How to buy Tesla (TSLA) shares in Australia

To buy Tesla shares in Australia, you need to first select an investing platform that allows you to invest in the U.S. stock market. There are many online platforms available, such as Stake.

This article focuses on how to buy specific securities, however, it is not a recommendation to invest in them and should not be taken as financial advice. Do your own research and make your own decisions, or even consider getting advice from a licensed financial adviser before investing.

Tesla has consistently been one of the hottest stocks of the last few years, both in performance and investor interest. Tesla stock has made its founder Elon Musk one of the richest men on Earth and almost single-handedly managed to shift how the public thought about electric vehicles. Learn more about the company and how to buy Tesla shares in Australia.

Here's what you'll learn in this article:

- How to buy Tesla shares in Australia

- Tesla, Inc. overview

- Tesla share price performance

- Tesla stock P/E ratio

- Tesla EBITDA

- Do Tesla shares pay dividends?

- Tesla stock splits

- ETFs with exposure to Tesla

- Tesla, Inc. FAQs

To buy Tesla shares in Australia, you will need to find an investing platform that provides access to the Nasdaq. There are several platforms in Australia that let you buy and sell U.S. stocks like Tesla. Make sure to compare online investing platforms and consider the brokerage fees, features and accessibility of the platform.

Follow the steps here to start investing in Tesla from just US$10.

1. Find a stock investing platform

To buy shares in U.S.-listed companies, you'll need to sign up to an investing platform with access to the U.S. stock market. There are a number of share trading platforms in Australia, of which Stake is one.

2. Fund your account

Complete an application with your personal and financial details. Fund your account with a bank transfer, debit card or even Apple/Google Pay.

3. Search for Tesla or TSLA

Find the share by name or ticker symbol: TSLA. Do your own research to ensure it is the right investment product for your own circumstances.

4. Choose an order type and buy TSLA shares

Buy on any trading day with a market order or use a limit order to delay your purchase of TSLA shares until it reaches your desired stock price. Look into dollar cost averaging to spread out your risk, which smooths out buying at consistent intervals.

5. Monitor your investment

Optimise your portfolio by tracking how your stock and the business perform with an eye on the long term. You may be eligible for dividends and shareholder voting rights that affect your stock.

✅ Gain access to shares like Tesla, Amazon and more with just US$10.

Tesla, Inc. overview

Tesla, Inc. is an American electric vehicle and clean energy company based in Palo Alto, California. The company was founded in 2003 by Elon Musk, JB Straubel, Martin Eberhard, Marc Tarpenning, and Ian Wright.

Tesla is best known for its electric cars, which have become increasingly popular in recent years due to their efficiency, performance, and low environmental impact. The company has also made significant strides in developing clean energy solutions, including solar panels and energy storage systems.

Tesla's current lineup of electric vehicles includes the Model S, Model X, Model 3, Model Y, and the Cybertruck, with a few others currently in development.

- The Model S is a luxury sedan that was introduced in 2012 and has since become one of Tesla's most popular models.

- The Model X is an SUV that was introduced in 2015 and features a unique falcon-wing door design. The Model 3 is a more affordable sedan that was introduced in 2017 and has been the company's best-selling car to date.

- The Model Y is a crossover SUV that was introduced in 2020 and shares many of its components with the Model 3.

- The Cybertruck is a futuristic pickup truck that was introduced in 2019 and production has started in 2023.

In addition to its electric vehicles, Tesla has also been working on developing clean energy solutions to power homes and businesses.

The company's solar panels and energy storage systems are designed to work together to provide a sustainable and reliable source of energy. Tesla's Powerwall is a rechargeable lithium-ion battery designed to store energy from solar panels, with battery energy storage allowing homeowners to use their own solar-generated power during peak energy usage times or during a power outage. The company also offers solar roofs, which are made of tempered glass tiles that resemble traditional roofing tiles but are capable of generating electricity from the sun.

Tesla's shares were first offered to the public on June 29, 2010, with an initial public offering (IPO) price of $17 per share. The first few years were marked by instability, with the stock's price experiencing a rocky start and declining sharply during the following year. However, the company's fortunes turned around in 2013 with the introduction of the Model S electric sedan, which was a huge success.

