What are the best defence ETFs to invest in? [2025]

The global defence industry is evolving at a breakneck speed. As the Trump administration upends alliances across the Western world, many countries are reacting by ramping up defence spending. Globally, military spending has climbed to levels not reached since the end of the Cold War.

For investors, this wave of investment could shift focus away from the hype of AI, tech and growth stocks, especially as tactics like drone warfare and cyberattacks reshape the modern battlefield. Explore our list of ten leading defence ETFs to consider below.

Check out this list of the defence ETFs available on Stake

Company Name | Ticker | Share Price | 1Y Return | Market Capitalisation |

|---|---|---|---|---|

iShares U.S. Aerospace & Defense ETF | US$153.14 | +16.08% | US$6.4B | |

Invesco Aerospace & Defense ETF | US$116.47 | +14.67% | US$4.8B | |

SPDR S&P Aerospace & Defense ETF | US$161.95 | +15.26% | US$2.7B | |

Global X Defense Tech ETF | US$46.44 | +39.88% | US$1.3B | |

Select STOXX Europe Aerospace & Defense ETF | US$33.77 | +34.27%* | US$470.0M | |

ARK Space Exploration & Innovation ETF | US$18.00 | +20.48% | US$269.6M | |

SPDR S&P Kensho Future Security ETF | US$63.67 | +11.08% | US$85.6M | |

Themes Transatlantic Defense ETF | US$28.77 | +13.39%* | US$10.8M | |

Gabelli Commercial Aerospace and Defense ETF | US$34.87 | +13.10% | US$4.0M | |

U.S. Global Technology and Aerospace & Defense ETF | US$19.57 | -2.12%* | US$3.0M |

Data as of 28 March 2025. Source: Stake, Google Finance.

*EUAD, NATO, and WAR returns are from inception.

*The list of ETFs mentioned is ranked by assets under management. When deciding what funds to feature, we analyse the financials, recent news, liquidity and volume, and whether or not they are actively traded on Stake.

Discover these defence industry ETFs to watch in 2025

1. iShares U.S. Aerospace & Defense ETF ($ITA)

ITA is one of the most popular defence ETFs on the market, with total assets of more than $6 billion. The fund is particularly notable for its low expense ratio of just 0.40%. As such, the fund could be a compelling choice to access a diversified basket of defence stocks for a low price.

ITA’s top holdings include GE Aerospace ($GE) (a former division of General Electric), RTX ($RTX), and Boeing ($BA). The fund is heavily exposed to U.S. defence contractors, particularly those focused on military aircraft.

🆚 Compare these ETFs: ITA vs PPA→

2. Invesco Aerospace & Defense ETF ($PPA)

PPA is another leading defence ETF, although the fund’s expense ratio of 0.58% is slightly higher than ITA. Nonetheless, PPA has similar exposure to ITA, with top holdings of Boeing, Lockheed Martin ($LMT), and RTX.

Although the two funds have similar strategies and performance, PPA is slightly more diversified than ITA, as the fund is less concentrated in its top holdings. PPA is overwhelmingly invested in the US, with small holdings in Israel and Canada.

