Stockest 100: Stake’s most traded ASX stocks of 2022

As investors start a new year thinking about what strategies can set them up for success, we look back at 2022’s trading activity on Stake for inspiration and insights. Meet the Stockest 100 – the most traded Australian stocks of last year.

Find stocks 1-50 below, and numbers 51-100 in Part 2 – which also starts with some interesting insights about trading behaviour on Stake.

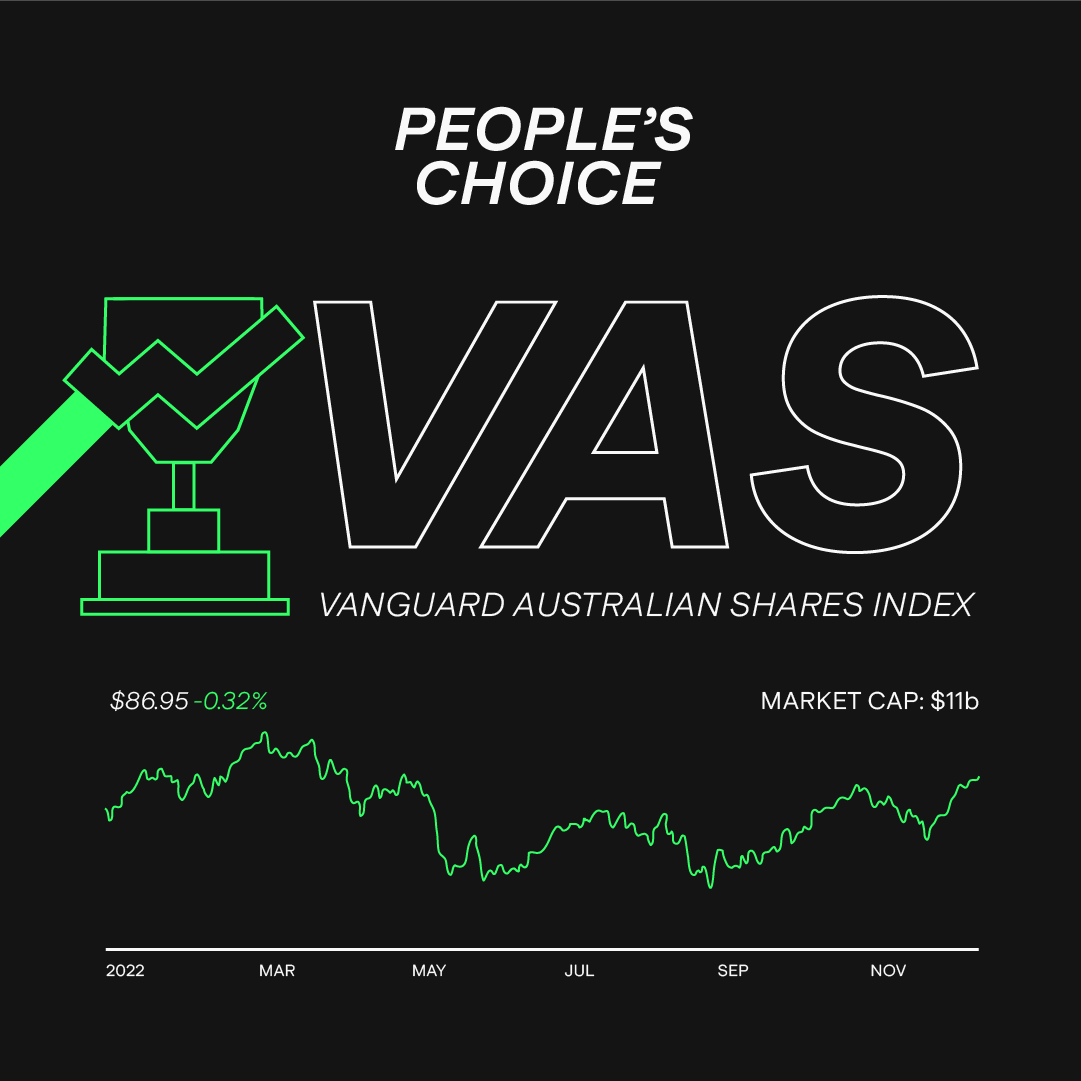

In addition to looking at the hard data to determine the Australian stocks most bought and sold on the Stake platform, we’ve also asked our community to vote for their favourite stock of 2022. Let’s begin with that before diving into the Stockest 100. And the People’s Choice is...

And now, here are the Stockest 100

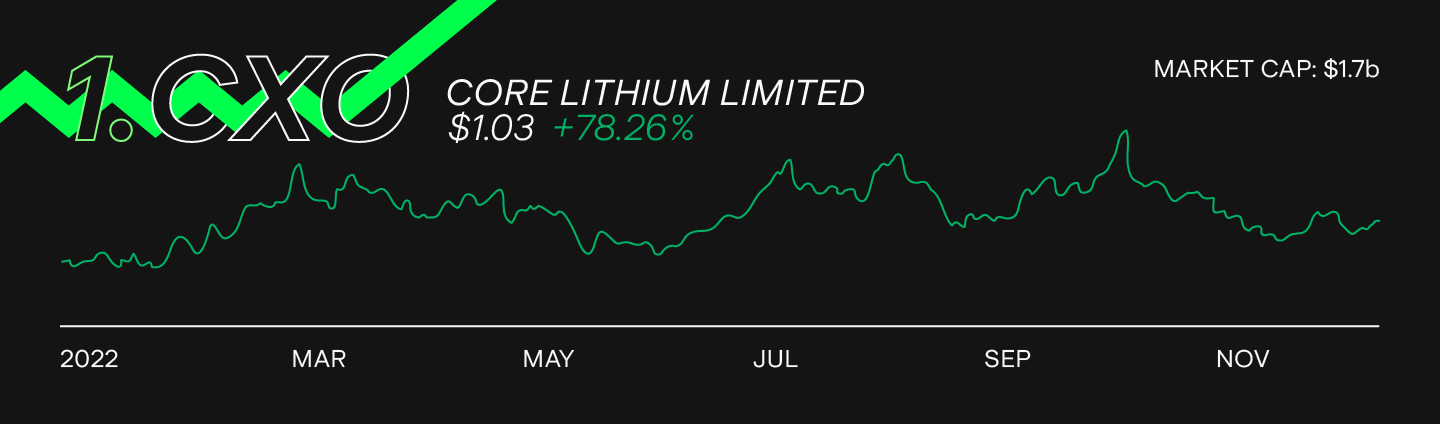

1. Core Lithium (CXO)

Stake platform bought / sold (2022): 65% / 35%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Core Lithium Ltd | Mining | $1.8b | $1.03 | +78.26% |

