.png&w=3840&q=100)

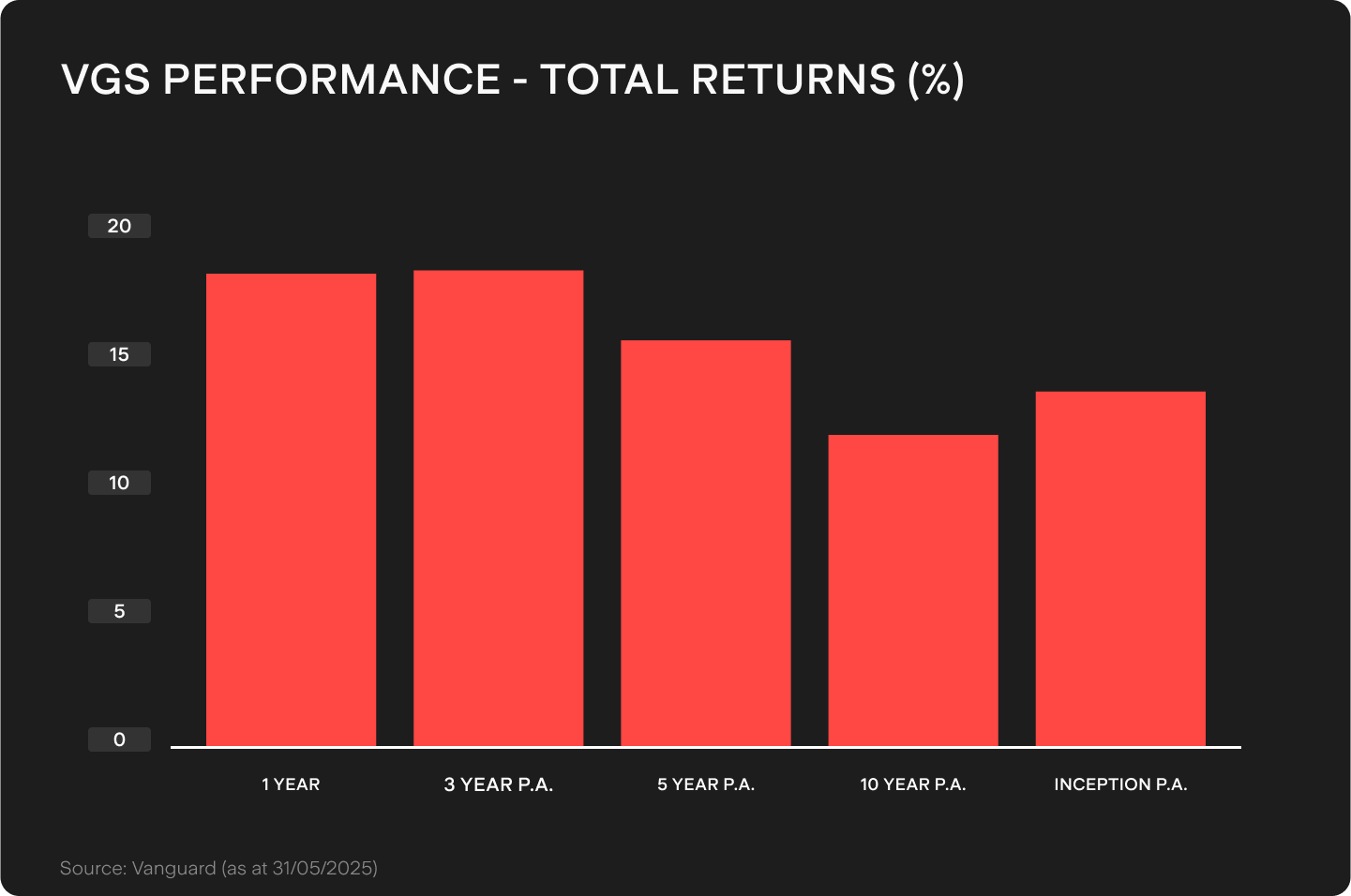

Under the Spotlight AUS: Vanguard MSCI Index International Shares ETF (VGS)

The Vanguard MSCI Index International Shares ETF opens the door to some of the world’s biggest names in investing – with a heavy dose of U.S. tech in the mix.

.png&w=3840&q=100)

The bulls are back. Wall Street has rallied, the S&P 500 and Nasdaq have pushed to record highs and global stockmarkets have caught the tailwinds.

No wonder the Vanguard MSCI Index International Shares ETF ($VGS) is one of the most traded ASX ETFs on Stake in 2025. It invests in large stocks from developed markets outside of Australia. It’s popular among investors looking to complement the Vanguard Australian Shares Index ETF ($VAS).

