Top drone stocks to watch right now [2025]

Drones are becoming an integral part of the modern world, with applications ranging from battlefield deployment to commercial package delivery. Read on as we explore some of the best drone stocks in the market and look at how investors can access this high-flying industry.

Explore these top drone stocks from Wall St

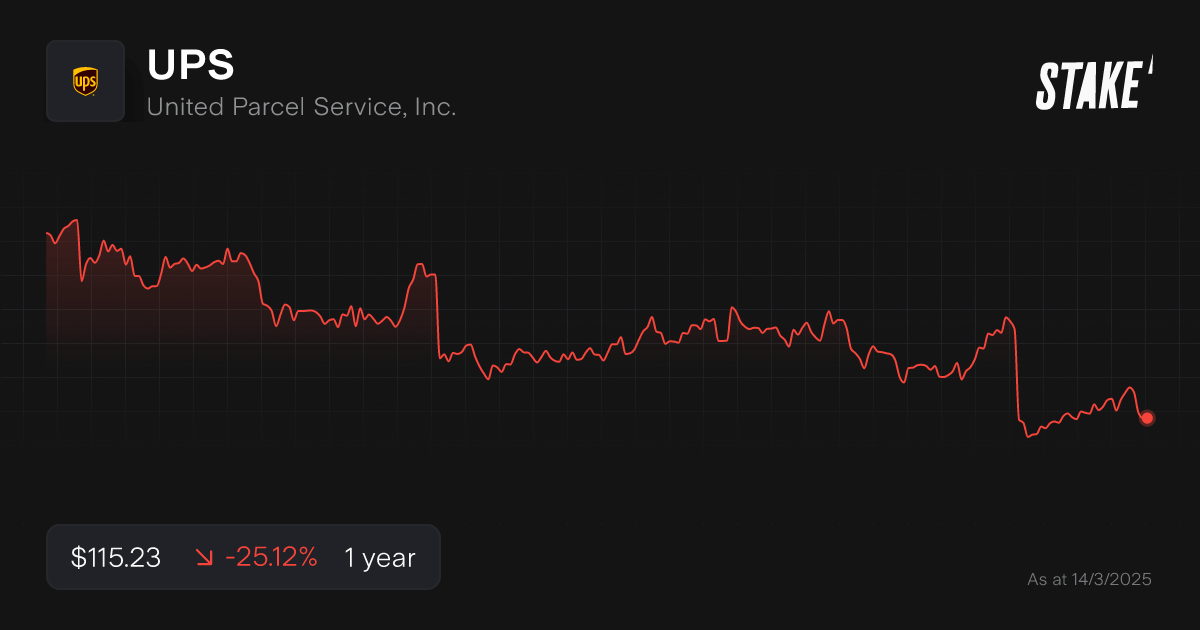

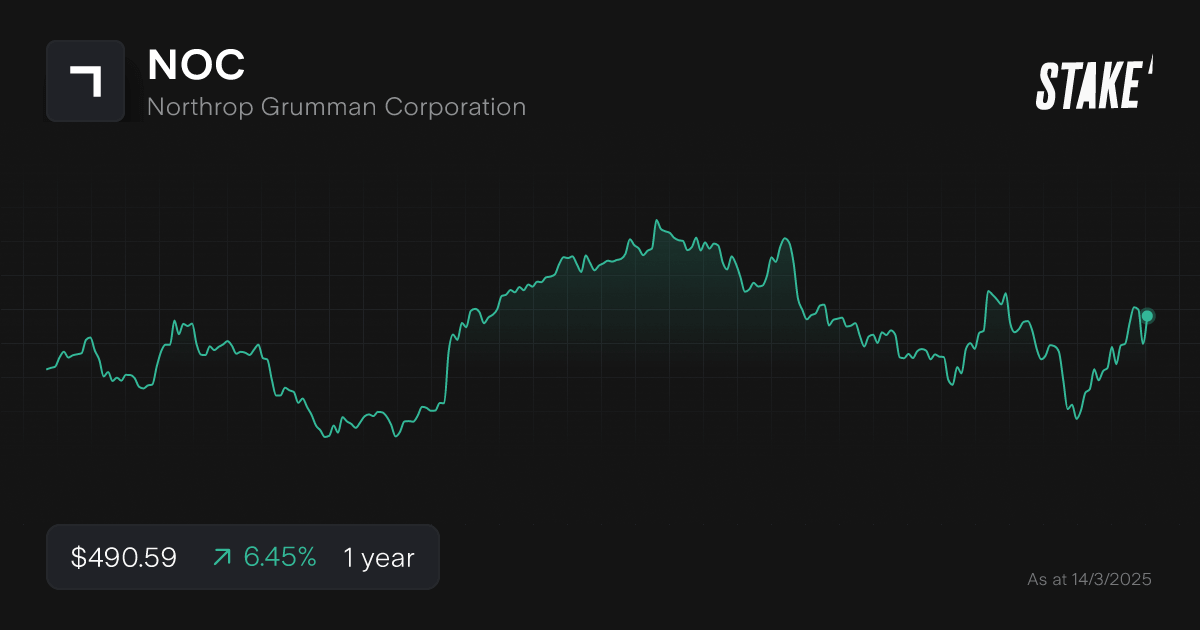

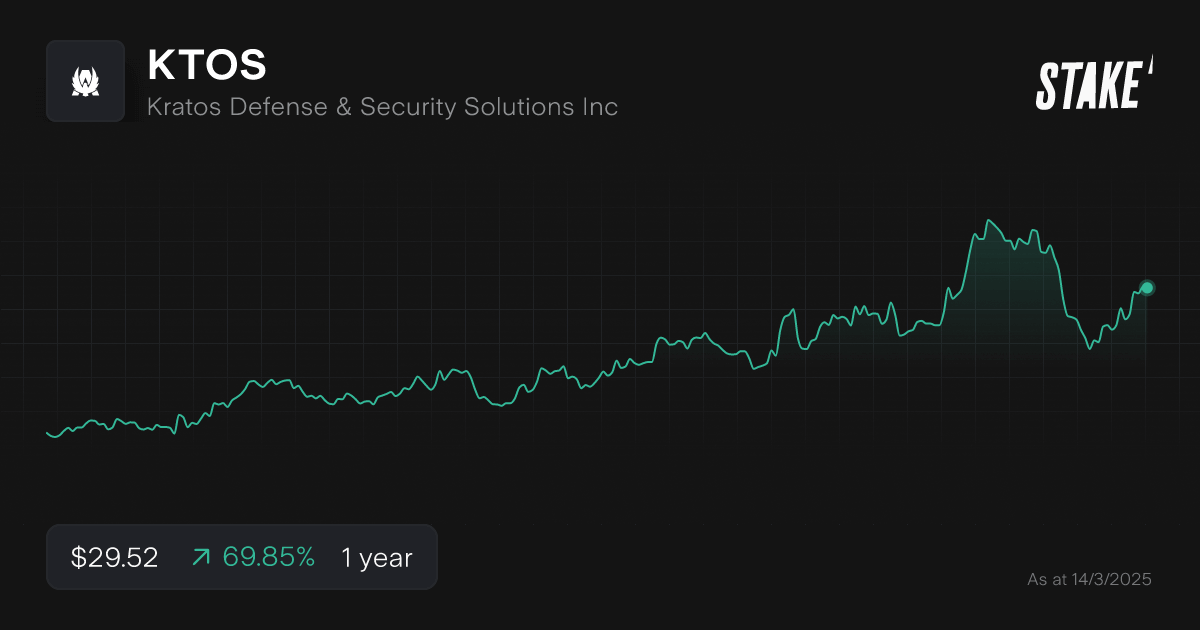

Company Name | Ticker | Share Price | 1Y Return | Market Capitalisation |

|---|---|---|---|---|

Amazon | US$197.13 | +14.64% | US$2.1t | |

Boeing | US$152.77 | -20.63% | US$114.5b | |

United Parcel Service | US$116.66 | -24.61% | US$99.6b | |

Northrop Grumman | US$490.31 | +6.76% | US$71.4b | |

Kratos | US$29.19 | +60.92% | US$4.4b | |

AeroVironment | US$123.78 | -22.58% | US$3.5b | |

EHang Holdings | US$22.38 | +75.39% | US$1.4b | |

Red Cat Holdings | US$4.81 | +465.88% | US$386.0m | |

Unusual Machines | US$5.57 | +131.12% | US$83.9m |

Data as of 11 March 2025. Source: Stake, Google.