Core Lithium's Finniss Project is expected to bring new lithium concentrate supplies onto the market in the first half of 2023. Record high lithium prices drove interest in the stock and are likely to have a major impact on its future performance. Investors who held on for a volatile ride were rewarded with a 78.26% return over 2022. Announcements about the acquisition of a new project in April and high grade lithium findings in August boosted the share price. Mid-year fears about slowing lithium demand and failure to convert a deal with Tesla in October caused a downtrend.

2. Vanguard Australian Shares Index ETF (VAS)

Stake platform bought / sold (2022): 91% / 9%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Vanguard Australian Shares Index ETF | Diversified ETF | $11.8b | $86.95 | -0.32% |

The Vanguard Australian Shares Index ETF reflected the general performance of Australia’s share market in 2022 by tracking the performance of the largest 300 companies by market cap. It was affected by lacklustre returns across global markets, with significant falls in June and September mirroring U.S. stocks. But the fund was cushioned by having around 30% of its companies related to commodities – 2022’s best performing sector on average. The question for 2023 is whether the interest rate decisions can temper inflation without leading to a recession.

3. Pilbara Minerals Limited (PLS)

Stake platform bought / sold (2022): 53% / 47%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Pilbara Minerals Limited | Mining | $11b | $3.75 | 16.10% |

Pilbara Minerals owns 100% of the large Pilgangoora Lithium Project in Western Australia. After an astonishing 133% return for 2021, the company saw a more subdued start to the year but the share price recovered in the second of 2022 alongside rising lithium prices. Going into profit helped it reach revenues of $1.2b, but the majority of growth in margins has been due to those higher lithium prices rather than increased production. A December announcement of lower selling prices for its latest cargoes hurt the stock. Analysts are split on whether 2023 will see a recovery or add pressure on Pilbara.

4. Lake Resources N.L. (LKE)

Stake platform bought / sold (2022): 61% / 39%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Lake Resources N.L. | Mining | $1.1b | $0.80 | -18.78% |

Mine developer Lake Resources initially rode the lithium boom into the ASX 200 by June 2022. It then saw a 55% drop in share price due to the unexpected departure of the CEO that same week. Further damage came from the lack of explanation and the CEO’s disposal of a significant number of shares on the same day. In September, doubts emerged about thedirect lithium extraction (DLE) technology key to the success of their flagship Kachi Project in Argentina. A short-lived ownership dispute with the DLE firm saw even more investors betting against the stock. Lake will need to show strong results for a 2023 recovery.

5. BHP Group Limited (BHP)

Stake platform bought / sold (2022): 75% / 25%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

BHP Group Limited | Mining | $232b | $45.63 | +37.13% |

With a portfolio of iron ore, copper, nickel, potash and coal, mining giant BHP benefitted from a strong commodities sector in 2022. But it was not a smooth ride: the company was affected by overall weaker economic sentiments at times. Falling iron prices and notice of new coal royalties in Queensland in June added particular downward pressure. However, BHP’s stock recovered from lows from the last quarter of 2022, benefitting from high coal prices and greater focus on copper. The lifting of COVID-19 restrictions in China could see renewed demand for commodities in 2023, but rapid growth might be held back due to fears of a recession.

6. BetaShares NASDAQ 100 ETF (NDQ)

Stake platform bought / sold (2022): 88% / 12%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

BetaShares NASDAQ 100 ETF | Information Technology ETF | $2.3b | $24.99 | -28.47% |

This BetaShares ETF follows the 100 largest non-financial businesses listed on the NASDAQ exchange. Providing exposure to shares of Microsoft, Apple, Amazon, Google, Meta and Tesla to name a few, it has proven popular amongst Australian investors. With nearly half of the firms in the tech sector, NDQ was greatly affected by the industry’s downturn in 2022. Valuations were hurt by the overlap of rising inflation and interest rates. Many also considered last year to be the end of a decade-long bull run, bringing in comparisons to the 2001 dot com bubble. Opinion is divided on whether 2023 will be an opportunity to invest in tech at a lower valuation or if prices can fall further.

7. Sayona Mining Limited (SYA)

Stake platform bought / sold (2022): 65% / 35%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Sayona Mining Limited | Mining | $1.6b | $0.19 | +46.15% |

Sayona expects to start production at its Canadian lithium operation in Q1 2023. This news supported a strong overall share price performance for the investors that held on for a bumpy ride over the year. The company was also affected by the rise in demand for lithium due to growth in the EV industry, leading to a decline alongside the industry from an April high. Positive news of finding new lithium deposits and clear plans for its Canada mine bolstered the stock from June. Sayona is likely to benefit if these operations successfully start next year, although it needs to be considered against potentially falling lithium prices.

8. Vanguard MSCI Index International Shares ETF (VGS)

Stake platform bought / sold (2022): 65% / 35%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Vanguard MSCI Index International Shares ETF | Diversified ETF | $5b | $91.68 | -12.40% |

Vanguard’s VGS ETF tracks over 1,400 large and mid cap listed companies across 22 developed markets excluding Australia. As the base for just over 70% of the firms, the U.S. and its market downturn had the greatest influence over this fund’s 2022 performance. Japan had the second largest allocation at 6% of the total. Outbreak of the Russia-Ukraine conflict last February saw a particular decline in share price, as most other companies are located in the most exposed region of Europe. Although the most significant sector exposure is to information technology at 21%, healthcare, financials, consumer discretionary and industrials are all over 10%. VGS’s fortune will again be determined by global economic events in 2023.

