10 Best stocks you need to watch in 2026

U.S. stocks head into 2026 with momentum still on their side. The economy has held up better than many expected, and the AI boom continues to pull capital toward the same group of dominant tech names. After two years of outsized gains, megacaps have done most of the heavy lifting for the S&P 500 and Nasdaq, keeping indexes near record highs. The upside is that earnings and AI spending remain strong; the risk is that valuations are now stretched, leaving far less room for disappointment if growth cools or investment slows.

Watch these stocks closely in 2026

Company Name | Ticker | Share Price | 1Y Return | Market Capitalisation |

|---|---|---|---|---|

Nvidia | US$186.23 | +32.24% | US$4.5T | |

Alphabet | US$330.00 | +66.62% | US$3.98T | |

Tesla | US$437.50 | +3.17% | US$1.37T | |

Palantir Technologies | US$170.96 | +133.97% | US$407.3B | |

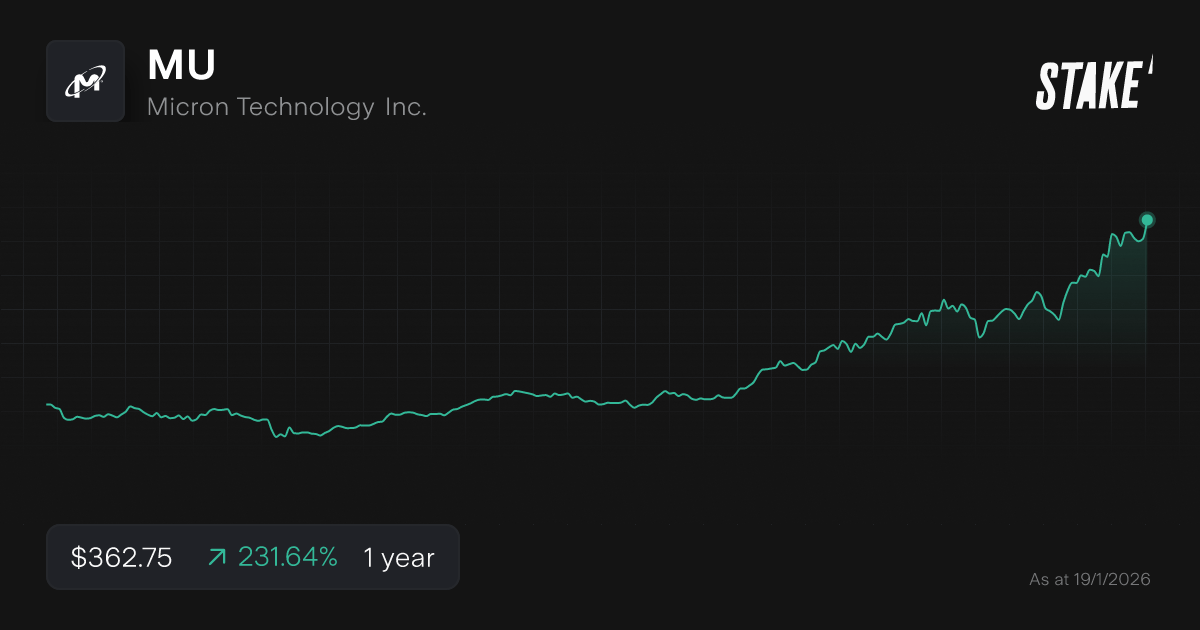

Micron | US$362.75 | +231.64% | US$402B | |

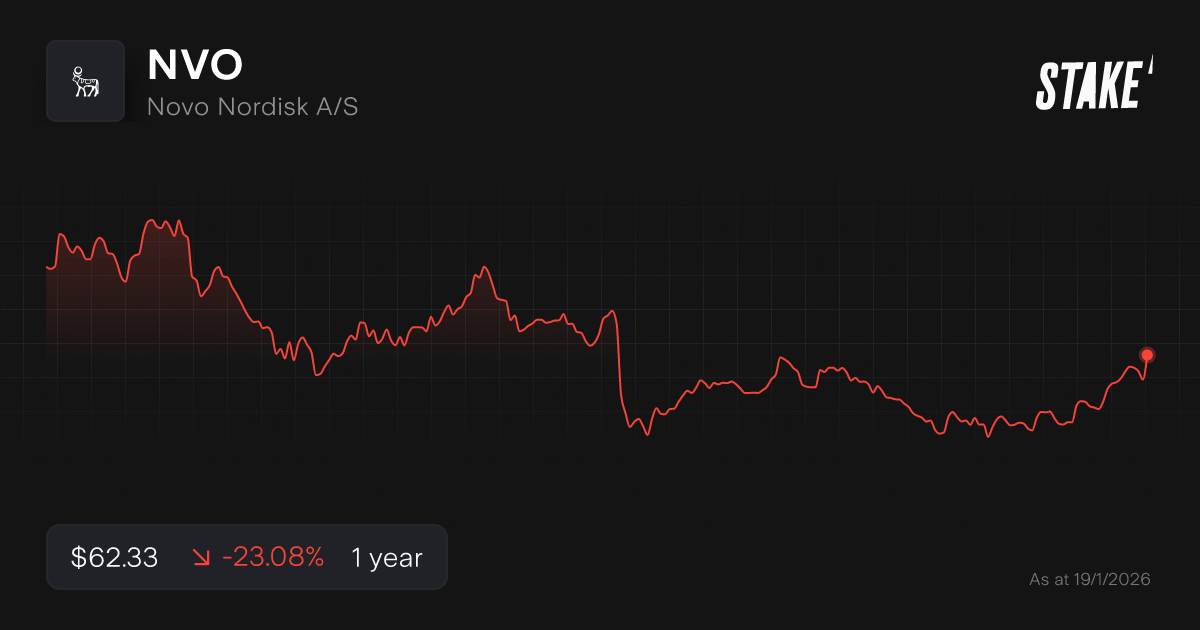

Novo Nordisk | US$62.33 | -23.08% | US$210B | |

Rocket Lab | US$96.30 | +207.96% | US$51.44B | |