Tesla's stock price began to soar in 2013, and the company's market capitalisation exceeded $20 billion by the end of the year. The company continued to innovate, with the introduction of the Model X SUV in 2015 and the Model 3 sedan in 2017. Tesla's shares continued to climb, reaching an all-time high of $409 in late 2021.

Tesla's growth has not been without setbacks, however. The company has faced criticism for its production and delivery delays, and there have been concerns about its profitability. In addition, Tesla's stock has been volatile and subject to large swings in response to news and events.

Despite the challenges, Tesla's stock has delivered impressive returns to its investors. The company's five-year return as of the end of April 2023 was over +700%, outpacing many other tech companies. The company's success can be attributed to its innovative products, strong brand, and commitment to clean energy. As the demand for electric vehicles and clean energy solutions continues to grow, Tesla is well-positioned to continue delivering strong returns for its investors.

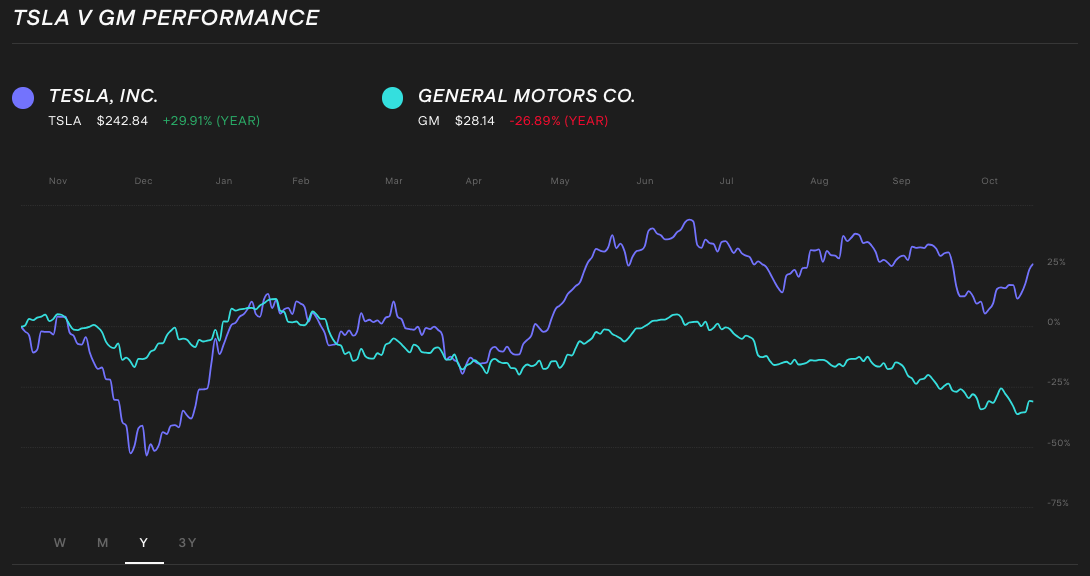

See how TSLA vs GM stock has faired over the last 12 months.

💡Related: Top EV shares to watch in 2023→

💡Related: ASX Lithium shares to watch in 2023→

Tesla stock P/E ratio

As of 15 November 2023, Tesla stock P/E ratio is around 78.25. The price-to-earnings ratio is constantly changing, as the share price varies everyday and new earnings reports come out every quarter. Historically, Tesla stock price to earnings has been higher than its peers as the firm prioritised growth instead of profitability, but Tesla's P/E has been dropping recently as the company matures.

Tesla EBITDA

Tesla's Earnings Before Interest, Taxes, Depreciation and Amortization have been growing considerably, totalling US$15.15Bb in 2023.

Tesla shares do not pay dividends.

Instead, the company reinvests its profits back into the business to fund research and development, build new factories, and expand its operations. This approach is consistent with Tesla's focus on growth and innovation, as the company believes that reinvesting in the business will yield greater returns for shareholders in the long run. While some investors may prefer dividend-paying stocks as a source of income, others are drawn to companies like Tesla that prioritise growth and innovation over paying out dividends.

Has Tesla ever had a stock split?

Tesla stock has had two splits.

The first split occurred on August 31, 2020, and was a 5 for 1 split. This means that for each share of TSLA held before the split, shareholders received 5 shares after the split. As an example, an investor with a pre-split position of 1,000 shares would have had a post-split position of 5,000 shares.