9. Fortescue Metals Group Ltd (FMG)

Stake platform bought / sold (2022): 70% / 30%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Fortescue Metals Group Ltd | Mining | $63.6b | $20.51 | +20.85% |

Fortescue is the world’s fourth largest producer of iron ore. The group is diversifying into green energy, with major plans for hydrogen production. Currently their fate is largely tied to iron prices, generally determined by demand from China. Worries about real estate debt levels saw declines earlier in 2022, whilst November’s removal of COVID-19 restrictions brought a major rebound in the share price. There are concerns whether prices will remain high enough to repeat a similar feat to the FY22 dividend of $2.07 per share, which added around 11% to the return excluding franking credits. Plans to spend US$6.2b to eliminate fossil fuels across the company’s businesses will also add pressure on their budget in the upcoming years.

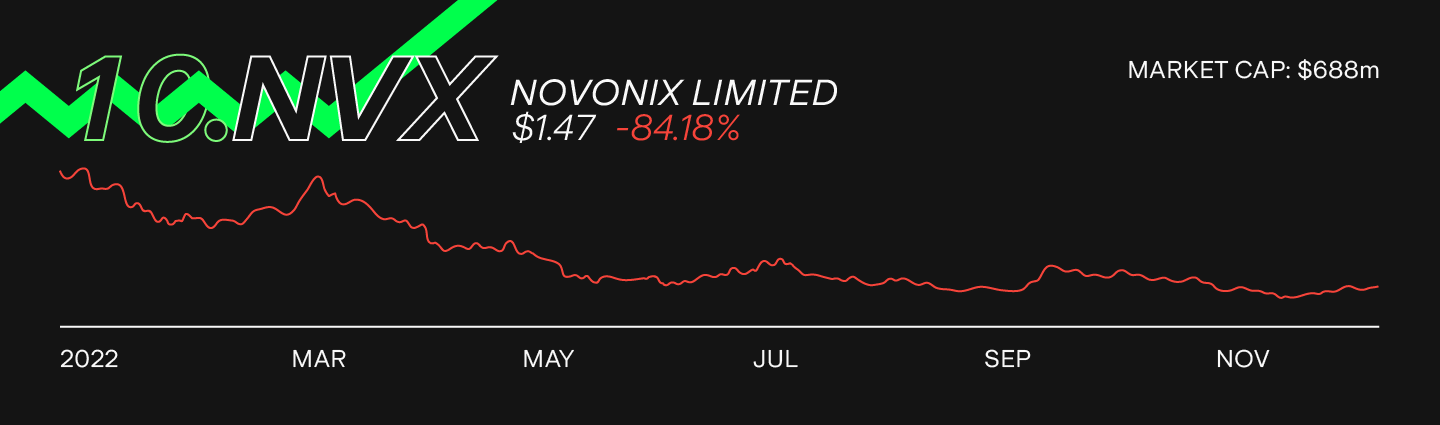

10. Novonix Limited (NVX)

Stake platform bought / sold (2022): 66% / 34%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Novonix Limited | Industrials | $688m | $1.47 | -84.18% |

Battery materials and technology company Novonix did not share lithium’s success in 2022, with many considering it as more of a technology business. After rapid growth in the second half of 2021 to a share price of $9.19, the stock reversed most of the gains over the following 12 months to decline to just $1.47. The focus on forward-looking valuations means more expensive debt hits harder for currently unprofitable companies. There’s potential longer-term recovery due to a graphite supply agreement and negotiations with the U.S. Department of Energy for US$150m of funding. But Novonix is under great pressure to raise cash in the short term.

11. Brainchip Holdings Ltd (BRN)

Stake platform bought / sold (2022): 61% / 39%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Brainchip Holdings Ltd | Information Technology | $1.1b | $0.75 | +7.97% |

Brainchip’s silicon chip moves AI processing from server farms and onto smaller devices. The share price reached an all-time high of $2.34 in January, but was unable to sustain the momentum as many investors took profits. On top of the general selloff in the tech market, Brainchip has been criticised for not delivering on plans, leading to low revenues. They’re also facing tough competition from large companies pouring millions of dollars into research and development in the chip industry. Only time will tell whether they can increase sales and see the stock rebound.

12. Vanguard Diversified High Growth Index ETF (VDHG)

Stake platform bought / sold (2022): 93% / 7%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Vanguard Diversified High Growth Index ETF | Diversified ETF | $1.9b | $53.63 | -8.91% |

This ETF tracks the average performance of a number of different stock indices. Though around 90% of assets are in ‘growth’ shares, the remaining 10% in fixed income holdings provided some insulation against the downturn. There’s a split of 36% in Australian shares and nearly 54% in international ones, including allocations to small caps and emerging markets. This means there are many factors behind the overall share price, although the ETF still reflected the overall slower growth of the global economy in 2022. Some places could see a recovery, whilst others could be constrained by more interest rate rises in 2023.

13. iShares S&P 500 ETF (IVV)

Stake platform bought / sold (2022): 92% / 8%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

iShares S&P 500 ETF | ETF | $4.8b | $37.83 | -12.57% |

This ETF tracks 500 of the largest U.S. stocks by market cap and provides a simple way of gaining exposure to the American economy. Its 2022 performance was affected by a rapid rise in interest rates with the aim to slow down inflation and fears of a recession. The first half of the year was characterised by the general downward trend; there was a short upswing in August and then further stagnation. Its 25% allocation to the tech sector also diminished the returns. News of inflation figures slowing in the U.S. in December 2022 suggests higher growth could return in 2023, but many are still concerned about a larger economic slowdown.

14. Zip Co Limited (ZIP)

Stake platform bought / sold (2022): 60% / 40%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Zip Co Limited | Financial Services | $386.5m | $0.51 | -88.17% |

The Buy-Now-Pay-Later (BNPL) fintech company offers consumer credit options for many kinds of shopping. Zip’s share price started declining in October 2021 and generally slid further down from a value of $4.33 at the start of 2022. It was affected by broad weakness in the tech sector and concerns over the company’s future. The stock had a small upturn in July, but it was confirmed that the business is still not profitable in August. They’re also facing increased competition, notably from Apple entering the sector internationally. Zip needs to show higher earnings to improve its share price in 2023. Inflation may push more consumers to Zip services, but many could reduce spending altogether.

