Initial Public Offering (IPO): What is an IPO?

One of the most exciting events of any market's calendar is IPO day. Years of hard work and growth are rewarded with the ceremonial ringing of the bell and life as a public company begins. Companies we’ve known and loved from their earliest days can now secure a place in your portfolio.

What is an IPO?

An initial public offering (IPO) is the process of offering shares to the public for the first time so that a company can raise equity capital. Investors may have the opportunity to access shares in an IPO either directly or through an investing platform. Once the IPO is completed, the company is listed on the stock market, and its shares become available for trading.

How does an IPO work?

Let’s now get into the specifics of how a company goes from private to public. There are typically 2 paths a company can take: the traditional bank under-written IPO or the more recently popular direct listing.

Underwritten IPO

A company looking to go public will approach an investment bank to underwrite the process. But what exactly does this mean?

Part of a traditional IPO involves issuing new shares. An investment bank like Goldman Sachs ($GS) or JP Morgan ($JPM) will work with the listing company to determine a fair value for these shares and the company. The bank then buys some or all of the new shares straight up from the listing company. They then sell those shares onto their network of funds, banks and high net worth individuals all for a cut. The listing company receives the benefit of cash upfront without the resource-intensive process of selling shares to scores of different buyers.

Then the big day comes. Once shares have been allocated, the company begins trading. The bank will offer an allotment of shares to the public market and trading commences. The underlying, predetermined price and valuation tends to bring stability to the stock but we have seen trading prices deviate greatly from initial underwritten valuations often in the past.

For example, Coinbase ($COIN) shares were priced at US$250 each before it listed in April. It began trading at US$328 on IPO day, well above the price institutions had access to.

Individual investors are often priced out of appealing listings which makes alternatives like a direct listing appealing.

Direct listing

A recent trend, some of the biggest names in the market from Spotify ($SPOT) to Palantir ($PLTR) have opted to go down: entering the public domain via a direct listing.

The company forgoes the underwriting process and insiders are able to sell shares directly to the public market. The stock price and value of a company are entirely determined by market supply and demand. Existing insider shareholders can sell their shares at a price they calculate as fair while traders and investors determine their bid price. The stock initially trades where the bid and the ask meet. Such a process risks extreme volatility as the market determines a fair price.

Of course, while a less resource-intensive process, direct listings do not allow companies to sell new shares and raise money. The NYSE is working on new hybrid listings which allow companies to raise capital while also listing directly.