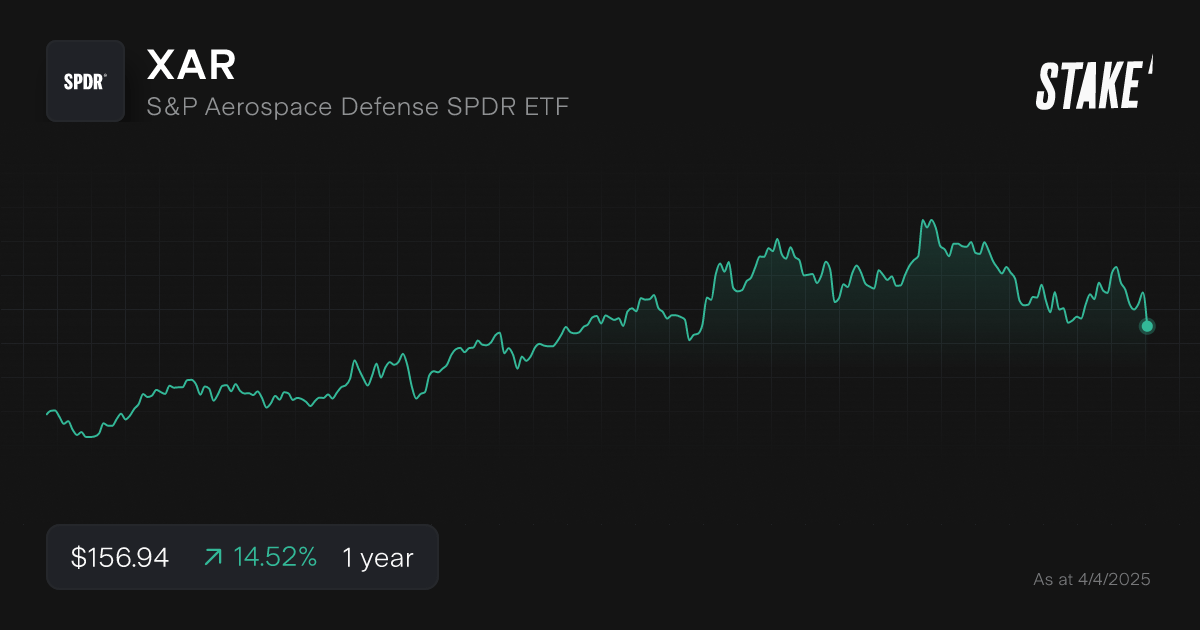

3. SPDR S&P Aerospace & Defense ETF ($XAR)

XAR is a notable defence ETF for several reasons. First, the fund’s expense ratio is the lowest on the list, at just 0.35%.

Next, XAR tracks a modified equal-weight index, offering investors ample diversification across many firms.

Some of XAR’s holdings include Rocket Lab ($RKLB), Boeing, and Transdigm ($TDG). While XAR is less exposed to major industry leaders, the fund could be attractive for investors who want broad access to companies across the defence sector.

Despite their differences, XAR has still demonstrated similar performance to ITA and PPA in recent years.

4. Global X Defense Tech ETF ($SHLD)

While many defence ETFs have an aerospace focus, SHLD is an exception. Although the fund’s top holdings include major defence contractors like RTX and Northrop Grumman ($NOC), they also include companies like Palantir ($PLTR), which focuses on defence-related software.

Moreover, SHLD has greater geographic diversification than some competitors, with just a 59% exposure to the U.S. SHLD also features a competitive expense ratio of 0.50%. This fund could be a compelling choice for investors who want defence exposure without outsized aerospace concentration.