15. Liontown Resources Limited (LTR)

Stake platform bought / sold (2022): 64% / 36%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Liontown Resources Limited | Mining | $2.8b | $1.32 | -20.24% |

Liontown is developing its Kathleen Valley mining project in Western Australia with the aim to start producing lithium in 2024. The stock’s performance was largely driven by lithium prices, which tends to have a major effect on companies in the development stage. It saw steep declines from March to April and another in December. Major milestones for the venture have been completed on time, but actual revenues won’t come in until next year. Goldman Sachs thinks that lithium commodity prices could decline from the second half of 2023. Others think demand from EVs is only starting and Liontown’s downturn instead represents a buying opportunity.

16. BetaShares Diversified All Growth ETF (DHHF)

Stake platform bought / sold (2022): 64% / 36%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

BetaShares Diversified All Growth ETF | ETF | $208.4m | $37.83 | -8.42% |

This ETF has a 100% allocation to shares and provides exposure to over 8,000 companies across over 60 exchanges. It’s invested in a blend of large, mid and small cap equities from Australia and overseas (developed and emerging markets). With around 37% dedicated to Australian assets and 36% to U.S. markets, the stock indices from these two nations strongly influence the final performance. Exposure to the financial sector is greatest at just over 20% and then tech at 13%. It draws many comparisons to VDHG and many similar factors will determine their 2023 returns, although DHHF does not have fixed income or currency hedged holdings.

17. Westpac Banking Corporation (WBC)

Stake platform bought / sold (2022): 65% / 35%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Westpac Banking Corporation | Financial Services | $81.7b | $23.35 | +14.46% |

The second-largest Big Four Australian bank proved most popular amongst Stake investors. Although the company will earn more from increased interest rates, the market wasn’t expecting how quickly the RBA would move. June 2022 saw a significant drop in share price, but the losses were gradually regained over the second half of the year. The stock soared nearly 17% in October with news of acquisition talks with Tyro Payments. Westpac enters 2023 with higher margins from property, but it remains to be seen whether it can keep its title of best performing bank.

18. Commonwealth Bank of Australia (CBA)

Stake platform bought / sold (2022): 67% / 33%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Commonwealth Bank of Australia | Financial Services | $172.4b | $102.60 | +4.28% |

The largest Big Four bank has always been a popular blue chip stock with high dividends. It had a relatively volatile year, but managed to end with a positive 4.28% return. Rumours of a share buyback pushed values up in March. Rising interest rates were also behind a drop in share price in June, and the October news of slowing increases from the RBA saw a rebound. Increased income from housing will help support dividend payouts for the year ahead and higher savings rates could attract more savings deposits. One headwind is that CBA is the most expensive of the banks in terms of price earnings ratio and could see lower share price growth.

19. Macquarie Group (MQG)

Stake platform bought / sold (2022): 75% / 25%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Macquarie Group | Financials | $64.9b | $166.96 | -16.44% |

The diversified financial services offerings of Macquarie were affected by turmoil in the global markets. Their large commodity-related business was a reason for the stock rising at the start of the Russia-Ukraine conflict. The release of full year results that did not meet expectations saw these gains eliminated in April. The company’s failed takeover bid for Suez’s UK waste business also hurt the share price in September. Macquarie will benefit from higher interest rates increasing lending profits, but other segments are more exposed to a potentially weaker economy in 2023.

20. Rio Tinto Limited (RIO)

Stake platform bought / sold (2022): 69% / 31%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Rio Tinto Limited | Mining | $173.2b | $116.41 | +28.77% |

Major mining company Rio Tinto produces a variety of commodities across its four main product groups of aluminium, copper, minerals and iron ore. The company posted record financial results in February, including a 60% year-on-year increase in net cash from operating activities to US$25.35b. The momentum was not sustained to mid-year results and general concerns about slowing growth saw the share price trend downwards. Iron ore is particularly important to Rio Tinto and it greatly benefitted from China’s lifting of COVID-19 restrictions in November. Whether the demand continues to grow into 2023 will make a big impact on the company’s future.

21. Arizona Lithium (AZL)

Stake platform bought / sold (2022): 66% / 34%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Arizona Lithium | Mining | $147m | $0.06 | -38.00% |

The company is developing the Big Sandy lithium mine in the state of Arizona in the U.S. The general demand for lithium supported share price growth in early 2022, but was a reason for its later decline. The -38% return also reflects the fact that progress at Big Sandy has been limited in 2022, due an outstanding permit. With news of the company’s plans to buy a separate lithium resource in Canada emerging in December, 2023 could see the team go on a different trajectory.

22. Australian and New Zealand Banking Group (ANZ)

Stake platform bought / sold (2022): 70% / 30%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Australia and New Zealand Banking Group | Financial Services | $70.9b | $23.66 | -9.27% |

As the third big bank, ANZ had a lacklustre 2022, failing to make a significant recovery from the share price slide that followed rapid interest rate rises. Investors were concerned about the news that its core underlying profit declined in the 12 months to October 2022. The company also announced plans to acquire the banking division of Suncorp Group ($SUN). This would help scale the business, but also comes with a large cost. The details and execution of this takeover could have a significant impact on ANZ’s 2023 performance. Higher interest rates should also support margins in 2023, although a share price recovery is not guaranteed.

23. Allkem Limited (AKE)

Stake platform bought / sold (2022): 62% / 38%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Allkem Limited | Industrials | $7.1b | $11.24 | +7.25% |

Allkem has various business segments related to lithium. They include a lithium and borax mine in Argentina, plans for another in Australia and a downstream processing project to manufacture chemicals for the battery industry in Japan. The company benefited from the generally positive sentiment towards lithium. It’s considered to be in a relatively strong position, with existing production and plans to capture added value with its downstream operations compared to earlier stage businesses. Whether Allkem could see further stock gains will depend on the team successfully growing production volumes in 2023.

