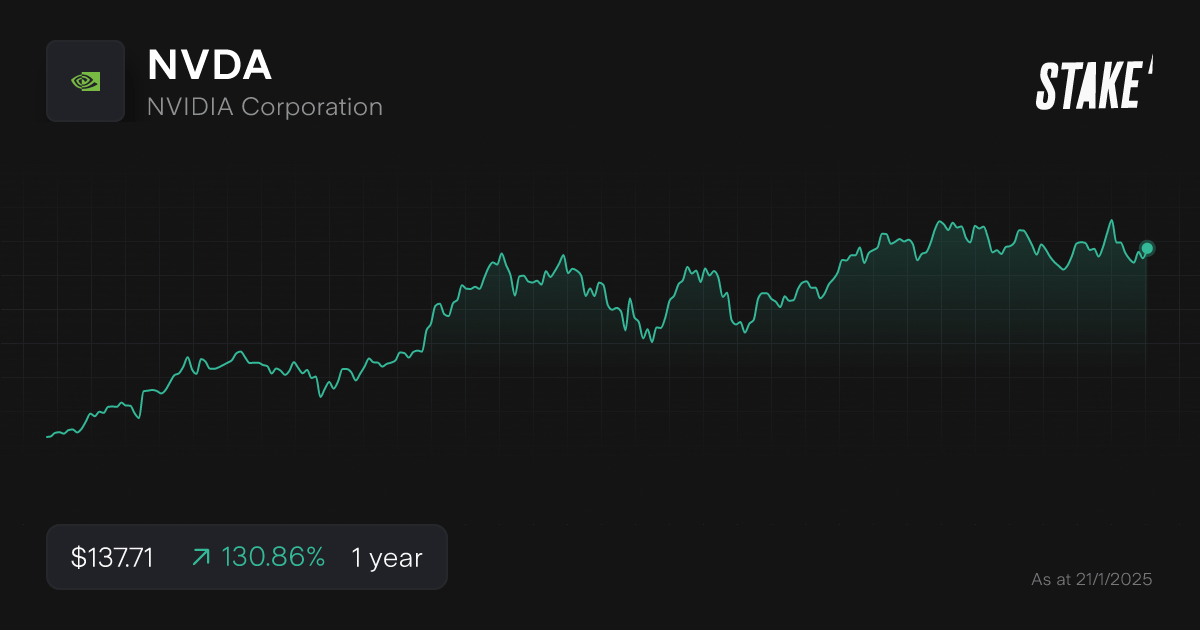

2. Nvidia ($NVDA)

- 203,384 Stake customers watching

- 219,986 orders executed on Stake

Nvidia’s 2025 is all about Blackwell, its latest graphics processing unit architecture. The Blackwell chip is packed with 208 billion transistors and can build and run real-time generative AI on trillion-parameter large language models at up to 25 times less cost and energy consumption than its predecessor. The company announced last year that Blackwell was sold out for the next 12 months given the boom in AI demand.

Analysts expect the company to grow its share of the AI processor market in 2025 as it powers the AI ambitions of tech giants like Google and Meta. Nvidia offers more than hardware: it also sells software that integrates its servers inside data centres. Nvidia is looking beyond Blackwell: it’s working on a new chip called Rubin that offers greater computing power and energy savings.

3. Microsoft ($MSFT)

- 51,514 Stake customers watching

- 170,542 orders executed on Stake

Microsoft has made its priorities for FY25 clear after unveiling plans to spend US$80b on data centres to handle its AI workload. The company has invested around US$14b in OpenAI and provides cloud infrastructure to the generative AI company. OpenAI’s ChatGPT has been embedded into Windows, Teams and other products.

Microsoft’s revenue from its Azure and other cloud services increased 33% YoY in Q1. The ability to bundle cloud-related products with other services like security and Teams is viewed as an earnings driver. Microsoft is expected to do more to improve and integrate CoPilot.

On the regulatory front, the company is under investigation by the Federal Trade Commission relating to its Azure, AI and cybersecurity products.

4. Alphabet ($GOOG)

- 21,966 Stake customers watching

- 47,848 orders executed on Stake

Investors will be focused on the impact on Google's advertising business from generative AI. Google has responded by deploying AI overviews that deliver summaries at the top of search queries.

Alphabet is driving revenue growth through its Performance Max advertising platform that automates buying across search, YouTube and other applications. Services revenue was up 13% YoY in Q3.

YouTube has been performing strongly with US$50b in ad and subscription revenue over the past four quarters. The monetisation of YouTube Shorts is increasing.

Alphabet is investing heavily in AI, unveiling its new AI model Gemini 2.0 in December. CEO Sundar Pichai said 25% of new Google code is generated by AI. Google cloud unit is enjoying strong AI demand, with revenue up 35% YoY in Q3.