The second split for TSLA took place on August 25, 2022, and was a 3 for 1 split. This means that for each share of TSLA held before the split, shareholders with one stock now received 3 shares after the split. As an example, an investor with a pre-split position of 5,000 shares would have had a post-split position of 15,000 shares.

🎓 Learn more: What is a stock split?→

What ETFs have exposure to Tesla?

There are many ETFs that hold Tesla in their portfolios. Here are a few examples of ETFs that are available on U.S. exchanges and ETFs available on the Australian Securities Exchange:

Market | ETF | Description |

|---|---|---|

Wall St | ARK Innovation ETF ($ARKK) | An actively managed ETF that focuses on innovative companies, including those in the fields of genomic research, artificial intelligence, and fintech. The ETF aims to invest in companies with disruptive technologies that have the potential to reshape industries. |

Wall St | iShares Global Clean Energy ETF ($ICLN) | ICLN invests in global companies that are involved in renewable energy production and distribution, including wind, solar, and hydroelectric power. The ETF aims to provide investors with exposure to the growth potential of the clean energy sector. |

Wall St | Invesco QQQ Trust ($QQQ) | An ETF that tracks the performance of the NASDAQ-100 index, which is composed of 100 of the largest non-financial companies listed on the NASDAQ stock exchange. The ETF provides investors with exposure to technology-focused companies across a range of industries. |

Wall St | SPDR S&P 500 ETF Trust ($SPY) | SPY tracks the performance of the S&P 500 index, which is composed of 500 of the largest publicly traded companies in the US. The ETF aims to provide investors with exposure to the broad US equity market. |

Wall St | Vanguard Information Technology ETF ($VGT) | VGT invests in technology-focused companies, including those in the fields of software, hardware, and IT services. The ETF aims to provide investors with exposure to the growth potential of the technology sector. |

AUS | BetaShares NASDAQ 100 ETF ($NDQ) | NDQ tracks the performance of the NASDAQ-100 index, which is composed of 100 of the largest non-financial companies listed on the NASDAQ stock exchange. The ETF provides investors with exposure to technology-focused companies across a range of industries. |

AUS | Battery Tech & Lithium ETF ($ACDC) | ACDC invests in global companies involved in the production and supply of lithium, as well as companies involved in the development and manufacturing of battery technology. The ETF aims to provide investors with exposure to the growth potential of the energy storage sector. |

AUS | VanEck Vectors Global Clean Energy ETF ($CLNE) | An ETF that invests in global companies that are involved in renewable energy production and distribution, including wind, solar, and hydroelectric power. The ETF aims to provide investors with exposure to the growth potential of the clean energy sector. |

AUS | BetaShares Global Sustainability Leaders ETF ($ETHI) | ETHI invests in global companies that are considered leaders in sustainability, as measured by their carbon footprint, environmental policies, and governance practices. The ETF aims to provide investors with exposure to companies that are considered to have a positive impact on the environment and society. |

AUS | iShares S&P 500 ETF ($IVV) | IVV tracks the performance of the S&P 500 index, which is composed of 500 of the largest publicly traded companies in the US. The ETF aims to provide investors with exposure to the broad US equity market. |

These ETFs provide exposure to Tesla, along with a diverse range of other companies and sectors. It is important to note that investing in exchange-traded funds carries some risks, including the possibility of losing money if the market or specific securities decline in value.

Tesla, Inc. FAQs

One Tesla share was worth US$242.84 as of 15 November 2023, but some platforms make it possible to trade fractional shares. This means you can buy and sell a portion of one share, for example, you could become a Tesla shareholder by investing as little as US$10 in the stock on using Stake.

As of 15 November 2023, there are approximately 3.18b outstanding shares of Tesla ($TSLA) stock. The number of outstanding shares represents the total number of shares that have been issued by the company and are owned by shareholders, including institutional investors, individual investors, and company insiders.

It's important to note that the number of outstanding shares can change over time due to various corporate actions such as stock splits, stock buybacks, and issuance of new shares. These actions can impact the number of shares available for trading and the ownership percentage of individual investors. Investors should monitor any changes to the number of outstanding shares and how they may affect their investments.

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking appropriate financial or taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.