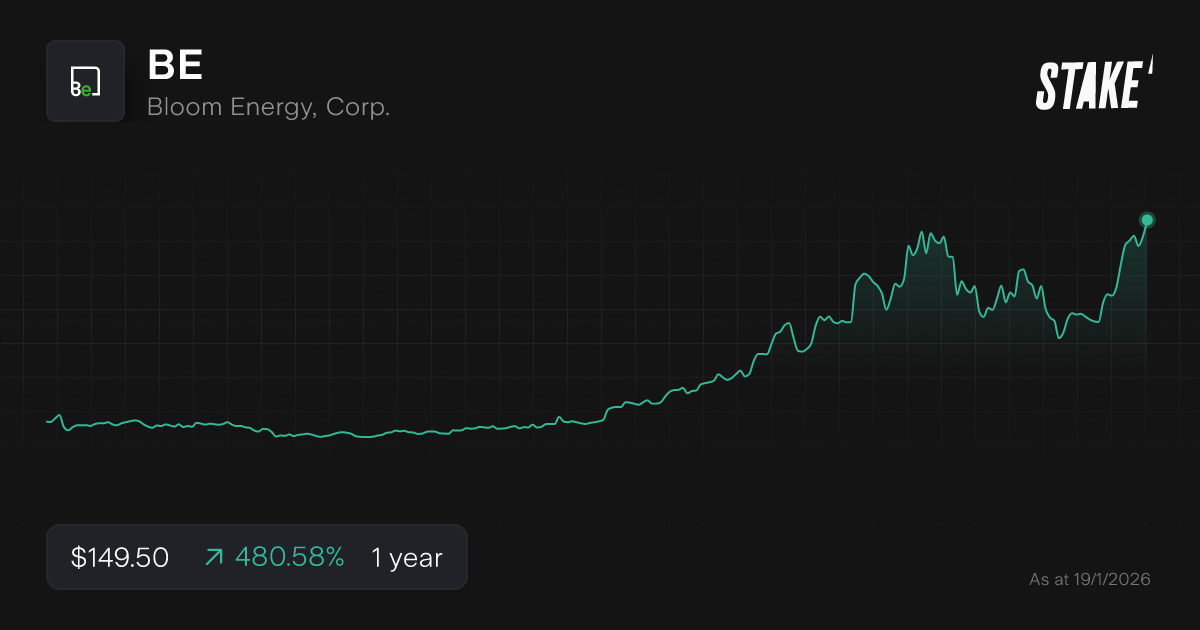

Bloom Energy | US$149.50 | +480.58% | US$35.3B | |

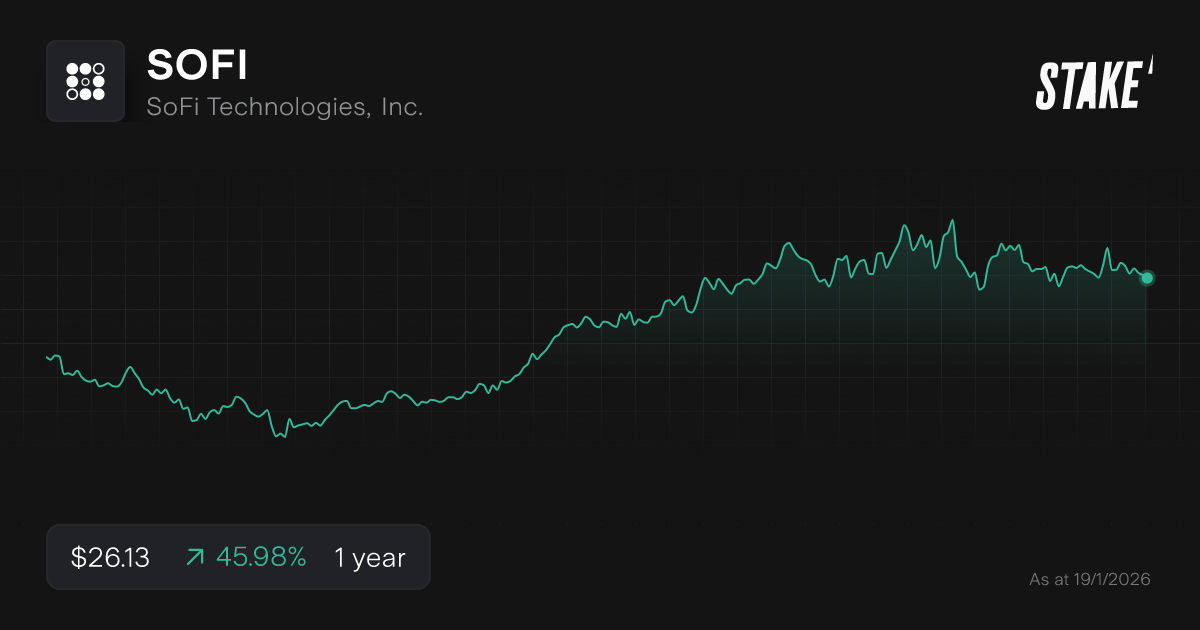

SoFi Technologies | US$26.13 | +45.98% | US$33.1B | |

Nebius | US$108.73 | +189.18% | US$27.33B |

Data as of 17 January 2026. Source: Stake, Google.

*The list of stocks mentioned is ranked by market capitalisation. When deciding what stocks to feature, we analyse the company's financials, recent news, advancement in their timeline, and whether or not they are actively traded on Stake.