*The list of drone stocks mentioned is ranked by market capitalisation. When deciding what companies to feature, we analyse the company's financials, recent news, advancement in their timeline, and whether or not they are actively traded on Stake.

1. Amazon ($AMZN)

Amazon aims to use drones to help optimise its vast logistics operations. Currently, the company relies on trucks and vans to transport packages the ‘last mile’ to customer’s front doors. Drone delivery offers the potential to improve speed and cut costs.

While this vision is compelling, Amazon’s drone rollout has hit a few speedbumps.

In fact, after several crashes, Amazon temporarily paused its drone delivery program earlier this year.[1]

Still, Amazon remains focused on the long-term potential of the technology, with the company aiming for 500 million global drone deliveries by the end of the decade.

2. Boeing ($BA)

While Boeing is well-known as a commercial plane manufacturer, the company is also a leading defence contractor, earning about a third of its revenue from the U.S. government. Since drones are now an integral part of military operations, Boeing has invested heavily in this space. The company’s MQ-25 drone, for instance, is the first unmanned aircraft capable of performing air-to-air refuelling.

For now, Boeing appears to be focused on drone technology that can support its core business in larger aircraft. The company is exploring the sale of its Insitu subsidiary, which manufactures lightweight surveillance drones.[2]

However, Boeing still develops drones designed for refuelling, maintenance, and inspection of planes & helicopters.

3. United Parcel Service ($UPS)

Like Amazon, UPS has been at the forefront of integrating drones as a logistics tool.

In 2019, the U.S. government approved UPS subsidiary Flight Forward as the first company allowed to operate a drone delivery network. Beyond packages, UPS has also used drones to quickly and safely deliver medical samples and vaccinations.

Although UPS is still testing its drone delivery program, the company has explored using trucks as mobile distribution hubs for drones to launch from. Notably, UPS previously partnered with Verizon ($VZ) to secure high-speed 5G connection for its drone fleet. As the largest package delivery company in the U.S., UPS could set the industry standard by deploying drone delivery at scale.

🆚 Compare UPS vs BA stock comparison→

4. Northrop Grumman ($NOC)

As America’s third-largest defence contractor, Northrop Grumman is on the cutting edge of military drone development. The firm’s flagship surveillance drones include the MQ-4C Triton plane and the Fire Scout helicopter. Intriguingly, Northrop’s drones go beyond just aircraft, including the AQS-24B/C maritime minehunting system.

The company is also a key drone supplier for Australia’s military, with Northrop preparing to deliver two Triton systems to the Royal Australian Air Force in the coming months.[3]

In terms of future development, Northrop is currently engaged with the U.S. government on the secretive ‘LongShot’ air combat drone project. The stock could be a good choice for investors who want to back a leading contractor with proven drone expertise.

5. Kratos ($KTOS)

Although Kratos is a much smaller contractor than competitors like Boeing or Northrop Grumman, the company punches far above its weight in drone technology.

In fact, Kratos has carved out a niche in the world of ‘attritable’ drones – low-cost, expendable systems designed to be used and discarded.

Kratos’ XQ-58 Valkyrie surveillance drone is a notable example of this, capable of being produced for less than half the price of competing options. Similarly, the company designs a range of one-use drones for fighter pilot target practice. Late last year, Kratos earned an $80 million follow-on contract to supply the U.S. Air Force with these target drones.

