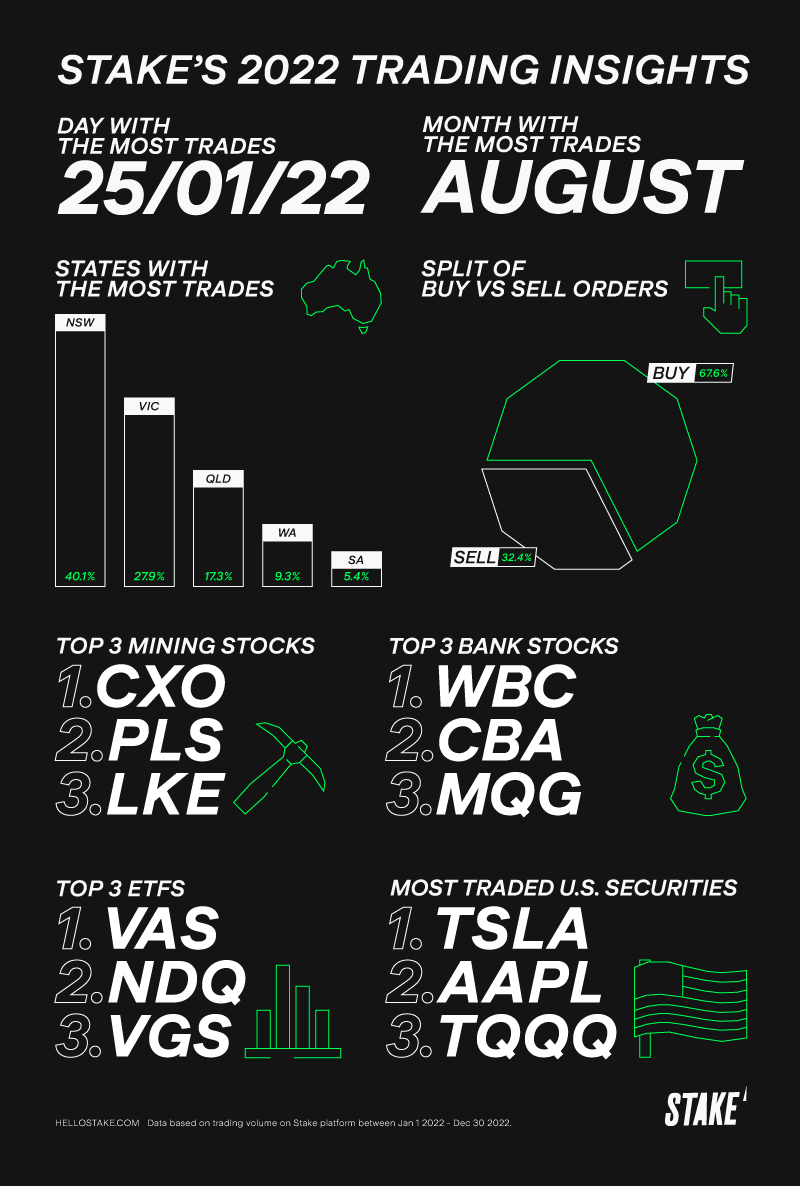

Stockest 100 (continued)

Here’s the second half of our top 100 most traded ASX stocks on Stake. Find numbers 51 to 100 below.

Before that, though, here are some interesting stats and insights revealed by Stake’s trading data in 2022.

This is not financial advice. Past performance is not a reliable indicator of future performance.

51. Arafura Rare Earths Ltd (ARU)

Stake platform bought / sold (2022): 66% / 34%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Arafura Rare Earths Ltd | Mining | $874.1m | $0.47 | +126.83% |

In contrast to the majority of the market, Arufura Rare Earths strongly outperformed the ASX 200 to gain 126% from the start to the end of 2022. While significantly higher than its 2021 share price (between $0.13 and $0.24), its current share price of $0.47 is still eclipsed by its all-time high of $1.79 back in 2007. In 2022, the company sought out $121m from investors in a new share purchase plan, and also signed an offtake agreement with Hyundai and Kia.

52. Vanguard Australian Shares High Yield ETF (VHY)

Stake platform bought / sold (2022): 88% / 12%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Vanguard Australian Shares High Yield ETF | ETF | $2.6b | $66.13 | +11.27% |

VHY is one of the top Vanguard ETFs when it comes to exposure to the highest-dividend-paying stocks in Australia, with its top 3 constituents being Commonwealth Bank, BHP Group, and National Australia Bank. Despite the stock market downturn in 2022, VHY grew over 11% in its stock price. That makes an average increase of 9.05% every year over the past five years. Since VHY is an ETF holding individual stocks, its performance will depend on the performance of those companies.

53. Lithium Power International Limited (LPI)

Stake platform bought / sold (2022): 60% / 40%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Lithium Power International Limited | Mining | $261.1m | $0.44 | -3.30% |

Since its IPO in 2016, Lithium Power reached its all-time high in March 2022 at a price of $0.91. It was an eventful year for the company with new acquisitions, a successful $25m share placement, and high-purity lithium being produced from its mines. Despite that, the company’s shares ended the year slightly below its 2021 close, which was $0.46.