24. Wesfarmers Limited (WES)

Stake platform bought / sold (2022): 77% / 38%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Wesfarmer Limited | Consumer Discretionary | $51.9b | $45.91 | -20.69% |

Wesfarmers holds a number of industrial and retail businesses, including well-known brands like Bunnings, OfficeWorks, Kmart and Target. Disappointing financial results due to COVID-19 restrictions saw a drop in share price in February, especially in Kmart Group earnings. There was stabilisation with the acquisition of Australian Pharmaceutical Industries in March, but Wesfarmers failed to fully recover to earlier levels due to inflation and higher interest rates trimming household budgets. Future performance will be dictated by Australian consumers, although the company also has more defensive divisions across industrial, chemical, energy and fertiliser sectors that could counteract retail trends.

25. Qantas Airways Limited (QAN)

Stake platform bought / sold (2022): 57% / 43%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Qantas Airways Limited | Aviation | $10.8b | $6.01 | +20.68% |

The airline benefitted from a rebound in travel after most restrictions were wound back and destinations opened up by mid-2022. But investors were concerned with the news of staff shortages and the share price declined over 18% in June. The upturn started with positive financial results being published in August. The report of expected profit in the first half of FY2023, which came out in October, went against expectations and strongly supported Qantas’ share market value. The company is expected to exit its COVID-19 recovery plan next year and dividend payments may be restarted. It remains to be seen whether travel demand will hold up against fewer flights and higher fuel costs continuing to push up prices for passengers.

26. Renascor Resoucres Limited (RNU)

Stake platform bought / sold (2022): 66% / 34%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Renascor Resources Limited | Mining | $509.6m | $0.22 | +48.28% |

Renascor is developing a vertically integrated battery anode project in South Australia, which will process materials from its graphite mine into purified spherical graphite (PSG) for lithium-ion batteries. The initial investor excitement due to signing an agreement with battery trader Hanwa declined after March. The share price was also affected by the general downturn in markets in June. News of securing approval to construct its manufacturing plant and upgrades to its Siviour resource bolstered the stock in the second half of 2022. An institutional investment at a 14.2% discounted share price caused a rapid fall in share price in December. Using these funds effectively could see another upturn in 2023.

27. Whitehaven Coal Limited (WHC)

Stake platform bought / sold (2022): 57% / 43%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Whitehaven Coal Limited | Commodities | $8.4b | $9.42 | +285.39% |

Whitehaven operates and develops thermal and metallurgical coal mines throughout Queensland and New South Wales. They've benefited from increased demand due to sanctions on Russian coal and uncertainty around gas supplies in the Northern Hemisphere. The share price went up along with a record average coal price of $581 per tonne, which generated $1.55 billion of cash in the September quarter. High prices allowed financial success despite an actual decline in production. FY22 saw the payout of its largest dividend on record, of $0.40 per share. The reopening of China and their potential removal of curbs against Australian coal exports could shape 2023 results.

28. BetaShares Australian Strong Bear (Hedge Fund) (BBOZ)

Stake platform bought / sold (2022): 57% / 43%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

BetaShares Australian Strong Bear (Hedge Fund) | Diversified ETF | $311.6m | $3.77 | -7.42% |

This is an inverse ETF that uses gearing to heighten the negative returns of the S&P ASX 200 index. It means that if the Australian share market has a 1% decline, BBOZ will show an estimated 2% to 2.75% increase in value. The product is targeted at investors who expect Australian shares to fall in value. Australian large caps had mixed fortunes in 2022 and the ASX 200 index saw a -5.45% fall. Alongside global markets and due to a strong influence from the U.S., the ASX saw a small dip in March and even larger drop in June. This initially benefitted BBOZ, but the gradual recovery of the share market pushed the ETF downwards.

29. Flight Centre Travel Group (FLT)

Stake platform bought / sold (2022): 61% / 39%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Flight Centre Travel Group | Consumer Discretionary | $2.8b | $14.49 | -18.27% |

The travel agency failed to capture the upswing as the industry rebounded in 2022 with the removal of COVID-19 restrictions and pent-up demand from travellers. Although Flight Centre managed to post a 37% improvement on its statutory losses before tax from the previous year, they remained at $378m for FY22. It should be noted that the company has one of the most shorted stocks on the ASX, adding downward pressure on its price. Concerns about inflation cutting into the ‘fun’ budgets of consumers will follow the business into 2023. Rising COVID cases in China could also mean a slower recovery in a major market.

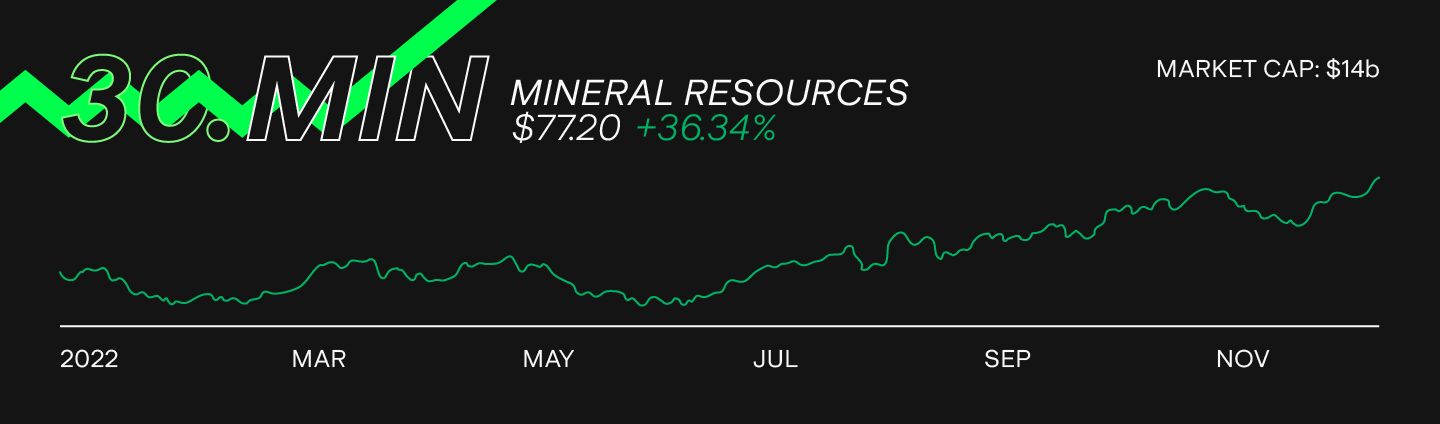

30. Mineral Resources Limited (MIN)

Stake platform bought / sold (2022): 58% / 42%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Mineral Resources Limited | Mining | $14.6b | $77.20 | +36.34% |

This diversified mining company has exposure to lithium, iron ore, gas, and is a provider of services to the industry. Its strong 2022 performance was assisted by multiple revenue streams and potential future growth plans. The initial declines of iron prices due to China’s real estate debt worries and removal of COVID-19 restrictions in late 2022 impacted the share. Mineral Resources’ stock is also affected by lithium demand, although not to the same extent as miners without other assets. The commodity market will drive the business’ fortunes in 2023 and determine the progress of its projects.