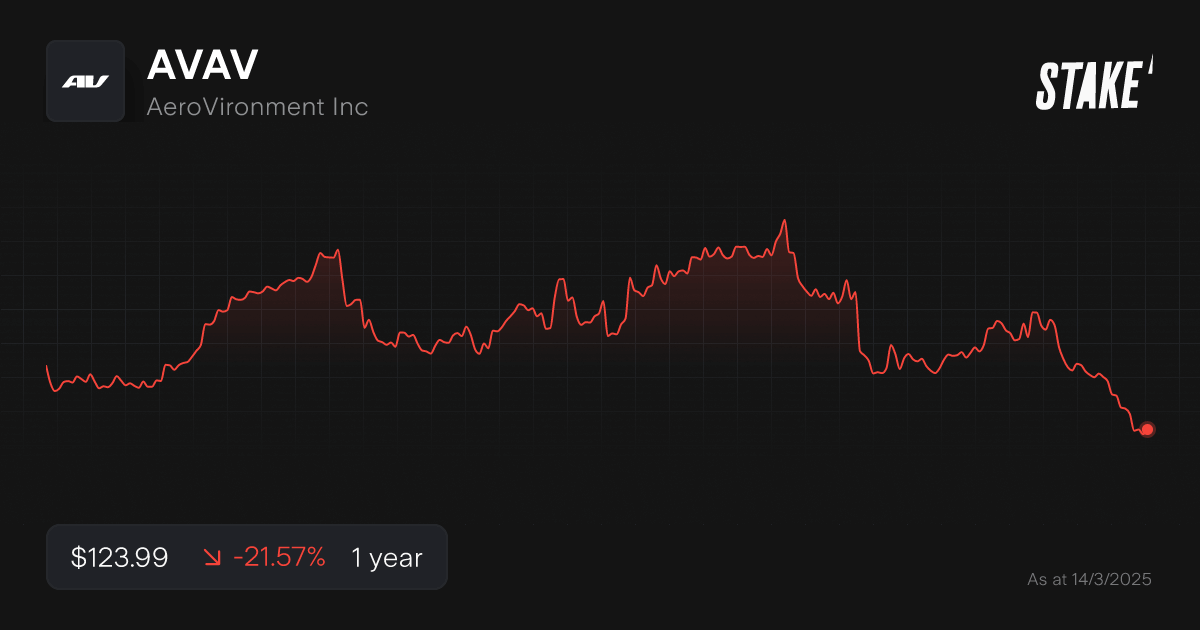

6. AeroVironment ($AVAV)

Although AeroVironment is also a defence contractor, the firm takes a far different approach to drone technology than competitors. The firm specialises in small, hand-held drones designed to be carried and deployed by individual infantry units. This focus has made AeroVironment the U.S. military’s largest supplier of hand-held drones, with popular models including the Switchblade 300 and the RQ-11 Raven.

While some of AeroVironment’s drones are purely surveillance tools, others are Loitering Munitions Systems (LMS), capable of performing precision strikes. Thousands of AeroVironment’s drones have been deployed in the Ukraine war following U.S. arms packages.

However, the pullback of U.S. support for Ukraine has created an uncertain future for AeroVironment, with the stock falling as a result.

🆚 Compare AVAV vs NOC stock comparison→

7. EHang Holdings ($EH)

EHang is a China-based company focused on civilian drone technology. In addition to package delivery drones, the firm has also developed experimental passenger drones, essentially, flying self-driving taxis.

Although EHang’s ‘urban air mobility’ vision is more speculative than other drone applications, it could also provide intriguing upside for investors. Notably, the company has received healthy government support for this approach.

In 2024, EHang announced a partnership with Beijing authorities to develop autonomous emergency rescue vehicles.