54. Vulcan Energy Resources Limited (VUL)

Stake platform bought / sold (2022): 61% / 39%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Vulcan Energy Resources Limited | Mining | $873.5m | $6.33 | -38.18% |

Vulcan Energy had humble beginnings when it IPO’d at $0.20 back in 2018. Despite its large fall of over 38% through 2022, the company’s share price has still come a long way. It experienced most of its rally in 2021 when it hit its all-time high of $15.90 (that’s over a 7000% return if you had bought into the stock’s IPO!). It also raised $200m in a share placement in late 2021. The company’s main project is based in Germany, but it began its expansion into France last year.

55. Essential Metals Limited (ESS)

Stake platform bought / sold (2022): 59% / 41%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Essential Metals Limited | Mining | $80.1m | $0.33 | +71.05% |

Essential Metals had an average daily volume of just $2.21m – lower than most stocks in this list. Despite that, 2022 saw the stock rally to new highs from its start of $0.18, briefly touching $0.70, before ending the year more modestly at $0.33. ESS had several product-related announcements over 2022 that involved its lithium project, most of them positive. This year, the big news is its pending M&A transaction – Tianqi Lithium Energy Australia agreed to acquire Essential Metals at $0.50 per share. If ESS shareholders vote in favour, the deal should be complete by May 2023.

56. BetaShares US Equities Strong Bear Currency Hedged (Hedge Fund) (BBUS)

Stake platform bought / sold (2022): 62% / 38%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

BetaShares US Equities Strong Bear Currency Hedged | Diversified ETF | $287.8m | $10.82 | +44.18% |

BBUS is a diversified ETF that magnifies the returns that are negatively correlated with the returns of the U.S. market. This means that the U.S. bear market of 2022 has resulted in this ETF outperforming. With its magnification of returns, a 1% fall in the U.S. markets delivers a 2-2.75% increase in the value of BBUS. Given that the markets are still expected to be in bearish territory over 2023, BBUS might once again outperform this year.

57. BetaShares Asia Technology Tigers ETF (ASIA)

Stake platform bought / sold (2022): 79% / 21%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

BetaShares Asia Technology Tigers ETF | Information Technology ETF | $451m | $6.83 | -26.13% |

ASIA is another ETF, which tracks the performance of the top 50 technology and retail stocks in Asia, such as Alibaba, Tencent, Baidu, and JD.com. It has underperformed in 2022, ending the year over 26% lower than how it started. This follows a 18.22% loss throughout 2021. The ETF has 50.7% of its holdings in China, followed by 22.8% in Taiwan, 17.8% in South Korea, and 7.9% in India. Leaning heavily on the performance of such countries, the performance of the ETF next year will depend particularly on how China can manage the end of its COVID-Zero policy.

58. AGL Energy Limited (AGL)

Stake platform bought / sold (2022): 65% / 35%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

AGL Energy Limited | Utilities | $5.5b | $8.07 | +35.50% |

Over 2022, AGL saw a rebound in its share price after being heavily sold off from the start of 2020 to the end of 2021. But it’s still a far cry from the $20.59 price it boasted in January 2020. The company’s fall from grace is mainly attributed to the lacklustre performance of wholesale electricity prices, less government incentives for consumers’ utility bills and the entry of renewable energy supply into the utilities market. Additionally, AGL is discontinuing one of its power stations, announcing its closure by 2026.

59. Coles Group (COL)

Stake platform bought / sold (2022): 69% / 31%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Coles Group | Consumer Staples | $22.5b | $16.72 | -3.92% |

As part of the consumer staple industry, which is historically a more defensive industry, Coles didn’t experience as much downside to its stock price as other industries. It reached a high of $19.36 in 2022 before retreating towards the end of the year. There wasn’t too much activity for the company – mainly just its regular dividend distribution, and a few M&A transactions. In volatile times, investors often embrace the view that ‘no news is good news’.

60. Cobre Limited (CBE)

Stake platform bought / sold (2022): 57% / 43%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Cobre Limited | Mining | $43.3m | $0.18 | +86.17% |

Cobre is a fairly new stock on the public market, having listed just three years ago. Its share price averaged out to just $0.20 between 2020 and mid-2021, before it crashed to its all-time low of $0.02 in June 2022. Then things suddenly looked much better for the stock, as it shot up all the way to $0.56 by August 2022 following a new material copper discovery and a successful capital raise. Some speculate CBE’s share price may just be a one-hit wonder, as the company is currently operating at a loss and also has a low amount of cash.

61. LEO Lithium Limited (LLL)

Stake platform bought / sold (2022): 67% / 33%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

LEO Lithium Limited | Mining | $458.8m | $0.49 | -12.96% |

Leo Lithium is one of the newest stocks in this list, having IPO’d only in June. The company was founded back in 2019 and engages in mining activities in Mali. It also used to be a subsidiary of Firefinch Limited (ASX:FFX). Not much else can be said about LLL at this early stage, but its share price hit a high of $0.78 and a low of $0.43 in 2022. The IPO was priced at $0.70.

62. Megaport Limited (MP1)

Stake platform bought / sold (2022): 65% / 35%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Megaport Limited | Information Technology | $982.m | $6.31 | -66.38% |

Megaport started 2022 on a high of $18.56, unfortunately losing over two-thirds of that price throughout the year. The company came from a strong bull run between 2019 and the end of 2021, going from $3.72 to as high as $21.46 in Nov 2021. But last year could be seen as a price correction, as Megaport’s revenues and income haven’t been improving and the company continues to operate at a loss. There was no significant activity from the company in 2022, mainly a few new clients and some updates on its product. The general consensus is that Megaport will finally start recording profits by 2025.