31. Magnis Energy Technologies (MNS)

Stake platform bought / sold (2022): 62% / 38%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Magnis Energy Technologies | Mining | $354.2m | $0.37 | -28.16% |

Magnis has a stake in the iM3NY lithium-ion battery manufacturing facility in the U.S. and is developing the Nachu graphite mine in Tanzania. The company’s share price suffered as news of the chairman being investigated by ASIC broke earlier last year. The start of commercial battery production at its U.S. factory pushed the stock up in August, but many of the gains were erased alongside declines by other exploration and battery technology companies in September. With plans to raise funds to expand this factory announced in December, 2023 is likely to be a busy year for Magnis.

32. Xero Limited (XRO)

Stake platform bought / sold (2022): 73% / 27%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Xero Limited | Information Technology | $10.3b | $70.27 | -51.24% |

The cloud accounting software business is another growth stock that was hit hard by rising interest rates. Companies in the Software-as-a-Service (SaaS) segment saw significant declines in share price with the general downturn of the tech industry. Xero also saw a fall in free cash flow due to expenses rising faster than revenues and the cost of new acquisitions. For investors focused on the longer term, there’s some consolation. Total subscribers increased 16% and operating revenue 30% to $658.5m in the first half of FY23. The next few months will show if the stock market is convinced a comeback can occur.

33. CSL Limited (CSL)

Stake platform bought / sold (2022): 64% / 36%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

CSL Limited | Pharmaceuticals | $137.8b | $287.76 | -0.48% |

CSL is a specialty biotechnology company with expertise in rare and serious diseases, flu vaccines, iron deficiency and kidney diseases. Despite a negative return, the company outperformed the ASX 200 in 2022. Investors were unsure if the company could raise funds for an acquisition as markets were rattled by the start of the Russia-Ukraine conflict. The completion of theVifor deal – a Swiss pharmaceutical company – in August saw the share price recover. However, news of the CEO’s plan to retire in 2023 saw the gains slip in December. The next leader faces the challenge of increasing sales in a potentially slower economy in 2023.

34. Latin Resources Limited (LRS)

Stake platform bought / sold (2022): 61% / 39%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Latin Resources Limited | Mining | $186.8m | $0.10 | +237.93% |

The company is developing the Salinas Lithium Project in Brazil. It holds additional assets, including another landholding with lithium in Argentina, copper play in Peru and a clay mineral halloysite in Australia. Latin Resources’ shares saw a rapid rise from $0.04 to $0.20 over March and April as lithium prices spiked. As an early stage project without current revenues, the stock never recovered to this high point – but it remains above initial levels with an impressive overall 237.93% return for 2022. The amount of progress on the Salinas Project and lithium demand are likely to determine its fate in 2023.

35. Woolworths Group (WOW)

Stake platform bought / sold (2022): 70% / 30%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Woolworths Group | Consumer Staples | $40.9b | $33.56 | -10.61% |

The major supermarket had a challenging 2022, with a performance that was surprisingly volatile for a ‘defensive’ stock. COVID-19 measures stymied growth in early 2022 and May’s general stock market downturn erased earlier gains. Although consumer staples tend to be relatively inflation resistant, investors need to keep in mind that Woolworths is also facing cost pressures itself, especially around fuel. One concern is that the group’s key supermarket division saw sales decline in Q1 FY23, causing a drop in share price from mid-August onwards. They’re looking at new avenues of growth: the company took a major stake in pet retailer PETstock in December.

36. Argosy Minerals Limited (AGY)

Stake platform bought / sold (2022): 64% / 36%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Argosy Minerals Limited | Mining | $730.3m | $0.57 | +80.95% |

Argosy holds interests in the Rincon Lithium Project in Argentina and Tonopah Lithium Project in the U.S. Despite a few hiccups along the way, the stock had a general upward trend in 2022 and notable gains of 80.95%. The market rewarded the company’s plans to reach a steady state of production at Rincon by the end of Q2 2023. If all goes as expected, Argosy could become only the second ASX-listed lithium carbonate producer. An outcome likely to further support the share price going into 2023, alongside general demand for the commodity.

37. Nickel Industries Limited (NIC)

Stake platform bought / sold (2022): 67% / 33%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Nickel Industries Limited | Mining | $2.6b | $0.97 | -29.94% |

The company runs a number of nickel mining and processing plants in Indonesia that produce materials for the stainless steel industry. The share price was greatly affected by events in the nickel market. Investor confidence was hurt after the London Metals Exchange cancelled trades in March. The Russia-Ukraine conflict had led to a squeeze on already limited stockpiles. Nickel Industries expanded its operations in 2022 and greater production levels helped support the share towards the end of the year. It remains to be seen whether the company can continue to uphold this trend into 2023.

38. BetaShares Autralia 200 ETF (A200)

Stake platform bought / sold (2022): 92% / 8%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

BetaShares Australia 200 ETF | Diversified ETF | $2.6b | $116.88 | +1.46% |

This ETF tracks the performance of the 200 largest companies in Australia by market cap. Its returns tend to mirror the S&P ASX 200 index after fees and expenses, as well as dividend payments. The latter helped push returns into positive territory, a relative achievement in a tough year for share markets. An allocation of just under 30% to financials and 24% to various miners helped cushion the worst of the downturn, sustained by the tech sector. Forecasts for 2023 vary from a minor recession to a quick rebound with slowing interest rate rises.