Let's breakdown these companies

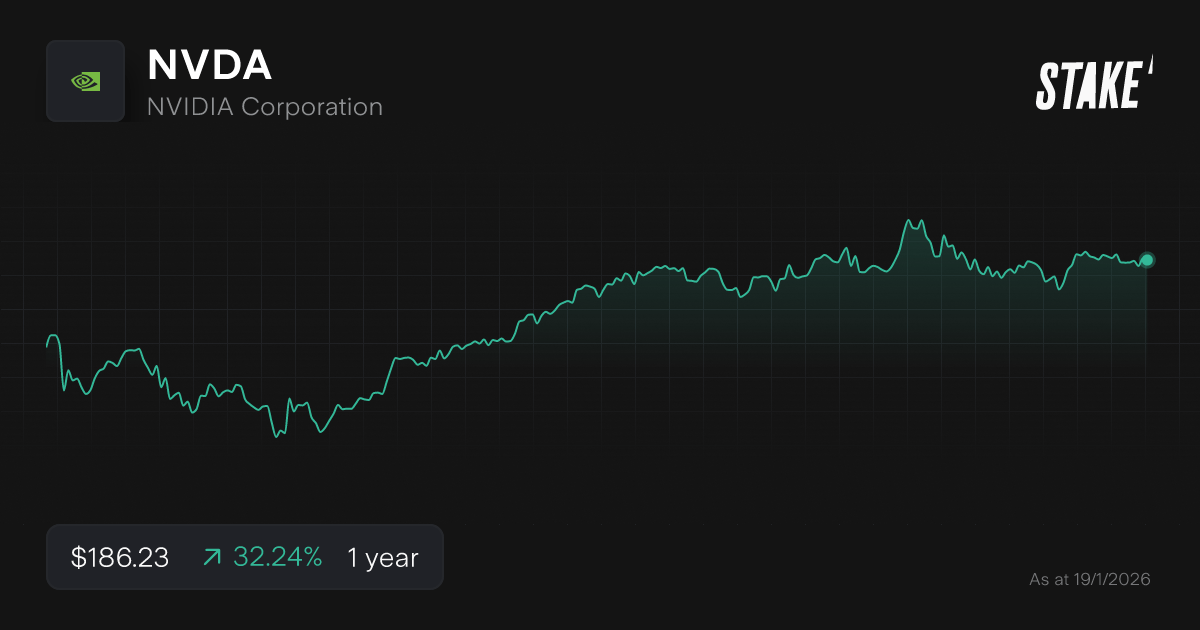

1. Nvidia ($NVDA)

- 340,283 Stake customers watching

- 306,465 orders executed on Stake

The AI growth story is still centred around Nvidia’s dominance in AI hardware amid surging data center investments and robust product pipelines. Hyperscalers plan even higher capital expenditures in 2026, with global data center investments potentially reaching trillions, much of which flows to NVIDIA's AI accelerators. Nvidia’s 2026 is all about its Vera Rubin ‘superchip’: it packages a Vera CPU with two Rubin GPUs on one module, positioned for ‘reasoning’ and agentic AI models. Named after the astronomer who proved dark matter exists, Vera Rubin could be just as influential in uncovering the invisible forces driving the next phase of AI growth.