63. Galileo Mining Ltd (GAL)

Stake platform bought / sold (2022): 54% / 46%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Galileo Mining Ltd | Mining | $156.1m | $0.86 | +289.77% |

Long-term investors of Galileo Mining would find themselves celebrating the year that was, as the company’s share price exploded from $0.23 at the start of 2022 to briefly touching $1.78 in May. While it retreated back to below $1, gains were still significant, thanks mainly to the uncovering of palladium, gold, copper, nickel, and even rhodium. While the future looks bright, investors need to take note that Galileo is yet to be making any significant revenue, let alone profit. The company has been around since 2003, so it’s already had a long run of operations.

64. Appen Limited (APX)

Stake platform bought / sold (2022): 60% / 40%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Appen Limited | Information Technology | $287.6m | $2.49 | -77.75% |

Appen is an AI-developing company that made headlines in 2020 when tech outperformed the entire market and it reached over $40 in share price. It was a short bull run – APX has been falling ever since. . In 2022, it released an announcement stating uncertain business conditions, triggering further losses. But the company still has a decent income statement, as it’s been recording net income and a growing revenue over the last few years.

65. Neometals Ltd (NMT)

Stake platform bought / sold (2022): 61% / 39%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Neometals Ltd | Mining | $439.4m | $0.80 | -33.61% |

Another rise-and-fall stock, Neometals touched $1.95 in May 2022 after rallying almost 600% from the start of 2021. While the share price has now subsided to $0.80, that’s still up by 220% since January 2021. Neometals’ bull run could be attributed to the strong market sentiment surrounding Lithium companies and its stronger income statement for FY2021. It’s worth noting that those statements don’t actually reflect operating revenues. Instead, its records of net income come from profits from the sale of discontinued operations, meaning the company has been downsizing. Not necessarily a bad sign, as companies often choose to sell off or demerge some holdings to focus on a stronger area.

66. Northern Star Resources Ltd (NST)

Stake platform bought / sold (2022): 57% / 43%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Northern Star Resources Ltd | Mining | $12.8b | $10.91 | +20.34% |

Northern Star Resources is a gold mining company whose share price tends to follow the price of gold. Given gold’s underperformance in both 2021 and 2022, the stock has been trending below its 2020 highs, mostly moving sideways. The biggest news in recent years for NST was its complete buy-out of Saracen Mineral, another gold miner that was previously listed in the ASX. Last year, NST sold off two gold projects to Black Cat Syndicate (BC8) and also announced a $300m buyback – its first ever. The outlook for 2023 heavily depends on the performance of gold, which is expected by some analysts to finally outperform.

67. Tempest Minerals Limited (TEM)

Stake platform bought / sold (2022): 51% / 43%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Tempest Minerals Limited | Materials | $11.6m | $0.02 | -4.17% |

Tempest Minerals is one of the smaller companies in this list, with a market cap below $20m. That’s after the miner shot up to a high of $0.18 last year, following a ‘significant discovery’ of copper in its wholly-owned project. The end of 2022 saw TEM announcing the completion of drilling at its project, but no further announcements have been made.

68. BeShares Global Cybersecurity ETF (HACK)

Stake platform bought / sold (2022): 86% / 14%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

BetaShares Global Cybersecurity ETF | Information Technology ETF | $604.1m | $7.80 | -22.11% |

Another ETF on this list, HACK provides exposure to leading companies in the cybersecurity sector. Its top 3 holdings are in Broadcom Inc, Cisco Systems and Infosys Ltd. Despite the increasing interest in cybersecurity last year, HACK ended 2022 down from its start, following the trajectory of the stock market overall.

69. Global Lithium Resources Limited (GL1)

Stake platform bought / sold (2022): 66% / 34%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Global Lithium Resources Limited | Mining | $359.2m | $1.85 | +113.29% |

Another fairly recent IPO among our most traded stocks, Global Lithium only listed on the ASX back in May 2021, at a price of $0.20. Whoever jumped in then would be rejoicing by now, with gains of almost 600% since. In 2022, Global Lithium saw its acquisition of another lithium project and a capital raise. The company is yet to make money, but some investors expect the stock to outperform in the coming years, estimating revenues to go from $0 to $100m by 2026. With that, their current target price range is $3.00 to $4.20 – a good percentage above the stock’s 2022 closing price.

70. BetaShares Global Sustainability Leaders ETF (ETHI)

Stake platform bought / sold (2022): 85% / 15%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

BetaShares Global Sustainability Leaders ETF | Diversified ETF | $2.2b | $11.01 | -15.45% |

ETHI is an ETF that tracks large global stocks identified as ‘Climate Leaders’, making sure to exclude companies with exposure to fossil fuels. As with the majority of the market, ETHI boomed between 2020 to the end of 2021, before slowly losing steam throughout 2022. The ETF’s top holdings are Visa, Home Depot, Mastercard, Apple and Nvidia. The performance of ETHI will depend on the performance of its constituents.