39. Woodside Energy Group Ltd (WDS)

Stake platform bought / sold (2022): 55% / 45%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Woodside Energy Group Ltd | Commodities | $66.7b | $35.44 | +77.10% |

Woodside Energy is a top ten independent company in the global oil and gas market, boosted by a merger with BHP Group in June 2022. They’re an important local Liquified Natural Gas (LNG) player, with the product accounting for 48% of its product mix in FY22. The share price growth has largely been due to the Russia-Ukraine conflict pushing up energy prices and causing many countries to look for alternative suppliers of LNG. How this geopolitical turmoil progresses – as well as the general levels of economic activity – could play a significant role in its 2023 performance.

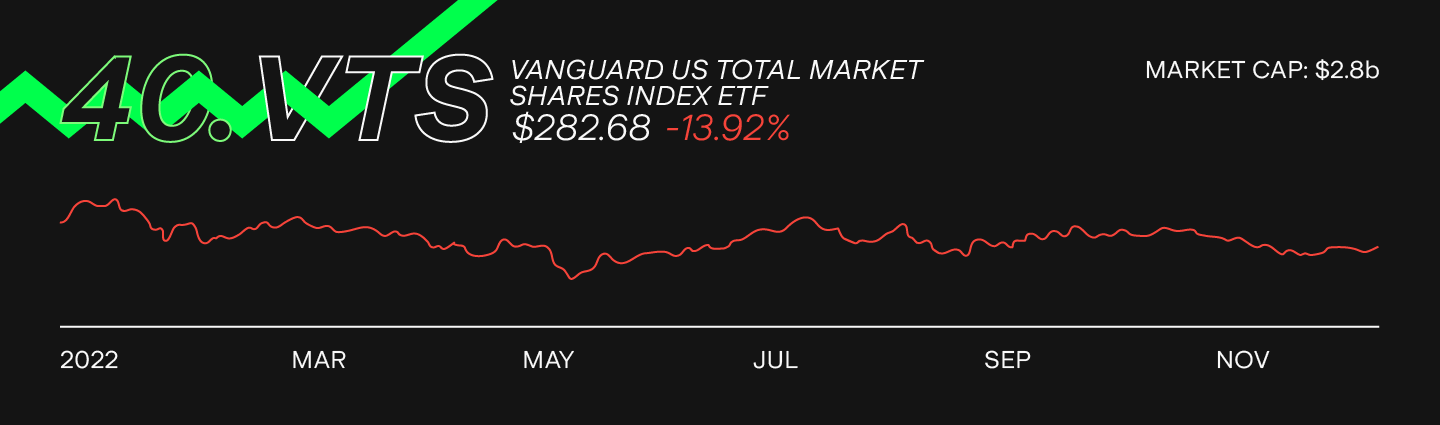

40. Vanguard US Total Market Shares Index ETF (VTS)

Stake platform bought / sold (2022): 92% / 8%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Vanguard US Total Market Shares Index ETF | Diversified ETF | $2.9b | $282.68 | -13.92% |

This Vanguard ETF follows the CRSP US Total Market Index of over 4,000 companies listed in the U.S. Although the overall return was negative, it outperformed the S&P 500 index of the 500 largest companies by market cap. This suggests that mid and small sized companies could have provided some reinforcement to VTS in 2022. Its most significant sector holdings are similar to the S&P 500 ETF of IVV, with 24% in tech and 14% in healthcare. As an unhedged product, the ETF is exposed to fluctuating currency values; this means that investors could have had extra gains from the U.S. dollar’s strong run last year.

41. Queensland Pacific Metals Limited (QPM)

Stake platform bought / sold (2022): 68% / 32%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Queensland Pacific Metals Limited | Mining | $192.1m | $0.11 | -35.29% |

At its Townsville Energy Chemicals Hub, Queensland Pacific Metals plans to process metals such as nickel and cobalt for the lithium-ion battery and EV sectors. Volatile nickel prices and weaknesses in global stock markets meant the stock was unable to return to 2021 highs. One concern going forward is in the new numbers for stage one of its Townsville Project, as published in December. The capital expenditure was estimated at $1.9b, up from $650m in 2020, due to higher planned capacity and increased input costs. This is around ten times its market cap and investors are aware that securing this amount of funding could be challenging for Queensland Pacific Metals.

42. Lynas Rare Earths Limited (LYC)

Stake platform bought / sold (2022): 65% / 35%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Lynas Rare Earths Limited | Mining | $7b | $7.85 | -23.56% |

Aside from its rare earth mine, Lynas also has a processing plant in Western Australia and a separation facility in Malaysia. The company’s stock fell on news that selling prices for its rare earth products sank to $49.30 per kilogram in Q1 FY23, down from $79.20/kg in Q4 FY22. They also faced challenges at operations in Malaysia during the same quarter. The team hopes for a change of fortunes in 2023, after putting work into expanding capacity at its mine and plans for a new separation facility in the U.S.. Although if China achieves its announced increased quota for rare earth production, Lynas could work in an oversupplied market this year.

43. New Hope Corporation (NHC)

Stake platform bought / sold (2022): 61% / 39%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

New Hope Corporation | Commodities | $5.5b | $6.36 | +229.55% |

New Hope Corporation has a range of business segments involving coal, port operations, agriculture and oil. But it’s still predominantly a coal exporter, and the stock was well supported by rising prices for the commodity. The Russia-Ukraine conflict caused a particular crunch in demand, as major coal exporter Russia faced sanctions and importers scrambled to secure alternative supplies. This trend slowed towards the end of 2022, with fears of a recession coming to the forefront. A significant dividend payout of $0.56 per share in October was also behind a fall in NHC stock – it’s common practice for many investors to sell shares after receiving a dividend. The coal price is likely to remain a driver for the stock’s performance in 2023.

44. Magellan Financial Group (MFG)

Stake platform bought / sold (2022): 68% / 32%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Magellan Financial Group | Financial Services | $1.6b | $8.94 | -54.38% |

The investment manager had a strenuous 2022 and has still not been able to recover pandemic losses. With the loss of a major client and unexpected departure of the CEO in December 2021, Magellan’s share price was facing challenges from the start of the year. When another founder left in March, the downward trend continued. A knock-on effect was that institutional and larger investors appeared to lose confidence in the business. Magellan suffered from high outflows of funds and will need to convince investors to return in 2023.