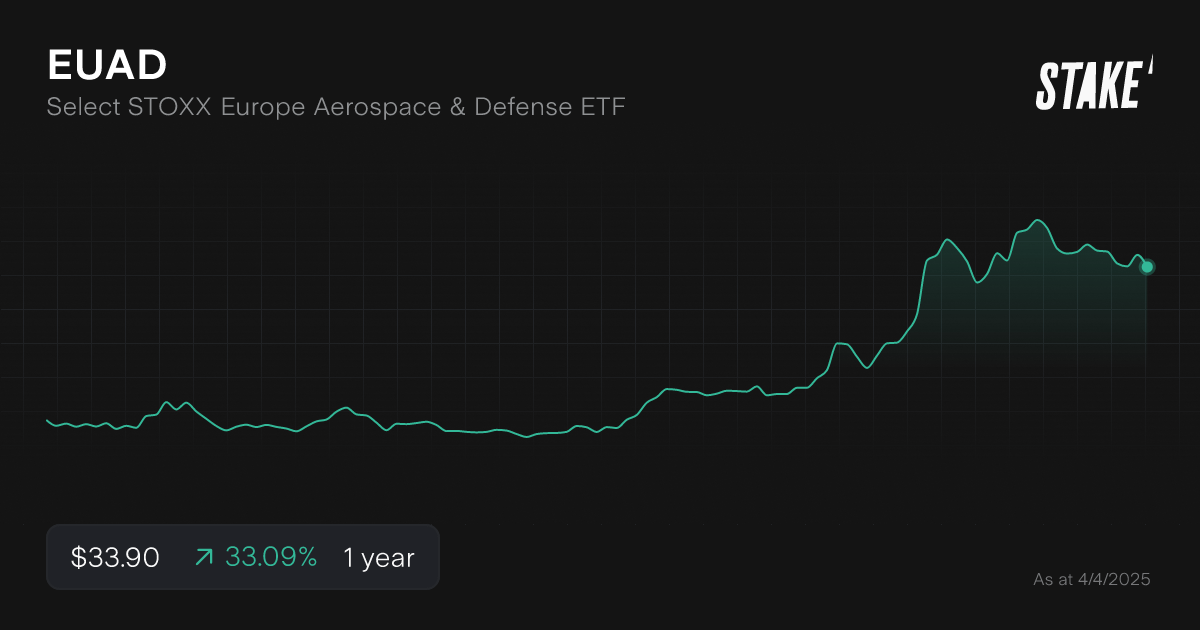

5. Select STOXX Europe Aerospace & Defense ETF ($EUAD)

EUAD is a European-focused defence ETF, tracking major contractors on the continent. The European defence industry has been seeing major gains driven by recent geopolitical tailwinds, as evidenced by EUAD’s strong performance.

The fund’s top holdings include names like Airbus, Safran, and Rheinmetall. While EUAD’s 0.50% expense ratio is competitive, the fund does not have a long track record, only listing late in 2024.

Still, investor enthusiasm for the European defence sector has already propelled the fund to nearly half a billion dollars in assets.

6. ARK Space Exploration & Innovation ETF ($ARKX)

Although ARKX isn’t specifically marketed as a defence fund, many of the leading firms in space innovation also serve the military as defence contractors.

In fact, a few of ARKX’s top holdings made our list of top defence stocks to watch, including Kratos Defence & Security ($KTOS).

As an actively managed fund, ARKX is slightly more expensive than competitors, featuring a 0.79% expense ratio.

The fund has also maintained strong performance over the past year, so this price could be worth it. Overall, ARKX may be a good fit for investors who want targeted exposure to military innovations in space.

7. SPDR S&P Kensho Future Security ETF ($FITE)

FITE’s mandate is to invest in companies in the ‘future security’ defence sector. This is a wide-ranging industry that includes areas like cybersecurity, border security, robotics, drones, and wearable technology.

Like many SPDR funds, FITE features a low expense ratio of 0.45%. The fund’s top holdings include defence technology companies like Red Cat ($RCAT), Blackberry ($BB), and Broadcom ($AVGO).

While FITE isn’t a traditional military defence ETF, the fund could be a strong choice for investors who want exposure to cutting-edge military technology innovation.