71. BetaShares Geared Australian Equity Fund (Hedge Fund) (GEAR)

Stake platform bought / sold (2022): 64% / 36%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

BetaShares Geared Australian Equity Fund | Diversified ETF | $361.6m | $22.95 | -1.24% |

Another ETF, GEAR tracks the performance of the broad Australian equity market. However, as a geared portfolio, this fund is comprised of 50-65% borrowed funds, and the remaining percentage to be investor funds. This means that one’s investment into GEAR is magnified since the fund adds leverage into the portfolio. Its 2023 performance will depend on how the ASX as a whole will perform.

72. EML Payments Limited (EML)

Stake platform bought / sold (2022): 62% / 38%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

EML Payments Limited | Support Services | $222.5m | $0.63 | -80.91% |

EML Payments was another short-term post-pandemic winner, gaining as much as 260% to $5.75 before quickly tapering off to where it is now. Back in 2020 when it boomed, EML was hot on acquisitions, seeking new placements and acquiring several smaller companies and projects. Last year’s weakness in EML’s share price was inversely related to the company’s growth and its income statement (which grew revenues and narrowed losses). The company focused more on expanding its core business, as it launched a new cryptocurrency Mastercard and grew its presence to 20 more countries in Europe. EML also announced a share buyback.

73. Block Inc. (SQ2)

Stake platform bought / sold (2022): 62% / 38%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Block Inc. | Financial Services | $15.4b | $91.94 | -40.43% |

After acquiring Aussie darling Afterpay in Jan 2022, Block extended its primary listing in the NYSE to be in the ASX as well. Unfortunately, the stock price did not experience a warm welcome, dropping significantly in the coming months – mainly a result of the tech sell-off experienced globally. Block continued to acquire several other companies in 2022, despite its latest earning guidance recording a significant net loss.

74. Santos Limited (STO)

Stake platform bought / sold (2022): 61% / 39%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Santos Limited | Commodities | $23.5b | $7.14 | +15.15% |

After acquiring Aussie darling Afterpay in Jan 2022, Block extended its primary listing in the NYSE to be in the Founded back in 1954, Santos has a very long history compared to most ASX companies. Its share price has mostly gone sideways last year, hitting a 52-week high of $8.86 and a low of $6.66.. Santos spent the year acquiring a few new projects. In April 2022, Santos announced a $250m share buyback; in December 2022, they increased it to $350m. As this share buyback scheme gets executed, STO stock should theoretically continue on its upward trajectory. This doesn’t always play out in practice though, so investors should take this with a grain of salt.

75. Tyro Payments Limited (TYR)

Stake platform bought / sold (2022): 70% / 30%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Tyro Payments Limited | Financial Services | $708.8m | $1.42 | -50.35% |

It’s no exaggeration to say that Tyro Payments had a bad year – the stock hit $0.60 for the first time since its IPO in 2019. Its fall from grace has been attributed to lacklustre margins despite its business growing across the year. Another major piece of news from Tyro in 2022 was when its $593m deal with Westpac fell through, after the former rejected the big bank’s takeover offer.

76. The A2 Milk Company (A2M)

Stake platform bought / sold (2022): 59% / 41%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

The A2 Milk Company | Consumer Staples | $5b | $6.88 | +23.74% |

A2 Milk has made headlines over the years, as its share price went from the double digits all the way down to $3.90. This fall was due to the class action lawsuit brought against the company for allegedly engaging in misleading and deceptive conduct and breaching disclosure requirements. The future in A2 Milk’s legal environment is still largely unsure, as the class action is still ongoing. But operationally, its income statement has shown steady revenues and income, plus the company has announced a share buyback scheme worth $150m.

77. Telstra Group (TLS)

Stake platform bought / sold (2022): 64% / 36%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Telstra Group | Telecommunications | $46b | $3.99 | -1.00% |

Telstra Group struggled through 2020 and 2021, but saw its stock price go mainly sideways in 2022. Telstra spent most of last year making investments into other projects and companies, such as providing Fetch TV $50m in funding. The new year will most likely see similar activities as previous years. The company also completed its $250m equity buyback scheme in June 2022, which may be a reason why its share price has increased since 2021. As an established company, Telstra wouldn’t have the level of growth that several other ASX companies would be experiencing. But it’s still important to note that Telstra’s net income has been in decline, with last year’s being less than half of its 2017 net income.

78. Winsome Resources Limited (WR1)

Stake platform bought / sold (2022): 57% / 43%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Winsome Resources Limited | Chemicals | $156.6m | $1.23 | +284.38% |

Another newly-listed company in this list, Winsome Resources IPO’d in November 2021 for an issue price of $0.20. Ending 2022 at $1.23 means that early investors have enjoyed five-fold returns. Winsome spent 2022 expanding its business through acquisitions. The company also had a follow-on equity offering, raising another $6.82m in funds.Yet to make any revenue and with its mining projects still in the exploration stage, the company will most likely be in growth mode for the near future.

79. Grange Resources Limited (GRR)

Stake platform bought / sold (2022): 68% / 32%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Grange Resources Limited | Mining | $1b | $0.85 | +29.94% |

Grange Resources had an eventful year for its stock price, as it rallied to a high of $1.79 in early June before losing steam and settling around $0.75 to $0.85 – still 20-30% higher than its price at the end of 2021. The only significant announcement the company made during this period was its cash dividend payout. Grange has been generating growing net income since 2016, which is a good sign for investors. The company also spent the last month of 2022 acquiring a new mining project and a larger stake in a deposit of minerals, which could generate more revenues for the company.