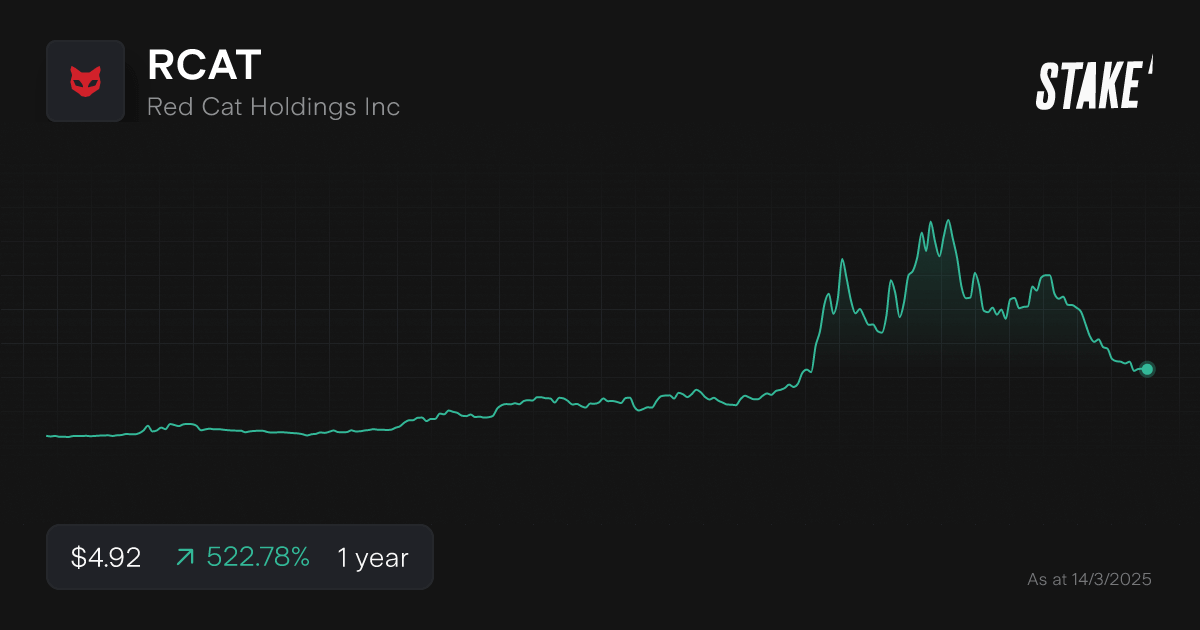

8. Red Cat Holdings ($RCAT)

Red Cat is a niche U.S. defence contractor focused on drones, similar to competitor AeroVironment. Red Cat is particularly notable for its lightweight Black Widow drone, which specialises in nighttime operations.

Red Cat shares have been on a tear over the past year, likely on enthusiasm for the company’s recent contract awards.

In late 2024, the U.S. Army chose Red Cat’s Teal drones for the military’s short-range reconnaissance initiative. Under the terms of the award, Red Cat will provide the Army with nearly 6,000 systems over the next five years.