🤖 Related: List of top cybersecurity ETFs→

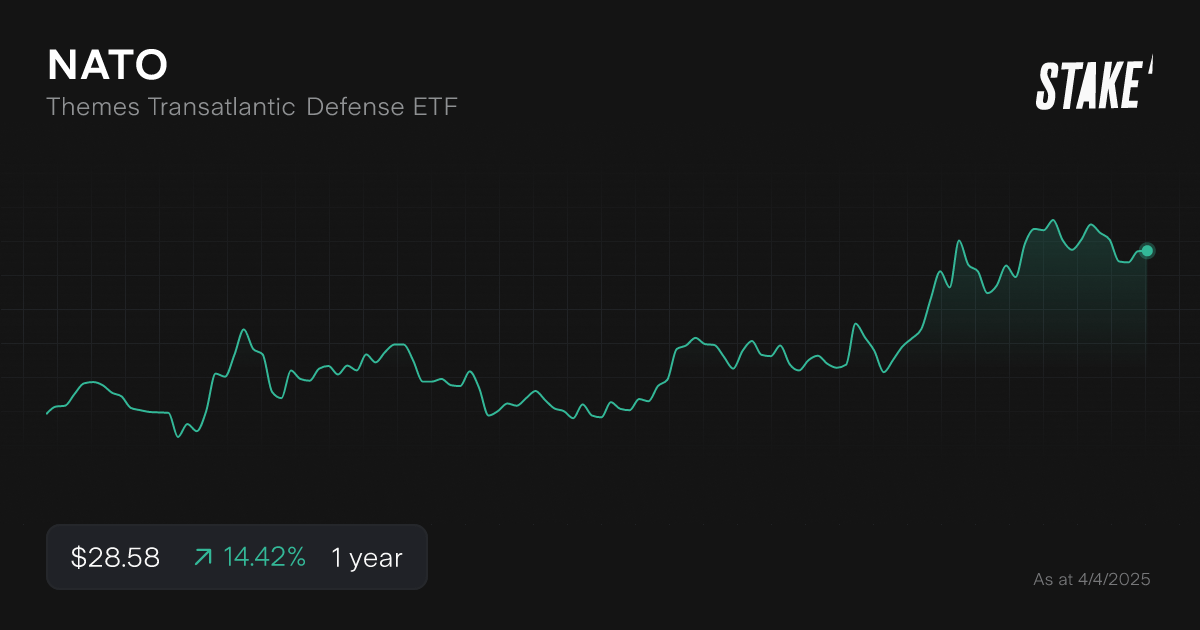

8. Themes Transatlantic Defense ETF ($NATO)

A relatively new ETF, NATO is a fund focused on investing in companies that support the North Atlantic Treaty Organization, the largest military alliance in the Western world. While the fund’s top holdings are U.S. defence contractors like Lockheed Martin and RTX, NATO also features sizable holdings of French firm Safran and British company Rolls-Royce ($RYCEY).

The fund’s expense ratio of 0.35% makes it among the cheapest on our list. NATO could be a good fit for investors with thematic views on the continued growth of defence spending within the alliance.

9. Gabelli Commercial Aerospace and Defense ETF ($GCAD)

GCAD is an actively managed, fundamentally focused ETF targeting the aerospace and defence sectors. The fund’s portfolio manager, Lieutenant Colonel Tony Bancroft, has ample experience in both the military and finance industry. GCAD’s latest reported holdings include names like Boeing and Spirit AeroSystems ($SPR).

While GCAD could be a good fit for investors who want to benefit from the manager’s crossover experience, the fund has relatively lower liquidity than other ETFs. Moreover, GCAD’s expense ratio is somewhat high at 0.90%.