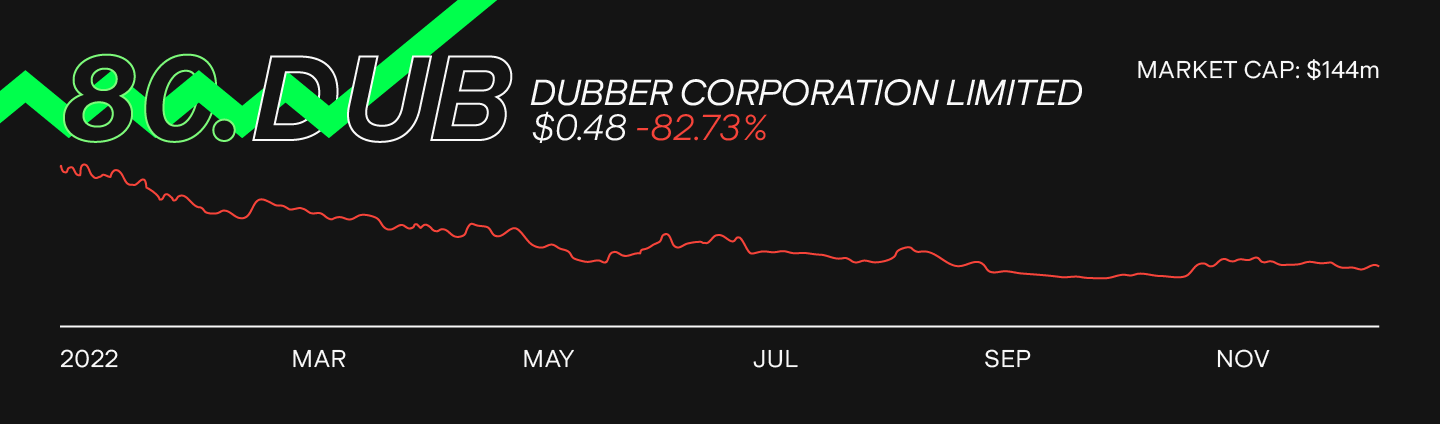

80. Dubber Corporation Limited (DUB)

Stake platform bought / sold (2022): 55% / 45%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Dubber Corporation Limited | Information Technology | $144.3m | $0.48 | -82.73% |

Dubber was one of the companies that boomed tremendously back in the dot com bubble, where it reached a high of $103 per share. Despite surviving the burst, DUB never recovered to those heights, with 2022 a particularly bad year for its stock price. This might be attributed to the company widening its net loss from $31.7m in FY2021 to $83.2m in FY2022. With that said, Dubber was busy acquiring new clients last year, signing agreements with Vodafone, Gamma Communications and several others. The company hasn’t generated any income since 2010.

81. iShares Core S&P/ASX 200 ETF (IOZ)

Stake platform bought / sold (2022): 82% / 18%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

iShares Core S&P/ASX 200 ETF | Diversified ETF | $3.6b | $28.49 | +1.09% |

IOZ is another ETF, one that closely tracks the ASX 200. This means that IOZ is an index fund, measuring the performance of the 200 largest securities listed on the ASX. As such, the fund’s performance depends on how those companies do and how the Australian market behaves. It’s no surprise that IOZ has moved mostly sideways in the tumultuous year that was 2022.

82. Domino's Pizza Enterprises Limited (DMP)

Stake platform bought / sold (2022): 69% / 31%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Domino's Pizza Enterprises Limited | Consumer Discretionary | $5.8b | $66.25 | -44.29% |

Domino’s Pizza saw its share price drop by over 40% in 2022. However, this followed the strong rally it had the previous year, when it gained 36%. An explanation for the rollercoaster may be the company’s net income. In 2021, it outperformed and generated $184.5m, thanks to the revenues during COVID lockdowns. This slipped to $158.7m in 2022. That’s still higher than pre-pandemic figures, as it earned $115.9m and $138.5m in 2019 and 2020, respectively. Only time will show whether Domino’s will be able to sustain its heightened income levels.

83. Melbana Energy Limited (MAY)

Stake platform bought / sold (2022): 61% / 39%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Melbana Energy Limited | Commodities | $209m | $0.06 | +186.36% |

One of the micro caps on this list, Melbana Energy rallied by almost 200% in 2022. But it doesn’t look like the rally was fuelled by any of the company’s activities over the year, given that Melbana only released drilling updates (a regular announcement) and filed for another equity offering for the amount of $15m. While MAY gained a lot last year, note that it’s been around since 1994 and is yet to make any revenue, let alone profit. Investors must do due diligence before investing in non-profitable companies.

84. Anson Resources Limited (ASN)

Stake platform bought / sold (2022): 64% / 36%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Anson Resources Limited | Mining | $200.3m | $0.19 | +54.17% |

Anson Resources is another microcap company (meaning a market cap below $250m). Much of the micro cap mining and materials sector had a field year in 2022, and Anson’s stock rallied to $0.48 at its peak. During the year, the company announced increases in the grade of its minerals (lithium) and also completed several resource drilling projects. Anson also raised an additional $50m through another equity offering. Like a few other microcaps, Anson Resources is yet to generate any revenue. The company was founded in 2009, and it is uncertain when it will finally start earning.