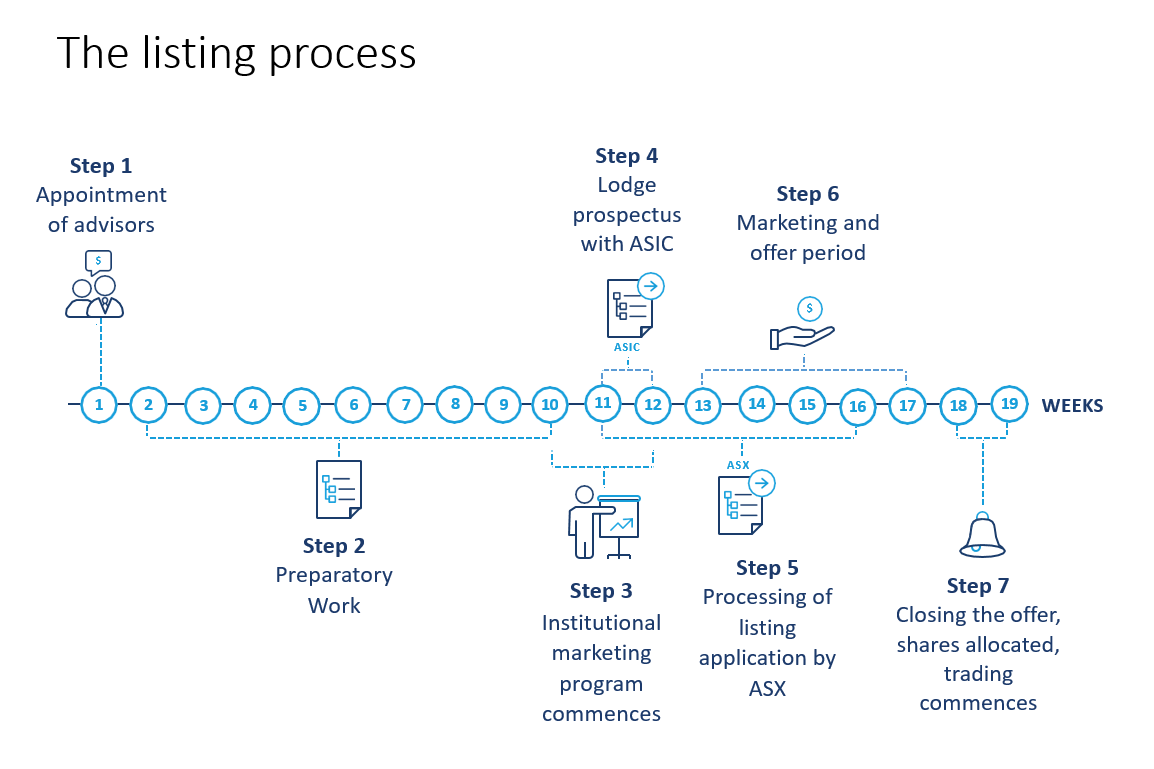

See the 7-step listing process for the ASX

See a step-by-step breakdown of how a private company can get listed on the Australian Securities Exchange.

Source: ASX

Alternatives to IPOs

The two most common ways to take a company from private to public are the underwritten and direct listing process mentioned above. Some initial public offering alternatives include the dutch auction and reverse takeover.

Dutch auction

In a Dutch auction, the price of an IPO is determined by collecting bids from investors for the number of shares they wish to purchase and the price they are willing to pay. Once the auction is complete, the underwriters assess the highest price at which all the shares of the company can be offered to the public. One of the biggest companies in the world, Google ($GOOGL), utilised a dutch auction for its IPO in 2004.

Reverse takeover

A reverse takeover (also known as a reverse merger or reverse IPO) occurs when a private company acquires a public firm, thereby allowing a single entity to offer shares to the public. This approach is more cost-effective and quicker than a traditional IPO. The most well-known reverse takeover came from Warren Buffett when he took Berkshire Hathaway ($BRK.A) public in 1965.

What is the purpose of an IPO?

IPOs offer companies access to new capital.

In the past, companies IPO’d when they reached profitability. At the time, the market valued stability and the prospect of dividends.

Now, a listing can be a growth engine; a chance to raise money, build a large marketing and product budget and continue the quest to take over the world. In 2009, 81% of companies were profitable following their IPO. In 2020, just 22% of companies were posting green figures. The market is more comfortable owning companies that aren’t guaranteed to deliver a profit or a dividend in the immediate future.

Private companies may be valuable, but cashing out is a difficult exercise. Shareholders are unable to easily sell their holdings and realise gains. An IPO gives holders access to the secondary market. Their shares can be exchanged for cash and their success can be realised in a more secure asset.

Be aware that many insiders are subject to mandated holding periods. To avoid executives offloading millions of dollars of shares on the listing day and suppressing the stock price, often insiders are required to hold their stock for months or years before selling.

There are also secondary, derivative benefits to being a listed company. The media coverage and publicity listed companies receive compounds act as a marketing exercise. Tesla ($TSLA) is an extreme example but consider the attention Tesla as a brand has received due to the stock’s performance.

Moreover, public companies have an easier time accessing debt at a lower interest rate.

Initial public offering advantages

The main advantage IPOs have is the ability to raise capital for a company but there are other pros for a private company to go public.

- Market will have greater awareness about the company.

- Significantly improves the business's ability to raise capital.

- Allows the company's securities to be used as currency for acquisitions.

- Improved valuation.

- Secondary market for the company’s shares.

- Alignment of employee and management interests.

Initial public offering disadvantages

The grass isn't always greener, so there could be some cons that a business needs to weigh up before listing.

- The owners will have to give up some control.

- Some loss of privacy due to the media exposure.

- Restrictions on the freedoms the owners have to make business decisions without getting shareholder approval first.

- Cost of listing and ongoing fees.

- Share price affected by market conditions.

- Greater levels of accountability to shareholders.

Initial public offering FAQs

How are IPOs priced?

The investment bank or stock broker responsible for managing the IPO will offer guidance on setting an appropriate price for the shares. This guidance will be based on various factors such as their valuation of the company and other market-related considerations.

For smaller IPOs on the ASX, the IPO share price can be fixed at a minimum of $0.20c per share.

What was the first company to IPO?

The first company to IPO was The Dutch East India Company (VOC). It held the first initial public offering in August 1602, a key event in financial history.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.