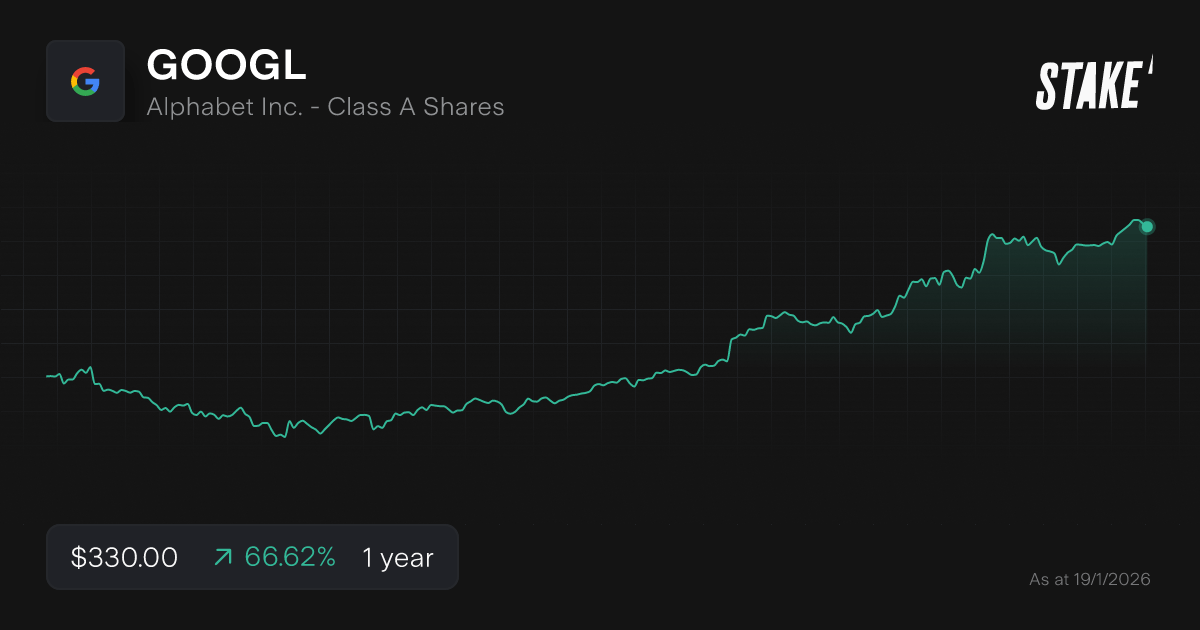

2. Alphabet ($GOOGL)

- 45,537 Stake customers watching

- 125,787 orders executed on Stake

Alphabet is doubling down on its AI bets in 2026, from Google Cloud’s AI infrastructure to the consumer-facing Gemini AI models. A big part of that picture is its custom-built AI accelerators or Tensor Processing Units (TPUs). Google's TPUs enable cost savings and faster scaling for Alphabet by reducing reliance on Nvidia's pricier GPUs. The firm’s strong start to 2026 was amplified by a partnership with Apple ($AAPL), which it also overtook to become the second-largest company by market capitalisation. Google Cloud's US$155 billion backlog, with over 70% tied to AI services, is one of the reasons analysts see Google as one of the big winners of AI this year.

3. Tesla ($TSLA)

- 375,850 Stake customers watching

- 919,652 orders executed on Stake

Tesla is now positioned as an AI company as much as an automaker. Its Dojo supercomputer powers next-generation vehicle autonomy, AI training, and robotics research.

In 2026, Tesla is expected to expand its AI software ecosystem, including FSD (Full Self-Driving) subscriptions and humanoid robotics initiatives. But Tesla has a history of missed timeline, which has lowered market confidence in its aggressive rollout claims. While EV margins face pressure from raw material costs, Tesla’s AI and energy storage ventures provide optionality that could redefine the company’s growth trajectory beyond automotive sales. Wedbush has an optimistic US$600 price target on $TSLA, while a majority of Wall Street analysts have a more cautious stance on the firm.