5. Amazon ($AMZN)

- 55,360 Stake customers watching

- 173,006 orders executed on Stake

Amazon’s online sales are growing at a solid pace – 7% YoY in Q3 – and the company has been investing in fulfilment centres to bring products closer to customers and cut delivery times. AWS will be in the spotlight given the AI boom is driving demand for its cloud computing platform. AWS is well positioned with a 30% share of the global cloud market. AWS sales have accelerated from a 12% YoY pace in Q2 2023 to 19% QoQ in Q3 2024.

Amazon has invested US$8b in Anthropic, which operates the Claude generative AI model. Amazon is Anthropic’s primary cloud and training partner. Amazon’s advertising business – the world’s third largest digital advertiser - is growing strongly, though the pace of growth has slowed from 26% YoY in Q3 2023 to 19% YoY in Q3 2024.

6. Meta Platforms ($META)

- 195,949 Stake customers watching

- 125,496 orders executed on Stake

Meta Platforms CEO Mark Zuckerberg warned his staff that 2025 will be ‘intense.’ It’s going to be so intense that Meta will cut 5% of its workforce, with underperformers gone by February.

Zuckerberg noted AI, the future of social media and the development of augmented reality glasses as priorities in 2025. Meta expects ‘significant capital expenditures growth’ in 2025 after forecasting capex of US$38b-US$40b in 2024. Look for more embedded AI in social media apps like Whatsapp and Instagram. Meta AI has 500m active monthly users. Competition from Chat-GPT and Gemini will see more money spent on its Llama large language model. Social media will be a hot topic after Meta abandoned third party fact checking.

7. Tesla ($TSLA)

- 245,834 Stake customers watching

- 843,908 orders executed on Stake

Much is riding on Tesla’s new Model Y - codenamed Juniper - to reinvigorate Tesla sales. CEO Elon Musk set a high bar for 2025, saying in October that he planned to lift vehicle sales by 30%. The ambitious target comes as Tesla faces stiff competition. It just pipped BYD ($BYDDY) to snare the crown for most EV sales in 2024, though Tesla’s annual sales fell from 2023 levels. However, BYD snared the top spot for annual EV production for the first time.

Musk’s close relationship with the Trump administration is expected to deliver a more favourable regulatory environment for autonomous vehicles. Level three autonomous driving software will be launched this year. Tesla plans to start producing its Cybercab in 2026, though analysts caution that robotaxis could take longer to gain regulatory approval.