85. Aussie Broadband Limited (ABB)

Stake platform bought / sold (2022): 70% / 30%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Aussie Broadband Limited | Telecommunications | $606m | $2.61 | -43.26% |

Aussie Broadband, which offers network services, cloud and security services to its users, unfortunately had a rather bad end to the year for its share price. During 2022, the company actually rallied to a high of $5.91, which leads to the question of why it dropped to half of that. The company increased its revenue for FY2022 and even generated a net income for the first time since it IPO’d in 2017. It also completed an acquisition of Over the Wire Holdings.

86. Australian Vanadium Limited (AVL)

Stake platform bought / sold (2022): 69% / 31%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Australian Vanadium Limited | Mining | $104.2m | $0.03 | -16.67% |

AVL is a microcap that engages in exploration and energy storage, with its main minerals being vanadium/titanium and uranium. Last year, its stock price experienced a high of $0.12 and a low of $0.024. Sadly, it closed the year in the lower side of the range. AVL has not yet generated any significant revenue, and has even been operating at a relatively large net loss. The company was founded in 1998 and investors would be wondering when it will finally be able to provide a return.

87. Pointsbet Holdings Limited (PBH)

Stake platform bought / sold (2022): 64% / 36%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Pointsbet Holdings Limited | Consumer Discretionary | $441.7m | $1.49 | -79.11% |

Pointsbet Holdings made news headlines after its dramatic fall from grace – from a high of $15.14 in mid-2021, to a mere $1.49 at the end of 2022. The largest concern that prompted investors to sell off their shares was its highly negative operating cash flow. The company was burning through its reserves rather quickly, which is a negative for investors as cash provides liquidity. PBH is also yet to generate any earnings in its history. Investors still rejoiced when financial trading firm, SIG Sports, injected more cash into Pointsbet as an investment into the company. With the $94.2m it received from the placement, Pointsbet announced plans of expanding into the U.S.

88. Newcrest Mining Limited (NCM)

Stake platform bought / sold (2022): 62% / 38%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Newcrest Mining Limited | Mining | $18.5b | $20.64 | -13.20% |

Newcrest Mining has been a long-established player in the mining industry, recording growing revenues and net income. Unfortunately, just like its weaker 2022 share price, the company experienced a drop in its earnings, going from A$1.55b in FY2021 to A$1.27b in FY2022. The good news is that Newcrest has continued to expand its business through acquisitions and placements.

89. Chalice Mining Limited (CHN)

Stake platform bought / sold (2022): 56% / 44%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Chalice Mining Limited | Mining | $2.3b | $6.30 | -33.75% |

Chalice Mining was a relatively small stock back in 2019, when its price was around $0.12-$0.20. It has certainly exploded since, now being worth almost 50x more. Interestingly, the company is continuing to operate at a high net loss (in the double-digit millions). The main explanation for its share price rally was the discovery of nickel sulphide in its Julimar Project in Western Australia – recorded as the largest discovery of its kind since 2002. Investors are hoping it finally translates into a profit.

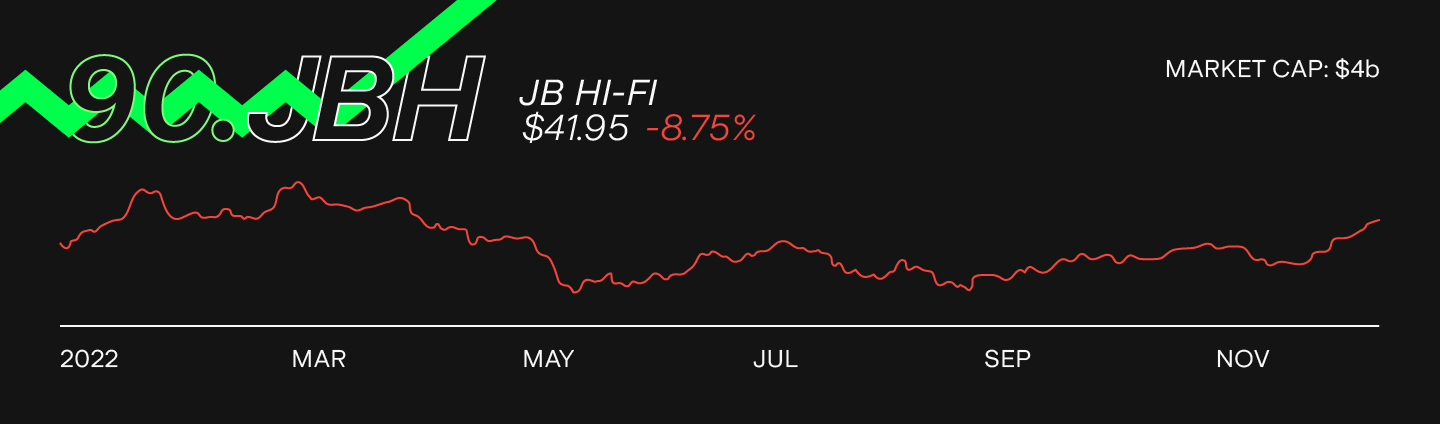

90. JB Hi-Fi Limited (JBH)

Stake platform bought / sold (2022): 72% / 28%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

JB Hi-Fi Limited | Consumer Discretionary | $4.6b | $41.95 | -8.75% |

A household name in Australian retail, JB Hi-Fi was a pandemic winner when people were forced to entertain themselves – as well as set up offices – in the comforts of their home. Back in 2021, the company briefly touched a $56 share price, up from its pre-COVID high of around $42. Despite the end of lockdowns, the company recorded even higher revenue and profit in FY22. JB Hi-Fi also authorised a share buyback plan worth $250m last year, and has once again achieved a record-breaking first half for FY2023, unfazed by the higher costs of living and increasing interest rates. Whether it can sustain this will depend on consumer appetite.