45. Paladin Energy Ltd (PDN)

Stake platform bought / sold (2022): 61% / 39%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Paladin Energy Ltd | Mining | $2b | $0.70 | -15.66% |

Paladin plans to restart the Langer Heinrich mine in Namibia on the back of increased uranium prices. The asset already has a ten-year track record and could produce over 76 million pounds of uranium in the future. With first production forecast for early 2024, profitability is some time away. Investors have remained sceptical and the stock had a relatively volatile year. Demand from the nuclear industry will likely be the main factor driving uranium prices and Paladin’s fortunes in 2023.

46. National Australia Bank Limited (NAB)

Stake platform bought / sold (2022): 63% / 37%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

National Australia Bank Limited | Financial Services | $94.3b | $30.06 | +7.62% |

Although NAB was the least popular big bank amongst Stake traders, the stock was well above the S&P ASX 200 with a relatively solid return of 7.62%. Like its competitors, NAB’s share price was hit hard by the RBA’s interest rate rises in June. It soon recovered and managed to hold onto the gains for the rest of 2022, supported by the FY22 report revealing positive cash earnings growth of 8.3% to $7.1b. NAB also expanded its portfolio with a $1.2b acquisition of Citigroup’s Australian consumer business in June. The company could continue an upward trend if it’s able to keep strengthening its balance sheet.

47. Hawsons Iron Ltd (HIO)

Stake platform bought / sold (2022): 61% / 39%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Hawsons Iron Ltd | Mining | $65m | $0.08 | -43.45% |

Hawsons is working on plans to develop an iron ore mine in NSW, which could become the world’s biggest high-quality project. Positive news about their progression rapidly pushed the share price to an all-time high in April. A generally weaker economic climate and falling Australian dollar in the later months saw the company faced with rising expenditures, whilst potential revenues remain far off in the future. Hawsons officially slowed work on its flagship project in December to preserve cash, meaning they won’t meet the expected deadlines. New funds are needed to reverse their fortunes in 2023.

48. South32 Limited (S32)

Stake platform bought / sold (2022): 68% / 32%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

South32 Limited | Mining | $18.3b | $4.00 | +7.74% |

South32 is an unusually diversified mining company. They produce bauxite, alumina, aluminium, copper, silver, lead, zinc, nickel, coal, and manganese from operations in Australia, southern Africa, and South America. But this means the outperformance of specific commodities like coal played a limited role in determining its overall share price. The company has been spending on new acquisitions to shift focus onto metals for low carbon applications, but these decisions could only pay off over a longer period of time.

49. Critical Resoucres Limited (CRR)

Stake platform bought / sold (2022): 57% / 43%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Critical Resoucres Limited | Mining | $63.1m | $0.04 | +10.26% |

This small cap is developing plans for a lithium mine in Canada. It also has longer-term plans to search for other metals on its landholdings in Australia and Oman. As a company in the early stages of realising its project, the share price was primarily driven by the dynamics of the lithium market. This is likely to remain a major factor for the stock in 2023, but the team also needs to show proof of progression. Look out for the publication of more information about the ongoing drill campaign and details about their lithium resource.

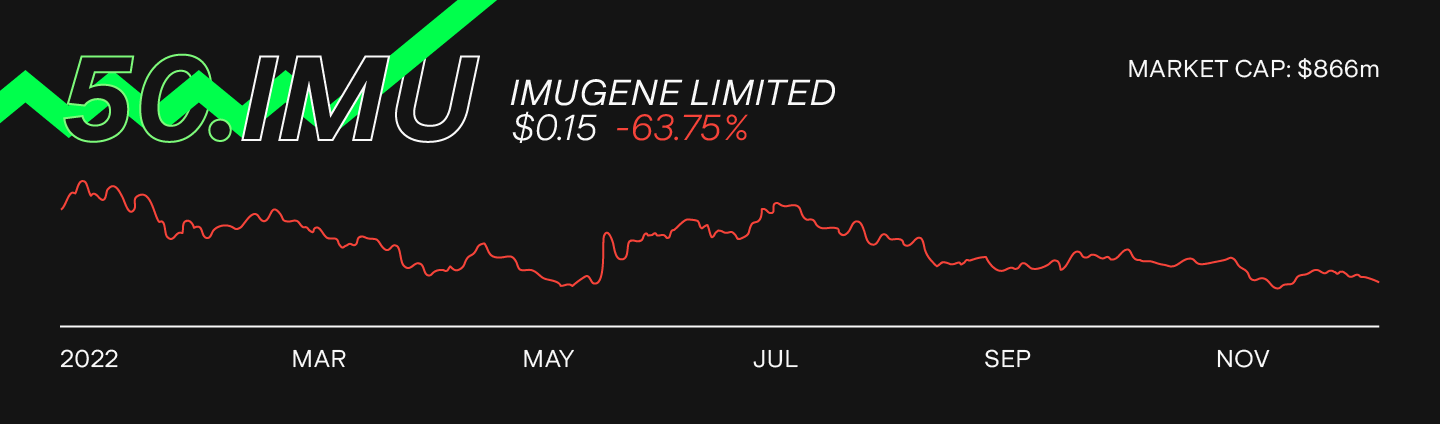

50. Imugene Limited (IMU)

Stake platform bought / sold (2022): 68% / 32%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Imugene Limited | Biotechnology | $866.9m | $0.15 | -63.75% |

Imugene’s stock price dropped over 60% in 2022, ending at $0.15, but this was preceded by a rally all through 2021 which brought the share price from $0.10 to $0.40. This biotech company researches cancer treatments, and 2022 was filled with lots of reports on clinical trials and new patents.

Go to stocks 51-100

The information gathered in this article was sourced from the Stake platform, the ASX and Market Index. Data is fully adjusted for dividends and capital events to provide total return, so performance metrics may differ from company websites. Numbers at market close on 30.12.2022.

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking appropriate financial or taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.