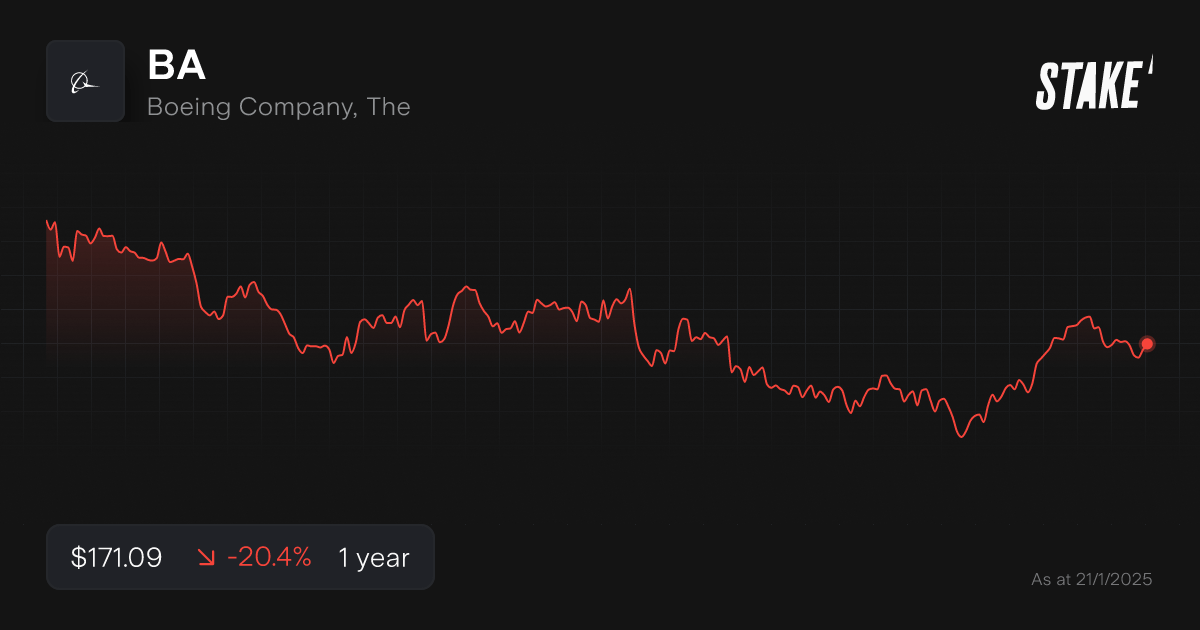

8. The Boeing Company ($BA)

- 10,654 Stake customers watching

- 33,401 orders executed on Stake

Boeing needs a big turnaround after a shocking 2024. The Trump administration is watching: Sean Duffy, nominee for Transport Secretary, said he would work ‘to restore global confidence in Boeing’ at his confirmation hearing. Boeing shares fell 32% in 2024 after a door fell off an Alaska Airlines 737 Max due to four missing bolts. The aircraft maker remains under the Federal Aviation Authority’s strict oversight. It’s prohibited from expanding 737 Max output beyond 38 a month. Production disruptions have it lagging rival Airbus.

Boeing delivered 348 planes in 2024 compared to Airbus’ 766 planes. Investors will be keen to hear CEO Kelly Ortberg’s plans to lift production when Boeing delivers Q4 results on 28 January.

9. Nike ($NKE)

- 18,816 Stake customers watching

- 32,507 orders executed on Stake

Nike has labelled 2025 the Year of the Mamba[1], but investors hope it will be the year of a share price recovery under new CEO Elliott Hill. The former Nike senior executive returned to the shoe and apparel giant last year amid market share losses to rivals Hoka ($DECK) and On ($ONON). It also suffered sagging sales of its flagship brands like Air Jordan. Hill needs to repair relationships with distributors and convince potential shoe buyers it still knows how to innovate.

Nike’s SNKRS Showcase[2] livestream in December provided a taste of what’s to come. Nike revealed 20 new styles set to be released in 2025, including restyled Air Max 95, Air Max Craze and Air Diamond Turf models.

10. Constellation Energy ($CEG)

- 777 Stake customers watching

- 858 orders executed on Stake

Who said utilities are boring? Constellation Energy is up 168% over the past year as the largest operator of nuclear power plants in the U.S. enjoys growing demand for low emissions power from the fast growing AI industry. The utility signed a 20-year power supply deal with Microsoft ($MSFT) last year that will see a restart of a unit at its Three Mile Island facility. Microsoft will use the electricity to power data centres.

Constellation will spend US$1.6b to revive the plant, which is expected to come online in 2028. The US$16.4b acquisition of Calpine, announced in January, will add gas-fired and geothermal energy to its portfolio.

Which industries to follow in 2025?

AI is the hottest industry at the moment as the biggest tech companies invest heavily in chips, large language models and data centres. Electric vehicles continue to be a popular theme, with competition between Tesla and BYD heating up. Nuclear energy is enjoying a renaissance as AI’s power demands force companies to seek out low emissions electricity.

List of ETFs you need to watch

Vanguard S&P 500 ETF ($VOO)

The Vanguard S&P 500 ETF offers low cost exposure to the largest U.S. companies. It has a big weighting in big tech companies but offers a diversified portfolio, with JPMorgan ($JPM), ExxonMobil ($XOM), Visa ($V), Mastercard ($MA) and Walmart ($WMT) among the top 20 holdings.

Invesco QQQ ETF ($QQQ)

The Invesco QQQ ETF tracks the Nasdaq 100 Index. It offers a sharper focus on tech stocks, with no exposure to slower growing sectors like banks. Apple ($AAPL) is its top holdings at 8.88% compared to a 7.6% weighting in the Vanguard S&P 500 ETF.

VanEck Uranium and Nuclear Energy ETF ($NLR)

Nuclear energy is enjoying renewed interest as tech companies and data centre operators seek sources of low emission energy to power the AI boom. The ETF tracks companies involved in uranium mining, nuclear construction and nuclear generation. The top five holdings include Constellation Energy ($CEG) and Cameco ($CCJ).

Which indices to follow closely moving into 2025?

The S&P 500 remains the index to watch given it’s the index most fund managers benchmark themselves against. But the Nasdaq will be a key index given hefty tech valuations and the massive flow of capital into AI.

✅ Learn more about how you can get started investing in the S&P 500 or the Nasdaq→

Will the technology sector have another big year?

Technology stocks should enjoy a solid year given the plans by big tech companies to continue investing heavily in AI. This could sustain demand across industries such as chips, servers and data centres. The question for investors is whether AI-driven earnings growth is already priced in.

Investors need to closely watch quarterly earnings to track demand.

This article was edited by Robert Guy - Senior Markets Writer at Stake.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Article sources

[1] https://about.nike.com/en/newsroom/releases/nike-kobe-year-of-mamba

[2] https://about.nike.com/en/newsroom/releases/nike-snkrs-showcase-2025-styles-official-images