91. Invictus Energy Ltd (IVZ)

Stake platform bought / sold (2022): 64% / 36%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Invictus Energy Ltd | Commodities | $235.3m | $0.29 | +123.08% |

Looking at Invictus Energy’s stock price chart, you’d see very volatile movements as its stock jumps from a low of $0.12 to a high of $0.34 two weeks later. This happened all throughout 2022 despite relatively benign developments in the business that simply involved drilling updates and a new equity offering. The company doesn’t record any revenue at the moment, operating at a net loss. It was founded in 2011, and has no set date for when it can finally offer shareholders a return other than its stock price movements.

92. Bank of Queensland Limited (BOQ)

Stake platform bought / sold (2022): 74% / 26%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Bank of Queensland Limited | Financial Services | $4.5b | $6.90 | -10.73% |

Like a few other banks in the ASX, Bank of Queensland had an underperforming 2022 as the share market experienced a broader decline on the index. Nothing notable happened last year for the bank, aside from its fixed income offering to the amount of $400m. Its income statement also grew stronger, up from $369m in FY2021 to $426m in 2022.

93. Yancoal Australia Limited (YAL)

Stake platform bought / sold (2022): 65% / 35%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Yancoal Australia Limited | Commodities | $7.9b | $6.06 | +189.28% |

Yancoal had a great 2022, starting with a share price of $2.60 and ending above $6.00. For long-term investors, Yancoal used to be at $0.13 as recently as 2019, which means a 3-yr return of over 47x. The company reached billions in net income for the first time last year, recording $2.66b in earnings. In comparison, it recorded $791m in 2021, and a $1.01b loss in 2020. The company was also supposed to be acquired in 2022 by a Chinese-listed company, Yankuang Energy Group (SEHK:1171), which pulled out of the deal. Regardless, Yancoal has had a strong run, even managing to pay back US$459m of its long-term debt earlier than expected. This will save the company US$91m in financing costs over the long run.

94. Ionic Rare Earths Limited (IXR)

Stake platform bought / sold (2022): 71% / 29%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Ionic Rare Earths Limited | Mining | $134m | $0.03 | -25.00% |

Micro cap Ionic Rare Earths was founded back in 1998, and is yet to make any revenue. Last year, it experienced a short rally in its share price as it touched $0.09, but the excitement subsided and IXR ended the year lower than it started from. Still in its exploration stage, Ionic replenishes its cash through equity offerings; in 2022, it raised another $30m. With a long history of non-revenue making activities, there are no signs of earning cash from operations in the near future.

95. Incannex Healthcare Limited (IHL)

Stake platform bought / sold (2022): 69% / 31%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Incannex Healthcare Limited | Pharmaceuticals | $269.8m | $0.18 | -68.75% |

Incannex Healthcare has R&D activities surrounding medical cannabis and psychedelic products. It trended at around $0.03 in 2020, before it shot up to $0.49 towards the beginning of 2021. As volume and interest around the stock subsided, its share price followed, falling almost 70% across 2022. It continues to do research on pharmaceuticals, sustaining its cash flows with equity offerings, such as its $13m raise last year. It also acquired APIRx Pharmaceuticals USA. The company is yet to generate any earnings.

96. Askari Metals Limited (AS2)

Stake platform bought / sold (2022): 56% / 44%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Askari Metals Limited | Mining | $21.2m | $0.44 | +112.20% |

Another newly-minted public company on this list, Askari Metals listed in July 2021 at an offer price of $0.20 a share. That price has moved between $0.21 and $0.78 last year, ending 2022 over 110% above where it started. As typical with new mining companies, Askari Metals spent the year expanding its business through acquisitions of new projects – in their case in Africa – as well as undergoing drilling operations and growing its stakes in existing projects. Askari doesn’t have much of a track record to show how it might perform in the following years. However, the share price rally shows that investors are pretty optimistic on its prospects.

97. BetaShares Crude Oil Index ETF-Currency Hedged (Synthetic) (OOO)

Stake platform bought / sold (2022): 67% / 33%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

BetaShares Crude Oil Index ETF | Commodities ETF | $172.8m | $5.47 | +18.86% |

One of the few commodity ETFs in the ASX, OOO focuses on crude oil, specifically tracking the performance of crude oil futures (differentiated from the spot price), and hedged for currency movements in the AUD/USD exchange rate. OOO has not performed strongly in the past few years, being a far cry from its share price between $12 and $16 from 2016 to 2019 – and even farther from the $40-$60 back between 2011 to 2014. As the world tries to shift to renewables, it’s hard to tell how well OOO can perform in the coming years.