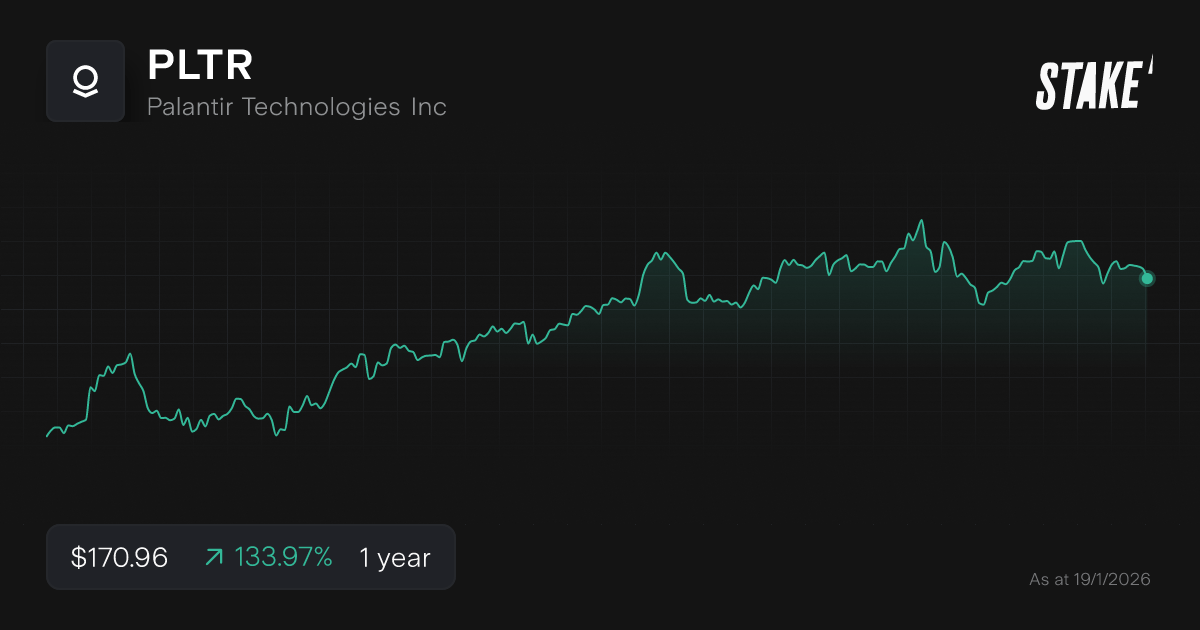

4. Palantir Technologies ($PLTR)

- 313,871 Stake customers watching

- 236,481 orders executed on Stake

Palantir’s 138% YoY run looks even more impressive when you consider it in comparison to the SaaS graveyard. Firms like Adobe ($ADBE) and monday.com ($MNDY) lost more than 30% over the same period as AI makes their core workflows irrelevant.

Palantir sits on the opposite side of that trade. Rather than being disrupted by AI, the company has positioned itself as the operating layer that helps governments and enterprises deploy AI into mission-critical environments. That momentum translated into another wave of large, multi-year contracts: the U.S. Department of Defense, CIA, and Homeland Security now account for about half of Palantir’s revenue. Its 176x PE ratio hasn't stopped analysts from issuing new buy ratings, raised price targets and forecasts, but the high valuation still leaves little margin for error.

5. Micron Technology ($MU)

- 10,012 Stake customers watching

- 27,518 orders executed on Stake

Memory is the new AI bottleneck and Micron is one of the biggest structural beneficiaries.The firm provides HBM3E memory integrated into AI accelerators like NVIDIA's Blackwell and Vera Rubin GPUs, enabling faster training and inference for large language models by handling massive datasets efficiently. Its solutions address AI's ‘memory wall,’ where high-speed access outperforms compute bottlenecks, with full 2026 HBM capacity already sold out to hyperscalers like Microsoft ($MSFT) and Alphabet ($GOOGL). High-bandwidth memory (HBM) demand from AI data centres has propelled Micron's revenue up 57% YoY to US$13.6B in Q1 fiscal 2026. Meanwhile, the supply constraint allows Micron’s gross margins to sit above 38%, with analysts optimistic about more room for growth.

6. Novo Nordisk ($NVO)

- 5,512 Stake customers watching

- 9,590 orders executed on Stake

The weight-loss drugs battle could intensify in 2026, and Novo Nordisk just delivered a punch to Eli Lilly’s () position. Novo rolled its FDA-approved oral Wegovy pill, an alternative to injectable GLP-1 drugs for the ‘needle-averse’ consumer. An oral Ozempic at a much more affordable US$149 price point could expand Novo’s addressable market significantly.

For value investors, $NVO's valuation is a dream come true. The company trades at a 15x PE ratio, implying it is significantly undervalued relative to its main rival $LLY which trades at a 50x PE multiple. In a market pricing perfection for Lilly, Novo’s combination of scale and value becomes increasingly hard to ignore.

7. Rocket Lab ($RKLB)

- 10,352 Stake customers watching

- 49,761 orders executed on Stake

Rocket Lab can’t match SpaceX’s scale, but it has emerged as a viable alternative for specific niches like small satellite launches and dedicated missions. The space stock rocketed to an all-time high after a series of analyst upgrades: Morgan Stanley is the latest firm to move $RKLB to an ‘overweight’ rating. Analysts are most optimistic about the firm’s 2026 prospects after its latest contract win. That’s Rocket Lab's largest contract: an $816M U.S. Space Development Agency (SDA) deal for 18 missile-tracking satellites, boosting total SDA awards over $1.3B and validating its defence prime status.

8. Bloom Energy ($BE)

- 2,788 Stake customers watching

- 7,211 orders executed on Stake

Bloom Energy is emerging as a critical picks-and-shovels play in the AI data center boom, addressing another one of the sector’s biggest bottlenecks: reliable power. The company’s solid oxide fuel cell systems provide on-site, always-on electricity that is increasingly attractive to hyperscalers and AI infrastructure providers facing grid constraints and long interconnection delays. In 2026, Bloom stands to benefit directly from the surge in AI-driven data center construction across the U.S. and Europe, particularly for edge facilities and high-density GPU clusters where uptime is mission-critical. The company announced a US$2.2B convertible senior note offering to fund manufacturing expansion as it looks to scale ahead of demand.