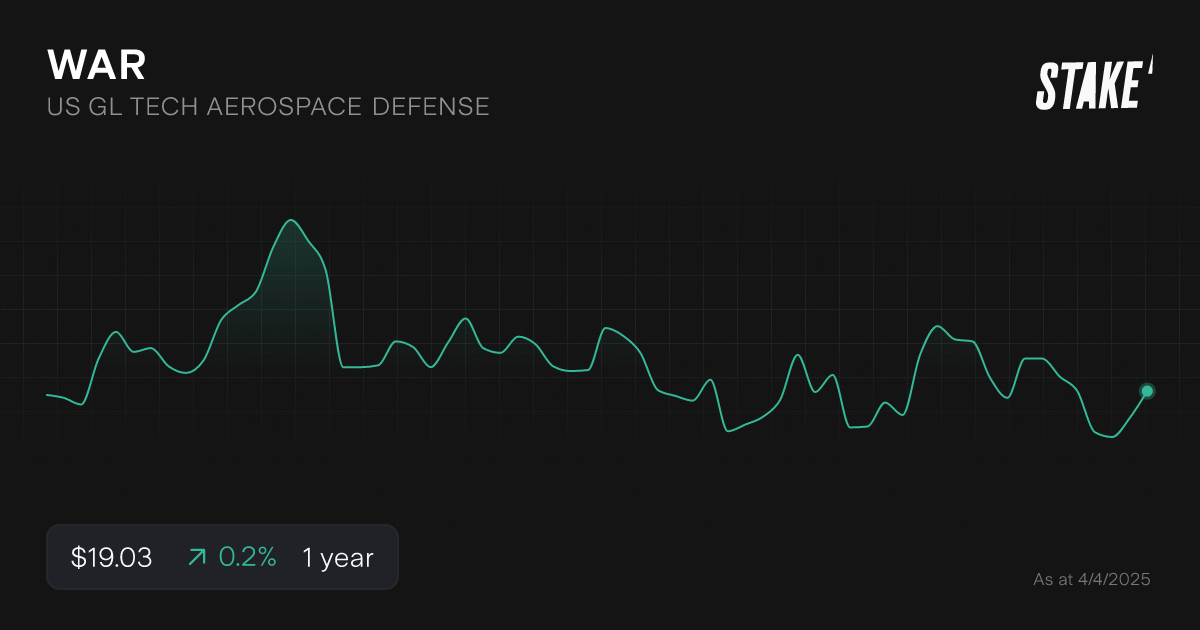

10. U.S. Global Technology and Aerospace & Defense ETF ($WAR)

The aptly named WAR ETF is a new entrant to the market, having only listed late in 2024. However, the fund could be an interesting choice for investors who want diversified defence exposure.

WAR’s industry exposure includes significant allocations to the semiconductor and cybersecurity sectors, as well as core holdings in aerospace and defence.

Like GCAD, WAR may struggle with lower liquidity than peers. However, while the fund is also actively managed, its expense ratio is more competitive at 0.60%.

How to invest in defence ETFs?

Follow our step-by-step guide below to start investing in defence ETFs from within Australia:

1. Find a stock investing platform

To invest in defence ETFs, you’ll first need to find an investing platform that offers access to exchanges like the NYSE, Nasdaq and ASX. There are several share investing platforms available, of which Stake is one.

Join 750K investors

Get a full U.S. share when you fund Stake Wall St or A$10 trading credit when you fund Stake AUS. Fund both, get both. T&Cs apply.

2. Fund your account

Next, open an account by completing an application with your personal and financial details. You’ll then need to fund your account with a bank transfer, debit card, or Apple/Google Pay.

3. Search for the ETF

Find the ETF name or ticker symbol. Always conduct your own research to ensure that the investment is suited to your risk tolerance and financial goals.

4. Set a market or limit order and buy the shares

You can buy an ETF almost instantly at the current price by using a market order during the trading day. Alternatively, enter a limit order to purchase your ETF when it reaches a specific price. Consider dollar cost averaging to spread out your risk, which involves buying at consistent intervals.

5. Monitor your investment

Once you own the ETF, monitor its performance over time. Check your portfolio regularly to ensure that your investment remains aligned with your financial goals.

What ASX defence ETFs are available?

The ASX features several listed ETFs that offer global defence exposure:

- Global X Defence Tech ETF ($DTEC): The DTEC fund is an Australia-domiciled version of Global X’s SHLD ETF. Both the holdings and expense ratio of the two funds are broadly similar.

- Beta Global Defence ETF ($ARMR): This ETF seeks to invest in defence companies in NATO and NATO-aligned countries. The fund’s top holdings include Safran, Palantir, and Raytheon, and it has an expense ratio of 0.55%.

- Vaneck Global Defence ETF ($DFND): The DFND ETF features broad exposure to the defence sector, with a particular focus on technology and R&D. The fund’s top holdings include Thales, Leonardo, and Palantir, and it has an expense ratio of 0.65%.

All these funds could be strong ASX-listed alternatives to the Wall Street ETFs on our list today.

What is the best-performing defence focused ETF?

The best-performing defence-focused ETF over the past year has been the Global X Defense Tech ETF ($SHLD).

This ETF has achieved a 39.88% one-year performance, well above the ~15% performance posted by most major defence ETFs. SHLD benefited from a significant stake in Palantir, which has appreciated strongly over the past year.

In the more recent past, the performance of the Select STOXX Europe Aerospace & Defense ETF ($EUAD) has been even more compelling. While the fund only launched in late 2024, it has already achieved a 34% return thanks to geopolitical tailwinds driving increased European defence spending.

Remember, past performance isn’t necessarily indicative of future performance. As global alliances continue to shift and the industry adapts to emerging technologies, new leading companies and sectors could emerge.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.