98. BetaShares Geared US Equity Fund Currency Hedged (Hedge Fund) (GGUS)

Stake platform bought / sold (2022): 78% / 22%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

BetaShares Geared US Equity Fund ETF | Diversified ETF | $132.2m | $20.30 | -47.20% |

GGUS is another index ETF for the U.S. equity markets. It’s a geared ETF, meaning that it combines funds from investors with borrowed funds in order to magnify the returns. The fund’s gearing ratio is between 50-65%, which means that investors’ funds will be matched at that rate. Given that the U.S. equity markets have underperformed in 2022, it’s no surprise that GGUS has followed, losing almost half of its share price through the year. Where GGUS’ price goes in 2023 will only depend on the performance of the U.S. market, which is still grappling with a recession, inflation, and higher interest rates.

99. Evolution Mining Ltd (EVN)

Stake platform bought / sold (2022): 64% / 36%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

Evolution Mining Ltd | Mining | $5.5b | $2.98 | -24.57% |

Founded in 1998, Evolution Mining has grown to become one of the ASX’s biggest gold miners. Like others in the space, EVN faced lower gold prices in 2022 as most investors flocked to the USD as a safe haven. Despite that, it recorded stronger revenues in FY2022, and just slightly lower profits than it did in FY2021. With the price of gold already on the rebound in the beginning of 2023, where EVN’s share price goes will depend on investors’ sentiment on the precious metal, and how well the company can manage the changing environment.

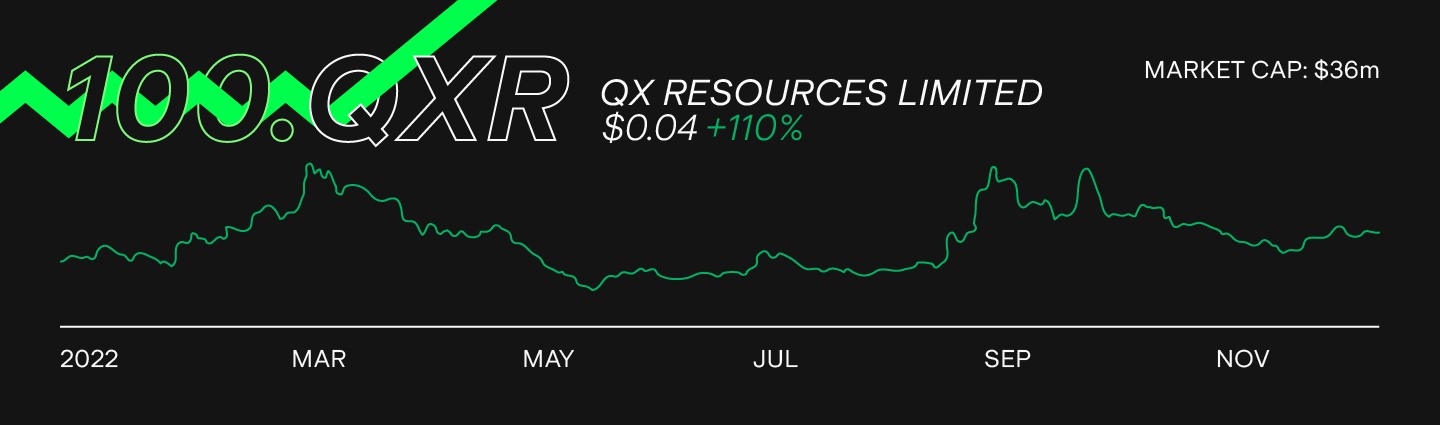

100. QX Resources Limited (QXR)

Stake platform bought / sold (2022): 54% / 46%

Company Name | Ticker | Sector | Market Cap | Stock Price (30 December 2022) | Price Change (2022) |

|---|---|---|---|---|---|

QX Resources Limited | Mining | $36.2m | $0.04 | +110.00% |

This small cap is searching for lithium in Western Australia and looking to develop a gold resource in Queensland. QXR benefitted from lithium’s price rise in early 2022, especially around April. The decision to exercise its option to acquire 100% of Turner River lithium project pushed the share price up again in October. A number of other miners have intersected lithium rocks around this area. As an early-stage company, the general demand for lithium could continue to have a major impact on this stock’s price, but investors can also look out for updates from QX’s current drill programs.

There you have it, ladies and gents: the most traded Aussie stocks on Stake, starting at #1 all the way down to 100. Hopefully the Stockest 100 has revealed some interesting facts and sparked some new ideas for you. Now it’s time to build towards the 2023 list.

The information gathered in this article was sourced from the Stake platform, the ASX and Market Index. Data is fully adjusted for dividends and capital events to provide total return, so performance metrics may differ from company websites. Numbers at market close on 30.12.2022.

This does not constitute financial product advice nor a recommendation to invest in the securities listed. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking appropriate financial or taxation advice before investing.

Stella is a markets analyst and writer with almost a decade of investing experience. With a Masters in Accounting from the University of Sydney, she specialises in financial statement analysis and financial modelling. Previously, she worked as an equity analyst at Australian finance start-up, Simply Wall St, where she took charge of the market insights newsletter sent out to over a million subscribers. At Stake, Stella has been key to producing the weekly Wrap articles and social media content.