9. SoFi Technologies ($SOFI)

- 11,789 Stake customers watching

- 79,054 orders executed on Stake

SoFi Technologies presents a compelling buy case for 2026 due to its accelerating profitability, membership growth, and diversified fintech ecosystem. Membership has grown over 900% since 2019 to more than 10 million and fee-based revenue and loan demand surged, contributing to record Q3 2025 net revenue of US$962M. Despite a forward PE of 46x, some analysts believe that SoFi’s growth exceeding mature peers like PayPal justifies the premium if execution continues at this scale. In 2026, the firm is betting big on the digital asset ecosystem after relaunching crypto trading in November 2025 and launching its own SoFiUSD stablecoin in December 2025. CEO Anthony Noto positions SoFiUSD as a bridge between traditional banking and blockchain, and expects it to further boost fees and engagement this year.

10. Nebius Group ($NBIS)

- 4,263 Stake customers watching

- 7,010 orders executed on Stake

Nebius is carving a niche as a pure-play AI infrastructure provider. Although its CEO dislikes being characterised as such, the ‘neocloud’ firm delivers high-performance GPU clusters and cloud services tailored for enterprise and hyperscaler AI workloads.

Last year, the firm scored major deals: a US$17.5B deal with Microsoft and a US$3B deal with Meta. These hyperscaler contracts enable Nebius to finance rapid data center builds in the U.S. and Europe, targeting 2.5 gigawatts of power capacity by late 2026 while prioritising high-margin AI services. The firm has also partnered with Nvidia as an early Cloud Partner for Vera Rubin NVL72 GPUs from H2 2026. That combination of hyperscaler backing, aggressive capacity build-out, and early access to next-generation Nvidia hardware puts Nebius at the centre of the next AI infrastructure wave.

List of ETFs you need to watch

Vanguard S&P 500 ETF ($VOO)

The Vanguard S&P 500 ETF offers low cost exposure to the largest U.S. companies. It has a big weighting in big tech companies but offers a diversified portfolio, with JPMorgan ($JPM), ExxonMobil ($XOM), Visa ($V), Mastercard ($MA) and Walmart ($WMT) among the top holdings.

Invesco QQQ ETF ($QQQ)

The Invesco QQQ ETF tracks the Nasdaq 100 Index. It offers a sharper focus on tech stocks, with no exposure to slower growing sectors like banks.

VanEck Uranium and Nuclear Energy ETF ($NLR)

Nuclear energy is enjoying renewed interest as tech companies and data centre operators seek sources of low emission energy to power the AI boom. The ETF tracks companies involved in uranium mining, nuclear construction and nuclear generation.

✅ Learn more about how you can get started investing in the S&P 500 or the Nasdaq→

Will the technology sector have another big year?

Technology stocks should enjoy a solid year given the plans by big tech companies to continue investing heavily in AI. This could sustain demand across industries such as chips, servers and data centres. The question for investors is whether AI-driven earnings growth is already priced in.

Investors need to closely watch quarterly earnings to track demand.

Disclaimer

The information contained above does not constitute financial product advice nor a recommendation to invest in any of the securities listed. Past performance is not a reliable indicator of future performance. When you invest, your capital is at risk. You should consider your own investment objectives, financial situation and particular needs. The value of your investments can go down as well as up and you may receive back less than your original investment. As always, do your own research and consider seeking appropriate financial advice before investing.

Any advice provided by Stake is of general nature only and does not take into account your specific circumstances. Trading and volume data from the Stake investing platform is for reference purposes only, the investment choices of others may not be appropriate for your needs and is not a reliable indicator of performance.

$3 brokerage fee only applies to trades up to $30k in value (USD for Wall St trades and AUD for ASX trades). Please refer to hellostake.com/pricing for other fees that are applicable.

Samy is a markets analyst at Stake, with seven years of experience in the world of investing, working across roles in private banking, venture capital and financial media. She has a Master’s degree in Finance and Data Analytics from The University of Sydney Business School.

.png&w=3840&q=100)