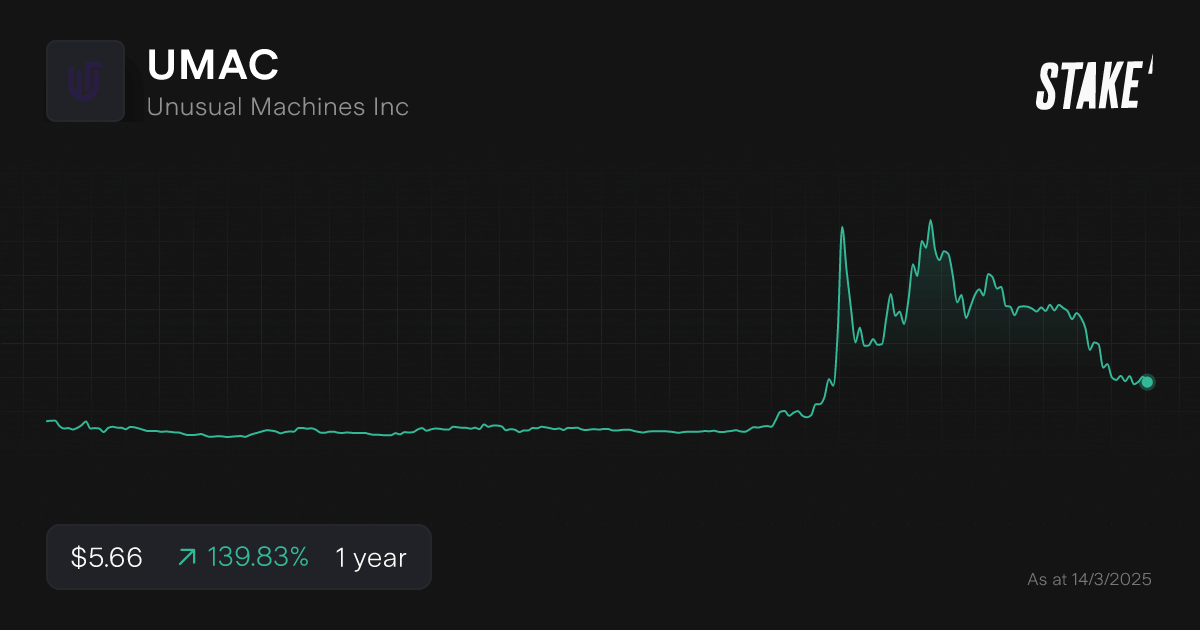

9. Unusual Machines ($UMAC)

Unusual Machines primarily focus on developing and selling drone accessories, rather than drones themselves. In particular, the company specialises in first-person headsets for drone operators. While Unusual Machines mostly targets the civilian market, the company recently secured a contract as a production partner for defence contractor Red Cat.

Founded in 2019, Unusual Machines is a relatively young company. The firm has been executing an aggressive acquisition-led growth strategy, having previously purchased headset manufacturer Fat Shark and drone marketplace Rotor Riot. This year, Unusual Machines announced the further purchase of fleet management platform Aloft.

Which ETFs have exposure to drone technology?

Unfortunately, there are currently no major ETFs exclusively focused on the drone industry. Previously, the AdvisorShares Drone Tech ETF offered access, but the fund was liquidated in 2023.

Although investors may not be able to access a drone-specific ETF, other funds do have notable exposure to the sector. Given the importance of drones for military applications, defence-focused ETFs could be a good option.

These include the iShares US Aerospace & Defense ETF ($ITA), with holdings that include Boeing, Northrop Grumman, and Kratos.

While not exclusively drone-focused, the ARK Autonomous Technology & Robotics ETF ($ARKQ) is another potential option. This fund targets autonomous tech broadly, with top holdings including Kratos, Tesla ($TSLA), and Teradyne ($TER).

🤖 Related: What are the best robotics stocks to invest in?

How to invest in drone stocks?

To invest in drone stocks, you’ll need to use an investment platform with access to U.S. markets. Follow our step-by-step guide below:

1. Find a stock investing platform

To invest in drone stocks, you’ll first need to find an investing platform that offers access to exchanges like the NYSE and Nasdaq. There are several share investing platforms available, of which Stake is one.

Get started with Stake

Sign up to Stake and join 750K investors accessing the ASX & Wall St all in one place.

2. Fund your account

Next, open an account by completing an application with your personal and financial details. You’ll then need to fund your account with a bank transfer, debit card, or even Apple/Google Pay.

3. Search for the stock

Find the company name or ticker symbol. Always conduct your own research to ensure that the investment is suited to your risk tolerance and financial goals.

4. Set a market or limit order and buy the shares

You can buy stock almost instantly at the current price by using a market order during the trading day. Alternatively, enter a limit order to purchase your stock when it reaches a specific price. Consider dollar cost averaging to spread out your risk, which involves buying at consistent intervals.

5. Monitor your investment

Once you own the stock, monitor its performance over time. Check your portfolio regularly to ensure that your investment remains aligned with your financial goals.

What is the best-performing drone stock?

Over the past year, the best-performing drone stock has been Red Cat Holdings ($RCAT), notching a 465% gain. That follows several encouraging developments, including the announcement of cutting-edge tech breakthroughs and securing lucrative contracts with the U.S. military. Other strong performers include EHang Holdings and Unusual Machines.

Remember, past performance is no guarantee of future returns. As the drone industry evolves amid a pullback in U.S. military funding and challenges in deploying logistics drones, different industry winners could be set to rise to the top.

The future outlook for drone technology

The outlook for drone technology appears strong. Industry analysts expect the drone market to expand at a 10% CAGR over the next five years.[4]

This anticipated growth is due to a number of tailwinds, including the increasing use of drones on the battlefield and growing concerns about the emissions impact of relying on trucks & vans for last-mile logistics. Some of the most exciting drone innovations include integrating AI technology into autonomous systems and longer flight times with improved battery technology.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Article sources

[1] Amazon Pauses Drone Deliveries After Aircraft Crashed in Rain

[2] Boeing Seeks Buyers for Insitu Drone Unit in Push to Shed Assets

[3] Northrop Grumman prepares to deliver second and third MQ-4Cs to Australia

[4] Commercial Drone Market Size, Share | Industry Report, 2030