VGS touts itself as international but has a decidedly American flavour. U.S. stocks make up about 73% of the portfolio, followed by Japan (5.7%) and the U.K. (3.8%). Investors pay a 0.18% annual fee and receive quarterly distributions.

AI rally

Big tech dominates VGS. Trillion dollar-plus titans Nvidia ($NVDA), Microsoft ($MSFT), Apple ($AAPL), Amazon ($AMZN) and Meta Platforms ($META) make up the top five positions – 18% of the fund.

AI is the common thread. Nvidia continues to see strong demand for its graphics chips, despite investors getting spooked about DeepSeek’s low-cost AI model. Microsoft and Amazon are the world’s largest hyperscale cloud platforms, while Meta’s AI assistant recently passed one billion users. Meta recently spent US$14.3b for a 49% stake in Scale AI.

But it’s stock #6 that’s the headline grabber. US$1.25t-valued Broadcom ($AVGO) is seeing demand rise for its AI-specific XPUs. They’re pricier than Nvidia’s general use GPUs but process faster and use less power. Broadcom is up 59% over the past year compared to Nvidia’s 24% climb.

VGS also offers exposure to major U.S. financials like JPMorgan Chase ($JPM), Warren Buffett’s Berkshire Hathaway ($BRK.B), Visa ($V) and Mastercard ($MA). A wave of deregulation has pushed U.S. banks to record highs as investors hope this will free up capital. The Dow Jones U.S. Banks Index is up 33% over the past year.

.png&w=3840&q=100)

Trade tensions

So how much higher can U.S. stocks go? Goldman Sachs reckons the market can rally through July, traditionally Wall Street’s strongest month. But Bank of America says its clients are selling stocks at the fastest pace since April.

All eyes are now on Trump’s 9 July tariff deadline. A repeat of April’s 12% drop in the S&P 500 Index isn’t on anyone’s wish list.

Trump’s indicated he won’t extend his 90 day tariff pause. The clock is ticking for the 'Dirty 15' – countries yet to ink U.S. favourable trade deals. Trump threatened to hit ‘very spoiled’ Japan with a 35% tariff. But we may also see another leg of the Trump Always Chickens Out (TACO) trade.

The big one is China. It’s eased rare earth and magnet export restrictions ahead of a potential August trade deal. Renewed hostilities would impact U.S. industry. A lack of specialty magnets recently forced Ford ($F) to idle production.

Earnings season

Q2 earnings season also looms large. FactSet’s estimated year-on-year (YoY) earnings growth rate for the S&P 500 is 5%. That would mark the lowest earnings growth since Q4 2023.

But the tech sector is expected to buck this trend with predicted 16.6% YoY earnings. No surprise as semiconductor and chip equipment companies are expected to deliver 33% YoY growth.

Interest rates are another pressing issue. Federal Reserve Chair Jerome Powell says the central bank would have cut rates again by now if it wasn’t for Trump’s tariffs.

The Fed’s own forecasts suggest two more rate cuts this year but markets are only pricing in a 25 basis point cut in September rather than July.

Best of the rest

VGS isn’t just a U.S. play. The top three non-U.S. stocks are all European.

Germany’s SAP ($SAP) is the largest of VGS’ European holdings. Shares in the world’s largest enterprise resource planning software are up 49% over the past year, after strong Q1 earnings thanks to growing cloud revenues.

ASML ($ASML) is down 2% this year and provides exposure to one of the most important companies in the semiconductor supply chain. The Netherlands-based company is the world leader in extreme ultraviolet lithography, used to print circuits on semiconductor chips.

Food giant Nestlé ($NSRGY) is also in VGS’ hamper. The Swiss company rallied 22% this year and owns brands like KitKat and Baci, Milo, Fancy Feast pet food and a range of coffee products.

Japanese heavyweights like Toyota Motor ($TM) Sony ($SONY) and Nintendo ($NTDOY) also feature. The latter hit a record high earlier this week after massive sales of its new Switch 2 console. The stock is up 55% over the past year.

But a focus on developed markets means VGS lacks exposure to Mainland China, Hong Kong, Taiwan and South Korea – a shame as Hong Kong’s Hang Seng is running hot, gaining 35% over the past year.

Going global

VGS offers investors low-cost, one-click access to a global portfolio of over 1,200 stocks.

But its U.S. bias means investors have to be alert to what happens stateside. There’s plenty to keep an eye on: earnings, interest rates and a very unpredictable President who likes to keep global markets on their toes.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

.png&w=3840&q=100)

.png&w=3840&q=100)

.png&w=3840&q=100)